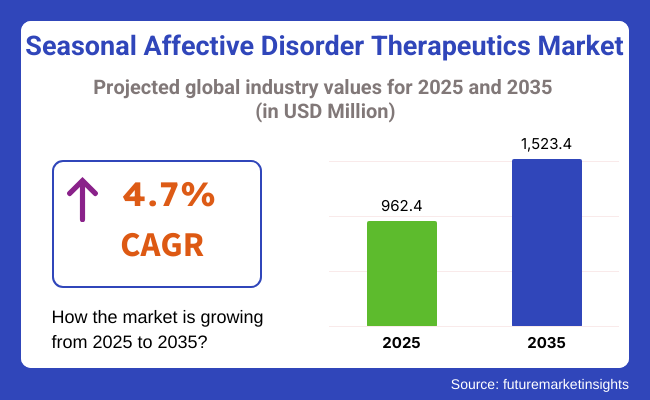

The global Seasonal Affective Disorder (SAD) Therapeutics Market is projected to be valued at USD 962.4 million in 2025, reaching USD 1,523.4 million by 2035, with a compound annual growth rate (CAGR) of 4.7% during the forecast period. The market is driven by rising prevalence of SAD especially in fall/winter seasons-in tandem with growing mental health awareness and supportive public health policies.

Light therapy, standard pharmacotherapies (SSRIs, NDRIs, MAOIs), and emerging digital interventions are delivering personalized care options that address individual circadian disruptions. Technological advancements, including wearable light devices, AI-powered mood tracking apps, and telepsychiatry platforms, are enhancing compliance and broadening access in primary care and remote settings. The integration of these modalities into value-based mental health frameworks is expected to sustain growth over the forecast period.

Major SAD therapeutics providers include Pfizer, Eli Lilly, GlaxoSmithKline, AbbVie, Novartis, and Teva Pharmaceuticals. These manufacturers are driving the market through strategic investments in the development of next-generation antidepressants. In 2024, Granules India gets USFDA nod for generic medication Bupropion Hydrochloride extended-release tablets to treat depression and Seasonal Affective Disorder.

"This ANDA approval marks a significant milestone in our journey to expand the company’s presence in the USA market.” commented by Krishna Prasad Chigurupati Chairman, Granules India. Simultaneously, medical device firms are expanding light therapy and dawn simulation devices into primary care and telehealth channels. These multi-modality strategies along with strategic partnerships across clinical and digital care networks are supporting broader adoption and reinforcing market growth.

North America dominates the SAD market in 2025, driven by high disease awareness and robust telepsychiatry infrastructure. Medicare and commercial insurance have expanded coverage for antidepressants and light therapy, particularly in mood winter depression cases. The USA FDA’s classification of wearable LED devices has accelerated market entry.

Integration within primary care and mental health startup ecosystems has further reduced stigma and improved patient access. Europe is expected to exhibit stable growth, supported by public health campaigns in Nordic countries where SAD prevalence is highest. Regulatory frameworks across the Europe have enabled faster deployment of digital therapeutics. Cross-border mental health networks and EU-funded telehealth initiatives have expanded access in remote communities

The below table presents the expected CAGR for the global seasonal affective disorder therapeutics market over several semi-annual periods spanning from 2024 to 2034. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 5.5%, followed by a slightly lower growth rate of 4.9% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 5.5% (2024 to 2034) |

| H2 | 4.9% (2024 to 2034) |

| H1 | 4.3% (2025 to 2035) |

| H2 | 4.0% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.3% in the first half and remain relatively moderate at 4.0% in the second half. In the first half (H1) the market witnessed a decrease of 120 BPS while in the second half (H2), the market witnessed a decrease of 90 BPS.

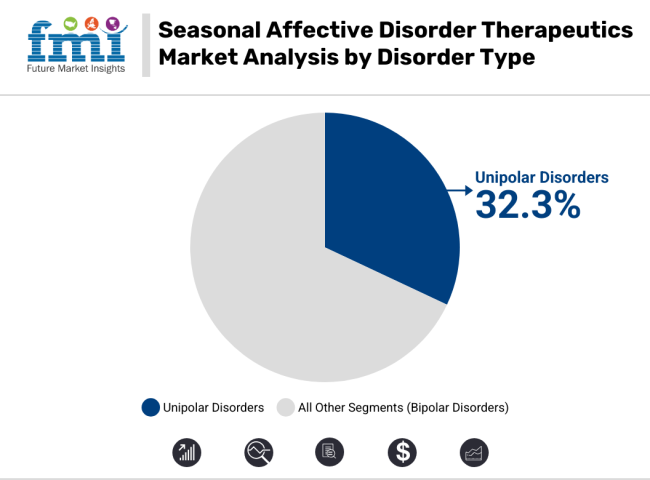

In 2025, unipolar disorder dominates the SAD therapeutics market, accounting for 85.1% of total revenue. This dominance has been attributed to the high global burden of major depressive episodes with seasonal patterns, which are classified under unipolar depression in the DSM-5. The segment has been driven by increased diagnostic specificity, leading to earlier and more accurate identification of seasonal subtypes.

Greater awareness campaigns and mental health screenings integrated within primary care have contributed to higher treatment rates. Furthermore, pharmaceutical pipelines have remained heavily focused on SSRIs and NDRIs, which are first-line treatments for unipolar seasonal depression. The widespread reimbursement support and clinical familiarity with these agents have further reinforced their adoption.

Additionally, non-pharmacologic interventions such as light therapy and cognitive behavioral therapy for SAD (CBT-SAD) have been increasingly used as adjuncts or alternatives, reinforcing treatment penetration. This sustained clinical prioritization has positioned unipolar disorder as the leading disorder segment in the SAD therapeutics market.

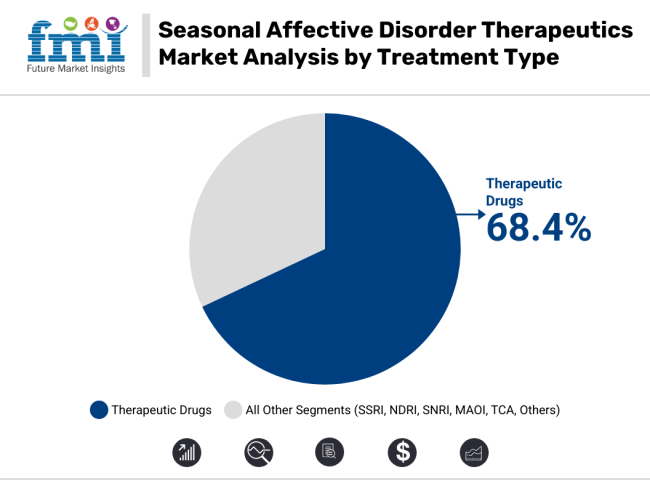

By Therapeutic devices, particularly light therapy devices, to lead the SAD therapeutics market with a 60.7% revenue share in 2025. Their growth has been driven by rising demand for non-pharmacologic interventions that offer fewer side effects and faster onset of action. Technological advancements have resulted in more compact, energy-efficient, and user-friendly devices, including wearable LEDs and dawn simulators that improve adherence and treatment efficacy.

Favorable regulatory pathways, have enabled rapid commercialization across developed markets. Additionally, integration with digital platforms, such as circadian rhythm apps and remote monitoring tools, has enhanced personalized care delivery. Hospitals, mental health clinics, and telepsychiatry platforms have increasingly adopted these devices as first-line or adjunctive treatment. Market expansion has also been facilitated by growing consumer awareness, e-commerce availability, and inclusion of light therapy in clinical practice guidelines. Collectively, these factors have reinforced the segment’s leadership in the SAD therapeutics landscape.

Rising prevalence of Seasonal Affective Disorder (SAD) and related mental health disorders has driven the Industry Growth

Seasonal Affective Disorder, or SAD, is a type of depression that occurs with the time change of the seasons, most often beginning in fall and continuing into winter when sunlight is scarce. It is experienced at a disproportionately higher rate by those living in northern regions-for example, parts of the United States, Germany, and Japan-where the dark days are longer and the temperatures are colder.

Increased awareness of SAD has made more and more people aware of symptoms like persistent low mood, fatigue, inability to concentrate, and changes in appetite, increasing the demand for effective therapeutic solutions.

There is increased recognition of the interrelationship of SAD with other general mental health conditions such as anxiety and major depressive disorder. Evidence has shown that comorbid mental health disorders among patients with SAD add to the overall burden of disease.

It has raised the ante for healthcare providers, governments, and insurers in terms of developing and providing comprehensive treatment options. This recognition has warranted the inclusion of SAD as a diagnosed medical condition into health policies and a number of countries insure the illness to remove any barrier to treatment that stems from finances.

Other factors contributing to the market's growth include increased diagnostic rates. SAD was poorly diagnosed or underdiagnosed in the past due to poor awareness among patients and healthcare professionals.

Integration of Treatments into Telemedicine Platforms fuels Seasonal Affective Disorder Therapeutics Industry Growth

Wearable light therapy devices are a very good avenue for growth. Light therapy remains the major treatment option in cases of SAD, and these wearable devices ensure great convenience, portability, and ease of operation compared to traditional stationary light boxes. The innovative product supports this increasing demand by consumers for flexibility and accessibility in managing health conditions; thus, this is one of the significant factors in market growth.

The main advantage of wearable light therapy devices is convenience. In contrast to big light boxes, where one has to sit for a long time, the wearable devices are usually light-emitting glasses or some sort of visors that allow one to continue his daily routine and get the treatment at the same time. This flexibility is all the more alluring to busy professionals, students, and people who would like to integrate therapy seamlessly into their lives.

Advancement in technology has also made these devices more effective and compact. Wearable devices, with features such as customizable light intensities, app connectivity, and progress tracking, will appeal to the tech-savvy consumer.

Companies can develop wearable light therapy devices with value addition in functionality, such as AI-based light intensity adjustment, real-time usage tracking, and ergonomic design for maximum comfort, to tap into the growth potential of these devices. Industry players can also collaborate with healthcare providers to offer these devices as part of integrated SAD treatment plans.

Wearable Light Therapy Devices Offers an Untapped Opportunity for Market Growth

Wearable light therapy devices are a very good avenue for growth. Light therapy remains the major treatment option in cases of SAD, and these wearable devices ensure great convenience, portability, and ease of operation compared to traditional stationary light boxes. The innovative product supports this increasing demand by consumers for flexibility and accessibility in managing health conditions; thus, this is one of the significant factors in market growth.

The main advantage of wearable light therapy devices is convenience. In contrast to big light boxes, where one has to sit for a long time, the wearable devices are usually light-emitting glasses or some sort of visors that allow one to continue his daily routine and get the treatment at the same time. This flexibility is all the more alluring to busy professionals, students, and people who would like to integrate therapy seamlessly into their lives.

Advancement in technology has also made these devices more effective and compact. Wearable devices, with features such as customizable light intensities, app connectivity, and progress tracking, will appeal to the tech-savvy consumer.

Companies can develop wearable light therapy devices with value addition in functionality, such as AI-based light intensity adjustment, real-time usage tracking, and ergonomic design for maximum comfort, to tap into the growth potential of these devices. Industry players can also collaborate with healthcare providers to offer these devices as part of integrated SAD treatment plans.

Limited Insurance Coverage for Non-Conventional Therapies Hinder the Market Growth

Traditional treatments like antidepressants with psychological counseling are often included in health insurance plans. Innovative therapies from light therapy devices to digital cognitive behavioral therapy (CBT) platforms fall outside the scope of coverage. This exclusion creates financial barriers for patients. It limits the accessibility and adoption of these effective treatments.

Non-conventional therapies come with high upfront costs. This makes them unaffordable for common individuals. Wearable light therapy devices offer convenience and portability. However, they tend to be more expensive. Subscription-based digital CBT platforms and mobile apps provide ongoing support.

These require recurring payments. These costs are prohibitive for many if not covered in insurance. As a result, many patients opt for less effective or less convenient treatments. These include over-the-counter supplements or simply enduring symptoms.

This financial burden affects healthcare providers’ recommendations. Physicians may hesitate to suggest therapies not covered by insurance. They know the financial strain it could impose on patients. The lack of insurance coverage reduces the visibility and adoption of non-conventional therapies in clinical practice.

The seasonal affective disorder therapeutics industry recorded a CAGR of 3.3% between 2020 and 2024. According to the industry, seasonal affective disorder therapeutics generated USD 922.7 million in 2024, up from USD 785.0 million in 2020.

Historically, SAD was often misdiagnosed or ignored. This was especially true in regions with low mental health awareness. Treatment options were rudimentary. They mainly focused on traditional antidepressants and limited psychological counseling. Public healthcare systems globally had not integrated SAD-specific interventions. This left patients underserved.

Today, the SAD therapeutics market has grown significantly. Campaigns promoting mental well-being in developed countries have reduced stigma. These campaigns encourage individuals to seek treatment for SAD. Advanced treatment options, like second-generation antidepressants, cognitive behavioral therapy (CBT), and light therapy devices, are widely available. The rise of telemedicine and digital health platforms has increased accessibility.

This is especially true in geographically dispersed areas. Japan has seen a cultural shift. Younger generations and professionals are embracing mental health care. Wearable light devices and AI-driven mental health tools are increasingly adopted. Insurers and governments in these countries now recognize SAD as a significant health issue. They offer reimbursement for therapies.

Advances in genomics and biomarkers are expected to enable more precise diagnosis and targeted treatments. This will enhance treatment efficacy. Digital therapeutics will likely dominate. AI-powered platforms will deliver real-time behavioral interventions and adaptive CBT programs. Wearable and IoT-enabled light therapy devices will become mainstream. These devices will offer convenience and portability.

Companies in the Tier 1 sector account for 42.3% of the global market, ranking them as the dominant players in the industry. Tier 1 players’ offer a wide range of product and have established industry presence. Having financial resources enables them to enhance their research and development efforts and expand into new markets.

A strong brand recognition and a loyal customer base provide them with a competitive advantage. Prominent companies within Tier 1 include Eli Lilly Company, Pfizer Inc., F. Hoffman-La Roche AG, GlaxoSmithKline, Novartis AG, Sanofi AG, and others.

Tier 2 players dominate the industry with a 29.2% market share. Tier 2 firms have a strong focus on a specific Product and a substantial presence in the industry, but they have less influence than Tier 1 firms. The players are more competitive when it comes to pricing and target niche markets.

New Product and services will also be introduced into the industry by Tier 2 companies. Tier 2 companies include Allergan plc, Janssen Pharmaceuticals Inc., Merck KgaA, Teva Pharmaceuticals, Bausch Health Companies Inc., and others.

Compared to Tiers 1 and 2, Tier 3 companies have smaller revenue spouts and less influence. Those in Tier 3 have smaller work force and limited presence across the globe. Prominent players in the tier 3 category are Mylan N.V., Koninklije Philips N.V., The Sunbox Company, Beurer GmbH, Lucimed S.A., and others.

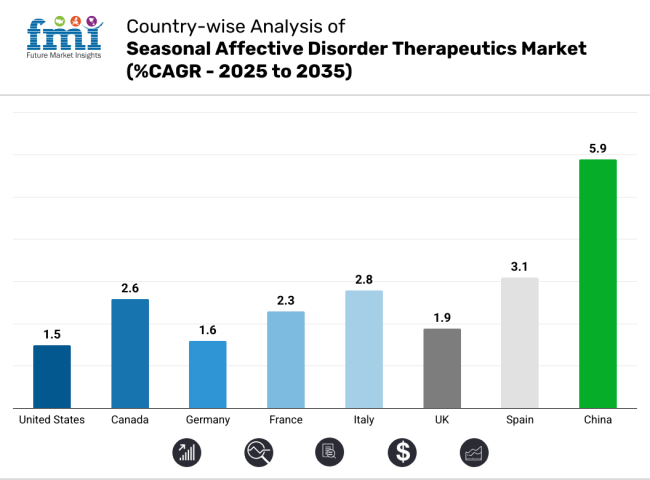

The section below covers the industry analysis for the seasonal affective disorder therapeutics for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA), is provided. The United States is anticipated to remain at the forefront in North America through 2035. India is projected to witness a CAGR of 6.2% from 2025 to 2035.

SAD affects millions of Americans annually. Symptoms of depression, lethargy, and social withdrawal, often start because of reduced sunlight exposure during the colder months. In the years since awareness of mental health conditions has led to demand for effective SAD treatments. National campaigns, mental health advocacy, and education have helped reduce stigma. These efforts encourage individuals to seek help, leading to higher diagnosis rates and a growing market for treatments.

Advanced healthcare infrastructure and insurance coverage support market growth. Certain policies, like the ACA, have increased insurance coverage for mental health services and made various forms of treatment options available, such as therapies, medication, and light therapy.

Telehealth services have also contributed significantly to ensuring ease of access to mental health professionals and treatment services, especially after the COVID-19 pandemic. Treatment has also become more personalized and efficient with advances in technology, including portable light therapy devices and new antidepressants.

Germany prioritizes holistic approaches to health. This aligns with the treatment of SAD. Many Germans prefer non-invasive, drug-free options for managing health conditions. Light therapy is a popular choice. Phototherapy devices, like light boxes, are widely adopted as a primary treatment for SAD.

These devices are supported by Germany’s healthcare infrastructure. The infrastructure ensures high accessibility and affordability. Many health insurance providers cover the costs of light therapy. This incentivizes patients to opt for this treatment.

Germany’s northern latitude plays a key role in the market’s growth. The country experiences long, dark winters, especially in the north. These winters contribute to a higher prevalence of SAD. Shorter daylight hours during these months impact the population. SAD is a notable public health concern. As awareness grows, more individuals are seeking treatment. This has led to an increase in demand for SAD therapies.

Traditionally, mental health problems in Japan carried an associated stigma. People were reluctant to seek treatment for ailments such as SAD. There has been a cultural sea change toward greater acceptance and recognition of mental health concerns, driven by public awareness campaigns and increasing media coverage. This has led to more and more people, especially during winter when the days are short and dark in Japan, actually seeing help for SAD.

The rapidly aging Japanese population contributes much to the growth of the market. Older adults are more susceptible to SAD. Biological changes in geriatric population interfere with their natural circadian rhythms and sensitivity to light.

The demographic shift in Japan has thus generated an overwhelming demand for SAD therapeutics targeted toward the elderly, including those that are non-invasive and easy to use. This focus by the government on mental health among the elderly also corresponds with the general health policy for older persons in improving their quality of life.

Market players are focusing on enhancing diagnostic accuracy and expanding treatment options. Key efforts include simplifying the diagnostic process. This includes bundling SAD codes into a single code for healthcare professionals. This improves the efficiency of diagnosis and treatment. Companies are investing in developing and marketing targeted therapies.

These include extended-release antidepressants to manage SAD symptoms. The focus is on managing symptoms during the fall and winter months. Companies are also focusing on awareness campaigns. These campaigns use television ads and digital media to educate the public about available treatments. Overall, companies aim to provide effective and accessible solutions for SAD management.

Recent Industry Developments in the Seasonal Affective Disorder Therapeutics Market:

In terms of treatment type, the industry is segmented into therapeutic drugs (selective serotonin reuptake inhibitors (SSRIs), norepinephrine-dopamine reuptake inhibitors (NDRIs), serotonin and norepinephrine reuptake inhibitors (SNRIs), monoamine oxidase inhibitors (MAOIs), tricyclic antidepressants (TCAs) and therapeutic devices (light boxes, dawn stimulators, desk lamps, and sun visors)

In terms of disorder type, the industry is bifurcated into unipolar disorders (fall-winter onset and spring-summer onset) and bipolar disorders

In terms of distribution channel, the industry is bifurcated into Institutional Sales (Hospitals, Clinics, and Wellness Centres & Spas) and Retail Sales (Retail Pharmacies, Drug Stores, and Online Sales)

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, the Middle East, and Africa have been covered in the report.

Seasonal affective disorder therapeutics market is expected to increase at a CAGR of 4.7% between 2025 and 2035.

The therapeutic drugs segment is expected to occupy 68.4% market share in 2025.

The market for seasonal affective disorder therapeutics is expected to reach USD 1,523.4 million by 2035.

The United States is forecast to see a CAGR of 1.5% during the assessment period.

The key players in the seasonal affective disorder therapeutics industry include Allergan plc, Eli Lily Company, GlaxoSmithKline, Pfizer Inc., Teva Pharmaceuticals, Bausch Health Companies Inc., F. Hoffman-La Roche AG, Mylan N.V., Sanofi AG, Novartis AG, Janssen Pharmaceuticals Inc., Koninklije Philips N.V., The Sunbox Company, Beurer GmbH, Lucimed S.A., and Others.

Table 01: Global Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis and Opportunity Assessment 2013–2028, By Treatment Type

Table 02: Global Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis and Opportunity Assessment 2013–2028, By Treatment Type

Table 03: Global Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis and Opportunity Assessment 2013–2028, By Disorder Type

Table 04: Global Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis- and Opportunity Assessment 2013–2028, By Distribution Channel

Table 05: Global Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis and Opportunity Assessment 2013–2028, By Region

Table 06: North America Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Country

Table 07: North America Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Treatment Type

Table 08: North America Seasonal Affective Disorder Therapeutics Market Volume (‘000 Units) Analysis 2013-2017 and Forecast 2018–2028, By Device Type

Table 09: North America Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Disorder Type

Table 10: North America Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Distribution Channel

Table 11: Latin America Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Country

Table 12: Latin America Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Treatment Type

Table 13: Latin America Seasonal Affective Disorder Therapeutics Market Volume (‘000 Units) Analysis 2013-2017 and Forecast 2018–2028, By Device Type

Table 14: Latin America Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Disorder Type

Table 15: Latin America Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Distribution Channel

Table 16: Europe Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Country

Table 17: Europe Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Treatment Type

Table 18: Europe Seasonal Affective Disorder Therapeutics Market Volume (‘000 Units) Analysis 2013-2017 and Forecast 2018–2028, By Device Type

Table 19: Europe Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Disorder Type

Table 20: Europe Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Distribution Channel

Table 21: South Asia Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Country

Table 22: South Asia Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Treatment Type

Table 23: South Asia Seasonal Affective Disorder Therapeutics Market Volume (‘000 Units) Analysis 2013-2017 and Forecast 2018–2028, By Device Type

Table 24: South Asia Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Disorder Type

Table 25: South Asia Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Distribution Channel

Table 26: East Asia Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Country

Table 27: East Asia Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Treatment Type

Table 28: East Asia Seasonal Affective Disorder Therapeutics Market Volume (‘000 Units) Analysis 2013-2017 and Forecast 2018–2028, By Device Type

Table 29: East Asia Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Disorder Type

Table 30: East Asia Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Distribution Channel

Table 31: Oceania Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Country

Table 32: Oceania Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Treatment Type

Table 33: Oceania Seasonal Affective Disorder Therapeutics Market Volume (‘000 Units) Analysis 2013-2017 and Forecast 2018–2028, By Device Type

Table 34: Oceania Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Disorder Type

Table 35: Oceania Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Distribution Channel

Table 36: MEA Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Country

Table 37: Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Treatment Type

Table 38: MEA Seasonal Affective Disorder Therapeutics Market Volume (‘000 Units) Analysis 2013-2017 and Forecast 2018–2028, By Device Type

Table 39: MEA Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Disorder Type

Table 40: MEA Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Distribution Channel

Table 41: China Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Treatment Type

Table 42: China Seasonal Affective Disorder Therapeutics Market Volume (‘000 Units) Analysis 2013-2017 and Forecast 2018–2028, By Device Type

Table 43: China Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Disorder Type

Table 44: China Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Distribution Channel

Table 45: Russia Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Treatment Type

Table 46: Russia Seasonal Affective Disorder Therapeutics Market Volume (‘000 Units) Analysis 2013-2017 and Forecast 2018–2028, By Device Type

Table 47: Russia Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Disorder Type

Table 48: Russia Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Distribution Channel

Table 49: Indonesia Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Treatment Type

Table 50: Indonesia Seasonal Affective Disorder Therapeutics Market Volume (‘000 Units) Analysis 2013-2017 and Forecast 2018–2028, By Device Type

Table 51: Indonesia Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Disorder Type

Table 52: Indonesia Seasonal Affective Disorder Therapeutics Market Value (US$ Mn) Analysis 2013-2017 and Forecast 2018–2028, By Distribution Channel

Figure 01: Global Seasonal Affective Disorder Therapeutics Market Volume Analysis (‘000 Units), By Devices, 2013-2017

Figure 02: Global Seasonal Affective Disorder Therapeutics Market Volume Forecast (‘000 Units), By Devices, 2018-2028

Figure 03: Light Boxes, Pricing Analysis per unit (US$), By Region, 2017

Figure 04: Light Boxes, Pricing Analysis per unit (US$), By Region, 2028

Figure 05: Dawn Stimulator, Pricing Analysis per unit (US$), By Region, 2017

Figure 06: Dawn Stimulator, Pricing Analysis per unit (US$), By Region, 2028

Figure 07: Desk Lamp, Pricing Analysis per unit (US$), By Region, 2017

Figure 08: Desk Lamp, Pricing Analysis per unit (US$), By Region, 2028

Figure 09: Sun Visors , Pricing Analysis per unit (US$), By Region, 2017

Figure 10: Sun Visors , Pricing Analysis per unit (US$), By Region, 2028

Figure 11: Global Seasonal Affective Disorder Therapeutics Market Value Analysis (US$ Mn), 2013-2017

Figure 12: Global Seasonal Affective Disorder Therapeutics Market Value Forecast (US$ Mn), 2018-2028

Figure 13: Global Seasonal Affective Disorder Therapeutics Market Absolute $ Opportunity, 2018 - 2028

Figure 14: Global Seasonal Affective Disorder Therapeutics Market Share Analysis (%), By Treatment Type, 2018 & 2028

Figure 15: Global Seasonal Affective Disorder Therapeutics Market Y-o-Y Analysis (%), By Treatment Type, 2018-2028

Figure 16: Global Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Treatment Type, 2018-2028

Figure 17: Global Seasonal Affective Disorder Therapeutics Market Share Analysis (%), By Disorder Type, 2018 & 2028

Figure 18: Global Seasonal Affective Disorder Therapeutics Market Y-o-Y Analysis (%), By Disorder Type, 2018-2028

Figure 19: Global Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Disorder Type, 2018-2028

Figure 20: Global Seasonal Affective Disorder Therapeutics Market Share Analysis (%), By Distribution Channel, 2018 & 2028

Figure 21: Global Seasonal Affective Disorder Therapeutics Market Y-o-Y Analysis (%), By Distribution Channel, 2018-2028

Figure 22: Global Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Distribution Channel, 2018-2028

Figure 23: Global Seasonal Affective Disorder Therapeutics Market Share Analysis (%), By Region, 2018 & 2028

Figure 24: Global Seasonal Affective Disorder Therapeutics Market Y-o-Y Analysis (%), By Region, 2018-2028

Figure 25: Global Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Region, 2018-2028

Figure 26: North America Seasonal Affective Disorder Therapeutics Market Value Share, By Treatment Type (2018 E)

Figure 27: North America Seasonal Affective Disorder Therapeutics Market Value Share, By Disorder Type (2018 E)

Figure 28: North America Seasonal Affective Disorder Therapeutics Market Value Share, By Distribution Channel (2018 E)

Figure 29: North America Seasonal Affective Disorder Therapeutics Market Value Share, By Country (2018 E)

Figure 30: North America Seasonal Affective Disorder Therapeutics Market Value Analysis (US$ Mn), 2013-2017

Figure 31: North America Seasonal Affective Disorder Therapeutics Market Value Forecast (US$ Mn), 2018-2028

Figure 32: North America Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Treatment Type, 2018-2028

Figure 33: North America Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Disorder Type, 2018-2028

Figure 34: North America Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Distribution Channel, 2018-2028

Figure 35: North America Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Country, 2018-2028

Figure 36: Latin America Seasonal Affective Disorder Therapeutics Market Value Share, By Treatment Type (2018 E)

Figure 37: Latin America Seasonal Affective Disorder Therapeutics Market Value Share, By Disorder Type (2018 E)

Figure 38: Latin America Seasonal Affective Disorder Therapeutics Market Value Share, By Distribution Channel (2018 E)

Figure 39: Latin America Seasonal Affective Disorder Therapeutics Market Value Share, By Country (2018 E)

Figure 40: Latin America Seasonal Affective Disorder Therapeutics Market Value Analysis (US$ Mn), 2013-2017

Figure 41: Latin America Seasonal Affective Disorder Therapeutics Market Value Forecast (US$ Mn), 2018-2028

Figure 42: Latin America Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Treatment Type, 2018-2028

Figure 43: Latin America Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Disorder Type, 2018-2028

Figure 44: Latin America Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Distribution Channel, 2018-2028

Figure 45: Latin America Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Country, 2018-2028

Figure 46: Europe Seasonal Affective Disorder Therapeutics Market Value Share, By Treatment Type (2018 E)

Figure 47: Europe Seasonal Affective Disorder Therapeutics Market Value Share, By Disorder Type (2018 E)

Figure 48: Europe Seasonal Affective Disorder Therapeutics Market Value Share, By Distribution Channel (2018 E)

Figure 49: Europe Seasonal Affective Disorder Therapeutics Market Value Share, By Country (2018 E)

Figure 50: Europe Seasonal Affective Disorder Therapeutics Market Value Analysis (US$ Mn), 2013-2017

Figure 51: Europe Seasonal Affective Disorder Therapeutics Market Value Forecast (US$ Mn), 2018-2028

Figure 52: Europe Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Treatment Type, 2018-2028

Figure 53: Europe Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Disorder Type, 2018-2028

Figure 54: Europe Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Distribution Channel, 2018-2028

Figure 55: Europe Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Country, 2018-2028

Figure 56: South Asia Seasonal Affective Disorder Therapeutics Market Value Share, By Treatment Type (2018 E)

Figure 57: South Asia Seasonal Affective Disorder Therapeutics Market Value Share, By Disorder Type (2018 E)

Figure 58: South Asia Seasonal Affective Disorder Therapeutics Market Value Share, By Distribution Channel (2018 E)

Figure 59: South Asia Seasonal Affective Disorder Therapeutics Market Value Share, By Country (2018 E)

Figure 60: South Asia Seasonal Affective Disorder Therapeutics Market Value Analysis (US$ Mn), 2013-2017

Figure 61: South Asia Seasonal Affective Disorder Therapeutics Market Value Forecast (US$ Mn), 2018-2028

Figure 62: South Asia Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Treatment Type, 2018-2028

Figure 63: South Asia Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Disorder Type, 2018-2028

Figure 64: South Asia Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Distribution Channel, 2018-2028

Figure 65: South Asia Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Country, 2018-2028

Figure 66: East Asia Seasonal Affective Disorder Therapeutics Market Value Share, By Treatment Type (2018 E)

Figure 67: East Asia Seasonal Affective Disorder Therapeutics Market Value Share, By Disorder Type (2018 E)

Figure 68: East Asia Seasonal Affective Disorder Therapeutics Market Value Share, By Distribution Channel (2018 E)

Figure 69: East Asia Seasonal Affective Disorder Therapeutics Market Value Share, By Country (2018 E)

Figure 70: East Asia Seasonal Affective Disorder Therapeutics Market Value Analysis (US$ Mn), 2013-2017

Figure 71: East Asia Seasonal Affective Disorder Therapeutics Market Value Forecast (US$ Mn), 2018-2028

Figure 72: East Asia Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Treatment Type, 2018-2028

Figure 73: East Asia Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Disorder Type, 2018-2028

Figure 74: East Asia Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Distribution Channel, 2018-2028

Figure 75: East Asia Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Country, 2018-2028

Figure 76: Oceania Seasonal Affective Disorder Therapeutics Market Value Share, By Treatment Type (2018 E)

Figure 77: Oceania Seasonal Affective Disorder Therapeutics Market Value Share, By Disorder Type (2018 E)

Figure 78: Oceania Seasonal Affective Disorder Therapeutics Market Value Share, By Distribution Channel (2018 E)

Figure 79: Oceania Seasonal Affective Disorder Therapeutics Market Value Share, By Country (2018 E)

Figure 80: Oceania Seasonal Affective Disorder Therapeutics Market Value Analysis (US$ Mn), 2013-2017

Figure 81: Oceania Seasonal Affective Disorder Therapeutics Market Value Forecast (US$ Mn), 2018-2028

Figure 82: Oceania Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Treatment Type, 2018-2028

Figure 83: Oceania Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Disorder Type, 2018-2028

Figure 84: Oceania Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Distribution Channel, 2018-2028

Figure 85: Oceania Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Country, 2018-2028

Figure 86: MEA Seasonal Affective Disorder Therapeutics Market Value Share, By Treatment Type (2018 E)

Figure 87: MEA Seasonal Affective Disorder Therapeutics Market Value Share, By Disorder Type (2018 E)

Figure 88: MEA Seasonal Affective Disorder Therapeutics Market Value Share, By Distribution Channel (2018 E)

Figure 89: MEA Seasonal Affective Disorder Therapeutics Market Value Share, By Country (2018 E)

Figure 90: MEA Seasonal Affective Disorder Therapeutics Market Value Analysis (US$ Mn), 2013-2017

Figure 91: MEA Seasonal Affective Disorder Therapeutics Market Value Forecast (US$ Mn), 2018-2028

Figure 92: MEA Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Treatment Type, 2018-2028

Figure 93: MEA Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Disorder Type, 2018-2028

Figure 94: MEA Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Distribution Channel, 2018-2028

Figure 95: MEA Seasonal Affective Disorder Therapeutics Market Attractiveness Analysis by Country, 2018-2028

Figure 96: Global Seasonal Affective Disorder Therapeutics Market Value Proportion Analysis, By Emerging Countries, 2018

Figure 97: Seasonal Affective Disorder Therapeutics Market, Global Vs. Country Growth Y-o-Y (%) Comparison, 2018-2028

Figure 98: China Seasonal Affective Disorder Therapeutics Market Value Analysis (US$ Mn), 2013-2017

Figure 99: China Seasonal Affective Disorder Therapeutics Market Value Forecast (US$ Mn), 2018-2028

Figure 100: Russia Seasonal Affective Disorder Therapeutics Market Value Analysis (US$ Mn), 2013-2017

Figure 101: Russia Seasonal Affective Disorder Therapeutics Market Value Forecast (US$ Mn), 2018-2028

Figure 102: Indonesia Seasonal Affective Disorder Therapeutics Market Value Analysis (US$ Mn), 2013-2017

Figure 103: Indonesia Seasonal Affective Disorder Therapeutics Market Value Forecast (US$ Mn), 2018-2028

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Depression And Seasonal Affective Disorder Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Seasonal Allergy Market Size and Share Forecast Outlook 2025 to 2035

Seasonal Influenza Vaccines Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Affective Computing Market Size and Share Forecast Outlook 2025 to 2035

Biotherapeutics Virus Removal Filters Market Trends – Growth & Forecast 2025 to 2035

COPD Therapeutics Market Report – Growth, Demand & Industry Forecast 2023-2033

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Peptide Therapeutics Market Analysis - Growth & Forecast 2024 to 2034

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Glaucoma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Leukemia Therapeutics Treatment Market Analysis - Growth & Forecast 2025 to 2035

Microbiome Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

The Canine Flu Therapeutics Market is segmented by product, and end user from 2025 to 2035

Stuttering Therapeutics Market Trends, Analysis & Forecast by Treatment, Type, End-Use and Region through 2035

Pet Cancer Therapeutics Market Insights - Growth & Forecast 2024 to 2034

Candidiasis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Therapeutics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Heart Block Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Aquaculture Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA