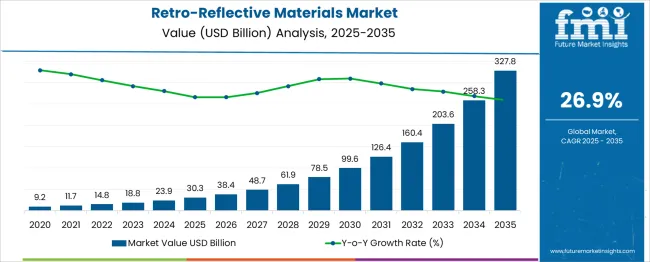

The global retro-reflective materials market is likely to reach from USD 30.3 billion in 2025 to approximately USD 327.8 billion by 2035, recording an absolute increase of USD 297.54 billion over the forecast period. This translates into a total growth of 982.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 26.9% between 2025 and 2035. The overall market size is expected to grow by nearly 10.83X during the same period, supported by increasing infrastructure development, rising safety regulations, growing automotive production, and expanding applications in smart transportation systems.

Between 2025 and 2030, the retro-reflective materials market is projected to expand from USD 30.3 billion to USD 126.4 billion, resulting in a value increase of USD 96.1 billion, which represents 32.3% of the total forecast growth for the decade. This phase of growth will be shaped by rising infrastructure investments, increasing vehicle production, growing focus on road safety measures, and expanding adoption of smart city initiatives. Transportation authorities and construction companies are integrating advanced retro-reflective materials to enhance visibility and safety standards across various applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 30.3 billion |

| Forecast Value in (2035F) | USD 327.8 billion |

| Forecast CAGR (2025 to 2035) | 26.9% |

From 2030 to 2035, the market is forecast to grow from USD 126.4 billion to USD 327.8 billion, adding another USD 201.4 billion, which constitutes 67.7% of the overall ten-year expansion. This period is expected to be characterized by widespread adoption of autonomous vehicles, integration of IoT-enabled reflective materials, and development of next-generation visibility solutions. The growing implementation of smart infrastructure and advanced traffic management systems will drive demand for high-performance retro-reflective materials with enhanced durability and optical properties.

Between 2020 and 2025, the retro-reflective materials market experienced robust expansion, driven by increasing focus on road safety, growing construction activities, and rising awareness about visibility enhancement in various applications. The market developed as governments worldwide began implementing stricter safety regulations and infrastructure standards. The COVID-19 pandemic initially disrupted supply chains but subsequently accelerated demand for safety materials as construction and transportation activities resumed with enhanced safety protocols.

Modern transportation infrastructure requires advanced visibility solutions to reduce accidents and enhance safety for both vehicles and pedestrians. The proven effectiveness of retro-reflective materials in improving visibility during low-light conditions makes them essential components in road signage, vehicle markings, and safety apparel applications.

The growing global infrastructure development, particularly in emerging economies, is creating substantial demand for retro-reflective materials in highway construction, urban development projects, and transportation networks. Government initiatives promoting smart cities and green transportation systems are driving the adoption of advanced reflective technologies. The rising production of commercial vehicles and increasing focus on fleet safety standards are also contributing to market growth across different geographic regions and application segments.

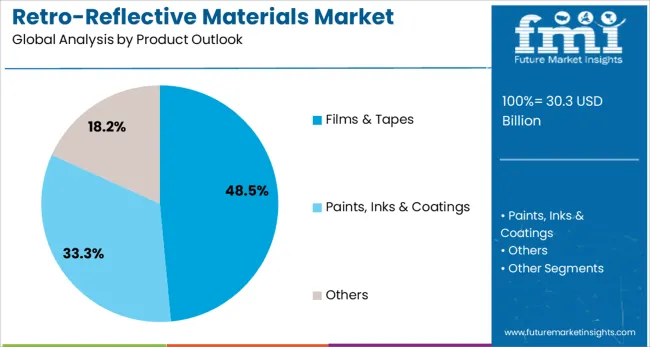

The market is segmented by application, product type, and region. By application, the market is divided into traffic control & work zone, safety apparel, automotive, industrial, and others. Based on product type, the market is categorized into films & tapes, paints & inks & coatings, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The traffic control & work zone application is projected to account for 31.3% of the retro-reflective materials market in 2025, reaffirming its position as the category's primary application. Growing urbanization and expanding transportation networks worldwide require comprehensive traffic management solutions that ensure optimal visibility and safety. Retro-reflective materials play a crucial role in road signs, lane markings, barriers, and construction zone equipment, providing essential visibility enhancement during both day and night conditions.

This application segment benefits from increasing government investments in infrastructure development and modernization projects. Regulatory requirements for traffic safety standards continue to drive the adoption of high-quality reflective materials in highway construction and maintenance activities. The growing complexity of urban traffic systems and increasing focus on pedestrian safety measures ensure demand for innovative traffic control solutions incorporating advanced retro-reflective technologies.

Films & tapes are projected to represent 48.5% of retro-reflective materials demand in 2025, underscoring their versatility and widespread applicability across multiple end-use sectors. These products offer ease of application, cost-effectiveness, and excellent optical performance, making them preferred choices for various marking and identification applications. The segment benefits from continuous technological improvements in adhesive formulations and reflective coatings that enhance durability and weather resistance.

The films & tapes segment serves diverse applications, including vehicle conspicuity marking, safety signage, personal protective equipment, and architectural applications. Manufacturers are developing specialized products with enhanced properties, including improved conformability, longer service life, and superior retroreflective efficiency. The growing trend toward customization and application-specific solutions continues to drive innovation and market expansion within this dominant product category.

The retro-reflective materials market is advancing rapidly due to increasing infrastructure development, growing safety consciousness, and expanding automotive production. The market faces challenges including raw material price volatility, technology standardization issues, and competition from alternative visibility enhancement solutions. Innovation in smart materials and green production practices continue to influence product development and market expansion patterns.

Worldwide infrastructure development projects are creating substantial demand for retro-reflective materials in transportation networks, urban development, and public safety applications. Smart city initiatives focuses on integrated technology solutions that improve safety and efficiency, driving adoption of advanced reflective materials. Government investments in highway modernization, airport expansion, and public transportation systems provide growth opportunities for manufacturers and suppliers.

The emergence of Internet of Things (IoT) applications is enabling the development of intelligent retro-reflective materials with embedded sensors and communication capabilities. Smart reflective materials can provide real-time performance monitoring, environmental data collection, and integration with traffic management systems. These technological advances create opportunities for value-added products and services while supporting the development of more responsive and efficient transportation infrastructure systems.

Environmental consciousness is driving the development of eco-friendly retro-reflective materials with reduced environmental impact. Manufacturers are investing in recyclable materials, green production processes, and life-cycle optimization to meet growing environmental standards. The trend toward circular economy principles and green building certifications continues to influence product development priorities and market positioning strategies across the industry.

| Countries | CAGR (2025-2035) |

|---|---|

| China | 36.3% |

| India | 33.6% |

| Germany | 30.9% |

| France | 28.2% |

| UK | 25.6% |

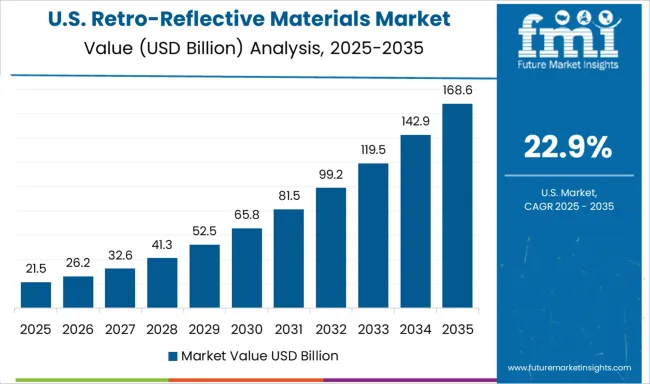

| USA | 22.9% |

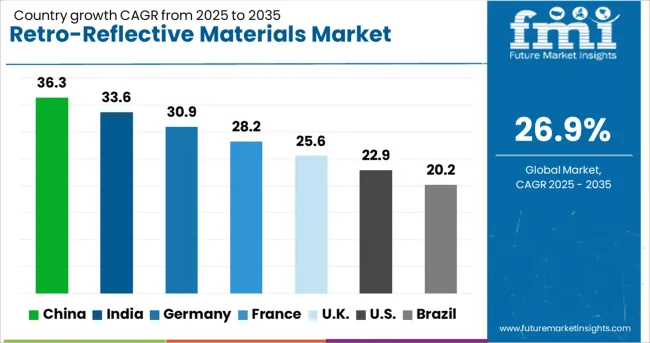

The retro-reflective materials market is experiencing exceptional growth globally, with China leading at a 36.3% CAGR through 2035, driven by unprecedented infrastructure development, urbanization, and manufacturing expansion. India follows at 33.6%, supported by government infrastructure initiatives, growing automotive sector, and increasing industrial development. Germany shows strong growth at 30.9%, focus on advanced manufacturing technologies and automotive applications. France records 28.2%, focusing on transportation infrastructure and industrial applications. The UK demonstrates 25.6% growth, prioritizing smart city development and transportation modernization.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from retro-reflective materials in China is projected to exhibit exceptional growth with a CAGR of 36.3% through 2035, driven by the country's massive infrastructure development programs and urbanization initiatives. The Belt and Road Initiative, domestic highway expansion, and smart city development create unprecedented demand for high-performance reflective materials. Major international and domestic manufacturers are establishing comprehensive production and distribution networks to serve the rapidly expanding market across tier-1, tier-2, and emerging tier-3 cities.

Revenue from retro-reflective materials in India is expanding at a CAGR of 33.6%, supported by government infrastructure initiatives, growing automotive production, and increasing safety consciousness. The country's Bharatmala highway development program, Smart Cities Mission, and industrial corridor development are driving demand for advanced reflective materials. Both international suppliers and domestic manufacturers are expanding capabilities to serve the growing demand for quality materials in transportation and industrial applications.

Demand for retro-reflective materials in Germany is projected to grow at a CAGR of 30.9%, supported by the country's leadership in automotive technology, advanced manufacturing, and infrastructure modernization. German manufacturers are pioneering next-generation microprismatic technologies and smart reflective solutions for autonomous vehicle applications. The market is characterized by strong demand for high-performance materials that meet stringent quality and environmental standards.

Revenue from retro-reflective materials in France is projected to grow at a CAGR of 28.2% through 2035, supported by ongoing transportation infrastructure modernization and urban development projects. French infrastructure authorities prioritize advanced visibility solutions for highway safety and urban traffic management. The market benefits from strong domestic manufacturing capabilities and European Union regulatory harmonization supporting quality standards.

Revenue from retro-reflective materials in the UK is projected to grow at a CAGR of 25.6% through 2035, supported by smart city initiatives, transportation modernization, and industrial development. British authorities focusing integrated technology solutions that combine traditional reflective materials with smart capabilities for enhanced safety and efficiency. The market is characterized by strong demand for innovative materials that support autonomous vehicle readiness and intelligent transportation systems.

Revenue from retro-reflective materials in the USA is projected to grow at a CAGR of 22.9%, supported by infrastructure modernization, automotive innovation, and industrial expansion. American manufacturers lead development of advanced microprismatic technologies and specialized applications for aerospace, defense, and high-performance industrial sectors. The market benefits from strong domestic demand and export opportunities for high-value specialty products.

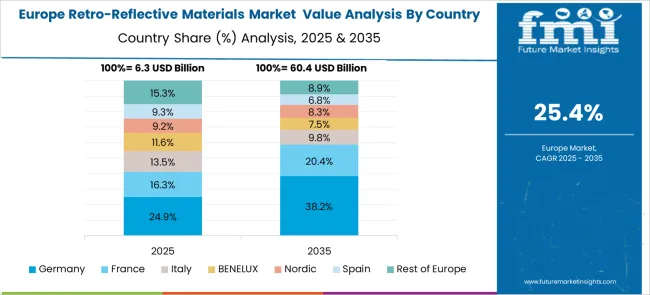

The European retro-reflective materials market demonstrates sophisticated development across major economies with Germany leading through its precision materials engineering excellence and advanced automotive technology capabilities, supported by companies focusing high-performance microprismatic materials, smart reflective solutions, and comprehensive transportation safety systems while maintaining strict quality standards and environmental compliance protocols. The UK shows strength in smart city development and transportation modernization initiatives, with organizations specializing in intelligent reflective materials and IoT-enabled visibility solutions that meet rigorous safety regulations.

France contributes through its transportation infrastructure development and urban renewal programs, delivering advanced retro-reflective solutions that combine traditional materials expertise with modern smart transportation technologies. Sweden and Nordic countries focuses on eco-friendly materials development and environmental responsibility in reflective material applications. Italy and Spain demonstrate growth in specialized infrastructure applications and automotive industry integration. The market benefits from stringent EU safety regulations, established materials manufacturing infrastructure, and growing demand for advanced reflective materials that provide superior visibility and smart functionality.

The Japanese retro-reflective materials market demonstrates steady growth driven by precision manufacturing focus, advanced optical technology development, and transportation industry preference for high-quality visibility solutions that ensure superior performance and safety compliance throughout infrastructure applications. Japanese organizations prioritize sophisticated optical engineering and comprehensive quality assurance systems, creating demand for retro-reflective materials featuring advanced microprismatic technology, precision manufacturing processes, and integrated smart capabilities that align with Japanese manufacturing excellence standards.

The market focuses on technological innovation in optical performance enhancement, material durability improvement, and smart technology integration that reflects Japanese attention to detail in materials science and transportation safety systems. Growing investment in autonomous vehicle development and intelligent transportation infrastructure supports adoption of next-generation reflective materials with IoT connectivity, sensor integration, and advanced optical properties for enhanced visibility applications. Japanese manufacturers focus on material precision, consistent optical performance, and long-term reliability for critical transportation and industrial safety applications.

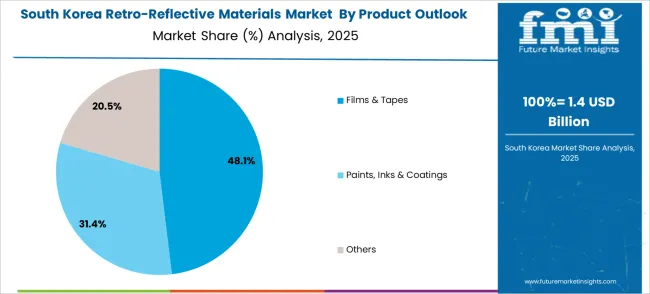

The South Korean retro-reflective materials market shows exceptional growth potential driven by expanding smart city infrastructure, increasing adoption of intelligent transportation systems, and growing demand for advanced visibility materials requiring comprehensive performance and connectivity capabilities. The market benefits from South Korea's technological leadership in electronics and telecommunications and increasing focus on smart infrastructure development that drives investment in innovative reflective materials meeting international safety standards.

Korean transportation authorities and construction organizations increasingly adopt smart reflective materials, IoT-enabled visibility solutions, and integrated transportation management systems to improve infrastructure safety and operational efficiency while ensuring regulatory compliance requirements. Growing influence of Korean technology companies and infrastructure innovation initiatives supports demand for sophisticated retro-reflective platforms that ensure comprehensive functionality while maintaining cost-effectiveness. The integration of 5G connectivity and smart infrastructure systems creates opportunities for intelligent reflective materials with real-time monitoring and adaptive performance capabilities.

The retro-reflective materials market is characterized by competition among established materials manufacturers, specialty chemical companies, and emerging technology players. Companies are investing in advanced manufacturing technologies, product innovation, strategic partnerships, and geographic expansion to deliver effective, reliable, and cost-competitive reflective material solutions. Technology development, quality assurance, and customer service capabilities are central to strengthening market position and competitive advantage.

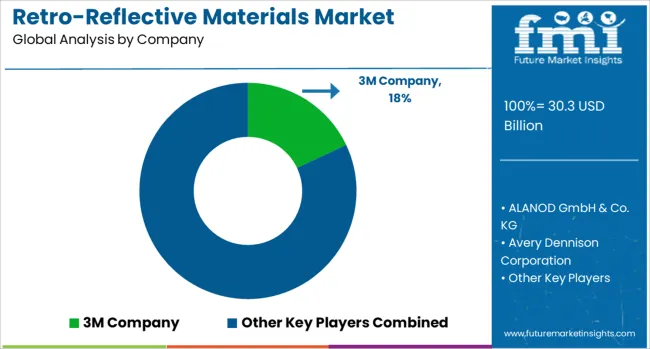

3M Company, USA-based, leads the market with 18.0% global value share, offering comprehensive retro-reflective material portfolios with focus on optical performance and application versatility. ALANOD GmbH & Co. KG, Germany, provides specialized reflective solutions with focuses on precision manufacturing and custom applications. Avery Dennison Corporation, USA, delivers innovative adhesive-backed reflective materials with focus on ease of application and durability. Changzhou Hua R Sheng Reflective Material Co. Ltd, China, focuses on cost-effective solutions serving Asian markets with competitive pricing and local manufacturing.

Coats Group Plc, UK, operates globally providing textile-based reflective materials with focuses on safety apparel and industrial applications. Daoming Reflective Material India Pvt. Ltd. specializes in regional market development with focus on infrastructure applications. NIPPON CARBIDE INDUSTRIES CO. INC., Japan, focuses advanced glass bead technologies and precision manufacturing. ORAFOL Europe GmbH, Germany, provides comprehensive product ranges for transportation and industrial applications. Reflomax focuses on specialized applications and custom solutions for specific market segments.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 30.3 billion |

| Application | Traffic control & work zone, Safety apparel, Automotive, Industrial, Others |

| Product Type | Films & tapes, Paints & inks & coatings, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | 3M Company, ALANOD GmbH & Co. KG, Avery Dennison Corporation, Changzhou Hua R Sheng Reflective Material Co. Ltd, Coats Group Plc, Daoming Reflective Material India Pvt. Ltd., NIPPON CARBIDE INDUSTRIES CO. INC., ORAFOL Europe GmbH, and Reflomax |

| Additional Attributes | Dollar sales by technology type and application segment, regional demand trends, competitive landscape, buyer preferences for glass bead versus microprismatic technologies, integration with smart city infrastructure, innovations in IoT-enabled materials, green production practices, and regulatory compliance requirements |

The global retro-reflective materials market is estimated to be valued at USD 30.3 billion in 2025.

The market size for the retro-reflective materials market is projected to reach USD 327.8 billion by 2035.

The retro-reflective materials market is expected to grow at a 26.9% CAGR between 2025 and 2035.

The key product types in retro-reflective materials market are traffic control & work zone, safety apparel, automotive, industrial and others.

In terms of product outlook, films & tapes segment to command 48.5% share in the retro-reflective materials market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA