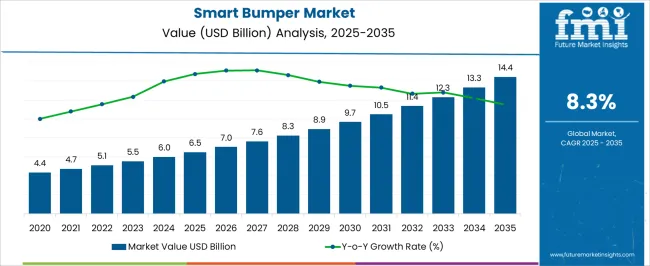

The Smart Bumper Market is estimated to be valued at USD 6.5 billion in 2025 and is projected to reach USD 14.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.3% over the forecast period. Raw materials such as polymers, lightweight composites, and metals account for a significant portion of costs, with suppliers of impact-resistant plastics and structural reinforcements forming the upstream segment. These materials are increasingly combined with embedded radar, lidar, and ultrasonic sensors, making sensor suppliers and electronics manufacturers critical stakeholders in the midstream stage. System integration represents another cost-intensive phase within the value chain, as automotive OEMs incorporate smart bumpers into advanced driver assistance systems and connected vehicle platforms.

The role of software providers is becoming more prominent, as real-time data analytics, object detection algorithms, and communication protocols are necessary to enable predictive safety features. Distribution is largely tied to OEM supply contracts, though aftermarket players are gradually entering the ecosystem with retrofit solutions. The cost structure is shifting from traditional materials and assembly toward high-value electronics and software. The value-chain dynamics suggest that collaboration between materials suppliers, sensor manufacturers, and system integrators will be decisive for profitability, while OEMs capture downstream value through differentiation in safety, compliance, and vehicle intelligence. This transition underpins the projected strong growth trajectory of the market through 2035.

| Metric | Value |

|---|---|

| Smart Bumper Market Estimated Value in (2025 E) | USD 6.5 billion |

| Smart Bumper Market Forecast Value in (2035 F) | USD 14.4 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

The smart bumper market is experiencing robust growth, driven by the rapid evolution of advanced driver-assistance systems and the increasing emphasis on passenger safety and accident prevention. As automotive OEMs prioritize the integration of intelligent technologies, bumpers are being transformed from passive safety components into active sensing modules.

The adoption of embedded electronics, real-time object detection, and AI-based signal processing is enabling smart bumpers to support collision mitigation, pedestrian alerts, and traffic-aware automation. Additionally, regulatory pushes for mandatory safety technologies in vehicles and the rising demand for electrified and autonomous vehicles are expanding the scope of smart bumpers in both premium and mid-range segments.

The market is also benefiting from innovations in lightweight materials and compact sensor packaging, allowing for seamless integration without compromising vehicle aesthetics or aerodynamics As vehicle architectures become more software-defined and sensor-dependent, smart bumpers are anticipated to play a central role in achieving holistic situational awareness and regulatory compliance in future mobility solutions.

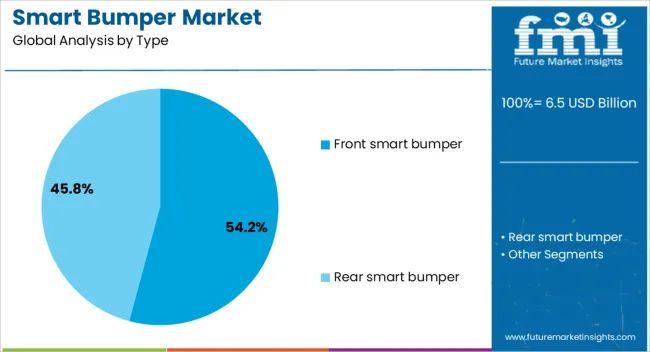

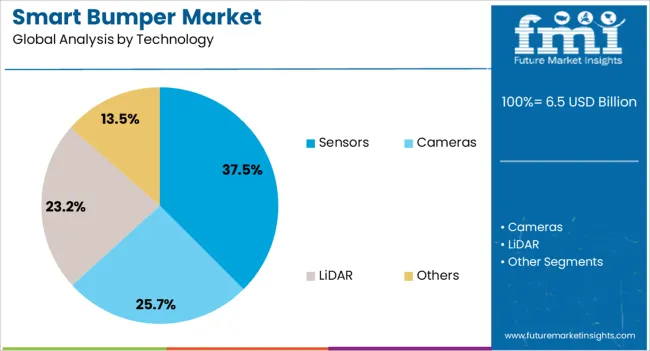

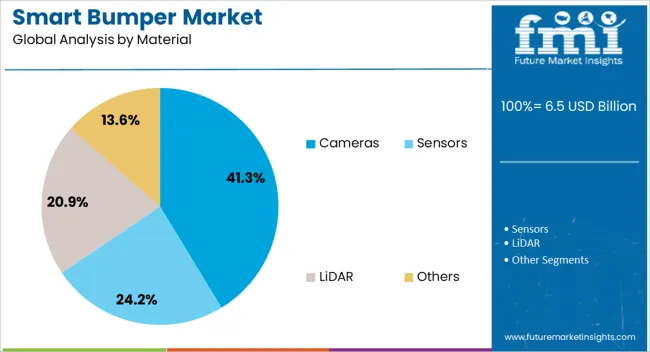

The smart bumper market is segmented by type, technology, material, vehicle type, sales channel, and geographic regions. By type, the smart bumper market is divided into Front smart bumpers and Rear smart bumpers. In terms of technology, the smart bumper market is classified into Sensors, Cameras, LiDAR, and Others. Based on the material, the smart bumper market is segmented into Cameras, Sensors, LiDAR, and Others.

By vehicle type, the smart bumper market is segmented into Passenger vehicles and Commercial vehicles. By sales channel, the smart bumper market is segmented into OEM and Aftermarket. Regionally, the smart bumper industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The front smart bumper segment is expected to contribute 54.2% of the total revenue in the smart bumper market in 2025, reflecting its critical role in forward-facing safety and perception functionalities. This segment’s leading position is being supported by the concentration of risk and decision-making at the vehicle’s frontal zone, where most driving and collision scenarios originate.

The adoption of forward-looking radar, LiDAR, ultrasonic sensors, and thermal imaging systems has been most prominent in front bumper modules due to their strategic placement for early object detection. Automakers have focused on embedding software-driven sensory systems into the front bumper to enable adaptive cruise control, autonomous emergency braking, and pedestrian recognition features.

The segment has further benefited from its integration with vehicle ECUs and real-time decision systems, offering dynamic responsiveness in diverse driving environments. As regulatory mandates increasingly require front-facing safety capabilities, and autonomous driving prototypes demand multi-modal sensor alignment, the front smart bumper is poised to maintain its dominance in next-generation vehicle platforms.

The sensors segment is projected to hold 37.5% of the overall revenue share in the smart bumper market in 2025, driven by its foundational role in enabling real-time data acquisition and environmental interaction. The inclusion of radar, ultrasonic, and proximity sensors in smart bumpers has become essential for delivering low-latency inputs to support advanced driving decisions.

These sensors are being deployed to detect static and dynamic obstacles, calculate safe distances, and trigger autonomous responses under varying environmental conditions. The segment’s growth is being fueled by the miniaturization of sensor hardware and improvements in power efficiency, allowing seamless embedding into bumper structures without compromising design or safety standards.

Continuous firmware updates and integration with vehicle telematics have allowed sensor-based systems to adapt to evolving use cases and regulatory changes. The rising focus on predictive safety and cross-traffic awareness, particularly in urban and congested zones, is reinforcing the importance of sensor technologies within the smart bumper ecosystem.

The cameras segment is anticipated to contribute 41.3% of the total revenue in the smart bumper market in 2025, underscoring its expanding utility in vision-based automotive systems. High-definition cameras are increasingly being integrated into bumper assemblies to capture wide-angle views and deliver real-time imaging for autonomous navigation, object classification, and driver-assist features. The segment’s momentum is being driven by advancements in image processing, dynamic range enhancement, and AI-based visual analytics.

Camera modules embedded within smart bumpers are enabling vehicles to perform lane recognition, traffic sign interpretation, and pedestrian detection with high precision. As demand grows for 360-degree situational awareness and augmented driver interfaces, bumper-mounted cameras are playing a pivotal role in delivering seamless visual inputs to central processing units.

Integration with deep learning models and vehicle perception stacks has positioned cameras as critical enablers of semi-autonomous and autonomous functionality. Regulatory encouragement for visual documentation in crash scenarios and driver monitoring has further accelerated adoption across vehicle classes.

The market has been gaining momentum due to advancements in automotive safety, connectivity, and lightweight materials. These bumpers, embedded with sensors, cameras, and energy-absorbing structures, have been designed to improve collision detection, pedestrian safety, and vehicle performance. Growing adoption of autonomous driving systems and stringent safety regulations has reinforced the use of intelligent bumpers across passenger and commercial vehicles. Integration with advanced driver-assistance systems has enhanced accident prevention, while innovations in material design and digital technology have driven global adoption of smart bumpers.

The market has been significantly influenced by stringent global vehicle safety regulations that require improved crashworthiness and pedestrian protection. Smart bumpers have been equipped with sensors, radar, and vision systems to detect collisions, mitigate impact, and protect vulnerable road users. Automotive regulatory bodies across Europe, Asia, and North America have introduced stricter crash test standards and pedestrian safety requirements, which have accelerated the adoption of advanced bumper technologies. These intelligent systems have enabled compliance with evolving safety frameworks while improving accident prevention. With rising road accident concerns and governmental support for smart safety technologies, demand for advanced bumpers has been reinforced across global automotive markets, making them a crucial component in modern vehicle design.

Integration with autonomous driving and connected vehicle systems has been a major factor driving the market. Smart bumpers have been developed to function as a key interface for advanced driver-assistance systems by incorporating radar, lidar, ultrasonic sensors, and cameras. These systems have enabled vehicles to detect pedestrians, cyclists, and obstacles with greater precision, ensuring enhanced safety during autonomous navigation. Connectivity with vehicle-to-everything communication platforms has allowed smart bumpers to transmit real-time collision data and support predictive driving technologies. As automakers have increased investment in self-driving capabilities and intelligent mobility solutions, smart bumpers have been positioned as essential components of future vehicle architectures. This synergy between connected technologies and safety functions has reinforced market expansion.

The market has been supported by continuous advancements in lightweight materials and energy-absorbing structures. Composite materials, thermoplastics, and aluminum alloys have been increasingly employed in bumper designs to improve strength while reducing overall vehicle weight. These innovations have enabled better energy absorption during impacts, enhancing both passenger and pedestrian safety. The integration of structural reinforcements and collapsible designs has further improved crash performance without compromising aesthetics or aerodynamics. Automakers have also focused on developing recyclable and eco-friendly materials to meet environmental standards while reducing manufacturing costs. These material advancements have not only optimized bumper efficiency but also enhanced vehicle fuel economy and overall performance, ensuring wider adoption of smart bumper technologies across diverse vehicle categories globally.

Despite advancements, the market has faced challenges related to cost, system integration, and aftermarket acceptance. The incorporation of advanced sensors, embedded electronics, and structural materials has increased production and installation costs, particularly for mass-market vehicles. Integrating bumper systems with complex electronic architectures, autonomous navigation modules, and connectivity platforms has required significant technical expertise and testing. Furthermore, aftermarket repair and maintenance of smart bumpers have been costly due to the need for sensor recalibration and component replacement. Regulatory compliance testing has also added to the cost burden for manufacturers. These factors have limited large-scale adoption in lower-cost vehicle segments. However, ongoing research in cost-efficient designs, modular sensor placement, and standardized architectures has been aimed at overcoming these challenges, ensuring the long-term viability of smart bumpers in global markets.

| Countries | CAGR |

|---|---|

| China | 11.2% |

| India | 10.4% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.9% |

| USA | 7.1% |

| Brazil | 6.2% |

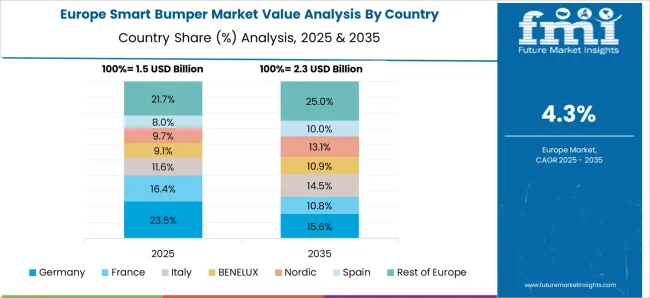

The market is projected to grow at a CAGR of 8.3% from 2025 to 2035, propelled by mandates for advanced safety, ADAS adoption, and integration of sensors, radars, and impact-mitigation materials. China leads with an 11.2% CAGR, engineering high-volume platforms that embed collision detection and pedestrian protection. India follows at 10.4%, integrating cost-optimized electronics as passenger car demand and local electronics manufacturing rise. Germany grows at 9.5%, innovating premium systems that fuse radar, cameras, and lightweight composites. The UK, at 7.9%, advances compliance-driven upgrades across new models and retrofits. The USA, at 7.1%, benefits from steady deployment of connected safety features across pickup, SUV, and fleet segments, supported by Tier-1 supplier ecosystems and ongoing software updates. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to expand at a CAGR of 11.2%, supported by the rapid adoption of advanced driver assistance systems. Automotive manufacturers are integrating smart sensors, radar, and camera systems into bumper designs to improve safety and collision avoidance. Government regulations promoting vehicle safety standards enhance the adoption of smart bumpers across passenger and commercial vehicles. The growing domestic automotive industry, coupled with technological investments in autonomous and connected vehicles, accelerates market expansion. Continuous development in material science and integration of lightweight composites contribute to durability and efficiency. Increasing demand for intelligent mobility solutions positions China as a leading hub for smart bumper production and innovation.

India is expected to grow at a CAGR of 10.4%, driven by rising safety awareness and regulatory compliance. Automakers are focusing on incorporating sensor-based technologies to improve driver assistance and pedestrian safety. Domestic vehicle production growth combined with rising consumer preference for premium vehicles supports market expansion. Collaborations between automotive companies and technology providers facilitate the development of advanced bumper systems suited to local conditions. Increasing government support for road safety initiatives provides further momentum. Long-term growth is reinforced by demand for connected vehicles and the push for enhanced automotive safety features across the Indian market.

Germany is anticipated to grow at a CAGR of 9.5%, supported by strong demand for advanced automotive safety solutions. German automakers are at the forefront of integrating radar, lidar, and camera-based systems within bumper structures. Stringent vehicle safety standards and environmental regulations drive innovation in lightweight and recyclable materials. Market growth is reinforced by increasing investment in autonomous and connected vehicle technologies. Collaboration between automakers, research institutions, and technology companies ensures continued development of high-performance smart bumper systems. Germany’s role as a leading automotive manufacturing hub provides consistent opportunities for both domestic consumption and international exports.

The United Kingdom Market is projected to expand at a CAGR of 7.9%, supported by regulatory frameworks promoting advanced vehicle safety. Automakers are integrating pedestrian detection systems and impact mitigation features within smart bumpers to enhance safety. The adoption of connected and semi-autonomous vehicles further drives demand. Continuous research collaborations between domestic automotive firms and global technology providers strengthen innovation. Government incentives supporting road safety initiatives and consumer demand for technologically advanced vehicles contribute to growth. The focus on next-generation mobility solutions positions the United Kingdom as a growing market for smart bumper technologies.

The United States Market is anticipated to grow at a CAGR of 7.1%, fueled by the expansion of autonomous and connected vehicle technologies. Automakers are increasingly integrating advanced sensors, cameras, and energy-absorbing materials in bumper systems to enhance safety and performance. Federal initiatives promoting vehicle safety standards and emission reduction strategies support adoption. Market growth is reinforced by rising demand for electric and hybrid vehicles equipped with advanced safety features. Collaborative projects between automotive manufacturers and technology firms accelerate the development of innovative bumper solutions tailored to the domestic market. The growing consumer shift toward smart and connected mobility solutions further supports long-term adoption.

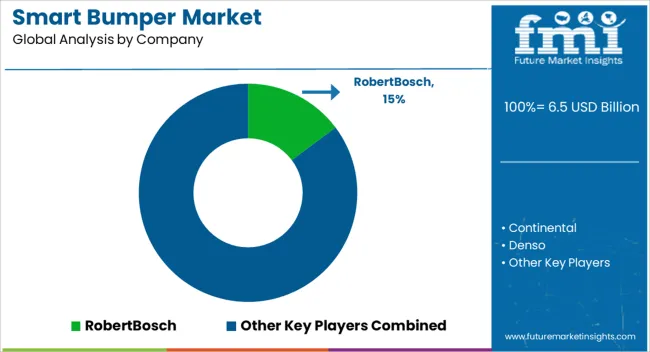

The market is expanding as automakers and component manufacturers integrate advanced electronics, sensors, and safety systems into bumper designs to improve vehicle intelligence and passenger protection. Robert Bosch, Continental, Denso, Valeo, Forvia, and ZF Friedrichshafen are among the global leaders driving this innovation, leveraging their expertise in automotive electronics and safety technologies. Their smart bumper solutions combine radar, lidar, and camera-based systems with adaptive materials to enable collision detection, pedestrian safety, and enhanced crash management functions.

Hyundai Mobis and Hyundai are strengthening their positions by embedding smart bumper technologies into next-generation vehicle platforms, supporting both electric and autonomous vehicle ecosystems. Their focus lies in integrating sensors with lightweight bumper materials and digital control systems, ensuring seamless communication between onboard electronics and external infrastructure. Specialized lighting and component suppliers such as Hella and Koito Manufacturing contribute by enhancing sensor visibility, durability, and performance through advanced optical technologies. Their solutions ensure that smart bumpers function reliably in varying environmental conditions, from low light to adverse weather.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.5 Billion |

| Type | Front smart bumper and Rear smart bumper |

| Technology | Sensors, Cameras, LiDAR, and Others |

| Material | Cameras, Sensors, LiDAR, and Others |

| Vehicle Type | Passenger vehicles and Commercial vehicles |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | RobertBosch, Continental, Denso, Valeo, Forvia, ZFriedrichshafen, HyundaiMobis, Hella, KoitoManufacturing, and Hyundai |

| Additional Attributes | Dollar sales by bumper type and vehicle category, demand dynamics across passenger and commercial vehicles, regional trends in adoption of advanced safety features, innovation in sensor integration, lightweight materials, and energy absorption, environmental impact of manufacturing and recycling, and emerging use cases in connected vehicles and autonomous driving systems. |

The global smart bumper market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the smart bumper market is projected to reach USD 14.4 billion by 2035.

The smart bumper market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in smart bumper market are front smart bumper and rear smart bumper.

In terms of technology, sensors segment to command 37.5% share in the smart bumper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair Market Forecast and Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Smart Doorbell Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA