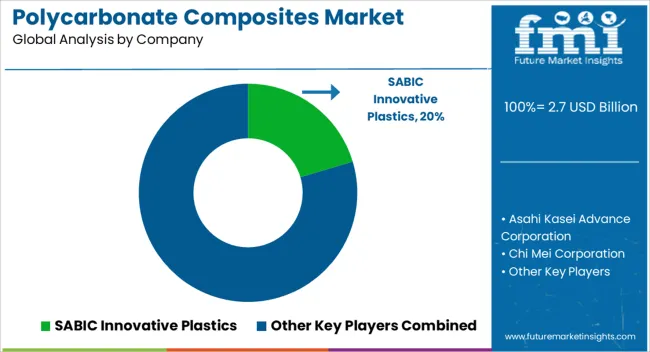

The polycarbonate composites market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 4.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. This trend reflects the expanding adoption of polycarbonate composites across sectors such as automotive, aerospace, electronics, and construction, where lightweight, durable, and high-performance materials are sought to enhance structural efficiency and reduce operational costs. By 2035, the polycarbonate composites market is projected to reach USD 4.9 billion, highlighting the increasing demand for resilient and versatile composite materials.

The steady growth trajectory indicates that manufacturers who provide reliable, high-strength composites will benefit from broader industrial adoption. These materials are being relied upon to improve mechanical performance, withstand harsh conditions, and support cost-effective production. The outlook underscores that polycarbonate composites are becoming integral in applications requiring durability, strength, and design flexibility, creating sustained opportunities for suppliers and reinforcing the material’s role in advanced manufacturing and industrial solutions.

The polycarbonate composites market is a specialized segment within the broader high-performance plastics market, where it holds approximately a 4-5% share due to its superior impact resistance, thermal stability, and lightweight properties that make it suitable for demanding applications. Within the automotive materials market, polycarbonate composites represent about a 3-4% share, largely used in headlamp lenses, interiors, and structural components, as manufacturers seek lightweight and durable alternatives to metals and traditional plastics.

In the aerospace and defense materials market, their share is slightly higher at around 5-6%, driven by applications in cabin interiors, protective panels, and lightweight structural components that help reduce fuel consumption and enhance safety.

Within the electronics and electrical components market, polycarbonate composites hold approximately 3-4% share, finding usage in housings, connectors, and insulating parts due to their excellent dielectric properties and mechanical strength. Meanwhile, in the construction and building materials market, the segment accounts for about a 2-3% share, primarily in glazing, panels, and protective coverings that require durability, transparency, and weather resistance.

| Metric | Value |

|---|---|

| Polycarbonate Composites Market Estimated Value in (2025 E) | USD 2.7 billion |

| Polycarbonate Composites Market Forecast Value in (2035 F) | USD 4.9 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The polycarbonate composites market is witnessing significant expansion driven by the material’s lightweight properties, superior impact resistance, and excellent thermal stability. Increased demand from electronics, automotive, and industrial sectors is prompting manufacturers to invest in enhanced reinforcement techniques and formulation innovations.

The rising adoption of composites over traditional metals and polymers in high-performance applications has supported broader integration across sectors. Additionally, advances in injection molding and additive manufacturing are enabling more customized and cost-efficient composite production.

Environmental pressures and regulatory moves toward sustainable and recyclable materials are also reshaping supply chains and influencing composite design strategies, giving rise to new formulations that meet both performance and compliance needs.

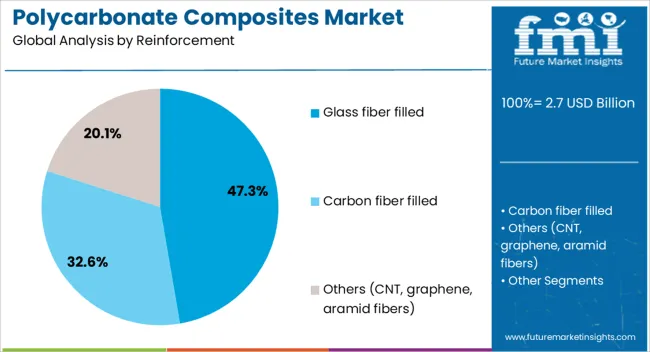

The polycarbonate composites market is segmented by reinforcement, end use, and geographic regions. By reinforcement, the polycarbonate composites market is divided into Glass fiber-filled, Carbon fiber-filled, and Others (CNT, graphene, aramid fibers).

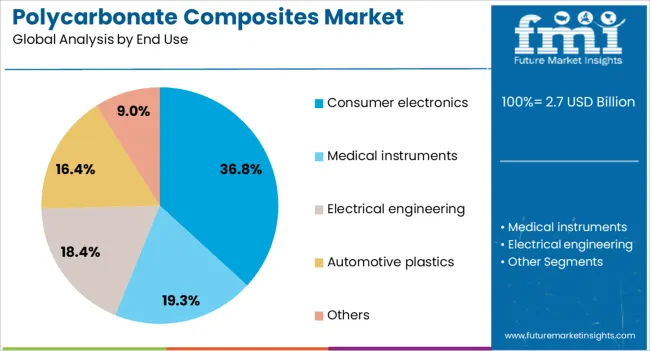

In terms of end use, the polycarbonate composites market is classified into Consumer electronics, Medical instruments, Electrical engineering, Automotive plastics, and Others. Regionally, the polycarbonate composites industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Glass fiber-filled composites are expected to contribute 47.30% of the total market share by 2025, making them the leading reinforcement type in the polycarbonate composites industry. This leadership is driven by their superior mechanical strength, dimensional stability, and flame retardancy, which make them ideal for structural and electrical applications.

Their ability to withstand high loads while maintaining lightweight properties aligns with the growing demand for automotive housings, electrical enclosures, and precision electronics. Additionally, cost-efficiency and compatibility with mass manufacturing processes such as injection molding are making glass fiber composites the preferred choice for high-volume production lines.

Their recyclability also supports compliance with circular economy frameworks, further boosting adoption.

The consumer electronics sector is projected to account for 36.80% of the total market share in 2025, making it the dominant end-use segment in the polycarbonate composites market. This leadership is fueled by the growing demand for durable, lightweight, and thermally stable materials in devices such as smartphones, laptops, and wearables.

Polycarbonate composites offer excellent insulation and design flexibility, enabling compact and aesthetically appealing device housings. The trend toward slimmer, more rugged devices is encouraging the use of high-performance composites that resist scratches, heat, and impact.

Additionally, the electronics industry's need for flame-retardant and EMI-shielding materials is further driving the reliance on advanced polycarbonate composite solutions.

The polycarbonate composites market is expanding due to rising demand from automotive, electronics, and construction applications. Opportunities exist in lightweighting and high-performance engineering, while trends highlight 3D printing and custom fabrication solutions. Challenges include high material costs and processing complexities. Overall, market growth is supported by adoption of durable, lightweight, and versatile composites, enabling energy-efficient, high-performance, and design-flexible applications across industrial and consumer sectors worldwide.

The polycarbonate composites market is being driven by increasing adoption in automotive, electronics, and construction sectors. Lightweight, high-strength, and impact-resistant properties make polycarbonate composites suitable for automotive body panels, electronic enclosures, and transparent architectural components. Growing demand for energy-efficient vehicles, compact electronics, and durable infrastructure is fueling market growth. OEMs and manufacturers are prioritizing polycarbonate composites to replace metals and conventional plastics, reducing weight while maintaining performance and safety standards. Expanding industrial applications are further supporting sustained market adoption globally.

Opportunities are evident in industrial facilities, warehouses, and cold storage projects where structural insulated panels ensure both durability and temperature control. Food and beverage industries are increasingly using them for refrigerated storage and distribution centers. Export opportunities are also expanding for manufacturers offering certified, high-performance panels. I believe companies focusing on large-scale industrial applications and expanding into cold chain infrastructure projects will capture significant opportunities, as these sectors require reliable, cost-efficient, and performance-driven insulation materials for long-term operations.

A notable trend is the adoption of polycarbonate composites in 3D printing and custom fabrication. Additive manufacturing enables rapid prototyping, lightweight designs, and complex geometries, creating opportunities for automotive, industrial, and healthcare applications. Advanced processing techniques, including injection molding and extrusion, allow manufacturers to tailor composites for strength, transparency, and thermal resistance. Increasing demand for modular, custom, and aesthetically versatile components reflects the market’s shift toward performance-oriented, adaptable solutions. These trends highlight the growing role of polycarbonate composites in modern manufacturing and design innovation.

The market faces challenges due to high raw material costs and complex processing requirements. Polycarbonate composites often demand specialized equipment, temperature control, and precise handling, increasing manufacturing expenses. Price sensitivity among end-users, particularly in emerging markets, can limit adoption. Additionally, recycling and end-of-life management of composite materials remain concerns for manufacturers seeking circular economy solutions. Overcoming these barriers requires cost-optimized production methods, process standardization, and the development of efficient recycling techniques to maintain competitive positioning while ensuring material performance.

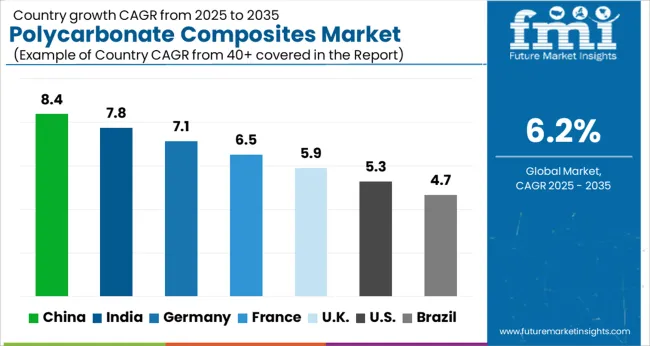

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

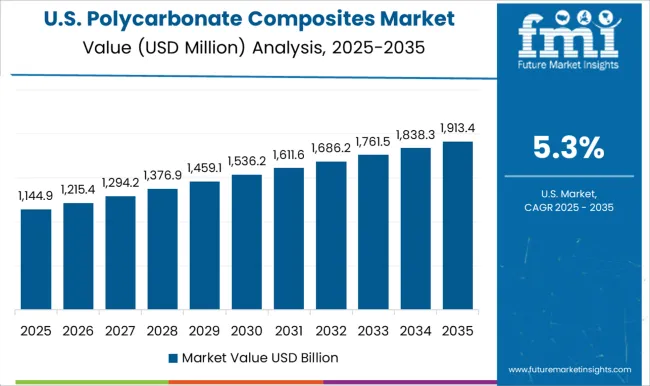

| USA | 5.3% |

| Brazil | 4.7% |

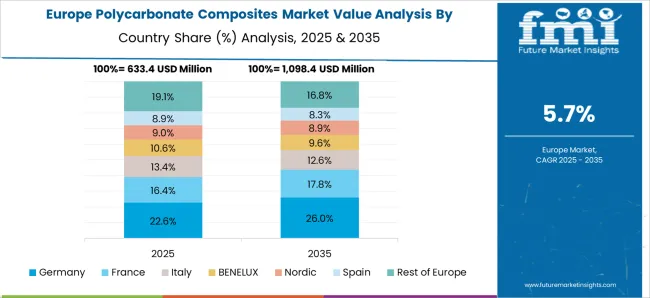

The global polycarbonate composites market is projected to grow at a CAGR of 6.2% from 2025 to 2035. China leads with a growth rate of 8.4%, followed by India at 7.8% and France at 6.5%. The United Kingdom records a growth rate of 5.9%, while the United States shows the slowest growth at 5.3%. Expansion is supported by increasing demand for lightweight, high-strength materials in automotive, construction, and electronics applications. Emerging markets like China and India benefit from rapid industrialization, growing automotive production, and infrastructure development, while developed countries such as the USA, UK, and France focus on performance-driven applications and design optimization. This report includes insights on 40+ countries; the top markets are shown here for reference.

The polycarbonate composites market in China is growing at 8.4% CAGR, the highest among leading nations. Growth is driven by rising automotive production, construction activities, and electronics manufacturing. Manufacturers are introducing lightweight, high-strength, and impact-resistant composites to meet diverse industrial needs. Increasing adoption in electric vehicles, building materials, and consumer electronics supports steady market expansion. Government incentives promoting advanced materials and infrastructure development further reinforce demand.

The polycarbonate composites market in India is advancing at 7.8% CAGR, fueled by growing automotive, electronics, and construction sectors. Adoption of lightweight and high-strength composites is increasing for electric vehicles, industrial machinery, and building materials. Domestic manufacturers focus on cost-effective and durable composite solutions to meet market demand. Rapid industrialization and rising infrastructure projects contribute to steady growth. Increasing awareness of material performance and energy efficiency enhances adoption across multiple sectors.

The polycarbonate composites market in France is growing at 6.5% CAGR, supported by demand in automotive, aerospace, and industrial applications. Manufacturers are introducing high-performance, lightweight, and impact-resistant composites to enhance product efficiency. Regulatory compliance and environmental standards influence material selection. Adoption in high-performance automotive components, structural applications, and consumer electronics contributes to steady market expansion. Focus on energy efficiency and material optimization reinforces growth.

The polycarbonate composites market in the United Kingdom is expanding at 5.9% CAGR, influenced by automotive, construction, and industrial machinery sectors. Adoption of durable, lightweight, and high-strength composites is increasing across structural and functional applications. Industrial modernization, building projects, and electric vehicle growth contribute to steady demand. Manufacturers emphasize performance, durability, and compliance with safety standards. The rise in high-end consumer electronics also supports market expansion.

The polycarbonate composites market in the United States is growing at 5.3% CAGR, the slowest among leading nations. Growth is driven by automotive, aerospace, and electronics industries. Manufacturers focus on lightweight, impact-resistant, and energy-efficient composites to enhance product performance. Adoption in electric vehicles, industrial machinery, and high-performance electronics supports market expansion. Regulatory standards and environmental guidelines influence material selection and design optimization, contributing to steady growth.

Leading suppliers in the polycarbonate composites market, such as SABIC Innovative Plastics, Covestro, and Asahi Kasei Advance Corporation, are competing by offering high-performance, lightweight materials that combine strength, thermal stability, and design flexibility. SABIC emphasizes polycarbonate composites for automotive, electronics, and construction applications, presenting brochures that highlight impact resistance, flame retardancy, and dimensional stability. Covestro focuses on transparent and reinforced grades, promoting versatility in engineering and consumer products. Asahi Kasei and Chi Mei Corporation target specialized applications, emphasizing chemical resistance, heat tolerance, and long-term durability in brochures aimed at OEMs and industrial clients.

Other players, including Formosa Chemicals & Fibre Corporation, LG Chem, and Mitsubishi Chemical Corporation, differentiate through custom compounding and high-precision molding solutions, supporting lightweighting and structural applications. Nudec, Samyang Corporation, and Sumika Polycarbonate Limited emphasize regional supply and specialized resin formulations designed for electronics, medical devices, and transportation sectors. Product brochures consistently highlight mechanical performance, thermal resistance, and design flexibility, framing polycarbonate composites as solutions for reducing weight without compromising strength. Market competition is driven by technical differentiation, compliance with industry standards, and the ability to deliver tailored materials that meet the evolving demands of industrial and consumer applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| Reinforcement | Glass fiber filled, Carbon fiber filled, and Others (CNT, graphene, aramid fibers) |

| End Use | Consumer electronics, Medical instruments, Electrical engineering, Automotive plastics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SABIC Innovative Plastics, Asahi Kasei Advance Corporation, Chi Mei Corporation, Covestro, Formosa Chemicals & Fibre Corporation, LG Chem, Mitsubishi Chemical Corporation, Nudec, Samyang Corporation, and Sumika Polycarbonate Limited |

| Additional Attributes | Dollar sales by composite type (unfilled, reinforced, blended) and form (sheet, rod, film, granule) are key metrics. Trends include rising demand in automotive, electronics, and construction for lightweight, high-strength materials. Regional adoption, advancements in processing technologies, and preference for durable, impact-resistant composites are driving market growth. |

The global polycarbonate composites market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the polycarbonate composites market is projected to reach USD 4.9 billion by 2035.

The polycarbonate composites market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in polycarbonate composites market are glass fiber filled, carbon fiber filled and others (CNT, graphene, aramid fibers).

In terms of end use, consumer electronics segment to command 36.8% share in the polycarbonate composites market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.