The permanent magnet motor market is experiencing robust growth driven by rising energy efficiency standards, demand for compact high-performance motors, and increasing electrification across multiple industries. Permanent magnet motors offer higher torque density, improved power factor, and reduced energy losses compared to conventional motors.

The market’s expansion is reinforced by widespread adoption in electric vehicles, industrial automation, and renewable energy systems. Declining magnet costs and technological advancements in motor control electronics are further supporting affordability and scalability.

Additionally, initiatives promoting clean energy and emission reduction have accelerated integration of permanent magnet technologies in transportation and industrial equipment. With continued innovation in rare-earth materials and magnetic composites, the market outlook remains strong, emphasizing sustainability and efficiency..

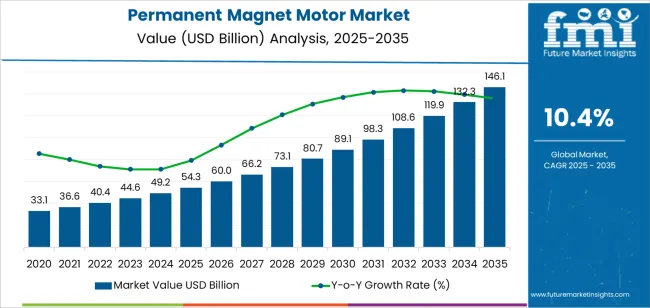

| Metric | Value |

|---|---|

| Permanent Magnet Motor Market Estimated Value in (2025 E) | USD 54.3 billion |

| Permanent Magnet Motor Market Forecast Value in (2035 F) | USD 146.1 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

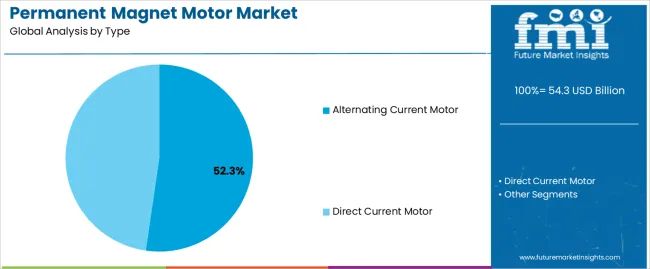

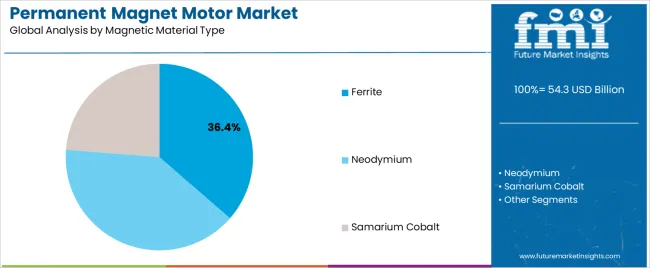

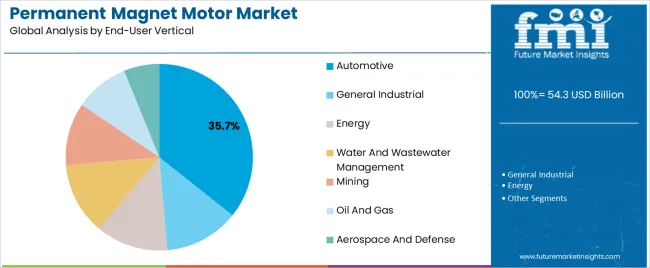

The market is segmented by Type, Magnetic Material Type, and End-User Vertical and region. By Type, the market is divided into Alternating Current Motor and Direct Current Motor. In terms of Magnetic Material Type, the market is classified into Ferrite, Neodymium, and Samarium Cobalt. Based on End-User Vertical, the market is segmented into Automotive, General Industrial, Energy, Water And Wastewater Management, Mining, Oil And Gas, and Aerospace And Defense. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

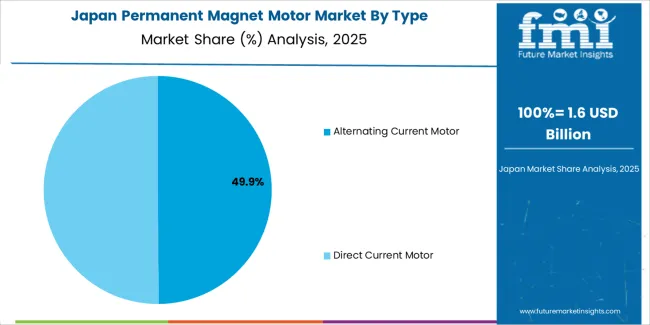

The alternating current motor segment dominates the type category, holding approximately 52.30% share. This leadership is attributed to its superior energy efficiency, high torque output, and adaptability across industrial and automotive applications.

AC permanent magnet motors provide smoother operation and better control compared to traditional induction motors. The segment’s growth is reinforced by increasing demand in electric vehicles, robotics, and industrial drives, where energy savings and performance are critical.

Advancements in inverter technology and digital motor control systems have further enhanced reliability and cost-effectiveness. As industries continue to prioritize operational efficiency and carbon reduction, the AC motor segment is projected to maintain its dominant position in the global market..

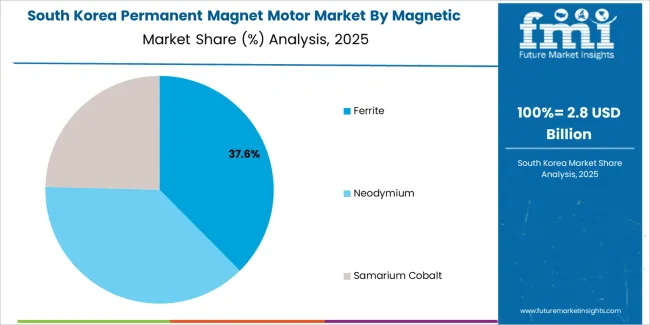

The ferrite segment accounts for approximately 36.40% share within the magnetic material type category, supported by its cost-effectiveness and resistance to corrosion and demagnetization. Ferrite magnets are widely used in low- to medium-power applications, offering a balance of performance and affordability.

The segment benefits from the limited dependence on rare-earth materials, making it less vulnerable to supply chain volatility. Growing use in household appliances, HVAC systems, and small electric motors has sustained demand.

With increasing emphasis on low-cost, environmentally stable magnet solutions, ferrite materials are expected to maintain strong utilization across mass-market applications..

The automotive segment leads the end-user vertical, representing approximately 35.70% share of the permanent magnet motor market. This dominance is fueled by the rising production of hybrid and electric vehicles that rely on high-efficiency motor systems for propulsion.

Permanent magnet motors provide superior acceleration, energy conversion efficiency, and compact design advantages in EV architectures. The segment also benefits from growing adoption in auxiliary systems such as power steering, cooling, and HVAC modules.

With regulatory mandates driving vehicle electrification and manufacturers investing heavily in lightweight motor technologies, the automotive segment is expected to remain the most influential end-use vertical during the forecast period..

The permanent magnet motor industry is anticipated to surpass a global valuation of USD USD 146.1 billion by the year 2035, with a growth rate of 10.40% CAGR. While the market is expected to experience remarkable growth, several restraining factors could adversely affect its development:

Depending on the motor type, the permanent magnet motor industry is bifurcated into DC and AC motors. The DC motors segment is anticipated to grow at a remarkable CAGR of 10.10%.

| Attributes | Details |

|---|---|

| Motor Type | Direct Current |

| CAGR | 10.10% |

The permanent magnet motor industry is categorized by materials into ferrite, neodymium, and samarium cobalt. The ferrite segment dominates the market and is anticipated to grow at an outstanding CAGR of 9.80%.

| Attributes | Details |

|---|---|

| Materials | Ferrite |

| CAGR | 9.80% |

The section provides an analysis of the permanent magnet motor industry by country, including Japan, China, the United States, South Korea, and the United Kingdom. The table presents the CAGR for each country, indicating the expected growth of the market in through 2035.

| Countries | CAGR |

|---|---|

| South Korea | 12.10% |

| The United Kingdom | 11.80% |

| China | 11.10% |

| The United States | 10.70% |

| Japan | 8.80% |

South Korea is one of the leading countries in this market. The South Korean permanent magnet motor industry is anticipated to retain its dominance by progressing at an annual growth rate of 12.10% till 2035.

The United Kingdom also dominates the permanent magnet motor industry. The United Kingdom's permanent magnet motor market is anticipated to retain its dominance by progressing at an annual growth rate of 11.80% till 2035.

China’s permanent magnet motor market is anticipated to exhibit a CAGR of 11.10% till 2035.

The United States is also one of the leading countries in the global permanent magnet motor industry, which is anticipated to register a CAGR of 10.70% through 2035.

The demand for permanent magnet motors in Japan is projected to rise at an 8.80% CAGR through 2035.

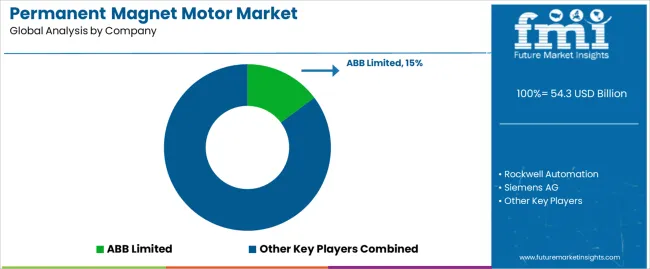

The global market for permanent magnet motors is filled with international and domestic countries. ABB Limited, Rockwell Automation, Siemens AG, Franklin Electric Company Inc., and Allied Motion Technologies Inc.

are prominent companies in the permanent magnet motor industry. These companies invest heavily in developing motors with increased efficiency, enhanced functionality, and smart features.

Key players in the market are also collaborating with government and non-government environmental entities to improve their reputation as socially responsible entities, attracting environmentally conscious consumers to the market.

Recent Developments

The global permanent magnet motor market is estimated to be valued at USD 54.3 billion in 2025.

The market size for the permanent magnet motor market is projected to reach USD 146.1 billion by 2035.

The permanent magnet motor market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in permanent magnet motor market are alternating current motor and direct current motor.

In terms of magnetic material type, ferrite segment to command 36.4% share in the permanent magnet motor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Permanent Magnet Generators Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Shielding Device Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Stripe Readers Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Drive Pump Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Separator Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Ballast Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Sensor Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Flowmeter Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Imaging Coils Market Analysis - Size, Share, and Forecast 2025 to 2035

Magnetic Tape Market Analysis Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Imaging (MRI) Contrast Agents Market Size and Share Forecast Outlook 2025 to 2035

Magneto Optic Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Crack Detectors Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Materials Market Growth - Trends & Forecast 2025 to 2035

Magnetic Resonance Imaging (MRI) Market Trends - Size, Share & Forecast 2025 to 2035

Magnetoresistive Sensors Market Growth & Demand 2025 to 2035

Magnetic Grill Market Analysis – Trends, Growth & Forecast 2025 to 2035

Magnetoencephalography Market - Growth & Technological Advancements 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA