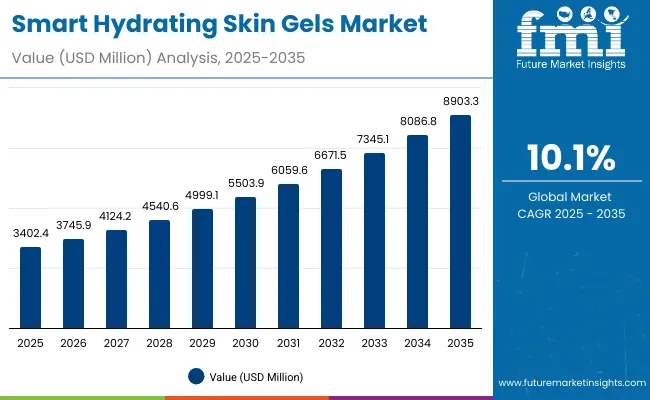

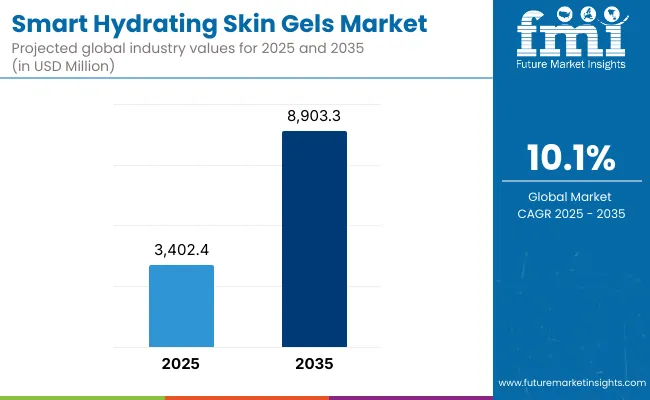

The Smart Hydrating Skin Gels Market is expected to record a valuation of USD 3,402.4 million in 2025 and USD 8,903.3 million in 2035, with an increase of USD 5,500.9 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 10.1% and a 2X increase in market size.

Smart Hydrating Skin Gels Market Key Takeaways

| Metric | Value |

|---|---|

| Smart Hydrating Skin Gels Market Estimated Value in (2025E) | USD 3,402.4 million |

| Smart Hydrating Skin Gels Market Forecast Value in (2035F) | USD 8,903.3 million |

| Forecast CAGR (2025 to 2035) | 10.1% |

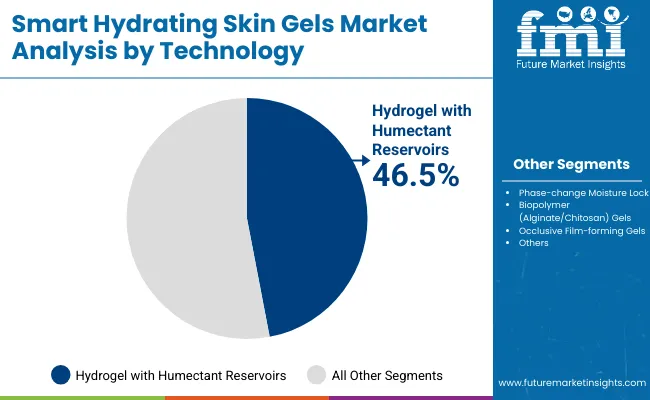

During the first five-year period from 2025 to 2030, the market increases from USD 3,402.4 million to USD 5,503.9 million, adding USD 2,101.5 million, which accounts for 38.2% of the total decade growth. This phase records steady adoption of daily moisturizer gels and mask/overnight gels, driven by strong demand for hydration, soothing, and preventive skincare. Hydrogels with humectant reservoirs dominate this period, catering to over 46.5% of technology-driven applications in 2025.

The second half from 2030 to 2035 contributes USD 3,399.4 million, equal to 61.8% of total growth, as the market jumps from USD 5,503.9 million to USD 8,903.3 million. This acceleration is powered by the widespread deployment of hyaluronic acid complexes, clean-label biopolymer gels, and premium overnight repair formats.

By the end of the decade, daily moisturizer and overnight gels together capture over 80% of demand, while digital-first D2C and subscription-based platforms add recurring revenue, increasing the e-commerce share beyond 50% of total value.

From 2020 to 2024, the Smart Hydrating Skin Gels Market grew steadily, driven by consumer adoption of lightweight daily moisturizers and mask/overnight gels. During this period, the competitive landscape was dominated by global skincare giants controlling nearly 70% of revenue, with leaders such as L’Oréal Paris, Shiseido, and Neutrogena focusing on hydration-boosting formulations and dermatologist-backed claims.

Competitive differentiation relied on ingredient innovation (hyaluronic acid complexes, ceramides, centella) and distribution strength across retail and e-commerce. Service-based personalization models had minimal traction, contributing less than 10% of total market value.

Demand for Smart Hydrating Skin Gels will expand to USD 3,402.4 million in 2025, and the revenue mix will shift as premium and clean-label formulations grow to over 30% share. Traditional global leaders face rising competition from digital-first Asian beauty brands offering subscription kits, AR skin diagnostics, and D2C personalization.

Major incumbents are pivoting to hybrid models, integrating eco-friendly packaging, AI-based skin analysis, and multi-channel retail strategies to retain relevance. Emerging entrants specializing in K-beauty inspired gels, microbiome-friendly actives, and sustainability-driven innovation are gaining share. The competitive advantage is moving away from basic hydration claims to ecosystem strength, personalization scalability, and recurring subscription revenue streams.

The market is also expanding due to the rapid adoption of digital-first sales channels and subscription ecosystems. Beauty brands are integrating AI-driven skin diagnostics, AR try-on tools, and customized replenishment kits to strengthen consumer engagement. This approach ensures convenience, personalization, and loyalty while shifting gels from being one-time retail purchases to recurring revenue streams. Particularly in Asia and the USA, D2C models and e-commerce marketplaces are enabling affordable access to both mass and premium products, fueling consistent demand and long-term market stickiness.

The rising consumer shift toward clean-label and sustainable biopolymer gels, particularly those derived from alginate and chitosan. These materials not only provide effective hydration but also align with eco-conscious purchasing trends by offering biodegradability and reduced environmental footprint.

Global and regional brands are investing in green chemistry R&D, creating gels that combine hydration efficacy with ethical sourcing. This alignment with sustainability mandates and consumer preference for eco-friendly skincare is unlocking new premium opportunities and strengthening long-term brand equity in competitive markets.

The Smart Hydrating Skin Gels Market is segmented by technology, use case, ingredient highlight, product format, distribution channel, price tier, and region. By technology, it includes hydrogel with humectant reservoirs, phase-change moisture lock gels, biopolymer (alginate/chitosan) gels, and occlusive film-forming gels.

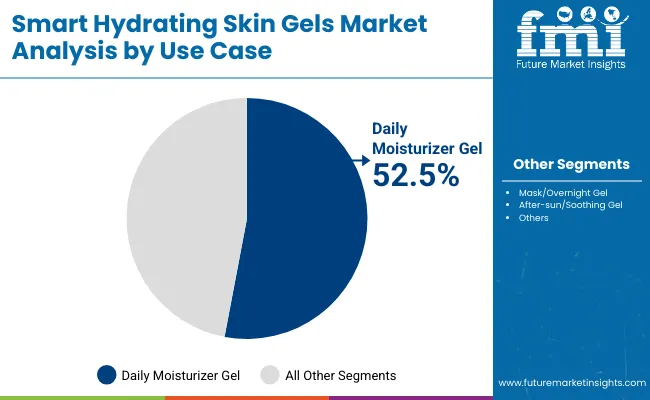

By use case, it is divided into daily moisturizer gels, mask/overnight gels, and after-sun/soothing gels. By ingredient highlight, the market is classified into hyaluronic acid complexes, ceramides & natural moisturizing factors (NMFs), and aloe/centella complexes. By product format, it covers jar & pump gel creams, sheet/patch gel masks, and leave-on overnight gels.

By distribution channel, it comprises direct-to-consumer (DTC) brand websites, e-commerce marketplaces, specialty beauty retail, and drugstore/pharmacy chains. By price tier, the market is segmented into mass, masstige, and premium gels. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

| Technology | Value Share % 2025 |

|---|---|

| Hydrogel with humectant reservoirs | 46.5% |

| Others | 53.5% |

The hydrogel with humectant reservoirs segment is projected to contribute 46.5% of the Smart Hydrating Skin Gels Market revenue in 2025, maintaining its lead as the dominant technology category. This is driven by the rising demand for lightweight, fast-absorbing daily moisturizers and overnight gels that ensure deep hydration through sustained release of humectants such as hyaluronic acid. Consumers prefer this format for its skin compatibility, cooling texture, and improved ingredient penetration, making it a staple in both mass and premium skincare lines.

The segment’s growth is further supported by ongoing innovation in hydrogel matrices, which enhance moisture retention and allow brands to incorporate advanced actives like ceramides and centella extracts. As clean-label and dermatologist-tested formulations become more prevalent, hydrogel technologies are evolving to support sustainable packaging and eco-friendly production. The hydrogel with humectant reservoirs segment is expected to remain the backbone of Smart Hydrating Skin Gels adoption worldwide.

| Use Case | Value Share % 2025 |

|---|---|

| Daily moisturizer gel | 52.5% |

| Others | 47.5% |

The daily moisturizer gel segment is forecasted to hold 52.5% of the Smart Hydrating Skin Gels Market revenue in 2025, led by its application as an everyday hydration solution for diverse skin types. These gels are favored for their lightweight texture, quick absorption, and suitability for both humid and dry climates, making them an essential part of daily skincare routines. Their ease of use and compatibility with multifunctional actives such as hyaluronic acid and ceramides have further facilitated widespread adoption across consumer groups.

The segment’s growth is bolstered by the rising demand for affordable masstige offerings in emerging markets and premium dermatologist-tested formulations in developed economies. With consumers increasingly seeking long-lasting hydration and barrier repair, daily moisturizer gels are expected to continue their dominance in the Smart Hydrating Skin Gels Market.

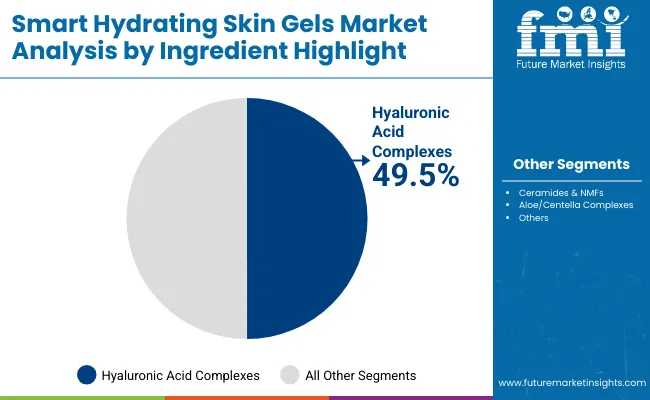

| Ingredient Highlight | Value Share % 2025 |

|---|---|

| Hyaluronic acid complexes | 49.5% |

| Others | 50.5% |

The hyaluronic acid complexes segment is projected to account for 49.5% of the Smart Hydrating Skin Gels Market revenue in 2025, establishing it as the leading ingredient highlight. Hyaluronic acid is preferred for its ability to retain up to 1,000 times its weight in water, providing instant and long-lasting hydration while plumping the skin. Its compatibility with diverse gel technologies, including hydrogels and overnight formulations, has made it the backbone of hydration-driven innovation in the category.

The segment’s growth is further enhanced by advancements in multi-molecular weight hyaluronic acid blends, which improve skin penetration and reduce transepidermal water loss. As consumers increasingly seek dermatologist-recommended and clinically validated ingredients, hyaluronic acid complexes are expected to maintain their leading role in the Smart Hydrating Skin Gels Market.

Innovation in Hydrogel Reservoir Technology

Hydrogel reservoir systems that allow controlled release of humectants such as hyaluronic acid, glycerin, and ceramides is a major growth driver is the advancement of. Unlike traditional creams, these smart gels provide layered hydration throughout the day, making them highly effective for diverse climates and skin types.

Global beauty leaders are leveraging this innovation to build premium and masstige product lines, enhancing consumer loyalty. The scientific credibility of reservoir-based hydration gels strengthens their adoption in both clinical dermatology and mainstream retail, fueling consistent growth across regions.

Rise of Digital-First Beauty Retail

The acceleration of digital-first retail and subscription ecosystems in beauty is another strong driver of the market. Brands are embedding AI skin diagnostics, AR-based try-ons, and personalized replenishment kits into their sales strategies, creating deeper consumer engagement.

This not only boosts product discovery but also ensures recurring demand through subscription refills. Particularly in Asia-Pacific, social commerce platforms such as Tmall, Shopee, and TikTok Shop are amplifying consumer adoption, especially for daily moisturizer gels. This shift toward digitally enabled sales channels is reshaping market accessibility, positioning smart gels as a staple in modern skincare routines globally.

High Cost of Premium Ingredients

The reliance on premium active ingredients such as multi-weight hyaluronic acids, peptides, and bio-based polymers. These add significant cost to formulation, which can limit affordability in price-sensitive regions. The challenge intensifies as consumers expect clean-label, sustainable, and dermatologist-tested formulations, which increase R&D and compliance expenses.

Mass-market players often struggle to balance ingredient quality with cost-effectiveness, creating a price gap that can slow adoption among middle-income groups. Without economies of scale, premium gel formats risk being confined to niche and high-income consumers, restricting broader penetration.

Shift Toward Clean-Label and Sustainable Biopolymer Gels

Smart Hydrating Skin Gels Market is the rapid transition toward clean-label and eco-friendly biopolymer formulations. Gels based on alginate, chitosan, and plant-derived polymers are increasingly replacing synthetic bases, meeting consumer demand for sustainability without compromising hydration performance.

In parallel, recyclable packaging and refillable jars are being adopted to align with global green beauty mandates. Consumers now associate hydration not just with efficacy but also with ethical sourcing and environmental responsibility, positioning clean-label gels as the future of mainstream skincare innovation.

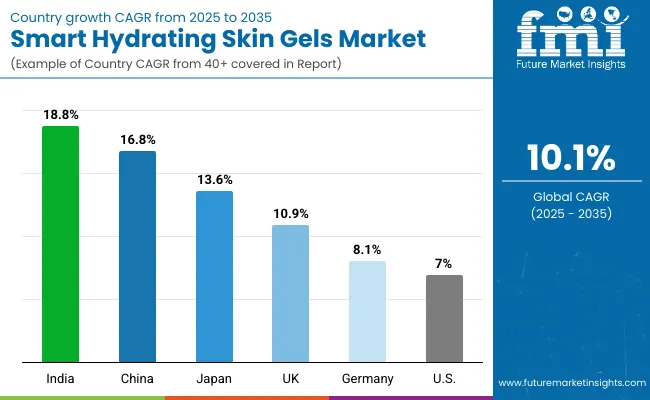

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 16.8% |

| USA | 7.0% |

| India | 18.8% |

| UK | 10.9% |

| Germany | 8.1% |

| Japan | 13.6% |

The global Smart Hydrating Skin Gels Market shows notable regional differences in adoption speed, strongly influenced by consumer preferences, skincare culture, and retail ecosystems. Asia-Pacific emerges as the fastest-growing region, anchored by China (16.8%) and India (18.8%).

Growth is driven by rising consumer awareness of hydration-focused skincare, booming D2C e-commerce ecosystems, and high adoption of daily moisturizer and overnight repair gels. In China, innovation in hyaluronic acid complexes and K-beauty inspired formats is reshaping mass and premium skincare. India’s trajectory reflects the expansion of masstige brands through online platforms, increasing affordability and penetration into tier-2 and tier-3 cities.

Europe maintains a strong growth profile, led by Germany (8.1%) and the UK (10.9%). Demand here is supported by dermatological validation, sustainability mandates, and strong pharmacy-driven retail networks. Premium gel formats emphasizing clean-label ingredients and eco-friendly packaging resonate strongly with European consumers. North America shows steady but moderate expansion, with the USA at 7.0% CAGR, reflecting market maturity.

Growth is supported by premium anti-aging and overnight gel segments, coupled with the rise of digital-first D2C skincare brands. The region emphasizes personalization, subscription models, and clinical-grade claims rather than volume-driven expansion.

Japan (13.6%) acts as a hub for R&D in smart hydrating formulations, especially biopolymer-based gels and advanced micromolecular hyaluronic acid complexes. Japanese brands lead in premiumization and technology-driven hydration solutions, influencing trends across the broader Asia-Pacific region.

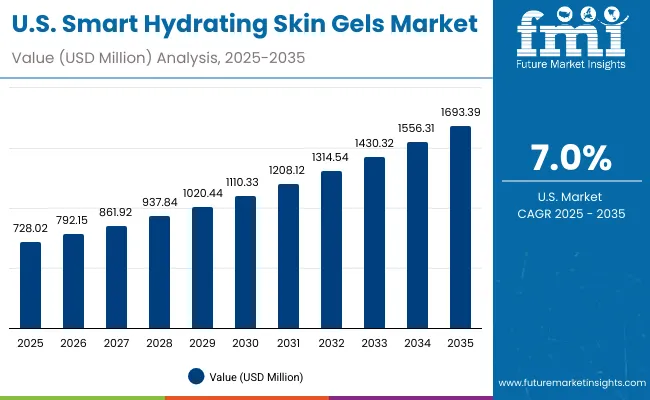

Sales Outlook for Smart Hydrating Skin Gels in the United States

| Year | USA Berberine Market (USD Million) |

|---|---|

| 2025 | 728.02 |

| 2026 | 792.15 |

| 2027 | 861.92 |

| 2028 | 937.84 |

| 2029 | 1020.44 |

| 2030 | 1110.33 |

| 2031 | 1208.12 |

| 2032 | 1314.54 |

| 2033 | 1430.32 |

| 2034 | 1556.31 |

| 2035 | 1693.39 |

The Smart Hydrating Skin Gels Market in the United States is projected to grow at a CAGR of 7.0% between 2025 and 2035, reflecting steady demand in a mature skincare market. Growth is led by strong consumer adoption of daily moisturizer gels and overnight repair gels, supported by rising awareness of anti-aging and barrier-repair formulations.

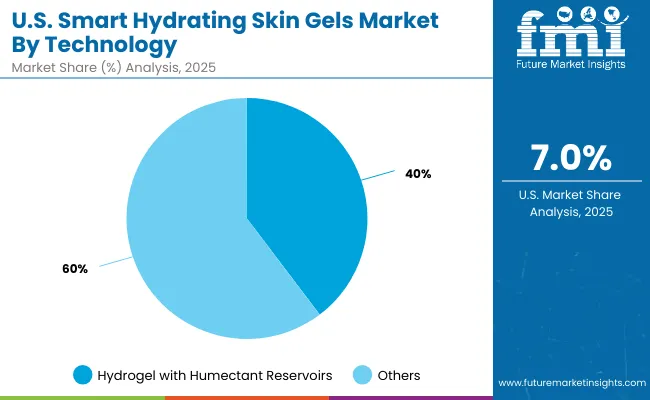

E-commerce and direct-to-consumer (D2C) brand platforms are driving accessibility, while premium players leverage subscription-based replenishment models to capture recurring demand. Hydrogels with humectant reservoirs hold a 39.7% share in 2025 (USD 289.02 million), making them a key technology segment.

The Smart Hydrating Skin Gels Market in the United Kingdom is expected to grow at a CAGR of 10.9% from 2025 to 2035, supported by rising consumer focus on premium skincare, hydration innovation, and clean-label formulations. British consumers are highly receptive to dermatologist-backed products and gels enriched with hyaluronic acid complexes and ceramides, which are widely distributed through pharmacies, specialty beauty retail, and online D2C platforms.

Sustainability mandates and regulatory standards in the UK are also pushing brands to develop eco-friendly packaging and refillable gel formats. Growth is further supported by strong masstige adoption among younger demographics.

India is witnessing rapid growth in the Smart Hydrating Skin Gels Market, which is forecast to expand at a CAGR of 18.8% through 2035. A sharp increase in adoption across tier-2 and tier-3 cities is being driven by affordable masstige launches and rising skincare awareness among younger demographics. Domestic and regional brands are leveraging e-commerce platforms and D2C websites to penetrate cost-sensitive markets, while premium players are focusing on urban centers with higher disposable income. Growth is also supported by the expansion of dermatology clinics and beauty chains, which are integrating smart hydrating gels into advanced skincare regimens.

The Smart Hydrating Skin Gels Market in China is expected to grow at a CAGR of 16.8%, the highest among leading economies. This momentum is driven by strong consumer demand for acne/blemish and brightening gels, especially among Gen Z and millennial consumers influenced by K-beauty and J-beauty trends. Local beauty brands are aggressively competing with international players by offering affordable hydrogel and overnight repair gels through leading e-commerce platforms such as Tmall and JD.com. Regulatory support for functional cosmetics innovation and rapid expansion of premium micromolecular hyaluronic acid complexes are further fueling growth.

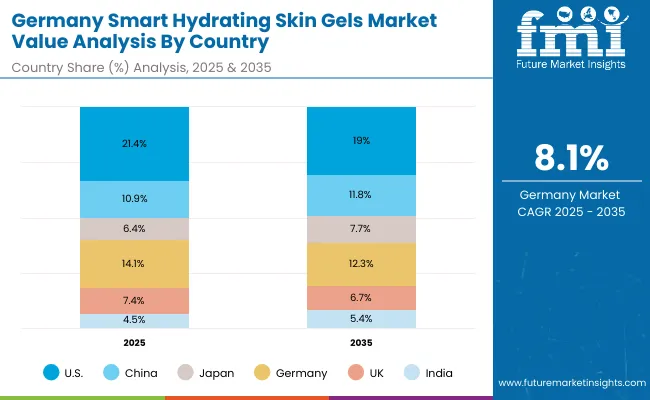

| Country | 2025 Share (%) |

|---|---|

| USA | 21.4% |

| China | 10.9% |

| Japan | 6.4% |

| Germany | 14.1% |

| UK | 7.4% |

| India | 4.5% |

| Country | 2035 Share (%) |

|---|---|

| USA | 19.0% |

| China | 11.8% |

| Japan | 7.7% |

| Germany | 12.3% |

| UK | 6.7% |

| India | 5.4% |

The Smart Hydrating Skin Gels Market in Germany is projected to grow steadily, supported by the country’s dermatology-driven skincare culture and strong pharmacy-led retail networks. German consumers prioritize scientifically validated, dermatologist-tested, and clean-label products, creating strong demand for gels enriched with hyaluronic acid complexes, ceramides, and centella extracts. Pharmacies and drugstores remain the dominant distribution channel, with premium daily moisturizers and overnight repair gels seeing robust adoption. Compliance with strict EU cosmetic regulations and sustainability mandates is further encouraging brands to focus on biopolymer-based hydrating gels and recyclable packaging solutions.

| USA By Technology | Value Share % 2025 |

|---|---|

| Hydrogel with humectant reservoirs | 39.7% |

| Others | 60.3% |

The Smart Hydrating Skin Gels Market in the United States is projected at USD 728.02 million in 2025, expanding steadily through 2035. Hydrogels with humectant reservoirs account for 39.7% of market value (USD 289.02 million), reflecting their strong role in daily hydration and overnight repair gels. Although other gel technologies (phase-change, biopolymer, and occlusive formats) collectively hold the majority share, USA consumers are gravitating toward lightweight hydrogels due to their quick absorption, dermatologist validation, and compatibility with multifunctional actives.

This balance reflects a market where premium anti-aging gels, clean-label innovations, and personalized subscription kits are steadily expanding share. Digital-first beauty brands in the USA are integrating AI-driven skin diagnostics, AR-based recommendations, and e-commerce subscriptions, creating recurring revenue streams. As consumer demand for eco-friendly packaging and refillable jars accelerates, USA manufacturers are increasingly aligning with sustainability and clinical efficacy, which will define the competitive landscape.

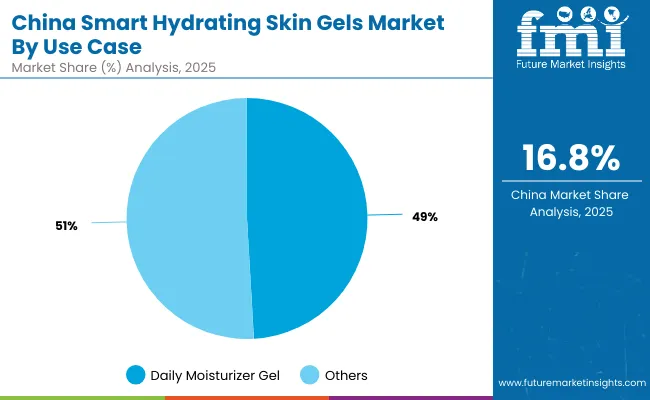

| China By Use Case | Value Share % 2025 |

|---|---|

| Daily moisturizer gel | 49.1% |

| Others | 50.9% |

The Smart Hydrating Skin Gels Market in China is valued at USD 372.10 million in 2025, with daily moisturizer gels holding 49.1% share (USD 182.70 million), followed closely by overnight and after-sun soothing gels at 50.9% (USD 189.40 million). The dominance of daily moisturizers reflects the country’s urban millennial and Gen Z consumer base, where hydration-focused skincare is seen as a core step in routine beauty regimens. The opportunity lies in premiumizing this category with multifunctional gels that not only hydrate but also target brightening and anti-aging concerns.

This advantage positions daily moisturizer gels as the gateway product for first-time users, creating opportunities for brands to upsell into overnight repair and treatment gels. Cross-border e-commerce and social commerce platforms such as Tmall, JD.com, and Douyin further enhance accessibility, allowing domestic players to compete with international giants. With the regulatory environment encouraging functional cosmetics innovation, China presents a fertile ground for expansion into clean-label, dermatologist-tested, and premium biopolymer-based hydrating gels.

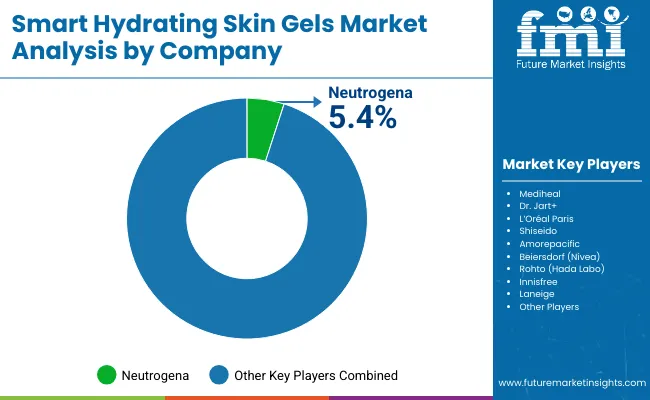

| Companies | Global Value Share 2025 |

|---|---|

| Neutrogena | 5.4% |

| Others | 94.6% |

The Smart Hydrating Skin Gels Market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused specialists competing across hydration, anti-aging, and soothing segments. Leading global players such as Neutrogena, L’Oréal Paris, and Shiseido hold notable market share, driven by their wide distribution networks, dermatologist-backed formulations, and investment in hydrogel and hyaluronic acid innovations. Their strategies emphasize ingredient transparency, sustainability in packaging, and digital-first engagement, ensuring strong resonance with both premium and mass consumers.

Established mid-sized brands, including Mediheal, Dr. Jart+, and Innisfree, focus on sheet/patch gel masks and overnight repair gels that appeal to younger demographics and K-beauty inspired skincare routines. These companies accelerate adoption through affordable masstige pricing, influencer marketing, and hybrid retail models, making them highly relevant in Asia-Pacific and Western markets.

Specialized providers, such as Laneige, Rohto (Hada Labo), and niche D2C players, emphasize innovation-driven niches, including microbiome-friendly gels, biopolymer-based hydration systems, and clean-label soothing gels. Their strength lies in customization, rapid trend adaptation, and strong digital presence, even if they lack the scale of global giants. Competitive differentiation is shifting away from basic hydration claims toward ecosystem-driven strategies that integrate personalized skincare apps, subscription refills, and AR-based product recommendations. The winning brands are those that combine clinical efficacy, consumer trust, and digital engagement to capture long-term loyalty in a crowded market.

Key Developments in Smart Hydrating Skin Gels Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3,402.4 Million |

| Technology | Hydrogel with humectant reservoirs, Phase-change moisture lock, Biopolymer (alginate/chitosan) gels, Occlusive film-forming gels |

| Use Case | Daily moisturizer gel, Mask/overnight gel, After-sun/soothing gel |

| Ingredient Highlight | Hyaluronic acid complexes, Ceramides & NMFs, Aloe/centella complexes |

| Product Format | Jar & pump gel creams, Sheet/patch gel masks, Leave-on overnight gels |

| Channel | DTC brand websites, E-commerce marketplaces, Specialty beauty retail, Drugstore/pharmacy |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Neutrogena, Mediheal, Dr. Jart+, L’Oréal Paris, Shiseido, Amorepacific, Beiersdorf (Nivea), Rohto (Hada Labo), Innisfree, Laneige |

| Additional Attributes | Dollar sales by scanner type and end-use industry, adoption trends in reverse engineering and quality control, rising demand for handheld and portable 3D scanners, sector-specific growth in aerospace, automotive, and healthcare, software and services revenue segmentation, integration with AR/VR and digital twin technologies, regional trends influenced by digitization initiatives, and innovations in laser triangulation, structured light, and photogrammetry methods. |

The global Smart Hydrating Skin Gels Market is estimated to be valued at USD 3,402.4 million in 2025.

The market size for the Smart Hydrating Skin Gels Market is projected to reach USD 8,903.3 million by 2035.

The Smart Hydrating Skin Gels Market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key Technology types in Smart Hydrating Skin Gels Market are hydrogel with humectant reservoirs, phase-change moisture lock gels, biopolymer (alginate/chitosan) gels, and occlusive film-forming gels.

In terms of use case, the daily moisturizer gel segment is set to command a 52.5% share of the Smart Hydrating Skin Gels Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair Market Forecast and Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Smart Doorbell Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA