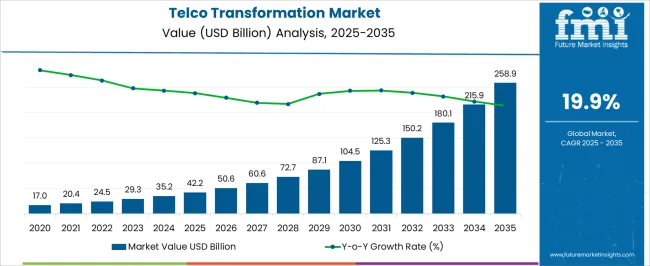

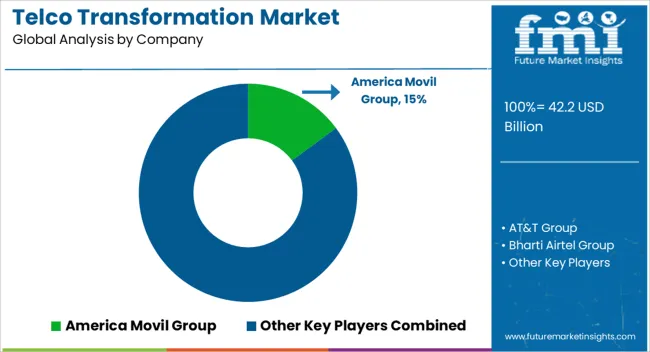

The Telco Transformation Market is estimated to be valued at USD 42.2 billion in 2025 and is projected to reach USD 258.9 billion by 2035, registering a compound annual growth rate (CAGR) of 19.9% over the forecast period.

| Metric | Value |

|---|---|

| Telco Transformation Market Estimated Value in (2025 E) | USD 42.2 billion |

| Telco Transformation Market Forecast Value in (2035 F) | USD 258.9 billion |

| Forecast CAGR (2025 to 2035) | 19.9% |

The telco transformation market is expanding steadily, driven by the rapid evolution of telecommunications networks and the increasing emphasis on digitalization. Rising consumer demand for high-speed connectivity, combined with enterprise requirements for scalable and reliable communication solutions, is accelerating adoption of advanced technologies. The integration of cloud-native infrastructure, edge computing, and artificial intelligence into telecom networks is enabling operators to modernize service delivery while improving efficiency and reducing operational costs.

Investments in 5G rollouts and network virtualization are shaping the future of telecom infrastructure, supporting higher bandwidth, lower latency, and enhanced service innovation. Regulatory mandates encouraging spectrum utilization and cross-industry collaboration are also influencing market dynamics.

Telecom operators are increasingly prioritizing flexible service delivery models to meet growing data traffic demands and to support digital services across industries As digital ecosystems expand globally, telco transformation initiatives are expected to intensify, paving the way for more agile, cost-efficient, and customer-centric networks that drive both commercial growth and technological advancement.

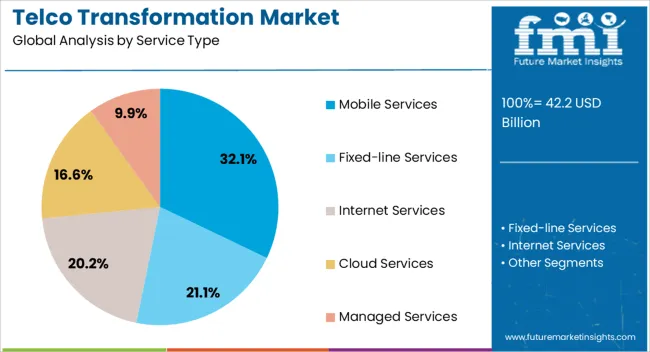

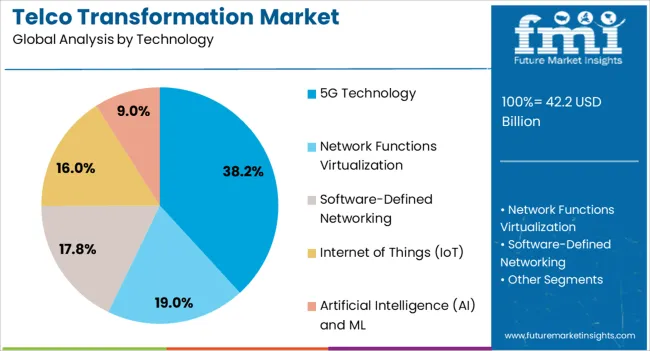

The telco transformation market is segmented by service type, technology, deployment mode, customer type, key application, and geographic regions. By service type, telco transformation market is divided into Mobile Services, Fixed-line Services, Internet Services, Cloud Services, and Managed Services. In terms of technology, telco transformation market is classified into 5G Technology, Network Functions Virtualization, Software-Defined Networking, Internet of Things (IoT), and Artificial Intelligence (AI) and ML.

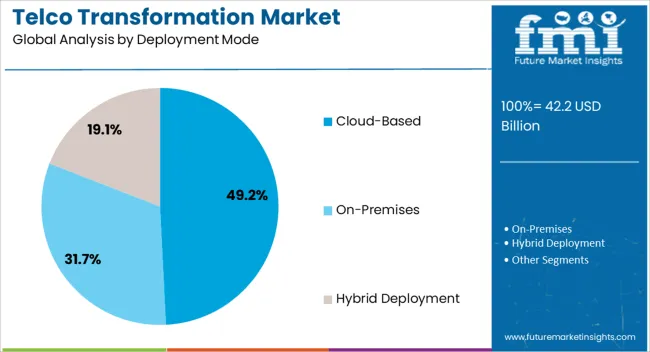

Based on deployment mode, telco transformation market is segmented into Cloud-Based, On-Premises, and Hybrid Deployment. By customer type, telco transformation market is segmented into Large Enterprises, Residential Customers, Small and Medium Enterprises (SMEs), Government and Public Sector, and Wholesale Customers.

By key application, telco transformation market is segmented into Network Management and Automation, Billing and Revenue Management, Customer Experience Management, Fraud Management, and Data Analytics and Insights. Regionally, the telco transformation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mobile services segment is projected to hold 32.1% of the telco transformation market revenue share in 2025, establishing itself as the leading service type. Growth in this segment is being propelled by the surge in mobile data consumption, increasing smartphone penetration, and rising adoption of digital applications across consumer and enterprise markets. Telecom operators are focusing on modernizing their mobile infrastructure to deliver enhanced quality of service, faster connectivity, and value-added offerings such as mobile banking, entertainment, and IoT-driven applications.

The adoption of advanced technologies like software-defined networking and network function virtualization is improving the scalability and flexibility of mobile service delivery. Growing demand for personalized and on-demand services is pushing operators to reconfigure mobile networks to support customer-centric innovation.

Furthermore, the role of mobile services in bridging the digital divide, particularly in emerging markets, is amplifying investment in infrastructure upgrades As 5G networks expand and digital ecosystems become more sophisticated, mobile services are expected to continue holding a leading share within the market.

The 5G technology segment is anticipated to account for 38.2% of the telco transformation market revenue share in 2025, making it the leading technology area. Its growth is being driven by the increasing need for ultra-fast connectivity, low latency communication, and massive device interconnectivity across both consumer and enterprise applications. Telecom operators are accelerating investment in 5G infrastructure to enable new services, including smart manufacturing, autonomous mobility, and advanced IoT ecosystems.

The capability of 5G networks to support high-capacity workloads and advanced use cases is redefining the role of telecom providers in the digital economy. Governments and regulators are actively supporting spectrum allocation and infrastructure investments, further enhancing adoption.

Enterprises are leveraging 5G to drive innovation in cloud applications, AR and VR solutions, and mission-critical communication systems The scalability and flexibility offered by 5G are positioning it as a cornerstone of telco transformation, ensuring its dominance as the most significant technology driver shaping the future of telecommunications.

The cloud-based deployment mode is expected to capture 49.2% of the telco transformation market revenue share in 2025, making it the dominant deployment model. This leadership is being supported by the ability of cloud platforms to deliver flexibility, scalability, and cost efficiency to telecom operators managing rapidly growing data traffic. Cloud-native architectures are enabling network functions virtualization and software-defined operations, reducing dependence on traditional hardware-based systems.

The adoption of cloud deployment is allowing telecom providers to roll out services faster, scale resources dynamically, and integrate AI and analytics to optimize performance. Operators are increasingly migrating to hybrid and multi-cloud environments to ensure resilience, compliance, and business continuity.

The model also supports collaboration with technology partners and hyperscale providers, broadening service innovation and expanding ecosystem offerings With the growing emphasis on digital transformation, cloud-based deployments are set to remain the foundation of next-generation telecom networks, reinforcing their position as the preferred choice for service providers in a competitive landscape.

Changes in regulations, rapidly changing consumer demand trends, newer technologies, spectrum crunch, and increased emphasis on digital content and data-oriented services are forcing companies to undertake business restructuring and adopt newer telco transformation technologies to streamline operations. Transformation requires simplification, increased consumer focus, and harmonization.

The foundation of any business transformation program is to define future investment targets today to be fully prepared to adopt and offer emerging business demands for telco transformation and the newer services of tomorrow.

The decline in voice revenues, lower subscriber loyalty and churn, regulatory pressure, and increasing spectrum issues are all key drivers for the telco transformation market. The key challenges in the telco transformation market are proper network planning for burgeoning network sizes and limited spectrum availability.

This problem is exacerbated by the emergence of new technologies such as 2G and 3G, HSPA and HSPA+, WiMAX, Wi-Fi, frequency division duplexing LTE (FDD LTE), time division duplexing LTE, LTE advanced, and wired broadband, among others. Most of these technologies must coexist, which has created new challenges in network planning and the telco transformation market.

The significant challenge of the telco transformation market is managing network products' end-of-life cycle to improve network efficiency and reliability.

Telco transformation market opportunities exist in emerging consumer segments such as banking and utilities, expanding their network infrastructure to improve productivity. Another key telco transformation market opportunity is to improve data-driven services and emphasize emerging technologies such as machine-to-machine (M2M).

North America is expected to dominate during the forecast period, gaining a sizable revenue share. In the United States and Canada, there is an increased use of hybrid telco cloud installations, which helps to embed best-in-class data analytics and artificial intelligence available in the public cloud sector to predict and fulfill consumers' needs and preferences.

The telco transformation is also used by businesses to eliminate database silos, consolidate customer data, provide an engaging Omni channel customer experience, and create a 360-degree view of the consumer.

The rapid growth of infrastructure in the Asia Pacific region, particularly in South Korea, Japan, India, and China, as well as the rapid development of the 5G network, bodes well for the implementation of the telecom cloud. Government initiatives and policies encourage companies to expand their operations in this region, thereby contributing to economic telco transformation market growth.

The reduction of administrative and operational costs, the high demand for telco transformation services, and business awareness of the telecom cloud are just a few of the factors driving regional telco transformation market growth.

Due to the presence of several players, the telco transformation market is fragmented and is expected to see increased competition. The players' increased spending on R&D activities to integrate cutting-edge technologies in telecom cloud marketing has increased competition among these players.

To gain a competitive advantage over their peers and capture a significant telco transformation market share, the players are increasing their connectivity with the help of technological advancement.Telco Transformation Market Overview

Globally, the challenges presented by external factors to telecom sector have been increasing and telecom companies (telcos) are undertaking a rapid transformation in order to strengthen business.

Changes in regulations, rapidly varying trends in consumer demand, newer technologies, spectrum crunch, and increasing focus digital content and data oriented services are forcing the companies to take up business restructuring and adoption of newer technologies to streamline business. Simpli?cation, increasing consumer focus and harmonization are key for transformation.

Although the path to such a transformation of telco business would need to change depending upon each network operator’s and service provider’s speci'c business needs and goals This transformation would not only need huge investments and increasing focus on next generation service deployments, but a primary shift in the telco business approach.

The basis of every business transformation program is to de?ne today the future investment targets in order to be fully ready to adopt and offer for the emerging business demands and newer services of tomorrow.

Key drivers for telco transformation include decline in voice revenues, reducing loyalty and churn rate of subscribers, regulatory pressure and increasing spectrum issues. Key challenges in this market are proper network planning for burgeoning network sizes with low availability of spectrum.

This issue is further complicated by emergence of multiple technologies including 2G and 3G (UMTS), HSPA and HSPA+, WiMAX, Wi-Fi, frequency division duplexing LTE (FDD LTE), time division duplexing LTE (TDD LTE), LTE advanced and wired broadband, among others. There is a need for co-existence of majority of these technologies together and this has created new challenges in network planning. Another key challenge is end-of-life cycle of network products and their life cycle management in order to enhance network efficiency and reliability.

Opportunities in this market exist in terms of emerging new consumer segments such as banking and utilities sector which are increasing their network infrastructure in order to enhance their productivity. Enhancing data based services and increasing focus on emerging technologies such as machine-to machine (M2M) is another key opportunity in this market.

Telco types in this market include fixed and mobile. Fixed type again includes residential and enterprise services. Mobile telco type can be segmented based on service into voice and data. Telco market can be further segmented based on consumer types into retail, wholesale and enterprise consumers.

Retail consumers again include post-paid and pre-paid consumers. Various products and services in this market include VoIP, triple play, IPTV, cloud services and managed services, among others. Different end-user verticals in this market include energy, transport, healthcare, government, entertainment industry, and residential consumers, among others.

Key players in this market include America Movil Group, AT&T Group, Bharti Airtel Group, China Mobile Communications Corp., China United Network Communications Group Co., Ltd., KPN N.V., MTN Group, Deutsche Telekom AG, NTT Docomo, Inc., SK Telecom Co., Ltd., SoftBank Mobile Corp., Sprint Corporation, Saudi Telecom Company, Telecom Italia Group, Telenor Group, Verizon Wireless, Telefonica, S.A., Vivendi SA, Vodafone Group Plc, Alcatel-Lucent, LM Ericsson, Huawei Technologies Co. Ltd., Nokia Solutions and Networks and ZTE Corp., among others.

This research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data and statistically-supported and industry-validated market data and projections with a suitable set of assumptions and methodology.

It provides analysis and information by categories such as market segments, regions, product type and distribution channels.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

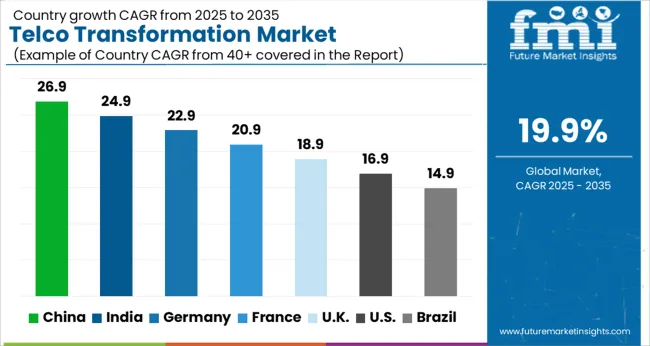

| Country | CAGR |

|---|---|

| China | 26.9% |

| India | 24.9% |

| Germany | 22.9% |

| France | 20.9% |

| UK | 18.9% |

| USA | 16.9% |

| Brazil | 14.9% |

The Telco Transformation Market is expected to register a CAGR of 19.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 26.9%, followed by India at 24.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 14.9%, yet still underscores a broadly positive trajectory for the global Telco Transformation Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 22.9%. The USA Telco Transformation Market is estimated to be valued at USD 16.0 billion in 2025 and is anticipated to reach a valuation of USD 76.2 billion by 2035. Sales are projected to rise at a CAGR of 16.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 2.0 billion and USD 1.2 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 42.2 Billion |

| Service Type | Mobile Services, Fixed-line Services, Internet Services, Cloud Services, and Managed Services |

| Technology | 5G Technology, Network Functions Virtualization, Software-Defined Networking, Internet of Things (IoT), and Artificial Intelligence (AI) and ML |

| Deployment Mode | Cloud-Based, On-Premises, and Hybrid Deployment |

| Customer Type | Large Enterprises, Residential Customers, Small and Medium Enterprises (SMEs), Government and Public Sector, and Wholesale Customers |

| Key Application | Network Management and Automation, Billing and Revenue Management, Customer Experience Management, Fraud Management, and Data Analytics and Insights |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | America Movil Group, AT&T Group, Bharti Airtel Group, KPN N.V., MTN Group, Deutsche Telekom AG, NTT Docomo, SK Telecom, SoftBank Mobile, Saudi Telecom Company, and Telecom Italia Group |

The global telco transformation market is estimated to be valued at USD 42.2 billion in 2025.

The market size for the telco transformation market is projected to reach USD 258.9 billion by 2035.

The telco transformation market is expected to grow at a 19.9% CAGR between 2025 and 2035.

The key product types in telco transformation market are mobile services, fixed-line services, internet services, cloud services and managed services.

In terms of technology, 5g technology segment to command 38.2% share in the telco transformation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital Transformation in Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation in Healthcare Market Analysis – Size, Share & Forecast 2025 to 2035

Digital Transformation in Supply Chain Market

SQL Server Transformation Market Size and Share Forecast Outlook 2025 to 2035

Data Center Transformation Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Rail Freight Digital Transformation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA