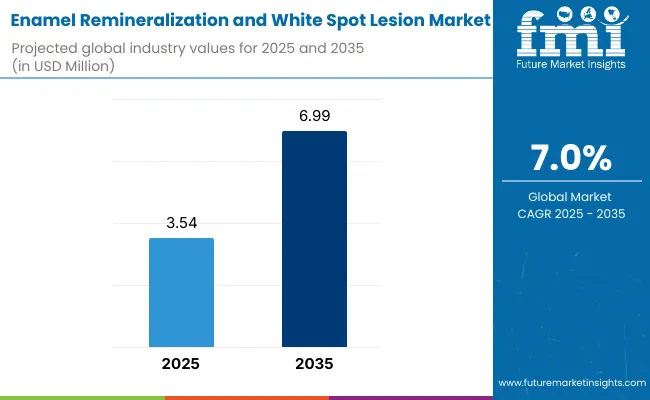

The Enamel Remineralization and White Spot Lesion Market is projected to reach a valuation of USD 3.54 million by 2025 and is expected to expand further to USD 6.99 million by 2035. This represents an incremental gain of USD 3.54 million over the ten-year period, reflecting a 97.5% increase in market value. The industry is anticipated to grow at a CAGR of 7.0%, signaling a rapid expansion trajectory supported by rising demand for minimally invasive dental care, increasing focus on aesthetic outcomes, and the growing prevalence of orthodontic treatments associated with white spot lesion development.

Enamel Remineralization and White Spot Lesion Market Key Takeaways

| Metric | Value |

|---|---|

| Enamel Remineralization and White Spot Lesion Market Estimated Value in (2025E) | USD 3.54 million |

| Enamel Remineralization and White Spot Lesion Market Forecast Value in (2035F) | USD 6.99 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

During the first half of the forecast period (2025-2030), the Enamel Remineralization and White Spot Lesion Market is projected to grow from USD 3.54 million to USD 5.15 million, recording an absolute increase of USD 1.61 million. This growth accounts for 45.5% of the total decade-long expansion, underscoring strong early momentum fueled by greater awareness of preventive and aesthetic dentistry, as well as the adoption of minimally invasive approaches that preserve natural tooth structure. Technological advances in biomimetic remineralization agents, peptide-based formulations, and nanohydroxyapatite products are converging with patient demand, enabling broader adoption across dental clinics, hospitals, and academic dental centers worldwide.

Between 2030 and 2035, the market is forecast to grow from USD 5.15 million to USD 6.99 million, contributing an additional USD 1.84 million, which represents 54.5% of the total decade-long growth. This acceleration will be driven by the introduction of next-generation biomimetic systems, peptide-based formulations, and nanotechnology-enabled materials that deliver superior durability and aesthetic outcomes. Rising global demand for cosmetic and minimally invasive dental solutions, coupled with the expanding orthodontic treatment base, will accelerate adoption across specialty clinics, dental hospitals, and academic institutions. Continuous innovation in chairside delivery systems and patient-friendly home-care solutions is expected to further shape the evolution of this market segment.

From 2020 to 2024, the global Enamel Remineralization and White Spot Lesion Market expanded from USD 2.65 million to USD 3.32 million, reflecting a steady rise in demand as preventive and aesthetic dentistry gained prominence. Growth during this period was primarily fueled by increasing awareness of white spot lesions as a common side effect of orthodontic treatments, coupled with the rising adoption of minimally invasive solutions to preserve natural tooth structure.

Academic and clinical research institutions also played a key role in validating the efficacy of biomimetic agents, nanohydroxyapatite formulations, and peptide-based systems, accelerating their integration into clinical practice. Leading players such as GC Corporation, 3M, and Ultradent Products collectively accounted for a significant share of the market by leveraging strong distribution networks, clinician training programs, and product innovations designed for both professional chairside use and patient-directed home-care applications.

In 2025, the Enamel Remineralization and White Spot Lesion Market is projected to reach approximately USD 3.54 million, underpinned by growing orthodontic procedure volumes, rising demand for cosmetic dentistry, and patients’ preference for non-invasive treatment pathways. Dental hospitals and specialty clinics are increasingly investing in advanced remineralization agents to complement orthodontic care, while dental practitioners are emphasizing preventive protocols to reduce lesion progression.

The market is also witnessing an upsurge in demand for patient-friendly home-use kits and nano-engineered formulations that provide accessible and effective solutions for post-orthodontic care. With growing emphasis on aesthetic outcomes, patient safety, and treatment durability, the segment is poised to witness broader adoption across both premium and mid-tier dental practices worldwide.

The growth of the Enamel Remineralization and White Spot Lesion Market is being driven by the convergence of rising orthodontic treatment volumes, increasing awareness of aesthetic dentistry, and the demand for minimally invasive treatment solutions. Patients and clinicians are increasingly prioritizing approaches that preserve natural tooth structure while addressing post-orthodontic enamel demineralization and cosmetic concerns.

Technological advances, such as biomimetic agents, peptide-based therapies, and nanohydroxyapatite formulations, are enhancing treatment efficacy and expanding adoption across dental hospitals, clinics, and academic centers. In addition, the growing availability of at-home remineralization products is making preventive and cosmetic solutions more accessible, further accelerating global market expansion.

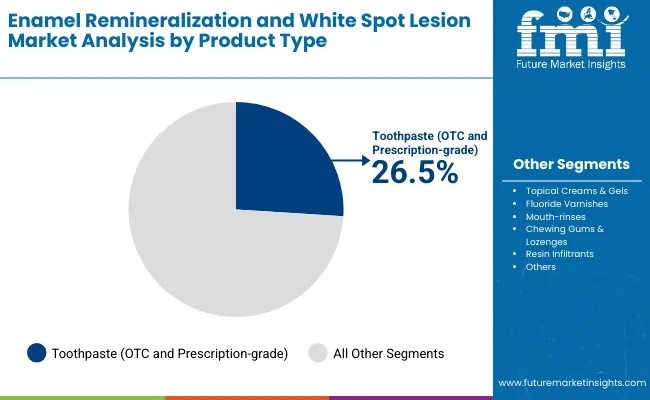

The market is segmented by product, by product type, ingredient type, age group, application, sales channel and region. Product include Toothpaste (OTC and Prescription-grade), Topical Creams & Gels, Fluoride Varnishes, Chewing Gums & Lozenges, Mouth-rinses, Resin Infiltrants and Others. Based on Ingredient Type, the segmentation includes Fluoride-based, Casein Phosphopeptide Amorphous Calcium Phosphate (CPP-ACP), Nano-hydroxyapatite, Bioactive Glass, Xylitol-based, Resin-based Infiltrants, Tricalcium Phosphate, Dual-Action Complexes. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

| Product type | Market Value Share, 2025 |

|---|---|

| Toothpaste (OTC and Prescription-grade) | 26.5% |

| Topical Creams & Gels | 17.8% |

| Fluoride Varnishes | 22.9% |

| Mouth-rinses | 9.7% |

| Chewing Gums & Lozenges | 5.7% |

| Resin Infiltrants | 10.6% |

| Others | 6.8% |

Toothpaste (OTC and prescription-grade) is projected to lead the product category with a 26.5% market share in 2030, and is expected to maintain this position due to its widespread availability, affordability, and patient compliance. Unlike specialized clinical treatments, toothpaste formulations can be seamlessly integrated into daily oral care routines, ensuring consistent and sustained remineralization benefits across large population groups.

Recent advances in fluoride, nano-hydroxyapatite, and calcium phosphate technologies have enabled toothpaste to not only prevent demineralization but also promote active repair of white spot lesions. In addition, prescription-grade products incorporating higher fluoride concentrations and novel biomimetic agents are gaining adoption in orthodontic and high-risk caries patients, broadening their clinical relevance.

A key factor behind toothpaste’s dominance is its dual presence in consumer retail channels and dental clinics. OTC products provide mass accessibility, while prescription formulations strengthen professional endorsement and targeted treatment outcomes. With global brands investing heavily in R&D and marketing, toothpaste remains the most recognized and trusted delivery vehicle for enamel protection and lesion management.

As awareness of preventive dentistry continues to grow, and as patients demand convenient, cost-effective, and clinically validated solutions, toothpaste both OTC and prescription-grade will remain the backbone of the enamel remineralization and white spot lesion market across consumer and professional segments alike.

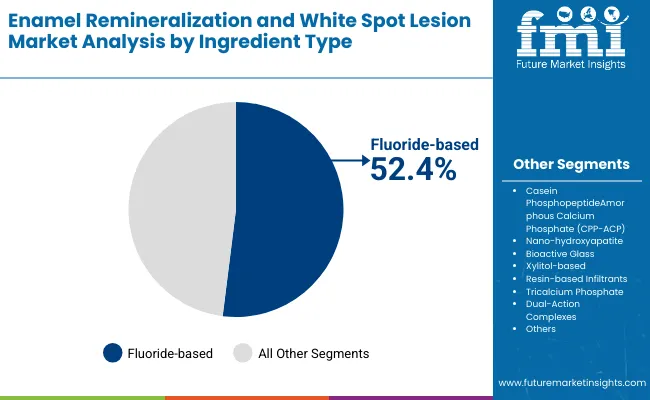

| Ingredient Type | Market Value Share, 2025 |

|---|---|

| Fluoride-based | 52.4% |

| Casein PhosphopeptideAmorphous Calcium Phosphate (CPP-ACP) | 8.0% |

| Nano-hydroxyapatite | 21.6% |

| Bioactive Glass | 4.6% |

| Xylitol-based | 3.0% |

| Resin-based Infiltrants | 4.6% |

| Tricalcium Phosphate | 3.8% |

| Dual-Action Complexes | 2.0% |

Fluoride-based formulations continue to dominate the ingredient landscape, accounting for over half of total demand in 2025. This class of compounds remains the foundation of enamel remineralization strategies due to its proven ability to promote remineralization, enhance enamel hardness, and provide long-term resistance against acid attack. As the most widely recognized and clinically validated intervention in preventive dentistry, fluoride-based systems offer unmatched efficacy in reversing early-stage white spot lesions and preventing caries progression.

What makes fluoride irreplaceable is its extensive clinical evidence, regulatory acceptance, and standardized incorporation into both OTC and prescription-grade formulations. Dental professionals and patients alike have decades of familiarity with fluoride through toothpaste, gels, varnishes, and rinses, building a robust ecosystem of trust, compliance, and widespread adoption. The compound’s effectiveness across age groups and its cost-efficiency further reinforce its market leadership.

Recent innovations in fluoride delivery, such as high-concentration prescription toothpastes, slow-release varnishes, and bioavailable complexes, have expanded its clinical utility and improved outcomes in patients at higher caries risk. Additionally, large-scale public health programs, community fluoridation initiatives, and inclusion in national dental guidelines continue to ensure a stable demand pipeline.

While alternative remineralizing agents such as nano-hydroxyapatite, calcium phosphates, and bioactive glass are gaining traction in niche or premium applications,fluoride remains the mainstay of the global market, largely due to its proven performance, affordability, and broad integration across preventive and therapeutic dental care.

The adoption of enamel remineralization therapies is expanding across preventive and restorative dentistry as clinical evidence and innovative biomimetic agents converge to improve the management of white spot lesions and early caries. While momentum is strong, the market also faces limitations tied to variable treatment efficacy, regulatory hurdles, and patient compliance in long-term use.

Expanding Role in Preventive and Restorative Dentistry

Enamel remineralization is now central to managing early-stage caries and orthodontic white spot lesions. It enables non-invasive repair of demineralized enamel by enhancing natural mineral uptake. Dental clinics and research institutions are adopting these therapies to improve patient outcomes and reduce restorative interventions. As preventive dentistry and minimally invasive care gain traction, remineralization solutions are becoming a standard element in modern dental treatment workflows.

Shift Toward Accessible and At-Home Remineralization Solutions

The enamel remineralization market is expanding as patients and dentists move beyond reliance on invasive restorative procedures. Manufacturers now offer user-friendly toothpastes, gels, and varnishes that can be applied in clinics or at home. These products combine proven fluoride delivery with biomimetic agents like CPP-ACP and bioactive glass, making them effective and easy to use even for non-specialists. Improved formulations, sustained-release technologies, and orthodontic-specific applications allow consistent protection without complex chairside procedures. Countries prioritizing preventive oral health are integrating these solutions into national dental programs, broadening adoption beyond specialist practices.

Efficacy, Compliance, and Regulatory Constraints

Enamel remineralization therapies face challenges in consistency and long-term outcomes treatment results vary depending on lesion severity, patient diet, and adherence to protocols. Many products require repeated application or strict compliance, which limits real-world effectiveness. Regulatory frameworks also restrict marketing claims, creating hurdles for companies seeking to position products as therapeutic rather than cosmetic. Dentists must be trained to select appropriate agents and educate patients, but lack of standardized guidelines creates variability in practice. These factors slow broader adoption in routine dental care and reimbursement systems, keeping growth concentrated among early adopters and preventive specialists.

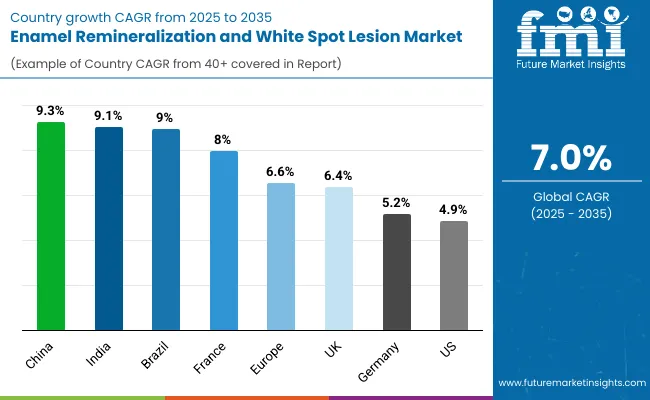

| Countries | CAGR |

|---|---|

| USA | 4.9% |

| Brazil | 9.0% |

| China | 9.3% |

| India | 9.1% |

| Europe | 6.6% |

| Germany | 5.2% |

| France | 8.0% |

| UK | 6.4% |

The adoption and growth patterns of enamel remineralization and white spot lesion treatments vary across regions, shaped by the maturity of dental care infrastructure, government investment in preventive oral health programs, and demand for minimally invasive cosmetic and restorative solutions.

In the United States, the enamel remineralization and white spot lesion market is characterized by steady growth supported by a well-developed dental care infrastructure, high prevalence of orthodontic procedures, and increasing patient awareness of preventive oral health. The widespread availability of advanced dental clinics and research-driven universities fosters adoption of remineralizing agents such as fluoride varnishes, CPP-ACP pastes, and bioactive glass formulations. The presence of specialized dental research centers and continuous investments in minimally invasive and cosmetic dentistry drive demand for these solutions, particularly for managing orthodontic white spot lesions and early-stage caries. The market here is projected to grow at a CAGR of 4.9%.

In Europe, countries such as Germany, France, and the UK lead the enamel remineralization and white spot lesion market with increasing emphasis on preventive dentistry and minimally invasive care. Government-supported oral health initiatives and public awareness programs promote the adoption of fluoride varnishes, CPP-ACP formulations, and bioactive glass technologies across both clinical and consumer settings.

Collaborative research between universities, dental product manufacturers, and clinical networks supports the validation of innovative remineralization approaches, particularly in orthodontics and early caries management. Regulatory backing for evidence-based preventive dentistry and strategic funding for oral health campaigns foster steady market expansion, though adoption progresses at different paces depending on reimbursement frameworks and patient awareness. The market in Germany is expected to expand at a CAGR of 5.2%, France at 8.0%, and the UK at 6.4%.

Overall, the enamel remineralization and white spot lesion market globally reflects a strategic blend of clinical innovation, preventive dentistry priorities, and institutional support, which together govern the pace and scale of adoption across different regions. This dynamic interplay underscores the central role that public health policies, dental care infrastructure, and practitioner expertise play in shaping the trajectory of this growing segment of preventive and restorative oral health care.

The enamel remineralization and white spot lesion market in the United States has been forecasted to expand at a CAGR of 4.9% between 2025 and 2035. The United States remains the most advanced and innovation-driven market for preventive and restorative dental care, with long-standing integration of remineralization strategies into orthodontic and general dentistry programs. Leading dental schools such as Harvard, University of Michigan, and UCSF, along with institutions like the American Dental Association and National Institute of Dental and Craniofacial Research, have been pivotal in setting global benchmarks for clinical guidelines and product validation in managing white spot lesions and early-stage caries. The USA also hosts a mature ecosystem of dental clinics, research centers, and consumer health companies, ensuring widespread access to professional and at-home remineralization products across diverse patient populations.

The enamel remineralization and white spot lesion market in India is expected to grow at a CAGR of 9.1% between 2025 and 2035, driven by rising awareness of preventive dentistry but limited adoption outside urban centers. Premier dental institutions like AIIMS, Maulana Azad Institute of Dental Sciences, and Manipal College of Dental Sciences are leading clinical adoption and research on remineralization therapies for early caries and post-orthodontic white spot lesions. However, the number of clinics routinely offering advanced remineralization treatments remains low, primarily due to high product costs, limited practitioner training, and uneven access to preventive dental care programs.

| Europe Countries | 2025 |

|---|---|

| Germany | 28.3% |

| France | 16.2% |

| Italy | 18.1% |

| Spain | 10.0% |

| BENELUX | 6.4% |

| Nordic Countries | 3.6% |

| Rest of Western Europe | 4.6% |

| Europe Countries | 2035 |

|---|---|

| Germany | 35.3% |

| France | 17.3% |

| Italy | 20.1% |

| Spain | 10.9% |

| BENELUX | 7.5% |

| Nordic Countries | 4.0% |

| Rest of Western Europe | 4.9% |

China’s enamel remineralization and white spot lesion market is projected to grow at a CAGR of 9.3% from 2025 to 2035. The market is expanding rapidly, driven by rising awareness of preventive dental care, government initiatives for oral health, and growing adoption of minimally invasive treatments among pediatric and orthodontic patients. Leading dental hospitals and universities, including Peking University School of Stomatology and West China School of Stomatology (Sichuan University), are increasingly implementing clinical studies and treatment protocols using advanced remineralization products.

The enamel remineralization and white spot lesion market in the United Kingdom is projected to grow at a CAGR of 6.4% between 2025 and 2035. Growth is driven by increasing awareness of early dental caries management, rising adoption of preventive dentistry, and government initiatives promoting oral health in schools and communities. Leading dental research institutions, including King’s College London Dental Institute and the University of Manchester, are actively integrating advanced remineralization therapies into clinical research and patient care protocols.

The UK benefits from widespread access to preventive dental care services, which are increasingly incorporating fluoride varnishes, calcium-phosphate-based pastes, and other remineralizing agents. In recent years, adoption of in-office and at-home enamel remineralization products has accelerated, supported by NHS pilot programs and private dental clinics promoting minimally invasive interventions.

The enamel remineralization and white spot lesion market in Germany is anticipated to grow at a CAGR of6.9% between 2025 and 2035. Germany is positioning itself as a leader in preventive and minimally invasive dentistry, particularly in aesthetic restorative treatments, pediatric care, and caries-preventive protocols. While academic dental research remains strong, much of the current growth is fueled by collaborations between university clinics, dental product manufacturers, and private practice networks. German firms are playing a strategic role in developing remineralization technologies including nano-hydroxyapatite pastes, fluoride-releasing varnishes, and calcium-phosphate formulations which are now being adopted across both clinical and consumer markets.

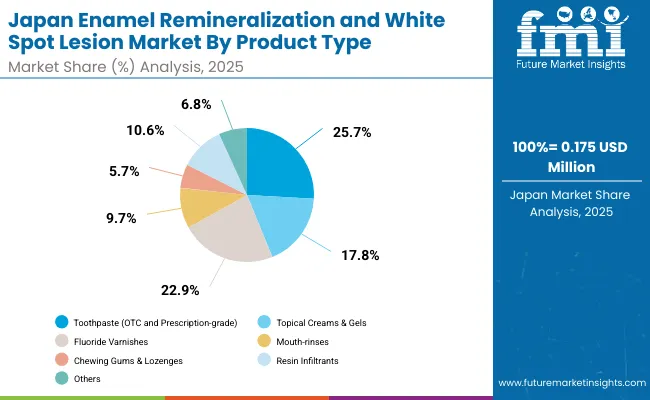

| Product | Market Value Share, 2025 |

|---|---|

| Toothpaste (OTC and Prescription-grade) | 25.7% |

| Topical Creams & Gels | 17.8% |

| Fluoride Varnishes | 22.9% |

| Mouth-rinses | 9.7% |

| Chewing Gums & Lozenges | 5.7% |

| Resin Infiltrants | 10.6% |

| Others | 6.8% |

Enamel Remineralization and White Spot Lesion Market in Japan The enamel remineralization and white spot lesion market in Japan has been projected to reach USD 0.175 million by 2025. Toothpaste (OTC and Prescription-grade) lead the product landscape with a 25.7% share, followed by fluoride varnishes at 22.9%. The Japanese market is shaped by a long-standing culture of preventive dentistry and strong emphasis on oral esthetics.

National universities and dental research institutes, such as Tokyo Medical and Dental University, Osaka Dental University, and Kyushu University, have made remineralization therapies central to clinical trials in pediatric, orthodontic, and cosmetic dentistry. Both hospital-based dental clinics and private practices are adopting advanced formulations, ranging from fluoride-based protocols to biomimetic nano-hydroxyapatite pastes.

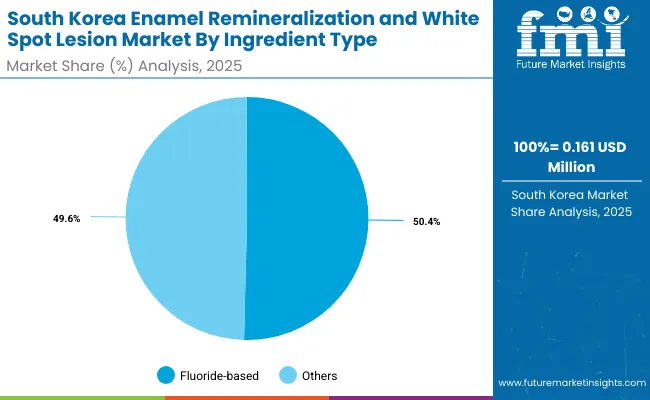

| Ingredient Type | Market Value Share, 2025 |

|---|---|

| Fluoride-based | 50.4% |

| Casein PhosphopeptideAmorphous Calcium Phosphate (CPP-ACP) | 8.0% |

| Nano-hydroxyapatite | 21.6% |

| Bioactive Glass | 4.6% |

| Xylitol-based | 3.0% |

| Resin-based Infiltrants | 4.6% |

| Tricalcium Phosphate | 3.8% |

| Dual-Action Complexes | 2.0% |

Enamel Remineralization and White Spot Lesion Market in South Korea The enamel remineralization and white spot lesion market in South Korea has been projected to reach USD 0.161million in 2025.Fluoride-based remineralization ingredient type are expected to lead with a 50.1% share. South Korea’s market is evolving from basic preventive dentistry toward highly esthetic, technology-enabled dental care.

National dental schools such as Seoul National University School of Dentistry and Yonsei University College of Dentistry are leading applied research focused on white spot lesion management, orthodontic aftercare, and biomimetic enamel repair. A key differentiator for South Korea is its early-stage adoption of AI-driven caries detection and digital monitoring systems, which are increasingly paired with remineralization protocols for both clinical and home-care applications.

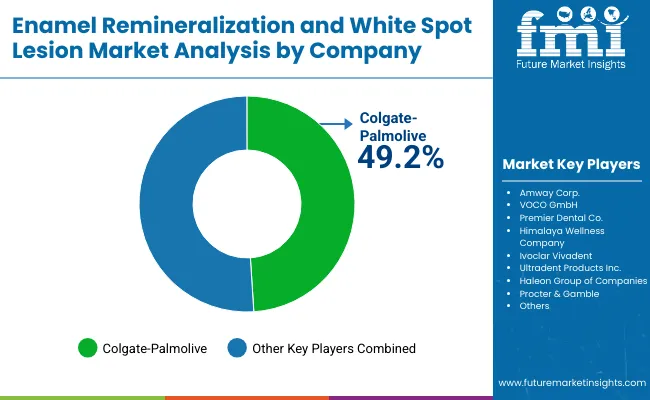

The enamel remineralization and white spot lesion market is moderately concentrated, with Colgate-Palmolive holding a leading global position due to its dominance in over-the-counter oral care products. The company’s strength is rooted in its integrated approach offering a wide portfolio of fluoride-based toothpastes, enamel-strengthening formulations, and at-home remineralization solutions supported by global brand recognition and extensive distribution networks. Colgate-Palmolive also invests heavily in clinical research and consumer education, positioning itself as the go-to vendor for large-scale preventive oral health and enamel repair solutions.

Other key players include Procter & Gamble, VOCO GmbH, and IvoclarVivadent, each addressing different segments of the enamel repair ecosystem. Procter & Gamble leverages its global oral care brands to expand access to fluoride-based and enamel-strengthening toothpastes across mass consumer markets. VOCO GmbH focuses on professional dentistry with specialized fluoride varnishes and biomimetic formulations, making it a strong player in clinical settings. IvoclarVivadent, meanwhile, integrates remineralization technologies into esthetic restorative systems, strengthening its position in cosmetic and restorative dentistry.

Additional participants include Himalaya Wellness Company, with its herbal and natural oral care portfolio; Premier Dental Co., which supplies chairside remineralization products for dental practices; Ultradent Products Inc., offering preventive and esthetic solutions for white spot lesions; Amway Corp., active in direct-to-consumer oral health products; and the Haleon Group of Companies, which markets fluoride-based preventive care solutions through its consumer health portfolio. Collectively, these companies contribute to the market’s diversity, ensuring both professional and consumer segments are addressed.

Key Developments in Enamel Remineralization and White Spot Lesion Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3.54 million |

| Product | Toothpaste (OTC and Prescription-grade), Topical Creams & Gels, Fluoride Varnishes, Mouth-rinses, Chewing Gums & Lozenges, Resin Infiltrants and others |

| Ingredient Type | Fluoride-based, Casein Phosphopeptide Amorphous Calcium Phosphate (CPP-ACP), Nano-hydroxyapatite, Bioactive Glass, Xylitol-based, Resin-based Infiltrants, Tricalcium Phosphate, Dual-Action Complexes. |

| Age Group | Pediatric (0-14 years), Teenagers (15-19 years), Adults (20-59 years) And Geriatric (60+ years) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Europe, Germany, France and UK |

| Key Companies Profiled | Colgate-Palmolive, Amway Corp., VOCO GmbH, Premier Dental Co., Himalaya Wellness Company, Ivoclar Vivadent, Ultradent Products Inc., Haleon Group of Companies, Procter & Gamble and others |

The global Enamel Remineralization and White Spot Lesion Market is estimated to be valued at USD 3.54 million in 2025.

The market size for the Angle-Resolved Photoemission Spectroscopy Market is projected to reach approximately USD 6.99 million by 2035.

The Enamel Remineralization and White Spot Lesion Market is expected to grow at a CAGR of 7.0 % between 2025 and 2035.

The key product formats in Enamel Remineralization and White Spot Lesion Market include Toothpaste (OTC and Prescription-grade), Topical Creams & Gels, Fluoride Varnishes, Chewing Gums & Lozenges, Mouth-rinses, Resin Infiltrants and others.

In terms of ingredient type, Fluoride-based segment is projected to command the highest share at 52.4% in the Enamel Remineralization and White Spot Lesion Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enameled Cookware Market Forecast and Outlook 2025 to 2035

Porcelain Enamel Coatings Market Size and Share Forecast Outlook 2025 to 2035

Breast Lesion Localization Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breast Lesion Localization Market Size and Share Forecast Outlook 2025 to 2035

Pigmented Lesion Treatment Market Growth - Trends & Forecast 2025 to 2035

Blind Spot Monitor Market Size and Share Forecast Outlook 2025 to 2035

Large Spot Fiber Collimator Market Size and Share Forecast Outlook 2025 to 2035

Blind Spot Detection Market Growth - Trends & Forecast 2025 to 2035

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Mobile Hotspot Router Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Machine Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Market Size and Share Forecast Outlook 2025 to 2035

Automotive Blind Spot Monitors Market

Automotive Dynamic Spotlight Market

White Top Testliner Market Size and Share Forecast Outlook 2025 to 2035

White Inorganic Pigment Market Size and Share Forecast Outlook 2025 to 2035

White Matter Injury Treatment Market Size and Share Forecast Outlook 2025 to 2035

White Tea Extract Market Size and Share Forecast Outlook 2025 to 2035

Whitening Gold Peptide Complex Market Size and Share Forecast Outlook 2025 to 2035

White Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA