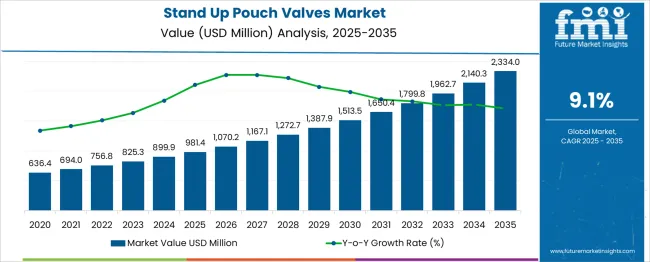

The Stand-Up Pouch Valves Market is estimated to be valued at USD 981.4 million in 2025 and is projected to reach USD 2334.0 million by 2035, registering a compound annual growth rate (CAGR) of 9.1% over the forecast period. This expansion signifies a cumulative gain of USD 1,352.6 million over the decade. To evaluate the Growth Contribution Index (GCI), each year’s contribution to this absolute gain is assessed to identify periods of more intense growth activity.

The years 2025 to 2028 show a combined increase of USD 291.3 million, accounting for nearly 21.5% of the total decade gain. This indicates a foundational buildup phase with moderate contributions to cumulative growth. The period from 2028 to 2031 marks an upward shift, contributing USD 363.3 million, or around 26.9% of the total gain. This interval suggests increasing demand momentum and higher sectoral contribution, likely due to rising applications in food and beverage packaging.

Between 2031 and 2035, the market experiences a surge, expanding by USD 698.0 million, equating to roughly 51.6% of the total growth. This late-phase escalation highlights peak contribution and intensified market activity, implying greater adoption of pouch-based dispensing formats. The GCI reveals a back-loaded growth curve, with the majority of market value addition occurring in the second half of the forecast window, driven by accelerated commercial acceptance and volume scalability.

| Metric | Value |

|---|---|

| Stand-Up Pouch Valves Market Estimated Value in (2025 E) | USD 981.4 million |

| Stand-Up Pouch Valves Market Forecast Value in (2035 F) | USD 2334.0 million |

| Forecast CAGR (2025 to 2035) | 9.1% |

The stand up pouch valves market is expanding steadily, driven by the evolution of packaging technologies, demand for extended shelf life, and brand emphasis on functional, consumer-friendly formats. Manufacturers are prioritizing convenience, leak-proof design, and waste reduction, making pouch valves an essential component in flexible packaging systems.

Advancements in high-speed pouching lines and compatibility with lightweight barrier materials have enabled broader adoption in food, beverage, and household product categories. As brands shift toward recyclable, mono-material pouches, valve design has become more integral to overall sustainability objectives.

Regulatory pressures on single-use plastic and increased interest in product freshness, resealability, and spill control are encouraging innovation across valve formats. Continued investment in automation and custom engineering solutions for form-fill-seal (FFS) systems is expected to enhance market efficiency and scalability in the near term.

The stand-up pouch valves market is segmented by product, technique, seal material, end-use, and geographic regions. By product, the stand-up pouch valves market is divided into Corner valve and Front valve. In terms of technique, the stand-up pouch valves market is classified into FFS (Form, fill & seal) and Preform.

Based on seal material, the stand-up pouch valves market is segmented into those without aluminum foil and those with aluminum foil. The end-use of the stand-up pouch valves market is segmented into Food & beverages, Mayonnaise, Ketchup, Beverages, Others, Household & personal care, Shampoo, Liquid soap, Detergent & softeners, Industrial, Others (Pharmaceutics, agriculture).

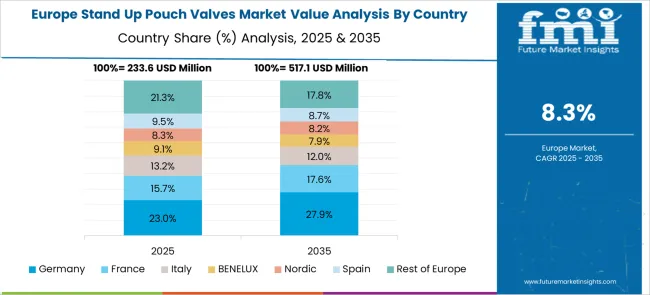

Regionally, the stand-up pouch valves industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

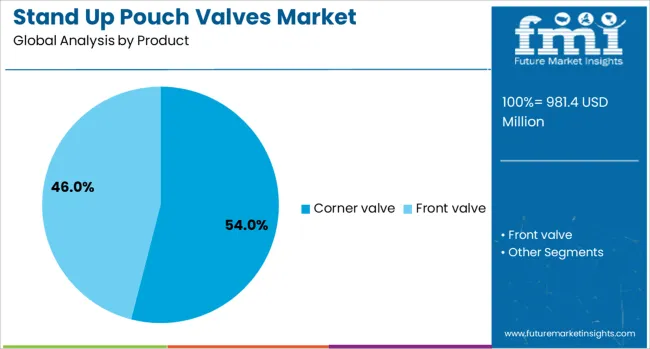

Corner valves are expected to lead the product segment in 2025, contributing 54.0% of the total market revenue. Their dominance is being driven by enhanced user convenience, ergonomic dispensing, and their ability to support clean and precise pouring across diverse liquid and semi-liquid products.

Placement at the pouch corner allows for optimal gravity-based flow, which is especially beneficial in consumer-packaged goods. The configuration is compatible with tamper-evident and reclosable technologies, supporting both safety and reusability.

In addition, brands have favored corner valves for their minimal impact on pouch aesthetics and ability to be easily integrated into automated pouching lines. This has reinforced their usage in foodservice, baby care, and beverage applications, where consumer interaction and shelf presentation are both critical.

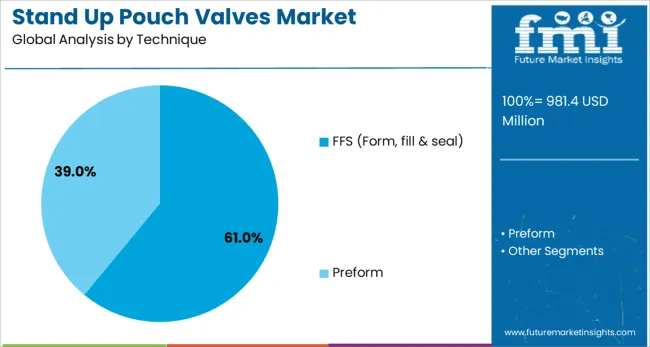

The form, fill & seal (FFS) segment is projected to capture 61.0% of the total market share by 2025, making it the leading technique used for stand up pouch valves. The preference for FFS stems from its efficiency, reduced operational costs, and high throughput, particularly in large-volume packaging environments.

The method allows for in-line integration of valve insertion during pouch formation, minimizing handling and contamination risk. Its compatibility with a variety of film structures and sealing mechanisms has expanded its adoption in industries demanding extended product shelf life and leak resistance.

As manufacturers scale up to meet demand with speed and flexibility, FFS technology remains the backbone of automated pouch production, especially for products with fluidic properties that benefit from precise, valve-controlled dispensing.

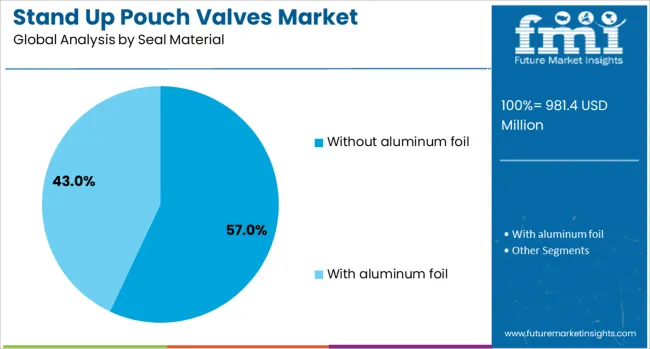

Pouches using seal materials without aluminum foil are forecast to dominate with 57.0% of market share in 2025. This shift is being influenced by growing environmental concerns and brand commitments to reduce carbon footprints.

Non-foil materials offer enhanced recyclability and are increasingly engineered to provide high-barrier performance without compromising product protection. Brands targeting circular economy goals are phasing out aluminum due to its challenges in curbside recycling and energy-intensive production.

Advances in polymer-based multi-layer films have enabled the development of sealable laminates that meet both durability and regulatory safety standards. Additionally, the elimination of foil simplifies pouch construction, allowing faster production and lower overall material costs an advantage that aligns with both sustainability and operational efficiency imperatives.

The market has grown as manufacturers have prioritized functionality, product protection, and consumer convenience in flexible packaging. These valves have been integrated into pouches for products that require controlled dispensing, resealing, or venting, including food, beverages, cleaning agents, and personal care formulations. The shift from rigid to flexible formats has increased the need for valve components that support mess-free usage and extend product shelf life. Pouch manufacturers have selected valve systems that maintain package integrity during transport and offer compatibility with high-speed filling lines. Valves have been adapted to pouch barrier materials, formats, and closure types, allowing brands to differentiate packaging while meeting performance standards.

Food and beverage packaging has accounted for a significant share of stand up pouch valve adoption due to its need for portion control, freshness preservation, and tamper resistance. Spouted pouches with built-in valves have been widely used for sauces, baby food, yogurt, and energy gels. These configurations have allowed consumers to reseal partially consumed contents, enhancing convenience and reducing waste. In beverage packaging, valve-equipped pouches have replaced traditional bottles or cartons in juice, cocktail mixers, and functional drink categories. Aseptic filling technologies have enabled integration of sterile valves without compromising hygiene or taste. Brands have selected child-safe, anti-drip, or directional flow valves depending on product viscosity and usage. These features have supported product differentiation in competitive grocery and on-the-go channels.

Valve suppliers have developed diverse shapes, flow profiles, and sealing mechanisms to ensure compatibility with pouch geometry, closure types, and filling technologies. Customization has been critical as brands have sought unique dispensing experiences and enhanced visual appeal. Low-profile valves have been used for single-serve products where space constraints are a concern. High-flow valves have supported thick or chunky formulations, while tamper-evident variants have addressed safety concerns in retail. Pouch manufacturers have emphasized compatibility with ultrasonic sealing, heat sealing, and spout welding methods to reduce production defects. Equipment suppliers have synchronized valve installation with pouch forming, filling, and sealing processes. This has enabled streamlined packaging operations and reduced cycle times.

Stand up pouch valves have gained traction in non-food sectors, particularly in household cleaning, automotive fluids, gardening solutions, and cosmetics. These applications have benefited from spill-proof, multi-use pouches that can be stored or carried without leakage. Valve-equipped pouches have replaced rigid containers to reduce storage footprint, weight, and packaging waste. Cleanroom-grade valves have been developed for personal care and pharmaceutical liquids to prevent contamination during dispensing. Valves with directional flow control or twist-lock closures have improved safety and ease of use in chemical applications. Demand has been shaped by shifting preferences toward refill packs and product refills. These formats have allowed brands to enhance brand engagement and user experience.

Valve producers have responded to increasing manufacturing integration by designing components that are easier to install and compatible with automation equipment. This has helped lower installation defects and ensure seal integrity. Lightweight valve designs have been introduced to reduce material usage and improve pouch recyclability. Manufacturers have aimed to standardize dimensions while offering multiple dispensing functionalities, enabling economies of scale. However, cost pressures from rising resin prices and energy costs have pushed converters to optimize valve sourcing and material formulation. Use of recyclable materials and mono-material pouches with integrated valves has gained attention to address post-use recovery concerns. As converters aim to meet stringent performance and cost targets, valve suppliers have been compelled to refine design and production processes.

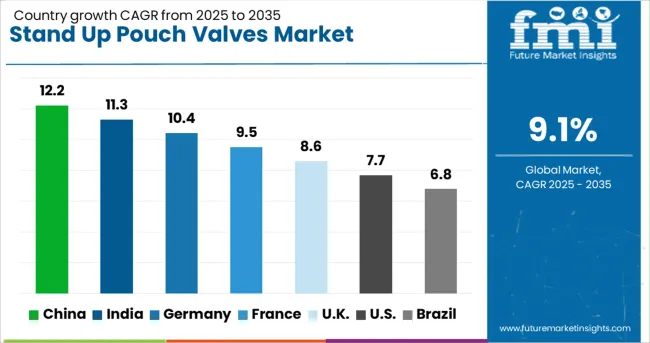

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

The stand up pouch valves market is projected to grow at a CAGR of 9.1% between 2025 and 2035, influenced by increased consumption of packaged liquids and flexible packaging innovations. China leads with an anticipated CAGR of 12.2%, bolstered by its expansive food and beverage processing industry and scale-driven packaging production. India follows at 11.3%, where demand is fueled by a shift toward consumer-friendly and spill-resistant formats. Germany is expected to expand at 10.4%, owing to investments in eco-efficient pouch formats and automation in filling lines. The UK is predicted to grow at 8.6% due to changes in beverage packaging trends and preferences for resealable solutions. The USA market, rising at 7.7%, benefits from customized pouch applications across non-food sectors. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to expand at a CAGR of 12.2% from 2025 to 2035 in the stand up pouch valves market, primarily driven by rapid advances in flexible packaging across the beverage, cleaning product, and food sectors. Manufacturers such as Zhongjin and Xuanwu Valve have increased output capacity to accommodate high-volume pouch filling machinery. Integration of recyclable materials in spouted pouch valves has improved compatibility with new generation filling lines. Domestic demand has been significantly influenced by the convenience factor in single-serve packaging and eCommerce logistics. Strategic supplier agreements with multinational food groups have also stimulated production of precision-fit closure systems. Valve customization for low-viscosity liquids is gaining traction within regional manufacturing zones.

India is forecasted to register a CAGR of 11.3% through 2035, with the pouch valve segment gaining visibility across edible oil, juices, and cosmetic refill markets. Indian converters such as Uflex and Essel Propack have introduced integrated spout and cap assemblies compatible with high-speed vertical form-fill-seal machines. Increased penetration of refillable liquid sachets in rural and semi-urban outlets has created sustained volume for low-cost valve formats. The shift toward compact packaging for travel-size toiletries and nutraceuticals is also accelerating valve demand. Government-led packaging standards have indirectly influenced valve precision through hygiene and safety mandates.

Germany is anticipated to grow at a CAGR of 10.4% as manufacturers emphasize functional packaging in household and organic food applications. German converters such as Pouch Partners and Gualapack Deutschland have invested in valve lines focused on low-impact production. Consumer preference has shifted toward controlled dispensing mechanisms, especially in cleaning and hygiene products. Adoption has also gained momentum in refill packs for dairy alternatives and baby food. Germany remains a key innovator in recyclable pouch valves, with focus on mono-material compatibility. Valve systems with built-in air return and anti-spill features are favored across high-margin segments.

The United Kingdom is expected to expand at a CAGR of 8.6%, with demand growing across homecare and beverage categories. British converters such as RPC Superfos and Tyler Packaging have shifted operations to accommodate multi-dispense valve formats. Growth has been aided by retailer preference for space-saving packs and self-standing liquid refills. Consumers have exhibited increased interest in minimal contact dispensers, particularly in kitchen and cleaning products. Foodservice providers are also adopting pouch valves to reduce storage footprint. Regulations on plastic waste have spurred innovation in detachable cap and valve combinations.

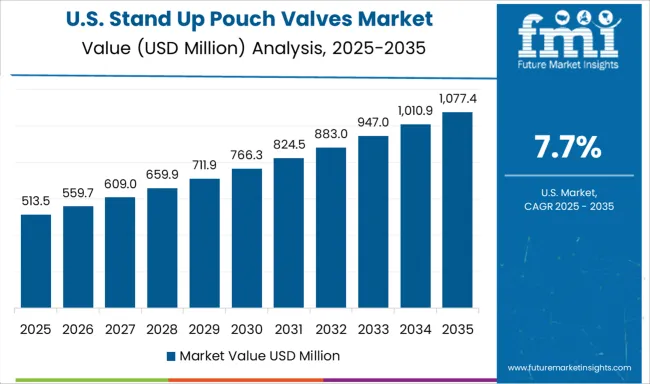

The United States is poised to grow at a CAGR of 7.7%, led by private label adoption of pouch valve technology in sauces, soups, and protein drinks. USA players such as Glenroy and Scholle IPN have extended valve product lines to cater to food and non-food sectors alike. The market has embraced touchless dispensing systems that align with hygiene concerns across institutional buyers. Pouches with resealable valves have also found strong placement in camping, travel, and fitness-based nutrition products. Retail-focused packaging upgrades have promoted wider acceptance of refill pouches in premium segments.

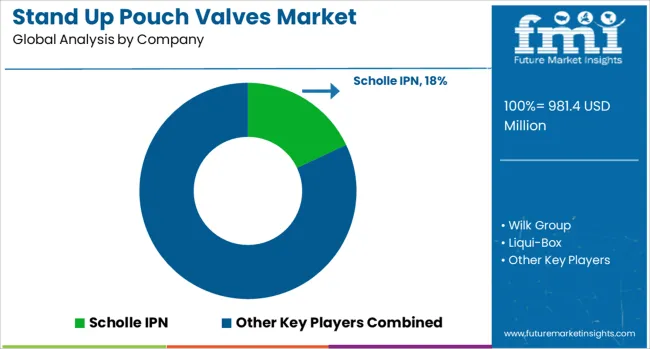

The stand up pouch valves market is anchored by companies delivering dispensing convenience and packaging integrity across food, beverage, household, and personal care segments. Scholle IPN plays a pivotal role with integrated fitment technologies and spouted pouch systems designed for aseptic and hot-fill applications.

Gualapack Group complements with high-barrier, pre-made pouches equipped with reliable valve systems optimized for baby food, sauces, and smoothies. Liqui-Box focuses on flexible liquid packaging using customizable dispensing valves that improve shelf stability and minimize leakage.

Amcor and Smurfit Kappa, both global packaging conglomerates, offer versatile pouch formats incorporating one-way valves, often tailored for coffee, sports nutrition, and industrial fluid applications. Menshen contributes a wide array of valve closures engineered for reusability and clean dispensing.

Wilk Group and Falakpack provide cost-sensitive valve solutions suited to mid-tier markets across Europe and Asia. Pacificbag and Swisspack cater to smaller SKUs with degassing valve features, primarily for specialty coffee and powdered goods. Edelpa supports Latin American supply chains with laminated structures equipped with functional pouch spouts.

The competitive landscape is defined by demand for lightweight, tamper-evident, and easy-to-reseal pouch solutions. Valve design evolution emphasizes material compatibility, consumer handling ease, and environmental compliance, making innovation in dispensing control a key differentiator in the segment.

| Item | Value |

|---|---|

| Quantitative Units | USD 981.4 Million |

| Product | Corner valve and Front valve |

| Technique | FFS (Form, fill & seal) and Preform |

| Seal Material | Without aluminum foil and With aluminum foil |

| End-Use | Food & beverages, Mayonnaise, Ketchup, Beverages, Others, Household & personal care, Shampoo, Liquid soap, Detergent & softeners, Industrial, and Others (Pharmaceutics, agriculture) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Scholle IPN, Wilk Group, Liqui-Box, Menshen, Falakpack, Edelpa, Pacificbag, Swisspack, Gualapack Group, Amcor, and Smurfit Kappa |

| Additional Attributes | Dollar sales by valve type and packaging segment, demand dynamics across food and beverage, personal care, and household products, regional trends in usage across North America, Europe, and Asia-Pacific, innovation in one-way degassing valves, tamper-evident designs, and recyclable materials, environmental impact of plastic usage, valve disposal, and material compatibility with recycling streams, and emerging use cases in ready-to-drink packaging, resealable functional pouches, and sustainable flexible packaging solutions. |

The global stand-up pouch valves market is estimated to be valued at USD 981.4 million in 2025.

The market size for the stand-up pouch valves market is projected to reach USD 2,334.0 million by 2035.

The stand-up pouch valves market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in stand-up pouch valves market are corner valve and front valve.

In terms of technique, ffs (form, fill & seal) segment to command 61.0% share in the stand-up pouch valves market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pouch Tapes Market Size and Share Forecast Outlook 2025 to 2035

Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pouch Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Pouch-Bowl Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pouch Filler Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Pouch Film Market Trends & Industry Growth Forecast 2024-2034

Pouch Market Insights – Growth & Trends 2024-2034

Pouch Sealing Machine Market

Pouch Dispensing Fitment Market

Arm Pouches Market Size and Share Forecast Outlook 2025 to 2035

Box Pouch Market by Pouch Type from 2025 to 2035

Competitive Breakdown of Box Pouch Providers

OPP Pouches Market Trends - Growth, Demand & Forecast 2024 to 2034

PCR Pouches Market

Doy Pouch Packaging Market

Foil Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Foam Pouch Market Analysis - Demand, Size & Industry Outlook 2025 to 2035

Twin Pouch Packaging Market

Peel Pouches Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA