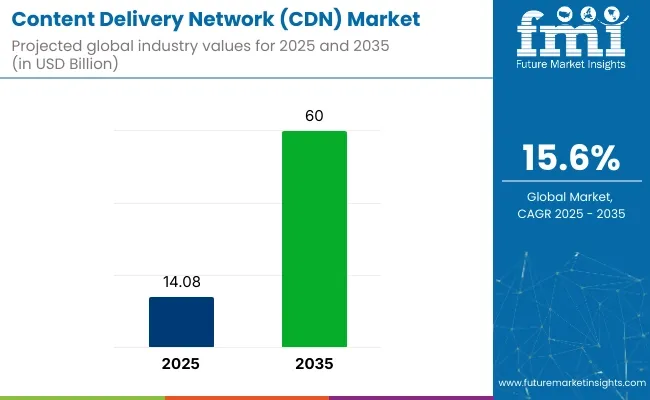

The global content delivery network (CDN) market is worth USD 14.08 billion in 2025 and is slated to reach USD 60 billion by 2035, which shows a robust CAGR of 15.6% over the forecast period. This growth is being driven by the exponential rise in data consumption, video streaming, gaming, and real-time content delivery across mobile and desktop platforms.

CDNs play a critical role in accelerating content distribution, minimizing latency, and enhancing user experiences by delivering digital assets via edge servers. As internet penetration deepens globally and more businesses shift to digital-first models, demand for scalable, secure, and low-latency content delivery is intensifying.

Technological advancements in edge computing, 5G infrastructure, AI-based traffic routing, and real-time analytics are further driving CDN adoption. Major service providers are investing in global data center expansions, content caching, and network optimization tools to support high-resolution streaming, virtual reality content, and dynamic web applications.

The growth of OTT platforms, cloud gaming, e-learning, and enterprise SaaS solutions has intensified the need for intelligent CDN services that can adapt to rapidly changing traffic patterns and user behavior. CDN platforms are also evolving with integrated cybersecurity features, including DDoS mitigation and bot protection, to ensure safe and uninterrupted content delivery.

Government policies and data compliance regulations are shaping the CDN landscape, particularly with regard to data sovereignty and localization. Regions such as the European Union enforce strict GDPR mandates, requiring CDN providers to ensure compliance in data storage and access control. Meanwhile, growing emphasis on digital infrastructure development in Asia-Pacific and the Middle East is opening up new market opportunities.

As content delivery becomes essential to digital economies, the CDN market is expected to expand rapidly, supported by rising cloud adoption, hybrid network architectures, and increasing enterprise investment in digital transformation strategies. Thus, these factors are contributing to the growth of the market.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 14.08 billion |

| Industry Value (2035F) | USD 60 billion |

| CAGR (2025 to 2035) | 15.6% |

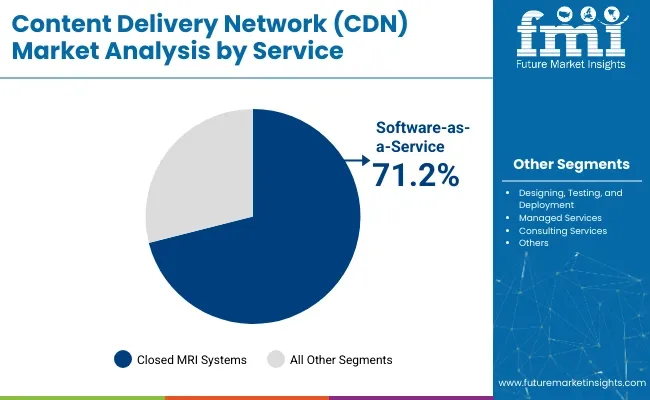

The market is segmented based on service, application, vertical, service provider, and region. By service, the market is divided into designing, testing, and deployment, software-as-a-service, managed services, and consulting services. In terms of application, it is categorized into media distribution/delivery, software distribution/delivery, website caching, and others (online gaming, video conferencing, e-learning platforms, and live event broadcasting).

Based on vertical, the market includes media & entertainment, e-commerce, IT & telecom, healthcare, government, advertisement, and others (online education, financial services, travel & hospitality, and gaming platforms).

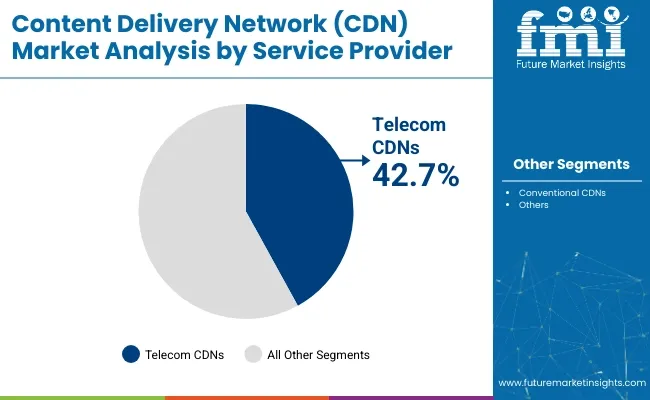

By service provider, the market is segmented into telecom CDNs, conventional CDNs, and others (cloud service providers, hybrid CDN vendors, enterprise CDN operators, and peer-to-peer (P2P) CDNs). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The software-as-a-service (SaaS) segment is projected to dominate the service category, accounting for 71.2% of the CDN market share in 2025. This dominance is supported by the scalability, ease of deployment, and cost-efficiency of SaaS models. Organizations prefer SaaS CDN offerings because they eliminate hardware dependencies, reduce setup complexity, and provide seamless infrastructure management through cloud-native platforms.

Real-time updates, simplified user interfaces, and integrated analytics make SaaS platforms particularly valuable for dynamic content distribution, live media streaming, and agile website performance. As digital transformation accelerates, SaaS solutions are favored by businesses of all sizes from startups to global enterprises looking to optimize content delivery across geographies without heavy infrastructure investments.

Managed services and consulting services continue to grow steadily, offering enterprises strategic guidance and operational support. This segment accounts for 24% share in 2025. Designing, testing, and deployment services remain critical for custom implementations, especially for sectors with high regulatory or performance standards.

Meanwhile, telecom CDNs and conventional service providers are partnering with cloud-based SaaS vendors to offer hybrid deployment models. These integrated systems support adaptive bitrate streaming, latency reduction, and edge computing integration. With strong demand across media, e-commerce, and education, the SaaS segment remains at the core of content delivery strategies and is projected to maintain its lead over the forecast period.

| Service | Share (2025) |

|---|---|

| Software-as-a-Service | 71.2% |

| Managed Services | 24% |

Website caching is emerging as the fastest-growing application in the CDN market, projected to expand at a CAGR of 6.8% from 2025 to 2035, accounting for 54% share. This segment thrives on its ability to enhance website performance by temporarily storing frequently accessed content closer to end users.

As online platforms scale to accommodate growing traffic, CDNs with advanced caching capabilities are preferred to ensure reduced latency, improved load times, and consistent user experience. With minimal backend strain, website caching solutions help prevent server overload during peak periods such as online sales events, product launches, or viral content surges. This positions them as a fundamental layer for high-traffic websites across sectors including e-commerce, news, streaming, and education.

Media distribution and software delivery remain key CDN applications but often operate alongside caching features. This segment accounts for 22% share. These workflows benefit from dynamic content acceleration and edge storage capabilities, especially for heavy payloads like videos, large software packages, or enterprise applications.

The “others” category including live event streaming, gaming platforms, and video conferencing is expanding, driven by rising user engagement and real-time interaction. As digital ecosystems evolve to support immersive and interactive content, website caching is expected to remain a strategic priority for CDN vendors offering performance-centric, cost-effective solutions.

| Application | Share (2025) |

|---|---|

| Website Caching | 54% |

| Media Distribution/Delivery | 22% |

The IT & telecom segment is expected to witness the fastest growth in the CDN market, projected to expand at a CAGR of 6.7% from 2025 to 2035 and registers 30% share. This growth is driven by escalating demand for real-time data delivery, software updates, and streaming services across distributed networks.

Telecom operators and technology providers increasingly rely on CDN infrastructure to reduce latency, minimize network congestion, and improve content transmission efficiency. As 5G deployment expands globally, the need for edge computing, network slicing, and low-latency streaming further intensifies CDN integration within the telecom ecosystem.

Media & entertainment continues to be the dominant vertical due to high bandwidth usage in OTT platforms, music streaming, and video-on-demand services. The media & entertainment segment occupies 23% share. Meanwhile, the e-commerce sector benefits from faster page loads, personalized content delivery, and secure transaction handling via CDN support. Healthcare applications are also emerging, particularly for telemedicine, cloud-based diagnostics, and medical training platforms.

The advertisement sector uses CDNs to deliver dynamic ad content in real time, optimizing campaign performance. With digital infrastructure becoming foundational to global connectivity, the IT & telecom sector is expected to remain the fastest-growing end-use vertical, driving innovations in CDN architecture and service delivery models.

| Vertical | Share (2025) |

|---|---|

| IT & Telecom | 30% |

| Media & Entertainment | 23% |

The telecom CDNs segment is projected to hold a strong position in the global market, accounting for 42.7% share in 2025. These CDNs benefit from existing broadband infrastructure, deep network penetration, and strong peering arrangements, allowing them to deliver content faster and with lower latency.

Telecom providers are leveraging their physical network advantages to reduce last-mile delivery costs and integrate CDN functionalities directly within their backbone. This is particularly beneficial for streaming services, OTT platforms, and mobile content, where low buffering and rapid response are essential to user satisfaction. Conventional CDN providers are expected to maintain significant relevance in the market. This segment witnesses 28% share.

These players, often independent from telecom carriers, rely on globally distributed server networks, smart caching, and dynamic routing to deliver scalable performance. They are particularly favored by multinational enterprises and large-scale platforms that require neutrality and global consistency.

The “others” category, comprising cloud service providers, hybrid CDN vendors, enterprise CDN operators, and peer-to-peer (P2P) CDNs, is gaining strong traction.

These providers offer customizable, software-defined, and edge-enabled solutions that are ideal for startups, IoT platforms, and decentralized content ecosystems seeking flexibility and speed in deployment. Their ability to provide cost-effective, on-demand scalability is expected to support their growing influence across the evolving CDN landscape.

| Service Provider | Share (2025) |

|---|---|

| Telecom CDNs | 42.7% |

| Conventional CDNs | 28% |

Increasing Preference for CDN Services for Dynamic Content Needs

Content delivery networks are highly competitive in quality of service in terms of digital content distribution. Consequently, market players leverage edge servers for localized caching, making dynamic security essential.

Software-defined networking (SDN) and network function virtualization (NFV) technologies are rapidly gaining ground, providing services with high-performance standards without requiring massively distributed infrastructure and generating key opportunities with large-scale cloud systems.

Content delivery networks not only improve speed and quality for video content and streaming, but they also provide high levels of reliable security and superior efficacy in terms of scalability, owing to lower data storage costs and the outsourcing of content management.

Cloud-based CDNs are gaining traction due to their scalability, flexibility, and cost-effectiveness. Cloud-based services, including Software-as-a-Service (SaaS), Infrastructure-as-a-Service (IaaS), and Platform-as-a-Service (PaaS), rely on CDNs to efficiently distribute data and applications to end-users worldwide.

As mobile internet usage continues to grow, there is a growing need for CDN services tailored specifically for mobile devices. Mobile CDNs optimize content delivery for mobile networks, reducing latency and improving the user experience on smartphones and tablets. This trend is driven by the increasing number of mobile applications and the demand for fast and reliable mobile content delivery.

Hybrid and Multi-CDN Strategies in Content Delivery Network Presents Lucrative Opportunities for Businesses

Traditional hardware-based CDNs are being replaced by cloud-based solutions that offer better performance, global reach, and easier management. Cloud CDN providers leveraged edge computing and distributed server infrastructure to deliver content efficiently.

CDNs offer security features, including DDoS protection, web application firewalls, and SSL/TLS encryption, which are vital for protecting websites and online services from cyber threats. As the frequency and sophistication of cyber-attacks increase, the demand for CDN-based security solutions is expected to rise.

CDNs could explore opportunities in emerging technologies such as virtual reality (VR), augmented reality (AR), and immersive media. These technologies require low latency, high bandwidth, and reliable content delivery, making CDNs an integral part of their ecosystem.

Many organizations adopt hybrid or multi-CDN strategies to improve performance, scalability, and redundancy. CDNs can capitalize on this trend by offering integrated solutions, analytics, and management tools to optimize content delivery across multiple providers.

Shift of Key Players to In-house CDN Infrastructure and Network Connectivity Issues Hamper Demand for CDNs

Some key organizations are shifting away from third-party CDN services and toward deploying their content delivery network customized to their individual needs. Viruses and cyberattacks are on the rise as more people utilize video streaming solutions to watch movies and advertise. The lack of appropriate standards and procedures for discovering and regulating video content could impede market expansion.

The industry is projected to be restrained by high-cost technology, insufficient connectivity, the need for high-quality service, and data security and privacy concerns. Technical difficulties in live video streaming, complicated architecture, and service quality issues may stymie the market growth.

Implementing and maintaining a CDN can be costly, especially for smaller organizations or startups. CDN providers often charge fees based on bandwidth usage, storage, and the number of requests. These costs may limit the adoption of CDN services, particularly for organizations with limited budgets.

The effectiveness of a CDN relies on the availability and distribution of edge servers across various geographic locations. However, in some regions or countries with limited network infrastructure, it may be challenging to establish an extensive CDN presence. This limitation can impact the overall performance and availability of CDN services in those regions.

Once an organization has integrated a specific CDN provider into its infrastructure, it may face challenges in switching to another provider due to potential vendor lock-in. Migrating from one CDN provider to another can be time-consuming, costly, and disruptive to the organization's operations. This vendor lock-in can limit the flexibility and competitiveness of the CDN market.

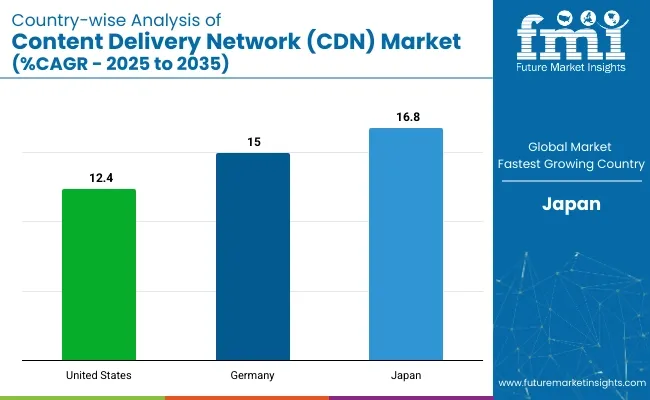

| Countries | 2025 Value Share in Global Market |

|---|---|

| United States | 12.4% |

| Germany | 15% |

| Japan | 16.8% |

The United States content delivery network market is witnessing steady growth owing to the high penetration of smart devices, higher adoption rates by SMEs, and widespread penetration of the internet. In addition, increasing acceptance of cloud-based services, deployment of high-speed data networks, and rising demand for smartphones are likely to drive market expansion in the United States. Another key element driving the usage of content delivery network solutions in the country is an increase in leisure spending.

The United States has witnessed a substantial surge in video streaming services, including OTT platforms and live streaming. CDNs are vital in delivering high-quality video content with reduced latency and buffering issues.

Enterprises in the United States are increasingly adopting multi-CDN strategies to enhance performance and reliability. By utilizing multiple CDN providers simultaneously, businesses can mitigate the risk of a single point of failure and ensure optimal content delivery across different regions.

Key players like Akamai Technologies, Fastly, and Cloudflare are driving innovation through partnerships, acquisitions, and the integration of emerging technologies. As the digital landscape evolves, the United States content delivery network market is expected to continue its growth trajectory, providing improved content delivery and enhanced user experiences.

Germany has a high level of internet penetration, with a large portion of the population having access to high-speed broadband connections. This factor has contributed to the growing demand for CDNs to deliver content seamlessly across various devices and platforms.

The popularity of video streaming services has surged in Germany, with an increasing number of consumers opting for on-demand content. CDNs are crucial in delivering high-quality video content, reducing buffering time, and ensuring a smooth streaming experience.

Germany has stringent data protection laws and regulations, such as the General Data Protection Regulation (GDPR). CDNs that offer enhanced data privacy measures, including data encryption, secure content delivery, and compliance with privacy regulations, are gaining popularity in the German content delivery network market.

Key players are strategically expanding their presence and focusing on technological advancements. In 2022, Deutsche Telekom, one of the leading telecommunications companies in Germany, partnered with Akamai, a global CDN provider. This collaboration aims to enhance the CDN infrastructure in Germany, providing improved content delivery capabilities and a better user experience.

The market in Japan has been witnessing significant growth in recent years due to

CDN providers in Japan are increasingly integrating edge computing capabilities into their networks. By placing content delivery servers closer to end-users, they can reduce latency and improve the overall performance of content delivery.

Japan has a distinct cultural and linguistic landscape, which creates a unique demand for localized content delivery. CDN providers are catering to this demand by offering localized edge servers, language-specific content caching, and support for Japan-specific content formats.

Japan has a thriving gaming industry, and CDN providers are capitalizing on this trend. They are developing specialized CDN solutions for game developers and publishers to optimize game downloads, updates, and multiplayer experiences.

The Japanese government has initiated the "Connected Japan" project to enhance digital infrastructure across the country. This initiative is expected to create opportunities for CDN providers to collaborate and deploy their services on a larger scale.

The United Kingdom content delivery network market has grown significantly in recent years. The popularity of video streaming services such as Netflix, Amazon Prime Video, and Disney+ has led to a surge in demand for CDN solutions to ensure smooth and buffer-free streaming experiences for users.

The United Kingdom has seen a substantial shift toward cloud computing, leading to increased reliance on CDN solutions for delivering content efficiently and securely from cloud servers to end users.

There is a growing emphasis on sustainability in the United Kingdom, including the CDN market. Key players are investing in eco-friendly infrastructure, renewable energy sources, and efficient data centers to reduce their carbon footprint.

Key players like Akamai Technologies, Cloudflare, Fastly, Limelight Networks, and Amazon Web Services are actively shaping the market with ongoing developments, partnerships, and strategies. They are catering to the evolving needs of businesses and content providers in the country.

China is a fast-growing market for content delivery networks. The growth can be attributed to the rapid spread of the e-Commerce sector, and the media and entertainment industry. Key players are investing heavily in high-speed network installations, which makes the deployment of content delivery networks essential in the country.

The China content delivery network market is witnessing substantial growth. China has the maximum number of internet users globally, with over 900 million people connected to the internet. This has led to a surge in online content consumption, driving the demand for efficient CDN services.

China's population is highly reliant on mobile devices for accessing the internet. With the widespread adoption of smartphones and 5G technology, there is a growing need for CDN solutions that can deliver content seamlessly across various mobile platforms.

The use of content delivery network solutions is likely to rise as a result of several initiatives done by government organizations that have enabled quick and secure data delivery management.

China's e-commerce industry is thriving, with many consumers engaging in online shopping. CDN services play a vital role in delivering fast and secure e-commerce platforms, reducing latency, and enhancing the overall user experience.

Leading CDN providers in China, such as ChinaCache, BaishanCloud, and Tencent Cloud, have been receiving significant investments to expand their infrastructure and enhance service capabilities. These investments aim to meet the rising demand for CDN services and improve nationwide network coverage.

India content delivery network market is likely to witness substantial growth compared to other countries during the forecast period.

India has experienced remarkable growth in internet penetration, driven by affordable smartphones, low data tariffs, and government initiatives such as Digital India. This has resulted in a surge in online content consumption, creating a demand for efficient content delivery networks.

India is predominantly a mobile-first market, with a significant portion of the population accessing the internet through smartphones. CDN providers are increasingly focusing on mobile optimization and edge caching strategies to enhance the mobile user experience and reduce latency.

India is a linguistically diverse country with a growing demand for regional language content. CDN providers are customizing their solutions to support the delivery of localized content in various Indian languages, catering to the preferences of regional audiences.

Content delivery network service providers are extensively focused on strategic partnerships within the industry and with end-user corporations to set up sustainable long-term revenue strategies and to aid in faster product development.

Content delivery solution providers are paying attention to key opportunities arising from video-on-demand and video conferencing applications.

Azure Content Delivery Network (CDN): Microsoft's CDN offering is called Azure CDN. It is an integrated part of the Microsoft Azure cloud platform, providing global content delivery and acceleration services. Azure CDN leverages Microsoft's extensive network infrastructure and offers features such as dynamic site acceleration, media delivery, and security enhancements.

Microsoft Corporation introduced the CDN service specifically for private enterprises in September 2022. The CDN service is known as the Enterprise Content Delivery Network (eCDN). It aims to optimize content delivery by utilizing the private network infrastructure of enterprise users. The primary focus of eCDN is to improve the quality of live video streaming throughout the organization.

Google Cloud CDN: Google Cloud CDN is part of the Google Cloud Platform and offers content delivery services integrated with other Google Cloud services. Google has been investing in expanding its CDN presence, improving performance, and integrating CDN capabilities with its broader cloud ecosystem.

In April 2022, Google introduced its Media CDN for content delivery. This platform leverages a robust infrastructure similar to that of YouTube to ensure efficient content distribution. Additionally, Media CDN offers ad insertion technologies that enable users to dynamically place advertisements within video content.

Fastly: Fastly is a CDN provider that emphasizes real-time content delivery and edge computing capabilities. Their platform enables developers to build and deploy custom CDN solutions. Fastly has been working on expanding its customer base, improving its edge cloud platform, and enhancing security features.

In March 2022, Fastly Inc., a renowned provider of the world's fastest edge cloud network and content, acquired Fanout. Fanout is a platform that specializes in simplifying the development and scalability of real-time and streaming APIs. The goal is to enhance client performance, security, and innovation. As a result, this acquisition is a perfect fit for Fastly's strategy.

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 14.08 billion |

| Projected Market Size (2035) | USD 60 billion |

| CAGR (2025 to 2035) | 15.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value and petabytes per second (PBps) for volume |

| By Service | Designing, Testing, and Deployment; Software-as-a-Service; Managed Services; Consulting Services |

| By Application | Media Distribution/Delivery, Software Distribution/Delivery, Website Caching, Others (Online Gaming, Video Conferencing, E-Learning Platforms, Live Event Broadcasting) |

| By Vertical | Media & Entertainment, E-Commerce, IT & Telecom, Healthcare, Government, Advertisement, Others (Online Education, Financial Services, Travel & Hospitality, Gaming Platforms) |

| By Service Provider | Telecom CDNs, Conventional CDNs, Others (Cloud Service Providers, Hybrid CDN Vendors, Enterprise CDN Operators, Peer-to-Peer (P2P) CDNs) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, United Kingdom, France, Germany, Japan |

| Key Players | Akamai Technologies Inc., Cloudflare Inc., Microsoft Corporation, Lumen Technologies, Edgio, CDNetworks Co. Ltd., Orange S.A., AT&T, Deutsche Telekom AG, StackPath LLC, Fastly, Imperva, Tencent Cloud, Broadpeak, Quantil, Google |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The global CDN market is expected to reach USD 60 billion by 2035, up from USD 14.08 billion in 2025, growing at a CAGR of 15.6% over the forecast period.

Software-as-a-Service (SaaS) is projected to lead the market with 71.2% share in 2025, driven by its scalability, ease of deployment, and cloud-native advantages for streaming, website optimization, and agile content delivery.

Website caching is expected to be the fastest-growing application, expanding at a CAGR of 6.8% from 2025 to 2035, due to its ability to reduce latency, improve user experience, and optimize server loads during peak traffic.

The IT & telecom sector is forecasted to grow at the fastest rate, with a CAGR of 6.7%, fueled by 5G deployment, cloud services, and real-time data delivery demands across global telecom infrastructures.

Leading companies include Akamai Technologies Inc., Cloudflare Inc., Microsoft Corporation, Lumen Technologies, Edgio, Fastly, StackPath LLC, Tencent Cloud, and Google each offering scalable and secure CDN platforms worldwide.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Vertical, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Service Provider, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Vertical, 2019 to 2034

Table 10: North America Market Value (US$ Million) Forecast by Service Provider, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 14: Latin America Market Value (US$ Million) Forecast by Vertical, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Service Provider, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 17: Western Europe Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 18: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Vertical, 2019 to 2034

Table 20: Western Europe Market Value (US$ Million) Forecast by Service Provider, 2019 to 2034

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Vertical, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Service Provider, 2019 to 2034

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Vertical, 2019 to 2034

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Service Provider, 2019 to 2034

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: East Asia Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 33: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 34: East Asia Market Value (US$ Million) Forecast by Vertical, 2019 to 2034

Table 35: East Asia Market Value (US$ Million) Forecast by Service Provider, 2019 to 2034

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Service, 2019 to 2034

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Vertical, 2019 to 2034

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Service Provider, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Service, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Vertical , 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Service Provider, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 13: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 14: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 15: Global Market Value (US$ Million) Analysis by Vertical , 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Vertical , 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Vertical , 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by Service Provider, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Service Provider, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Service Provider, 2024 to 2034

Figure 21: Global Market Attractiveness by Service, 2024 to 2034

Figure 22: Global Market Attractiveness by Application, 2024 to 2034

Figure 23: Global Market Attractiveness by Vertical , 2024 to 2034

Figure 24: Global Market Attractiveness by Service Provider, 2024 to 2034

Figure 25: Global Market Attractiveness by Region, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Service, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Vertical , 2024 to 2034

Figure 29: North America Market Value (US$ Million) by Service Provider, 2024 to 2034

Figure 30: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by Vertical , 2019 to 2034

Figure 41: North America Market Value Share (%) and BPS Analysis by Vertical , 2024 to 2034

Figure 42: North America Market Y-o-Y Growth (%) Projections by Vertical , 2024 to 2034

Figure 43: North America Market Value (US$ Million) Analysis by Service Provider, 2019 to 2034

Figure 44: North America Market Value Share (%) and BPS Analysis by Service Provider, 2024 to 2034

Figure 45: North America Market Y-o-Y Growth (%) Projections by Service Provider, 2024 to 2034

Figure 46: North America Market Attractiveness by Service, 2024 to 2034

Figure 47: North America Market Attractiveness by Application, 2024 to 2034

Figure 48: North America Market Attractiveness by Vertical , 2024 to 2034

Figure 49: North America Market Attractiveness by Service Provider, 2024 to 2034

Figure 50: North America Market Attractiveness by Country, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Service, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) by Vertical , 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) by Service Provider, 2024 to 2034

Figure 55: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 59: Latin America Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Vertical , 2019 to 2034

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Vertical , 2024 to 2034

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Vertical , 2024 to 2034

Figure 68: Latin America Market Value (US$ Million) Analysis by Service Provider, 2019 to 2034

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Service Provider, 2024 to 2034

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Service Provider, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Service, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 73: Latin America Market Attractiveness by Vertical , 2024 to 2034

Figure 74: Latin America Market Attractiveness by Service Provider, 2024 to 2034

Figure 75: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Service, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 78: Western Europe Market Value (US$ Million) by Vertical , 2024 to 2034

Figure 79: Western Europe Market Value (US$ Million) by Service Provider, 2024 to 2034

Figure 80: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 84: Western Europe Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 87: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 90: Western Europe Market Value (US$ Million) Analysis by Vertical , 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Vertical , 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Vertical , 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) Analysis by Service Provider, 2019 to 2034

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Service Provider, 2024 to 2034

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Service Provider, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Service, 2024 to 2034

Figure 97: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 98: Western Europe Market Attractiveness by Vertical , 2024 to 2034

Figure 99: Western Europe Market Attractiveness by Service Provider, 2024 to 2034

Figure 100: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) by Service, 2024 to 2034

Figure 102: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 103: Eastern Europe Market Value (US$ Million) by Vertical , 2024 to 2034

Figure 104: Eastern Europe Market Value (US$ Million) by Service Provider, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Vertical , 2019 to 2034

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Vertical , 2024 to 2034

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Vertical , 2024 to 2034

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Service Provider, 2019 to 2034

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Service Provider, 2024 to 2034

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Service Provider, 2024 to 2034

Figure 121: Eastern Europe Market Attractiveness by Service, 2024 to 2034

Figure 122: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 123: Eastern Europe Market Attractiveness by Vertical , 2024 to 2034

Figure 124: Eastern Europe Market Attractiveness by Service Provider, 2024 to 2034

Figure 125: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 126: South Asia and Pacific Market Value (US$ Million) by Service, 2024 to 2034

Figure 127: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 128: South Asia and Pacific Market Value (US$ Million) by Vertical , 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) by Service Provider, 2024 to 2034

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Vertical , 2019 to 2034

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vertical , 2024 to 2034

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vertical , 2024 to 2034

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Service Provider, 2019 to 2034

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service Provider, 2024 to 2034

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service Provider, 2024 to 2034

Figure 146: South Asia and Pacific Market Attractiveness by Service, 2024 to 2034

Figure 147: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 148: South Asia and Pacific Market Attractiveness by Vertical , 2024 to 2034

Figure 149: South Asia and Pacific Market Attractiveness by Service Provider, 2024 to 2034

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 151: East Asia Market Value (US$ Million) by Service, 2024 to 2034

Figure 152: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) by Vertical , 2024 to 2034

Figure 154: East Asia Market Value (US$ Million) by Service Provider, 2024 to 2034

Figure 155: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 159: East Asia Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 162: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 165: East Asia Market Value (US$ Million) Analysis by Vertical , 2019 to 2034

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Vertical , 2024 to 2034

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Vertical , 2024 to 2034

Figure 168: East Asia Market Value (US$ Million) Analysis by Service Provider, 2019 to 2034

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Service Provider, 2024 to 2034

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Service Provider, 2024 to 2034

Figure 171: East Asia Market Attractiveness by Service, 2024 to 2034

Figure 172: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 173: East Asia Market Attractiveness by Vertical , 2024 to 2034

Figure 174: East Asia Market Attractiveness by Service Provider, 2024 to 2034

Figure 175: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Value (US$ Million) by Service, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 178: Middle East and Africa Market Value (US$ Million) by Vertical , 2024 to 2034

Figure 179: Middle East and Africa Market Value (US$ Million) by Service Provider, 2024 to 2034

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Service, 2019 to 2034

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Service, 2024 to 2034

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service, 2024 to 2034

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Vertical , 2019 to 2034

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Vertical , 2024 to 2034

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vertical , 2024 to 2034

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Service Provider, 2019 to 2034

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Service Provider, 2024 to 2034

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service Provider, 2024 to 2034

Figure 196: Middle East and Africa Market Attractiveness by Service, 2024 to 2034

Figure 197: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 198: Middle East and Africa Market Attractiveness by Vertical , 2024 to 2034

Figure 199: Middle East and Africa Market Attractiveness by Service Provider, 2024 to 2034

Figure 200: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Content Analytics Discovery And Cognitive Systems Market Size and Share Forecast Outlook 2025 to 2035

Content Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Content Distribution Software Market Size and Share Forecast Outlook 2025 to 2035

Content Creation Software Market Size and Share Forecast Outlook 2025 to 2035

Content Disarm and Reconstruction Market Size and Share Forecast Outlook 2025 to 2035

Content Creation Market Size and Share Forecast Outlook 2025 to 2035

Content Curation Software Market Size and Share Forecast Outlook 2025 to 2035

Content Experience Platforms Market Size and Share Forecast Outlook 2025 to 2035

Content Analytics, Discovery, and Cognitive Software Market Analysis by Product Type, End User, and Region through 2035

Content Service Platform Market Trends - Demand & Growth Forecast 2025 to 2035

Content Intelligence – AI-Powered Insights for Marketers

Content as a Service (CaaS) Market

Content Automation AI Tools Market

Content Protection and Watermarking Market

Content Delivery Network Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Japan’s content delivery network (CDN) Industry Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Content Delivery Network Security Market

AI-Powered Content Creation – Automating Digital Media

OTT Content Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA