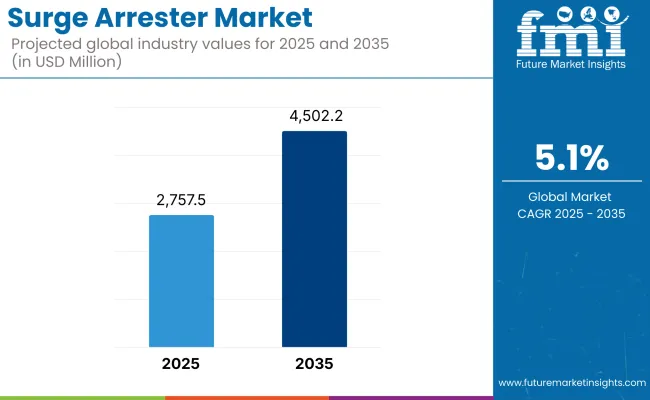

The global surge arrester market is expected to witness steady growth over the forecast period, driven by rising demand for reliable electrical infrastructure, increasing industrialization, and advancements in smart grid technology. The market is projected to grow from USD 2,757.5 million in 2025 to USD 4,502.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.1%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2,757.5 million |

| Industry Value (2035F) | USD 4,502.2 million |

| CAGR (2025 to 2035) | 5.1% |

These devices protect electrical systems from equipment damage caused by voltage surges that result from lightning strikes, switching operations, and insulation failures. As patterns of electricity consumption become more complex and power demand growth returns - the long-term expectation is for electricity consumption to continue to grow worldwide, but the speed of post-COVID recovery remains to be determined utilities and industries are investing big in hardware for power transmission and distribution, which is on a track to enable delivery of electricity increasingly efficiently and seamlessly. Investment in electrical networks is one of the key driving factors for the growth of the surge arresters market.

The surge arrester market is thriving due to a number of elements. Rising investments in the power transmission and distribution networks in the developing and developed economies is a major factor responsible for the growth of the demand. The adoption of surge arresters is getting propelled across industrial, commercial and residential applications as a result of growing apprehension over safety of electrical instruments and grid reliability.

One of the major growth drivers for the surge arrester market is the expansion of the power transmission and distribution network around the world.

And this is exactly why in the race toward an electric future on a global scale, automakers are putting their money where their mouths are and re-inventing themselves to catch up with the climate and energy markets and semiconductor technologies, and all of it comes with a huge bill.

Not to mention the drive towards deploying a smart grid to boot, for which the utilities are also spending their capital on infrastructure upgrades where needed to keep working in partnership with the emerging smart electric economy and can continue engaging with the market to both optimize it and provide services that will improve efficiency and keep the downtime low.

We have surge arresters that protect vital equipment from unforeseeable voltage spikes. Demand for the market is also fueled by large-scale grid expansion projects in emerging economies, particularly in the Asia-Pacific region.

North America surge arrester market is expected to grow due to the ageing power infrastructure and increase in investments for grid modernization. The growing need for surge protection equipment stems from the efforts by the United States and Canada to enhance the reliability of their electrical networks.

The proliferation of renewable energy and electric vehicle charging networks is also favoring high-performance surge arresters. Additionally, range works to encourage electrical safety and resilience (including FERC initiatives) collectively help to enhance market expansion.

Europe’s surge arrester market is persistently fueled by increasing energy efficiency and safety standards. Germany, France and the UK and other nations have entered into grid expansion and the infrastructure needed for more renewables, increasing demand for surge arresters.

In the quest to shift to wind and solar generation, there's an increased need for voltage protection solutions and system stability. Regions with good manufacturers of quality power equipment will aid in the technological advancement of surge protection devices in the area.

The Middle East and Africa (MEA) region is witnessing increasing demand for surge arresters due to rapid urbanization, expanding electrification projects, and investments in power infrastructure. In countries such as Saudi Arabia, the UAE and in South Africa, maintaining electricity networks to meet the growing industrial and commercial sectors is a key responsibility. Additional demand is fueled by the rollout of large-scale energy projects ranging from solar farms in North Africa and the Middle East.

The market is growing in other regions too, like Latin America, Southeast Asia, etc. The key driver is the growing government initiatives to upgrade the power infrastructure and ongoing electrification projects in Brazil, Mexico, Indonesia, and Vietnam. There is an increase in high-rise industrial and commercial buildings, bringing with them the demand for suitable surge protection systems for electrical and electronic equipment.

Challenges

High Cost of Advanced Surge Protection Technologies

Commercially available advanced surge protection technologies have high initial costs, which acts as a growth barrier in the market. Manufacturers of high-grade surge arresters often use expensive materials (e.g., metal oxides, polymeric compounds, etc.) for their construction. This boosts R&D growth but raises production costs for SMEs. When it comes to developing economies, a majority of buyers are price sensitive and reluctant to invest in high-end surge protection solutions, leading to slow market penetration.

Fluctuations in Raw Material Prices

The rising requirement for surge arresters for these projects is thus creating an opportunity for the surge arrester market. The differing costs of these components also contributes to complicating manufacturers’ attempts to keep profit margins stable. Cost fluctuations can be unpredictable thanks to things like trade policies, conflict between nation-states and supply chain disruptions. Manufacturers must move toward strategic sourcing, long-term supplier contracts, and alternative materials to protect themselves from price volatility.

Complex Regulatory Compliance and Standardization

The surge arrester industry must comply with stringent regulations and varying standards across different regions. Countries enforce distinct safety and performance guidelines, including IEC, ANSI, and IEEE standards, which necessitate extensive testing and certification processes.

As a result, abiding by these regulations increases the operational costs and hinders the entry of new entrants in such industries. The adoption of additional standards means establishing additional testing facilities, training personnel and investing in quality assurance mechanisms. In response, manufacturers are working proactively with regulatory agencies on guidance to speed up approval time with globally accepted standards.

Opportunities

Expansion of Renewable Energy Integration

Moreover, surge arrester market would see growth from increase in renewable sources of energy such as wind or solar energy Countries committing to net-zero emissions push and strive for carbon-neutrality and green energy demand superior solutions for surge protection.

The dynamic nature of weather and intermittent power generation used in the renewable energy installations also makes them more prone to transient voltage surges. This generates the need of surge arresters for protection of critical electrical equipment and rising reliability of renewable energy systems.

Smart Grid and Infrastructure Modernization

The trend towards smart grids and upgraded electrical infrastructure across the globe is another key factor contributing to the expansion of the surge arrester market. Smart grids employ greater digital communication and automated controls, and as a result are more susceptible to power surges and electrical disturbances.

In a time when utilities and government budgets have struggled to upgrade antiquated power grids, the deployment of smart surge protectors will soon be a requirement. In addition, smart grid will use smart surge arresters with comprehensive monitoring and diagnostics for real-time protection of the system and reduced downtime.

Growing Demand for Industrial Automation and IoT Connectivity

The need for protection from surge-induced failures is booming with more and more industries adopting industrial automation and Internet of Things (IoT). In industrial environments, real-time problems are solved while productivity is improved and operational efficiency enhanced through the use of IoT (Internet of Things)-enabled devices, robotics and advanced automation systems.

All these high-tech systems are very sensitive to voltage variations and transient surges, so they demand reliable protection mechanisms. It would provide a scope for surge arrestor manufacturers to design tailored solutions well aligned with the aesthetics of industrial automation, data centers and IoT-connected ecosystem.

Surge arrester market is witnessing a significant growth during the period of 2020 to 2024 due to the promotions in investments towards power infrastructure, safety of electrical equipment (due to the high voltage transient due to the surges) and the increasing volume of renewable energy installations.

The rapid development of power transmission and distribution networks globally has created an enormous need for reliable surge protection solutions. Some of the key factors fueling the market during this time include rapid urbanization, grid modernization programs and stringent regulatory requirements for electrical safety.

Looking ahead to 2025 to 2035, growth in the residential energy management market is expected to speed up as the sector will be supported by developing smart grid technologies, rising electric vehicle (EV) adoption, and the growing prevalence of IoT-enabled monitoring systems.

Sustainability and circular economy will also be an important driver for the evolution of eco-friendly surge protective devices. Moreover, emerging markets across the Asia-Pacific region, Latin America, and Africa are anticipated to offer significant growth prospects due to increasing electrification projects and industrialization.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter rules for electrical safety and government guidance on grid reliability. |

| Technological Advancements | Polymeric and metal oxide surge arresters; improved material durability. |

| Industry-Specific Demand | Rising demand for Utilities, industrial manufacturing, commercial infrastructure . |

| Sustainability & Circular Economy | Initial efforts in sustainable material usage. |

| Production & Supply Chain | Supply chain disruptions due to COVID-19; which increased raw material costs. |

| Market Growth Drivers | Expansion in Urbanization, grid modernization, and industrial applications. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | These consist of stricter environment and safety policies as well as sustainability mandates. |

| Technological Advancements | AI-driven predictive maintenance, IoT-enabled monitoring, and eco-friendly materials. |

| Industry-Specific Demand | Diversifying into renewable energy ventures or intelligent grids or EV charging station networks. |

| Sustainability & Circular Economy | Growing focus on recyclable components and energy-efficient designs. |

| Production & Supply Chain | AI-driven supply chain development and strategies for local production. |

| Market Growth Drivers | Increased EV adoption, expansion of smart cities, and advancements in digital substations. |

The United States is witnessing a surge in investments aimed at modernizing power grids and integrating renewable energy sources. As extreme weather events like hurricanes, wildfires and snowstorms become more common, state-of-the-art surge protection systems have grown essential for grid resilience.

In addition, the government is also purposing for the initiatives that is beneficial in the high standards of electrical safety which is also fueling the market growth. Additionally, the rising demand from industrial and commercial sectors for surge protection solutions, particularly in data centers and manufacturing plants, is driving market expansion. Expansion of smart grid infrastructure and renewable energy integration.

| Country | CAGR (2025 to 2035) |

|---|---|

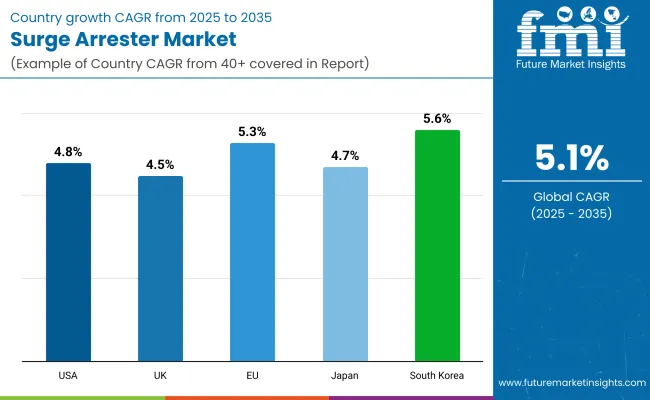

| United States | 4.8% |

The UK surge arrester market is expected to grow with a CAGR of 4.5% in the forecast period. Here in the UK, the energy landscape is changing, with more and more investment going towards renewable energy projects like offshore wind farms. At the same time, the transition to smart grids and digital substations has also led to a demand for an even more reliable solution for surge protection.

In addition, existing power infrastructure is aging in many areas of the country and is being repaired and upgraded, resulting in new and additional surge arresters being installed. Large investment in renewable energy - especially offshore wind and solar projects.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.5% |

The European Union is a case in point, with regulatory frameworks already in solid shape through initiatives such as the European Green Deal, which aims to make the block carbon-neutral by 2050. Havelsan has made significant investments in sustainability and energy transition projects, including very high voltage (HV) direct current (DC) systems that require strong surge protection.

Additionally, the increase in industrial automation and the expansion of high-speed rail networks in various countries of Europe are also driving the surge arresters market. Development of support systems for HVDC systems and renewable energy grid.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.3% |

Japan is expected to be the fastest growing market, with the Japan surge arrester market estimated to grow at a CAGR of 4.7%, owing to significant investment towards upgrading electrical grid systems. The energy sector in Japan has undergone significant changes since the Fukushima incident, leading to a greater emphasis on a more resilient and sustainable energy grid.

Considering the spiraling occurrence of natural disasters (earthquakes, typhoons, and others) in the country, the adoption of high-performance surge protection solutions is vital. Reliance on government technologies and incentives to stabilize grid.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

South Korea is projected to record the highest CAGR of 5.6% throughout the analysis period. Norway’s aggressive push towards smart city development, 5G infrastructure and industrial automation has driven up demand for advanced surge protection systems. South Korea's government is specifically supporting upgrades to energy infrastructure in smart grid networks. Project growth on smart cities and industrial automation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

Polymeric Surge Arresters Dominate Due to Superior Performance and Durability

The polymeric surge arresters are the rapidly growing segment of the surge arrester market owing to mechanical strength, light weight and better resistance. Unlike traditional porcelain arresters, polymeric shapes use a silicone or ethylene propylene diene monomer (EPDM) housing, giving them high resistance to weathering, UV, and contamination. They are preferred in modern power distribution systems due to significantly extending their service life and reducing the frequency of these tasks.

Additionally, polymeric surge arresters are witnessing increasing traction in emerging markets with enhanced activities pertaining to advanced grid technologies. While porcelain was common for many years, utilities looking to upgrade aging infrastructure are increasingly turning to polymeric arresters for their ability to withstand harsh environmental conditions and mechanical stress, making them particularly desirable for high-voltage applications.

Porcelain Surge Arresters Maintain Demand in High-Voltage Applications

Although polymeric surge arresters are gaining momentum over their porcelain counterparts, especially at UHV, porcelain surge arresters still capture a huge share of the market. These arresters have become essential for substations, transmission networks, and for heavy industrial applications owing to their robustness, thermal stability, and a tolerance for extreme electrical stress.

Porcelain surge arresters are popular in areas where longevity and high reliability are a must like in North America and Europe. Due to their better resistance against fire hazards and mechanical damage compared to polymeric counterparts, they are suitable for environments with higher risk exposure.

Utilities Segment Leads Due to Grid Modernization and Reliability Requirements

Utilities consume a majority portion of the surge arresters, mainly due to massive investments in the modernization of power grids, infrastructure expansion, and integration of renewable energy. In transmission and distribution networks, utilities need surge protection equipment to maintain the reliability and stability of the networks. Growing electrification projects and the deployment of smart grids are significantly increasing the demand for surge arresters in this segment.

Rapid development in projects such as solar and wind energy infrastructure is a huge reason for growth in the industry. Moreover, these energy sources also bring variation in power flow that demands advanced surge protection mechanisms.

Industrial Segment Experiences Strong Growth Amid Rising Automation and Manufacturing Expansion

The rising integration of automation, expansion of manufacturing sectors, and the need to ensure an uninterrupted power supply in the industrial segment has led to an extensive uptick of surge arresters in the commercial sector over the coming years.

Voltage transients can be harmful, and this is later confirmation that electrical equipment used in sectors like oil & gas, chemicals, automotive, and other manufacturing sectors are very sensitive to this type of influences. Powered by Dynamic tags, surge arresters serve a crucial function by safeguarding industrial machinery, control apparatus, and production lines against electrical interferences.

Leading the charge for this division is Industry 4.0, which brings automation, digitalization, and smart manufacturing. The growing need for upwardly mobile industries is also putting great pressure on protecting their motors with things like advanced robotic systems at work, IoT-enabled on-track machinery, and energy-efficient motors. A voltage spike can damage expensive components of an electronic device, resulting in expensive downtime and loss of production.

The surge arrester market is a critical segment of the electrical infrastructure sector, fueled by growing demand for power transmission and distribution (T&D) networks, renewable energy integration, and smart grid deployments. The market is filled with key global players, whilst regional contributors serve the localized demand.

Market dynamics are shaped by technological innovations like polymer-housed and high-energy absorption arresters, sustainability initiatives such as green insulation materials and enhancements in recyclability, and market consolidation trends owing to mergers and acquisitions for reinforcing global footprints.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Siemens AG | 15 to 20% |

| ABB Ltd. | 12-16% |

| Eaton Corporation | 10-14% |

| General Electric | 8-12% |

| Schneider Electric | 6-10% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Siemens AG | Manufactures high-voltage surge arresters particularly for T&D networks; concentrates on smart grid applications. |

| ABB Ltd. | Focusing on surge protection for medium and high voltages; prioritizes digital solutions and sustainability. |

| Eaton Corporation | Provides space-saving, energy-friendly surge arresters; invests in regulatory compliance and safety enhancements. |

| General Electric | Designs arresters with high energy absorption capacity; targeting grid modernization and renewables. |

| Schneider Electric | Installer of surge protective devices to industrial and commercial environment and focus on eco-friendly materials. |

Key Company Insights

Siemens AG

Innovative polymer-housed arresters and IoT-enabled monitoring solutions drive new growth for Siemens AG and keep it ahead of competitors, focusing on smart grids and grid resilience. Global leader in surge arresters for low, medium and high voltage solutions. As it traverses the ever-evolving landscape of technology, Siemens AG has been leading the charge in smart surge arresters with real-time monitoring functionalities that improve grid efficiency and protection. Their constant R&D activities keep their products highly competitive in the market.

ABB

ABB Ltd. is a leading provider of surge protection solutions, especially suitable for medium- and high-voltage applications. The digital transformation enhances predictive maintenance by embedding intelligent monitoring systems in its surge arresters. Sustainability constitutes a fundamental part of ABB’s strategy, driving us toward the creation of new materials that are more recyclable and more energy efficient. Its solutions for surge protection are widely used in utility networks, industrial plants, and renewables installations.

Eaton Corporation

The Eaton Corporation has made a name for itself by designing compact, high-performance surge arresters that meet stringent international safety standards. The company focuses greatly on energy efficiency and keeps its environmental impact to a minimum. Because of their durability and reliability, Eaton's surge arresters are the preferred choice for power utilities and industrial applications. Eaton invests significantly in research and development to adapt its products to the changing needs of contemporary electrical infrastructure.

General Electric

General Electric: General Electric focuses on the surge arrester market by offering high-capacity arresters for high-voltage transmission networks. It is engaged in updating power grids and bringing renewable sources online. General Electric's surge protection products are designed to protect against vast voltage changes, allowing for the preservation of important power systems. I work for a company that partners with utility companies across the world to increase their grid resilience using next-generation protection technologies.

Schneider Electric

Schneider Electric is a key player in the surge arrester market in the industrial and commercial segments. Hurricane's eco-friendly product designs and sustainability initiatives make their surge protection devices an excellent choice for environmentally conscious businesses. With the right way of focusing on the emerging markets Schneider Electric is growing its footprints in multiple countries offering the surge protection products which are cost effective but performed better based on regional electrical power distribution conditions.

In terms of product Type, the industry is divided into Polymeric and Porcelain.

In terms of end use, the industry is divided into Utilities, Industries, Transmission and Transportation.

In terms of application, industry is divided into AIS, GIS and Others

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Surge Arrester market is projected to reach USD 2,757.5 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.1% over the forecast period.

By 2035, the Surge Arrester market is expected to reach USD 4,502.2 million.

The portable segment is expected to dominate the market, due to its ease of deployment, cost-effectiveness, adaptability across industries, increasing demand for temporary power protection, and rising infrastructure and maintenance activities worldwide.

Key players in the Surge Arrester market include, Siemens AG, ABB Ltd., Eaton Corporation, General Electric, Schneider Electric.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymer Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Porcelain Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Demand for DC Surge Arrester in USA Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Surge Tanks Market Growth - Trends & Forecast 2025 to 2035

Biosurgery Equipment Market Size and Share Forecast Outlook 2025 to 2035

Post-Surgery Skin Repair Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Neurosurgery Surgical Power Tools Market Analysis – Growth & Forecast 2022-2032

Storm Surge Barriers Market

Type 3 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Type 1 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Type 2 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Electrosurgery Accessories Market Size and Share Forecast Outlook 2025 to 2035

Guided Surgery Kits Market Size, Growth, and Forecast for 2025 to 2035

Electrosurgery Devices Market Overview - Trends & Growth Forecast 2025 to 2035

Electrosurgery Generators Market Analysis - Size, Share, and Forecast 2025 to 2035

General Surgery Devices Market Insights – Demand and Growth Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA