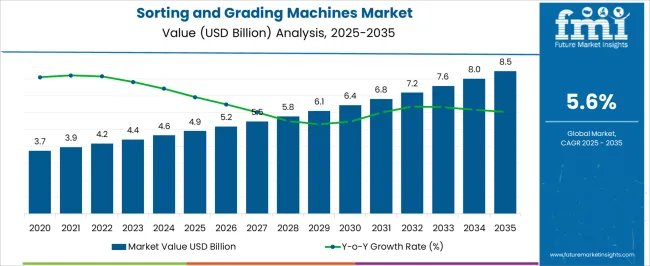

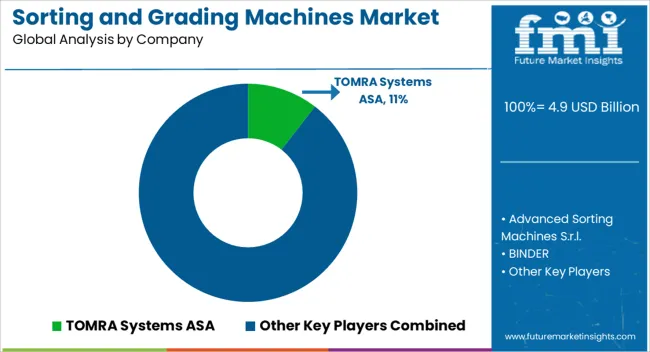

The sorting and grading machines market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 8.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The sorting and grading machines market is projected at USD 4.9 billion in 2025 and is anticipated to reach USD 8.5 billion by 2035, representing a CAGR of 5.6%. This absolute dollar opportunity highlights the growing importance of automated precision systems in industries where quality, uniformity, and efficiency are central. It is being observed that manufacturers in agriculture, food processing, mining, and recycling are steadily investing in sorting and grading equipment to minimize waste, maximize yield, and ensure compliance with strict quality standards. From an opinionated standpoint, this growth reflects how industries are moving towards dependable, scalable systems that optimize throughput and reduce manual error. With the market moving from under USD 5 billion to over USD 8 billion, the value creation lies in consistent integration of optical, mechanical, and digital solutions across critical applications.

By 2035, the sorting and grading machines market will likely stand as a more indispensable part of production and supply chains, with its valuation reaching USD 8.5 billion. This CAGR of 5.6% demonstrates a balanced expansion, underpinned by strong demand in agricultural sectors for crop handling, in logistics for packaging, and in mining for raw material refinement. In my opinion, the market is being propelled by a need for accuracy, efficiency, and throughput, rather than reliance on unpredictable manual systems. The absolute dollar opportunity over the decade signifies the market’s role in enabling industries to remain competitive through process efficiency and better yield management. As adoption deepens, sorting and grading machines are expected to be viewed less as optional investments and more as critical infrastructure in production ecosystems.

The sorting and grading machines market commands a notable position across its parent industries due to its role in accuracy, quality assurance, and throughput enhancement. Within the agricultural equipment market, sorting and grading systems hold nearly 20-22% share, as they are essential in classifying grains, fruits, and vegetables by size, weight, and quality. In the food processing equipment market, these machines account for 25-28%, since food producers heavily rely on them to meet regulatory compliance and consumer expectations.

In the industrial machinery market, they represent close to 12-15%, reflecting their growing adoption for standardization in raw materials and manufactured parts. Within the packaging machinery market, sorting and grading machines contribute around 18-20% of the share, driven by the need for precise categorization before automated packaging. The recycling equipment market records almost 22-24% share, as these machines play a critical role in separating plastics, metals, and other materials for reuse.

These percentages highlight how indispensable sorting and grading systems have become in maintaining efficiency and reducing human dependency in high-volume operations. Although concerns around operational costs and machine calibration persist, their integration into diverse industries demonstrates their irreplaceable nature. It is my opinion that the market’s trajectory shows a widening relevance, as industries that depend on consistency and regulatory compliance continue to rely on automated sorting and grading solutions to safeguard product quality and operational trust.

| Metric | Value |

|---|---|

| Sorting and Grading Machines Market Estimated Value in (2025 E) | USD 4.9 billion |

| Sorting and Grading Machines Market Forecast Value in (2035 F) | USD 8.5 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The sorting and grading machines market is experiencing steady expansion, supported by increasing automation in food processing, agriculture, and manufacturing industries. Industry publications and company press releases have highlighted that technological advancements, such as AI-enabled sorting and real-time defect detection, are enhancing operational efficiency and product quality. Rising global demand for uniform product standards in both domestic and export markets has further driven adoption.

Additionally, manufacturers are investing in machinery with higher accuracy, faster throughput, and reduced operational costs, aligning with the needs of large-scale production facilities. Government initiatives promoting modernization in agricultural processing, alongside stricter quality control regulations, are boosting demand. With the integration of sensor-based technologies and advanced vision systems, the market is expected to maintain a strong growth trajectory over the coming years.

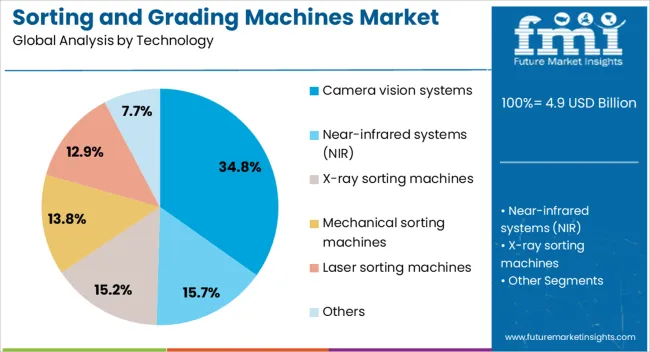

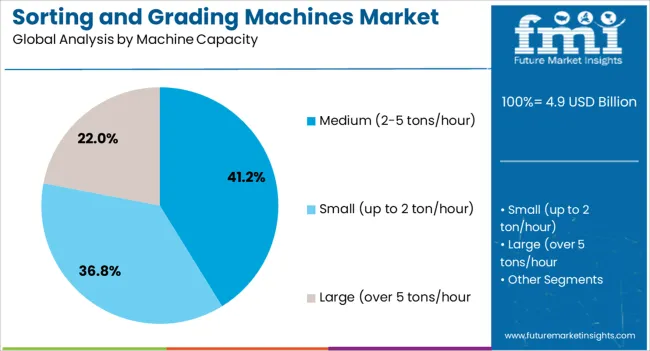

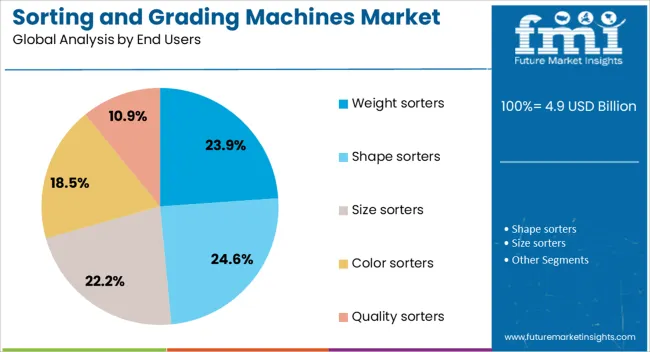

The sorting and grading machines market is segmented by technology, machine capacity, end users, application, distribution channel, and geographic regions. By technology, sorting and grading machines market is divided into camera vision systems, near-infrared systems (NIR), X-ray sorting machines, mechanical sorting machines, laser sorting machines, and others. In terms of machine capacity, sorting and grading machines market is classified into medium (2-5 tons/hour), small (up to 2 ton/hour), and large (over 5 tons/hour. Based on end users, sorting and grading machines market is segmented into weight sorters, shape sorters, size sorters, color sorters, quality sorters, defect sorters, material detects sorters, specialty sorter & graders, and others (Acoustic sorters, density sorters, gravity separators, etc.). By application, sorting and grading machines market is segmented into agriculture, food & beverage, mining & minerals, recycling, pharmaceuticals, and others (e.g. textile, timber). By distribution channel, sorting and grading machines market is segmented into direct sales and indirect sales. Regionally, the sorting and grading machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The camera vision systems segment is projected to contribute 34.8% of the sorting and grading machines market revenue in 2025, making it the leading technology segment. Growth in this category is driven by its ability to deliver high-speed, accurate detection of defects, size, color, and shape. Industries such as food processing and packaging have increasingly relied on camera vision solutions to minimize human error and maintain product consistency. The integration of machine learning algorithms has enhanced these systems’ adaptability, enabling real-time adjustments to sorting parameters. Furthermore, camera vision systems offer the flexibility to handle a variety of product types without significant reconfiguration, making them cost-effective over the long term. As manufacturers prioritize precision, efficiency, and compliance with international quality standards, the Camera Vision Systems segment is expected to sustain its leadership.

The medium (2-5 tons/hour) segment is projected to hold 41.2% of the sorting and grading machines market revenue in 2025, maintaining its dominance in machine capacity. This capacity range has gained favor for its balance between throughput and operational flexibility, making it suitable for mid-scale producers in agriculture, seafood, and manufacturing sectors. Medium-capacity machines are often designed to provide high accuracy while minimizing energy consumption, aligning with operational cost optimization goals. They also offer scalability, allowing producers to handle seasonal or fluctuating production volumes efficiently. Manufacturers have been increasingly developing medium-capacity models with modular components, enabling upgrades or process-specific customization. The versatility and cost-efficiency of these systems have positioned them as the preferred choice for facilities seeking to combine performance with manageable infrastructure requirements.

The weight sorters segment is projected to account for 23.9% of the sorting and grading machines market revenue in 2025, representing a significant portion of end-user adoption. These machines have become essential in industries where product weight directly influences pricing, packaging, and regulatory compliance, such as seafood, poultry, and fresh produce. The appeal of weight sorters lies in their ability to deliver precise and consistent weight-based classification, reducing giveaway and ensuring adherence to quality standards. Recent innovations have introduced faster weighing sensors and automated calibration features, increasing efficiency while minimizing downtime. Additionally, weight sorters integrate well with downstream packaging and labeling systems, creating a seamless processing workflow. As industries continue to focus on waste reduction and operational precision, the Weight Sorters segment is expected to maintain steady growth.

The sorting and grading machines market is expanding as industries seek precision, automation, and compliance with quality standards. Opportunities are significant in agriculture and food processing, with AI-powered and vision-based systems driving modern trends. However, high costs and technical complexities challenge broader adoption. Overall, the market outlook remains positive, fueled by the need for efficiency, standardization, and advanced quality control solutions across global industries.

The sorting and grading machines market is experiencing strong demand driven by industries prioritizing precision, consistency, and efficiency in product quality management. Agriculture, food processing, pharmaceuticals, and recycling sectors increasingly adopt these machines to reduce human error, ensure compliance with quality standards, and boost productivity. Growing consumer awareness about food safety and strict government regulations further push adoption. The capacity of these machines to deliver high-speed, reliable, and uniform product classification is shaping demand, especially in bulk production environments requiring accuracy and operational consistency.

Significant opportunities are arising from the agricultural and food processing sectors, where demand for automated grading is increasing to handle larger harvests and packaging volumes. Farmers and processors are turning to advanced machines that grade fruits, vegetables, grains, and packaged food products based on size, color, and weight. Expanding export trade and the need for standardization across global markets strengthen adoption prospects. Suppliers offering customized, cost-effective, and integrated grading solutions that cater to diverse crops and processed foods are poised to capture growth in both developed and emerging markets.

The market is witnessing a clear trend toward AI-powered and vision-based systems that enhance accuracy, reduce waste, and improve throughput. Machine learning algorithms and advanced imaging technologies allow real-time analysis, ensuring precise detection of defects or irregularities. Food and recycling industries are particularly investing in these technologies to meet quality benchmarks while reducing reliance on manual labor. Compact and modular designs with easy integration into existing production lines are becoming popular, further shaping the trend toward smarter, highly adaptable sorting and grading solutions.

One of the major challenges in this market lies in the high initial investment and ongoing technical complexities associated with operation and maintenance. Small and medium-scale enterprises may find the cost of advanced systems prohibitive, delaying adoption. Moreover, the need for skilled operators and frequent software upgrades can create operational hurdles. Integration with legacy systems is also a recurring issue for many industries. Vendors must focus on affordable solutions, simplified user interfaces, and robust after-sales support to overcome these barriers and drive wider adoption.

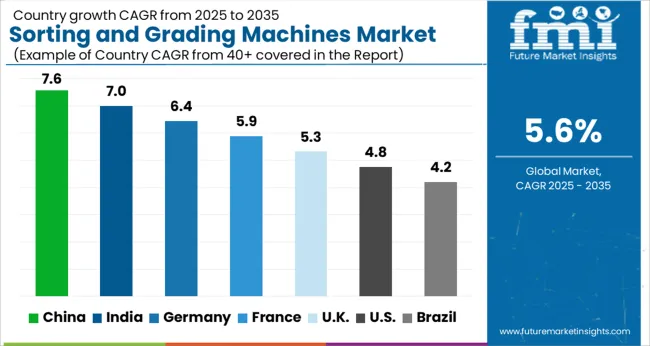

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The global sorting and grading machines market is projected to grow at a CAGR of 5.6% between 2025 and 2035. China leads with 7.6% growth, followed by India at 7%, and Germany at 6.4%. The UK and USA trail slightly behind with growth rates of 5.3% and 4.8%, respectively. Demand is driven by the need for automation in food processing, agriculture, and manufacturing sectors.

Emerging economies such as China and India experience rapid adoption due to rising agricultural exports and demand for efficiency in crop handling. Meanwhile, developed markets like Germany, the UK, and the USA are emphasizing precision, automation, and digital integration for higher productivity and quality control. The outlook remains favorable as food safety regulations, supply chain efficiency, and labor optimization drive market expansion globally. This report includes insights on 40+ countries; the top markets are shown here for reference.

The sorting and grading machines market in China is expected to grow at a CAGR of 7.6%. Growth is strongly driven by the country’s dominance in agricultural production and its focus on efficiency in food processing. Large-scale adoption is observed in grain, fruit, and vegetable sorting, where automated systems enhance speed and reduce waste.

The expansion of domestic consumption and export markets supports consistent demand. Moreover, China’s investment in intelligent and AI-driven sorting systems reflects its push toward industrial modernization. With strong government support for agricultural modernization and rising labor costs, automation in sorting and grading is expected to accelerate further.

The sorting and grading machines market in India is forecasted to grow at a CAGR of 7%. Expansion is supported by the country’s rapidly growing agricultural sector and rising export of fresh produce. The demand for better post-harvest handling, improved packaging, and compliance with international quality standards drives adoption.

India is witnessing growing usage of automated machines in food processing, grain milling, and fruit grading. The government’s support through agricultural mechanization programs enhances affordability and penetration. As consumer demand for processed and packaged food increases, Indian companies are investing in advanced grading machines to meet quality expectations and minimize losses across supply chains.

The sorting and grading machines market in Germany is projected to expand at a CAGR of 6.4%. Growth is shaped by the country’s advanced manufacturing base, high-quality food processing industry, and demand for automation. German companies emphasize precision engineering and integration of AI for product quality consistency.

Rising labor costs and strict food safety regulations accelerate adoption of advanced systems. The agricultural sector, particularly in fruits, grains, and dairy, benefits from efficient sorting and grading solutions. Additionally, German equipment is exported widely, influencing global standards. With emphasis on productivity and compliance with European regulations, adoption in both domestic and export-oriented industries is robust.

The sorting and grading machines market in the United Kingdom is expected to grow at a CAGR of 5.3%. The UK market is influenced by demand in the food and beverage industry, where automation ensures compliance with food safety regulations. Fruit and vegetable processing plants increasingly adopt advanced grading machines to optimize throughput and meet retailer quality standards.

The rise of e-commerce grocery distribution and retail chains further enhances the need for precision sorting to reduce returns and waste. Focus on digital integration and remote monitoring solutions strengthens competitiveness. Despite moderate growth compared to emerging economies, steady industrial modernization supports long-term demand.

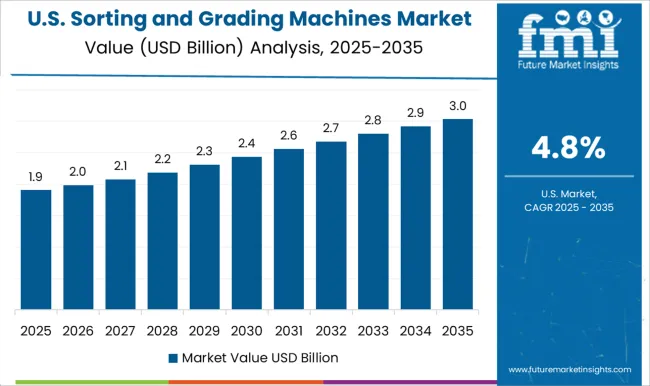

The sorting and grading machines market in the United States is forecasted to grow at a CAGR of 4.8%. Growth is primarily influenced by the large-scale food processing industry and emphasis on automation to reduce operational costs. Adoption is widespread across grain handling, meat processing, and fresh produce packaging. Rising demand for traceability and compliance with USDA and FDA standards enhances the need for precision systems.

Companies are investing in advanced AI-driven grading machines for better accuracy and consistency. Expansion of e-commerce grocery channels and focus on supply chain optimization continue to strengthen equipment adoption in the USA

The sorting and grading machines market is led by players such as TOMRA Systems ASA, Bühler AG, and Satake Corporation, who compete by positioning themselves as precision-driven solution providers for food, agriculture, and industrial applications. Their brochures emphasize optical sensors, real-time data analysis, and reduced waste, appealing to buyers seeking efficiency and consistency.

Advanced Sorting Machines S.r.l., Compac Sorting Equipment Ltd., and GREEFA highlight their competitive edge in fruit and vegetable handling, often focusing on gentle product treatment and throughput reliability. Strategies are centered around automation, customization, and performance credibility to differentiate in a segment where quality assurance remains a priority. Competitors like Key Technology, Inc., Raytec Vision S.p.A., and Sesotec GmbH market themselves through innovation in detection technologies, highlighting infrared, X-ray, and AI-driven sorting in their brochures.

FOSS Analytical A/S, Meyer Optoelectronic Technology Inc., and Newtec A/S stress laboratory-grade accuracy applied to large-scale operations, gaining trust among food processors and manufacturers. Daewon GSI Co., Ltd., BINDER, and Cimbria A/S contribute by targeting niche segments, combining durability with adaptable designs.

Brochures across the industry are crafted to underline value in reduced labor costs, improved yield, and compliance with safety standards. With rising expectations for precision and consistency, the market competition thrives on technological credibility and strong product positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.9 billion |

| Technology | Camera vision systems, Near-infrared systems (NIR), X-ray sorting machines, Mechanical sorting machines, Laser sorting machines, and Others |

| Machine Capacity | Medium (2-5 tons/hour), Small (up to 2 ton/hour), and Large (over 5 tons/hour |

| End Users | Weight sorters, Shape sorters, Size sorters, Color sorters, Quality sorters, Defect sorters, Material detects sorters, Specialty Sorter & Graders, and Others (Acoustic sorters, density sorters, gravity separators, etc.) |

| Application | Agriculture, Food & beverage, Mining & minerals, Recycling, Pharmaceuticals, and Others (e.g. textile, timber) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TOMRA Systems ASA, Advanced Sorting Machines S.r.l., BINDER, Bühler AG, Cimbria A/S, Compac Sorting Equipment Ltd., Daewon GSI Co., Ltd., FOSS Analytical A/S, GREEFA, Key Technology, Inc., Meyer Optoelectronic Technology Inc., Newtec A/S, Raytec Vision S.p.A., Satake Corporation, and Sesotec GmbH |

| Additional Attributes | Dollar sales by machine type (optical, weight-based, size-based, texture-based) and application (food, agriculture, mining, recycling) are key metrics. Trends include rising demand for automated quality control, growth in food safety compliance, and adoption in high-volume processing industries. Regional adoption, technological advancements, and efficiency-driven requirements are driving market growth. |

The global sorting and grading machines market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the sorting and grading machines market is projected to reach USD 8.5 billion by 2035.

The sorting and grading machines market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in sorting and grading machines market are camera vision systems, near-infrared systems (nir), x-ray sorting machines, mechanical sorting machines, laser sorting machines and others.

In terms of machine capacity, medium (2-5 tons/hour) segment to command 41.2% share in the sorting and grading machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sorting Hampers Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Cell Sorting Market Share Analysis: Global Industry Analysis and Opportunity Assessment 2025 to 2035

Cash Sorting Machines Market

AI Waste Sorting Robots Market Forecast and Outlook 2025 to 2035

Vegetable Sorting Machine Market Analysis by Processing Capacity, Technology, Operation Type, Vegetable Type, and Region Through 2035

Fluorescence-Activated Cell Sorting Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA