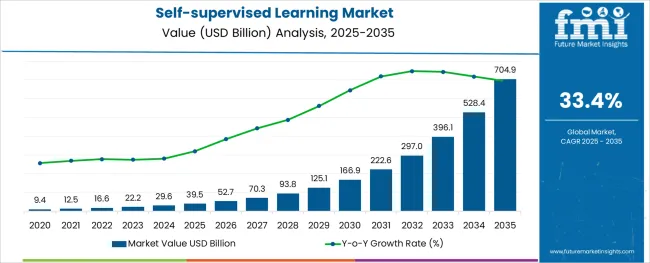

The Self-supervised Learning Market is estimated to be valued at USD 39.5 billion in 2025 and is projected to reach USD 704.9 billion by 2035, registering a compound annual growth rate (CAGR) of 33.4% over the forecast period.

The self supervised learning market is advancing steadily as organizations seek to reduce reliance on large labeled datasets and improve model efficiency across various AI applications. The ability to extract meaningful patterns from unlabeled data has made self supervised learning a preferred approach in sectors prioritizing data privacy, adaptability, and cost efficiency.

Recent developments in transformer architectures, representation learning, and transfer learning have enhanced the practical deployment of these models across language, vision, and multi modal domains. Enterprises are increasingly adopting self supervised models to improve performance in low data environments and accelerate AI integration across business functions.

As data volumes continue to grow and annotation becomes more resource intensive, the market outlook remains promising with demand intensifying across industries such as healthcare, finance, and cybersecurity where data diversity and privacy are critical factors.

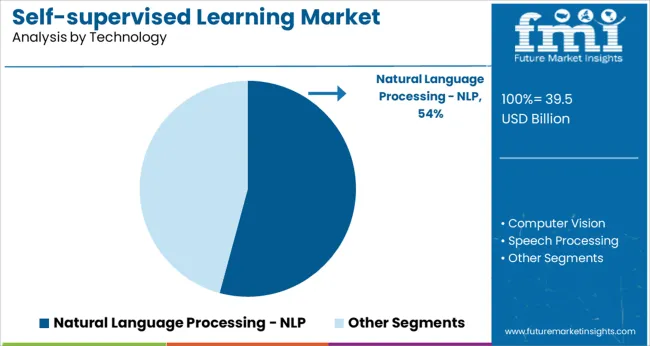

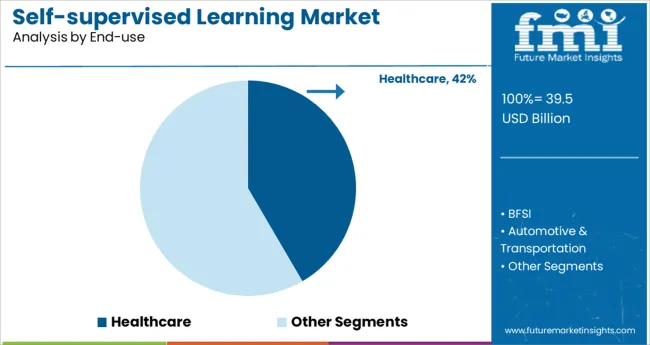

The market is segmented by End-use and Technology and region. By End-use, the market is divided into Healthcare, BFSI, Automotive & Transportation, Software Development - IT, Advertising & Media, and Others. In terms of Technology, the market is classified into Natural Language Processing - NLP, Computer Vision, and Speech Processing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The natural language processing segment is projected to represent 54.20% of total market revenue by 2025 within the technology category, establishing it as the most significant contributor. This leadership position is supported by the growing need for machines to understand and generate human language in applications ranging from customer service automation to content moderation and medical documentation.

Self supervised techniques have significantly improved the quality and efficiency of pretraining large language models by leveraging vast amounts of unlabeled text. These advancements have enabled NLP systems to adapt rapidly to specific tasks with minimal fine tuning, making them ideal for dynamic and multilingual environments.

Organizations have increasingly adopted NLP solutions to drive operational automation, enhance user experience, and derive actionable insights from unstructured textual data, ensuring continued dominance of this technology segment.

The healthcare segment is expected to hold 41.60% of overall market revenue by 2025 under the end use category, placing it at the forefront of industry adoption. The segment’s growth is driven by the need for efficient data interpretation in medical imaging, electronic health records, and patient monitoring systems where labeled data is often limited or sensitive.

Self supervised learning models are being utilized to improve diagnostic accuracy, accelerate clinical decision support, and personalize treatment recommendations without extensive manual data annotation. The healthcare sector’s focus on early disease detection, operational efficiency, and compliance with data privacy regulations has further fueled the integration of AI powered solutions based on self supervised techniques.

As institutions increasingly adopt data driven strategies to enhance care outcomes and reduce operational burden, healthcare continues to lead the way in self supervised learning deployment.

The development of AI systems that can benefit from vast volumes of accurately labeled data has advanced significantly in recent years. The expert models created using this supervised learning paradigm have a history of success in their designated applications. Constructing smarter generalist models that can switch gears between tasks and pick up new abilities without massive amounts of labeled data is made more difficult by supervised learning.

Both the American tech giants Apple and Microsoft are increasing their spending on research and development. Companies like these are also exploring novel technologies like artificial intelligence and machine learning. Market participants like the American company Meta are researching and experimenting with self-reinforcement learning, which opens substantial expansion opportunities for the sector.

Data2vec

In January, Meta AI introduced the data2vec technique for use in building computer vision models for processing audio and visual information. For natural language processing challenges, data2vec was first published as a competition that does not employ contrastive learning or rely on the reconstruction of the input sample. In order to train data2vec, the team claimed, only a subset of the input data is shown during training, and the model representations are predicted.

STEGO

The Self-Supervised Transformer with Energy-based Graph Optimisation (STEGO) was created by MIT's Computer Science and AI Lab in collaboration with Microsoft and Cornell University to find and pinpoint semantically relevant categories in image corpora without human annotation. The system employs a semantic segmentation technique to assign labels to each pixel in a picture.

ColloSSL

ColloSSL is a collaborative self-supervised framework for human activity detection created by researchers from Nokia Bell Labs, Georgia Tech, and the University of Cambridge. A signal for representation learning can be generated from the combination of unlabelled sensor datasets recorded simultaneously from numerous devices. The paper discusses three methods: device selection, contrastive sampling, and multi-view contrastive loss.

ML's Increasing Role in the Healthcare Industry

Numerous healthcare-related issues could benefit immediately from ML technology. In healthcare, this technology is utilized for a wide variety of purposes, including data analysis, prediction, risk assessment, and resource allocation. The major uses of this technology in healthcare are the detection and diagnosis of rare or difficult-to-diagnose diseases and ailments.

Increased Global Adoption of Cloud Computing

Increased adoption of cloud computing and social media platforms is driving the adoption of self-supervised learning. Cloud computing, which provides options for large-scale data storage, is widely utilized by all modern enterprises. One of the main advantages of cloud computing is the ability to perform real-time data analysis owing to online data analysis tools and the widespread use of cloud storage. Due to cloud computing, analyzing data may be done at any time, from any location.

Many benefits of the ML platform are helping to drive the sector forward. However, the lack of some key features is expected to hinder the platform's global progress. Inaccurate and sometimes unfinished algorithms are a major problem in the industry. The accuracy of big data and machine learning in manufacturing is essential. The development of flawed products is possible if the algorithm makes even a single mistake.

The BFSI market was worth USD 29.6 billion in 2024 and is expected to grow at a CAGR of 33.3% over the forecast period. This market's expansion may be traced back to the sector's increasing interest in machine learning and artificial intelligence.

Market researchers predict that the advertising and media industry will grow at a rapid pace of 33.7% CAGR over the next several years. The need for consumer insights is being driven, in part, by the rise of online shopping and widespread internet access, both of which lend themselves to the use of self-reinforcement learning. Moreover, the advertising and media sector is projected to increase demand for this technology due to the growing popularity of self-reinforcement learning for identifying hate speech on social media.

In 2024, Natural Language Processing generated 38.6% of total revenue and was expected to post the fastest growth in terms of compound annual growth rate (CAGR) at 34.1%. The proliferation of natural language processing (NLP) applications like text prediction and chatbots is largely responsible for the expansion of this market category.

Additionally, both international and domestic market leaders provide NLP-based products and services. For instance, BlueMessaging, based in Mexico, offers SmartChat, an AI-based service that aids businesses in creating chatbots. A 32.4% CAGR is projected for the computer vision market between 2024 and 2025, making it the second-largest revenue contributor in that year.

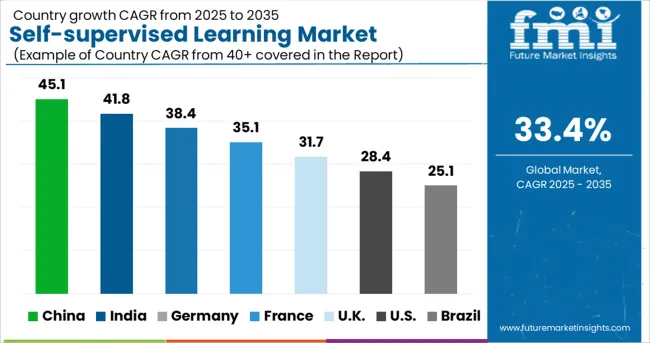

In 2024, North America had 31.7% of the demand for self-supervised learning, and it is projected to grow at a CAGR of approximately 34.0% during the forecast period. The expansion of the sales of self-supervised learning in the region is expected to be spurred by several factors, including the presence of major market participants like the United States Meta, Microsoft, and Google; the availability of specialists; and advanced technological infrastructure.

The USA companies frequently lead the pack in adopting emerging technologies like 4G, 5G, and LTE, as well as big data analytics, IoT, additive manufacturing, A.I., augmented reality (A.R.), connected industries, machine learning (ML), and virtual reality (V.R.).

In 2025, Germany's market was worth the most in Europe's self-supervised learning market by country, and it is projected to maintain its dominance through 2035 when it will be worth USD3,445.5 million. At a CAGR of 31.7%, the United Kingdom market is expected to expand rapidly over the next several years. The demand for self-supervised learning in France, meanwhile, would grow at a CAGR of 33.8% over the same time frame.

The G-Cloud program is Britain's attempt to streamline the process by which government agencies can purchase cloud-based I.T. services of a standard quality. Due to a set of framework agreements with suppliers, government agencies that use the G-Cloud can make purchases without holding tenders or holding competitions. The Digital Marketplace is an online marketplace where government agencies can find providers of G-Cloud-compliant services.

The government of China is pushing the rate of its industries' digital transformation to unprecedented heights. To enhance the digital economy's governance model, Beijing must also expand access to digital public services. The Chinese government is achieving this by increasing spending on 6G Research and Development (R&D) and fostering creativity in strategic areas like integrated circuits and AI.

In 2025, China's sales of self-supervised learning were worth the most in the Asia Pacific self-supervised learning market, and this trend is expected to continue through 2035.

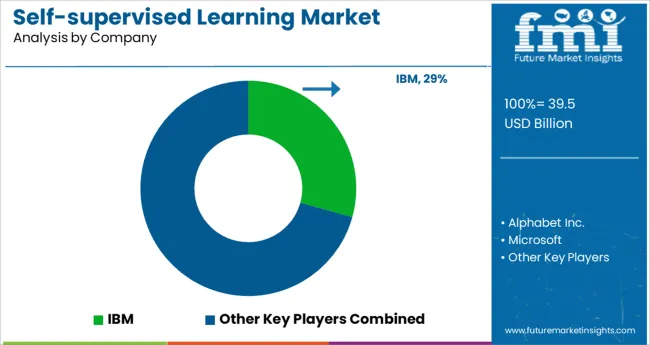

There are many different international and domestic competitors in this sector. Those active in the market are spending money on research and development (R&D) to create cutting-edge solutions and give themselves an edge. The market is characterized by innovation, disruption, and rapid change, and in response, businesses are forming alliances and M&A deals.

For instance, IBM bought the American cloud services firm Neudesic in February 2025. IBM has financed the development of the firm's hybrid cloud and artificial intelligence infrastructure. Information analytics, data engineering, and Azure cloud proficiency are all areas where Neudesic excels. IBM's goal in making this purchase is to better provide for customer needs by increasing its proficiency in cloud service.

Major developments and strategies adopted by the players in the self-supervised learning market include:

Geographical Expansions

In February 2025, Microsoft established a larger presence in that country. This development was made to help users who are creating and running applications and workloads. The Microsoft Cloud would enable businesses to make use of digital capabilities and technologies like ML, AI, IoT, and analytics by centrally managing their demands in all these environments (public, private, and hybrid).

In January 2024, AWS began offering AWS CCI Solutions to its partners across the world, thus increasing the company's global footprint. The present contact center provider might benefit from the AWS CCI solution by integrating AWS's ML capabilities, leading to increased efficiencies and improved personalization of the customer experience.

Partnerships & Collaborations

In May of 2024, Microsoft formed a strategic alliance with Darktrace, a market leader in autonomous AI for cyber security. Through this collaboration, Microsoft and Darktrace will be able to offer enhanced protection for hybrid cloud deployments, streamline threat investigations, and free up team resources for more strategic work.

Baidu and BlackBerry, a defunct manufacturer of mobile devices and associated services, formed a collaboration in January 2024. Automakers hoped to speed up the production of safe autonomous vehicles and advance the intelligently networked vehicle sector through this alliance.

Mergers & Acquisitions

Databand, an Israel-based data observability software vendor, was acquired by IBM in July 2025. With this purchase, IBM will have a complete set of observability capabilities in IT, including those for applications, data, and machine learning.

In May of 2025, Microsoft acquired Nuance Communications, an industry pioneer in ambient intelligence and conversational AI. In acquiring Nuance, Microsoft would gain access to cutting-edge conversational AI and ambient intelligence while also bolstering its own portfolio of trusted industrial cloud services.

Product Launches

PEER, a collaborative language model, designed to simulate the writing process, was released by Meta AI in August of 2025. To improve the model's text-writing capabilities across domains, PEER was created. Edits made in many domains improve PEER's ability to comprehend and act upon instructions and to locate and use appropriate sources.

In July 2025, Meta AI launched a publicly available model to improve the quality of Wikipedia articles. The launch would facilitate the expansion of volunteer efforts by effectively recommending citations and reliable sources. As a result, human editors would only have to look at the few potentially problematic citations instead of potentially thousands.

Some of the prominent players in the self-supervised learning market are:

The global self-supervised learning market is estimated to be valued at USD 39.5 billion in 2025.

It is projected to reach USD 704.9 billion by 2035.

The market is expected to grow at a 33.4% CAGR between 2025 and 2035.

The key product types are healthcare, bfsi, automotive & transportation, software development - it, advertising & media and others.

natural language processing - nlp segment is expected to dominate with a 54.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Learning Management System (LMS) Market Size and Share Forecast Outlook 2025 to 2035

Learning Analytics Solution Market Analysis by Solution, Deployment Mode, Service, End User, and Region Through 2035

E-Learning Solution Market by Solution, Deployment, & Region Forecast till 2035

Microlearning Platforms Market Size and Share Forecast Outlook 2025 to 2035

Deep Learning Market Size and Share Forecast Outlook 2025 to 2035

Microlearning Market Size and Share Forecast Outlook 2025 to 2035

Remote Learning Technology Spending Market Analysis by Technology Software, Technology Services, Learning Mode, End User and Region Through 2025 to 2035

Machine Learning As A Services Market

Augmented Learning Market

Automated Machine Learning Market Forecast Outlook 2025 to 2035

Smart Education and Learning Market Analysis by Component, Learning, End User, and Region Through 2035

Social and Emotional Learning Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA