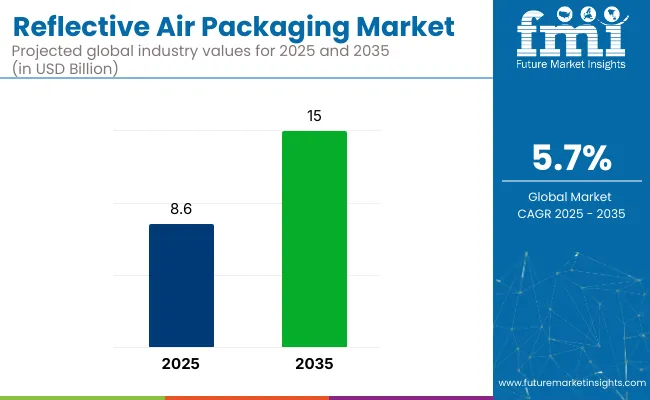

The global reflective air packaging market is projected to grow from USD 8.6 billion by 2025 to approximately USD 15.0 billion by 2035, registering a CAGR of 5.7% during the forecast period. Sales in 2024 were recorded at USD 944.1 million.

This market expansion is fueled by rising demand for temperature-sensitive and impact-resistant packaging solutions across key industries such as food & beverage, pharmaceuticals, and electronics. Reflective air packaging combines thermal insulation and cushioning properties by integrating multi-layered reflective materials and air bubble structures, ensuring product integrity throughout cold chain logistics. The format is gaining traction due to increasing global e-commerce deliveries and consumer preference for safer, tamper-evident transit packaging.

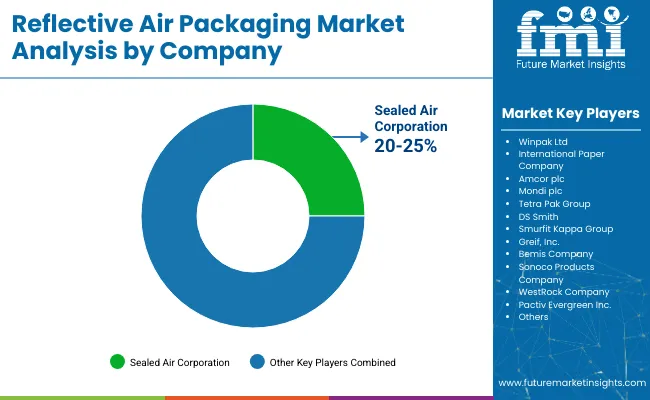

In 2023, Sealed Air Corporation introduced its strategic Reinvent SEE 2.0 initiative, aimed at improving operational efficiency and supporting sustainable innovation. Though the company did not release a dedicated figure toward reflective air packaging, its “CTO2Grow” (Cost Take-Out to Grow) program included significant investments across automation and sustainable packaging systems.

“Our actions will enable SEE to operate with greater efficiency and deliver high-quality, sustainable packaging innovations for our customers,” stated Ted Doheny, then-President and CEO of Sealed Air. These investments are expected to indirectly benefit insulated and thermal packaging solutions, including reflective formats tailored for cold chain applications.

Innovations in the reflective air packaging space are currently centered on replacing non-recyclable multilayer foils with recyclable and bio-based alternatives. Companies are actively developing lightweight reflective bubble mailers, reusable thermal liners, and multi-use air-cell wraps that offer high-performance insulation while reducing environmental impact.

Some products now incorporate integrated temperature sensors to help pharmaceutical and food logistics providers monitor real-time temperature conditions. These advancements are enabling brands to meet both logistical and regulatory requirements, while also enhancing sustainability credentials and consumer trust.

The Asia-Pacific region is anticipated to exhibit the fastest growth in the reflective air packaging market, fueled by expanding pharmaceutical and e-grocery delivery networks in China, India, Japan, and Southeast Asia. Urbanization, rising middle-class income, and an uptick in online purchases of perishable goods are driving demand for high-performance insulated packaging.

Local manufacturers are responding by investing in recyclable insulated mailers and hybrid barrier films, positioning themselves to cater to both domestic and export requirements. Additionally, governmental emphasis on reducing plastic waste is further prompting adoption of environmentally friendly reflective air packaging solutions across the region.

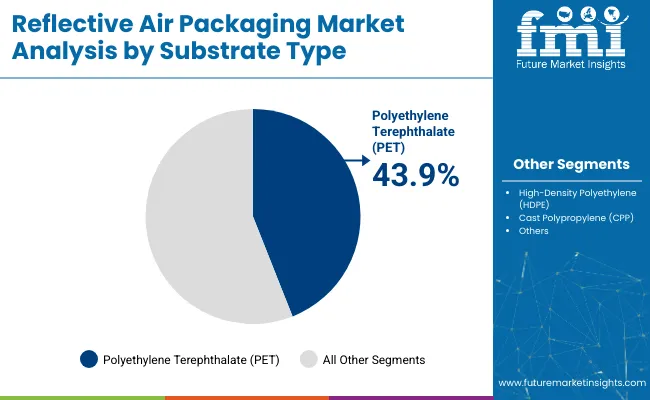

The market has been segmented based on substrate type, end use, application, and region. By substrate type, polyethylene terephthalate (PET), high-density polyethylene (HDPE), cast polypropylene (CPP), and other polymeric materials are utilized to deliver high thermal insulation, mechanical durability, and moisture resistance properties for air-based barrier packaging.

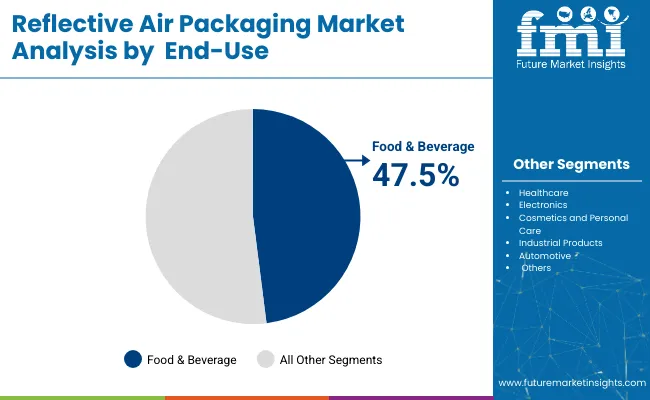

End-use segmentation includes food and beverages, healthcare, electronics, cosmetics and personal care, industrial products, automotive, and others reflecting the cross-sector demand for temperature-sensitive, damage-resistant packaging solutions. Applications are classified into flexible packaging, rigid packaging, and pouch packaging, underscoring product adaptability across consumer and industrial supply chains.

Regional segmentation spans North America, Europe, South America, Asia Pacific, and the Middle East and Africa, capturing divergent trends in e-commerce growth, cold-chain infrastructure, and sustainability regulations driving demand for reflective air insulation packaging.

The polyethylene terephthalate (PET) segment is projected to dominate the substrate type category with a 43.9% share in 2025, driven by its excellent thermal insulation, high tensile strength, and superior barrier properties. PET is widely used in reflective air packaging due to its ability to resist moisture, oxygen, and external contaminants critical for temperature-sensitive and high-value product categories.

Its reflective metallic surface efficiently maintains internal temperatures, making it ideal for cold chain logistics in food, pharmaceuticals, and biotech applications. PET-based reflective packaging is commonly employed in multilayer formats, laminated with insulating foams or bubbles to create advanced thermal envelopes and box liners.

The material’s high clarity and puncture resistance make it suitable for both flexible and semi-rigid configurations. Additionally, PET is recyclable, aligning well with sustainability commitments across retail and industrial supply chains. Its compatibility with automated packaging systems and custom die-cutting technologies has expanded its adoption in e-commerce and direct-to-consumer (D2C) shipping environments.

As industries face tightening regulations on thermal packaging emissions and plastic recycling mandates, PET continues to offer a balance of performance, cost-efficiency, and environmental compliance cementing its position as the leading substrate in reflective air packaging.

The food and beverages segment is anticipated to account for the largest share of 47.5% in the reflective air packaging market by 2025, fueled by the growing demand for thermal protection across frozen foods, fresh produce, dairy, meat, and ready-to-eat meal deliveries. With the rapid rise of online grocery platforms and direct-from-farm delivery services, temperature-sensitive packaging solutions have become critical to maintaining product freshness and safety.

Reflective air packaging enables superior insulation by reflecting radiant heat and minimizing thermal exchange, which is essential for both ambient and refrigerated supply chains. It is extensively used in combination with gel packs, EPS boxes, and corrugated outer containers to maintain the required temperature profiles during transit.

Global cold chain infrastructure investments especially in North America, Europe, and Asia Pacific-have accelerated the adoption of reflective materials in both B2B and B2C distribution. Furthermore, food safety regulations from entities like the FDA, EU EFSA, and HACCP have increased the demand for compliant, food-grade packaging materials that ensure hygiene and integrity.

High Manufacturing Costs

The Reflective Air Packaging Market faces a formidable challenge with advanced insulation materials having to be made at huge expense. The manufacture of such things as multilayer reflective films and air cushioning materials requires special processes, with overhead costs increasing and the ability of these products to be bought by small firms drastically curtailed.

Environmental Concerns and Recycling Limitations

Reflective air packaging, which lies on the use of non-biodegradable materials, lays environmental burdens. As many of these marriages are simply not in short supply-or not, anyway-this creates problems of waste management and means growing amounts of pressure from agencies that seek ways users can adopt ecologically-friendly alternatives.

Growing Demand for Sustainable Packaging

Growing demand for sustainable packaging. Both the rise of sustainability and people's demand for green packaging present good opportunities. For example, businesses producing biodegradable and/or recyclable reflective air packaging materials can tap into a brand new set of environmentally concerned consumers.

Expanding E-commerce and Cold Chain Logistics

Large increase in e-commerce business and the demand for carrying products that are sensitive to temperatures sum to provide powerful weights on reflective air packaging. Portions as disparate as fast food, pharmaceuticals, and office materials must all keep safe as the wind changes its direction as yet uncertain which way it will finally blow market growth for reflective air-packaging products is well underway.

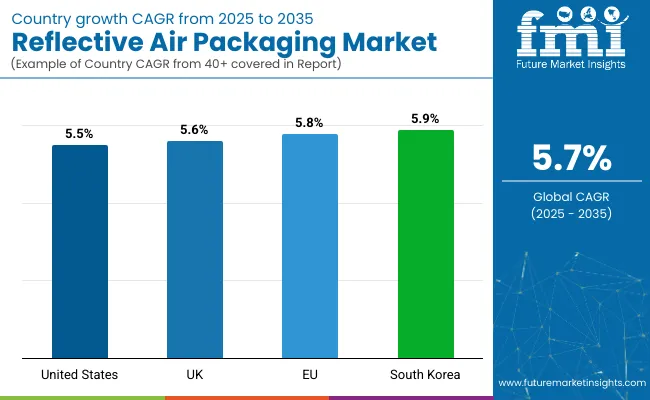

Over the industry's history in the United States, Reflective Air Packaging has always been powered by consistently robust demand for temperature-controlled packaging among pharmaceuticals, food and beverage production or e-commerce.

Even today, fresh online grocery shoppers and meal kit receivers have merely enlarged the need for insulated protective packaging. Stringent rules to protect sustainable packaging while seeking the advantages of eco-friendly materials are a driving force behind further growth

Country

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.5% |

Reflective Air Packaging is gaining momentum in the UK on account of the burgeoning cold chain logistics industry. The need for precise temperature controlled packaging in pharmaceutical and perishable food industries is what propels market growth.Sustainability projects and the drive to make packaging recyclable and biodegradable are helping launch innovative reflective air packaging technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.6% |

Reflective Air Packaging is being increasingly adopted in the European Union, particularly by the medical, food and logistics sectors. Germany, France and Italy-three leaders in sustainable packaging solutions for the EU due to strict regulations to limit plastic waste-are among those making greater investments in research and development of cutting-edge insulated packaging materials. The surge in cross-border e-commerce and pharmaceutical exports all fuel demand for high performance reflective air packaging.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.8% |

The Reflective Air Packaging market in South Korea is expanding dramatically, supported by a strong presence of electronic, pharmaceutical and food delivery branches. The rise in demands for home delivery service has led to temperature-sensitive meal kit requirements; so there is a growing need for highly insulated packaging materials.

The government policies to encourage packaging sustainability and development of innovative, high-performance, lightweight packaging materials are moulding global trends in the market for reflective air packaging. South Korea's advanced hardware skills and attention to technological advances are also encouraging the adoption of reflective air packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.9% |

The reflective air packaging market continues to grow for a variety of materials in a wide range of sizes as well as types. The breakthrough of laminated film the reflective air packaging market continues to expand. Demand is strong for temperature sensitive and protective packaging in such industries as food, pharmaceutical products or e-commerce logistics development is being driven by efficient insulation, preventing heat transfer and ensuring product integrity.

The overall market size for Reflective Air Packaging market was USD 8.6 billion in 2025.

The Reflective Air Packaging market is expected to reach USD 15.0 billion in 2035.

The Reflective Air Packaging market will grow due to increasing demand for temperature-sensitive shipping, sustainable insulation materials, expanding e-commerce logistics, and enhanced protective packaging in food, pharmaceuticals, and other industries.

The top 5 countries which drives the development of Reflective Air Packaging market are USA, European Union, Japan, South Korea and UK.

Flexible Reflective Air Packaging demand supplier to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reflective Sportswear Fabric Market Size and Share Forecast Outlook 2025 to 2035

Reflective Condenser Market Size and Share Forecast Outlook 2025 to 2035

Reflective Fiber Collimator Market Size and Share Forecast Outlook 2025 to 2035

Reflective Tape Market Trends – Growth & Forecast 2024-2034

Reflective Air Bags Market

Anti-Reflective Coatings Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down Market Share in Anti-reflective Coatings Industry

Retroreflective Material Market

Retro-Reflective Materials Market Size and Share Forecast Outlook 2025 to 2035

Solar Reflective Glass Market Size and Share Forecast Outlook 2025 to 2035

Retro-Reflective Labels Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA