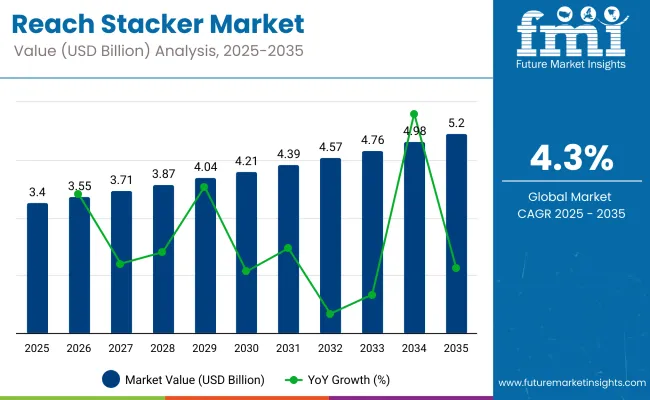

In 2025, the reach stacker market is valued at USD 3.4 billion and is projected to reach approximately USD 5.2 billion by 2035, reflecting a compound annual growth rate of 4.3%.

The absolute dollar opportunity over this period amounts to around 1.78 billion USD, representing the additional market value available for participants. The multiplying factor for this growth, calculated as the ratio of the 2035 market size to the 2025 base, is approximately 1.52.

This indicates steady market expansion over the ten-year period, supported by rising demand for efficient container handling equipment, expansion of port infrastructure, and modernization of logistics operations in both developing and developed regions.

From 2025 to 2035, the market is expected to grow consistently due to replacement demand for aging machinery and wider adoption of automated solutions in ports and intermodal transport facilities. Investments in advanced reach stackers with higher load capacity, improved safety features, and energy-efficient operations will drive adoption among end-users.

The absolute dollar opportunity highlights the tangible revenue potential for manufacturers, suppliers, and service providers. With a multiplying factor of 1.52, the market trajectory indicates steady growth, underlining the increasing role of reach stackers in enhancing operational efficiency and productivity in container handling worldwide.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.4 billion |

| Industry Value (2035F) | USD 5.2 billion |

| CAGR (2025 to 2035) | 4.3% |

The market is supported by five parent markets with varying contributions. Material handling equipment accounts for approximately 45%, supplying cranes, forklifts, and container handling solutions. Logistics and warehousing contribute around 25%, driven by port terminals, container yards, and storage operations. Ports and shipping represent about 15%, enabling efficient container stacking, loading, and unloading.

Construction and heavy machinery hold roughly 10%, supporting bulk material movement and on-site cargo handling. Industrial automation and robotics account for nearly 5%, integrating automated stacking, remote operation, and fleet management. These markets collectively enable global reach stacker adoption and operational efficiency.

Recent trends in the reach stacker market focus on electrification, automation, and strategic partnerships. Leading players such as Kalmar, Konecranes, Liebherr, and Hyster-Yale are introducing electric and hybrid reach stackers to reduce emissions and operating costs. IoT-enabled fleet management platforms and telematics systems are improving productivity, predictive maintenance, and real-time monitoring.

Remote-controlled and semi-automated reach stackers are being deployed at major ports to enhance safety and operational efficiency. Companies are forming public-private partnerships and investing in smart port infrastructure. Strategic mergers, technology collaborations, and sustainability-focused initiatives continue to shape the market and accelerate adoption of next-generation cargo handling solutions.

The market is expanding as ports and container terminals manage rising cargo volumes. Global container traffic exceeded 850 million TEUs in 2024 and is projected to surpass 1 billion TEUs by 2030, driving demand for high-capacity handling equipment. Operators are upgrading fleets to reduce turnaround times, improve stacking efficiency, and handle heavier loads safely. Automation and integration with terminal management systems are accelerating modernization. Modern reach stackers allow vertical stacking of up to 5 containers, optimizing yard space by 20-30% and cutting handling time by 15-25%.

Container throughput is rising steadily, with major ports handling over 10 million TEUs annually. Reach stackers enable vertical stacking up to 5 containers, improving yard space efficiency by 20-30% and allowing terminals to process more cargo without expanding land. Advanced hydraulic systems and electric models cut fuel use while reducing container handling time by 15-25%.

Safety enhancements like load monitoring and anti-collision sensors lower the risk of accidents. Operators in Asia and Europe are replacing older equipment to handle growing cargo volumes efficiently, while developing regions are gradually adopting modern reach stackers to optimize terminal performance.

Electric reach stackers are reducing fuel consumption by 30-40% and meeting stricter environmental requirements. Integration with terminal management software enables real-time tracking and predictive maintenance, cutting downtime by 10-15%. Smart features such as automated stacking, anti-collision systems, and remote operation enhance safety and operational efficiency.

Countries with large container throughput are adopting hybrid and electric models to improve yard productivity. Expansion of smart stackers in both developed and developing ports is creating opportunities for retrofitting older diesel units and enhancing overall cargo handling capacity, while also lowering operating costs. Terminal operators benefit from better labor efficiency and reduced operational delays.

Container throughput in emerging markets is growing at 6-8% annually, increasing demand for modern reach stackers. Southeast Asian and African ports are investing in high-capacity equipment to handle rising import and export volumes. IoT-enabled monitoring, GPS tracking, and predictive maintenance help reduce operational errors and downtime.

Adoption of electric and hybrid models lowers fuel consumption and meets emission standards. Operator training and integration with terminal systems further improve productivity and safety. These investments allow developing ports to maximize space utilization with vertical stacking and handle growing cargo efficiently while maintaining lower operational costs.

Reach stackers are high-value assets, costing USD 150,000 to USD 500,000 depending on capacity and automation. Annual maintenance, including hydraulic servicing, battery replacement, and sensor calibration, adds 10-15% of the original purchase cost. Skilled operators are required to maximize efficiency, and downtime can reduce terminal throughput by 10-20%.

These high upfront and recurring costs slow adoption in smaller ports and developing countries. Transitioning from diesel to electric or hybrid models requires additional investment in infrastructure. Proper financial planning is crucial to balance operational efficiency with capital expenditure while maintaining safe and reliable terminal operations.

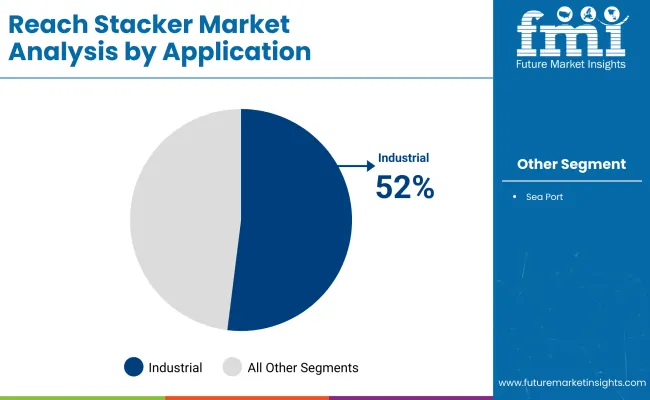

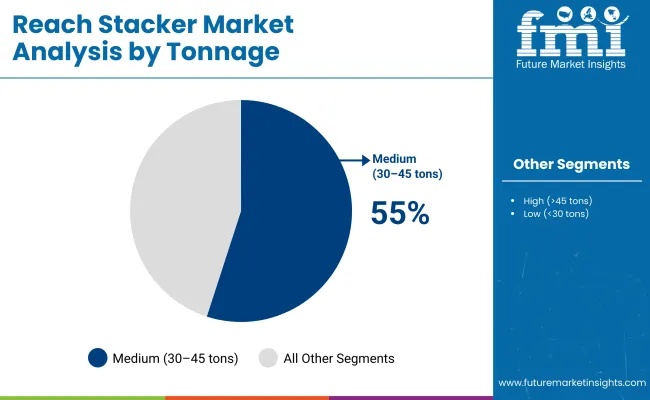

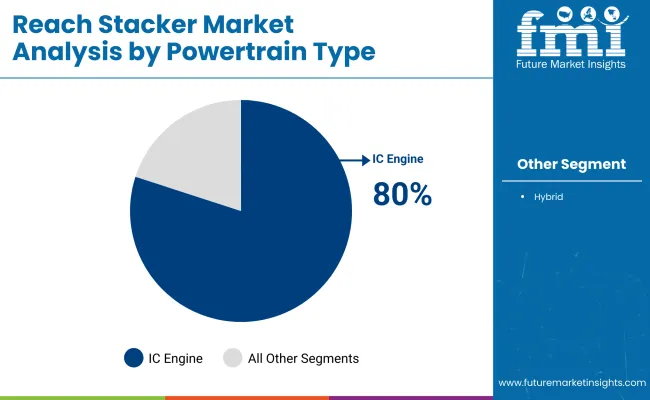

The reach stacker market is led by industrial applications, medium tonnage units, and IC engine powertrains. Industrial operations account for 52% as warehouses, manufacturing plants, and inland depots focus on faster cargo movement and reduced labor dependency. Medium tonnage units of 30-45 tons represent 55% share, preferred for standard container handling and maneuverability in yards. IC engine models dominate at 80% due to high torque, continuous operation, and global fuel availability. These segments present the most strategic opportunities for OEMs, port operators, and logistics providers globally.

Industrial applications are the top segment with 52% share, supporting factories, warehouses, and logistics depots. Reach stackers improve efficiency by reducing manual handling, increasing throughput, and optimizing storage space. Leading suppliers such as Kalmar, Konecranes, Hyster, and Liebherr provide units equipped with ergonomic cabins, high precision controls, and safety monitoring systems. Industrial hubs in Asia Pacific, North America, and Europe are actively upgrading fleets to meet higher production and cargo handling demands. Predictive maintenance and telematics integration are widely applied to monitor usage and reduce downtime, ensuring smoother operations.

Medium tonnage reach stackers from 30-45 tons’ account for 55% of the market, balancing lifting capacity with maneuverability. These units are suitable for standard container sizes and versatile yard operations, offering better fuel efficiency compared to high tonnage models. Kalmar, Konecranes, Hyster, and Liebherr supply medium tonnage units with adjustable boom systems, stability controls, and onboard monitoring for optimized operations. Ports and industrial facilities prefer these machines to reduce capital expenditure while maintaining productivity. Growth in logistics and regional container terminals supports steady demand.

IC engine powered reach stackers dominate at 80%, selected for high performance, continuous operation, and global fuel availability. Diesel engines deliver high torque for lifting heavy loads efficiently, making them suitable for ports, industrial depots, and container yards. Kalmar, Liebherr, Hyster, and Konecranes provide IC engine units with low emission technologies, advanced diagnostics, and rugged designs for long term durability. Hybrid powertrains account for 20% but remain niche in environmentally sensitive regions. IC engine units are preferred for multi shift operations and areas lacking electric charging infrastructure, ensuring reliable material handling worldwide.

Sea ports represent 48% of reach stacker deployment, handling container throughput, yard management, and cargo stacking. Reach stackers improve operational efficiency by reducing turnaround times for vessels and optimizing container retrieval. Kalmar, Liebherr, Konecranes, and Hyster supply specialized port models with telematics, automated monitoring, and high lift cycles. Expansion of container terminals in Asia, Europe, and North America drives demand for reliable, durable units. Advanced monitoring systems help schedule maintenance, track utilization, and prevent unplanned downtime, ensuring smooth port operations.

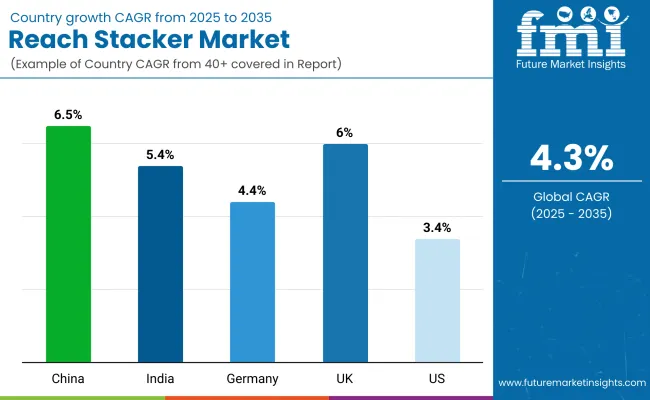

The global reach stacker market is projected to expand at a CAGR of 4.3% from 2025 to 2035. China leads with 6.5%, outperforming the global average by +51%, fueled by port expansion and industrial logistics growth across BRICS. The United Kingdom follows at 6.0%, marking a +40% premium, supported by modernization of container handling and transport infrastructure within OECD frameworks. India records 5.4%, or +26% above the global rate, reflecting ASEAN-linked industrial collaborations and rising cargo handling needs.

Germany grows at 4.4%, slightly above the global average by +2%, driven by structured port upgrades and logistics efficiency programs. The United States shows the slowest pace at 3.4%, −21% below the global benchmark, due to established infrastructure and incremental equipment replacement cycles. The BRICS economies demonstrate faster adoption, while OECD markets advance steadily at measured rates.

The demand of reach stacker in China is expanding at a CAGR of 6.5%, supported by the rapid development of ports, logistics hubs, and intermodal terminals. Increasing trade volumes and the need for efficient container handling are driving adoption. Chinese manufacturers are producing high-capacity reach stackers with advanced automation and telematics features, enhancing operational efficiency. Government initiatives to modernize port infrastructure further stimulate demand. Adoption is concentrated in major ports such as Shanghai, Shenzhen, and Ningbo, where container traffic continues to grow. Integration with digital fleet management and remote monitoring systems is becoming a standard feature, providing both operational safety and productivity improvements.

The reach stacker market in the United Kingdom is growing at a CAGR of 6%, driven by increased port activity, intermodal terminal upgrades, and investment in logistics automation. Ports like Felixstowe and Southampton are modernizing container handling operations, prompting adoption of reach stackers with enhanced load capacity and precision handling. Leasing models are becoming popular among smaller operators to optimize costs. The market also benefits from integration of energy-efficient engines and hybrid technologies to reduce fuel consumption. Operators are prioritizing fleet management solutions to track maintenance, optimize scheduling, and enhance safety during container stacking operations.

The reach stacker market in India is growing at a CAGR of 5.4%, fueled by expanding port throughput and growing industrial logistics needs. Key ports including Jawaharlal Nehru Port, Mundra, and Chennai are investing in high-capacity container handling equipment to improve operational efficiency. Domestic and international manufacturers are introducing diesel-electric and fully electric models to meet efficiency and cost requirements. Adoption is increasing in intermodal terminals and private container yards, driven by rising trade activity and government-backed infrastructure projects. Fleet management systems and remote diagnostics are increasingly being implemented to minimize downtime and maximize performance.

The reach stacker market in Germany is expanding at a CAGR of 4.4%, largely driven by modernization of logistics and intermodal terminals. Operators are focusing on high-precision handling, automation, and integration with digital management systems to improve throughput. The market benefits from Germany’s strong industrial base and advanced engineering capabilities, which enable efficient, high-capacity equipment. Adoption is concentrated in large ports like Hamburg and Bremerhaven. Energy-efficient diesel and hybrid models are increasingly replacing older units, supporting cost reduction and environmental efficiency in operations. Germany also sees steady demand from rail-linked container depots for reach stackers capable of handling high-volume traffic.

The reach stacker industry in the United States is growing at a CAGR of 3.4%, driven by port modernization and logistics optimization. Key ports such as Los Angeles, Long Beach, and New York are investing in high-capacity equipment to handle increasing container volumes. Operators are gradually adopting hybrid and electric models to improve fuel efficiency and reduce maintenance costs. The market also benefits from leasing solutions that allow smaller operators to access modern reach stackers without heavy capital expenditure. Fleet management systems are increasingly being implemented to monitor productivity, reduce downtime, and improve safety.

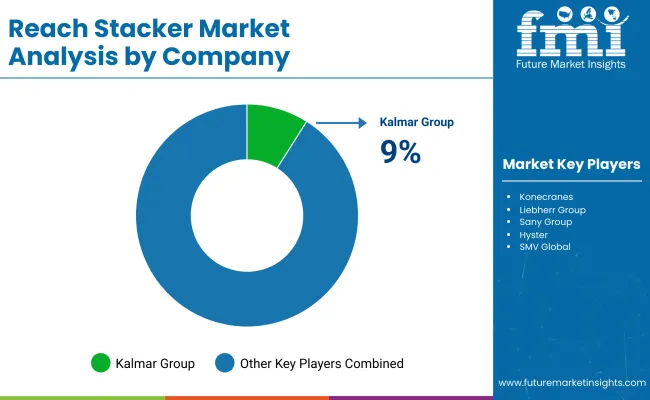

The global market is shaped by several established players and emerging participants, each employing distinct strategies to strengthen their position. CVS Ferrari S.P.A. continues to expand its product portfolio through regular launches of high-capacity reach stackers designed for efficiency in port and terminal operations. Kalmar Group emphasizes research and development to improve machine performance and operator comfort, while Konecranes leverages its global distribution network to penetrate new markets and offer after-sales support.

Liebherr Group focuses on customized solutions for varying cargo handling needs, combining durability with advanced control systems. Sany Group has recently expanded its presence with competitively priced models targeting mid-sized terminals, highlighting its strategy of blending affordability with operational capability.

Other players, including Hyster, SMV Global, and Toyota, are actively enhancing their offerings through product upgrades and partnerships. Hyster has introduced electric-powered reach stackers to meet diverse operational requirements, while SMV Global invests in optimizing machine design and maintenance services. Toyota focuses on integrating ergonomic features to improve productivity and safety. These companies are strengthening their market presence through focused product development, regional expansion, and strategic collaborations, ensuring they remain competitive in a dynamic global market for reach stackers.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 3.4 billion |

| Projected Market Size (2035) | USD 5.2 billion |

| CAGR (2025 to 2035) | 4.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Applications Analyzed (Segment 1) | Sea Ports, Industrial |

| Tonnage Categories Analyzed (Segment 2) | Low, Medium, High |

| Power Train Types Analyzed (Segment 3) | IC Engine, Hybrid |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific; Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, China, Japan, India, UAE, South Africa |

| Key Players Influencing the Market | CVS Ferrari S.P.A., Kalmar Group, Konecranes , Liebherr Group, Sany Group, Hyster , SMV Global, Toyota |

| Additional Attributes | Dollar sales by model type and lifting capacity , demand dynamics across ports, container yards, and industrial logistics, regional trends in adoption across Asia-Pacific, Europe, and North America, innovation in electric and hybrid models, telematics integration, environmental impact of fuel use and emissions, and emerging use cases in automated container handling and smart port operations. |

The market is expected to reach USD 5.2 billion by 2035, growing at a 4.3% CAGR from USD 3.4 billion in 2025.

Medium tonnage units of 30–45 tons dominate with 55% of the market due to versatility in ports and warehouses.

Electric models cut fuel use by 30-40%, improving operational efficiency and lowering costs.

IC engine powered units account for 80% of the market, preferred for heavy-duty continuous operations.

Kalmar holds about 9% of the industry share, providing medium tonnage and IC engine reach stackers with advanced safety features.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reachers Market Size and Share Forecast Outlook 2025 to 2035

Reach-In Freezers Market - Industry Demand & Market Growth 2025 to 2035

Reach-In Refrigerators Market – Commercial Cooling & Industry Outlook 2025 to 2035

Stacker Crane Market Growth – Trends & Forecast 2025 to 2035

Stacker Truck Market

Mast Reach Truck Market Forecast and Outlook 2025 to 2035

Power Stacker Market Size and Share Forecast Outlook 2025 to 2035

Walkie Stackers Market Size and Share Forecast Outlook 2025 to 2035

Sit-Down Reach Truck Market Size and Share Forecast Outlook 2025 to 2035

Electric Stacker Market Size and Share Forecast Outlook 2025 to 2035

Fork Over Stacker Market Size and Share Forecast Outlook 2025 to 2035

Blogger Outreach Software Market Size and Share Forecast Outlook 2025 to 2035

Industrial Stackers Market Forecast and Analysis by Type, End- Use Industry & Region 2025-2035

Automated Breach and Attack Simulation Market

Demand for Sit-Down Reach Truck in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA