The loan origination software market demonstrates projected exponential growth from 2025 to 2035 because the financial sector implements digital advancements and customers seek automated lending technologies while AI and cloud computing continue to advance.

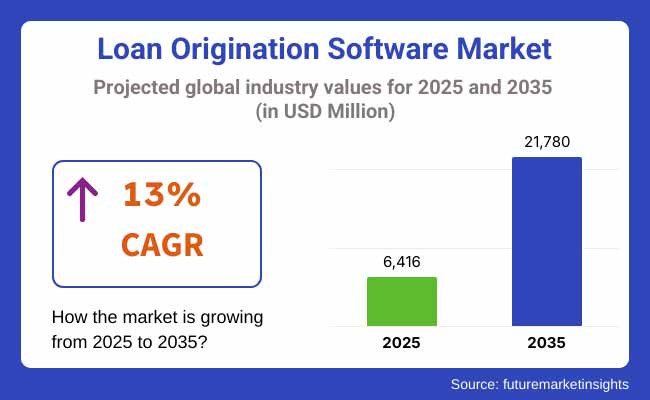

The implementation of loan origination software speeds up financial operations by optimizing how loans get processed while reducing overall period until funds reach applicants. A CAGR projection of 13% indicates the market will expand from USD 6,416 million in 2025 to USD 21,780 million in 2035.

The market grows because cloud-based lending platforms get more popular while regulatory compliance rules and digital banking technologies advance the sector. AI-powered loan origination tools enable financial institutions to measure credit risks as well as automate underwriting procedures and deliver improved customer experiences through their loan applications. The demand for advanced origination platforms grows because customers show increasing preference for digital applications and mobile banking services.

The deployment of AI software faces resistance due to data protection risks together with problems in integrating new technology into existing infrastructure and expensive implementation expenses. Software providers dedicate effort to creating protected and expandable and affordable solutions which specifically meet different lending requirements.

The loan origination software market observes two main segments which include deployment model and end-user industry while registering improved utilization across banking organizations and credit unions together with alternative financial institutions.

Two deployable software categories appear in the market: on premise loan origination software along with cloud-based loan origination software. Cloud solutions control the market through their flexible nature which along with budget-friendly operations and distance access helps financial institutions optimize their loan management. Large banks together with institutions use on premise solutions for their custom secure lending platforms that require high security.

Loan origination software serves the banking sector most extensively because financial institutions use it for personal loans and business financing and mortgage lending applications. The fintech industry expands its adoption by using digital-first lending systems that provide instant loan approval while employing artificial intelligence to assess credit risks.

Credit unions together with non-banking financial companies (NBFCs) use loan origination solutions to enhance their borrower experiences along with their lending operations. Modern software providers update their digital lending solutions with artificial intelligence technologies and block chain systems for fraud detection and open banking functionality to boost loan processing quality and security.

The North America loan origination software market is flourishing owing to various factors such as the high-growth adoption of digital lending platforms, surging demand for artificial intelligence (AI)-enabled underwriting solutions, and demanding regulatory compliance requirements. In the USA and Canada, fintech start-ups, cloud-based loan origination platforms, and automated credit assessment tools are increasingly being funded. Moreover, the rising trend of mobile banking and mobile loan applications also accelerates the market growth.

Growing adoption of open banking in the region, regulatory frameworks such as the Revised Payments Services Directive (PSD2), and demand for cost-effective and streamlined loan origination processes drive Europe loan origination software market. The market is dominated by Germany, France and the UK, and banks deploy lending automation powered by AI. Bird-eye view - European lenders are focused on offering secure, compliant, and flexible origination platforms to improve customer experience and mitigate credit risks.

Asia-Pacific is the fastest-growing market for loan origination software, owing to the growing financial inclusion, increasing digital banking penetration, and rising fintech adoption. Strong demand for cloud-based lending solutions (SME finance and expansion of consumer credit) is prevalent in countries like China, India, Japan, and Australia. The expanding scope of market is supported by government initiatives that fuel digital transactions and accessibility to financial transactions.

Challenge: Compliance Complexity and Integration with Legacy Systems

Constraints on the loan origination software market due to the need for regulatory compliance and integration with older bank systems. Loan origination solutions that need constant updating as financial institutions adapt to changing regulations like the GDPR, Fair Lending Laws, and AML policies.

Moreover, many banks and credit unions continue to use outdated core banking systems that are not easy to integrate with new cloud-based loan origination solutions. Upgrading systems, migrating data, and implementing cybersecurity solutions can be complex and costly, posing challenges for financial institutions attempting to optimize lending processes.

Opportunity: Growth in AI-Powered Automation and Digital Lending Solutions

The growing trend towards digital loan processing, AI-based risk assessment, and automated underwriting will open up the largest opportunity for the loan origination software market. This is causing lenders to evolve towards cloud-based, or API-driven, loan origination platforms that allow for speedier loan approvals, paperless processing, and more personalized credit scoring.

They also improve fraud detection, credit risk evaluation, and regulatory compliance through the integration of artificial intelligence, machine learning, and robotic process automation (RPA). Moreover, the increasing prevalence of peer-to-peer lending, neobanks, and embedded finance products also facilitate innovation in loan origination technology - making it easier and more efficient for borrowers to lend.

The market underwent rapid adoption of cloud-based loan origination systems from 2020 to 2024 as financial institutions focused on improving customer experience and digital transformation. The increased proliferation of remote banking and fintech lending platforms has driven demand for automated credit decisioning, AI-based fraud detection, and digital document management. Cybersecurity threats, regulatory updates and the complexity of system integration were still top of mind for lenders implementing new origination software, however.

Meanwhile, from 2025 to 2035, the market will have fully automated and AI-driven loan origination ecosystems that will also contain real-time risk evaluation and block chain based digital lending methods. New paradigms in decentralized finance (DeFi), tokenized credit systems, and biometric identity verification will redefine loan origination, thereby making lending safer, and more widely available.

Moreover, low-code and no-code loan origination platforms will allow financial institutions to automate workflows quickly as per their use cases, which will shorten the deployment time and drive higher operational agility.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with Fair Lending, GDPR, and AML policies required frequent software updates. |

| Technological Advancements | Adoption of cloud-based loan origination platforms and digital document processing. |

| Sustainability Trends | Increased use of e-signatures and paperless loan processing. |

| Market Competition | Growth driven by fintech disruptors and digital-first banking solutions. |

| Industry Adoption | Widespread adoption in traditional banks, credit unions, and online lenders. |

| Consumer Preferences | Demand for faster loan approvals, automated underwriting, and digital lending experiences. |

| Market Growth Drivers | Growth fueled by digital banking transformation and increased demand for automated lending. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered regulatory compliance automation and block chain-based lending records for transparency. |

| Technological Advancements | Fully automated AI-driven loan origination with real-time risk analysis and embedded finance. |

| Sustainability Trends | Expansion of decentralized lending platforms and smart contract-based loan management. |

| Market Competition | Traditional banks, fintechs, and DeFi platforms competing in an integrated digital lending landscape. |

| Industry Adoption | Expansion into decentralized finance (DeFi), embedded lending, and cross-border digital lending. |

| Consumer Preferences | Preference for instant, AI-personalized loan approvals with predictive credit scoring. |

| Market Growth Drivers | Expansion driven by AI-powered risk assessment, block chain-based security, and DeFi innovations. |

The USA loan origination software market is growing, driven by increasing digitization of financial services, advancement in AI-driven underwriting and growth of online lending platforms. The proliferation of fintech providers, neobanks, and digital mortgage lenders has intensified the need for automated and cloud-based LOS solutions that streamline aspects including processing, compliance, and customer experience.

Furthermore, the implementation of regulatory demands from the Consumer Financial Protection Bureau (CFPB) and other financial authorities has propelled lenders toward adopting compliance-led LOS solutions that meet federal lending guidelines. Feed innovation in loan origination automation is driven further by AI-powered risk assessment, as well as credit decisioning.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 13.2% |

The advent of open banking and surging demand for digital lending are driving the growth of the loan origination software market in the UK, as is the growth of alternative assessment platforms. Under Financial Conduct Authority (FCA) guidelines, conventional banks and credit unions are spending more on artificial intelligence (AI)-powered originations software that promotes improved lending efficiencies and compliance with regulatory standards.

Cloud-based and API-integrated LOS solutions also gained traction due to the emergence of buy now, pay later (BNPL) services and peer-to-peer (P2P) lending platforms. The use of blockchain for smart contracts is also on the rise in loan processing, especially in mortgage and SME lending.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 12.8% |

The European Union loan origination software market is driven by various factors including the rise of financial institutions' digital transformation, growing need for regulatory compliance, and advent of technology that powers AI-enabled credit risk and assessment. Germany, France and Italy are a few countries which have been leading the cloud-based LOS solutions market that help in streamlining the loan origination process and prevent fraud as well.

The robust focus on financial transparency and consumer protection seen in the EU since the introduction of GDPR and PSD2 has driven secure, digital identity verification and automated credit decisioning into LOS platforms. This, along with the increased adoption of embedded lending solutions within e-commerce and B2B transactions, is driving the demand for scalable and API integrated loan origination software.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 13.1% |

The loan origination software market is exhibiting stable growth in the country with the growing digital banking solution adoption, demand for automated lending processes, and the evolution of AI-based credit score systems in the country. Japan's tightly-controlled finance industry that operates under the aegis of the Financial Services Agency (FSA) has begun nudging banks and lending enterprises to deploy compliance-friendly, fraud resistant loan origination processes due to the increase of loan defaults.

The demand for mobile-first and cloud-based LOS platforms that facilitate seamless, end-to-end loan processing is also being driven by Japan's burgeoning fintech ecosystem and push for a cashless economy. This enables lenders to improve the accuracy of loan approvals and also significantly increase the efficiency of their processes through predictive risk analysis powered by machine learning.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 13.0% |

The South Korean loan origination software market is experiencing rapid growth due to the rise of digital banking, regulatory support for fintech innovation, and increasing demand for automated loan processing. Advanced mobile banking ecosystem builds up in South Korea to have the common adoption of AI-powered LOS Platforms integrating real-time credit assessment, alternative credit scoring algorithms, and block chain-backed lending processes.

In addition, the Korea Financial Services Commission (FSC) is encouraging the adoption of financial technology, prompting traditional banks and lending companies to upgrade their loan origination systems to cloud-based and API-driven solutions. In addition, the growth of digital lending services, including small and medium enterprises (SME) financing and micro-lending, contributes to the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 13.0% |

Integrated lending platforms and standalone loan origination software are the major segments of the global loan origination software market, which provide financial institutions with the tools required to streamline borrowing, reduce operating expenses, and enhance the overall experience for borrowers.

The growing need for seamless digital lending, regulatory compliance, and data-driven decision-making power industry has led to the widespread adoption of loan origination software throughout retail banking, mortgage lending, and business financing sectors.

As AI algorithms can tailor credit risk by filtering the vast amounts of personal data into the data lake for an analysis of credit rating applicants, leading to automated too many challenges have also arisen in use cases such as credit assessment, underwriting, and loan application tracking to name a few.

The adoption of predictive analytics, cloud-based infrastructure, and AI-powered risk assessment derivatives in the industry has further bolstered the market growth, enabling lenders to have personalized loan offerings, optimize credit decisioning, and improve regulatory compliance.

Integrated lending platforms have become an increasingly favoured option for banks, financial institutions, and alternative lenders looking for holistic end-to-end digital lending solutions. Their platforms streamline loan origination, underwriting, risk assessment, document management and loan servicing functionalities all on a single system, eliminating processing delays, operational inefficiencies and compliance risks.

Integrated lending platforms allow financial institutions to automate credit application workflows, minimize human effort for assessment and verification, and expedite loan approvals. These systems work with personal loans, mortgages, auto loans, and business financing, allowing lenders to run high meant loans with little mistakes.

According to studies, integrated platforms, which can be customized as per requirements and are automated and compliance-ready, are preferred by more than 70% of financial institutions using digital lending solutions.

Integrated lending platforms are being increasingly adopted in processing mortgages, consumer banking and fintech-powered alternative lending. The traditional lending players such as credit unions and commercial banks are using these platforms to simplify home loan approvals process, provide automated mortgage underwriting solutions, and digital mortgage tools to engage the borrowers.

Integrated lending platforms are increasingly being used by retail banks to process personal loans, credit card applications and small business financing, enabling rapid credit decisioning and enhanced customer experience.

The adoption of integrated lending platforms has also been propelled by the significant role played by Fintech companies and digital lenders offering AI based loan origination solutions which make borrower assessment, fraud prevention and instant loan disbursement a seamless process. With the growth of AI-driven lending automation and predictive credit analytics, the appetite for fully integrated, multi-functional lending platforms will probably continue to grow across all financial services lines of business.

Loan origination software deployment has significantly matured, where financial institutions must opt for cloud-based or on-premises solutions depending on scalability, data privacy and security, and procedural efficiency. Even if cloud-based approaches are broadly appreciated for their reduced cost of ownership, scalability, and remote usage, on-premises loan origination software remains the preferable approach for organizations with elevated data security, a need for data control, and tailored infrastructure security demands.

Digital banking, AI-driven credit risk modelling, and real-time loan application processing have pushed financial institutions further to invest in cloud-native loan origination software to boost procedural agility, optimize resource allocation, and enrich borrower experience.

On-premises loan origination solutions are popular for maintaining data proprietorship in organizations domestic and offshore, and for extensive network security procedures and legacy system coordination. Cloud-Based Loan Origination Software Most Preferred Following Escalation for Scalability and Digital Lending Evolution. Cloud-based LO software has defined the landscape of digital lending by lowering expenditure on integrated infrastructure, ensuring consistent loan workflows, and improving real-time access to information.

Cloud-native lending software is being increasingly adopted mostly due to the need for flexible, AI-driven, and API-connected software that efficiently integrates with digital banks, credit bureau software, and alternative lenders. The platform may process actual loan applications rapidly due to a lack of server downtime, and borrowers can access lending data when and where they like. Lending analytics are increasingly commonly driven through the resultant use of cloud, AI, and compliance management automation.

By deploying on the cloud, financial institutions can save money through infrastructure cost reduction, increase their efficiency of loan processing, and achieve a higher security for their data by utilizing cloud encryption. Cloud-based loan origination software leverages the ability to seamlessly set up instant system upgrades, fine-tune credit decisioning models, and avail cloud-native data analytics to play a pivotal role in next-gen digital lending.

With all its advantages, there are still challenges arising from cybersecurity risks, adherence to regional data protection legislation, and dependence on a third-party cloud service provider for cloud-based deployment. But the implementation of these AI-powered fraud detection, decentralized identity verification, and block chain-based lending security have ultimately improved the resilience of cloud infrastructure and regulatory compliance. Increase in cloud-based loan origination automation adoption will boost the market growth in digital-first lending spaces.

Enterprise banks, giant-scale financial institutions and organizations seeking strict compliance still prefer on premise loan origination software. In heavily regulated markets, many banks and lending institutions prefer on-premises deployment to maintain complete control of borrower data, reduce cybersecurity threats, and work effortlessly with legacy banking infrastructure.

On-premise loan origination software delivers maximum system ownership, customization, and security protocols which enables financial institutions to safeguard sensitive borrower data and prevent unauthorized access by third parties. Despite the relatively fast-paced transition to cloud-native solutions, over 45% of global banks still run on-premises loan origination software, highlighting the continued significance of its market position.

Though on premise solutions demand more upfront investment, maintenance resources, and IT skills, financial institutions focused on data security, regulatory compliance, and hands-on access to infrastructure still favour locally hosted lending platforms. While the traditional lending mechanism is yet to undergo modernization, hybrid cloud architectures, AI-powered risk mitigation models, and on-premises digital banking integrations can improve operational procedure.

With the growth of digital lending adoption, financial institutions need to balance on premise security of their data with cloud-based scalability while adopting the digital loan origination software in a more tactical manner. As AI-driven credit risk assessment, block chain-based loan verification, and real-time borrower analytics continue to evolve, both cloud and on-premises loan origination software solutions will help to define the landscape of next-gen lending technology.

The loan origination software market is a highly competitive arena, with the growing need for automated, AI-driven, and cloud-based lending solutions driving demand. Banks, credit unions, non-banking financial companies (NBFCs), and other financial institutions are leveraging the latest generation of loan origination software to speed up application processing, enhance credit risk assessment, and comply with regulations.

Key players concentrate on providing end-to-end digital lending platforms, AI-driven underwriting, and seamless integration with third-party financial services. The marketplace includes international FinTech corporates, niche industry loan software firms and cloud-based loan management system developers for the retail and commercial lending markets.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Ellie Mae (ICE Mortgage Technology) | 18-22% |

| Fiserv, Inc. | 15-19% |

| Black Knight, Inc. | 12-16% |

| Finastra | 8-12% |

| Temenos AG | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Ellie Mae (ICE Mortgage Technology) | Develops Encompass® loan origination system, offering AI-powered automation, cloud-based loan processing, and regulatory compliance solutions. |

| Fiserv, Inc. | Provides LoanComplete™ and digital lending solutions, integrating risk management, fraud detection, and AI-enhanced credit evaluation. |

| Black Knight, Inc. | Specializes in Empower® LOS, a comprehensive loan origination and servicing platform for mortgage lenders. |

| Finastra | Offers Fusion Mortgagebot™, an AI-driven loan origination system, ensuring fast loan processing and seamless third-party integrations. |

| Temenos AG | Provides Temenos Infinity Loan Origination, a cloud-native digital lending platform with built-in analytics and compliance tools. |

Key Company Insights

Ellie Mae (ICE Mortgage Technology)

Ellie Mae leads the loan origination market with Encompass®, a cloud-based, AI-driven LOS platform, offering end-to-end automation, compliance management, and mortgage lending solutions.

Fiserv, Inc.

Fiserv provides LoanComplete™ and digital lending solutions, integrating real-time credit risk assessment, AI-based fraud detection, and efficient loan decisioning tools.

Black Knight, Inc.

Black Knight specializes in Empower® LOS, delivering advanced mortgage origination solutions with real-time loan tracking and compliance automation.

Finastra

Finastra offers Fusion Mortgagebot™, a digital-first lending system, focusing on enhanced borrower experience, AI-powered credit decisioning, and regulatory compliance.

Temenos AG

Temenos provides Temenos Infinity Loan Origination, a cloud-native digital lending platform that integrates advanced analytics, AI-powered risk assessment, and open banking capabilities.

Other Key Players (30-40% Combined)

Several other companies contribute to the loan origination software market, focusing on AI-driven lending solutions, cloud-based loan processing, and digital-first borrower experiences:

The overall market size for the loan origination software market was USD 6,416 million in 2025.

The loan origination software market is expected to reach USD 21,780 million in 2035.

The increasing adoption of digital lending solutions, rising demand for automated loan processing systems, and growing focus on compliance and risk management fuel the loan origination software market during the forecast period.

The top 5 countries driving the development of the loan origination software market are the USA, UK, European Union, Japan, and South Korea.

Integrated lending platform and standalone loan origination software lead market growth to command a significant share over the assessment period.

Table 1: Global Market Value (US$ million) Analysis (2018 to 2022) By Component

Table 2: Global Market Value (US$ million) Forecast (2023 to 2033) By Component

Table 3: Global Market Value (US$ million) Analysis (2018 to 2022) By Deployment

Table 4: Global Market Value (US$ million) Forecast (2023 to 2033) By Deployment

Table 5: Global Market Value (US$ million) Analysis (2018 to 2022) By Enterprise Size

Table 6: Global Market Value (US$ million) Forecast (2023 to 2033) By Enterprise Size

Table 7: Global Market Value (US$ million) Analysis (2018 to 2022) By End-user

Table 8: Global Market Value (US$ million) Forecast (2023 to 2033) By End-user

Table 9: Global Market Value (US$ million) Analysis (2018 to 2022) By Region

Table 10: Global Market Value (US$ million) Forecast (2023 to 2033) By Region

Table 11: North America Market Value (US$ million) Analysis (2018 to 2022) By Component

Table 12: North America Market Value (US$ million) Forecast (2023 to 2033) By Component

Table 13: North America Market Value (US$ million) Analysis (2018 to 2022) By Deployment

Table 14: North America Market Value (US$ million) Forecast (2023 to 2033) By Deployment

Table 15: North America Market Value (US$ million) Analysis (2018 to 2022) By Enterprise Size

Table 16: North America Market Value (US$ million) Forecast (2023 to 2033) By Enterprise Size

Table 17: North America Market Value (US$ million) Analysis (2018 to 2022) By End-user

Table 18: North America Market Value (US$ million) Forecast (2023 to 2033) By End-user

Table 19: North America Market Value (US$ million) Analysis (2018 to 2022) by Country

Table 20: North America Market Value (US$ million) Forecast (2023 to 2033) by Country

Table 21: Latin America Market Value (US$ million) Analysis (2018 to 2022) By Component

Table 22: Latin America Market Value (US$ million) Forecast (2023 to 2033) By Component

Table 23: Latin America Market Value (US$ million) Analysis (2018 to 2022) By Deployment

Table 24: Latin America Market Value (US$ million) Forecast (2023 to 2033) By Deployment

Table 25: Latin America Market Value (US$ million) Analysis (2018 to 2022) By Enterprise Size

Table 26: Latin America Market Value (US$ million) Forecast (2023 to 2033) By Enterprise Size

Table 27: Latin America Market Value (US$ million) Analysis (2018 to 2022) By End-user

Table 28: Latin America Market Value (US$ million) Forecast (2023 to 2033) By End-user

Table 29: Latin America Market Value (US$ million) Analysis (2018 to 2022) by Country

Table 30: Latin America Market Value (US$ million) Forecast (2023 to 2033) by Country

Table 31: Europe Market Value (US$ million) Analysis (2018 to 2022) By Component

Table 32: Europe Market Value (US$ million) Forecast (2023 to 2033) By Component

Table 33: Europe Market Value (US$ million) Analysis (2018 to 2022) By Deployment

Table 34: Europe Market Value (US$ million) Forecast (2023 to 2033) By Deployment

Table 35: Europe Market Value (US$ million) Analysis (2018 to 2022) By Enterprise Size

Table 36: Europe Market Value (US$ million) Forecast (2023 to 2033) By Enterprise Size

Table 37: Europe Market Value (US$ million) Analysis (2018 to 2022) By End-user

Table 38: Europe Market Value (US$ million) Forecast (2023 to 2033) By End-user

Table 39: Europe Market Value (US$ million) Analysis (2018 to 2022) by Country

Table 40: Europe Market Value (US$ million) Forecast (2023 to 2033) by Country

Table 41: South Asia & Pacific Market Value (US$ million) Analysis (2018 to 2022) By Component

Table 42: South Asia & Pacific Market Value (US$ million) Forecast (2023 to 2033) By Component

Table 43: South Asia & Pacific Market Value (US$ million) Analysis (2018 to 2022) By Deployment

Table 44: South Asia & Pacific Market Value (US$ million) Forecast (2023 to 2033) By Deployment

Table 45: South Asia & Pacific Market Value (US$ million) Analysis (2018 to 2022) By Enterprise Size

Table 46: South Asia & Pacific Market Value (US$ million) Forecast (2023 to 2033) By Enterprise Size

Table 47: South Asia & Pacific Market Value (US$ million) Analysis (2018 to 2022) By End-user

Table 48: South Asia & Pacific Market Value (US$ million) Forecast (2023 to 2033) By End-user

Table 49: South Asia & Pacific Market Value (US$ million) Analysis (2018 to 2022) by Country

Table 50: South Asia & Pacific Market Value (US$ million) Forecast (2023 to 2033) by Country

Table 51: East Asia Market Value (US$ million) Analysis (2018 to 2022) By Component

Table 52: East Asia Market Value (US$ million) Forecast (2023 to 2033) By Component

Table 53: East Asia Market Value (US$ million) Analysis (2018 to 2022) By Deployment

Table 54: East Asia Market Value (US$ million) Forecast (2023 to 2033) By Deployment

Table 55: East Asia Market Value (US$ million) Analysis (2018 to 2022) By Enterprise Size

Table 56: East Asia Market Value (US$ million) Forecast (2023 to 2033) By Enterprise Size

Table 57: East Asia Market Value (US$ million) Analysis (2018 to 2022) By End-user

Table 58: East Asia Market Value (US$ million) Forecast (2023 to 2033) By End-user

Table 59: East Asia Market Value (US$ million) Analysis (2018 to 2022) by Country

Table 60: East Asia Market Value (US$ million) Forecast (2023 to 2033) by Country

Table 61: Middle East and Africa Market Value (US$ million) Analysis (2018 to 2022) By Component

Table 62: Middle East and Africa Market Value (US$ million) Forecast (2023 to 2033) By Component

Table 63: Middle East and Africa Market Value (US$ million) Analysis (2018 to 2022) By Deployment

Table 64: Middle East and Africa Market Value (US$ million) Forecast (2023 to 2033) By Deployment

Table 65: Middle East and Africa Market Value (US$ million) Analysis (2018 to 2022) By Enterprise Size

Table 66: Middle East and Africa Market Value (US$ million) Forecast (2023 to 2033) By Enterprise Size

Table 67: Middle East and Africa Market Value (US$ million) Analysis (2018 to 2022) By End-user

Table 68: Middle East and Africa Market Value (US$ million) Forecast (2023 to 2033) By End-user

Table 69: Middle East and Africa Market Value (US$ million) Analysis (2018 to 2022) by Country

Table 70: Middle East and Africa Market Value (US$ million) Forecast (2023 to 2033) by Country

Figure 1: Global Market Size (US$ million) and Y-o-Y Growth Rate from 2023 to 2033

Figure 2: Global Market Size and Y-o-Y Growth Rate from 2023 to 2033

Figure 3: Global Market Value (US$ million), 2018 to 2022

Figure 4: Global Market Value (US$ million), 2023 to 2033

Figure 5: Global Market Value Share Analysis (2023 to 2033) By Component

Figure 6: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Component

Figure 7: Global Market Attractiveness By Component

Figure 8: Global Market Value Share Analysis (2023 to 2033) By Deployment

Figure 9: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment

Figure 10: Global Market Attractiveness By Deployment

Figure 11: Global Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 12: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 13: Global Market Attractiveness By Enterprise Size

Figure 14: Global Market Value Share Analysis (2023 to 2033) By End-user

Figure 15: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End-user

Figure 16: Global Market Attractiveness By End-user

Figure 17: Global Market Value Share Analysis (2023 to 2033) By Region

Figure 18: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Region

Figure 19: Global Market Attractiveness By Region

Figure 20: North America Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 21: Latin America Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 22: Europe Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 23: East Asia Market Absolute $ Opportunity (US$ million), 2018- 2033

Figure 24: South Asia & Pacific Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 25: Middle East & Africa Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 26: North America Market Value (US$ million), 2018 to 2022

Figure 27: North America Market Value (US$ million), 2023 to 2033

Figure 28: North America Market Value Share Analysis (2023 to 2033) By Component

Figure 29: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Component

Figure 30: North America Market Attractiveness By Component

Figure 31: North America Market Value Share Analysis (2023 to 2033) By Deployment

Figure 32: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment

Figure 33: North America Market Attractiveness By Deployment

Figure 34: North America Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 35: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 36: North America Market Attractiveness By Enterprise Size

Figure 37: North America Market Value Share Analysis (2023 to 2033) By End-user

Figure 38: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End-user

Figure 39: North America Market Attractiveness By End-user

Figure 40: North America Market Value Share Analysis (2023 to 2033) by Country

Figure 41: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 42: North America Market Attractiveness by Country

Figure 43: USA Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 44: Canada Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 45: Latin America Market Value (US$ million), 2018 to 2022

Figure 46: Latin America Market Value (US$ million), 2023 to 2033

Figure 47: Latin America Market Value Share Analysis (2023 to 2033) By Component

Figure 48: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Component

Figure 49: Latin America Market Attractiveness By Component

Figure 50: Latin America Market Value Share Analysis (2023 to 2033) By Deployment

Figure 51: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment

Figure 52: Latin America Market Attractiveness By Deployment

Figure 53: Latin America Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 54: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 55: Latin America Market Attractiveness By Enterprise Size

Figure 56: Latin America Market Value Share Analysis (2023 to 2033) By End-user

Figure 57: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End-user

Figure 58: Latin America Market Attractiveness By End-user

Figure 59: Latin America Market Value Share Analysis (2023 to 2033) by Country

Figure 60: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 61: Latin America Market Attractiveness by Country

Figure 62: Brazil Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 63: Mexico Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 64: Rest of Latin America Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 65: Europe Market Value (US$ million), 2018 to 2022

Figure 66: Europe Market Value (US$ million), 2023 to 2033

Figure 67: Europe Market Value Share Analysis (2023 to 2033) By Component

Figure 68: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Component

Figure 69: Europe Market Attractiveness By Component

Figure 70: Europe Market Value Share Analysis (2023 to 2033) By Deployment

Figure 71: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment

Figure 72: Europe Market Attractiveness By Deployment

Figure 73: Europe Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 74: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 75: Europe Market Attractiveness By Enterprise Size

Figure 76: Europe Market Value Share Analysis (2023 to 2033) By End-user

Figure 77: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End-user

Figure 78: Europe Market Attractiveness By End-user

Figure 79: Europe Market Value Share Analysis (2023 to 2033) by Country

Figure 80: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 81: Europe Market Attractiveness by Country

Figure 82: Germany Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 83: Italy Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 84: France Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 85: UK Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 86: Spain Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 87: BENELUX Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 88: Russia Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 89: Rest of Europe Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 90: South Asia & Pacific Market Value (US$ million), 2018 to 2022

Figure 91: South Asia & Pacific Market Value (US$ million), 2023 to 2033

Figure 92: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Component

Figure 93: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Component

Figure 94: South Asia & Pacific Market Attractiveness By Component

Figure 95: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Deployment

Figure 96: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment

Figure 97: South Asia & Pacific Market Attractiveness By Deployment

Figure 98: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 99: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 100: South Asia & Pacific Market Attractiveness By Enterprise Size

Figure 101: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By End-user

Figure 102: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End-user

Figure 103: South Asia & Pacific Market Attractiveness By End-user

Figure 104: South Asia & Pacific Market Value Share Analysis (2023 to 2033) by Country

Figure 105: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 106: South Asia & Pacific Market Attractiveness by Country

Figure 107: India Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 108: Indonesia Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 109: Malaysia Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 110: Singapore Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 111: Australia& New Zealand Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 112: Rest of South Asia & Pacific Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 113: East Asia Market Value (US$ million), 2018 to 2022

Figure 114: East Asia Market Value (US$ million), 2023 to 2033

Figure 115: East Asia Market Value Share Analysis (2023 to 2033) By Component

Figure 116: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Component

Figure 117: East Asia Market Attractiveness By Component

Figure 118: East Asia Market Value Share Analysis (2023 to 2033) By Deployment

Figure 119: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment

Figure 120: East Asia Market Attractiveness By Deployment

Figure 121: East Asia Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 122: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 123: East Asia Market Attractiveness By Enterprise Size

Figure 124: East Asia Market Value Share Analysis (2023 to 2033) By End-user

Figure 125: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End-user

Figure 126: East Asia Market Attractiveness By End-user

Figure 127: East Asia Market Value Share Analysis (2023 to 2033) by Country

Figure 128: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 129: East Asia Market Attractiveness by Country

Figure 130: China Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 131: Japan Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 132: South Korea Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 133: Middle East and Africa Market Value (US$ million), 2018 to 2022

Figure 134: Middle East and Africa Market Value (US$ million), 2023 to 2033

Figure 135: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Component

Figure 136: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Component

Figure 137: Middle East and Africa Market Attractiveness By Component

Figure 138: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Deployment

Figure 139: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment

Figure 140: Middle East and Africa Market Attractiveness By Deployment

Figure 141: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 142: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 143: Middle East and Africa Market Attractiveness By Enterprise Size

Figure 144: Middle East and Africa Market Value Share Analysis (2023 to 2033) By End-user

Figure 145: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End-user

Figure 146: Middle East and Africa Market Attractiveness By End-user

Figure 147: Middle East and Africa Market Value Share Analysis (2023 to 2033) by Country

Figure 148: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 149: Middle East and Africa Market Attractiveness by Country

Figure 150: GCC Countries Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 151: Turkey Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 152: South Africa Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 153: Rest of Middle East and Africa Market Absolute $ Opportunity (US$ million), 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chloangiocarcinoma (CCA) Therapeutics Market - Growth & Drug Innovations 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Camera (SDC) Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Software Distribution Industry

Software Distribution Market Analysis by Deployment Type, by Organization Size and by Industry Vertical Through 2035

Software-Defined WAN Market - Growth & Forecast through 2034

Software Defined Video Networking Market

UK Software Distribution Market Analysis – Size & Industry Trends 2025-2035

VPN Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA