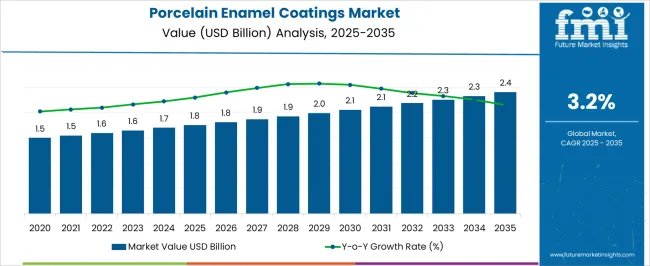

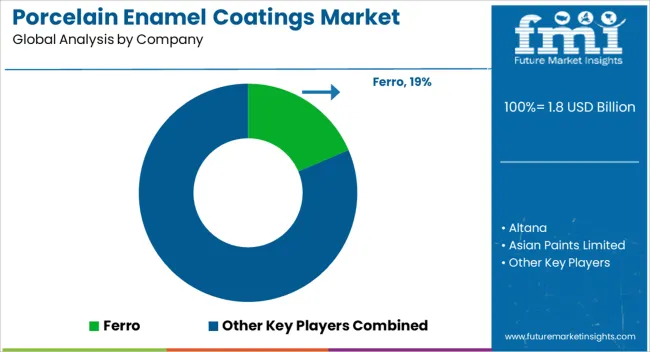

The porcelain enamel coatings market is valued at USD 1.8 billion in 2025 and is projected to reach USD 2.4 billion by 2035, with a CAGR of 3.2%. The saturation point analysis reveals a gradual but consistent growth in the market, approaching its saturation point by the later years of the forecast period. From 2021 to 2025, the market is expected to grow from USD 1.5 billion to USD 1.8 billion, passing through incremental values of USD 1.5 billion, USD 1.6 billion, USD 1.6 billion, and USD 1.7 billion. This early phase shows stable growth, driven by increasing demand for durable, heat-resistant coatings in applications such as home appliances, cookware, and industrial equipment.

Porcelain enamel coatings offer high durability, aesthetic appeal, and corrosion resistance, which contribute to their adoption in various industries. Between 2026 and 2030, the market expands from USD 1.8 billion to USD 2.1 billion, progressing through USD 1.9 billion and 2.0 billion. This period sees moderate growth as the market begins approaching saturation in its core applications, with incremental increases driven by new product developments and innovations in coating formulations. From 2031 to 2035, the market is expected to reach USD 2.4 billion, progressing through values of USD 2.1 billion, USD 2.2 billion, USD 2.3 billion, and USD 2.3 billion. The final phase exhibits a slower growth rate, suggesting that the market is approaching its saturation point, with growth primarily driven by incremental demand in mature markets and product innovation.

| Metric | Value |

|---|---|

| Porcelain Enamel Coatings Market Estimated Value in (2025E) | USD 1.8 billion |

| Porcelain Enamel Coatings Market Forecast Value in (2035F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

The coatings and paints market is the largest contributor, accounting for approximately 40-45% of the market. Porcelain enamel coatings are used as a durable and protective layer in many applications, including appliances, automotive components, and industrial equipment, due to their high resistance to heat, corrosion, and wear. The appliances market contributes around 20-25%, as porcelain enamel coatings are commonly applied to household appliances such as stoves, refrigerators, and ovens, where heat resistance and durability are critical.

The automotive market holds about 15-18%, with porcelain enamel coatings used in automotive parts like exhaust systems, brake parts, and engine components to enhance durability and resist corrosion under extreme conditions. The construction and building materials market adds approximately 10-12%, as porcelain enamel coatings are utilized in architectural applications, including roofing materials, facades, and decorative panels, for their aesthetic appeal and weather resistance. Lastly, the industrial equipment market contributes around 5-8%, with porcelain enamel coatings applied to equipment such as storage tanks, heat exchangers, and pipelines to protect against harsh environments and ensure long-term performance.

The porcelain enamel coatings market is witnessing steady growth, supported by increasing demand across industrial, consumer, and architectural applications. The market’s expansion is underpinned by the superior durability, corrosion resistance, and aesthetic appeal offered by porcelain enamel coatings compared to conventional finishes. Rising adoption in cookware, bakeware, sanitary ware, and construction components has reinforced the market’s relevance in both residential and commercial segments.

Additionally, the coatings’ ability to withstand high temperatures and chemical exposure positions them as a preferred choice in heavy-duty environments. Growing consumer preference for long-lasting, low-maintenance products is further driving adoption. From a supply perspective, advancements in manufacturing technologies have enabled cost-effective production with improved color consistency and surface finish.

Looking ahead, increased investment in infrastructure development and the premiumization of household products are expected to sustain demand. Regulatory compliance concerning material safety and environmental performance also aligns with market growth, making porcelain enamel coatings a competitive and reliable solution across diverse sectors.

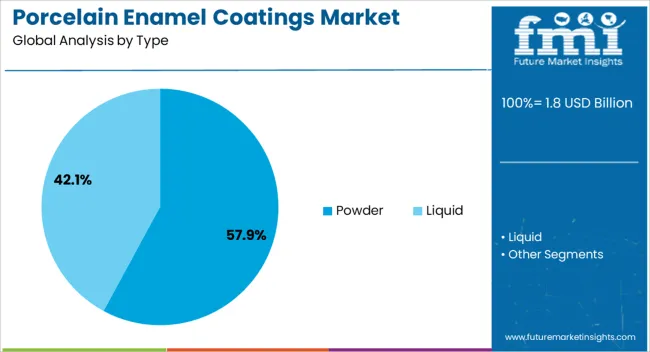

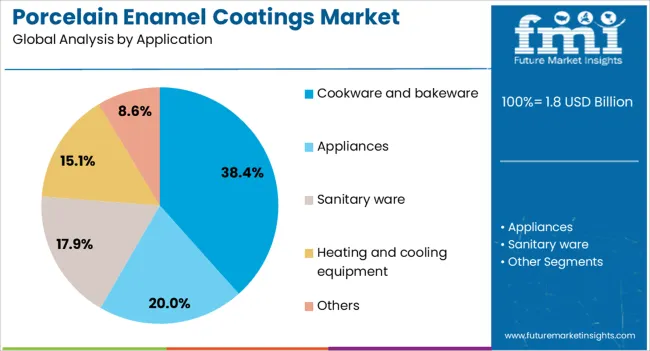

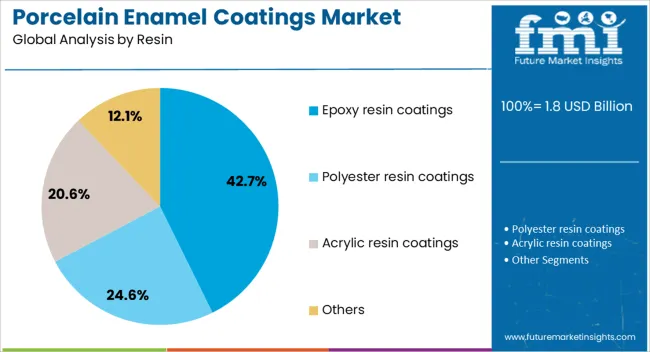

The porcelain enamel coatings market is segmented by type, application, resin, and geographic regions. By type, porcelain enamel coatings market is divided into Powder and Liquid. In terms of application, porcelain enamel coatings market is classified into Cookware and bakeware, Appliances, Sanitary ware, Heating and cooling equipment, and Others. Based on resin, porcelain enamel coatings market is segmented into Epoxy resin coatings, Polyester resin coatings, Acrylic resin coatings, and Others. Regionally, the porcelain enamel coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The powder segment accounts for approximately 57.9% of the porcelain enamel coatings market, maintaining its lead due to its efficient application process and high-performance finish. Powder coatings offer enhanced adhesion, uniform coverage, and reduced material wastage, making them highly cost-effective for large-scale manufacturing. Their solvent-free composition aligns with environmental regulations, providing an advantage over liquid alternatives.

The segment’s dominance is reinforced by its suitability for a wide range of substrates, including metals used in cookware, bakeware, appliances, and industrial equipment. Powder coatings also deliver consistent thickness and excellent wear resistance, extending the service life of coated products.

Growing investments in automated coating lines and technological advancements in powder formulation have further boosted adoption. With rising global demand for sustainable, durable, and visually appealing finishes, the powder segment is expected to retain its leading share throughout the forecast period, supported by its compatibility with modern production requirements and environmental mandates.

The cookware and bakeware segment leads the application category, accounting for around 38.4% of the porcelain enamel coatings market. This leadership is attributed to the coatings’ ability to provide superior non-stick performance, thermal resistance, and ease of cleaning-qualities essential in kitchenware products. Their inert and non-reactive nature ensures food safety, while the smooth enamel surface enhances both aesthetics and hygiene.

The segment benefits from growing consumer preference for durable, premium cookware that retains its performance and appearance over time. Manufacturers have increasingly adopted porcelain enamel coatings to differentiate products in a competitive market, offering a variety of colors and finishes to meet diverse consumer tastes.

The rising trend of home cooking and baking, coupled with the popularity of high-quality kitchenware in emerging markets, has further strengthened demand. With continued innovation in coating formulations and designs, the cookware and bakeware segment is poised to maintain its leading role in driving market growth.

The epoxy resin coatings segment holds the largest share in the resin category, contributing approximately 42.7% of the porcelain enamel coatings market. Its prominence stems from epoxy’s superior adhesion, chemical resistance, and mechanical strength, making it a preferred choice for demanding applications. These coatings are widely utilized in both consumer and industrial products, where durability and surface protection are critical.

Epoxy resin coatings also offer excellent compatibility with metal substrates, ensuring a robust bond and long-lasting performance even in high-wear environments. The segment has gained traction due to its versatility, covering applications from kitchen appliances to infrastructure components.

Additionally, advancements in epoxy formulation have enabled improved curing efficiency and enhanced environmental compliance, meeting evolving industry standards. With ongoing demand from sectors prioritizing both performance and aesthetics, the epoxy resin coatings segment is expected to sustain its leadership, supported by innovation and a broad application base across global markets.

The demand for porcelain enamel coatings is driven by their exceptional hardness, scratch resistance, and heat resistance, making them ideal for products exposed to high temperatures and harsh environments. Challenges in the market include fluctuating raw material prices, such as the cost of enamel frits and metal substrates, as well as the high energy consumption involved in the firing process. Opportunities are emerging in the growing demand for eco-friendly coatings, particularly in architectural applications. Trends show an increasing focus on innovative applications and the use of porcelain enamel coatings in new, high-performance sectors.

The porcelain enamel coatings market is being driven by the growing demand for durable, high-performance coatings in the appliance and automotive industries. Porcelain enamel coatings are valued for their ability to provide a long-lasting, aesthetically pleasing finish that is highly resistant to heat, corrosion, and scratching. In the appliance sector, porcelain enamel is widely used for surfaces such as ovens, stovetops, and washing machines, where durability and appearance are essential. The automotive industry is also increasingly adopting porcelain enamel coatings for components exposed to high temperatures, such as exhaust systems and engine parts. This growing demand for porcelain enamel coatings in both functional and aesthetic applications is expected to continue driving market growth.

The porcelain enamel coatings market faces several challenges related to costs and production complexities. The raw materials required for producing porcelain enamel, such as enamel frits and metal substrates, can be subject to price fluctuations, which can affect overall production costs. The firing process used to cure porcelain enamel coatings is energy-intensive and can drive up operational costs. Regulatory pressures regarding emissions from high-temperature firing processes, particularly in the appliance and automotive sectors, also add complexity to the market. Manufacturers must adapt to environmental regulations, especially in regions with stringent emissions standards. Moreover, technical challenges related to achieving consistent coating quality, durability, and adhesion to metal surfaces require advanced technology and expertise, further complicating production.

Opportunities in the porcelain enamel coatings market are emerging in the demand for eco-friendly solutions and expanding architectural applications. As industries look to reduce environmental impact, there is growing interest in low-emission firing techniques and coatings with reduced harmful chemicals. In the architectural sector, porcelain enamel coatings are gaining popularity due to their excellent durability and aesthetic appeal for applications such as building facades, signage, and decorative panels. The demand for these coatings in public infrastructure and urban development projects is growing, particularly in areas where long-lasting, corrosion-resistant finishes are required. Suppliers that can offer environmentally friendly formulations and tailor their products for specific architectural and industrial applications are well-positioned to capture emerging market opportunities.

The porcelain enamel coatings market is seeing trends toward product innovation and enhanced performance characteristics. Manufacturers are focusing on developing coatings that offer improved resistance to abrasion, corrosion, and extreme temperatures while maintaining aesthetic appeal. There is also a growing emphasis on enhancing the environmental profile of porcelain enamel coatings, with innovations in low-emission firing technologies and the use of alternative raw materials. Additionally, the market is witnessing an expansion of applications, with porcelain enamel coatings being used in new sectors such as electronics, renewable energy systems, and high-performance industrial components. As industries seek coatings that offer both functional and aesthetic benefits, the demand for porcelain enamel coatings with advanced performance features is expected to increase.

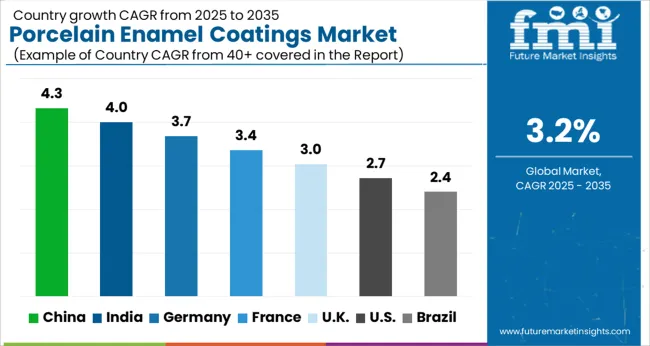

| Country | CAGR |

|---|---|

| China | 4.3% |

| India | 4.0% |

| Germany | 3.7% |

| France | 3.4% |

| UK | 3.0% |

| USA | 2.7% |

| Brazil | 2.4% |

The porcelain enamel coatings market is expected to grow at a global CAGR of 3.2% from 2025 to 2035. China leads the market with a CAGR of 4.3%, followed by India at 4.0%. France is projected to grow at 3.4%, while the UK and USA are expected to experience growth rates of 3.0% and 2.7%, respectively. The growth in the market is driven by increasing demand for durable, high-performance coatings in various applications, particularly in appliances, cookware, and industrial equipment. The market is also supported by advancements in coating technologies and the rising focus on energy-efficient products. The analysis includes over 40 countries, with the leading markets shown below.

The porcelain enamel coatings market in China is expected to grow at a CAGR of 4.3% from 2025 to 2035, driven by the country’s robust manufacturing sector and increasing demand from the appliance and automotive industries. China is one of the largest producers of household appliances, including stoves, ovens, and refrigerators, all of which require porcelain enamel coatings for durability and aesthetic appeal. Additionally, the automotive sector is adopting enamel coatings for both functional and decorative purposes. The country’s strong industrial base, coupled with a growing middle class seeking premium household products, is propelling the demand for high-quality porcelain enamel coatings. China’s focus on improving energy efficiency in manufacturing processes and reducing emissions is also pushing manufacturers to opt for advanced, durable coatings like porcelain enamel.

The porcelain enamel coatings market in India is expected to grow at a CAGR of 4.0% from 2025 to 2035. The market’s growth is primarily driven by the increasing demand for durable coatings in household appliances and industrial equipment. With India’s growing urban population and expanding middle class, there is a rising demand for home appliances such as stoves, refrigerators, and cookware, all of which use porcelain enamel coatings.India’s thriving manufacturing sector, particularly in the automotive industry, is contributing to the growth of the porcelain enamel coatings market. The country’s shift towards more energy-efficient and sustainable solutions in manufacturing is further boosting the demand for high-performance coatings like porcelain enamel.

The porcelain enamel coatings market in France is expected to grow at a CAGR of 3.4% from 2025 to 2035. The market is driven by the country’s well-established appliance and automotive industries, both of which are key consumers of porcelain enamel coatings. France has a strong tradition of producing high-quality cookware, and porcelain enamel coatings are essential for ensuring the durability, ease of cleaning, and aesthetic appeal of kitchenware. The automotive sector in France is using enamel coatings for various components, both for their functional properties and to enhance the vehicle’s appearance. France’s increasing focus on environmentally friendly solutions and energy efficiency is also encouraging the use of durable, long-lasting coatings like porcelain enamel.

The UK porcelain enamel coatings market is projected to grow at a CAGR of 3.0% from 2025 to 2035, driven by increasing demand for durable, high-performance coatings in household appliances and industrial applications. The UK’s robust manufacturing industry, particularly in the appliance sector, is fueling the demand for porcelain enamel coatings for items such as cooking stoves, ovens, and refrigerators.The automotive sector is using porcelain enamel coatings to improve the durability and aesthetics of vehicle components. The growing trend towards energy-efficient and environmentally friendly products is also supporting the market, as porcelain enamel coatings are recognized for their durability and reduced environmental impact.

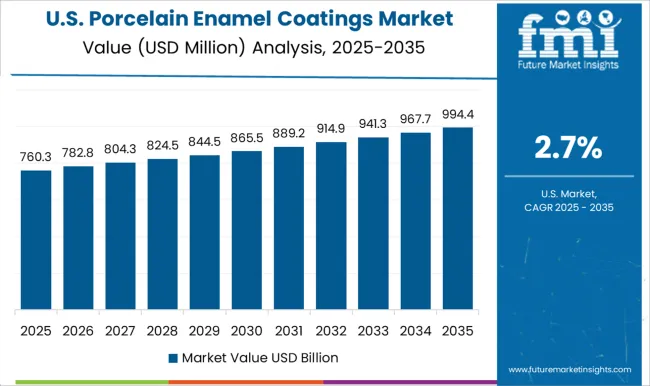

The USA porcelain enamel coatings market is expected to grow at a CAGR of 2.7% from 2025 to 2035. The market’s growth is driven by the increasing adoption of durable coatings in the appliance, automotive, and industrial sectors. The USA is a major producer of household appliances, and the demand for porcelain enamel coatings is rising as consumers seek long-lasting, easy-to-maintain products. The automotive sector’s focus on improving vehicle durability and appearance is contributing to the market’s growth. With the country’s ongoing emphasis on energy efficiency and reducing waste in manufacturing, the demand for durable and recyclable coatings like porcelain enamel is expected to increase.

In the porcelain enamel coatings market, competition is driven by the need for durable, heat-resistant, and aesthetically appealing coatings used in industries like appliances, automotive, architecture, and cookware. Ferro competes by offering a comprehensive range of porcelain enamel coatings, widely used in kitchen appliances, industrial applications, and architectural facades. The company focuses on product innovation and sustainability, emphasizing durability and heat resistance. Altana specializes in high-quality porcelain enamel coatings for automotive and industrial applications, offering formulations that provide superior corrosion resistance and excellent surface hardness. Their products cater to high-performance applications, particularly in the automotive sector. Asian Paints Limited offers porcelain enamel coatings for both decorative and functional purposes, focusing on providing vibrant, long-lasting finishes for home appliances and cookware.

The company emphasizes customer-centric solutions, expanding its portfolio of coatings with eco-friendly features. BASF, with its extensive global presence, competes by offering innovative porcelain enamel solutions that meet stringent quality standards, focusing on high durability, corrosion resistance, and environmental compliance. Colormaker is another significant player, offering enamel coatings used for a range of applications, particularly in the manufacturing of industrial and domestic cookware, known for their high-quality finish and resilience under high temperatures. Decoral System focuses on decorative porcelain enamel coatings, targeting the architectural and design industries.

Their coatings are widely used in facades, providing not only aesthetic appeal but also longevity and protection against harsh weather conditions. FERRO-ENAMEL, a subsidiary of Ferro Corporation, specializes in producing porcelain enamel coatings for appliances, offering products that ensure excellent surface durability and high-temperature resistance. Glidden Paints, Mayco Industries, and Minerva Paints & Coatings target the commercial and DIY markets with versatile porcelain enamel solutions for both functional and decorative purposes. PPG, Royal DSM, The Sherwin-Williams Company, and TIGER Drylac offer highly specialized porcelain enamel coatings for various industrial applications, including automotive and appliance industries. These companies emphasize product differentiation through superior performance, sustainability, and customization. Trimite Global Coatings focuses on providing porcelain enamel products that cater to industrial and automotive sectors, with a focus on ease of application and consistent, high-quality finishes.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Type | Powder and Liquid |

| Application | Cookware and bakeware, Appliances, Sanitary ware, Heating and cooling equipment, and Others |

| Resin | Epoxy resin coatings, Polyester resin coatings, Acrylic resin coatings, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ferro, Altana, Asian Paints Limited, BASF, Colormaker, Decoral System, FERRO-ENAMEL, Glidden Paints, Mayco Industries, Minerva Paints & Coatings, PPG, Royal DSM, The Sherwin-Williams, TIGER Drylac, and Trimite Global Coatings |

| Additional Attributes | Dollar sales by product type (industrial, decorative, automotive, architectural), coating type (single-layer, multi-layer), and application (appliances, automotive, construction, signage). Demand dynamics are driven by the need for durable, heat-resistant coatings in automotive and appliance sectors, as well as the growing demand for aesthetic and long-lasting finishes in architecture. Regional growth is prominent in North America, Europe, and Asia-Pacific, supported by the expanding construction industry, rising automotive production, and increasing demand for high-quality finishes in various industrial applications. |

The global porcelain enamel coatings market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the porcelain enamel coatings market is projected to reach USD 2.4 billion by 2035.

The porcelain enamel coatings market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in porcelain enamel coatings market are powder and liquid.

In terms of application, cookware and bakeware segment to command 38.4% share in the porcelain enamel coatings market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Porcelain Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Porcelain Tableware Market Trends - Growth & Demand Forecast 2025 to 2035

Post Porcelain Insulator Market Size and Share Forecast Outlook 2025 to 2035

Line Post Porcelain Insulator Market Size and Share Forecast Outlook 2025 to 2035

Transformer Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

Ceramic and Porcelain Tableware Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

Disc Suspension Porcelain Insulator Market Size and Share Forecast Outlook 2025 to 2035

Enameled Cookware Market Forecast and Outlook 2025 to 2035

Enamel Remineralization and White Spot Lesion Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Smart Coatings Market Size and Share Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Marine Coatings Market Size and Share Forecast Outlook 2025 to 2035

Filter Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA