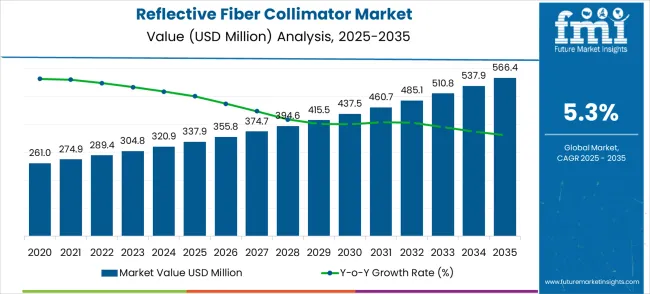

The reflective fiber collimator market is projected to grow from USD 337.9 million in 2025 to USD 566.4 million by 2035, with a compound annual growth rate (CAGR) of 5.3%. The YoY percentage changes reflect steady growth, but there are notable accelerations in specific years. For instance, the year-on-year growth between 2025 and 2026 shows an increase of 5.3%, which is consistent with the overall CAGR. However, as the market matures, there are years where growth becomes more pronounced, particularly in the 2029 to 2030 period, where a sharp 6% increase in revenue can be expected. This acceleration likely results from increased investments in industries like telecommunications, healthcare, and aerospace, where reflective fiber collimators are used for advanced optical systems. As fiber optics and communication networks evolve, the market continues to benefit from the expanding need for precision in light projection systems.

The steady YoY growth for the reflective fiber collimator market is a direct result of rising demand for high-performance optical systems, driven by industries such as telecommunications, medical diagnostics, and defense. The highest growth spike in this market is expected between 2029 and 2030, driven by technological advancements in optical fiber systems. This acceleration is likely fueled by heightened demand for reliable optical collimators used in next-gen communication infrastructure and satellite systems. Additionally, government policies and infrastructure investments in high-speed internet and satellite technologies are supporting this upward trend. As the market evolves, continued growth is expected as these sectors increasingly rely on fiber optics for their critical systems, thereby amplifying the demand for reflective fiber collimators. Thus, while the market grows steadily, these accelerations and decelerations reveal key periods of strategic expansion driven by external forces in telecommunications and defense.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 337.9 million |

| Forecast Value in (2035F) | USD 566.4 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

The reflective fiber collimator market is positioned within the optical components market, where it holds around 2.1% of the total market share. Within the fiber optic components market, it has a slightly higher share, at approximately 3.4%, due to the growing need for precision optical systems. In the optical fibers market, reflective fiber collimators contribute about 1.8%, driven by their utility in efficient light transmission and alignment in fiber optic systems.

Within the broader photonics market, the market share of reflective fiber collimators stands at 2.9%, as their role in manipulating light plays a crucial part in various photonic devices. Finally, in the telecommunications equipment market, reflective fiber collimators capture around 2.3% of the market share, owing to their importance in signal transmission and optical communication systems. This market is expected to grow as technological needs for precise light manipulation and communication increase across various industries.

The reflective fiber collimator market is set for steady expansion, driven by growing fiber optic communication networks, precision device packaging, and demand for high-performance photonics. By 2035, these pathways together unlock USD 220–260 million in incremental revenue opportunities.

Pathway A – Fiber Optic Device Packaging. High-precision fixed collimators for packaging applications in telecom and datacom create the largest near-term opportunity. Expected pool: USD 50–70 million.

Pathway B – Fiber Optic Coupled Sources. Focus-adjustable collimators for coupling light sources into fiber networks and photonic devices represent a growing segment. Pool: USD 40–55 million.

Pathway C – Telecom & Data Center Networks. Deployment in high-speed optical networks and cloud infrastructure drives recurring demand for precision collimators. Market pool: USD 35–50 million.

Pathway D – LIDAR & Sensing Applications. Use in autonomous vehicles, industrial sensors, and 3D scanning applications expands demand for custom collimators. Incremental pool: USD 25–40 million.

Pathway E – Test & Measurement Systems. Collimators in fiber-optic testing equipment, lab instrumentation, and calibration devices provide a specialized niche. Pool: USD 20–30 million.

Pathway F – Emerging Photonics Markets. Adoption in quantum communication, medical photonics, and aerospace sensing presents a medium-term growth pathway. Expected pool: USD 20–30 million.

Pathway G – OEM Partnerships & Integrated Systems. Collaborating with device manufacturers for bundled optical solutions ensures steady revenue and market penetration. Pool: USD 15–25 million.

Pathway H – Precision & Custom Solutions. High-value bespoke collimators for specialized industrial, defense, and research applications offer incremental opportunities. Pool: USD 15–20 million.

Market expansion is being supported by the increasing deployment of fiber optic communication systems worldwide and the corresponding demand for high-quality optical components that ensure optimal light transmission and beam quality. Modern optical systems require precise collimation to achieve the beam characteristics necessary for efficient light coupling, accurate measurement, and reliable system performance across diverse applications. Advanced reflective fiber collimators provide the optical performance characteristics needed to minimize beam divergence, reduce system losses, and maintain consistent beam quality in critical optical applications.

The growing emphasis on high-speed data transmission and advanced optical communication technologies is driving demand for precision collimators that can support demanding performance requirements in telecommunications infrastructure. Industrial applications requiring accurate laser processing and optical measurement are creating opportunities for specialized collimator designs that combine high optical performance with robust mechanical construction. The rising adoption of optical sensing systems and laser-based manufacturing processes is also contributing to increased demand for collimators with superior beam quality and environmental stability across different industrial and scientific applications.

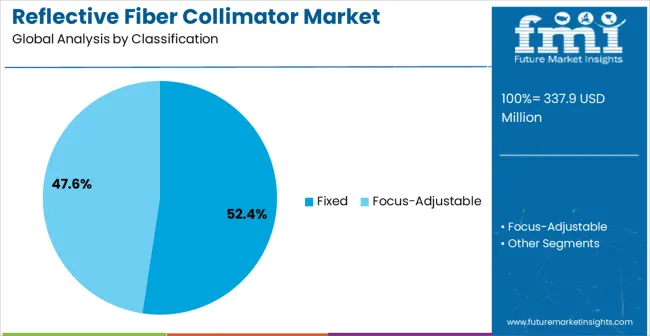

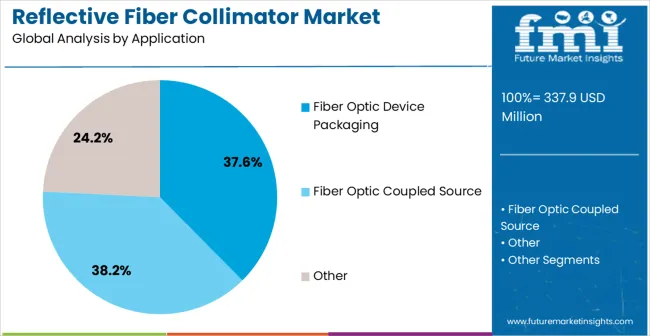

The market is segmented by type, end-use, and region. By type, the market is divided into fixed fiber collimator and focus-adjustable fiber collimator. Based on end-use, the market is categorized into fiber optic device packaging, fiber optic coupled source, and others. Regionally, the market is divided into North America, East Asia, South Asia & Pacific, Europe, Latin America, and Middle East & Africa.

The fixed fiber collimator segment is projected to account for 52.4% of the reflective fiber collimator market in 2025, reaffirming its position as the category's most widely adopted configuration type. Manufacturers increasingly understand the reliability and cost-effectiveness of fixed collimator designs in standard optical applications, including telecommunications systems, laser processing equipment, and optical measurement instruments. Fixed collimators' proven performance in maintaining consistent beam characteristics and simplified optical system integration directly addresses manufacturers' requirements for dependable optical components.

This collimator type forms the foundation of most volume production optical system positioning, as it represents the most economical and performance-proven solution for standard collimation applications. Industry validation and extensive field testing continue to strengthen adoption of fixed collimator systems. With optical system manufacturers demanding cost-effective solutions and reliable optical performance, fixed collimators align with both operational efficiency and manufacturing cost optimization goals. Their widespread compatibility across diverse optical configurations ensures sustained market dominance, making them the central technology driver of reflective fiber collimator demand.

The fiber optic coupled source application is projected to represent 38.2% of reflective fiber collimator demand in 2025, positioning it as the largest application category for precision optical components. This segment’s growth is anchored in its critical role in enabling efficient light delivery and stable optical performance across diverse fiber optic systems. Coupled source collimators ensure optimized beam alignment, reduced signal loss, and high coupling efficiency, making them indispensable in advanced optical device integration. Manufacturers prioritize this application for its technical importance, scalability, and contribution to next-generation optical communication and sensing platforms.

The segment is supported by rising deployment of high-bandwidth fiber optic networks and the increasing adoption of laser-based optical sources requiring precise collimation. Furthermore, the demand for miniaturized and energy-efficient optical devices continues to accelerate, reinforcing the value of coupled source collimators in compact system designs. As optical communication infrastructure and photonics-based applications expand globally, fiber optic coupled source applications are set to dominate collimator demand, consolidating their position as a cornerstone of modern optical component markets.

The reflective fiber collimator market is experiencing growth driven by the increasing demand for precision optical devices across telecommunications, laser systems, and imaging applications. These collimators are essential for directing light beams accurately, reducing signal loss, and enhancing optical system performance. Opportunities are expanding with advancements in fiber optic technology and increasing use in medical and industrial sectors. However, challenges persist related to manufacturing complexities, high production costs, and competition from alternative optical solutions that provide similar performance at lower costs.

The demand for reflective fiber collimators is rising, particularly within optical systems and fiber networks. In opinion, industries relying on high-speed communication, such as telecommunications and data transmission, depend on collimators to ensure precise beam alignment and signal clarity. As the global demand for faster and more reliable fiber optic systems continues to grow, reflective fiber collimators play an indispensable role in minimizing signal loss and improving overall system efficiency. With the expanding need for low-loss, high-precision light transmission, this market is set for continued growth in data communication and optical systems.

The reflective fiber collimator market is seeing expanding opportunities in sectors such as medical, defense, and industrial applications. In opinion, reflective collimators are becoming crucial for laser-based procedures in the medical field, especially for optical imaging and surgical applications. Similarly, industries like defense and manufacturing are increasingly adopting these devices for high-precision laser systems and material processing. The market is also benefiting from growing research activities in optical sciences, where these collimators provide essential light control and manipulation. As these sectors continue to evolve, the demand for specialized, high-performance reflective fiber collimators is expected to rise.

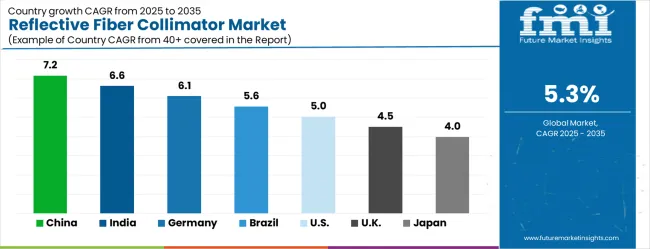

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| Brazil | 5.6% |

| United States | 5% |

| United Kingdom | 4.5% |

| Japan | 4% |

The reflective fiber collimator market is experiencing steady growth globally, with China leading at 7.2% CAGR through 2035, driven by rapid expansion of fiber optic infrastructure, increasing telecommunications investment, and growing optical component manufacturing capabilities. India follows at 6.6%, supported by expanding telecommunications networks, increasing digitization initiatives, and growing optical technology adoption. Germany shows robust growth at 6.1%, emphasizing precision optical engineering and advanced photonics technology development. Brazil records 5.6%, focusing on telecommunications infrastructure modernization and optical component market development. The United States demonstrates 5.0% growth, prioritizing optical technology innovation and advanced manufacturing capabilities. The United Kingdom shows 4.5% expansion, supported by photonics research excellence and optical component development programs. Japan maintains 4.0% growth, leveraging precision manufacturing expertise and advanced optical technology capabilities.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The reflective fiber collimator market in China is growing at a CAGR of 7.2%, supported by the country's robust telecommunications infrastructure and expanding optical technology sector. China’s growing demand for precision optical components in industries such as fiber optics, medical devices, and laser systems is driving the adoption of reflective fiber collimators. The government’s focus on developing high-tech infrastructure and increasing investments in research and development further support market growth.

The reflective fiber collimator market in India is projected to grow at a CAGR of 6.6%, fueled by rising demand for optical components in the telecommunications, electronics, and research sectors. India’s growing telecommunications industry, along with increasing investments in research and technology, are driving the demand for high-precision optical devices such as reflective fiber collimators. Additionally, the country's expanding manufacturing sector further accelerates the adoption of these optical components.

The reflective fiber collimator market in Germany is expected to grow at a CAGR of 6.1%, driven by the country’s advanced manufacturing sector and strong research capabilities in optical technologies. Germany's focus on industrial automation, telecommunications, and scientific research continues to foster the adoption of fiber optic technologies, including reflective fiber collimators. The country’s commitment to developing high-precision optical solutions for various applications further supports market expansion.

The reflective fiber collimator market in Brazil is expected to grow at a CAGR of 5.6%, supported by the increasing adoption of optical components in telecommunications, industrial, and research sectors. Brazil’s growing focus on improving its telecommunications infrastructure, along with rising demand for laser systems and precision optical components, drives the market for reflective fiber collimators. Additionally, the country’s expanding technology sector and growing investments in R&D provide further momentum to market growth.

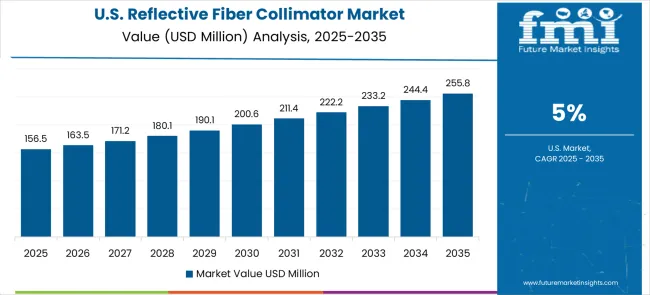

The reflective fiber collimator market in the United States is growing at a CAGR of 5%, driven by the country’s advanced research and technology sectors. The USA is experiencing increasing demand for high-precision optical components in industries such as telecommunications, defense, and scientific research. The country’s focus on technological innovation and investments in fiber optic technologies further contribute to the adoption of reflective fiber collimators in various applications.

The reflective fiber collimator market in the United Kingdom is projected to grow at a CAGR of 4.5%, supported by the country’s growing demand for optical components in research and telecommunications. The UK has been a hub for scientific research and technological development, which continues to drive the adoption of fiber optic technologies, including reflective fiber collimators. The market is further supported by ongoing innovation in telecommunications and laser technologies.

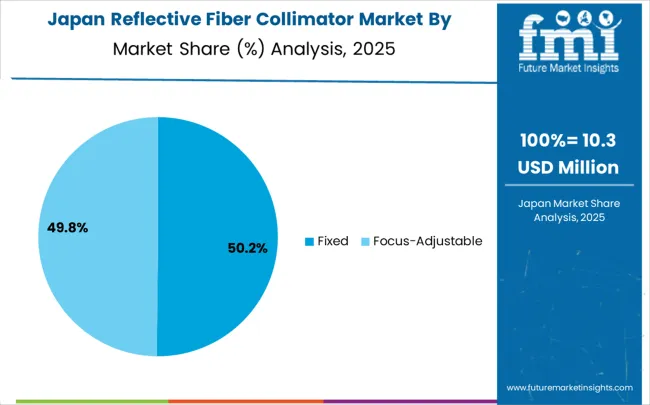

The reflective fiber collimator market in Japan is expected to grow at a CAGR of 4%, driven by the country’s focus on precision optical technologies and increasing demand for high-quality optical components. Japan’s growing telecommunications and electronics sectors, along with strong research and development initiatives in optical technologies, are accelerating the adoption of reflective fiber collimators. The market is also supported by Japan’s focus on automation and advanced manufacturing processes.

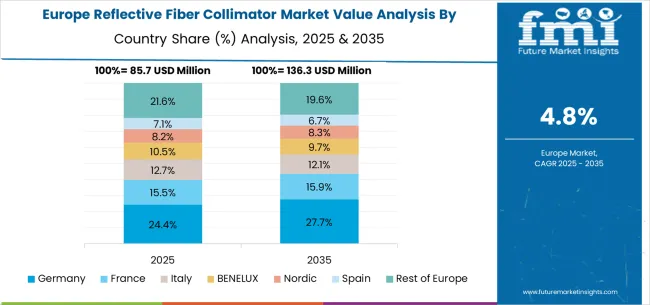

The reflective fiber collimator market in Europe is projected to grow from USD 85.7 million in 2025 to USD 136.3 million by 2035, at a CAGR of 4.8%. Germany will maintain leadership, moving from 22.4% in 2025 to 27.7% by 2035, driven by advanced optical component manufacturing, telecommunications infrastructure, and innovation in photonics. France will hold 15.5% in 2025, softening to 12.1% by 2035, reflecting a relative slowdown in adoption. Italy will see stable demand, at 12.7% in 2025 and easing to 12.1% by 2035, supported by modest but steady optical technology adoption.

The BENELUX region will account for 10.2% in 2025, slightly declining to 9.3% in 2035, while the Nordic countries will move from 8.2% to 8.3%, showing consistent demand backed by telecom expansion and high-quality standards. Spain will contribute 7.1% in 2025, dipping to 6.7% by 2035, while the Rest of Europe will shrink from 21.6% in 2025 to 19.8% by 2035, reflecting a consolidation of market activity in Germany.

The reflective fiber collimator market is characterized by competition among specialized optical component manufacturers, photonics technology companies, and precision optics providers focusing on high-performance optical solutions for telecommunications and industrial applications. Companies are investing in advanced optical design capabilities, precision manufacturing technologies, comprehensive quality control programs, and technical support services to deliver reliable, accurate, and cost-effective collimator solutions for demanding optical applications. Technology innovation, optical performance optimization, and manufacturing excellence are central to strengthening product portfolios and market positioning in this specialized optical component sector.

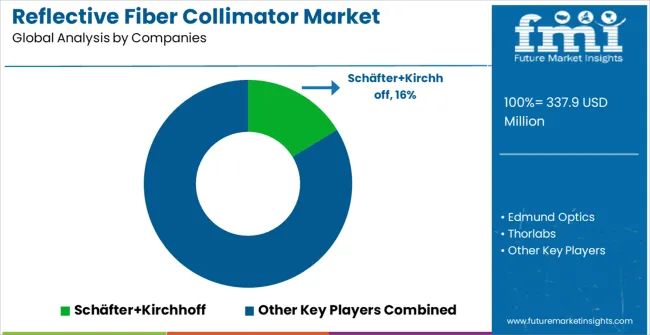

Schäfter+Kirchhoff, Germany-based, provides comprehensive optical component solutions with focus on precision fiber optic coupling, advanced collimator designs, and specialized optical systems for research and industrial applications. Edmund Optics, USA, delivers extensive optical component portfolios with emphasis on catalog availability, technical support, and rapid delivery for diverse optical applications. Thorlabs offers sophisticated optical components and systems with focus on research applications, modular system integration, and comprehensive technical documentation. IPG Photonics provides specialized fiber optic components with emphasis on high-power laser applications and advanced optical system integration.

Z Optics delivers precision optical components with focus on custom design capabilities and specialized manufacturing processes. Meet Optics, Lumiworks, and Optical Surface provide specialized collimator solutions with emphasis on performance optimization and application-specific designs. Optikos, LBTEK, and Silicon Lightwave offer comprehensive optical testing and component solutions for demanding applications. Hobbite, Changchun Sunday Optics, Huirui Optics, Castech, OPTO Wide, C.F. Technology, and Dimension Labs provide specialized optical components across diverse market segments, maintaining focus on quality assurance, performance reliability, and cost-effective manufacturing for telecommunications, industrial, and scientific applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 337.9 million |

| Type | Fixed Fiber Collimator, Focus-Adjustable Fiber Collimator, Others |

| End-Use | Fiber Optic Device Packaging, Fiber Optic Coupled Source, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Schäfter+Kirchhoff, Edmund Optics, Thorlabs, IPG Photonics, Z Optics, Meet Optics, Lumiworks, Optical Surface, Optikos, LBTEK, Silicon Lightwave, Hobbite, Changchun Sunday Optics, Huirui Optics, Castech, OPTO Wide, C.F. Technology, Dimension Labs |

| Additional Attributes | Dollar sales by collimator type and wavelength range, regional adoption trends across telecommunications and industrial markets, competitive landscape analysis with established optical component manufacturers and emerging photonics technology providers, customer preferences for fixed versus adjustable collimator configurations, integration with fiber optic systems and laser processing applications |

The global reflective fiber collimator market is estimated to be valued at USD 337.9 million in 2025.

The market size for the reflective fiber collimator market is projected to reach USD 566.4 million by 2035.

The reflective fiber collimator market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in reflective fiber collimator market are fixed and focus-adjustable.

In terms of application, fiber optic coupled source segment to command 38.2% share in the reflective fiber collimator market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA