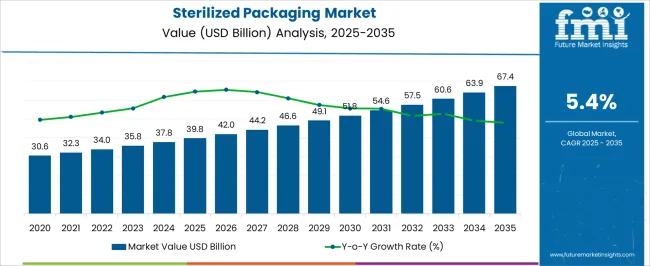

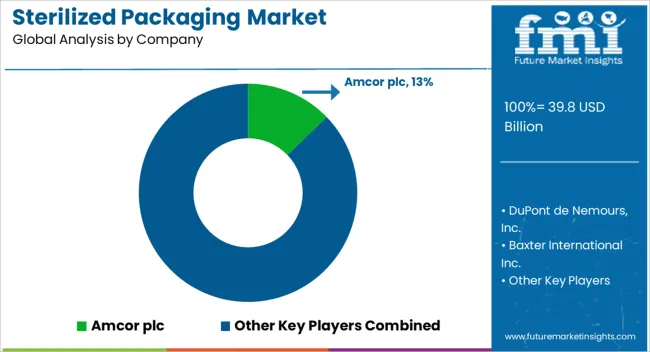

The Sterilized Packaging Market is estimated to be valued at USD 39.8 billion in 2025 and is projected to reach USD 67.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Sterilized Packaging Market Estimated Value in (2025 E) | USD 39.8 billion |

| Sterilized Packaging Market Forecast Value in (2035 F) | USD 67.4 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The sterilized packaging market is expanding steadily as the global healthcare, pharmaceutical, and food industries increasingly adopt packaging solutions that ensure product safety, extended shelf life, and regulatory compliance. Demand is being driven by rising concerns regarding infection control, sterile product integrity, and patient safety, particularly in medical devices, surgical instruments, and pharmaceutical products. The increasing prevalence of chronic diseases and the rising number of surgical procedures are fueling higher consumption of sterilized packaging across hospitals and clinical facilities.

Innovations in packaging materials such as high-barrier plastics, multi-layer laminates, and recyclable formats are improving durability while meeting sustainability goals. Stringent government regulations regarding sterilization and contamination prevention are also reinforcing the adoption of standardized packaging solutions.

Moreover, growth in the food sector, particularly ready-to-eat and perishable products, is contributing to the market’s expansion, as sterilized packaging provides the dual advantage of freshness and safety With ongoing advancements in material science, sterilization technologies, and eco-friendly solutions, the market is expected to maintain robust growth, supported by increasing investments in healthcare infrastructure and rising consumer awareness of safety and hygiene.

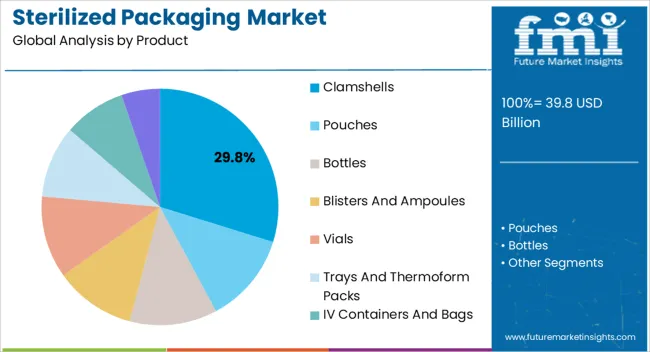

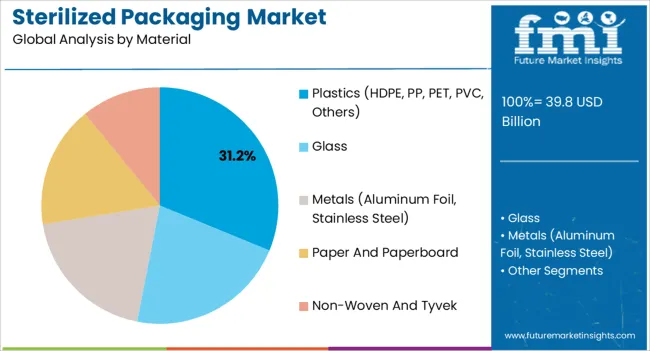

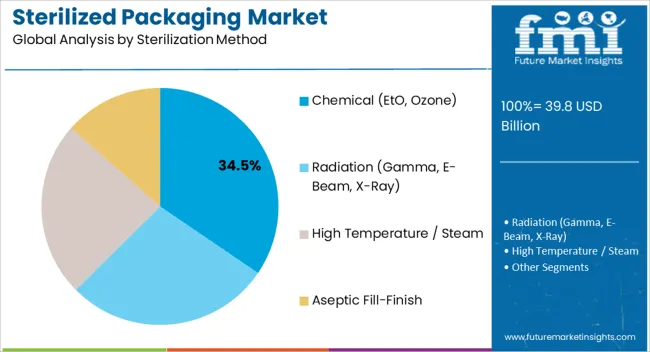

The sterilized packaging market is segmented by product, material, sterilization method, end-user industry, and geographic regions. By product, sterilized packaging market is divided into Clamshells, Pouches, Bottles, Blisters And Ampoules, Vials, Trays And Thermoform Packs, IV Containers And Bags, and Others. In terms of material, sterilized packaging market is classified into Plastics (HDPE, PP, PET, PVC, Others), Glass, Metals (Aluminum Foil, Stainless Steel), Paper And Paperboard, and Non-Woven And Tyvek. Based on sterilization method, sterilized packaging market is segmented into Chemical (EtO, Ozone), Radiation (Gamma, E-Beam, X-Ray), High Temperature / Steam, and Aseptic Fill-Finish. By end-user industry, sterilized packaging market is segmented into Medical And Surgical Instruments, Pharmaceutical And Biological, In-Vitro Diagnostics, Food And Beverage, Veterinary And Animal Health, and Other Industrial. Regionally, the sterilized packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The clamshells product segment is anticipated to hold 29.8% of the sterilized packaging market revenue share in 2025, positioning it as the leading product type. Growth in this segment is supported by the rising preference for packaging formats that provide excellent product visibility, secure sealing, and strong protective properties. Clamshells are extensively used in sterile medical devices, consumer goods, and food packaging, where tamper-evident and contamination-resistant formats are essential.

Their compatibility with multiple sterilization methods and adaptability across industries makes them a preferred choice for manufacturers. Additionally, the reclosable and user-friendly design of clamshells improves consumer convenience while ensuring sterility. The increasing focus on sustainable and recyclable clamshells, particularly those made from bio-based plastics, is further driving adoption.

Their ability to support high-volume production with consistent quality is reinforcing their dominance in large-scale distribution As demand grows for secure and versatile sterile packaging solutions, clamshells are expected to retain a leading market position, benefiting from both functionality and broad acceptance across end-use industries.

The plastics material segment is projected to account for 31.2% of the sterilized packaging market revenue share in 2025, making it the dominant material type. Growth is being driven by the versatility, lightweight nature, and cost-effectiveness of plastics such as HDPE, PP, PET, and PVC in sterile packaging applications. Plastics offer excellent barrier properties, resistance to sterilization processes, and compatibility with diverse product requirements, from pharmaceuticals to medical devices and food packaging.

Their ability to withstand heat, radiation, and chemical sterilization without compromising strength or clarity reinforces their importance. Additionally, innovations in recyclable and bio-based plastics are enabling manufacturers to address sustainability concerns while maintaining sterile performance. Plastics also allow for high levels of customization, such as multi-layer structures and transparent formats, which improve product visibility and usability.

With the healthcare and food sectors increasingly prioritizing safety and compliance, plastics continue to dominate as the most reliable and scalable packaging material As demand for lightweight, durable, and eco-conscious solutions rises, the plastics segment is expected to remain central to the market’s growth trajectory.

The chemical sterilization method segment is expected to capture 34.5% of the sterilized packaging market revenue share in 2025, establishing itself as the leading sterilization method. This dominance is being driven by the effectiveness of chemical agents such as ethylene oxide and ozone in sterilizing heat-sensitive products, which cannot withstand high-temperature processes. Chemical sterilization is widely adopted for medical devices, pharmaceutical packaging, and certain food applications where precision and safety are paramount.

The method ensures deep penetration into packaging materials and complex device structures, guaranteeing sterility without compromising product integrity. Its adaptability to large-scale industrial applications has further reinforced its leadership in the market. Ongoing advancements in reducing toxic residues and improving cycle efficiency are making chemical sterilization safer and more sustainable.

With rising demand for sterile medical and pharmaceutical products, particularly in emerging economies, the method is expected to remain central to industry practices As healthcare and food safety standards grow more stringent, chemical sterilization will continue to dominate, supported by reliability, scalability, and regulatory acceptance.

The global sterilized packaging market is expected to be worth US$ 34 Billion in 2025. According to a report by Future Market Insights, demand for sterilized packaging is expected to rise at a CAGR of 5.4% from 2025 to 2035. By the end of the aforementioned assessment period, a valuation of US$ 58.1 Billion.

| Data Points | Key Statistics |

| Expected Market Value for Sterilized Packaging (2025) | US$ 34 Billion |

| Projected Market Value for Sterilized Packaging (2035) | US$ 58.1 Billion |

| Global Growth Rate (2025 to 2035) | 5.4% CAGR |

How Sterilized Packaging Helps in Enhancing the Safety in Food Consumption

FMI predicts sterilized packaging will be crucial for maintaining the sterility of the contained items. Packaging plays a critical role in the food industry in terms of maintaining the quality and taste of the packaged food for a longer time. With the improvement in the standard of living of the consumers globally, demand for packaged food has shown rapid surge over the years.

Globally, almost 10% of the population falls ill after eating contaminated food. Additionally, 40% of diseases in children are foodborne diseases. FDA has suggested the use of sterile packaged food to improve the safety in food consumption.

According to the FSSAI, the sales volume of packaged food products surged by over 48% in the span of 2025 to 2025. With the increase in demand for packaged food and awareness for the use of aseptic and sterile packaging is driving the market growth.

Sterilized packaging is considered a medical device and thus it must undergo validation testing before being used in healthcare facilities. There are several types of sterilized packaging systems in the market today.

A report from Future Market Insights suggests that the sterilized containers are designed to maintain the sterility of the contained items while allowing the penetration of the sterilizing agent and providing an efficient way to sterilize multiple items simultaneously. However, there are a set of guidelines and standards that they must follow, with not all packaging systems being compatible with all types of sterilization processes.

There are basically three types of sterilization packages: flat wrappers, sterilization containers, and paper-plastic peel pouches. This article will discuss standards for sterilization packaging and sterilization packaging requirements for packaging manufacturers issued by the Food and Drug Administration (FDA).

Packaging materials include wrapped perforated instrument cassettes, peel pouches of plastic or paper, and sterilization wraps (which can be either woven or unwoven). Packaging materials should be designed for the type of sterilization process being used and should be appropriate for the items being sterilized.

Sterilization packaging is classified by the Food and Drug Administration (FDA) as a Class II medical device. This requires it to meet certain regulatory standards, particularly regarding factors that affect sterility, such as package quality, handling, transport, and storage.

Each type of sterilization container has its own directions for use. Furthermore, regardless of container used, each sterilized package should include information on the label regarding the sterilizer used, cycle or load number, date of sterilization, and expiration date, where applicable.

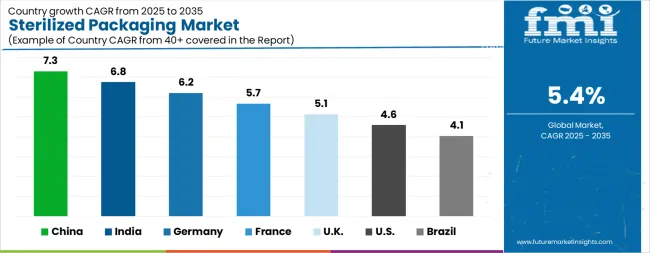

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The Sterilized Packaging Market is expected to register a CAGR of 5.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.3%, followed by India at 6.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Sterilized Packaging Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.2%. The USA Sterilized Packaging Market is estimated to be valued at USD 14.8 billion in 2025 and is anticipated to reach a valuation of USD 23.2 billion by 2035. Sales are projected to rise at a CAGR of 4.6% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 2.0 billion and USD 1.4 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 39.8 Billion |

| Product | Clamshells, Pouches, Bottles, Blisters And Ampoules, Vials, Trays And Thermoform Packs, IV Containers And Bags, and Others |

| Material | Plastics (HDPE, PP, PET, PVC, Others), Glass, Metals (Aluminum Foil, Stainless Steel), Paper And Paperboard, and Non-Woven And Tyvek |

| Sterilization Method | Chemical (EtO, Ozone), Radiation (Gamma, E-Beam, X-Ray), High Temperature / Steam, and Aseptic Fill-Finish |

| End-User Industry | Medical And Surgical Instruments, Pharmaceutical And Biological, In-Vitro Diagnostics, Food And Beverage, Veterinary And Animal Health, and Other Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor plc, DuPont de Nemours, Inc., Baxter International Inc., Gerresheimer AG, SCHOTT AG, West Pharmaceutical Services, Inc., AptarGroup, Inc., Tekni-Plex, Inc., Sealed Air Corporation, Sonoco Products Company, SteriPack Group, Wipak Group, Placon Corporation, Inc., and SGD Pharma |

The global sterilized packaging market is estimated to be valued at USD 39.8 billion in 2025.

The market size for the sterilized packaging market is projected to reach USD 67.4 billion by 2035.

The sterilized packaging market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in sterilized packaging market are clamshells, pouches, bottles, blisters and ampoules, vials, trays and thermoform packs, iv containers and bags and others.

In terms of material, plastics (hdpe, pp, pet, pvc, others) segment to command 31.2% share in the sterilized packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Trends and Growth 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Services Market Analysis - Size, Share, and Forecast 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Packaging Inserts Market Insights - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Machine Heaters Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA