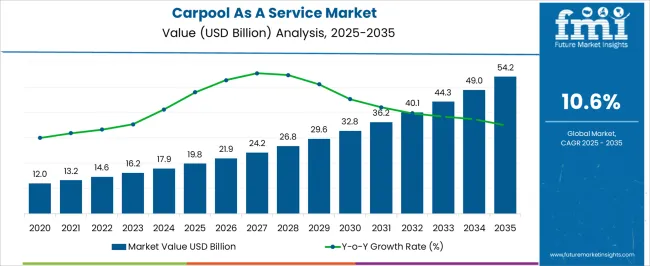

The carpool as a service market is projected to grow from USD 19.8 billion in 2025 to USD 54.2 billion in 2035, at a CAGR of 10.6%. From 2020 to 2024, the market remained in its early adoption stage, building the foundation through gradual participation and awareness. This phase established a consistent yet modest base, increasing from USD 12.0 billion in 2020 to USD 17.9 billion in 2024.

By 2025, scaling begins, marking a sharper demand curve. Between 2025 and 2030, the market experiences rising adoption momentum, expanding from USD 19.8 billion to USD 29.6 billion, with broader user integration. From 2030 to 2035, the market transitions into consolidation, where adoption stabilizes at a higher level while competitive positioning strengthens. This period reflects the industry’s maturity, moving from USD 32.8 billion in 2030 to USD 54.2 billion in 2035. Growth during this stage remains steady, signaling deeper penetration, wider acceptance, and retention of established users.

The CAGR of 10.6% demonstrates robust long-term potential, showing that the market’s expansion is not only reliant on new entrants but also on consistent scaling of usage models. This maturity curve indicates a well-structured lifecycle trajectory across adoption stages.

| Metric | Value |

|---|---|

| Carpool As A Service Market Estimated Value in (2025 E) | USD 19.8 billion |

| Carpool As A Service Market Forecast Value in (2035 F) | USD 54.2 billion |

| Forecast CAGR (2025 to 2035) | 10.6% |

The carpool as a service market, valued at USD 19.8 billion in 2025 and projected to reach USD 54.2 billion by 2035 at a CAGR of 10.6%, may show certain seasonal trends tied to commuting behaviors and travel demand. Usage often rises during working months when office attendance is high and stabilizes or dips during holiday seasons or long vacation periods when people travel less for daily commuting.

Additionally, academic calendars also influence demand as student commuting represents a substantial share. Monitoring these recurring short-term demand patterns allows providers to optimize fleet allocation, pricing models, and promotional campaigns across the year. Cyclicality in the Carpool as a Service market is influenced more by macroeconomic factors, fuel prices, and overall transportation costs.

During economic expansions, more users adopt carpool services as a cost-effective alternative to private ownership, while downturns may either increase demand due to cost savings or decrease usage if employment levels fall and commuting declines. Over the longer cycle from 2025 to 2035, consistent growth suggests rising adoption despite short-term fluctuations. Identifying both seasonal commuting peaks and cyclical shifts in mobility preferences enables service providers to refine long-term growth strategies, mitigate risks, and maintain operational efficiency.

The market is experiencing sustained expansion as urban mobility patterns evolve toward more sustainable and cost-efficient transportation options. The growth is being driven by rising fuel prices, increasing congestion in metropolitan areas, and heightened environmental awareness among commuters. Technological advancements, particularly in mobile connectivity, location tracking, and digital payment systems, have enhanced the accessibility and convenience of carpooling platforms.

Integration with real-time traffic data and AI-powered matching algorithms is enabling more efficient route optimization and improved user experiences. Supportive government policies promoting shared mobility to reduce carbon emissions are also encouraging adoption.

The market is benefiting from increased participation by both established mobility providers and emerging technology-driven startups.

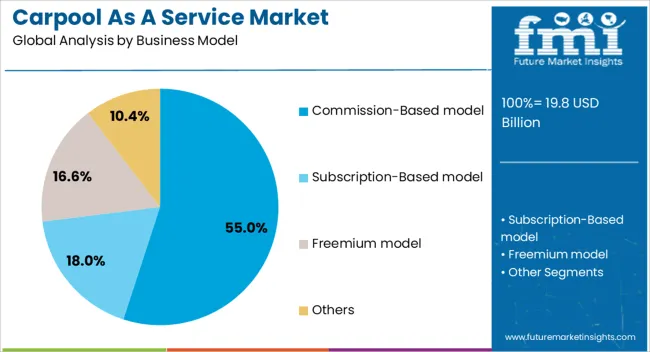

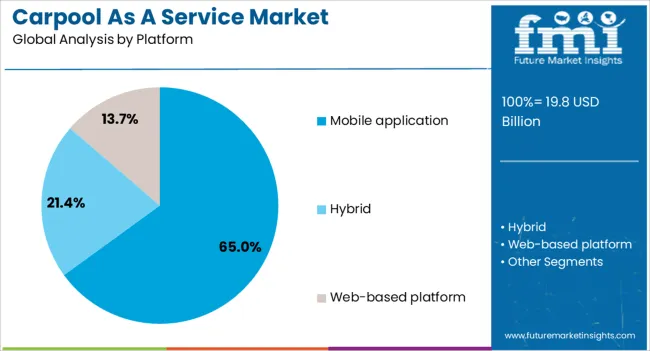

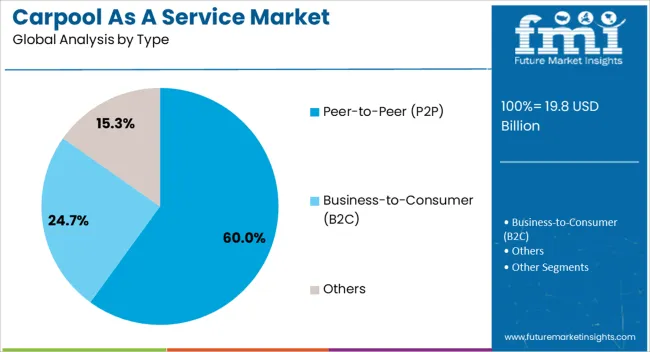

The carpool as a service market is segmented by business model, platform, type, application, and geographic regions. By business model, carpool as a service market is divided into Commission-Based model, Subscription-Based model, Freemium model, and Others. In terms of platform, carpool as a service market is classified into Mobile application, Hybrid, and Web-based platform.

Based on type, carpool as a service market is segmented into Peer-to-Peer (P2P), Business-to-Consumer (B2C), and Others. By application, carpool as a service market is segmented into Daily commuting, Long-Distance travel, Airport transfers, Event-Based travel, and Others. Regionally, the carpool as a service industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The commission-based model is expected to hold 55% of the Carpool As A Service market revenue share in 2025, making it the leading business model. Growth in this segment has been driven by its ability to generate sustainable revenue streams while aligning platform profitability with transaction volumes. This model allows providers to charge a percentage fee on each ride booked, which incentivizes them to enhance service quality and user retention.

The approach reduces the need for high upfront user costs, encouraging broader participation from both drivers and passengers. Commission-based pricing is also adaptable to different markets, enabling scalability across regions with varying economic conditions.

By aligning costs with actual usage, this model offers a balanced value proposition to customers while ensuring long-term platform viability. The success of this approach has been reinforced by the increasing digitalization of payment systems and the growing trust in secure online transactions, both of which are essential for market penetration and expansion.

The mobile application platform is projected to account for 65% of the Carpool As A Service market revenue share in 2025, establishing it as the dominant platform type. This leadership is being driven by the widespread adoption of smartphones and the increasing reliance on mobile apps for everyday services. Mobile applications provide real-time ride matching, route optimization, and secure payment integration, enhancing user convenience and engagement.

The platform’s capability to integrate features such as in-app communication, ride tracking, and safety verification has further boosted user confidence. Mobile app accessibility also enables rapid market expansion by allowing providers to reach large user bases without extensive physical infrastructure.

Continuous updates and feature enhancements can be delivered seamlessly to improve user experience and retention. The growth of mobile-first economies and the proliferation of high-speed internet services are further strengthening the dominance of mobile applications in enabling scalable and efficient carpooling services across urban and suburban regions.

The peer-to-peer type is anticipated to secure 60% of the Carpool As A Service market revenue share in 2025, positioning it as the leading service type. Growth in this segment has been attributed to its decentralized nature, which connects individual drivers and passengers directly through a digital platform. This model reduces operational overhead for service providers while fostering a community-driven approach that appeals to cost-conscious and environmentally aware users.

The scalability of the P2P type is enhanced by its ability to leverage existing private vehicles, minimizing the need for fleet ownership or large-scale infrastructure investments. Users benefit from competitive pricing and flexible scheduling, while drivers can monetize unused vehicle capacity.

Trust-building features such as identity verification, ratings, and reviews have further encouraged adoption. With urban populations seeking affordable and convenient alternatives to traditional transport, the P2P type is expected to remain a preferred choice, supporting both market growth and broader sustainability objectives.

The Carpool as a Service (CaaS) market is expanding as urbanization, traffic congestion, and environmental concerns drive demand for shared mobility solutions. Enabled by mobile platforms, real-time tracking, and digital payment integration, CaaS provides cost-efficient and eco-friendly commuting options. Adoption is supported by government sustainability policies, growing corporate ridesharing programs, and rising consumer awareness of carbon footprint reduction. However, regulatory ambiguity, rider safety concerns, and competitive alternatives such as ride-hailing services present challenges. Technology innovation and public-private collaboration remain key growth enablers.

One of the biggest challenges in the CaaS market is building trust among users regarding rider safety, data security, and service reliability. Unlike traditional ride-hailing, carpools involve multiple passengers with varied destinations, requiring optimized algorithms to balance efficiency and convenience. Ensuring accurate route-matching, preventing cancellations, and delivering consistent availability are ongoing operational hurdles. Rider reluctance, particularly in emerging markets, stems from cultural reservations about sharing vehicles with strangers. Corporate adoption also requires strong compliance with workplace safety standards and liability frameworks. Platforms must invest heavily in background checks, in-app safety features, and transparent rating systems to build confidence. Meanwhile, fluctuating user participation leads to inconsistent demand-supply dynamics, limiting network scalability. Overcoming these adoption barriers requires a balance of trust-building measures, advanced routing technologies, and incentive structures to encourage regular participation. Without resolving these issues, mass-market penetration of CaaS will remain slow in many regions.

The CaaS market is experiencing strong momentum through digital integration and sustainability-focused innovations. AI-driven route optimization, predictive analytics, and GPS-enabled platforms are enhancing the efficiency of shared rides. Integration with digital payments and multi-modal mobility platforms allows seamless booking across transport ecosystems, positioning CaaS as part of “Mobility-as-a-Service” (MaaS) frameworks. Corporations and universities are adopting dedicated carpool platforms to reduce parking demand and meet sustainability targets, strengthening demand in B2B channels. Additionally, rising urban policies aimed at lowering congestion and carbon emissions are aligning with shared mobility solutions. Sustainability is increasingly a consumer priority, with carpooling marketed as an affordable, eco-friendly commuting option compared to ride-hailing. Integration with electric vehicle (EV) fleets and incentives for green commuting further reinforce this trend. Collectively, digital innovation and eco-conscious mobility goals are pushing CaaS into mainstream commuting behavior while strengthening its role in the broader shared mobility ecosystem.

The CaaS market holds significant opportunities through corporate, municipal, and community-driven adoption. Employers are increasingly integrating carpooling platforms into workforce mobility programs to cut commuting costs, reduce parking congestion, and support ESG initiatives. Cities facing traffic congestion and air quality concerns are incentivizing shared commuting through tax breaks, lane access privileges, and integration with public transport. Emerging markets in Asia-Pacific, Latin America, and the Middle East present large-scale adoption potential due to growing urbanization and limited public transit infrastructure. Platform providers that offer flexible models—such as corporate carpool subscriptions, intercity ride-sharing, or integration with EV charging hubs—can tap into new revenue streams. Partnerships with governments and transportation authorities also enhance credibility and market penetration. With the rise of digital ecosystems, localized carpool networks tailored for residential communities, universities, and industrial hubs represent untapped growth opportunities that can significantly expand the CaaS market footprint globally.

Despite growing interest, the CaaS market faces regulatory and competitive restraints that impact adoption. Rules governing shared mobility vary widely across regions, with some jurisdictions classifying carpooling as a commercial service, thereby imposing licensing and insurance requirements that deter operators. Ambiguity in liability frameworks further complicates large-scale adoption, particularly for corporate fleets. At the same time, strong competition from ride-hailing and micro-mobility services diverts potential users, as consumers often prioritize convenience over cost savings. Market growth is also restrained by inconsistent participation rates, especially during off-peak commuting hours. Seasonal disruptions, such as remote working trends, can significantly reduce demand. Additionally, limited awareness in developing regions hampers user acquisition. Until regulatory harmonization, liability clarity, and competitive differentiation improve, scaling CaaS will remain challenging. Providers must navigate compliance complexities while building compelling value propositions that differentiate carpooling from established mobility alternatives.

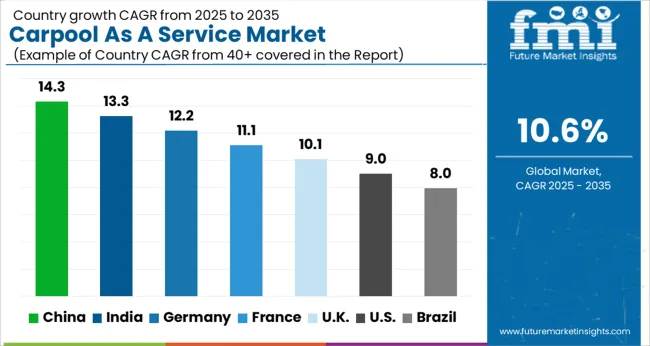

| Country | CAGR |

|---|---|

| China | 14.3% |

| India | 13.3% |

| Germany | 12.2% |

| France | 11.1% |

| UK | 10.1% |

| USA | 9.0% |

| Brazil | 8.0% |

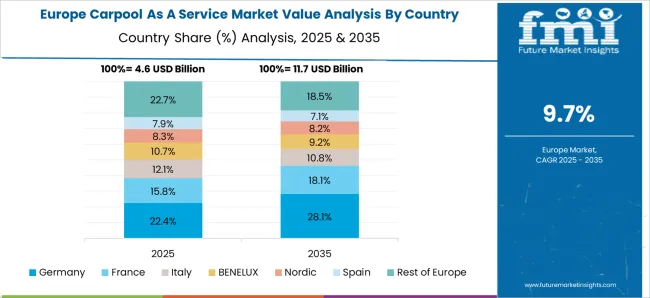

The global Carpool As A Service Market is projected to expand at a CAGR of 10.6% through 2035, supported by increasing adoption across urban mobility, shared transportation, and sustainable commuting solutions. Among BRICS nations, China has been recorded with 14.3% growth, driven by rapid integration of ride-sharing platforms and smart city initiatives, while India has been observed at 13.3%, supported by rising urban population and demand for affordable transport alternatives. In the OECD region, Germany has been measured at 12.2%, reflecting strong uptake in eco-friendly and cost-efficient commuting options. The United Kingdom has been noted at 10.1%, influenced by regulatory support and digital adoption in shared mobility, while the USA has been recorded at 9.0%, where carpool services are being increasingly utilized to reduce congestion and emissions. This report includes insights on 40+ countries; the top five markets are highlighted here.

The carpool as a service market in China is growing at a CAGR of 10.6%, reflecting rising urbanization, traffic congestion, and environmental awareness among commuters. Large cities are seeing increased adoption of shared mobility solutions, supported by government policies encouraging green transportation. Mobile apps are simplifying ride matching, payments, and route optimization, making carpooling convenient for daily commuters. Companies and tech startups are offering subscription based plans, loyalty rewards, and corporate carpool programs to attract more users. Integration with public transport networks is also enhancing last mile connectivity. The market is benefiting from both younger and working professional populations seeking cost effective and sustainable transportation alternatives. Advanced data analytics are enabling service providers to optimize routes, reduce wait times, and improve user experience, while safety features such as driver verification and in app tracking are increasing trust among users.

Carpool as a service market in India is expanding at a CAGR of 10.6%, driven by rapid urban population growth and rising fuel costs. Tier 1 and tier 2 cities are witnessing growing adoption among office commuters, university students, and gig economy workers. App based platforms are offering real time route optimization, cost sharing, and dynamic pricing to increase efficiency. Government initiatives promoting sustainable transport and emission reduction are further encouraging shared mobility adoption. Startups are targeting daily commute solutions with subscription models and loyalty incentives, while ride safety is enhanced through driver ratings, GPS tracking, and in app emergency features. Partnerships with corporate offices and educational institutions are creating structured carpool networks. Social campaigns highlighting environmental benefits and reduced traffic congestion are boosting awareness and long term acceptance of carpooling as a reliable alternative to private vehicle use.

Carpool as a service market in Germany is recording a CAGR of 12.2%, supported by strong environmental consciousness and high urban mobility needs. Shared rides are increasingly preferred in large cities to reduce congestion and emissions. App based carpool platforms are offering automated route matching, fare calculation, and real time trip monitoring to enhance convenience. Corporate mobility programs are incentivizing employees to adopt shared commuting solutions. Integration with public transport systems enables smoother first mile and last mile connectivity. Ride safety measures, including verified driver profiles and secure payment options, are driving user confidence. Subscription based models and loyalty rewards are helping retain regular commuters. Additionally, Germany’s strict traffic and safety regulations ensure high quality service standards, while marketing campaigns emphasizing eco friendly and cost effective commuting options are increasing adoption among urban populations.

The United Kingdom is experiencing a CAGR of 10.1% in the carpool as a service market, driven by increasing urban traffic and rising awareness of environmental sustainability. Commuters are adopting app based platforms for real time ride sharing, dynamic fare calculation, and flexible scheduling. Subscription and loyalty programs encourage repeat usage, while partnerships with employers and local councils are boosting structured carpool networks. Integration with public transport hubs and park and ride facilities facilitates easier first and last mile connectivity. Government campaigns promoting emission reduction and sustainable commuting are increasing awareness. Safety measures such as driver verification, user reviews, and live tracking are enhancing trust in the services. Marketing efforts are highlighting cost savings, reduced congestion, and environmental benefits, making carpooling a convenient and socially responsible transport alternative for urban and suburban populations.

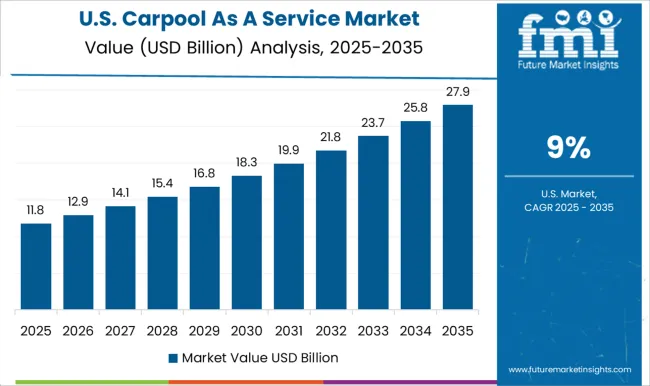

The United States carpool as a service market is growing at a CAGR of 9.0%, driven by rising traffic congestion, urban sprawl, and awareness of sustainability. App based carpool platforms are enabling commuters to share rides efficiently through automated route optimization, cost sharing, and flexible scheduling. Corporate carpool programs and university initiatives are creating structured networks for consistent usage. Integration with public transport hubs improves last mile connectivity, while subscription plans and loyalty incentives encourage frequent participation. Safety features, including verified drivers, ratings, and GPS tracking, are increasing user confidence. Marketing campaigns are promoting cost effectiveness, environmental impact reduction, and reduced commute stress. Increasing interest in smart mobility and digital solutions among younger populations further contributes to market adoption across major metropolitan regions and suburban areas.

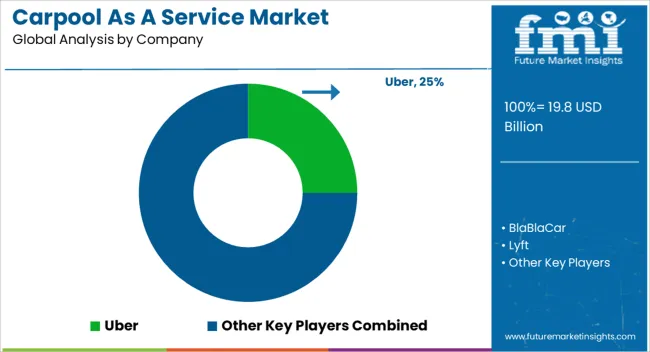

The carpool-as-a-service market is highly competitive, led by global giants and regional innovators. Uber dominates with Uber Pool, using advanced algorithms and a large user base to optimize ride matching and reduce costs. Lyft, its main USA competitor, emphasizes shared rides through Lyft Line, promoting affordability and lower environmental impact. BlaBlaCar focuses on long-distance travel across Europe, connecting drivers and passengers through community-driven carpooling. DiDi Chuxing, dominant in China, integrates carpooling across its platform to cater to diverse transportation needs. Local and regional startups carve niches with solutions tailored to specific markets, often responding faster to unique urban or rural mobility challenges.

Strategies revolve around technology integration, user experience, and brand trust. Uber and Lyft blend carpooling into broader ride-hailing platforms, streamlining operations through intuitive apps, dynamic pricing, and predictive routing. BlaBlaCar builds loyalty with verified profiles, reviews, and social engagement, emphasizing shared journeys rather than just transportation. DiDi leverages its massive domestic network to offer flexible, localized solutions, while startups rely on agile, highly customized offerings.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.8 Billion |

| Business Model | Commission-Based model, Subscription-Based model, Freemium model, and Others |

| Platform | Mobile application, Hybrid, and Web-based platform |

| Type | Peer-to-Peer (P2P), Business-to-Consumer (B2C), and Others |

| Application | Daily commuting, Long-Distance travel, Airport transfers, Event-Based travel, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Uber, BlaBlaCar, Lyft, DiDi, Local / regional startups, and Others |

| Additional Attributes | Dollar sales by type including app-based carpooling, corporate ride-sharing, and peer-to-peer solutions, application across daily commuting, intercity travel, and corporate mobility, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising urban congestion, cost-effective mobility demand, and increasing focus on sustainable transportation. |

The global carpool as a service market is estimated to be valued at USD 19.8 billion in 2025.

The market size for the carpool as a service market is projected to reach USD 54.2 billion by 2035.

The carpool as a service market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types in carpool as a service market are commission-based model, subscription-based model, freemium model and others.

In terms of platform, mobile application segment to command 65.0% share in the carpool as a service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asthma Treatment Market Forecast and Outlook 2025 to 2035

Asphalt Mixing Plants Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Aspirating System Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Formulation Processing Market Size and Share Forecast Outlook 2025 to 2035

Asphalt Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Astringent Skin Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Aseptic Containment Systems Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asset Performance Management Market Size and Share Forecast Outlook 2025 to 2035

Asphalt Mixing Plant Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Asian Sea Bass Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Aspirin Drug Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pallets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific and Europe Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Astringents Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Assembly Fastening Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA