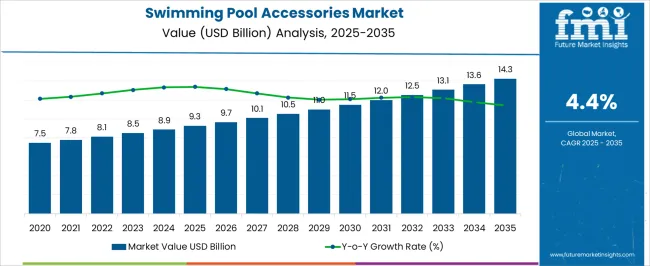

The swimming pool accessories market is projected to expand from USD 9.3 billion in 2025 to USD 14.3 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.4%. The market trajectory indicates a steady increase in demand for products such as pool covers, filtration systems, cleaning equipment, and water treatment devices, which are being deployed to enhance pool functionality and user experience. From an industry perspective, the adoption of advanced pool accessories is being reinforced by both residential and commercial pool owners seeking convenience, efficiency, and performance in maintenance solutions.

The steady market growth demonstrates that manufacturers focusing on product reliability, operational efficiency, and enhanced durability are positioned to capture significant market share. The decade-long growth highlights that consumer preferences and facility management requirements are driving the continued relevance of swimming pool accessories across regions. By 2035, with the market expected to reach USD 14.3 billion, the year-on-year expansion reflects that pool accessory adoption is being reinforced by increasing attention to maintenance efficiency, safety standards, and performance optimization.

The growth pattern suggests that stakeholders emphasizing innovative designs, easy-to-install solutions, and compatibility with existing pool systems are likely to strengthen their market presence. In this opinion, the CAGR of 4.4% indicates that incremental improvements in accessory functionality and material quality are being recognized as critical factors by end-users. Operational reliability, consistent supply chains, and tailored product offerings are expected to define competitive advantage, positioning the swimming pool accessories market as a steadily growing segment with long-term potential in both residential and commercial applications.

| Metric | Value |

|---|---|

| Swimming Pool Accessories Market Estimated Value in (2025 E) | USD 9.3 billion |

| Swimming Pool Accessories Market Forecast Value in (2035 F) | USD 14.3 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The swimming pool accessories market holds a substantial share within its parent markets, driven by increasing demand for pool-related products and services. Within the swimming pool equipment market, accessories constitute a significant portion, reflecting their essential role in enhancing pool functionality and user experience. In the swimming pool chemicals market, accessories such as chemical dispensers and testing kits represent a notable share, highlighting their importance in maintaining water quality and safety.

The residential construction market sees a growing integration of pool accessories in new developments, contributing to the market's expansion. Within the leisure and recreation market, swimming pool accessories are increasingly recognized for their role in promoting outdoor activities and wellness, leading to a rise in consumer interest. In the retail distribution market, both online and offline channels have seen a surge in the availability and sales of pool accessories, driven by consumer demand for convenience and variety. These dynamics underscore the significant role of swimming pool accessories across various sectors, reflecting their integral part in the broader pool industry ecosystem. The market's growth trajectory is supported by factors such as increased disposable incomes, a growing emphasis on home leisure activities, and advancements in product offerings that cater to diverse consumer needs.

Despite challenges like seasonal demand fluctuations and competition from alternative leisure activities, the swimming pool accessories market continues to thrive, bolstered by its essential role in enhancing the swimming experience.

The swimming pool accessories market is witnessing stable growth, underpinned by rising adoption of residential and commercial pools and a steady replacement demand cycle. Market momentum is being supported by heightened consumer focus on safety, convenience, and maintenance efficiency, leading to increased adoption of premium accessories. Technological advancements in materials and manufacturing processes have improved product durability, reducing lifecycle costs and encouraging repeat purchases.

Regional climatic conditions, urban infrastructure expansion, and the growth of the tourism and hospitality sector have further reinforced demand patterns. The sector is also benefiting from a growing inclination toward customized pool environments, prompting higher investments in both functional and aesthetic enhancements.

Pricing stability, coupled with strategic distribution networks, has enabled suppliers to expand market penetration, especially in developing economies where pool ownership rates are increasing. Over the forecast period, continuous product innovation, integration of automation, and expansion of aftermarket service offerings are expected to sustain revenue growth and enhance competitiveness.

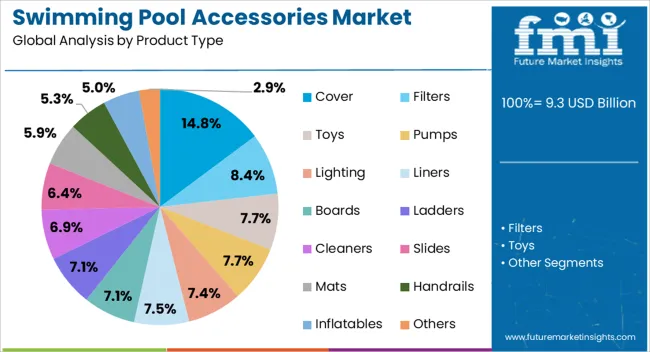

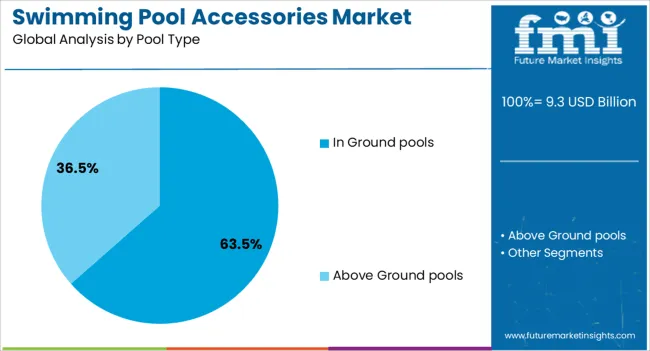

The swimming pool accessories market is segmented by product type, pool type, pool size, price range, end users, distribution channel, and geographic regions. By product type, swimming pool accessories market is divided into Cover, Filters, Toys, Pumps, Lighting, Liners, Boards, Ladders, Cleaners, Slides, Mats, Handrails, Inflatables, and Others. In terms of pool type, swimming pool accessories market is classified into In Ground pools and Above Ground pools.

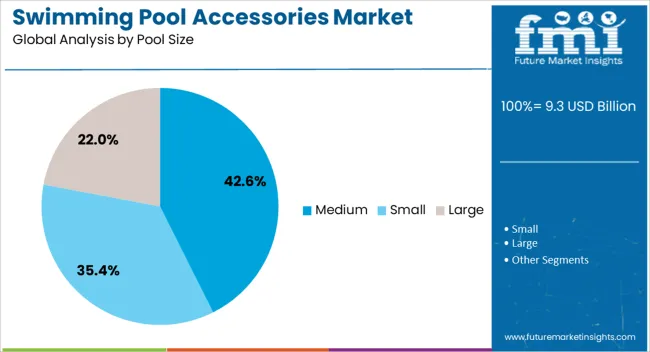

Based on pool size, swimming pool accessories market is segmented into Medium, Small, and Large. By price range, the swimming pool accessories market is segmented into the Medium range, the Lower range, and the Luxury range. By end users, swimming pool accessories market is segmented into Residential and Commercial. By distribution channel, swimming pool accessories market is segmented into Offline and Online. Regionally, the swimming pool accessories industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cover segment, holding 14.80% of the product type category, has been gaining traction due to its critical role in pool maintenance, energy efficiency, and safety compliance. Demand has been reinforced by the ability of covers to reduce water evaporation, retain heat, and minimize debris accumulation, which collectively lower maintenance costs. Increased consumer awareness of water conservation and energy savings has further supported adoption.

Advances in material engineering have led to more durable, UV-resistant, and lightweight covers, making installation and operation easier for both residential and commercial users. Regulatory influences, particularly in regions with stringent safety requirements, have driven mandatory cover usage in specific settings.

Supply chains have become more responsive, with modular and custom-fit solutions catering to diverse pool designs. The segment’s growth outlook is favorable as integration with automated roller systems and smart controls becomes more prevalent, enhancing both convenience and long-term value.

The in-ground pool segment, accounting for 63.50% of the pool type category, continues to dominate the market due to its prevalence in both luxury residential and commercial properties. Its high market share is sustained by longer lifespan, aesthetic appeal, and the capacity for greater customization compared to above-ground alternatives. Demand has been driven by property value enhancement considerations and the integration of advanced filtration, lighting, and heating systems that require compatible accessories.

The segment benefits from a steady replacement market, as existing pools require periodic accessory upgrades to maintain functionality and compliance. Geographic regions with warmer climates and year-round usage patterns have been key contributors to sustained demand.

Construction trends in premium housing developments and resort facilities are expected to further boost adoption rates. Enhanced distribution channels, including direct-to-consumer and specialized retailers, have improved product availability, while installation service partnerships are strengthening aftermarket sales opportunities.

The medium pool size segment, representing 42.60% of the pool size category, has maintained its lead due to its balance between functional capacity and cost-efficiency. It caters to a wide range of residential users and smaller commercial facilities, making it an accessible choice for a broad customer base. Medium-sized pools allow for sufficient accessory integration without excessive installation or maintenance costs, appealing to budget-conscious yet quality-oriented buyers.

Demand has been supported by standardized sizing, which streamlines accessory compatibility and simplifies procurement processes. The segment has also benefited from growing adoption in urban and suburban households where space constraints limit the feasibility of large pools.

Technological advancements in accessory design, such as modular covers, energy-efficient pumps, and adaptable lighting systems, have improved operational convenience and enhanced user experience. Continued preference for this pool size is anticipated as it aligns with evolving homeowner priorities for functional leisure spaces that remain affordable and easy to maintain.

The swimming pool accessories market is growing due to demand from residential, commercial, and luxury aquatic facilities. Opportunities lie in smart, automated, and energy-efficient solutions, while trends emphasize sustainability and user convenience. Challenges include seasonal demand fluctuations, price sensitivity, and maintenance complexity. The market is expected to expand steadily as manufacturers innovate with smart, eco-friendly, and high-performance accessories to meet global consumer and commercial requirements.

The swimming pool accessories market is witnessing rising demand due to the increasing construction of residential pools, hotel resorts, and commercial aquatic centers. Consumers are investing in cleaning equipment, filtration systems, pool covers, lighting, and decorative elements to enhance pool maintenance and aesthetic appeal. Seasonal demand, lifestyle upgrades, and growing disposable income in urban areas are further boosting adoption. Maintenance efficiency and safety enhancements, including automated cleaners and chemical dispensers, have become critical factors, making accessories an essential component of modern pool ownership and commercial pool management worldwide.

Opportunities are emerging with the adoption of smart, automated, and energy-efficient pool accessories. Automated cleaning robots, IoT-enabled water quality monitors, and remote-controlled pool systems offer convenience, safety, and operational efficiency. Integration with home automation systems and smartphone applications is creating new avenues for consumer engagement. Growth in luxury resorts, wellness centers, and residential complexes in emerging economies presents potential for market expansion. Companies investing in smart solutions, premium quality materials, and customizable accessories can capture higher-value segments and strengthen their market presence globally.

A notable trend is the increasing preference for sustainable and energy-efficient swimming pool accessories. Solar-powered pumps, LED lighting, low-energy filtration systems, and eco-friendly cleaning solutions are gaining traction. Consumers and commercial operators are prioritizing products that reduce electricity consumption, water usage, and chemical reliance. Additionally, aesthetic customization, modular designs, and multi-functional accessories are shaping buying preferences. These trends reflect the growing awareness of environmental impact, cost efficiency, and enhanced user experience, positioning energy-efficient and eco-conscious products as key drivers of market adoption.

The market faces challenges due to seasonal fluctuations, price sensitivity, and maintenance complexities. Demand peaks during the summer months, leading to uneven sales cycles for manufacturers and distributors. Price-sensitive consumers may prefer budget alternatives, impacting the adoption of premium or technologically advanced accessories. Additionally, installation, maintenance, and compatibility issues with existing pool systems can hinder growth. Manufacturers must balance affordability, performance, and quality while offering support services and warranties to address consumer concerns and sustain market competitiveness.

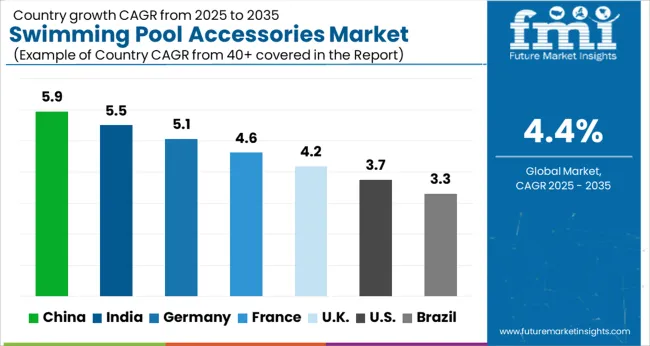

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The global swimming pool accessories market is projected to grow at a CAGR of 4.4% from 2025 to 2035. China leads with a growth rate of 5.9%, followed by India at 5.5% and France at 4.6%. The United Kingdom is expected to expand at 4.2%, while the United States shows steady growth at 3.7%. Increasing residential and commercial swimming pool construction, coupled with rising consumer awareness of pool hygiene and safety, drives market expansion. Emerging markets such as China and India benefit from growing urban development, rising disposable incomes, and expanding leisure industries. Mature markets including the USA , UK, and France focus on premium pool solutions, automated accessories, and enhanced maintenance technologies. Overall, global lifestyle trends and recreational growth underpin the adoption of swimming pool accessories worldwide. This report includes insights on 40+ countries; the top markets are shown here for reference.

The swimming pool accessories market in China is projected to grow at a CAGR of 5.9%. Rapid urban development, rising disposable incomes, and increasing residential and commercial pool constructions drive market demand. Adoption of advanced cleaning, filtration, and maintenance solutions enhances convenience and safety. Manufacturers are introducing automated pool cleaning systems, water treatment accessories, and smart monitoring equipment to meet evolving consumer expectations. Growth in hotel, resort, and leisure sectors further contributes to increased accessory adoption. Domestic production capacities are being expanded to support rising demand, while government regulations ensure safety and water hygiene standards. China’s proactive approach to improving residential and commercial pool infrastructure positions it as the leading growth market globally.

The swimming pool accessories market in India is expected to grow at a CAGR of 5.5%. Rising urbanization, expanding real estate development, and increasing disposable incomes contribute to higher pool installations. Adoption of maintenance accessories, filtration systems, and safety equipment is on the rise. Manufacturers focus on cost-effective and reliable products to cater to both residential and commercial markets. Growth in hotel, resort, and recreational facilities stimulates demand for high-quality pool accessories. Government regulations regarding water safety and hygiene encourage the use of standardized products. Overall, India’s market is poised for steady growth as consumer interest in leisure and wellness increases across urban centers.

The swimming pool accessories market in France is projected to grow at a CAGR of 4.6%. Adoption is primarily driven by residential pools, luxury resorts, and hotel projects. Consumers increasingly prefer automated cleaning devices, energy-efficient pumps, and advanced filtration solutions. Manufacturers focus on high-quality, durable, and eco-friendly products to meet premium market requirements. Growth is supported by investments in leisure infrastructure and rising tourism, which demand well-maintained pool facilities. Regulations related to water safety and hygiene encourage consistent use of accessories and cleaning systems. France’s market benefits from high standards in construction and hospitality, ensuring steady expansion of swimming pool accessory adoption.

The swimming pool accessories market in the United Kingdom is forecast to grow at a CAGR of 4.2%. Adoption is supported by rising consumer preference for home pools, recreational facilities, and commercial complexes. Manufacturers emphasize durable, high-quality, and energy-efficient accessories such as filtration systems, water treatment solutions, and cleaning equipment. Market growth is also supported by increasing renovation and modernization of existing pool facilities. Regulatory requirements for safety and hygiene encourage the use of standardized products. While growth is moderate compared to emerging markets, the UK market is steady due to consumer demand for advanced and reliable pool accessories in both residential and commercial sectors.

The swimming pool accessories market in the United States is expected to expand at a CAGR of 3.7%. Adoption is driven by residential pools, hotels, resorts, and recreational facilities seeking maintenance, safety, and aesthetic solutions. Manufacturers focus on automated cleaning devices, chemical treatment systems, and energy-efficient pumps to meet consumer expectations. Demand is further supported by pool renovation projects and upgrades in commercial complexes. Regulatory compliance for water safety and hygiene reinforces adoption of standardized accessories. While growth is slower than in Asia, the USA remains a major market due to high pool ownership, mature industrial base, and steady consumer spending on recreational products.

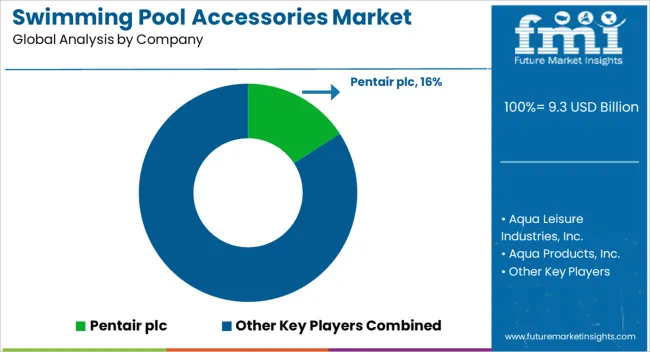

The swimming pool accessories market is being shaped by manufacturers and distributors focusing on quality, durability, and innovative product offerings for residential and commercial pools. Pentair plc and Hayward Industries, Inc. lead with comprehensive solutions including pumps, filters, automation systems, and cleaning equipment, emphasized in brochures for performance, reliability, and energy efficiency. Fluidra S.A. and Zodiac Pool Systems LLC differentiate through integrated smart pool systems and automated cleaning solutions, targeting tech-savvy consumers and large-scale commercial installations. Aqua Leisure Industries, Inc., Blue Wave Products, Inc., and Emaux Water Technology Co., Ltd. emphasize versatility, cost-effectiveness, and ease of installation in their product portfolios.

Other key players, including Intex Recreation Corp, Pool Corporation (POOLCORP), and Leslie’s, Inc., focus on aftermarket accessories and maintenance products, highlighting convenience, compatibility, and accessibility. Aqua Products, Inc., Maytronics Ltd., S.R. Smith, LLC, and Speck Pumps-Pool Products, Inc. provide specialized solutions like robotic cleaners, water treatment systems, and pool safety accessories. Waterco Limited emphasizes innovation in water circulation, filtration, and sanitation systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.3 Billion |

| Product Type | Cover, Filters, Toys, Pumps, Lighting, Liners, Boards, Ladders, Cleaners, Slides, Mats, Handrails, Inflatables, and Others |

| Pool Type | In Ground pools and Above Ground pools |

| Pool Size | Medium, Small, and Large |

| Price Range | Medium range, Lower range, and Luxury |

| End Users | Residential and Commercial |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Pentair plc, Aqua Leisure Industries, Inc., Aqua Products, Inc., Blue Wave Products, Inc., Emaux Water Technology Co., Ltd., Fluidra S.A., Hayward Industries, Inc., Intex Recreation Corp, Leslie's, Inc., Maytronics Ltd., Pool Corporation (POOLCORP), S.R. Smith, LLC, Speck Pumps-Pool Products, Inc., Waterco Limited, and Zodiac Pool Systems LLC |

| Additional Attributes | Dollar sales by product type (filters, pumps, covers, lighting, cleaning equipment) and material (plastic, metal, composite) are key metrics. Trends include rising demand for energy-efficient and automated pool accessories, growth in residential and commercial pools, and increasing focus on aesthetics and safety. Regional adoption, technological advancements, and lifestyle-driven preferences are driving market growth. |

The global swimming pool accessories market is estimated to be valued at USD 9.3 billion in 2025.

The market size for the swimming pool accessories market is projected to reach USD 14.3 billion by 2035.

The swimming pool accessories market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in swimming pool accessories market are cover, filters, toys, pumps, lighting, liners, boards, ladders, cleaners, slides, mats, handrails, inflatables and others.

In terms of pool type, in ground pools segment to command 63.5% share in the swimming pool accessories market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Swimming Caps Market

Rat and Mouse Forced Swimming Test System Market Size and Share Forecast Outlook 2025 to 2035

Portable & Inflatable Swimming Pool Market Trends - Growth & Demand to 2025 to 2035

Pool and Spa Market Size and Share Forecast Outlook 2025 to 2035

Carpool As A Service Market Size and Share Forecast Outlook 2025 to 2035

Pallet Pooling Market Forecast and Outlook 2025 to 2035

Motorized Pool Tube Market Size and Share Forecast Outlook 2025 to 2035

Medical Whirlpool Market

Solar Floating Pool Lights Market Insights – Trends, Demand & Growth 2025-2035

Car Accessories Market Size and Share Forecast Outlook 2025 to 2035

Bar Accessories Market

Jack Accessories Market Size and Share Forecast Outlook 2025 to 2035

Dock Accessories Market Size and Share Forecast Outlook 2025 to 2035

Golf Accessories Market Size and Share Forecast Outlook 2025 to 2035

Apple Accessories Market Report – Demand, Trends & Forecast 2025–2035

Cable Accessories Market Growth - Trends & Forecast 2025 to 2035

Laptop Accessories Market Size and Share Forecast Outlook 2025 to 2035

E-Bike Accessories Market Size and Share Forecast Outlook 2025 to 2035

Travel Accessories Market Analysis by Product Type, Material, Distribution Channel, End-User and Region 2025 to 2035

Key Players & Market Share in Laptop Accessories Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA