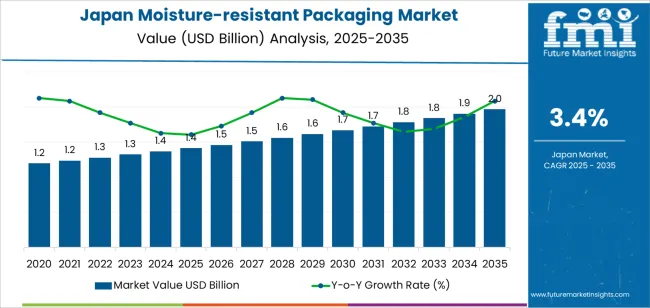

The demand for moisture-resistant packaging in Japan is valued at USD 1.4 billion in 2025 and is projected to reach USD 2.0 billion by 2035, reflecting a compound annual growth rate of 3.4%. Growth is influenced by the increasing use of packaging solutions that protect products from humidity, condensation and environmental exposure. Industries such as food, pharmaceuticals and personal care rely on moisture barriers to maintain product integrity during storage and transport. As product lines diversify and packaging requirements become more specialized, manufacturers continue to refine material structures and sealing technologies. These developments support rising adoption across retail and industrial applications where protection from moisture is essential for quality preservation and extended shelf life.

The growth curve shows a steady, incremental pattern, beginning at USD 1.2 billion in earlier years and progressing toward USD 1.4 billion in 2025 before reaching USD 2.0 billion by 2035. Yearly increases remain modest but consistent, moving from USD 1.5 billion in 2026 to USD 1.6 billion in 2027 and continuing upward across the forecast horizon. This gradual expansion reflects stable reliance on moisture-resistant formats across sectors where product degradation from humidity remains a key concern. As companies adopt improved films, coatings and multilayer structures to address varied packaging needs, demand continues to rise in line with production volumes and the broader shift toward protective packaging designs in Japan.

Demand in Japan for moisture resistant packaging is projected to increase from USD 1.4 billion in 2025 to USD 2.0 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 3.4%. Beginning at USD 1.2 billion in 2020, the value rises gradually each year USD 1.3 billion in 2024, USD 1.4 billion in 2025 and progresses through USD 1.6 billion by around 2029 before reaching USD 2.0 billion by 2035. Growth is driven by increasing demand in food, electronics, and pharmaceutical sectors for packaging that prevents moisture ingress, extends shelf life and maintains product integrity during transport and storage.

The value uplift over the decade is approximately USD 0.6 billion, reflecting modest but steady opportunity. Early years of the forecast are characterised by baseline volume growth, incremental adoption of improved barrier formats, with the latter half of the period more influenced by premiumisation of materials and innovation in moisture barrier technology. As manufacturers adopt higher performance films, coatings and packaging formats to meet stricter product protection requirements, the average value per unit rises. Additionally, growth in e-commerce, longer supply chains and increased sensitivity to moisture damage in various product categories support the gradual upward trend toward USD 2.0 billion by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.4 billion |

| Forecast Value (2035) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The demand for moisture-resistant packaging in Japan is largely driven by the need to protect products in sectors such as food & beverage, pharmaceuticals, electronics and personal care from humidity and moisture exposure. Japan’s humid climate and the high value placed on product quality and shelf life prompt manufacturers to adopt packaging formats that keep contents dry. The growth of convenience foods, ready-to-eat meals and pharmaceuticals used in home care settings adds urgency to this need. At the same time, increasing e-commerce shipments require packaging that can endure longer transit and variable storage conditions.

Brand owners in Japan are responding by specifying barrier films, multi-layer laminates and moisture-protective coatings that maintain product integrity while conforming to recycling and sustainability goals. The shift toward smaller households and single-serve formats amplifies the importance of packaging that prevents spoilage and waste. Despite pressures from rising raw-material and coating costs, and regulatory scrutiny over single-use plastics, the trend toward better protective packaging remains strong and supports steady growth in demand for moisture-resistant packaging in Japan.

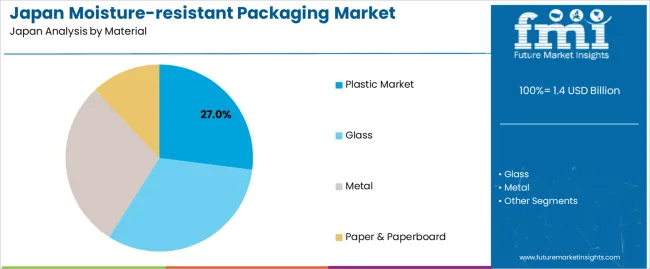

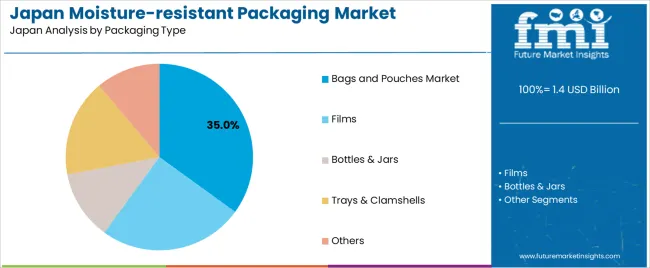

The demand for moisture-resistant packaging in Japan is shaped by the materials used and the packaging formats selected by manufacturers. Materials such as plastic, glass, metal and paper & paperboard each offer different levels of protection and functional qualities suited to food, personal care, electronics and industrial products. Packaging types including bags and pouches, films, bottles and jars, trays and clamshells and other formats support varied requirements for product safety, transport and storage. As brands emphasize protection from humidity, condensation and handling conditions, the combination of durable materials and appropriate packaging formats drives consistent demand across applications in the Japanese market.

Plastic accounts for 27% of total demand for moisture-resistant packaging materials in Japan. Its leading position is supported by its ability to provide strong barriers against moisture, extending the usability of packaged goods. Plastic is commonly used for food, household items and consumer products that require protection during distribution and storage. Its adaptability for different shapes and filling methods makes it suitable for high-volume production lines. The combination of flexibility, durability and compatibility with printing helps maintain product identity while supporting consistent performance in humid environments.

Demand for plastic is also driven by its stable mechanical properties, which help prevent damage during transport and handling. Japanese manufacturers value materials that provide dependable moisture protection without compromising product form or integrity. Plastic supports a range of thicknesses and structures that match both lightweight and reinforced packaging needs. As producers seek materials that meet performance targets across retail and industrial segments, plastic continues to hold a significant role in moisture-resistant applications across the country.

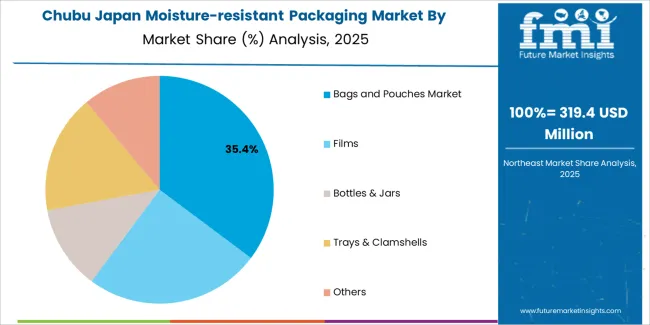

Bags and pouches account for 35.0% of total demand for moisture-resistant packaging types in Japan. Their popularity stems from versatility across food, personal care and household items. These formats provide reliable moisture barriers while remaining lightweight and easy to store or transport. Resealable options support repeated use, which appeals to consumers purchasing items such as snacks, powdered goods or daily-use products. Their flat profiles reduce space requirements in logistics and retail displays, making them efficient for both manufacturers and retailers.

Demand for bags and pouches is strengthened by their ability to accommodate multiple materials and sealing technologies. This flexibility enables manufacturers to adjust barrier strength and durability based on product needs. Clear or printed designs also help brands present information effectively. Japanese consumers appreciate packaging that is easy to open, close and carry, reinforcing the role of bags and pouches in daily purchases. As product categories expand, this packaging format maintains a central position within moisture-resistant solutions.

How Are Consumer Expectations and Industry Requirements Influencing Moisture-Resistant Packaging Demand in Japan?

Japanese consumers expect high quality, freshness and safe packaging, particularly in food, cosmetics and pharmaceuticals. For manufacturers this creates demand for packaging formats that can resist humidity, maintain barrier performance and support long-term storage. At the same time logistics and e-commerce fulfilment add exposure to varying climates and transportation conditions, increasing the need for moisture-resistant solutions. The combined effect of consumer expectations and supply-chain demands accelerates interest in advanced packaging formats in Japan.

Where Are Growth Opportunities Arising for Moisture-Resistant Packaging in Japan?

Opportunities are emerging in segments such as frozen and chilled foods, high-barrier pharmaceuticals, premium personal care items, and online direct-to-consumer shipments. Brands that require long shelf life, precision dosing or transport through variable climates seek moisture-resistant formats. In Japan, manufacturers who can provide lightweight, high-barrier films, laminated structures or recyclability credentials are well positioned. Growth also exists in regional and convenience channel segments where packaging plays a key role in product differentiation.

What Challenges Are Limiting the Wider Adoption of Moisture-Resistant Packaging in Japan?

Despite favourable demand conditions, uptake faces several barriers. Higher cost of barrier materials and specialised lamination increases unit cost, especially for smaller brands. Recycling and circular-economy pressures require development of new barrier formats that are both effective and sustainable, which adds complexity. Moreover, alternative packaging formats such as rigid containers or pouches may suffice in some applications, reducing incentive to adopt more advanced moisture-resistant solutions. These issues restrict how rapidly moisture-resistant packaging penetrates across all segments in Japan.

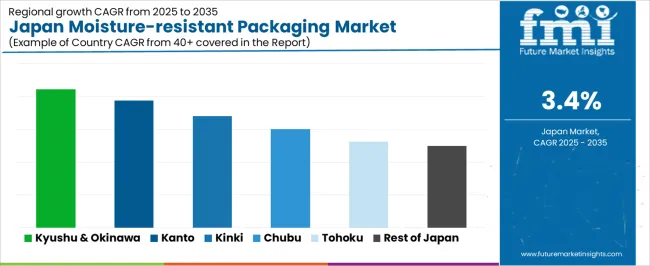

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.2% |

| Kanto | 3.9% |

| Kinki | 3.4% |

| Chubu | 3.0% |

| Tohoku | 2.6% |

| Rest of Japan | 2.5% |

Demand for moisture-resistant packaging in Japan is increasing across all regions, with Kyushu and Okinawa leading at 4.2%. Growth in this region reflects steady activity in food processing and rising use of protective packaging for distribution. Kanto follows at 3.9%, supported by its large consumer base and strong presence of manufacturers that rely on packaging to maintain product quality. Kinki records 3.4%, shaped by stable demand from retail, healthcare, and household product categories. Chubu grows at 3.0%, influenced by manufacturing and regional logistics networks. Tohoku reaches 2.6%, where adoption rises with expanding retail channels. The rest of Japan shows 2.5%, reflecting gradual growth across smaller commercial areas.

Kyushu & Okinawa is projected to grow at a CAGR of 4.2% through 2035 in demand for moisture-resistant packaging. The region’s food, beverage, and pharmaceutical sectors increasingly use moisture-resistant materials to maintain product quality, extend shelf life, and prevent spoilage. Urban centers like Fukuoka are adopting innovative packaging solutions to meet consumer expectations for safety and convenience. Manufacturers in Kyushu & Okinawa are integrating advanced materials, including coated films and laminates, to enhance moisture protection. Rising consumer awareness of product preservation and hygiene drives adoption, supporting steady growth in the moisture-resistant packaging segment.

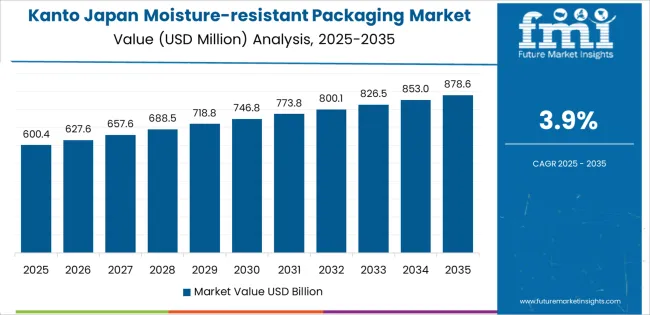

Kanto is projected to grow at a CAGR of 3.9% through 2035 in demand for moisture-resistant packaging. As Japan’s industrial and commercial hub, including Tokyo, the region leads in the adoption of advanced packaging solutions for food, pharmaceuticals, and personal care products. Increasing consumer expectations for product freshness and durability drive manufacturers to invest in moisture-resistant materials. Retailers and e-commerce platforms further support adoption by requiring reliable packaging for transportation and storage. Kanto’s concentration of industrial production, packaging innovation, and quality standards ensures continued growth of moisture-resistant packaging solutions.

Kinki is projected to grow at a CAGR of 3.4% through 2035 in demand for moisture-resistant packaging. The region’s industrial hubs, particularly Osaka and Kyoto, are adopting moisture-resistant packaging solutions for processed foods, beverages, and pharmaceuticals. Rising consumer preference for product safety, hygiene, and convenience accelerates adoption. Manufacturers in Kinki are using laminated films, barrier coatings, and innovative materials to enhance moisture protection. The combination of industrial production, consumer awareness, and packaging innovation ensures steady growth of moisture-resistant solutions in both urban and semi-urban areas across Kinki.

Chubu is projected to grow at a CAGR of 3.0% through 2035 in demand for moisture-resistant packaging. The region’s manufacturing and food processing sectors, including Nagoya, are increasingly integrating advanced packaging materials to maintain product quality and durability. Rising demand for ready-to-eat foods, beverages, and personal care products requires moisture-resistant solutions. Manufacturers in Chubu are implementing coatings, laminates, and barrier films to protect against moisture and extend shelf life. The focus on product safety, convenience, and consumer satisfaction ensures steady adoption of moisture-resistant packaging in the region.

Tohoku is projected to grow at a CAGR of 2.6% through 2035 in demand for moisture-resistant packaging. The region’s smaller manufacturing and food processing facilities are increasingly using moisture-resistant packaging to protect products during transportation and storage. Rising awareness of hygiene, product preservation, and shelf-life extension drives adoption. Local manufacturers are incorporating laminated and coated packaging materials to maintain quality. Tohoku’s focus on meeting industry standards for food and pharmaceutical packaging supports the steady adoption of moisture-resistant solutions across rural and semi-urban areas.

The Rest of Japan is projected to grow at a CAGR of 2.5% through 2035 in demand for moisture-resistant packaging. Smaller cities and rural areas are gradually adopting advanced packaging materials to protect food, beverages, and personal care products. The focus on hygiene, product safety, and durability drives adoption. Local manufacturers are using barrier films and laminated packaging solutions to extend shelf life and ensure quality. The increasing awareness of proper storage and transportation practices further supports steady growth in the moisture-resistant packaging segment across non-urban regions.

The demand for moisture-resistant packaging in Japan is driven by several converging factors. A growing e-commerce sector increases shipments across climate-varying zones, creating need for packaging that safeguards product quality during transit. Food and beverage manufacturers prioritise extended shelf life and flavour integrity, thus selecting barrier films and laminates that resist humidity and moisture ingress. The healthcare and personal-care segments require packaging that protects sensitive formulations from environmental degradation, enhancing efficacy and safety. At the same time, regulatory pressures and consumer preference for high-performance and recyclable solutions push brand owners to adopt advanced materials. Materials innovation such as coated papers and multilayer films—enables conventional packaging to meet these functional demands effectively.

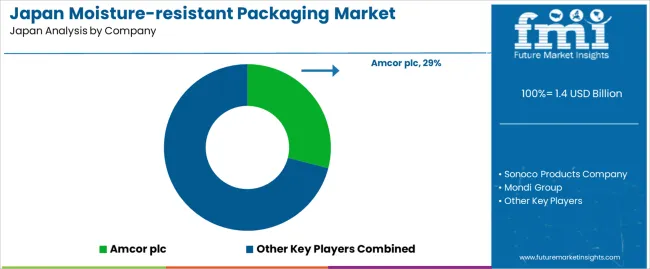

Major global firms active in Japan’s moisture-resistant packaging segment include Amcor plc, Sonoco Products Company, Mondi Group, WestRock Company and Smurfit Kappa Group plc. These companies supply high-barrier packaging solutions across flexible films, pouches, cartons and corrugated formats tailored for the Japanese market. They engage with local brand owners and converters to deliver moisture-protection features while aligning with Japan’s recycling and materials-reduction policies. Their global footprint supports scale and technical expertise, while regional operations enable responsiveness to Japan’s strict packaging standards and consumer expectations. These providers thus shape how moisture-resistant packaging evolves in Japan’s dynamic and demanding environment.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| End Users | Food & Beverages, Pharmaceutical, Electrical and Electronics, Cosmetics & Personal Care, Chemical & Fertilizer, Other Consumer Goods |

| Material Types | Plastic, Glass, Metal, Paper & Paperboard |

| Packaging Types | Bags and Pouches, Films, Bottles & Jars, Trays & Clamshells, Others |

| Applications | Product protection from moisture, shelf-life extension, hygiene maintenance, safe transport and storage |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Amcor plc, Sonoco Products Company, Mondi Group, WestRock Company, Smurfit Kappa Group plc, DS Smith plc |

| Additional Attributes | Dollar by sales by material, packaging type, and end use; regional adoption patterns; premiumisation and high-barrier innovation; influence of e-commerce on packaging demand; regulatory compliance and recycling initiatives; material structure and sealing technology improvements. |

The demand for moisture-resistant packaging in Japan is estimated to be valued at USD 1.4 billion in 2025.

The market size for the moisture-resistant packaging in Japan is projected to reach USD 2.0 billion by 2035.

The demand for moisture-resistant packaging in Japan is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in moisture-resistant packaging in Japan are plastic market , glass, metal and paper & paperboard.

In terms of packaging type, bags and pouches market segment is expected to command 35.0% share in the moisture-resistant packaging in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA