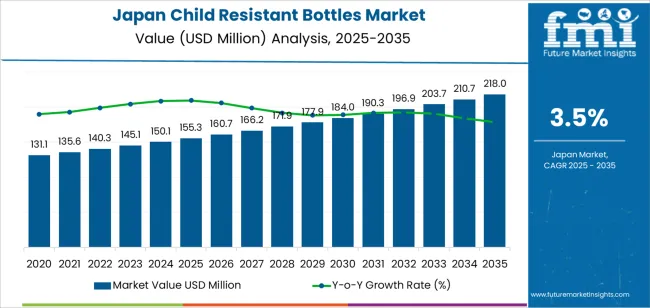

The demand for child resistant bottles in Japan is expected to grow from USD 155.3 million in 2025 to USD 218.0 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.5%. These bottles play a critical role in packaging products that need to be kept away from children for safety reasons, such as pharmaceuticals, household cleaners, and cannabis products. With increasing awareness of safety and the growing concern over child-proofing potentially dangerous substances, the demand for child resistant bottles will continue to rise across multiple industries. As the pharmaceutical and cannabis sectors expand, particularly with the growing acceptance and legalization of cannabis, the need for child resistant packaging will become even more significant.

In the pharmaceutical sector, child resistant packaging is crucial for medications that can be harmful if ingested by children. As Japan's aging population continues to grow, the demand for medications and treatments will rise, driving the need for more secure packaging. The cannabis industry, in particular, is expected to see a significant increase in the demand for child resistant packaging as the market expands. The ongoing development and regulation of this sector will require packaging solutions that ensure safety while also complying with strict government regulations.

Between 2025 and 2030, the demand for child resistant bottles in Japan is expected to increase from USD 155.3 million to USD 160.7 million. This steady growth is driven by the expanding need for safety packaging in key industries like pharmaceuticals, cannabis, and household products. As regulations become more stringent, manufacturers will continue to innovate in the design and functionality of child resistant bottles, ensuring they are not only secure but also easy for adults to open and use. These factors will contribute to gradual market growth during this period.

From 2030 to 2035, the demand for child resistant bottles is expected to rise more significantly, from USD 160.7 million to USD 218.0 million. This phase will see a pronounced increase in demand, driven by several key factors. First, the expanding pharmaceutical and cannabis markets will continue to fuel the need for secure packaging. As stricter regulations are enforced and consumer safety standards become more rigorous, demand for high-quality, child resistant packaging will increase. As consumer and regulatory pressure for more sustainable packaging grows, the market will see more innovations in eco-friendly materials that also meet safety standards. This shift towards more sustainable, yet secure packaging solutions will be a major contributor to market expansion during this period.

| Metric | Value |

|---|---|

| Demand for Child Resistant Bottles in Japan Value (2025) | USD 155.3 million |

| Demand for Child Resistant Bottles in Japan Forecast Value (2035) | USD 218.0 million |

| Demand for Child Resistant Bottles in Japan Forecast CAGR (2025 to 2035) | 3.5% |

The demand for child-resistant bottles in Japan is growing as regulatory requirements and consumer safety concerns rise, particularly in sectors such as pharmaceuticals, household chemicals, and consumer goods. These bottles play a critical role in preventing accidental ingestion by children, meeting both regulatory standards and the heightened focus on product safety. Japan’s strict packaging regulations, along with an increasing number of products requiring secure and tamper-proof packaging, are key drivers of this growth.

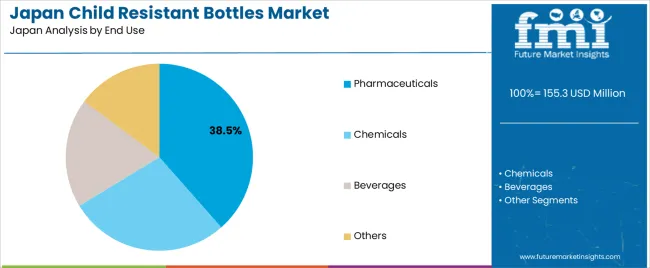

The pharmaceutical sector is a major contributor to this demand, with an increase in the use of liquid medicines and over-the-counter products, which necessitate child-resistant closures. Similarly, household cleaning products and chemicals require secure packaging solutions to reduce risks to children, further increasing the need for child-resistant bottles. As these industries continue to innovate and introduce more consumer-friendly products, the demand for packaging that balances accessibility for adults with safety for children will rise.

Advancements in packaging technology are also driving growth. Modern child-resistant bottles are designed to be easier to open for adults while maintaining effectiveness in preventing access by children. These innovations, coupled with the rising focus on consumer safety, contribute to the steady growth in demand for child-resistant bottles in Japan through 2035.

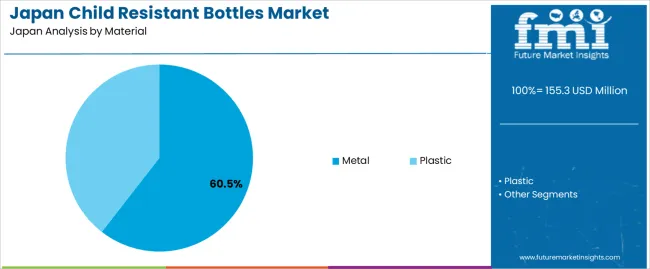

Metal bottles account for 61% of the demand for child resistant bottles in Japan. The preference for metal is driven by its durability, strength, and ability to provide a secure, tamper-evident seal, ensuring the contents remain protected. Metal is ideal for products that require an additional layer of security, such as pharmaceuticals and chemicals, where child safety is a key concern.

The sturdy nature of metal makes these bottles resistant to damage during transport and storage, maintaining the integrity of the packaging. Metal bottles are recyclable and can be more sustainable, which aligns with the growing environmental consciousness in Japan. The demand for child resistant packaging solutions in the pharmaceutical and chemical sectors, where the risk of accidental ingestion or tampering is high, ensures that metal bottles will continue to dominate this segment

Pharmaceuticals account for 39% of the demand for child resistant bottles in Japan. Child resistant packaging is a regulatory requirement in the pharmaceutical industry to prevent the accidental ingestion of potentially harmful medications, especially by children. Pharmaceuticals such as prescription drugs, over-the-counter medicines, and liquid medications require secure and reliable packaging that minimizes the risk of misuse or contamination.

The pharmaceutical industry's focus on patient safety, regulatory compliance, and public health has driven the high demand for child resistant bottles. As the prevalence of chronic diseases increases and the use of medication becomes more widespread, the demand for these packaging solutions continues to grow. Given the critical importance of preventing drug-related accidents, pharmaceuticals will remain the largest end-user of child resistant bottles in Japan.

Key drivers include stricter safety regulations and increasing regulatory focus on child safety in pharmaceuticals, household chemicals and nutraceuticals. Japanese consumers are also becoming more aware of accidental ingestion risks, prompting brands to adopt certified child‑resistant bottle formats. Demand is further stimulated by growth in e‑commerce and home delivery of chemical and pharmaceutical products, which require secure packaging during transit. Restraints include higher production costs for certified closures and bottles, which may challenge smaller domestic brands. Complexity in certification and testing for child‑resistant formats, especially for niche chemical or cosmetic products, adds time and cost. Legacy packaging and reluctance to change existing formats can slow adoption of new child‑resistant bottle types.

In Japan, demand for child‐resistant bottles is growing because pharmaceutical companies, household chemical producers and nutraceutical brands are under mounting pressure to ensure packaging prevents access by children while still being user‑friendly for adults. With an ageing population and more frequent home‑based medication and chemical product usage, the stakes for packaging safety have increased. The shift to online retail and direct delivery models means packaging must survive transit and storage in homes, raising demand for secure bottle solutions. As Japanese consumers prioritise both safety and convenience, brands adopt child‑resistant bottle formats to enhance trust, meet regulatory requirements and reduce liability risk.

Technological innovations are shaping the child‐resistant bottle segment in Japan by improving usability, material efficiency and compliance. New closure mechanisms such as push‑and‑turn, squeeze‑and‑turn and snap‑lock designs are engineered to meet stringent child‑resistance standards while remaining accessible to older adults. Materials technology is advancing with recyclable or lighter plastics and multi‐layer composites that maintain safety without significantly increasing weight or cost.

Manufacturing automation and quality‑control systems ensure consistent performance of child‑resistant closures in high volume. These innovations allow Japanese packaging producers to offer certified solutions that meet both regulatory requirements and consumer expectations, driving wider adoption across pharmaceutical, chemical and nutraceutical sectors.

Despite increasing demand, adoption of child‐resistant bottles in Japan faces several challenges. One major obstacle is cost: certified closures and bottles with child‐resistant features often command higher prices, which can be a disadvantage in highly competitive or low‑margin product segments. Certification and compliance processes are time‐consuming and require rigorous testing, adding to lead times and cost, which may discourage smaller manufacturers. Balancing child security with adult usability particularly for older populations common in Japan is technically challenging. Supply‑chain constraints, such as sourcing specialized closures or recyclable child‑resistant materials, may limit scalability and delay implementation across all product lines.

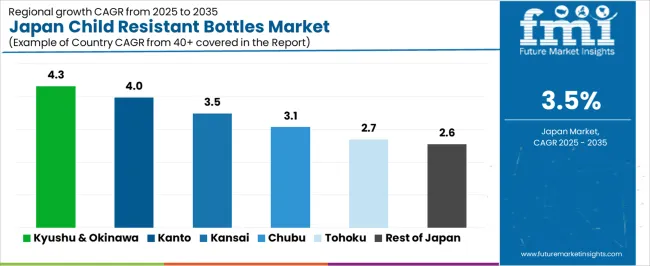

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.3 |

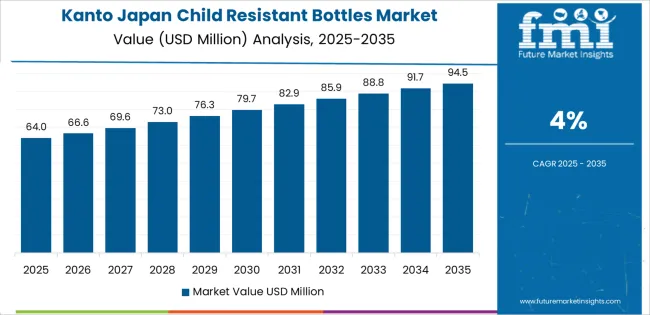

| Kanto | 4.0 |

| Kinki | 3.5 |

| Chubu | 3.1 |

| Tohoku | 2.7 |

| Rest of Japan | 2.6 |

Demand for child resistant bottles in Japan is growing steadily across all regions, with Kyushu & Okinawa leading at a 4.3% CAGR. This growth is supported by the region’s expanding pharmaceutical and consumer goods sectors, particularly in safety-conscious markets. Kanto follows with a 4.0% CAGR, driven by its large concentration of healthcare facilities and retail markets. Kinki shows a 3.5% CAGR, with demand rising due to the region's focus on packaging safety in pharmaceuticals and food products.

Chubu experiences a 3.1% CAGR, supported by its growing pharmaceutical and manufacturing industries. Tohoku sees a 2.7% CAGR, with steady demand driven by the increasing need for secure packaging in healthcare and consumer goods. The Rest of Japan shows the lowest growth at 2.6%, but steady adoption remains due to local manufacturing and regulatory compliance needs.

Kyushu & Okinawa are experiencing the highest demand for child resistant bottles in Japan, with a 4.3% CAGR. This growth is driven by the increasing regulation and safety standards within industries like pharmaceuticals, cannabis, and over-the-counter products. The region’s expanding pharmaceutical sector, coupled with the rise of regulated markets such as cannabis, has led to greater demand for child resistant packaging.

Kyushu, in particular, is home to several manufacturing hubs that cater to both local and international markets, where safety in packaging is a top priority. The region’s focus on ensuring product integrity and safety through compliant packaging solutions is supporting the growing adoption of child resistant bottles. As industries in Kyushu & Okinawa continue to expand and new regulations emerge, the demand for child resistant bottles will continue to increase, particularly in sectors that prioritize child safety.

Kanto is experiencing steady demand for child resistant bottles in Japan, with a 4.0% CAGR. The region’s strong pharmaceutical, healthcare, and consumer goods sectors are major drivers of this growth. Kanto, home to Tokyo and other key cities, has a high concentration of businesses in the healthcare and wellness industries, where child resistant packaging is crucial for safety and regulatory compliance. The region’s strict safety standards, particularly in pharmaceuticals and the growing legal cannabis market, are pushing for the use of child resistant bottles to ensure consumer safety.

With the increasing emphasis on packaging compliance in both local and international markets, businesses in Kanto are adopting child resistant packaging solutions to meet the evolving demand. As Kanto remains at the forefront of innovation in packaging technology, the region’s demand for child resistant bottles is expected to continue growing.

Kinki is experiencing moderate demand for child resistant bottles in Japan, with a 3.5% CAGR. The region’s demand is primarily driven by its large pharmaceutical and consumer goods industries, particularly in cities like Osaka and Kyoto. As the pharmaceutical sector continues to grow and more over-the-counter products enter the market, the need for child resistant packaging solutions has risen. Kinki’s focus on safety in both healthcare and consumer products is contributing to the steady adoption of these packaging solutions.

The region’s expanding retail and e-commerce markets, which see an increase in packaged goods being delivered to consumers’ homes, also contribute to the growing need for secure and safe packaging. Kinki’s emphasis on technological advancements in packaging solutions further drives the demand for child resistant bottles as manufacturers adopt more advanced and reliable systems to meet safety regulations.

Chubu is experiencing moderate demand for child resistant bottles in Japan, with a 3.1% CAGR. The region’s growing pharmaceutical and consumer goods sectors, especially in cities like Nagoya, are driving the demand for safe and secure packaging solutions. As industries in Chubu focus on maintaining high safety standards in packaging, particularly for pharmaceuticals, food, and over-the-counter products, the use of child resistant bottles has become more prevalent.

Chubu's manufacturing base continues to evolve with increased focus on compliance with safety regulations, particularly in the healthcare and chemicals industries. The region’s expanding focus on sustainability and innovation in packaging technologies is also contributing to the adoption of child resistant bottles. As Chubu’s industries continue to grow and new regulations emerge, the demand for child resistant packaging will remain an essential part of the region’s manufacturing processes.

Tohoku is experiencing steady demand for child resistant bottles in Japan, with a 2.7% CAGR. The region’s demand is primarily driven by the growing pharmaceutical and consumer products sectors, where safety in packaging is critical. Tohoku, known for its agricultural and manufacturing bases, has seen an increase in the production of over-the-counter medications and food products, all of which require secure, child resistant packaging.

With increasing health awareness and safety regulations in both local and international markets, the demand for child resistant bottles is expected to continue growing. As Tohoku’s pharmaceutical sector expands and more consumer goods are produced, packaging compliance remains a priority, further boosting demand for child resistant bottles. As the region focuses on improving product safety standards and adhering to regulatory requirements, Tohoku’s adoption of child resistant packaging is expected to remain steady.

The Rest of Japan is seeing the lowest demand for child resistant bottles in Japan, with a 2.6% CAGR. While the region does not have the same level of industrial activity as larger hubs like Kanto or Kyushu, demand for child resistant packaging remains steady. Regional pharmaceutical companies and local manufacturers of consumer goods, including food and over-the-counter products, are increasingly adopting child resistant bottles as part of their commitment to safety and regulatory compliance.

As the Rest of Japan continues to develop its healthcare and retail sectors, the need for secure packaging solutions that prevent access by children will remain a priority. Local manufacturers and small-scale producers are adopting these solutions to meet safety regulations and ensure the integrity of their products. As new safety standards are enforced, the demand for child resistant bottles in the Rest of Japan is expected to grow modestly.

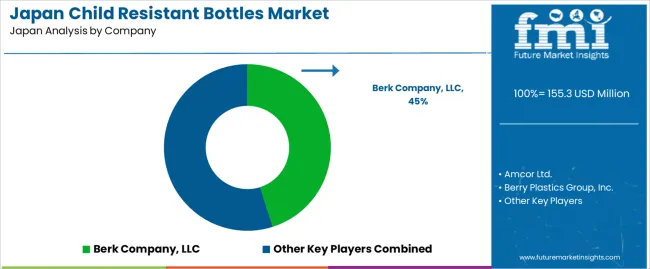

In Japan demand for child resistant bottles is driven by regulatory emphasis on safety for pharmaceuticals and household chemicals combined with an aging population that demands packaging designed for accessibility and security. Key firms competing in this space include Berk Company LLC with a 45.1% share, Amcor Ltd., Berry Plastics Group Inc., Gerresheimer AG and Alpha Packaging. These companies lead by supplying certified bottles and closures tailored to Japan’s regulatory and user needs environment.

Berk Company retains a strong position through its broad product portfolio, strong manufacturing presence and familiarity with Japan’s market standards for pharmaceutical and speciality packaging. The other players distinguish themselves via service capabilities such as custom moulding, high barrier materials, multi layer containers, and localized support. Because child resistant bottles must meet both rigorous safety tests and usability standards especially for older users the suppliers that align performance with ease of use and regulatory compliance succeed.

Competitive dynamics in the Japanese child resistant bottle sector are shaped by three central factors. First, the tightening of safety regulations for medications and hazardous household products drives demand for certified solutions. Second, innovation in closure technologies and materials e.g., push and turn mechanisms, tamper evident features, advanced plastics becomes a key differentiator. Third, pressure on cost and the need for efficient manufacturing and distribution create barriers for smaller suppliers. Firms that combine robust safety credentials, local service excellence and efficient supply chain execution are best positioned to win in Japan’s child resistant bottle segment.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Material | Metal, Plastic |

| Capacity | < 600 ml, 600 to 750 ml, 750 ml to 1,000 ml, 1,000 ml to 2,000 ml, > 2,000 ml |

| Closure Type | Screw Caps, Snap Caps, Flip Top Caps, Others |

| End Use | Pharmaceuticals, Chemicals, Beverages, Others |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Berk Company, LLC, Amcor Ltd., Berry Plastics Group, Inc., Gerresheimer AG, Alpha Packaging |

| Additional Attributes | Dollar sales by material type and capacity; regional CAGR and adoption trends; demand trends in child resistant bottles; growth in pharmaceuticals, chemicals, and beverage sectors; technology adoption for child-resistant closure mechanisms; vendor offerings including packaging solutions, design services, and integration solutions; regulatory influences and industry standards |

The demand for child resistant bottles in japan is estimated to be valued at USD 155.3 million in 2025.

The market size for the child resistant bottles in japan is projected to reach USD 218.0 million by 2035.

The demand for child resistant bottles in japan is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in child resistant bottles in japan are metal and plastic.

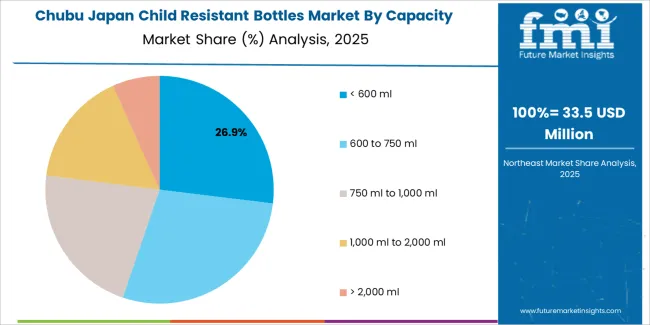

In terms of capacity, < 600 ml segment is expected to command 26.9% share in the child resistant bottles in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Child Resistant Bottles Market Size and Forecast

United States and Canada Child Resistant Bottles Market Size and Share Forecast Outlook 2025 to 2035

Child resistant Zipper Market Size and Share Forecast Outlook 2025 to 2035

Child-Resistant Pumps Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Re-Closable Edible Bags Market Size and Share Forecast Outlook 2025 to 2035

Child-Resistant Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Pouches Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Single Dose Pouches Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Pipette Closures Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Dropper Caps Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Locking Pouches Market from 2025 to 2035

Child-Resistant Containers Market Trends & Demand 2025 to 2035

Competitive Landscape of Child Resistant Re-Closable Edible Bags Providers

Market Share Distribution Among Child-Resistant Pouches Manufacturers

Leading Providers & Market Share in Child-Resistant Foil Packaging

Market Share Insights for Child Resistant Dropper Caps Manufacturers

Market Share Distribution Among Child Resistant Pipette Closures Manufacturers

Child Resistant Bags Market

Demand for Moisture-resistant Packaging in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Glass Cosmetic Bottles in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA