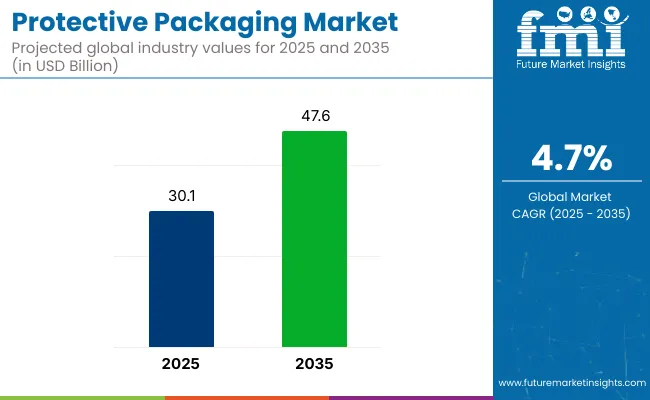

The global protective packaging market is projected to reach USD 30.1 billion in 2025 and grow to USD 47.6 billion by 2035, registering a CAGR of 4.7%. Sales in 2024 were recorded at USD 28.5 billion.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 30.1 Billion |

| Industry Value (2035F) | USD 47.6 Billion |

| CAGR (2025 to 2035) | 4.7% |

Growth has been driven by the expanding e-commerce sector, the proliferation of cold chain logistics, and stringent product safety standards across multiple industries. Protective packaging has been increasingly adopted to reduce product damage during transit and storage, with demand surging across electronics, pharmaceuticals, and food & beverage applications.

Corrugated boxes are projected to maintain dominance, commanding over 33.9% market share by 2035, supported by their strength, stackability, and cost-effectiveness. On the materials front, plastics are anticipated to lead, capturing 42.6% of the total market, due to their lightweight properties and protective performance. In 2024, Asia Pacific emerged as the leading region, contributing 34.8% of global revenues. The regional lead is reinforced by robust e-commerce growth and infrastructure investments in logistics and cold chain systems.

Industry players are channeling investments into sustainable innovation and quality-driven solutions. For example, Amcor plc has focused on developing recyclable flexible packaging to support clients’ ESG targets. As stated by Peter Konieczny, CEO of Amcor plc, “Our focus remains on delivering packaging solutions that not only protect products but also contribute to a more sustainable future,” reflecting the sector’s pivot toward circular economy principles.

With increased regulatory scrutiny and evolving consumer expectations, the protective packaging market is being reshaped by technological advancements, eco-friendly material adoption, and strategic partnerships, ensuring both product safety and environmental responsibility.

The below table presents the expected CAGR for the global protective packaging market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 4.4% |

| H2(2024 to 2034) | 4.6% |

| H1(2025 to 2035) | 4.6% |

| H2(2025 to 2035) | 4.8% |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 4.4%, followed by a slightly higher growth rate of 4.6% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.6% in the first half and remain relatively moderate at 4.8% in the second half. In the first half (H1) the market witnessed a decrease of 110 BPS while in the second half (H2), the market witnessed an increase of 120 BPS.

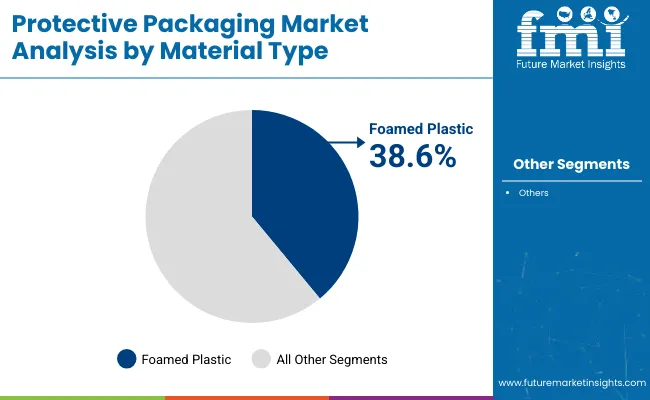

Foamed plastic material is expected to hold the largest share of 38.6% in the protective packaging market in 2025, as its usage has been driven by high impact absorption, shock resistance, and lightweight construction.

Expanded polyethylene, polystyrene, and polyurethane foams have been utilized across appliance, electronics, and industrial component packaging. Compression resilience and dimensional stability have been optimized for repeated handling and stacking. Complex part geometries and void fills have been accommodated through custom-molded foam inserts.

Compatibility with die-cutting, lamination, and automated assembly systems has improved operational efficiency. Static dissipation and thermal insulation properties have enhanced the material’s utility in sensitive equipment logistics. Multi-density configurations have supported performance across light-duty and heavy-duty applications. Continued adoption has been sustained by broad material availability and consistent protective results across supply chains.

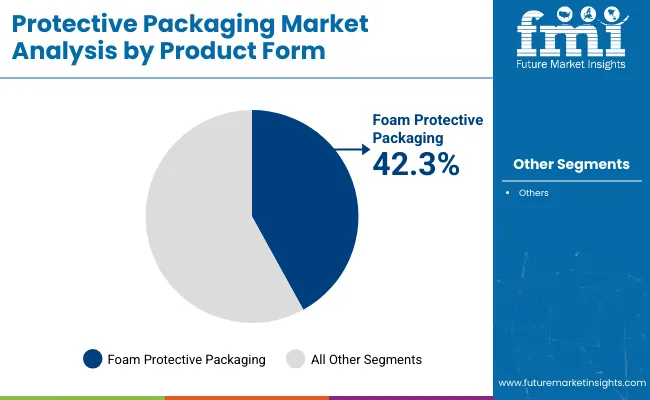

The foam protective packaging segment is projected to account for 42.3% of the protective packaging market in 2025, as its leadership has been maintained through widespread use in shipping electronics, medical devices, and instruments.

Cushion blocks, corner pads, and inner trays have been employed to prevent surface abrasion and internal movement during transit. High energy absorption, shape retention, and structural integrity have been prioritized in foam formats. Custom solutions have been deployed for product-specific requirements in both B2B and retail channels.

Close-fitting foam designs have been tailored to reduce vibration, impact, and scuffing during handling and delivery. Multi-layered configurations have been implemented for modular and stacked shipments. Foam inserts have been incorporated into returnable and disposable packaging systems depending on product lifecycle needs. Segment dominance has been reinforced by the need for precision fit and comprehensive surface protection.

Surging Demand for Secure and Shock-Resistant Packaging in Electronics Industry

Rising production of consumer electronics, semiconductors, and batteries fuels demand for shock-resistant, anti-static, and tamper-proof protective packaging. Manufacturers pay extra attention to packaging that resists ESD, damage, and moisture entry so that products remain unaltered during storage and transportation. As the global export of high-value tech products rises, companies need safe, impact-resistant materials that minimize possible losses from shipment-related damage.

As businesses optimize supply chains, there is an increasing demand for custom-molded foams, anti-static bags, and rigid enclosures. Packaging solutions must offer precision cushioning along with barrier protection as fragile components continue to get smaller and more delicate. Companies also integrate smart packaging with impact indicators and tamper evidence for better security and quality control in the electronics supply chain.

Global Trade Expansion and Supply Chain Complexity Drive Protective Packaging Demand

The growth in global trade and increased complexity in a supply chain are major drivers of demand for protective packaging. As international trade continues to increase, companies struggle with complying with regional shipping regulations. Therefore, companies increasingly require versatile, compliant protective packaging that protects the products while adapting to different standards.

Besides, companies seek lighter, leaner packaging materials that help reduce transportation costs and optimize logistics. These materials must weigh the strength versus the durability factor for the assurance of safety at transit. Today, with complicated supply chains throughout the world, cost-effective solutions, efficient methods of packaging for protective purposes while enduring long distance travel and regionally compliant conditions remain in an increasingly high demand.

Environmental Concerns over Packaging Waste May Hinder Protective Packaging Growth

Growing environmental concerns regarding waste generated by protective packaging are a significant challenge. Single-use plastics, foams, and non-biodegradable materials widely used in packaging are some of the contributors to the growing volume of waste. Poor disposal habits increase the volumes of landfill overflows and increase pollution levels in marine ecosystems.

Consumers and business are now awakened to the environmental implications of waste from packaging. However, the use of eco-friendly materials is costly in terms of production and logistics. Those companies that refuse to switch to greener options may experience regulatory forces against them, damage to their reputation, and a change in consumer preferences. All these may hinder the expansion of the protective packaging market.

Tier 1 companies comprise market leaders capturing significant market share in global market. These industry leaders stand out for having a large product variety and a high production capacity. These industry giants stand out for having a wide geographic reach, a wealth of production experience in a variety of package styles, and a strong customer base.

They offer a variety of services, such as recycling and manufacturing, using state-of-the-art equipment, according to legal requirements, and offering the best possible quality. Among the well-known businesses in tier 1 are Sealed Air Corporation, Sonoco Products Company, Smurfit Westrock and DS Smith plc.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. They are distinguished by having a significant international presence and in-depth industry expertise. These market participants may not have cutting-edge technology or a broad worldwide reach, but they do guarantee regulatory compliance and have good technology.

Among the well-known businesses in tier 2 are Schur Flexibles Holding GesmbH,3M Company, Intertape Polymer Group Inc, Storopack Hans Reichenecker GmbH, International Paper Company, Elsons International, Protective Packaging Inc., Ibex Packaging, Bradford Company, Orcon Industries and Supreme Protective Packaging.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets Due to their specialization in serving the demands of the local market, these companies are classified as belonging to the tier 3 sharing sector. They only operate on a small scale and within a limited geographic area. Within this specific context, Tier 3 is categorized as an unstructured market, denoting an industry that is significantly less formalized and structured than its organized rivals.

The section below covers the future forecast for the protective packaging market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is anticipated to grow with a CAGR of 3.2% through 2035. In Western Europe, Germany is projected to witness a CAGR of 2.7% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.2% |

| Germany | 2.7% |

| China | 5.2% |

| UK | 1.1% |

| Spain | 2.9% |

| India | 6.0% |

| Canada | 2.4% |

A growing pharmaceutical and medical device industry is major driver in USA for higher demand for protective packaging solutions. Since medical devices and biologics are sensitive to environmental factors, including temperature, light, and physical damage, they need packaging that ensures product sterility alongside ruggedness for protection during shipment and through the entire supply chain.

Protective packaging such as sterile bags, sealed pouches, and custom foams ensure protection throughout the supply chain. In addition, with rising biologics, which are highly temperature sensitive, and require specialized storage, insulated packaging such as gel packs and thermal containers are also much on demand. This growing need reflects the broader shift toward specialized, high-performance packaging in the healthcare sector.

Spain's manufacturing and logistics sectors are growing progressively because of various investments in key logistics hubs, like Madrid and Barcelona. The cities are becoming center points for international shipping, thereby enhancing Spain as the major distribution hub in Europe. As cross-border trade increases especially within the EU, so is the demand for protective packaging solutions to ensure undamaged goods delivery.

Advanced solutions such as cushioning materials, insulated packaging, and secure sealing are required for protective packaging in various industries, including automotive, consumer electronics, and food exports. The growth in logistics and manufacturing results in more robust demand for protective packaging to support Spain's expanding global supply chain.

Leading companies in the protective market are expanding their geographic reach and merging with other companies. Few of them are also working together to develop new products in partnerships with start-up businesses and regional brands.

Key Development

In 2025, UFP Technologies continued its strategic expansion in the medical protective packaging sector by acquiring Welch Fluorocarbon. This acquisition enhances UFP's capabilities in producing thermoformed components and packaging solutions for medical devices, aligning with the growing demand for specialized protective packaging in the healthcare industry.

In terms of material, the industry is segmented into paper & paperboard, plastic, foam and others (wood, metal and fabric).

In terms of packaging format, the industry is segmented into boxes, bags & pouches, labels & tags, tapes, wraps & rolls, envelopes & mailers and other formats (packaging peanuts, end caps and edge protectors).

End uses for protective packaging are manufacturing & warehousing and logistics & transportation. Manufacturing & warehousing includes food, beverages, pharmaceuticals, personal care & cosmetics, homecare & toiletries, electrical & electronics, chemical & fertilizers and other industrial.

Key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa are covered.

The protective packaging industry is projected to witness CAGR of 4.7% between 2025 and 2035.

The global protective packaging industry stood at USD 29.1 billion in 2024.

Global protective packaging industry is anticipated to reach USD 47.6 billion by 2035 end.

South Asia & Pacific is set to record a CAGR of 6.1% in assessment period.

The key players operating in the protective packaging industry are Sealed Air Corporation, Sonoco Products Company, Smurfit Westrock and DS Smith plc.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.