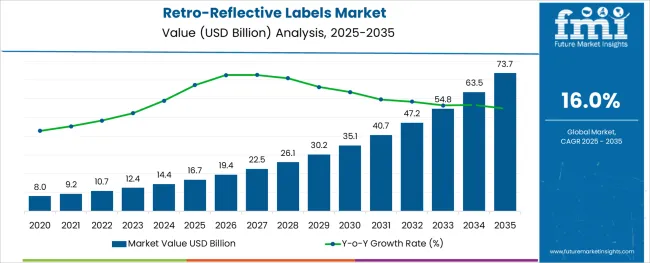

The Retro-Reflective Labels Market is estimated to be valued at USD 16.7 billion in 2025 and is projected to reach USD 73.7 billion by 2035, registering a compound annual growth rate (CAGR) of 16.0% over the forecast period.

The retro-reflective labels market is experiencing steady expansion driven by the increasing need for enhanced visibility, safety, and brand differentiation across multiple industries. Improvements in label materials and printing technologies have enabled the production of highly durable, reflective labels that perform reliably in diverse lighting and environmental conditions. Growing regulatory emphasis on product traceability, packaging safety, and anti-counterfeiting measures has further encouraged adoption.

The food and beverage sector, in particular, is driving demand for these labels to improve packaging appeal, enhance product information clarity, and meet compliance requirements. Sustainability trends have also led manufacturers to explore recyclable and eco-friendly plastic substrates while maintaining performance standards.

Technological integration, such as digital printing and variable data capabilities, is expanding customization options and shortening lead times, enabling faster go-to-market strategies. Collectively, these factors are creating fertile ground for market growth across developed and emerging regions.

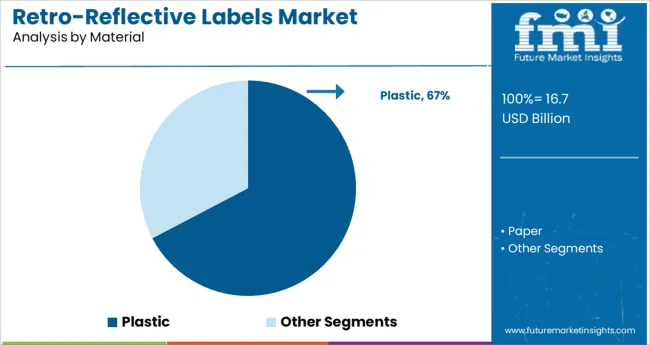

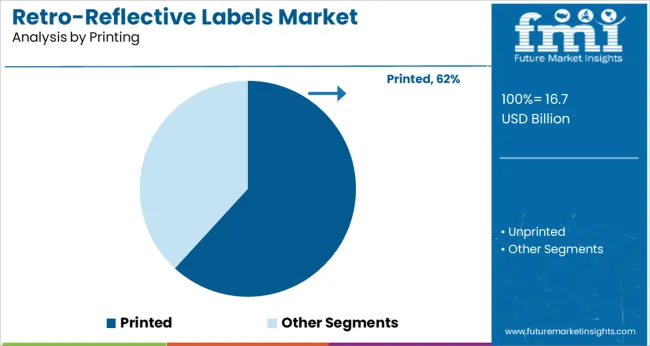

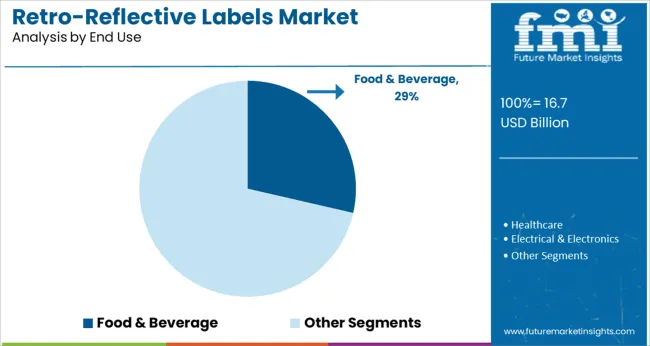

The market is segmented by Material, Printing, and End Use and region. By Material, the market is divided into Plastic and Paper. In terms of Printing, the market is classified into Printed and Unprinted. Based on End Use, the market is segmented into Food & Beverage, Healthcare, Electrical & Electronics, Shipping & Logistics, and Other Consumer Goods. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic material segment is expected to hold 67.3% of the market revenue share in 2025, establishing it as the dominant material type. This leadership is attributed to plastic’s excellent durability, moisture resistance, and flexibility, which make it ideal for retro-reflective labels used in demanding environments.

Its ability to withstand harsh conditions while preserving reflective qualities ensures reliable performance for extended periods. Moreover, plastic substrates offer compatibility with a variety of adhesives and printing techniques, facilitating customization and scalability for different applications.

The relatively low cost and recyclability advancements have further encouraged adoption by manufacturers seeking sustainable yet effective labeling solutions. As a result, plastic materials continue to form the backbone of retro-reflective label production and sales.

The printed segment is projected to represent 61.8% of the retro-reflective labels market revenue in 2025, positioning it as the leading printing technology. The dominance is explained by the capacity to combine retro-reflective properties with high-resolution graphics, branding, and compliance information.

Advances in printing processes, including digital and flexographic techniques, have enabled precise color reproduction and variable data integration on reflective substrates. This facilitates enhanced product differentiation, traceability, and regulatory compliance.

The ability to produce customized, high-quality printed labels at scale has driven their adoption across multiple end-use industries, including food and beverage, automotive, and logistics. Continued innovation in printing inks and curing technologies supports durability and colorfastness, reinforcing printed labels’ market share.

The food and beverage segment is forecasted to capture 28.6% of the retro-reflective labels market revenue in 2025, making it the leading end-use industry. This growth is driven by the sector’s increasing focus on packaging that enhances product visibility, brand storytelling, and safety information under various retail and transportation conditions.

Retro-reflective labels enable improved shelf appeal through eye-catching effects, while also supporting mandatory labeling for nutritional and regulatory compliance. The demand for sustainable and recyclable labeling solutions aligns with the industry’s push toward eco-conscious packaging.

Additionally, the growth of e-commerce and direct-to-consumer sales in food and beverage has accelerated the need for durable, tamper-evident, and traceable labels to ensure product integrity during shipping and handling. These factors collectively sustain the food and beverage sector’s prominent role in the market.

The worldwide retroreflective labels market is segmented by producers that specialize in retail and industrial applications. Sales of retroreflective labels are subject to improvement due to technological compositions and sophisticated design principles that are included in the material selection and production process.

Retroreflective labels simplify identification, and reflective barcodes, with their long-range legibility, are ideal for expediting identification in industrial applications. For example, warehouses can utilize long-range labels to identify fourth-tier bins. By reading a retroreflective label on a bin from a distance of more than 30 feet, a forklift operator may instantly retrieve critical information about that bin — what it contains, where it has to be transported, and where it originated from.

Sales of retroreflective labels are also blooming as they provide several advantages, including economic effectiveness, reduced labour needs, and simplicity of inventory management. The worldwide sales of retroreflective labels rapid expansion are projected to fuel demand for retroreflective labels.

The ease and comfort of transporting bulk packaging solutions safely have fueled the rise in worldwide sales of retroreflective labels. Manufacturers of retroreflective labels are seeing significant business prospects growing demand for retroreflective labels from manufacturers and shipping & logistics end-users.

Barcodes have been in use for decades and have developed into a critical component of business in terms of utility. Only during the last decade have barcodes seen a boom in popularity. Improving sales of retroreflective labels is due to the technological surge in connection, where the majority of customers obtain information via electronic devices.

Due to their longevity, thermal transfer labels are increasingly being utilised to print barcodes. Additionally, brand owners and package manufacturers worldwide are looking for novel ways to meet the demand for retroreflective labels through technical developments in retroreflective labels production. These factors are projected to fuel the sales of retroreflective labels even more throughout the forecast period.

The greatest market for sales of retro-reflective labels is APAC. The area's rapid expansion in industries such as automotive and transportation, as well as building and infrastructure, has helped the region establish a leadership position in the global retro-reflective labels market.

According to significant producers such as 3M (USA), ORAFOL (Germany), and Avery Dennison, the area is also a prospective in the retro-reflective labels market (US). The area has a significant demand for retro-reflective labels used in a variety of applications, including safety gear, road markings, signboards, and conspicuity markings.

Avery Dennison Corporation, UPM Raflatac, PPG Industries, Inc., Brady Worldwide, Inc., 3M Company, Lintec Corporation, etc. are some of the leading participants in the retro-reflective labels market.

Recent Developments of the Retro-Reflective Labels Market:

ORAFOL purchased a graphic distributor with a substantial presence in Melbourne, Perth, and Adelaide in August 2020. (Australia). With such a broad presence, the acquired graphic distributor became the only provider of ORAFOL goods in Australia's retro-reflective and

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 16% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Product type, material type, application, end users, region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Avery Dennison Corporation; UPM Raflatac; PPG Industries, Inc.; Brady Worldwide, Inc.; 3M Company; Lintec Corporation, etc. |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. |

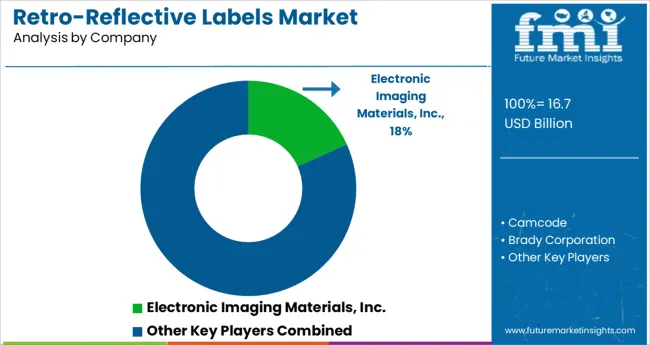

The global retro-reflective labels market is estimated to be valued at USD 16.7 billion in 2025.

It is projected to reach USD 73.7 billion by 2035.

The market is expected to grow at a 16.0% CAGR between 2025 and 2035.

The key product types are plastic and paper.

printed segment is expected to dominate with a 61.8% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Labels Market Forecast and Outlook 2025 to 2035

Labels, Tapes And Films Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Labels Companies

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among USA Labels Providers

Foam Labels Market Trends and Growth 2035

Market Share Breakdown of Foil Labels Manufacturers

Foil Labels Market Analysis by Metal Foils & Polymer-Based Foils Through 2035

Kraft Labels Market Size and Share Forecast Outlook 2025 to 2035

HAZMAT Labels Market Growth and Forecast 2025 to 2035

In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Printed Labels Market Size and Share Forecast Outlook 2025 to 2035

Sheeted Labels Market Size and Share Forecast Outlook 2025 to 2035

QR Code Labels Market Size and Share Forecast Outlook 2025 to 2035

Braille Labels Market Size and Share Forecast Outlook 2025 to 2035

Syringe Labels Market Size and Share Forecast Outlook 2025 to 2035

Thermal Labels Market Analysis - Size, Growth & Outlook 2025 to 2035

Competitive Landscape of In-Mold Labels Providers

Competitive Breakdown of Braille Labels Manufacturers

Canning Labels Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA