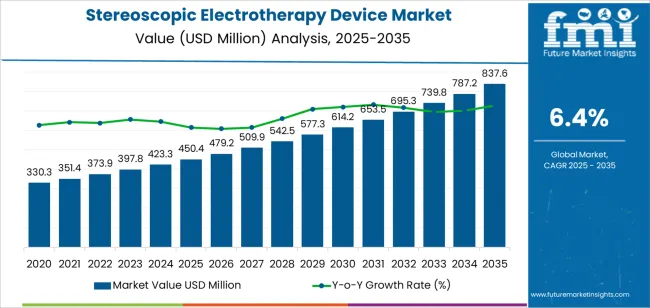

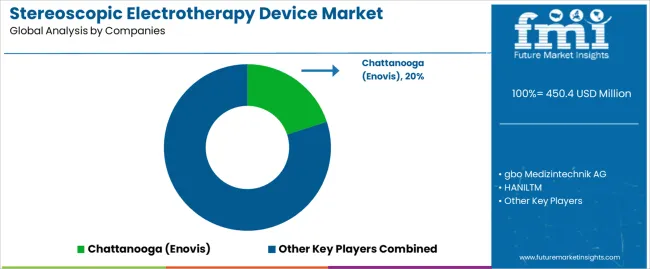

The global stereoscopic electrotherapy device market is valued at USD 450.4 million in 2025. It is slated to reach USD 837.5 million by 2035, recording an absolute increase of USD 387.1 million over the forecast period. This translates into a total growth of 86.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.4% between 2025 and 2035. The overall market size is expected to grow by approximately 1.86 times during the same period, supported by increasing demand for non-invasive pain management solutions in rehabilitation and physiotherapy settings, growing adoption of stereoscopic electrotherapy devices for chronic pain treatment and muscle rehabilitation applications, and rising emphasis on drug-free therapeutic approaches across diverse hospital, clinic, and rehabilitation facility applications.

Between 2025 and 2030, the stereoscopic electrotherapy device market is projected to expand from USD 450.4 million to USD 614.2 million, resulting in a value increase of USD 163.8 million, which represents 42.3% of the total forecast growth for the decade. This phase of development will be shaped by increasing prevalence of chronic pain conditions and musculoskeletal disorders, rising demand for effective rehabilitation equipment in physical therapy practices and sports medicine facilities, and growing emphasis on patient-centered pain management and recovery optimization programs. Healthcare facility operators and rehabilitation specialists are expanding their stereoscopic electrotherapy capabilities to address the growing demand for reliable and effective solutions that ensure treatment efficacy and patient satisfaction.

From 2030 to 2035, the market is forecast to grow from USD 614.2 million to USD 837.5 million, adding another USD 223.3 million, which constitutes 57.7% of the overall ten-year expansion. This period is expected to be characterized by the expansion of home healthcare applications and portable device technologies, the development of smart therapeutic systems with biofeedback and treatment customization capabilities, and the growth of specialized applications for neurological rehabilitation and post-surgical recovery programs. The growing adoption of telemedicine integration and remote therapy monitoring will drive demand for stereoscopic electrotherapy devices with enhanced connectivity and treatment tracking features.

Between 2020 and 2025, the stereoscopic electrotherapy device market experienced steady growth, driven by increasing awareness of electrotherapy benefits and growing recognition of stereoscopic electrotherapy devices as essential equipment for managing pain and facilitating rehabilitation in diverse clinical and therapeutic applications. The market developed as physiotherapists and pain management specialists recognized the potential for stereoscopic electrotherapy technology to reduce pain perception, promote tissue healing, and support recovery objectives while meeting patient comfort requirements. Technological advancement in waveform generation and electrode design began emphasizing the critical importance of maintaining treatment precision and patient safety in therapeutic environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 450.4 million |

| Forecast Value in (2035F) | USD 837.5 million |

| Forecast CAGR (2025 to 2035) | 6.4% |

Market expansion is being supported by the increasing global demand for non-invasive pain management solutions driven by opioid crisis concerns and chronic pain prevalence, alongside the corresponding need for specialized therapeutic equipment that can enhance treatment outcomes, enable drug-free pain relief, and maintain patient compliance across various hospital rehabilitation departments, physiotherapy clinics, sports medicine facilities, and pain management centers. Modern healthcare providers and rehabilitation specialists are increasingly focused on implementing stereoscopic electrotherapy device solutions that can deliver effective pain reduction, accelerate recovery processes, and provide consistent therapeutic results in clinical treatment environments.

The growing emphasis on patient-centered care and conservative treatment approaches is driving demand for stereoscopic electrotherapy devices that can support multimodal pain management strategies, enable personalized treatment protocols, and ensure comprehensive rehabilitation support. Medical equipment manufacturers' preference for therapeutic systems that combine clinical effectiveness with patient comfort and operational efficiency is creating opportunities for innovative stereoscopic electrotherapy device implementations. The rising influence of value-based healthcare and evidence-based medicine is also contributing to increased adoption of stereoscopic electrotherapy devices that can provide superior therapeutic outcomes without compromising patient safety or treatment quality.

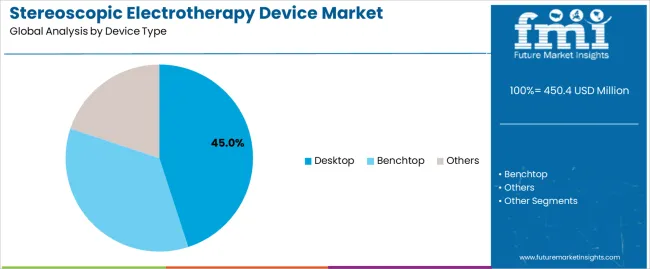

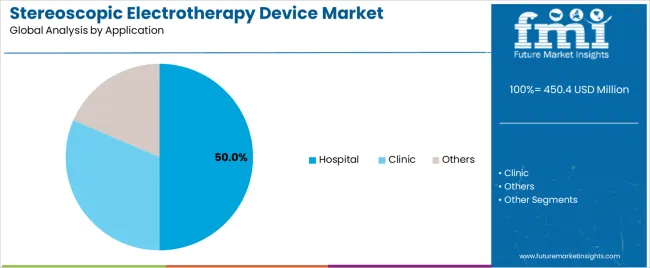

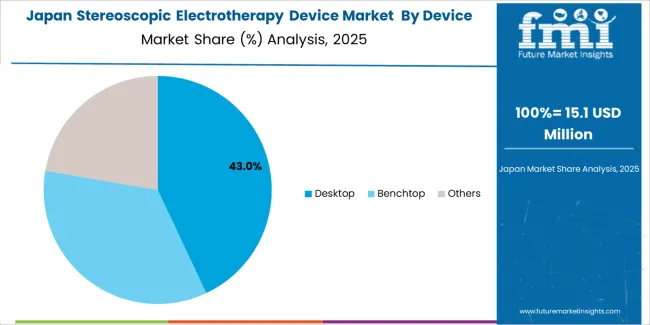

The market is segmented by device type, application, and region. By device type, the market is divided into desktop, benchtop, and others. Based on application, the market is categorized into hospital, clinic, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The desktop device segment, which holds a 45% market share in 2025, is projected to maintain its leading position in the stereoscopic electrotherapy device market, reaffirming its role as the preferred device configuration for clinical rehabilitation and hospital-based pain management applications. Physical therapy departments and rehabilitation centers increasingly utilize desktop stereoscopic electrotherapy devices for their comprehensive feature sets, professional-grade capabilities, and proven effectiveness in delivering sophisticated treatment protocols while maintaining operational reliability. Desktop device technology's proven effectiveness and clinical versatility directly address the industry requirements for comprehensive therapeutic capability and effective patient treatment across diverse clinical platforms and therapeutic protocols.

This device category forms the foundation of modern rehabilitation medicine, as it represents the equipment with the greatest contribution to treatment flexibility and established performance record across multiple therapeutic applications and patient populations. Healthcare facility investments in rehabilitation technologies continue to strengthen adoption among hospital rehabilitation departments and specialized therapy centers. With treatment pressures requiring effective outcomes and clinical versatility, desktop stereoscopic electrotherapy devices align with both therapeutic objectives and facility requirements, making them the central component of comprehensive rehabilitation equipment strategies.

The hospital application segment, which commands a 50% market share in 2025, is projected to represent the largest share of stereoscopic electrotherapy device demand, underscoring its critical role as the primary driver for device adoption across rehabilitation departments, pain management clinics, and post-surgical recovery units. Hospital administrators and rehabilitation managers prefer stereoscopic electrotherapy devices for patient treatment due to their exceptional therapeutic effectiveness, evidence-based treatment benefits, and ability to support multimodal pain management while addressing diverse patient conditions and regulatory compliance objectives. Positioned as essential equipment for modern hospital rehabilitation services, stereoscopic electrotherapy devices offer both clinical advantages and operational benefits.

The segment is supported by continuous innovation in electrotherapy technologies and the growing availability of advanced devices that enable superior treatment outcomes with enhanced patient comfort and reduced treatment duration requirements. Additionally, medical device manufacturers are investing in comprehensive product development programs to support increasingly complex rehabilitation protocols and hospital requirements for reliable therapeutic solutions. As hospital rehabilitation services expand and pain management approaches evolve, the hospital application will continue to dominate the market while supporting advanced electrotherapy utilization and patient care optimization strategies.

The stereoscopic electrotherapy device market is advancing steadily due to increasing demand for non-invasive therapeutic solutions driven by chronic pain epidemic and growing adoption of conservative treatment approaches that require specialized electrotherapy equipment providing enhanced pain relief and rehabilitation acceleration benefits across diverse hospital rehabilitation departments, physiotherapy clinics, sports medicine facilities, and pain management centers. The market faces challenges, including limited reimbursement coverage in some healthcare systems and insurance constraints, competition from alternative pain management modalities and pharmaceutical treatments, and clinical limitations related to treatment contraindications and patient selection criteria. Innovation in waveform technologies and treatment protocols continues to influence product development and market expansion patterns.

The growing prevalence of chronic pain conditions is driving demand for non-pharmacological treatment options that address pain management challenges including opioid dependency risks, medication side effects, and long-term pain control requirements. Modern healthcare systems require effective stereoscopic electrotherapy device solutions that deliver superior pain reduction across multiple patient populations while maintaining safety and cost-effectiveness. Healthcare providers are increasingly recognizing the competitive advantages of electrotherapy integration for pain management enhancement and opioid prescription reduction, creating opportunities for innovative therapeutic devices specifically developed for next-generation pain treatment applications.

Modern stereoscopic electrotherapy device manufacturers are incorporating digital control systems and programmable treatment capabilities to enhance therapeutic precision, support individualized treatment protocols, and address comprehensive patient management objectives through customized waveform parameters and biofeedback integration. Leading medical device companies are developing sensor-equipped devices with real-time treatment monitoring, implementing data connectivity for treatment tracking, and advancing control algorithms that improve therapeutic outcomes and treatment optimization. These technologies improve clinical capabilities while enabling new therapeutic benefits, including personalized treatment protocols, objective outcome measurement, and evidence-based practice support. Advanced technology integration also allows clinicians to support comprehensive rehabilitation objectives and clinical excellence beyond traditional manual electrotherapy control methods.

The expansion of home healthcare demand, patient convenience preferences, and chronic condition management needs is driving development of portable stereoscopic electrotherapy devices with precisely engineered miniaturization and exceptional user-friendliness. These advanced systems require specialized designs with simplified operation that address home-use requirements, creating emerging market segments with differentiated value propositions. Manufacturers are investing in advanced battery technologies and intuitive interfaces to serve growing home healthcare applications while supporting innovation in patient self-management and telemedicine industries.

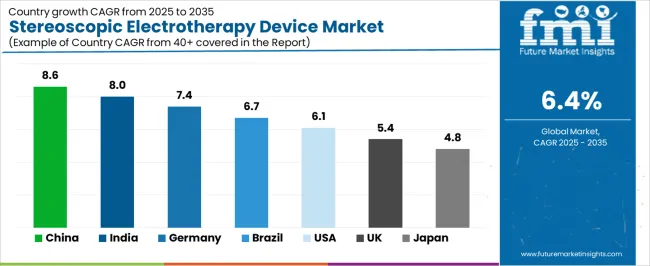

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| Brazil | 6.7% |

| United States | 6.1% |

| United Kingdom | 5.4% |

| Japan | 4.8% |

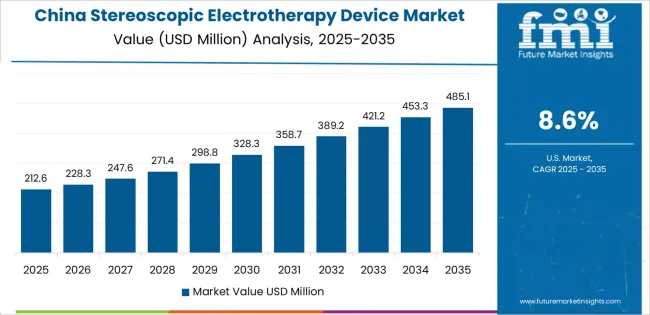

The stereoscopic electrotherapy device market is experiencing solid growth globally, with China leading at an 8.6% CAGR through 2035, driven by expanding healthcare infrastructure, growing rehabilitation medicine development, and increasing adoption of physiotherapy equipment in hospitals and specialized centers. India follows at 8.0%, supported by healthcare facility expansion, rising chronic pain awareness, and growing physiotherapy profession development. Germany shows growth at 7.4%, emphasizing rehabilitation medicine excellence, physiotherapy standards, and advanced therapeutic equipment adoption. Brazil demonstrates 6.7% growth, supported by healthcare infrastructure investment, rehabilitation services expansion, and growing pain management awareness. The United States records 6.1%, focusing on chronic pain management innovation, rehabilitation facility modernization, and alternative pain treatment adoption. The United Kingdom exhibits 5.4% growth, emphasizing physiotherapy services and pain management program development. Japan shows 4.8% growth, supported by aging population healthcare needs and rehabilitation technology sophistication.

The report covers an in-depth analysis of 20 countries, with top-performing countries highlighted below.

Revenue from stereoscopic electrotherapy devices in China is projected to exhibit exceptional growth with a CAGR of 8.6% through 2035, driven by expanding healthcare infrastructure and rapidly developing rehabilitation medicine sector supported by government healthcare improvement initiatives and chronic disease management policies. The country's massive healthcare sector transformation and increasing investment in rehabilitation equipment are creating substantial demand for stereoscopic electrotherapy device solutions. Major medical device manufacturers and healthcare equipment suppliers are establishing comprehensive production capabilities to serve both domestic markets and export opportunities.

Demand for stereoscopic electrotherapy devices in India is expanding at a CAGR of 8.0%, supported by the country's healthcare facility expansion, growing chronic pain awareness, and increasing demand for rehabilitation equipment driven by physiotherapy profession growth and healthcare service modernization. The country's comprehensive healthcare development and rising rehabilitation medicine awareness are driving electrotherapy device adoption throughout diverse healthcare sectors. Leading medical equipment distributors and international manufacturers are establishing distribution and service facilities to address growing domestic demand.

Revenue from stereoscopic electrotherapy devices in Germany is growing at a CAGR of 7.4%, supported by the country's rehabilitation medicine excellence, established physiotherapy standards, and strong emphasis on evidence-based therapeutic interventions. The nation's clinical sophistication and healthcare quality are driving electrotherapy device capabilities throughout rehabilitation and physiotherapy sectors. Leading medical device manufacturers and healthcare equipment providers are investing extensively in advanced therapeutic technologies and clinical applications.

Demand for stereoscopic electrotherapy devices in Brazil is anticipated to expand at a CAGR of 6.7%, supported by the country's healthcare infrastructure investment, rehabilitation services expansion, and growing adoption of pain management best practices. The nation's comprehensive healthcare system development and increasing rehabilitation awareness are driving demand for effective electrotherapy device solutions. Medical equipment distributors and healthcare service providers are investing in capabilities to serve expanding rehabilitation and physiotherapy sectors.

Revenue from stereoscopic electrotherapy devices in the United States is projected to grow at a CAGR of 6.1%, supported by the country's focus on chronic pain management innovation, established rehabilitation services, and growing emphasis on opioid alternatives and conservative treatment approaches. The nation's comprehensive healthcare system and rehabilitation excellence are driving demand for advanced electrotherapy device solutions. Medical device manufacturers and rehabilitation equipment suppliers are investing in technology development and distribution capabilities to serve diverse clinical markets.

Demand for stereoscopic electrotherapy devices in the United Kingdom is expanding at a CAGR of 5.4%, driven by the country's physiotherapy services emphasis, pain management program development, and growing focus on conservative treatment approaches in healthcare delivery. The nation's healthcare system structure and clinical guidelines are supporting investment in effective therapeutic technologies. Medical equipment suppliers and physiotherapy service providers are establishing capabilities for equipment supply and clinical support programs.

Revenue from stereoscopic electrotherapy devices in Japan is growing at a CAGR of 4.8%, supported by the country's aging population healthcare needs, rehabilitation technology sophistication, and strong emphasis on quality therapeutic interventions and patient care excellence. Japan's healthcare technology excellence and demographic challenges are driving demand for effective electrotherapy device systems. Medical device manufacturers and healthcare facility management companies are investing in therapeutic technologies suitable for geriatric care environments.

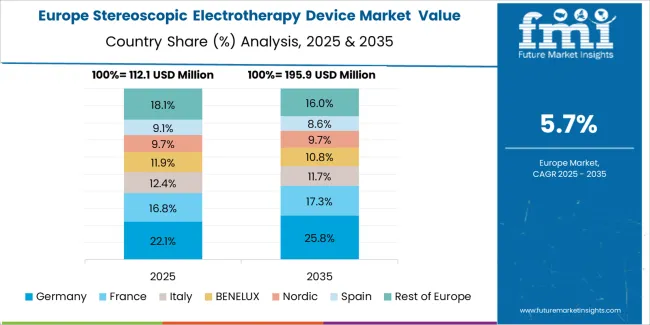

The stereoscopic electrotherapy device market in Europe is projected to grow from USD 163.6 million in 2025 to USD 269.8 million by 2035, registering a CAGR of 5.1% over the forecast period. Germany is expected to maintain leadership with a 27.4% market share in 2025, moderating to 27.1% by 2035, supported by rehabilitation medicine excellence, physiotherapy standards, and medical device manufacturing strength.

France follows with 19.2% in 2025, projected at 19.4% by 2035, driven by physiotherapy services, hospital rehabilitation departments, and healthcare modernization programs. The United Kingdom holds 16.8% in 2025, rising to 17.0% by 2035 on the back of physiotherapy profession development and pain management services. Italy commands 13.5% in 2025, increasing to 13.7% by 2035, while Spain accounts for 10.3% in 2025, reaching 10.5% by 2035 aided by rehabilitation services expansion and sports medicine development. Netherlands maintains 6.4% in 2025, up to 6.6% by 2035 due to physiotherapy quality standards and healthcare innovation. The Rest of Europe region, including Nordic countries, Switzerland, Belgium, and other markets, is anticipated to hold 6.4% in 2025 and 5.7% by 2035, reflecting steady development in rehabilitation services, physiotherapy practice growth, and therapeutic equipment adoption.

The stereoscopic electrotherapy device market is characterized by competition among established medical device manufacturers, specialized electrotherapy equipment producers, and regional healthcare equipment suppliers. Companies are investing in waveform technology development, treatment protocol enhancement, product range expansion, and application-specific device optimization to deliver high-performance, clinically effective, and user-friendly stereoscopic electrotherapy device solutions. Innovation in digital control systems, treatment customization capabilities, and patient comfort features is central to strengthening market position and competitive advantage.

Chattanooga (Enovis) leads the market with comprehensive rehabilitation equipment solutions with a focus on clinical applications, quality manufacturing, and global distribution across diverse physiotherapy and rehabilitation settings. gbo Medizintechnik AG provides medical technology products with emphasis on therapeutic equipment and European market service. HANILTM delivers electrotherapy devices with focus on Asian market requirements and clinical effectiveness. Xiangyu Medical offers therapeutic equipment with emphasis on Chinese market presence and product innovation. Shandong Zepu provides medical devices with comprehensive electrotherapy offerings for clinical facilities. Lifotronic specializes in rehabilitation and physiotherapy equipment. Ruihe focuses on therapeutic device manufacturing. TIANJIN BORD ELECTRONIC EQUIPMENT delivers medical electronic equipment solutions. Nanjing Huawei Medical Equipment provides rehabilitation and physiotherapy devices. Yujian offers medical equipment for therapeutic applications.

Stereoscopic electrotherapy devices represent a specialized medical equipment segment within rehabilitation medicine and pain management applications, projected to grow from USD 450.4 million in 2025 to USD 837.5 million by 2035 at a 6.4% CAGR. These therapeutic devices primarily serve pain relief and rehabilitation requirements in hospital physiotherapy departments, outpatient rehabilitation clinics, sports medicine facilities, and pain management centers where non-invasive treatment delivery, therapeutic effectiveness, and patient comfort are essential. Market expansion is driven by increasing chronic pain prevalence, growing demand for opioid alternatives, expanding rehabilitation medicine services, and rising adoption of evidence-based physiotherapy interventions across diverse healthcare sectors.

How Healthcare Regulators Could Strengthen Device Standards and Clinical Safety?

How Industry Associations Could Advance Clinical Standards and Professional Development?

How Stereoscopic Electrotherapy Device Manufacturers Could Drive Innovation and Clinical Leadership?

How Healthcare Providers Could Optimize Treatment Outcomes and Patient Care?

How Research Institutions Could Enable Clinical Advancement?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 450.4 million |

| Device Type | Desktop, Benchtop, Others |

| Application | Hospital, Clinic, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 20 countries |

| Key Companies Profiled | Chattanooga (Enovis), gbo Medizintechnik AG, HANILTM, Xiangyu Medical, Shandong Zepu, Lifotronic |

| Additional Attributes | Dollar sales by device type and application category, regional demand trends, competitive landscape, technological advancements in waveform technology, treatment protocol development, smart monitoring integration, and therapeutic outcome optimization |

The global stereoscopic electrotherapy device market is estimated to be valued at USD 450.4 million in 2025.

The market size for the stereoscopic electrotherapy device market is projected to reach USD 837.6 million by 2035.

The stereoscopic electrotherapy device market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in stereoscopic electrotherapy device market are desktop, benchtop and others.

In terms of application, hospital segment to command 50.0% share in the stereoscopic electrotherapy device market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ophthalmic Stereoscopic 3D Display Market Size and Share Forecast and Outlook 2025 to 2035

Electrotherapy System Market Size and Share Forecast Outlook 2025 to 2035

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

X-Ray Device Market Size and Share Forecast Outlook 2025 to 2035

Power Device Analyzer Market Growth – Trends & Forecast 2025 to 2035

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Biopsy Device Market Forecast and Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Mobile Device Management Market Analysis by Deployment Type, Solution, Business Size, Vertical, and Region Through 2035

Venous Device Market

Serial Device Servers Market

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA