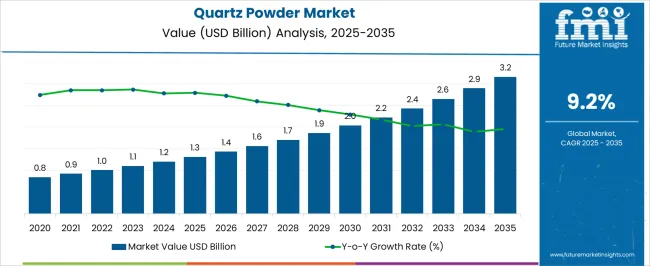

The Quartz Powder Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period. This represents a compound annual growth rate (CAGR) of 9.2% from 2025 to 2035. Factors driving this market expansion include increasing demand across various industries, particularly in construction, manufacturing, and electronics, where quartz powder plays a vital role. The demand for high-quality quartz powder, essential for enhancing material strength, durability, and functionality, is likely to support the market's upward trajectory.

As industries continue to rely on quartz powder for critical applications, its consumption is projected to increase steadily over the next decade. Key market drivers such as rising construction activities, particularly in emerging markets, alongside growing investments in manufacturing technologies, are set to fuel this upward momentum. By 2035, significant revenue generation is anticipated, as demand from sectors like ceramics, paints, coatings, and glass production is poised to rise. This suggests that companies operating in the quartz powder market may experience considerable growth if they capitalize on these evolving demand dynamics.

| Metric | Value |

|---|---|

| Quartz Powder Market Estimated Value in (2025 E) | USD 1.3 billion |

| Quartz Powder Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The quartz powder market is experiencing consistent expansion, supported by its versatile applications across construction, manufacturing, electronics, and industrial sectors. Growth is being driven by the rising demand for high-purity silica materials that offer superior mechanical strength, chemical resistance, and thermal stability. Increasing infrastructure development projects in both emerging and developed economies are boosting consumption within the construction and engineered stone industries.

Advancements in processing technology are enabling the production of more uniform particle sizes and enhanced material quality, meeting the stringent requirements of high-performance applications. The electronics sector’s growing need for silica in semiconductors, optical devices, and photovoltaic components is further supporting market growth. Additionally, industrial and manufacturing sectors are adopting quartz powder for its reinforcing properties in composites, ceramics, and coatings.

As global manufacturing output rises and end-user industries expand capacity, the demand for high-quality quartz powder is expected to remain strong. Regulatory focus on sustainable mining and material traceability is also influencing supply chain strategies, prompting manufacturers to invest in efficient production and environmentally responsible sourcing practices.

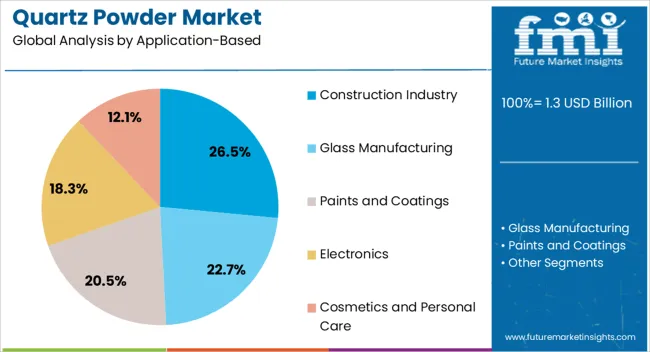

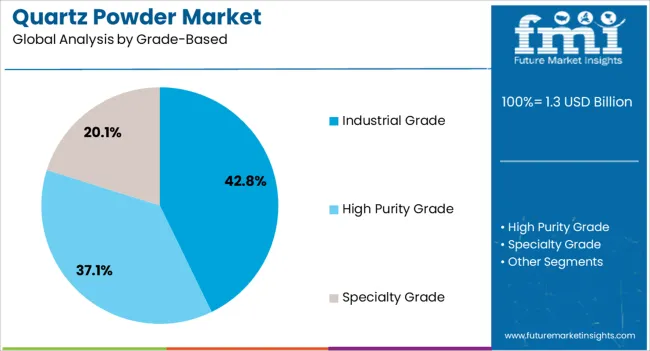

The quartz powder market is segmented by application-based, grade-based, particle size, end-user industry, sales channel, and geographic regions. By application-based, quartz powder market is divided into Construction Industry, Glass Manufacturing, Paints and Coatings, Electronics, and Cosmetics and Personal Care. In terms of grade-based, quartz powder market is classified into Industrial Grade, High Purity Grade, and Specialty Grade.

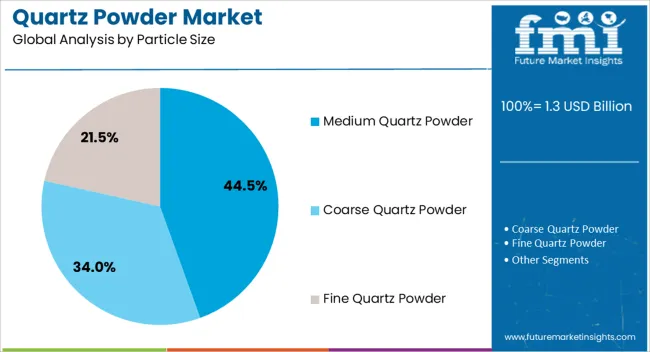

Based on particle size, quartz powder market is segmented into Medium Quartz Powder, Coarse Quartz Powder, and Fine Quartz Powder. By end-user industry, quartz powder market is segmented into Construction, Automotive, Aerospace, and Energy. By sales channel, quartz powder market is segmented into Direct Sales, Online Sales, and Retail Sales. Regionally, the quartz powder industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The construction industry segment is projected to account for 26.5% of the quartz powder market revenue share in 2025, making it a leading application category. This position is being driven by the material’s widespread use in engineered stone, cement, glass, and other construction composites where durability and aesthetic appeal are essential. Quartz powder’s hardness and resistance to wear make it ideal for flooring, countertops, and surface finishes that require long-term performance in both residential and commercial spaces.

The ongoing urbanization and rapid infrastructure development across Asia-Pacific, the Middle East, and parts of Africa are contributing to sustained demand. Additionally, the push for high-performance construction materials that can withstand environmental stress is encouraging the adoption of silica-rich products.

Advances in engineered stone manufacturing have also enhanced design flexibility, further boosting usage. The segment’s growth is reinforced by strong demand in renovation and remodeling projects, as quartz-based materials are increasingly preferred for their visual quality, ease of maintenance, and extended lifecycle compared to traditional alternatives.

The industrial grade segment is anticipated to represent 42.8% of the quartz powder market revenue share in 2025, establishing itself as the dominant grade category. This leadership is being supported by the segment’s extensive use in foundries, ceramics, paints, refractories, and chemical processing industries, where material purity and performance consistency are critical. Industrial-grade quartz powder offers excellent thermal stability, high compressive strength, and resistance to corrosive substances, making it suitable for a wide range of demanding applications.

Manufacturers in sectors such as metallurgy and glass production rely on industrial-grade silica to ensure process efficiency and end-product quality. Rising investment in heavy manufacturing and industrial infrastructure in developing economies is contributing to higher consumption volumes.

The availability of industrial-grade quartz in various particle sizes and purity levels enhances its versatility, allowing it to cater to both bulk industrial needs and specialized manufacturing requirements. This adaptability, coupled with a stable global supply chain, is expected to reinforce the segment’s dominant position in the market over the coming years.

The medium quartz powder particle size segment is expected to hold 44.5% of the quartz powder market revenue share in 2025, making it the leading particle size category. Its prominence is attributed to the balance it provides between workability, strength, and cost-effectiveness in end-use applications. Medium-sized particles are well-suited for engineered stone, construction materials, coatings, and industrial composites where optimal mechanical properties are required without compromising surface smoothness.

This particle size is widely used in applications that demand consistent packing density, uniform texture, and reliable bonding characteristics. The segment’s growth is also supported by its compatibility with modern production techniques, enabling manufacturers to achieve desired performance specifications while maintaining production efficiency.

Growing demand from the construction and engineered stone industries, combined with industrial applications such as ceramics and refractories, is reinforcing its market leadership. Additionally, the ability of medium-sized quartz powder to deliver consistent results across diverse end-user requirements ensures its continued preference among manufacturers seeking reliable and versatile material options.

The quartz powder market is currently experiencing robust demand across multiple sectors, particularly construction and electronics. As manufacturing practices evolve, there is potential for growth in specialized, high-purity quartz applications. However, challenges such as raw material price volatility and sustainability pressures are impacting the supply chain. The overall outlook remains positive, with companies focusing on improving production efficiency and exploring new sourcing strategies to maintain profitability and meet growing demand.

The demand for quartz powder has surged due to its extensive application in construction materials and the automotive industry. Quartz is a key ingredient in producing high-strength concrete, glass, and ceramic products. As construction activities ramp up globally, especially in emerging economies, the market is seeing consistent growth. Manufacturers are incorporating quartz powder into products to enhance durability and quality. Increased urbanization in developing nations is expected to drive the consumption of quartz powder, further fueling demand for building materials, which is likely to sustain growth in the upcoming years.

There is a growing opportunity for quartz powder in specialized products such as semiconductor materials, solar panels, and advanced coatings. With the rising interest in clean energy and electronics, the demand for high-purity quartz powder is set to increase. This is particularly true in the semiconductor industry, where quartz is used in the production of silicon wafers. Investment in research for more efficient extraction methods and higher-grade quartz materials could provide manufacturers with a competitive edge. This trend could significantly expand the application of quartz powder in high-tech sectors, boosting market prospects.

The market is witnessing a shift towards more sustainable sourcing practices. Many quartz powder suppliers are adapting to rising consumer awareness and are being pressured to find more environmentally conscious methods of extraction. In addition, automated production processes are reducing operational costs and improving efficiency. This shift is helping producers maintain profitability while catering to the growing demand from industries like construction, electronics, and automotive. However, challenges remain in balancing cost efficiency with sustainable practices, making it a complex dynamic for producers.

Rising raw material costs and fluctuating supply chains pose significant challenges for quartz powder manufacturers. In regions where quartz reserves are limited or extraction is costly, raw material prices have surged, squeezing profit margins for many companies. Logistics constraints and higher transportation costs are also creating barriers for international trade. This situation could lead to market fragmentation, with some regions experiencing higher prices and constrained availability. Manufacturers will need to explore alternative sources and increase efficiency in their operations to maintain stability in an unpredictable market landscape.

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

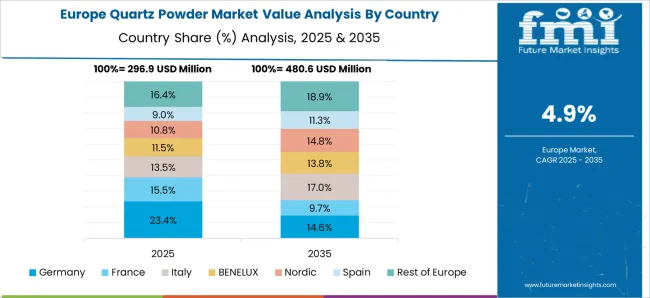

The global quartz powder market is projected to grow at a 9.2% CAGR from 2025 to 2035. China leads with a growth rate of 12.4%, followed by India at 11.5%, and Germany at 10.6%. The United Kingdom records a growth rate of 8.7%, while the United States shows the slowest growth at 7.8%. These varying growth rates are driven by the increasing demand for quartz powder in construction, electronics, and manufacturing applications. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, infrastructure development, and the rising demand for high-quality materials, while more mature markets like the USA and the UK see steady growth fueled by technological advancements, sustainable construction trends, and increased demand for electronics and advanced manufacturing solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The quartz powder market in China is projected to grow at a robust CAGR of 12.4%. As the largest producer and consumer of quartz powder, China’s rapid industrialization, urbanization, and extensive infrastructure projects are major factors fueling market growth. The demand for quartz powder in the electronics and construction industries is surging as the country continues to expand its manufacturing base. With increasing investments in advanced manufacturing technologies and a growing demand for solar panels, quartz powder remains a critical material in various applications.

The quartz powder market in India is projected to grow at a CAGR of 11.5%. India’s booming construction industry, combined with a rising demand for durable materials in the manufacturing and electronics sectors, is driving the market. Quartz powder is in high demand for various applications, such as in the production of glass, ceramics, and as a filler in paints. Furthermore, rapid urbanization, along with the government's infrastructure development initiatives, is expected to continue pushing the market forward.

The quartz powder market in Germany is expected to grow at a steady CAGR of 10.6%. The country’s strong industrial base, particularly in the automotive, construction, and electronics sectors, is driving demand for quartz powder. Germany’s commitment to precision manufacturing, coupled with an emphasis on high-performance materials, positions it as a key player in the European market. The rising demand for eco-friendly and durable construction materials further supports market growth.

The quartz powder market in the United Kingdom is projected to grow at a CAGR of 8.7%. The UK’s growing demand for quartz powder in construction and electronics is a key driver of market growth. With a well-established manufacturing sector and increasing investments in green building materials, the UK continues to be a strong market for quartz powder. As the country’s demand for sustainable construction materials grows, quartz powder’s role in the industry becomes increasingly significant.

The quartz powder market in the United States is projected to grow at a CAGR of 7.8%. The USA is witnessing strong demand for quartz powder in various industries, including construction, electronics, and manufacturing. The growth of the real estate and infrastructure sectors, particularly in the context of renovation and urban development, is a major factor driving market growth. Additionally, the electronics industry’s increasing use of quartz powder in semiconductors, photovoltaic cells, and other advanced materials is expected to further fuel demand.

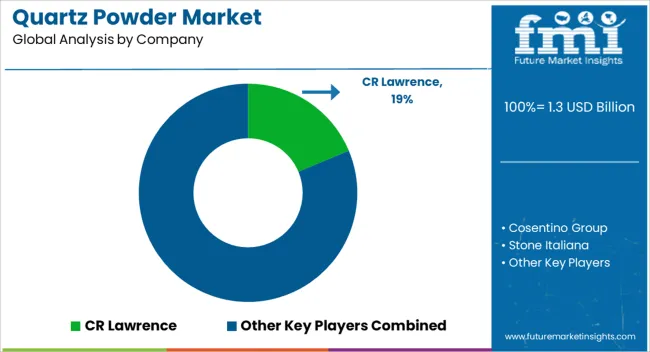

Leading suppliers in the quartz powder market, including CR Lawrence, Cosentino Group, and Stone Italiana, are strategically expanding their global reach by focusing on high-quality materials and tailored solutions for diverse applications. These companies leverage their advanced processing technologies to cater to both commercial and residential sectors, where quartz powder is used in countertops, flooring, and surface coatings. By offering products that combine durability with aesthetic appeal, these players maintain a competitive edge in an industry that increasingly demands premium finishes and customization. Their strong manufacturing capabilities and robust distribution networks ensure that they can meet the growing demand in key markets such as North America, Europe, and Asia, while continuing to innovate within the realm of design and functionality.

Other notable players like Technistone, DuPont, and LG Hausys are focusing on differentiating themselves through enhanced product offerings that highlight performance and environmental benefits. By using cutting-edge technology, these suppliers develop quartz powders with superior durability, scratch resistance, and stain resistance, essential for meeting consumer demands. Compac, Vicostone, and Caesarstone are also gaining traction in the premium segment by emphasizing natural aesthetics and advanced features like anti-bacterial properties. Regional players, including TOMRA Sorting Solutions, are further carving out their niche by improving the efficiency of quartz powder production through advanced sorting technology. Despite the competitive intensity in the market, the key to maintaining growth lies in product innovation, strong supplier partnerships, and effective distribution strategies.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Application-Based | Construction Industry, Glass Manufacturing, Paints and Coatings, Electronics, and Cosmetics and Personal Care |

| Grade-Based | Industrial Grade, High Purity Grade, and Specialty Grade |

| Particle Size | Medium Quartz Powder, Coarse Quartz Powder, and Fine Quartz Powder |

| End-User Industry | Construction, Automotive, Aerospace, and Energy |

| Sales Channel | Direct Sales, Online Sales, and Retail Sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CR Lawrence, Cosentino Group, Stone Italiana, Technistone, DuPont, LG Hausys, Compac (TOMRA Sorting Solutions), Vicostone, and Caesarstone |

| Additional Attributes | Dollar sales by grade (standard vs premium) and form (fine powder, coarse powder, lumps) are key metrics. Trends include rising demand in electronics, semiconductors, construction materials, and solar panels. Regional patterns, environmental regulations, technological advancements, and sustainability practices are significantly influencing industry growth. |

The global quartz powder market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the quartz powder market is projected to reach USD 3.2 billion by 2035.

The quartz powder market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in quartz powder market are construction industry, glass manufacturing, paints and coatings, electronics and cosmetics and personal care.

In terms of grade-based, industrial grade segment to command 42.8% share in the quartz powder market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Quartz High-Pressure Sensors Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Quartz Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Quartz Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

UK Synthetic Quartz Market Trends – Demand & Industry Outlook 2025-2035

USA Synthetic Quartz Market Report – Size, Share & Trends 2025-2035

ASEAN Synthetic Quartz Market Analysis – Size, Share & Forecast 2025-2035

Germany Synthetic Quartz Market Insights – Size, Trends & Growth 2025-2035

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Powder Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Powder Dispenser Market Analysis by Product Type, Size, Dispensing Mode, End-use Industry, and Region through 2025 to 2035

Analysis and Growth Projections for Powder Induction and Dispersion Systems Business

Leading Providers & Market Share in Powder Packing Machines

Key Players & Market Share in Powder Dispenser Manufacturing

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Powdered Fats Market – Growth, Demand & Industrial Applications

Powdered Beverage Market Outlook – Growth, Demand & Forecast 2024-2034

Powder Feed Center Market

Powder Funnels Market

Powdered Hand Soap Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA