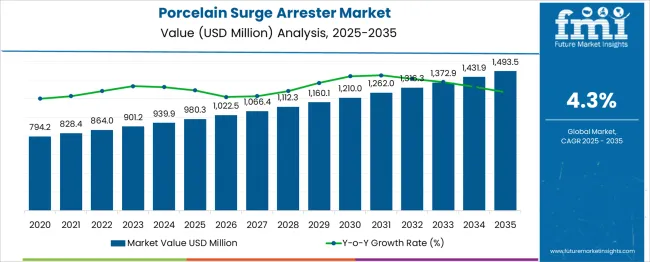

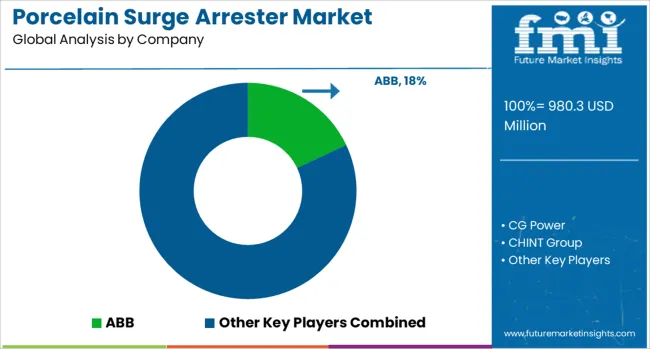

The Porcelain Surge Arrester Market is estimated to be valued at USD 980.3 million in 2025 and is projected to reach USD 1493.5 million by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

From 2025 to 2030, the market is expected to rise from USD 980.3 million to USD 1,210.0 million, reflecting steady demand driven by grid modernization initiatives and the expansion of high-voltage transmission infrastructure. Year-on-year analysis indicates consistent growth, with the market reaching USD 1,022.5 million in 2026 and USD 1,066.4 million in 2027, supported by the adoption of advanced surge protection technologies to enhance power system reliability. By 2028, the market is forecasted to reach USD 1,112.3 million, advancing to USD 1,160.1 million in 2029 and USD 1,210.0 million by 2030. Growth is anticipated to be further influenced by the increasing deployment of porcelain-based surge arresters in outdoor and harsh environmental conditions, where mechanical strength and durability are critical. Manufacturers are focusing on optimizing performance standards, including higher energy absorption capacity and enhanced insulation characteristics, to meet stringent grid protection requirements. These dynamics position porcelain surge arresters as a vital component in safeguarding electrical networks against overvoltage events, ensuring operational continuity across utility and industrial applications.

| Metric | Value |

|---|---|

| Porcelain Surge Arrester Market Estimated Value in (2025 E) | USD 980.3 million |

| Porcelain Surge Arrester Market Forecast Value in (2035 F) | USD 1493.5 million |

| Forecast CAGR (2025 to 2035) | 4.3% |

The porcelain surge arrester market occupies a specialized share within the electrical and power infrastructure sectors. In the Electrical Equipment Market, it accounts for approximately 4%, as the segment also includes transformers, switchgear, and other components. Within the Power Transmission and Distribution Market, its share is about 6%, reflecting its critical role in protecting substations and overhead lines. For the High-Voltage Equipment Market, porcelain surge arresters represent nearly 8%, driven by their application in extra-high-voltage networks and substations. In the Grid Infrastructure Market, the share is close to 3%, given the broader scope of smart grid systems and renewable integration solutions. Within the Industrial Protection Devices Market, its share stands at about 5%, as surge protection competes with circuit breakers and relays in ensuring system reliability.

Growth is driven by rising investments in power transmission projects, grid modernization, and renewable energy integration, which increase the need for reliable surge protection against voltage spikes. The preference for porcelain housings stems from their mechanical strength, pollution resistance, and ability to withstand extreme outdoor conditions, making them suitable for high-stress environments. Despite competition from polymer-based alternatives, porcelain surge arresters remain vital in heavy-duty applications, ensuring long-term grid stability and operational safety worldwide.

The porcelain surge arrester market is witnessing steady momentum as the demand for reliable overvoltage protection continues to rise across transmission and distribution networks. With aging grid infrastructure and increased occurrence of transient voltage events due to climate-related disruptions, the role of robust insulation materials like porcelain has gained renewed importance.

Investments in grid modernization, electrification of rural areas, and integration of renewable energy have further accelerated the deployment of arresters that can withstand extreme environmental conditions. Regulatory pressure on utilities to ensure network safety and system availability has also prompted upgrades to legacy equipment with high-performance surge protection solutions.

Over the forecast period, advancements in sealing technology, hydrophobic coatings, and mechanical endurance are expected to make porcelain-based designs a viable and long-lasting option for high-stress electrical environments.

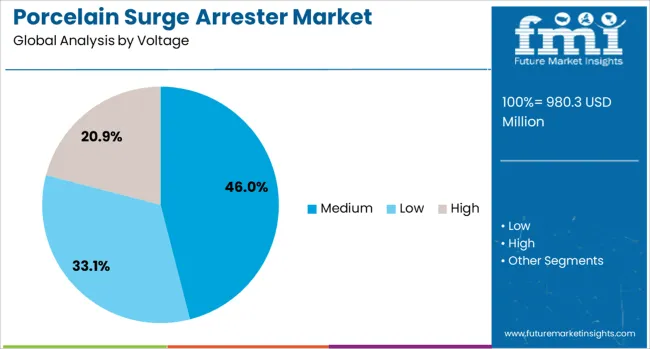

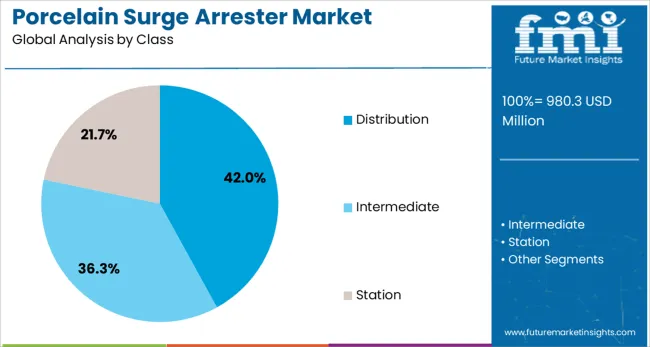

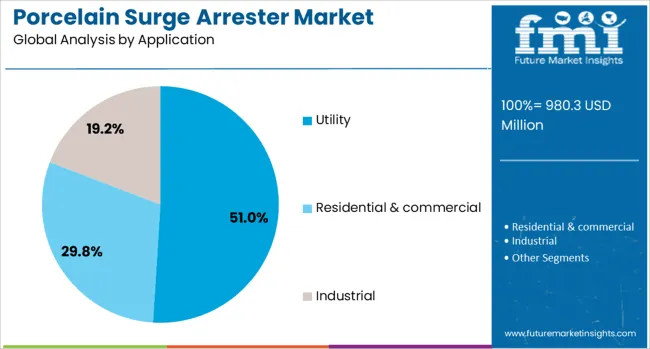

The porcelain surge arrester market is segmented by voltage, class, application, and geographic regions. The porcelain surge arrester market is divided by voltage into Medium, Low, and High. The porcelain surge arrester market is classified into Distribution, Intermediate, and Station. Based on the application, the porcelain surge arrester market is segmented into Utility, Residential & commercial, and Industrial. Regionally, the porcelain surge arrester industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Medium voltage surge arresters are projected to dominate the porcelain surge arrester market with a 46.0% revenue share in 2025. This leading position is attributed to widespread applications in substations, overhead lines, and industrial switchgear systems.

Medium voltage networks form the backbone of urban and semi-urban distribution systems, necessitating reliable insulation solutions to mitigate damage from lightning strikes and switching surges. Porcelain-based arresters are preferred in this range for their high thermal stability, resistance to UV degradation, and ability to operate in polluted or coastal zones.

As utilities focus on enhancing service continuity and safety, investment in medium voltage surge protection is expected to continue its upward trajectory.

Distribution class surge arresters are expected to account for 42.0% of total market revenue in 2025, making them the dominant product class within the market. This growth has been driven by increasing electricity demand, expansion of distribution grids, and the need to safeguard transformers and circuit breakers at the last mile of energy delivery.

Porcelain arresters in this class offer durability under repetitive surge conditions and are preferred in regions with harsh climates due to their structural resilience.

Their integration into smart grid deployments and compatibility with automated reclosers have further reinforced their relevance across expanding and digitizing networks.

Utility-based deployments are forecast to contribute 51.0% of the total revenue in the porcelain surge arrester market by 2025, making this the most prominent application segment. Utilities are actively investing in surge protection devices to reduce outage frequency and asset downtime, especially in regions prone to lightning or unstable load conditions.

The longevity and mechanical robustness of porcelain arresters make them well-suited for high-exposure outdoor installations.

With utility companies focusing on grid reliability, regulatory compliance, and performance-based maintenance strategies, porcelain surge arresters are being widely integrated across substations and feeder lines to ensure uninterrupted power supply.

The global porcelain surge arrester market was valued at approximately USD 939.9 million in 2024 and is forecast to grow at a CAGR of 4.3–5.3% from 2025 onward. Growth in 2024 and 2025 was driven by investments in grid modernization, renewable energy installations, and expansion of T&D networks. Opportunities are evident in utility-scale solar, EV charging infrastructure support, and robust protection for industrial, commercial, and data center applications. However, high raw material cost volatility, regulatory constraints on additives, and competition from polymeric arresters are key limits. Overall, demand is anchored by global power infrastructure expansion and equipment protection needs.

Rapid build‑out of transmission and distribution networks and large‑scale solar/wind projects acted as major growth drivers in 2024 and 2025. Investments by governments and utilities in regions such as Asia‑Pacific (notably China and India) boosted demand for medium‑ and high‑voltage porcelain arresters to safeguard power lines and substations. Renewable energy grid integration and demand for reliable equipment protection in mission‑critical infrastructure such as data centers and industrial plants further supported expansion. These trends underline that infrastructure resilience and grid reliability remain core drivers of market momentum.

Strong opportunities exist in utility networks, industrial facilities, and solar/wind plant protection. In 2025, deployment of arresters in utility‑scale solar farms and EV charging stations rose sharply as electrical infrastructure expanded. Industrial clients such as data centers and manufacturing units increasingly demanded durable porcelain devices for medium‑voltage protection. Utility sector led market share (~36.4% in 2024) and is projected to grow steadily due to ongoing electrification programs. Manufacturers focusing on these verticals with tailored voltage classes and configurations are best positioned for future demand capture.

Emerging trends include the integration of remote monitoring sensors and predictive maintenance capabilities into porcelain arresters. Development of compact designs and enhanced ceramic materials for improved durability was observed in 2024. Technology is shifting toward smart arresters enabled with IoT connectivity to offer real‑time diagnostics. Material innovations improved lifespan and dielectric performance. These trends demonstrate that performance enhancements, remote asset monitoring, and form‑factor optimization are reshaping product offerings to meet evolving grid protection requirements.

Key restraints include fluctuations in raw material costs (such as ceramic and glaze components) and environmental compliance challenges. In 2024 and 2025, rising input prices impacted profitability and pricing strategies. Complex manufacturing processes and strict quality standards limited scalability, especially for small suppliers. Additionally, there is growing competition from polymeric surge arresters, which offer lighter weight and easier installation. Performance limitations in extreme temperature conditions and costs associated with high-voltage porcelain designs further constrained broad adoption. These issues emphasize the need for cost-effective materials and streamlined production workflows.

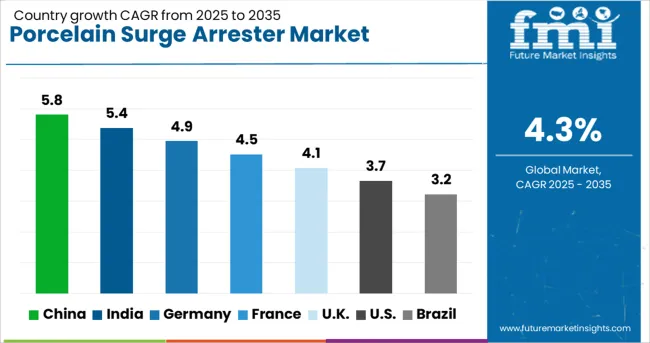

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The global porcelain surge arrester market is expected to grow at 4.3% CAGR from 2025 to 2035. China leads with 5.8% CAGR, driven by large-scale power grid expansion and renewable energy integration. India follows at 5.4%, supported by rural electrification projects and substation upgrades. Germany records 4.9% CAGR, focusing on grid modernization and compliance with EU energy standards. The United Kingdom grows at 4.1%, while the United States posts 3.7%, reflecting stable demand in mature electricity networks with emphasis on replacement and smart grid resilience. Asia-Pacific leads overall growth due to rising infrastructure investments, while Europe and North America prioritize safety, digital monitoring, and eco-friendly designs.

The porcelain surge arrester market in China is forecasted to grow at 5.8% CAGR, driven by massive investments in high-voltage transmission lines and substation infrastructure. Growing renewable energy capacity, particularly wind and solar projects, necessitates robust surge protection to ensure grid reliability. Domestic manufacturers introduce advanced porcelain-based designs with superior leakage resistance, while smart arrester technologies integrated with IoT sensors gain momentum for predictive maintenance. Belt and Road projects further support demand for surge arresters in cross-border power systems.

The porcelain surge arrester market in India is projected to grow at 5.4% CAGR, supported by government-led rural electrification schemes and urban distribution upgrades. Rising investments in smart grid initiatives and power reliability improvements drive demand for surge protection across high-voltage substations. Local manufacturers develop cost-effective solutions for transmission projects, while premium-grade porcelain arresters dominate utility-scale installations. Increasing adoption of arrester monitoring systems with remote diagnostics strengthens long-term performance in critical power infrastructure.

The porcelain surge arrester market in Germany is expected to grow at 4.9% CAGR, supported by grid modernization programs aligned with EU renewable energy transition targets. Expansion of wind and solar farms creates demand for surge arresters in transmission and substation systems. Manufacturers innovate eco-compliant designs using recyclable materials to meet sustainability objectives. Adoption of intelligent arrester systems integrated with SCADA platforms strengthens grid reliability. Demand for high-performance solutions increases in industrial zones and urban energy infrastructure upgrades.

The porcelain surge arrester market in the United Kingdom is forecasted to grow at 4.1% CAGR, driven by ongoing efforts to enhance grid stability and resilience against electrical faults. Investments in renewable energy and smart grid deployments boost demand for surge arresters across transmission and distribution networks. Manufacturers introduce compact, maintenance-free designs compatible with existing infrastructure. Regulatory mandates for reliability and energy security encourage utilities to adopt high-quality porcelain arresters for critical applications.

The porcelain surge arrester market in the United States is projected to grow at 3.7% CAGR, reflecting stable replacement demand in a mature power grid. Federal initiatives promoting grid hardening against extreme weather events and cybersecurity threats reinforce the need for robust surge protection. Utilities prioritize hybrid solutions integrating digital diagnostics for real-time performance tracking. Growth in renewable energy integration and electric vehicle charging infrastructure further contributes to surge arrester installations in high-voltage networks.

The porcelain surge arrester market is dominated by ABB, which maintains leadership through its advanced surge protection solutions engineered for high-voltage transmission and distribution systems. ABB strengthens its dominant position with a global manufacturing footprint, innovative designs for reliability, and proven performance across utility and industrial applications. Key players such as Siemens Energy, General Electric, Eaton, Toshiba Energy Systems, Hitachi Energy, and Hubbell hold significant shares by offering robust porcelain-based surge arresters designed to ensure system safety under lightning and switching surge conditions. These companies emphasize high mechanical strength, long service life, and compliance with international standards to serve both grid modernization and new installation projects. Emerging players including CG Power, CHINT Group, DEHN, Elpro, Ensto, Hangzhou Yongde Electric, Izoelektro, Orient Electric, Rashtriya Electrical, TE Connectivity, Surgetek, Electric Powertek, Zhejiang Ruili Electric, and Zhejiang Volcano Electrical are expanding their presence by delivering cost-effective solutions and targeting regional markets with localized manufacturing strategies. Their initiatives include customization for varying voltage classes and harsh environmental conditions. Market growth is driven by increasing investments in transmission and distribution infrastructure, rising demand for reliable surge protection in renewable energy integration, and upgrades in aging grid systems. Continuous improvements in material durability and insulation technology are expected to shape competitive strategies globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 980.3 Million |

| Voltage | Medium, Low, and High |

| Class | Distribution, Intermediate, and Station |

| Application | Utility, Residential & commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, CG Power, CHINT Group, DEHN, Eaton, Electric Powertek, Elpro, Ensto, General Electric, Hangzhou Yongde Electric, Hitachi Energy, Hubbell, Izoelektro, Orient Electric, Rashtriya Electrical, Siemens Energy, Surgetek, TE Connectivity, Toshiba Energy Systems, Zhejiang Ruili Electric, and Zhejiang Volcano Electrical |

| Additional Attributes | Dollar sales segmented by arrester type (residual voltage, metal-oxide porcelain housing) and channel (utility procurement, OEM, distributors). Asia-Pacific leads adoption, driven by grid expansion, while North America and Europe emphasize compliance. Innovations include weather-resistant porcelain, IoT-enabled surge monitoring, and recyclable materials, with growing integration into renewable-energy microgrids and smart substations. |

The global porcelain surge arrester market is estimated to be valued at USD 980.3 million in 2025.

The market size for the porcelain surge arrester market is projected to reach USD 1,493.5 million by 2035.

The porcelain surge arrester market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in porcelain surge arrester market are medium, low and high.

In terms of class, distribution segment to command 42.0% share in the porcelain surge arrester market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surge Arrester Market Growth - Trends & Forecast 2025 to 2035

Polymer Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Demand for DC Surge Arrester in USA Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Porcelain Enamel Coatings Market Size and Share Forecast Outlook 2025 to 2035

Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Porcelain Tableware Market Trends - Growth & Demand Forecast 2025 to 2035

Surge Tanks Market Growth - Trends & Forecast 2025 to 2035

Biosurgery Equipment Market Size and Share Forecast Outlook 2025 to 2035

Post Porcelain Insulator Market Size and Share Forecast Outlook 2025 to 2035

Post-Surgery Skin Repair Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Neurosurgery Surgical Power Tools Market Analysis – Growth & Forecast 2022-2032

Storm Surge Barriers Market

Flame Arrester Market

Type 3 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Type 1 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Type 2 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Electrosurgery Accessories Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA