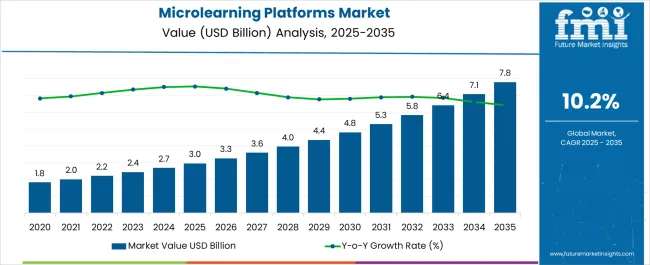

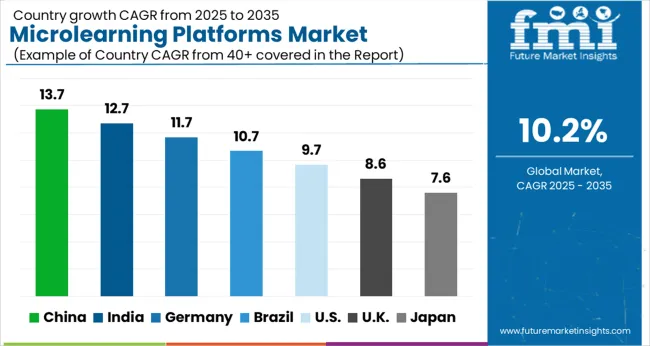

The Microlearning Platforms Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 7.8 billion by 2035, registering a compound annual growth rate (CAGR) of 10.2% over the forecast period.

| Metric | Value |

|---|---|

| Microlearning Platforms Market Estimated Value in (2025 E) | USD 3.0 billion |

| Microlearning Platforms Market Forecast Value in (2035 F) | USD 7.8 billion |

| Forecast CAGR (2025 to 2035) | 10.2% |

The microlearning platforms market is expanding rapidly, shaped by the rising emphasis on flexible, personalized, and engaging training methods across industries. Industry updates and corporate training reports have highlighted that organizations are increasingly adopting microlearning to improve employee productivity, reduce training fatigue, and deliver just-in-time learning content.

Investments in digital transformation have accelerated the deployment of platforms that provide mobile-first, interactive, and modular learning experiences. Technology advancements in AI-driven content recommendation, gamification, and analytics have further strengthened adoption by enabling measurable learning outcomes.

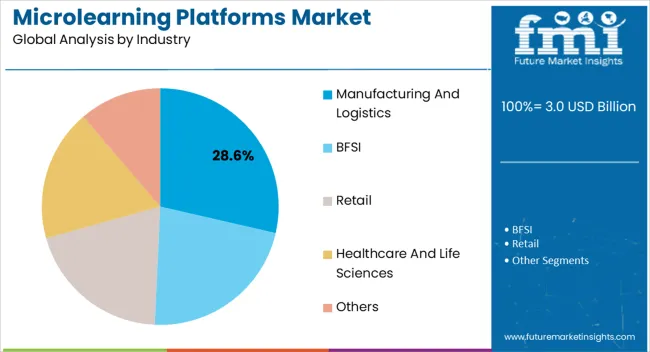

Corporate boardroom presentations and investor briefings have underscored the role of microlearning in addressing workforce skill gaps, especially in dynamic sectors such as logistics, healthcare, and IT. Future growth is expected to be fueled by the integration of microlearning with enterprise learning management systems, the rise of hybrid workplaces, and the demand for scalable solutions that cater to distributed and multilingual workforces. Segmental momentum is being led by on-premises deployment in organizations requiring greater control, solutions as the primary revenue driver, and strong adoption in manufacturing and logistics due to operational training demands.

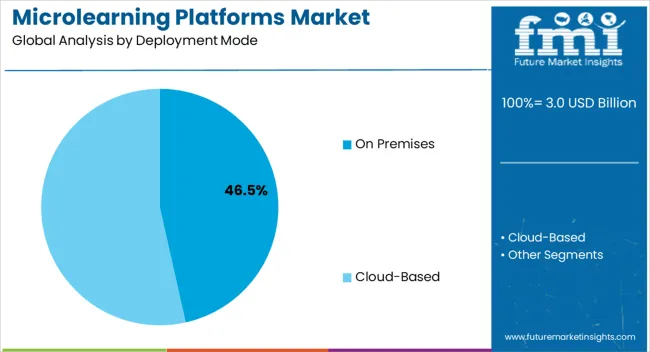

The On-Premises segment is projected to account for 46.5% of the microlearning platforms market revenue in 2025, maintaining a significant share due to data security, customization, and integration requirements in large enterprises. Organizations with sensitive information and compliance-driven operations have preferred on-premises deployment for greater control over infrastructure and learning content.

Industry reports have indicated that this mode supports tailored integrations with legacy systems, ensuring smooth workflow continuity. Furthermore, regulated sectors such as banking, manufacturing, and government institutions have relied on on-premises platforms to meet stringent data protection laws.

While cloud-based adoption is accelerating, the entrenched advantages of on-premises deployment in terms of control, customization, and compliance are expected to sustain its importance in the overall market.

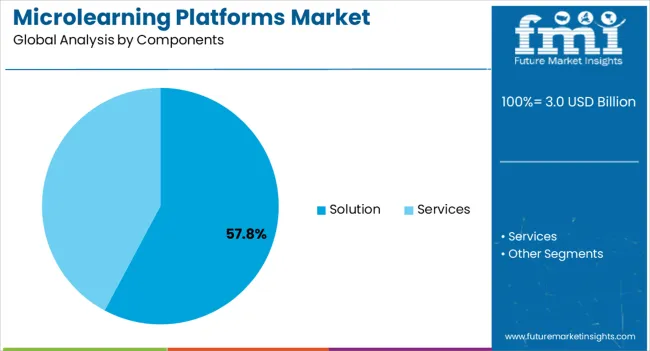

The Solution segment is projected to contribute 57.8% of the microlearning platforms market revenue in 2025, reinforcing its role as the dominant component category. The demand for comprehensive learning solutions has been driven by the need for content delivery, tracking, and performance analytics in a unified system.

Corporate training leaders have emphasized solutions that incorporate video-based modules, gamified content, and AI-driven personalization to improve learner engagement and outcomes. Press releases from leading platform providers have showcased expanded product portfolios offering robust solutions that integrate seamlessly with enterprise HR and talent management systems.

As companies focus on aligning learning initiatives with business objectives, the Solution segment is expected to remain central, delivering both scalability and measurable ROI for organizations.

The Manufacturing and Logistics segment is projected to hold 28.6% of the microlearning platforms market revenue in 2025, establishing itself as the leading industry adopter. This growth has been supported by the sector’s reliance on continuous workforce training to enhance safety, efficiency, and compliance.

Industry publications have highlighted that microlearning modules tailored to operational tasks, equipment handling, and safety protocols have significantly improved skill retention among employees in manufacturing plants and logistics operations. Companies in this sector have prioritized rapid, task-oriented training methods to reduce downtime and enhance productivity.

Additionally, microlearning has proven effective in onboarding seasonal and contract workers, a common requirement in logistics hubs and manufacturing environments. With growing pressure to maintain workforce agility and meet evolving compliance standards, the Manufacturing and Logistics segment is expected to sustain strong demand for microlearning platforms.

As per the Microlearning Platforms Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2025, market value of the microlearning platforms increased at around 8.6% CAGR. With an absolute dollar opportunity of USD 3 billion during 2025 to 2035, the market is projected to reach a valuation of USD 7.8 billion by 2035, at a CAGR of 10.6%.

The market is being driven by the increasing adoption and availability of the cloud, which provides the platform and infrastructure to address the scalability limitations of on-premise microlearning experiences. Microlearning is also becoming more widely used in gamification for customer engagement and value creation. Furthermore, millennials' increasing demand for high flexibility and a variety of jobs has resulted in half of the workforce being made up of freelancers who change jobs frequently and combine different projects at different organizations rather than working long hours. As a result, microlearning solution providers are increasingly targeting these freelancers.

Microlearning platforms are used as corporate learning solutions by HR and learning and development departments. These training solutions provide employees with short bursts of targeted instructional information that fit into a daily workflow and are accessible on any device. Companies can either create their own learning materials or use a pre-existing library of video, animation, and text-based learning materials. Corporate learning management systems (LMS) and learning experience platform (LEP) software are not the same as microlearning platforms. LEPs and micro-learning platforms assist organizations with a variety of challenges, as well as their target audiences. LEPs frequently provide employee-driven, computer- or desk-based instructional content.

Microlearning provides businesses with a centralized solution for providing effective training and education to the stakeholders including employees, workers, and channel partners. The learning methodologies used in corporate training programs are changing.

Traditional classroom training is gradually being surpassed by online learning methods that provide learners with greater flexibility. Businesses are focusing on providing employees with a better learning experience through a variety of engaging learning and development activities. As a result, businesses are eager to adopt training methods that are directly oriented toward a learning objective, such as specific skills or compliance understanding.

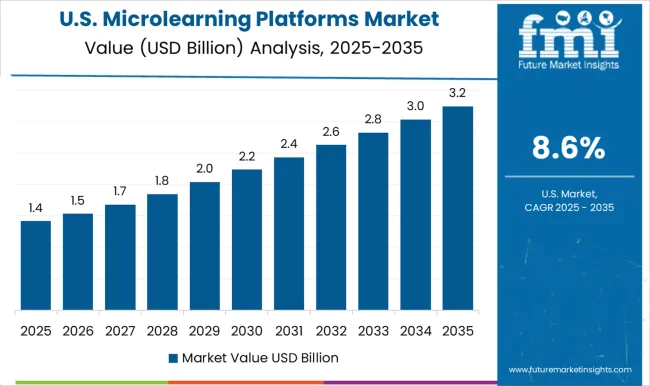

In 2025, North America was the largest regional segment of the microlearning market. The significant increase in the adoption of technology by numerous organizations to provide adequate training to their employees is largely responsible for the region's growth. In North America, the United States and Canada are the most important markets for microlearning. The market in the region will grow at a faster rate than the market in Europe.

In North America, the demand for education technologies started with schools and colleges converting traditional classrooms to digital classrooms by investing in basic hardware and software solutions. Advances in information technology have transformed communication and educational practices. Technology is transforming K-12 and higher education by offering teachers the ability to reject distracting educational technologies. Schools use personalized learning and job-embedded professional learning to meet the demands of teaching schedules and to support teachers' learning styles.

The number of smartphone subscribers in North America is expected to reach 3 Million by 2025, according to the GSMA. Furthermore, by 2025, the region's mobile subscribers with 86% and internet penetration rates of 80% may rise to the second highest in the world. The virtual reality market in the region will benefit from increased device penetration. According to an IBM study, 75% of Gen-Zers prefer to use a smartphone over other mobile devices. As a result, a mobile-focused microlearning training strategy will become more popular in the future to keep them interested in learning.

The United States is expected to account for the highest market share of USD 7.8 billion by the end of 7.8033 with an absolute dollar growth opportunity of USD 1.3 billion. By 7.8033, the United States is likely to account for nearly 40% of the global microlearning market. It is rising as a result of many organizations’ rapid technological adoption and failure to provide adequate training to their employees. Microlearning providers in the country will benefit largely from the growth of e-learning.

Gamification's ability to increase engagement and loyalty by an average of 30% in time, on-site, repeat visits, and viral distribution attracted organizations in the United States. Apart from participation, the revenue effects of gamification are also impressive. Autodesk, an American multinational software company, increased trial usage by 40% and conversion rates by 15%, while Extraco Bank increased customer acquisitions by 700%.

IT & telecom industries dominated the other sub-segments with a CAGR of 10.2% during the forecast period 2025 to 2035. Microlearning's rapid growth is due to an increase in the number of smartphones and mobile devices, which has created a large base for gamification in the microlearning market.

The high recognition of gamification systems as a method to architect human behavior to induce innovation, productivity, or engagement is fueling growth. According to an article published in Harvard Business Review, gamification improves customer retention by 5%, increases profits by 25% to 95%, and can help businesses achieve better results. Scanning codes on products can be provided by brands, and customers can receive a certain number of loyalty points by scanning the code.

During the forecast period, enterprise gamification in training, productivity, and skill enhancement is expected to grow significantly. Collaboration systems, which do not create a competitive environment and are widely considered counterproductive, have shown a strong preference among organizations. Gamification in microlearning solutions also serves as a useful tool for increasing employee overall productivity through a variety of methods, such as rewards for task completion in project management or data contribution or access in knowledge management.

The client organization's server hosts the on-premises microlearning solution, however, the user or buyer must purchase a license to use the microlearning solution, which is also customizable. The buyer's internal IT staff handles the setup and maintenance, and the buyer has complete control over the microlearning solution.

Enterprises can use the on-premises microlearning solution to create, store, and deliver business-critical data while also controlling access to training programs. On-premises microlearning solutions are losing market share as these applications require large upfront investments and long-term developer commitment. Enterprises that rely on the continuous availability of a learning system for the success of their business processes use on-premises microlearning solution.

By deploying an on-premises microlearning solution, businesses gain more control over the infrastructure investments they make, as well as lower overall network costs.

However, cloud-based microlearning is expected to gain traction across industries as the demand for scalable and cost-effective solutions grows. Users log into the service provider's site to access cloud-based microlearning solutions, which are hosted over an internet connection. Trainers can use their web browsers to upload course content, create new courses, and interact with students without having to install any management software.

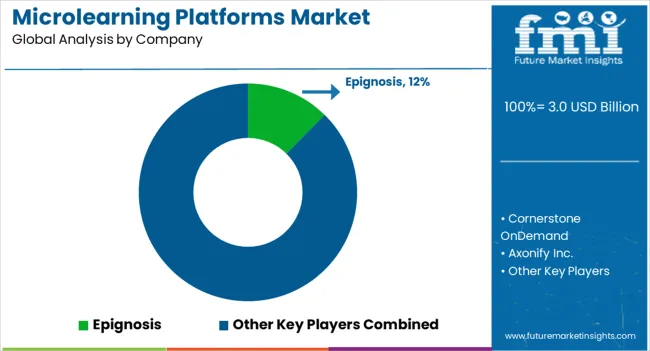

In a fast-growing education sector, the market is fragmented, with many local and regional players competing with one another. Players in the microlearning market are working to deliver their content in an interactive format that will pique learners' interest in these training platforms. Microlearning platform providers are also focusing on innovation and strategic partnerships with other vendors to expand their service offerings and meet the demands of an expanding customer base. Some of the leading players include Epignosis, Cornerstone OnDemand, Axonify Inc., iSpring Solutions Inc., and Bigtincan.

Some of the recent developments of microlearning platforms market are as follows :

The global microlearning platforms market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the microlearning platforms market is projected to reach USD 7.8 billion by 2035.

The microlearning platforms market is expected to grow at a 10.2% CAGR between 2025 and 2035.

The key product types in microlearning platforms market are on premises and cloud-based.

In terms of components, solution segment to command 57.8% share in the microlearning platforms market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microlearning Market Size and Share Forecast Outlook 2025 to 2035

Sales Platforms Software Market - Growth & Forecast 2034

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Platforms Market Growth – Trends & Forecast through 2034

IP Centrex Platforms Market

Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

AI Security Platforms Market Size and Share Forecast Outlook 2025 to 2035

Virtual Event Platforms Market Trends - Growth & Forecast 2025 to 2035

Competitive Landscape of Virtual Event Platforms Market Share

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

BRICS Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Digital Publishing Platforms Market Size and Share Forecast Outlook 2025 to 2035

Patient Engagement Platforms Market Size and Share Forecast Outlook 2025 to 2035

Content Experience Platforms Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Customer Experience Platforms Market by Interaction Points, Deployment, Enterprise Size, Region-Forecast through 2035

Fixed Business Voice Platforms And Services Market Size and Share Forecast Outlook 2025 to 2035

Theranostic Workflow Platforms Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Experience Optimization Platforms Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA