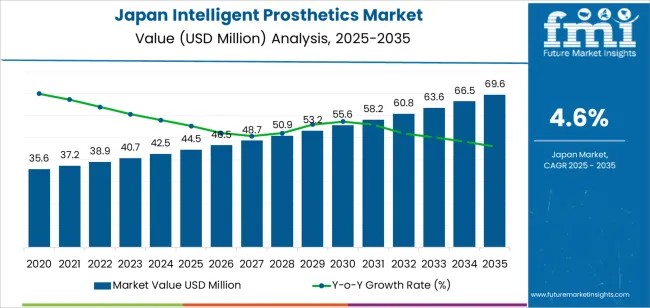

The Japan intelligent prosthetics demand is valued at USD 44.5 million in 2025 and is expected to reach USD 69.6 million by 2035, recording a CAGR of 4.6%. Demand is shaped by increased use of sensor-based control systems, wider availability of myoelectric prosthetic devices, and clinical preference for technologies that improve functional mobility. Intelligent prosthetics support enhanced grip control, smoother motion patterns, and better alignment through embedded electronics and adaptive feedback mechanisms. Growth is also linked to rehabilitation programs designed for ageing populations and individuals requiring long-term prosthetic support.

Upper-extremity prosthetics represent the leading product type due to their role in restoring fine-motor capabilities essential for daily activities. These systems integrate multi-articulating hands, pattern-recognition algorithms, and responsive surface sensors that interpret user intent. Improvements in lightweight materials, joint-motion precision, and battery lifespan continue to influence device selection among clinicians and prosthetic specialists.

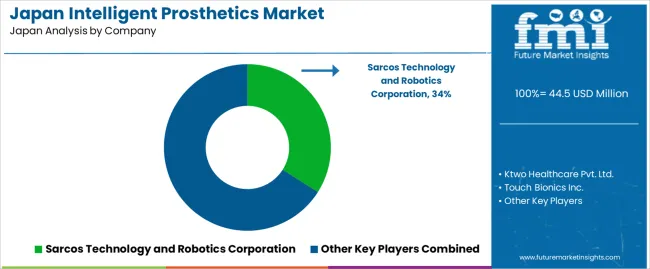

Demand is concentrated in Kyushu & Okinawa, Kanto, and Kinki, where rehabilitation centres, specialist clinics, and clinical-research institutions are located. Key suppliers include Sarcos Technology and Robotics Corporation, Ktwo Healthcare Pvt. Ltd., Touch Bionics Inc., HDT Global, and SynTouch, Inc., offering advanced prosthetic components and adaptable control technologies.

Year-on-year growth analysis shows a steady, low-volatility pattern supported by consistent clinical demand and gradual adoption of sensor-enabled, microprocessor-controlled limb systems. Between 2025 and 2028, YoY growth will remain close to the long-term average as rehabilitation centres, orthotic clinics, and hospitals expand access to advanced prosthetic components aimed at improving gait stability and functional mobility. Incremental improvements in joint-actuation mechanisms and battery performance will reinforce this early yearly progression.

From 2029 to 2032, YoY growth may experience mild variation due to policy adjustments, reimbursement-cycle timing, and procurement decisions across public and private healthcare providers. These fluctuations remain contained because overall clinical need is stable and prosthetic-device replacement intervals are predictable. Between 2033 and 2035, YoY growth is expected to stabilise as product portfolios mature and upgrades centre on refined motion-control algorithms and improved comfort materials rather than major platform shifts. The YoY pattern reflects a mature assistive-technology segment shaped by long device lifecycles, consistent clinical pathways, and steady reliance on intelligent prosthetics across Japan’s rehabilitation systems.

| Metric | Value |

|---|---|

| Japan Intelligent Prosthetics Sales Value (2025) | USD 44.5 million |

| Japan Intelligent Prosthetics Forecast Value (2035) | USD 69.6 million |

| Japan Intelligent Prosthetics Forecast CAGR (2025 to 2035) | 4.6% |

The demand for intelligent prosthetics in Japan is growing because technological advances allow prosthetic devices to offer more natural motion, sensor feedback and adaptive control for users with limb loss. An ageing population and prevalence of vascular conditions, accidents and diabetes increase the base of prosthetic users and thus the need for advanced solutions. Research and development in Japan emphasise robotics, artificial intelligence and bio-signal integration which supports local innovation of smart prosthetic limbs and hands.

Advances in rehabilitation technology, 3D-printing and connectivity support modular designs and personalised fittings that appeal to patients seeking premium mobility solutions. Healthcare providers and clinics are increasingly recognising the benefits of smart prosthetics in improving functional outcomes and quality of life for users. Constraints include high cost of intelligent prosthetic systems, limited insurance or reimbursement coverage for premium features, regulatory import or certification hurdles and the requirement for specialist fitting and training. Some users may opt for simpler prosthetic solutions when budget or access is restricted.

Demand for intelligent prosthetics in Japan reflects clinical needs across rehabilitation facilities, specialised prosthetic centres, and hospitals managing trauma cases and limb-loss conditions. Adoption patterns align with Japan’s emphasis on precision engineering, structured rehabilitation programmes, and aging-population needs. Product-type demand is shaped by functional requirements, device complexity, and patient lifestyle considerations. Distribution-channel patterns reflect the structure of Japan’s healthcare ecosystem and the clinical workflow involved in prosthetic evaluation, fitting, and long-term follow-up.

Upper-extremity intelligent prosthetics hold 58.6% of national demand, making them the dominant product category in Japan. These devices support fine-motor tasks, multi-grip control, and motion-adaptive functions required for daily activities and workplace tasks. Myoelectric hands, articulated wrists, and multi-finger systems are widely used in rehabilitation centres and specialised clinics, where customised fitting and training support functional recovery. Lower-extremity prosthetics account for 41.4%, serving users requiring stabilised movement, gait correction, and secure weight-bearing assistance. These devices include microprocessor-controlled knees and powered ankles suited for long-term mobility improvement. Product-type distribution reflects patient needs, rehabilitation progress, and integration of sensor-controlled features across prosthetic systems.

Key drivers and attributes:

Hospitals hold 46.1% of Japan’s demand for intelligent prosthetics and form the primary distribution channel. These facilities manage acute injuries, surgical follow-ups, and first-stage evaluations that determine prosthetic type and training needs. Prosthetic clinics represent 21.3%, providing detailed fitting, adjustments, and device optimisation across long-term rehabilitation cycles. Rehabilitation centres hold 17.5%, supporting gait training, motor-skill development, and adaptation to intelligent control features. The remaining 15.1% includes outpatient facilities and specialised units that assist with maintenance and device updates. Channel distribution reflects Japan’s structured patient-care pathways, where early-stage assessment occurs in hospitals and long-term optimisation is carried out in clinics and rehabilitation settings.

Key drivers and attributes:

Ageing population, technological capability and increasing emphasis on rehabilitation outcomes support demand.

Japan’s demographic profile, with a substantial elderly population and rising incidence of limb loss due to vascular disease, diabetes, and trauma, underpins demand for advanced prosthetic solutions. Japanese research and med-tech ecosystems are highly developed, enabling creation and clinical adoption of intelligent prosthetic limbs embedded with sensors, robotics and AI-driven controls. Government and institutional focus on rehabilitation, mobility and quality-of-life improvement for amputees and older adults further supports procurement of prosthetic devices that offer greater functionality, adaptive control and long-term wear comfort.

High cost, reimbursement complexity and cultural preferences limit wider uptake.

Intelligent prosthetics command higher purchase and maintenance costs compared to conventional prosthetic limbs, which may restrict access in certain clinical settings or for patients with less private coverage. Complex reimbursement pathways and administrative burden within Japan’s healthcare system may delay approvals for new, high-technology prosthetic options. Some users may prefer simpler prosthetic solutions when their mobility needs are well served by traditional designs, which slows diffusion of more advanced devices.

Modular upgradeable limbs, home- and outpatient-fitting services and integration of AI/robotics in prosthetic care shape the industry outlook.

Manufacturers and providers in Japan are shifting toward prosthetic systems that allow modular upgrades where sensors, actuators or control units can be refreshed rather than replacing the entire limb. Outpatient clinics and home-fitting platforms are expanding, reducing the barrier to adoption for advanced prosthetic technologies outside major hospitals. The integration of AI, machine learning and robotics into prosthetic limbs is advancing rapidly, allowing devices to adapt gait, grip and posture automatically and offering near-natural movement control. These developments support broader acceptance of intelligent prosthetics in Japan’s mobility and rehabilitation landscape.

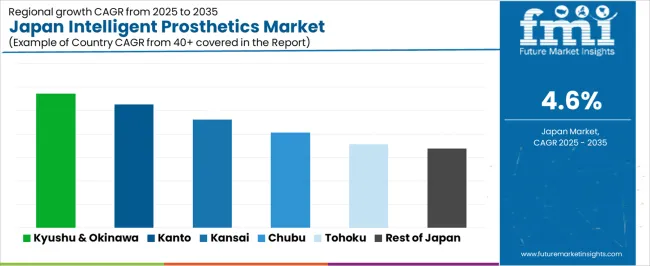

Demand for intelligent prosthetics in Japan is increasing through 2035 as rehabilitation centers, orthopedic clinics, and advanced hospitals adopt microprocessor-controlled limbs, sensor-assisted joints, and myoelectric systems for patients requiring improved mobility and functional precision. Growth is shaped by aging demographics, clinical demand for improved gait stability, and broader integration of digital fitting and motion-analysis tools. Intelligent prosthetics support trauma recovery, congenital limb conditions, and chronic disease–related amputations. Regional differences reflect healthcare density, rehabilitation-facility availability, and access to specialized prosthetic technicians. Kyushu & Okinawa leads with a 5.7% CAGR, followed by Kanto (5.3%), Kinki (4.6%), Chubu (4.1%), Tohoku (3.6%), and the Rest of Japan (3.4%).

| Region | CAGR (2025 to 2035) |

|---|---|

| Kyushu & Okinawa | 5.7% |

| Kanto | 5.3% |

| Kinki | 4.6% |

| Chubu | 4.1% |

| Tohoku | 3.6% |

| Rest of Japan | 3.4% |

Kyushu & Okinawa grows at 5.7% CAGR, supported by consistent rehabilitation workloads and expanding access to advanced prosthetic services across Fukuoka, Kumamoto, and Kagoshima. Hospitals use microprocessor-controlled knees, adaptive ankles, and myoelectric upper-limb systems for patients recovering from trauma or chronic limb diseases. Rehabilitation centers incorporate sensor-based gait-training tools to improve prosthetic alignment and patient mobility. Elderly populations require stable support for limb-loss management, reinforcing ongoing adoption of intelligent devices. Okinawa’s distributed healthcare system relies on digital fitting tools and remote-adjustment capabilities due to geographically spread patient groups. Clinical demand remains steady as providers prioritize functional improvement and long-term mobility outcomes for diverse patient needs.

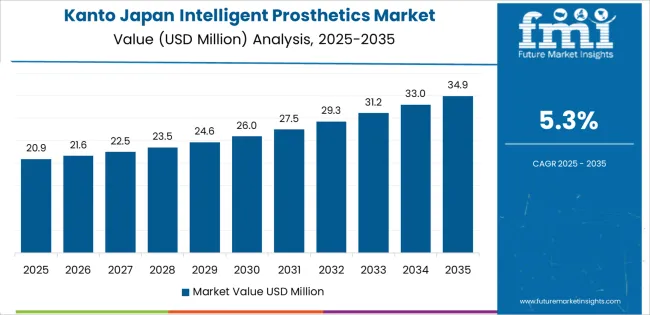

Kanto grows at 5.3% CAGR, driven by Japan’s largest concentration of tertiary hospitals, rehabilitation centers, and orthopedic facilities. Tokyo, Kanagawa, and Chiba adopt advanced prosthetic systems with motion-sensing components, multi-axis joints, and real-time feedback modules that improve movement efficiency. Clinical teams use digital fitting tools for precise alignment and patient comfort. High patient volumes, including postoperative and chronic-condition cases, sustain regular prosthetic device usage. Specialized centers offer advanced training programs for users transitioning to intelligent prosthetics. Insurance coverage and institutional procurement patterns reinforce continuous demand across metropolitan areas.

Kinki grows at 4.6% CAGR, supported by rehabilitation facilities and orthopedic departments across Osaka, Kyoto, and Hyogo that manage steady caseloads involving limb loss, trauma, and chronic disease. Providers adopt intelligent prosthetics with adaptive joint control, myoelectric input, and sensor-based monitoring to enhance user stability. Rehabilitation centers rely on structured training programs to help patients adjust to advanced devices. Clinics use digital assessment tools to refine prosthetic alignment and reduce discomfort. Although adoption rates are moderate compared with larger metropolitan regions, continuous treatment needs among elderly and mobility-impaired populations ensure stable demand.

Chubu grows at 4.1% CAGR, supported by orthopedic networks and rehabilitation services across Aichi, Shizuoka, and Mie. Hospitals deploy intelligent prosthetics for postoperative amputations, industrial injuries, and chronic-disease-related limb loss. Rehabilitation centers use gait-analysis technology and motion-tracking systems to optimize device function and user training. Clinics adopt adaptive-joint prosthetics and updated socket-design technologies for improved patient comfort. Home-based care programs use digital tools for remote follow-up and alignment adjustments. Although overall adoption is moderate, stable clinical workloads ensure recurring prosthetic requirements across regional healthcare facilities.

Tohoku grows at 3.6% CAGR, supported by rehabilitation centers and hospitals across Miyagi, Fukushima, and Iwate that treat chronic conditions, trauma, and degenerative disease. Facilities implement intelligent prosthetics with microprocessor controls and sensor-guided components to improve patient mobility and reduce fall risk. Clinics use digital modeling tools to enhance socket fitting and gait alignment. Elderly populations in the region require ongoing limb-care support, reinforcing usage of advanced prosthetics. Although facility density is lower, essential rehabilitation services maintain stable adoption of intelligent devices across both urban and semi-rural prefectures.

The Rest of Japan grows at 3.4% CAGR, supported by distributed rehabilitation clinics, community hospitals, and local prosthetic providers across rural prefectures. Patients with trauma-related or chronic-condition limb loss rely on intelligent prosthetics that improve balance, comfort, and daily mobility. Clinics adopt lightweight myoelectric systems and adaptive ankle units suited for varied usage needs. Digital fitting and remote-assessment tools help providers support patients across wide geographic areas. Although population density is lower, essential prosthetic requirements and continued modernization of regional care services ensure ongoing device adoption.

Demand for intelligent prosthetics in Japan is shaped by a concentrated group of advanced prosthetic developers supplying powered limbs, sensor-integrated joints, and adaptive control systems for clinical rehabilitation and long-term assistive use. Sarcos Technology and Robotics Corporation holds the leading position with an estimated 34.0% share, supported by established capability in robotic actuation, controlled motion algorithms, and durable powered-joint assemblies suited to clinical and home environments. Its position is reinforced by reliable component stability and consistent collaboration with rehabilitation centres.

Ktwo Healthcare Pvt. Ltd. and Touch Bionics Inc. follow as significant participants, offering myoelectric and microprocessor-driven prosthetic solutions that support fine-motor tasks and daily functional activities. Their strengths include stable signal processing, adaptive grip or gait patterns, and dependable alignment with custom socket systems fitted by Japanese prosthetists. HDT Global maintains a notable presence through mechanically robust devices suited to users who require higher load capacity and reinforced structural components. SynTouch, Inc. contributes specialized capability with tactile-sensing technologies that enhance grip feedback and functional realism in upper-limb prosthetics, supporting broader adoption of sensory-enabled devices within Japan’s rehabilitation ecosystem.

Competition across this segment centers on sensor accuracy, actuator endurance, battery efficiency, ergonomic fit, and consistency of myoelectric signal interpretation. Demand continues to grow due to Japan’s aging population, expanding rehabilitation services, and increasing uptake of powered, sensor-integrated prosthetic systems that offer improved mobility, dexterity, and user comfort across clinical and daily-living scenarios.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | Upper Extremity, Lower Extremity |

| Distribution Channel | Hospitals, Prosthetic Clinics, Rehabilitation Centre, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Sarcos Technology and Robotics Corporation, Ktwo Healthcare Pvt. Ltd., Touch Bionics Inc., HDT Global, SynTouch, Inc. |

| Additional Attributes | Dollar sales by product type and distribution channel categories; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of robotic and sensor-integrated prosthetic manufacturers; advancements in myoelectric controls, AI-assisted movement systems, and lightweight limb materials; integration with rehabilitation centres, hospital orthopaedic departments, and specialized prosthetic clinics in Japan. |

The global demand for intelligent prosthetics in japan is estimated to be valued at USD 44.5 million in 2025.

The market size for the demand for intelligent prosthetics in japan is projected to reach USD 69.6 million by 2035.

The demand for intelligent prosthetics in japan is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in demand for intelligent prosthetics in japan are upper extremity and lower extremity.

In terms of distribution channel, hospitals segment to command 46.1% share in the demand for intelligent prosthetics in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Intelligent Touch Screen Cash Register Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Road Test Instruments Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Driving Technology Solution Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Completion Market Size and Share Market Forecast and Outlook 2025 to 2035

Intelligent Rubber Tracks Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Cervical Massager Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Garment Hanging Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Rotary Kiln Monitoring Systems Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Multifunctional Laser Bird Repeller Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Platform Management Interface (IPMI) Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Lighting Control Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Vending Machine Market Insights – Demand, Size & Industry Trends 2025–2035

Intelligent Transportation System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Intelligent Virtual Store Design Solution Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Enterprise Data Capture Software Market Size, Growth, and Forecast 2025 to 2035

Intelligent Fencing Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Intelligent Enterprise Data Capture Software Market in Korea – Trends & Forecast 2025 to 2035

Intelligent Power Module Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA