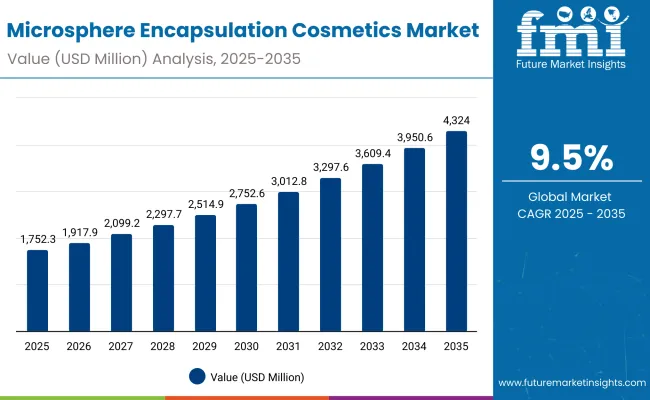

The Microsphere Encapsulation Cosmetics Market is expected to record a valuation of USD 1,752.3 million in 2025 and USD 4,324.0 million in 2035, with an increase of USD 2,571.7 million, which equals a growth of 147% over the decade. The overall expansion represents a CAGR of 9.5% and a 2.5X increase in market size.

Microsphere Encapsulation Cosmetics Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,752.3 million |

| Market Forecast Value in (2035F) | USD 4,324.0 million |

| Forecast CAGR (2025 to 2035) | 9.5% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,752.3 million to USD 2,752.6 million, adding USD 1,000.3 million, which accounts for 39% of the total decade growth. This phase records steady adoption in skincare, color cosmetics, and suncare, driven by the need for ingredient stability and controlled release. Retinol dominates this period as it caters to over 57% of ingredient encapsulation value in key regions such as the USA

The second half from 2030 to 2035 contributes USD 1,571.4 million, equal to 61% of total growth, as the market jumps from USD 2,752.6 million to USD 4,324.0 million. This acceleration is powered by widespread deployment of encapsulated vitamin C, peptides, and UV filters in masstige and premium skincare. Silica and lipid-based microspheres together capture a larger share above 49% by the end of the decade. Skincare remains the backbone application, accounting for over 55% of total value in 2025 and maintaining its lead through 2035.

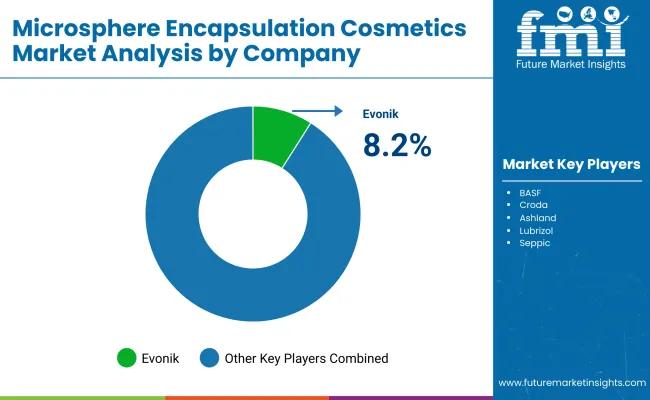

From 2020 to 2024, the Microsphere Encapsulation Cosmetics Market grew steadily, driven by skincare-centric adoption. During this period, the competitive landscape was dominated by multinational ingredient suppliers controlling nearly 70% of revenue, with leaders such as Evonik, BASF, and Croda focusing on encapsulation technologies for active ingredients like retinol and vitamin C. Competitive differentiation relied on stability, delivery efficiency, and premium positioning, while fragrance encapsulation remained an auxiliary offering rather than a primary revenue stream. Service-based models had minimal traction, contributing less than 10% of the total market value.

Demand for microsphere encapsulation in cosmetics will expand to USD 1,752.3 million in 2025, and the revenue mix will shift as peptides, vitamin C, and UV filters grow to over 40% share. Traditional ingredient leaders face rising competition from niche players specializing in natural lipid-based carriers and color cosmetic encapsulation. Major suppliers are pivoting to hybrid models, integrating biotechnology and clean formulation technologies to retain relevance. Emerging entrants specializing in regional supply partnerships, K-beauty collaborations, and sustainable shell materials are gaining share. The competitive advantage is moving away from ingredient supply alone to ecosystem strength, brand partnerships, and multi-segment applications.

Advances in encapsulation technologies have improved ingredient stability, bioavailability, and controlled release, allowing for more efficient delivery across diverse cosmetic applications. Retinol encapsulation has gained popularity due to its ability to reduce irritation and preserve potency. The rise of vitamin C encapsulation has contributed to enhanced skin-brightening claims, while peptides and UV filters are increasingly integrated into multifunctional products. Skincare remains the leading driver, supported by demand for anti-aging, sun protection, and dermocosmetic formulations.

Expansion of encapsulation into color cosmetics, fragrance, and hybrid beauty has fueled market growth. Innovations in lipid-based and silica microspheres, combined with polymer advancements, are expected to open new application areas. Segment growth is expected to be led by retinol encapsulation, polymer microspheres, and skincare products due to their adaptability and consumer demand.

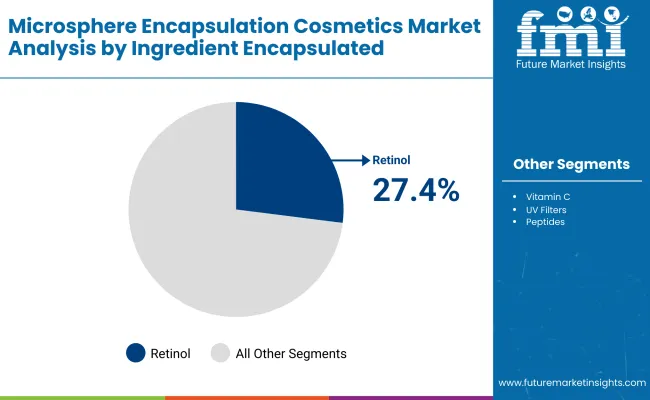

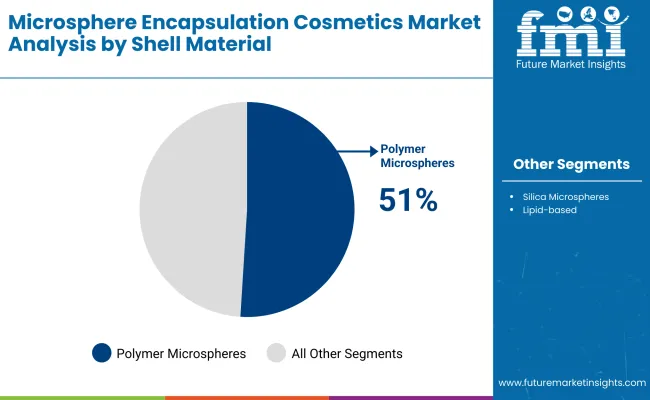

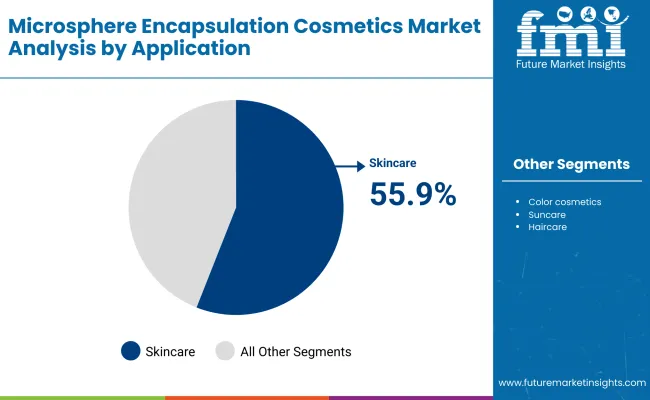

The market is segmented by ingredient encapsulated, shell material, application, product format, end consumer tier, and geography. Ingredients include retinol, vitamin C, UV filters, fragrances, and peptides, highlighting the active components driving adoption. Shell materials include polymer microspheres, silica microspheres, and lipid-based carriers to cater to different formulation requirements. Based on application, segmentation includes skincare, color cosmetics, suncare, and haircare. In terms of product format, categories encompass serums & creams, foundations & primers, and powders. End consumer tiers include mass, masstige, and premium. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

| Ingredient Segment | Market Value Share, 2025 |

|---|---|

| Retinol | 27.4% |

| Others | 72.6% |

The retinol segment is projected to contribute 27.4% of the Microsphere Encapsulation Cosmetics Market revenue in 2025, maintaining its lead as the dominant ingredient category. Encapsulation addresses the instability of retinol, which normally degrades quickly when exposed to light or oxygen. By using polymer and lipid microspheres, cosmetic brands can extend shelf life, improve skin tolerance, and ensure controlled release, making retinol more effective in anti-aging and dermocosmetic applications. While retinol remains the anchor, other ingredients such as vitamin C and peptides are experiencing rapid momentum, supported by consumer preference for brightening, collagen-boosting, and firming claims in skincare routines.

| Shell Material Segment | Market Value Share, 2025 |

|---|---|

| Polymer microspheres | 51.0% |

| Others | 49.0% |

The polymer microspheres segment is forecasted to hold 51.0% of the market share in 2025, reflecting its adaptability across skincare, color cosmetics, and suncare. Polymers allow for precise control of release mechanisms, enabling gradual diffusion of actives such as retinol and vitamin C over several hours. This technology aligns well with the performance and efficacy expectations of both mass-market and premium consumers. However, silica microspheres are becoming increasingly popular in powder-based products due to their oil-absorbing and texture-enhancing properties, while lipid-based microspheres are aligning with clean beauty trends and natural-origin claims. Together, they represent a diversifying market where innovation in carrier materials will become a differentiating factor for brands.

| Application Segment | Market Value Share, 2025 |

|---|---|

| Skincare | 55.9% |

| Others | 44.1% |

The skincare segment is projected to account for 55.9% of the Microsphere Encapsulation Cosmetics Market revenue in 2025, establishing it as the dominant application. The dominance of skincare is fueled by the strong global consumer focus on anti-aging, hydration, brightening, and sun protection solutions. Encapsulation enhances both perceived and actual efficacy of skincare products by ensuring actives penetrate deeper layers of the skin without irritation.

The rise of hybrid products, such as tinted moisturizers with encapsulated UV filters or serums with encapsulated peptides, is also blurring boundaries between skincare and makeup. Meanwhile, color cosmetics are increasingly adopting encapsulation to improve long-wear properties, while suncare and haircare are emerging categories leveraging the technology to create multifunctional and more stable formulations.

Drivers

Rising Demand for Stable and Effective Active Ingredients

One of the strongest drivers for the Microsphere Encapsulation Cosmetics Market is the consumer shift toward high-performance skincare and cosmetics featuring actives such as retinol, vitamin C, and peptides. These ingredients are notoriously unstable when exposed to air, light, or moisture, often losing potency before reaching the skin. Encapsulation technology solves this issue by stabilizing sensitive actives, allowing controlled release, enhanced penetration, and reduced irritation. This not only boosts consumer confidence in product efficacy but also enables brands to market premium, science-backed solutions across both skincare and color cosmetics.

Growth of Premium and Masstige Beauty Segments

Encapsulation aligns perfectly with the rising demand for masstige and premium beauty products, where consumers are willing to pay more for innovation, proven benefits, and sustainability. Encapsulated actives are increasingly used in luxury anti-aging creams, serums, and multifunctional products like hybrid foundations with skincare benefits. As East Asia and South Asia & Pacific expand rapidly in these tiers, global suppliers and brands are scaling encapsulated solutions to cater to consumers who associate encapsulation with advanced, dermatologically tested, and superior-quality formulations.

Restraints

High Cost of Encapsulation Technology

Encapsulation adds complexity and cost to cosmetic product development, from R&D investment to specialized production equipment and carrier materials. For brands targeting mass-market consumers, higher formulation costs can limit adoption or lead to premium pricing that may alienate cost-sensitive buyers. This challenge is particularly evident in price-sensitive regions such as Latin America and parts of Asia, where consumers are still highly value-driven.

Regulatory and Labeling Challenges

Cosmetic regulations in markets such as the EU, USA, and China impose strict requirements on ingredient safety, claims, and labeling. Encapsulated actives often need additional testing to validate safety, release profiles, and long-term stability, which can delay time-to-market. Furthermore, “encapsulation” is not always well understood by consumers, requiring brands to balance regulatory compliance with clear communication of benefits without making exaggerated medical-like claims.

Key Trends

Expansion of Hybrid Beauty Products

Hybrid products combining skincare benefits with makeup functions are a major trend shaping the market. Examples include foundations infused with encapsulated peptides, sunscreens containing encapsulated vitamin C, and powders with encapsulated fragrances. Consumers increasingly seek multifunctional products that provide both cosmetic coverage and long-term skincare benefits, and encapsulation is central to this positioning.

Shift Toward Natural and Clean Encapsulation Carriers

While polymer microspheres currently dominate, there is a strong trend toward lipid-based and silica microspheres, as clean beauty and natural-origin claims grow in importance. Lipid carriers resonate with sustainability-conscious consumers, while silica microspheres are increasingly used in powders and oil-control products. This trend reflects how encapsulation is not only a performance tool but also an enabler of clean label and eco-friendly positioning.

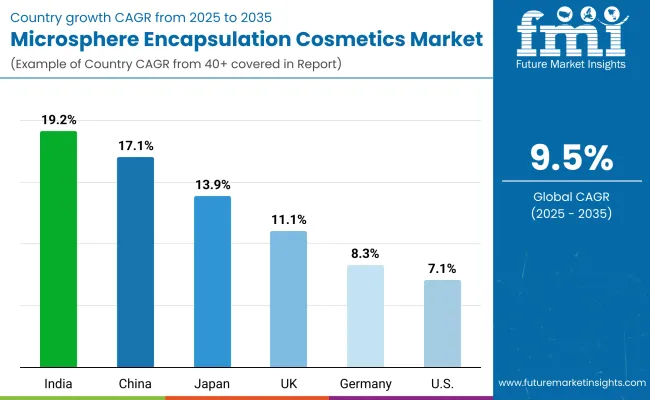

Markets such as China and India are growing at 17.1% and 19.2% CAGR, respectively, outpacing global averages. Rising middle-class income, rapid masstige/premium adoption, and the popularity of K-beauty and J-beauty formulations are fueling encapsulation adoption. Local brands are also partnering with global ingredient suppliers to differentiate products with encapsulated actives, accelerating regional penetration.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 17.1% |

| USA | 7.1% |

| India | 19.2% |

| UK | 11.1% |

| Germany | 8.3% |

| Japan | 13.9% |

The Microsphere Encapsulation Cosmetics Market shows strong geographical contrasts in growth rates between 2025 and 2035. India (19.2% CAGR) and China (17.1% CAGR) are the fastest-expanding markets, reflecting their rapidly growing middle-class consumer base, rising disposable incomes, and the increasing popularity of masstige and premium beauty products. Demand in these regions is driven by skincare awareness, the influence of K-beauty and J-beauty trends, and the appeal of multifunctional cosmetics with encapsulated actives such as retinol, vitamin C, and peptides. Japan also stands out with a double-digit CAGR of 13.9%, as its mature market continues to innovate through technology-led formulations, particularly in anti-aging and hybrid cosmetic solutions.

In contrast, developed Western markets such as the USA (7.1% CAGR), Germany (8.3% CAGR), and the UK (11.1% CAGR) are expected to grow at steadier rates. These markets are highly saturated, but innovation in premium skincare and clean beauty encapsulation formats will sustain demand. The USA continues to be a hub for retinol encapsulation, while European consumers are showing stronger adoption of silica and lipid-based carriers aligned with natural and sustainable beauty preferences. Overall, while growth in Western regions will be incremental, the rapid acceleration in Asia will be the primary driver behind the global market’s near 2.5X expansion over the forecast period.

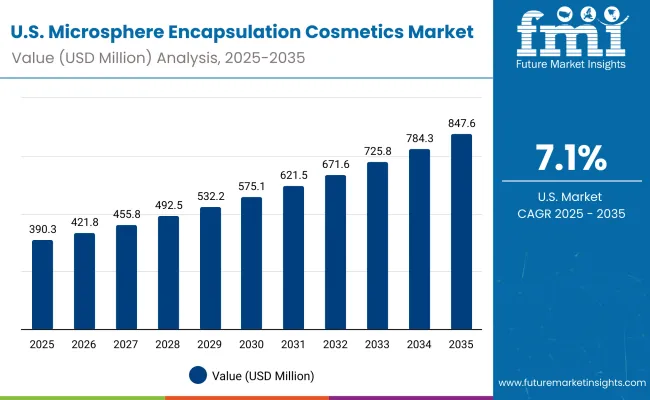

| Year | USA Microsphere Encapsulation Cosmetics Market (USD Million) |

|---|---|

| 2025 | 390.3 |

| 2026 | 421.8 |

| 2027 | 455.8 |

| 2028 | 492.6 |

| 2029 | 532.3 |

| 2030 | 575.2 |

| 2031 | 621.6 |

| 2032 | 671.7 |

| 2033 | 725.8 |

| 2034 | 784.4 |

| 2035 | 847.6 |

The Microsphere Encapsulation Cosmetics Market in the United States is projected to grow at a CAGR of 7.1%, led by sustained consumer demand for anti-aging and dermatology-inspired skincare. Encapsulated retinol remains the most dominant ingredient, accounting for nearly 58% of the USA market in 2025, reflecting its critical role in serums, night creams, and dermocosmetic solutions. Growth is also supported by the premiumization of masstige brands and strong positioning of encapsulated vitamin C in brightening formulations. Innovation is accelerating through partnerships between ingredient suppliers and clinical skincare brands, with an emphasis on efficacy validation and consumer trust.

The Microsphere Encapsulation Cosmetics Market in the United Kingdom is expected to grow at a CAGR of 11.1%, supported by consumer demand for hybrid formulations and advanced skincare. UK brands are rapidly incorporating encapsulated vitamin C, peptides, and UV filters into multifunctional products such as brightening serums and tinted moisturizers. Retailers and indie beauty labels are increasingly marketing encapsulation as a differentiator, highlighting stability, clean beauty alignment, and long-lasting efficacy. Regulatory compliance with EU and UK cosmetic safety laws continues to be a cornerstone, pushing suppliers to invest in testing and transparent labeling.

India is witnessing rapid growth in the Microsphere Encapsulation Cosmetics Market, which is forecast to expand at a CAGR of 19.2% through 2035, the fastest among all leading countries. Rising incomes, urbanization, and the spread of beauty consumption into tier-2 and tier-3 cities are fueling demand. Consumers are highly receptive to masstige and premium skincare products that promise visible benefits, such as anti-aging, brightening, and sun protection. Encapsulation is gaining visibility in dermatologist-recommended formulations, while domestic and international brands are localizing encapsulated actives into price-sensitive SKUs to capture mass appeal.

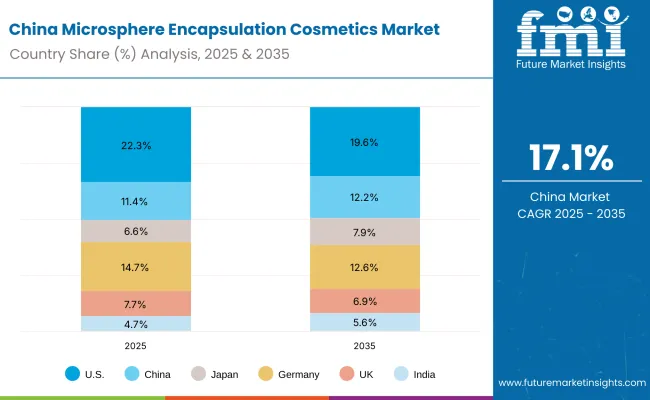

| Countries | 2025 Share (%) |

|---|---|

| USA | 22.3% |

| China | 11.4% |

| Japan | 6.6% |

| Germany | 14.7% |

| UK | 7.7% |

| India | 4.7% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 19.6% |

| China | 12.2% |

| Japan | 7.9% |

| Germany | 12.6% |

| UK | 6.9% |

| India | 5.6% |

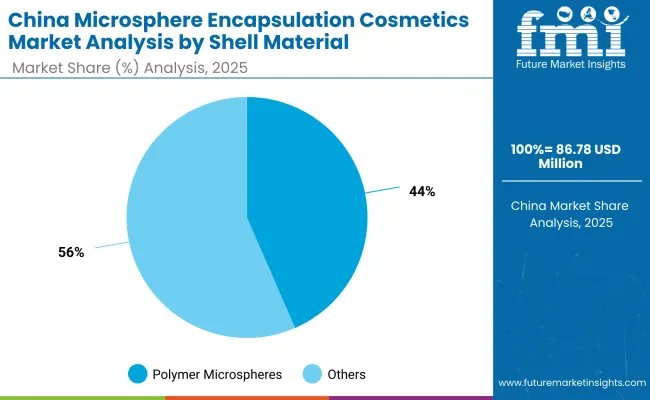

The Microsphere Encapsulation Cosmetics Market in China is expected to grow at a CAGR of 17.1%, making it one of the fastest-growing markets globally. Growth is propelled by strong consumer preference for brightening, whitening, and UV protection products, with encapsulated vitamin C and UV filters seeing sharp adoption. While polymer microspheres account for 43.5% of the Chinese market in 2025, silica and lipid-based microspheres are expanding rapidly, reflecting the clean beauty trend and demand for natural-origin carriers. Domestic brands are partnering with international ingredient suppliers to accelerate product differentiation, while affordable premium offerings are gaining traction across e-commerce platforms.

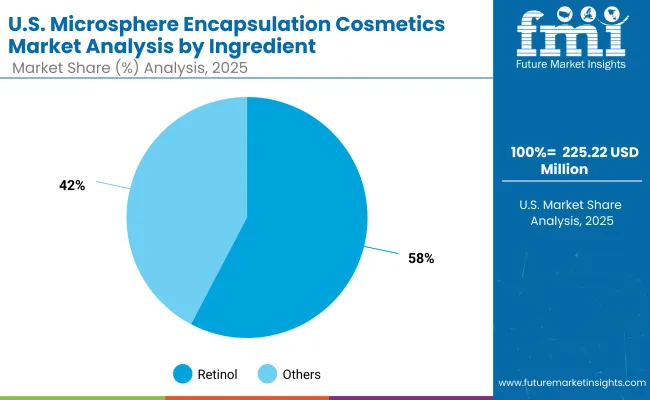

| Ingredient Segment | Market Value Share, 2025 |

|---|---|

| Retinol | 57.7% |

| Others | 42.3% |

The Microsphere Encapsulation Cosmetics Market in the United States is valued at USD 304.02 million in 2025, with retinol leading at 57.7% of ingredient-encapsulated value. Dominance of retinol reflects the USA market’s emphasis on clinical, anti-aging efficacy where encapsulation improves stability, reduces irritation, and enables sustained release in serums and night creams. Premium and masstige brands are amplifying encapsulated vitamin C and peptides in brightening and firming routines, while dermatologist-endorsed labels and specialty retailers push science-backed claims. Polymer microspheres remain the default carrier for broad compatibility, and brands are pairing encapsulation with consumer-perceivable benefits (longer wear, reduced sensitivity, improved potency) to justify price ladders.

This positioning makes encapsulated actives a core lever for premiumization and routine “upgrade” behavior, with strong upsell in serums & creams and growing use in hybrid color products (foundations/primers with skincare claims). Regulatory rigor and claim-substantiation norms steer investment into testing and data, reinforcing barriers to entry. As retail shifts toward education-led selling and DTC clinics, suppliers that bundle technical support + ready-to-formulate microcaps win faster adoption cycles.

| Shell Material Segment | Market Value Share, 2025 |

|---|---|

| Polymer microspheres | 43.5% |

| Others | 56.5% |

The Microsphere Encapsulation Cosmetics Market in China is valued at USD 199.96 million in 2025, with silica & lipid-based carriers collectively leading at 56.5%. This split mirrors China’s clean-beauty tilt and preference for brightening and UV-defense routines, where encapsulated vitamin C and UV filters are center stage. Silica microspheres add oil-control and texture refinement in powders and hybrid color formats, while lipid carriers bolster natural-origin narratives and skin-affinity claims. Domestic brands leverage rapid product cycles and e-commerce storytelling to mainstream encapsulation, often co-developing with global suppliers to secure differentiating claims and stability profiles.

As cross-border trends (K-beauty/J-beauty) shape aesthetics, encapsulation becomes a platform for multi-benefit launches: long-wear complexion products with skincare payoff, sunscreens with reduced irritation, and peptide-infused brightening serums. Expect faster adoption of masstige SKUs with premium cues, supported by livestream retail and ingredient-education content that clearly explains the “why” behind encapsulation.

The market is moderately fragmented, with multinational ingredient leaders, agile mid-sized innovators, and niche specialists competing across skincare, color cosmetics, suncare, and haircare. Evonik leads globally on encapsulation platforms and delivery systems, while BASF, Croda, Ashland, Lubrizol, Seppic, Gattefossé, Kobo Products, INOLEX, and Sensient Cosmetic Technologies scale portfolios spanning polymer, silica, and lipid microcarriers. Differentiation has shifted from “capsule available” to end-to-end enablement: stability data, in-use performance, sensorial tuning, claim language support, and regional compliance toolkits.

Mid-sized and specialty players win with ready-to-formulate concentrates, tailored particle sizes, and hybrid carriers optimized for specific actives (retinol, vitamin C, peptides). Color-cosmetic specialists push silica-rich textures for blurring/soft-focus effects; skincare-first suppliers advance low-irritation retinol and photostable UV systems. Across the board, competitive strategies emphasize:

Key Developments in Microsphere Encapsulation Cosmetics Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,752.3 million |

| Ingredient Encapsulated | Retinol, Vitamin C, UV Filters, Fragrances, Peptides |

| Shell Material | Polymer microspheres, Silica microspheres, Lipid-based |

| Application | Skincare, Color cosmetics, Suncare, Haircare |

| Product Format | Serums & creams, Foundations & primers, Powders |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Evonik, BASF, Croda, Ashland, Lubrizol, Seppic, Gattefossé, Kobo Products, INOLEX, Sensient Cosmetic Technologies |

| Additional Attributes | Dollar sales by ingredient and application, adoption trends in skincare and hybrid beauty, rising demand for encapsulated retinol and vitamin C, sector-specific growth in premium and masstige skincare, emerging role of lipid-based and silica carriers, software-supported formulation data and claim substantiation, regional trends influenced by clean beauty and sustainability, and innovations in polymer microspheres, peptide delivery, and photostable UV filter encapsulation. |

The Microsphere Encapsulation Cosmetics Market is estimated to be valued at USD 1,752.3 million in 2025.

The market size for the Microsphere Encapsulation Cosmetics Market is projected to reach USD 4,324.0 million by 2035.

The Microsphere Encapsulation Cosmetics Market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product formats in the Microsphere Encapsulation Cosmetics Market are serums & creams, foundations & primers, and powders.

In terms of ingredient encapsulated, retinol will command 27.4% share in the Microsphere Encapsulation Cosmetics Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microsphere Market Analysis by Type, Applications and Region: Forecast from 2025 to 2035

Expandable Microspheres Market Size and Share Forecast Outlook 2025 to 2035

Thermoexpandable Polymer Microsphere Market Size and Share Forecast Outlook 2025 to 2035

Injectable Osteoarthritis Microspheres Market Size and Share Forecast Outlook 2025 to 2035

EVOH Encapsulation Film Market Size and Share Forecast Outlook 2025 to 2035

Microencapsulation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Encapsulation Market Analysis- Size, Growth, and Forecast 2025 to 2035

Global Food Encapsulation Market Size, Growth, and Forecast for 2025 to 2035

Solar Encapsulation Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Encapsulation Material Market

Solar Encapsulation Materials Market

Liquid Encapsulation Market Analysis by Material, Product, and Region Through 2035

Flavor Encapsulation Market

Softgel Encapsulation Machine Market Growth - Trends & Forecast 2025 to 2035

Thin Film Encapsulation TFE Market Size and Share Forecast Outlook 2025 to 2035

Live Cell Encapsulation Market Analysis & Forecast for 2025 to 2035

Cosmetic Nanoencapsulation Market Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Encapsulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Pet Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA