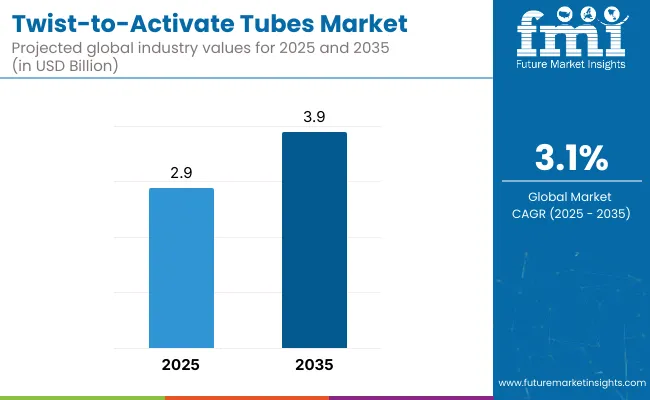

The twist-to-activate tubes market is projected to reach a valuation of USD 2.9 billion in 2025 and is expected to grow to USD 3.9 billion by 2035, reflecting a net addition of USD 1.0 billion over the ten-year period. This equates to a 34.5% total increase, with a compound annual growth rate (CAGR) of 3.1%. The market expands by a 1.3 multiple over the forecast timeline.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.9 billion |

| Industry Value (2035F) | USD 3.9 billion |

| CAGR (2025 to 2035) | 3.1% |

During the initial five-year phase from 2025 to 2030, the market rises from USD 2.9 billion to USD 3.3 billion, adding USD 0.4 billion, which represents 40.2% of the overall decade growth. Growth in this stage is driven by demand for unit-dose delivery formats in personal care, cosmetics, and topical pharmaceuticals. Convenience, hygiene, and accurate dispensing play a pivotal role, especially for serums, gels, and travel-sized medical ointments.

In the latter half from 2030 to 2035, the market climbs from USD 3.3 billion to USD 3.9 billion, contributing USD 0.6 billion, or 60.0% of the decade’s growth. The surge in premium packaging innovations, along with expansion into emerging markets and adoption for functional nutraceutical creams and active skincare, fuels this upward shift. Recyclable and bio-based polymer tubes with integrated activation mechanisms also gain popularity, aligning with sustainability trends and regulatory shifts.

From 2020 to 2024, the twist-to-activate tubes market grew from USD 410 million to USD 690 million, driven by hardware-centric adoption in personal care, cosmetics, pharmaceutical, and OTC product packaging. During this period, the competitive landscape was dominated by tube and closure manufacturers controlling nearly 70% of revenue, with leaders such as Neopac, Albéa, Berry Global, and Alltub focusing on precision-engineered tube systems that enable user-controlled dispensing and enhanced product protection.

Competitive differentiation relied on tamper-evidence, controlled flow, and barrier integrity, while smart dispensing mechanisms were bundled as an auxiliary offering rather than a core revenue stream. Service-based models had limited uptake, contributing less than 10% of the total market value, as manufacturers emphasized functionality and shelf appeal over post-sale engagement.

Demand for twist-to-activate tubes will expand to USD 3.3 billion in 2030, and the revenue mix will shift as integrated dispensing technologies and design services grow to over 40.2% share. Traditional tube manufacturers face rising competition from digital-first packaging innovators offering smart closures, dosage-tracking components, and sustainability-focused modular solutions. Major hardware vendors are pivoting to hybrid models, integrating recyclable materials, twist-lock safety mechanisms, and personalization-ready features to retain relevance.

Emerging entrants such as C. L. Smith, Kaufman Container, Kansai Tube Co., LTD, TAKEMOTO, and GuangZhouHuaXin Plastic Product Co., Ltd are gaining share by specializing in recyclable mono-material tubes, airless dispensing variants, and application-specific twist formats. The competitive advantage is moving away from static design innovation to full-system customization, sustainability leadership, and recurring value-added service streams.

Demand for convenient, hygienic, and single-use packaging formats in cosmetics, pharmaceuticals, and personal care products is driving the growth of the twist-to-activate tubes market. These tubes allow consumers to activate and dispense a formula such as gels, creams, or serums by a simple twist mechanism, ensuring precise application and minimizing product contamination. Increasing focus on user-friendly dispensing solutions and premium packaging aesthetics is accelerating adoption across both mass and luxury brands.

Dual-compartment twist-to-activate formats have gained popularity due to their ability to keep ingredients separate until use, preserving product potency and extending shelf life. These tubes are especially effective for active formulations like vitamin C, retinol, or hair colorants that require activation at the point of application. The combination of ease-of-use and portion control supports consumer satisfaction and brand differentiation in competitive markets.

Industries such as dermocosmetics, clinical skincare, OTC pharmaceuticals, and wellness are driving demand for packaging that ensures dosing precision, tamper-resistance, and intuitive use. These tubes support evolving consumer preferences for experiential packaging and enhance compliance in daily skincare or treatment regimens.

Segment growth is expected to be led by dual-chamber tube formats, personal care applications in end-use segments, and recyclable or biodegradable materials due to sustainability demands, functional integrity, and alignment with premium brand positioning.

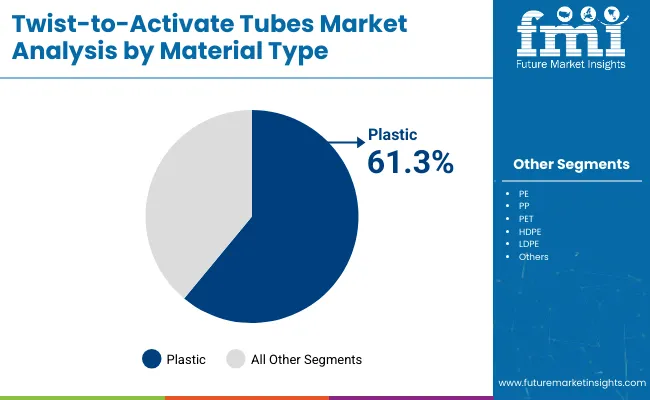

The market is segmented by material type, tube capacity, application, and region. Material type includes plastic (PE, PP, PET, HDPE, LDPE), aluminum, laminated (plastic + aluminum), and biodegradable/compostable materials, each offering specific benefits in terms of barrier protection, recyclability, and sustainability.

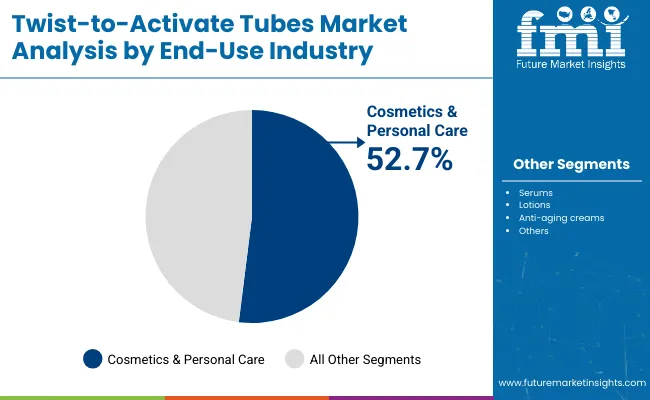

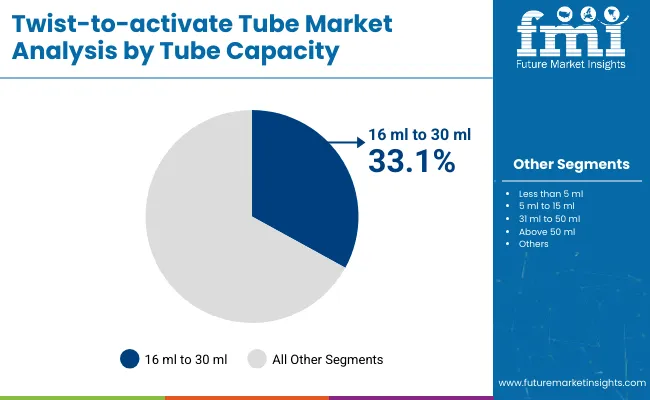

Tube capacity segmentation consists of less than 5 ml, 5 ml to 15 ml, 16 ml to 30 ml, 31 ml to 50 ml, and above 50 ml, accommodating various dosage and usage frequency preferences. Application areas cover pharmaceuticals (ointments, topical drugs, gels), cosmetics & personal care (serums, lotions, anti-aging creams), and oral care (whitening gels, fluoride gels), reflecting growing demand for hygienic, single-use, and travel-friendly packaging formats. Regionally, the market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The plastic segment is anticipated to account for the largest share of 61.3% in the twist-to-activate tubes Market by 2025. This dominance stems from the material's versatility, moldability, and compatibility with twist-dispensing mechanisms. Plastics such as polyethylene (PE) and polypropylene (PP) are extensively used due to their excellent barrier properties, low cost, and ease of customization. These materials enable precise formulation delivery, especially for multi-compartment and dual-dispensing tube formats that require flexibility and structural stability.

the increasing demand for portable, tamper-proof, and single-dose packaging has made plastic the material of choice for manufacturers aiming to offer convenience and extended shelf life. With ongoing innovations in recyclable and biodegradable plastic tubes, sustainability concerns are also being addressed without compromising on performance. As a result, plastic continues to maintain dominance in this segment by supporting both functional and eco-friendly packaging objectives.

The cosmetics & personal care segment is projected to lead the application category in the twist-to-activate tubes market with a 52.7% share in 2025. This leadership is driven by a surge in consumer demand for hygienic, single-touch, and time-release dispensing systems across skincare, haircare, and cosmeceuticals. Twist-to-activate tubes are particularly favored for products requiring dual-phase activation, such as vitamin-infused serums, whitening creams, and anti-aging gels.

Brands are increasingly utilizing this packaging to enhance consumer experience and differentiate their premium offerings. The format supports active ingredient preservation and on-demand formulation mixing, which appeals to modern consumers seeking fresh and potent applications. the rise in travel-size and e-commerce beauty formats has further boosted adoption of twist-activated solutions. With growing focus on skincare precision and luxury functionality, this application category is expected to continue its dominance throughout the forecast period.

The 16 ml to 30 ml segment is expected to account for the highest share of 33.1% in 2025 in the twist-to-activate tubes market. This segment's dominance stems from its optimal size range for single-use and travel-size applications, particularly in premium skincare, topical pharmaceuticals, and specialty cosmetics. Tubes in this capacity provide a balance between portability and adequate volume for targeted treatments or limited-duration regimens.

Consumers increasingly prefer compact, tamper-evident formats that align with on-the-go lifestyles, and twist-to-activate tubes in this range meet that need with precision dosing and minimal contamination risk.

Production cost variation and sealing complexities limit twist-to-activate tube scalability, even as demand grows in skincare, pharmaceuticals, and food applications for on-the-go, user-controlled dispensing and precise multi-phase product activation.

User-controlled Dispensing and Growing Demand for Multi-Phase Formulations

Twist-to-activate tubes are gaining rapid traction in cosmetics, personal care, pharmaceutical, and food sectors due to their convenience, hygiene, and controlled dispensing mechanisms. These packaging solutions allow two-component or multi-phase products such as serums and actives, or gels and powders to remain isolated until activation, preserving efficacy and shelf life.

In skincare and dermatological treatments, consumer demand for customizable regimens and freshness assurance is driving adoption. The twist mechanism offers a tamper-evident seal, portability, and a single-use format, all of which enhance safety and reduce contamination risks. The format’s intuitive functionality aligns with premium and clinical-grade product positioning in both retail and professional channels.

Complexity in Material Compatibility and High Manufacturing Overhead

Despite their functional benefits, twist-to-activate tubes face challenges associated with intricate design requirements, especially around barrier compatibility and precision engineering. These tubes require multiple compartments, tight rotational tolerances, and robust sealing to prevent premature activation or leakage.

As a result, tooling, molding, and quality testing processes are significantly more demanding than standard tubes, leading to higher production costs and longer lead times. the compatibility of actives with materials like plastics or laminates must be carefully validated, especially for pharmaceuticals and nutraceuticals. These technical and regulatory challenges can deter low-volume brands or those without dedicated packaging R&D capabilities.

Innovation in Active Packaging and Sustainable Tube Construction

A major trend in the twist-to-activate tubes market is the convergence of active packaging with eco-conscious design. Manufacturers are increasingly developing recyclable mono-material tubes and integrating biopolymers to meet sustainability benchmarks without compromising product integrity. Simultaneously, twist-based activation is being enhanced with audible clicks, visible indicators, or pressure-controlled release systems to elevate user engagement and dosing accuracy.

These innovations are particularly appealing in high-end beauty, functional foods, and wellness-focused pharmaceuticals. As clean-label demands grow and consumers seek smarter, minimal-contact formats, twist-to-activate tubes are emerging as a premium solution balancing convenience, innovation, and environmental responsibility.

The global twist-to-activate tubes market is experiencing modest yet positive growth, driven by demand for precise dosage control, enhanced product shelf life, and consumer convenience in active ingredient delivery. This packaging format is gaining steady traction in dermo-cosmetics, medicated topicals, and specialty personal care products.

Europe and North America remain stable growth hubs, supported by OTC pharmaceutical launches and premium skincare formulations requiring compartmentalized activation. South Korea is leading growth globally, supported by K-beauty innovation and rising demand for single-use, fresh-dispense packaging.

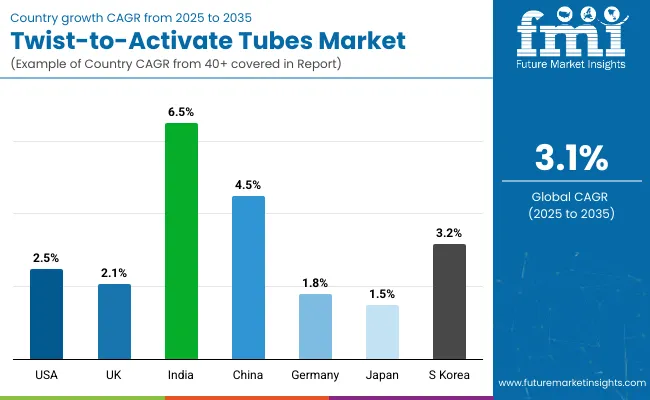

The twist-to-activate tubes market in the United States is forecast to grow at a CAGR of 2.5% from 2025 to 2035. Steady adoption is observed in derma-cosmeceuticals, prescription creams, and OTC pain relief gels that benefit from dual-compartment separation. Brands are deploying twist-to-activate formats to preserve ingredient efficacy and provide on-demand activation. Demand is also supported by seniors and patients seeking single-handed, intuitive dispensing formats.

The twist-to-activate tubes market in the United Kingdom is projected to grow at a CAGR of 2.1%, supported by premium skincare, cosmeceuticals, and pharmacy chains offering value-added packaging. With a strong trend toward efficacy-focused beauty, British brands are launching serums and boosters that require precise ingredient blending at the point of use. Shelf differentiation and packaging novelty continue to support niche brand adoption across retail and e-commerce.

India’s twist-to-activate tubes market is expected to grow at a slow CAGR of 6.5%, constrained by high cost-per-unit and limited consumer awareness. The market is highly price-sensitive, and most domestic skincare and pharmaceutical brands prefer mono-dose or conventional squeeze tubes. However, some adoption is seen in high-end skincare imported via D2C platforms and among urban consumers experimenting with Korean and Japanese routines.

The twist-to-activate tubes market in China is forecast to grow at a CAGR of 4.5%, driven by premium beauty, dermo-cosmetics, and localized innovation in packaging for fresh-mix serums and clinical skincare. Urban consumers are becoming increasingly ingredient-savvy, favoring precise, activation-based formats. Domestic OEMs are developing low-cost, twist-to-release mechanisms for volume manufacturing.

The twist-to-activate tubes market in Germany is projected to grow at a CAGR of 1.8%, supported by strong demand from dermaceuticals, pharmacy-backed skincare, and OTC creams. German manufacturers are integrating precision dispensing and hygienic single-use caps to meet medical-grade requirements. Twist formats are preferred in products where actives degrade quickly or require mechanical mixing prior to application.

The twist-to-activate tubes market in Japan is forecast to grow at a CAGR of 1.5%, shaped by minimalist beauty trends and limited market penetration for multi-chamber packaging. Although Japan leads in compact, travel-friendly dispensers, the twist-to-activate format remains niche due to cost sensitivity and strong preference for foil or pump tubes. Nonetheless, select applications in medical skincare and hybrid cosmetics are emerging.

The twist-to-activate tubes market in South Korea is projected to grow at a CAGR of 3.2%, the highest among major countries. This growth is propelled by K-beauty’s emphasis on skin-first, ingredient-fresh delivery systems. Twist-to-activate tubes are popular for ampoules, boosters, and clinical serums where active ingredients must be mixed just before use. The packaging trend is also driven by social media visibility, with consumers attracted to the transformation process.

The twist-to-activate tubes market is moderately fragmented, with global packaging giants, regional converters, and niche functional specialists competing across skincare, pharmaceuticals, adhesives, and nutraceuticals. Global players such as Neopac, Albéa, and Berry Global command notable market share, driven by ergonomic tube designs, multi-compartment precision dosing, and active ingredient protection. Their strategies increasingly emphasize barrier-laminated materials, tamper-evident activation features, and sustainability integration for premium healthcare and cosmetic formulations.

Established mid-sized players, including C. L. Smith, Kaufman Container, and Kansai Tube Co., LTD, serve mid-volume brands with customizable twist-to-dispense tube formats. These companies are expanding adoption by offering dual-component formulations, wide viscosity compatibility, and region-specific compliance (e.g., FDA, REACH) across beauty, industrial, and veterinary care products.

Specialized providers such as TAKEMOTO, Alltub, Rose Plastics, and GuangZhouHuaXin Plastic Product Co., Ltd. focus on price-sensitive, application-specific solutions for regional cosmetics, OTC drugs, and personal wellness. Their strength lies in compact tube formats, low-MOQ manufacturing, and ODM capabilities tailored for emerging markets and fast-evolving product lines.

Competitive differentiation is shifting away from standard squeeze-tube models toward patented twist-based delivery systems that offer dosing accuracy, compartmentalized stability, and single-use hygienic dispensing aligned with rising consumer safety and convenience preferences.

Key Development

The global twist-to-activate tubes market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the twist-to-activate tubes market is projected to reach USD 3.9 billion by 2035.

The twist-to-activate tubes market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in the twist-to-activate tubes market include single-use tubes, multi-dose tubes, dual-chamber tubes, and airless twist dispensers.

In terms of material, the plastic segment is expected to command the highest share of 61.3% in the twist-to-activate tubes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tube and Core Market Size and Share Forecast Outlook 2025 to 2035

Tube Tester Market Size and Share Forecast Outlook 2025 to 2035

Tube Rotator Market Size and Share Forecast Outlook 2025 to 2035

Tuberculosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Tube Laminating Films Market Size and Share Forecast Outlook 2025 to 2035

Tube Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Tube Ice Machine Market Size and Share Forecast Outlook 2025 to 2035

Tube Closures Market Size and Share Forecast Outlook 2025 to 2035

Tube Sealing Machines Market Analysis by Tube type, Technology type, End User, and Region through 2025 to 2035

Tuberculous Meningitis Treatment Market - Demand & Innovations 2025 to 2035

Tube Feeding Formula Market Analysis by Product Type, Form, End User, Primary Condition and Distribution Channel Through 2035

Market Share Distribution Among Tube Filling Machine Manufacturers

Competitive Breakdown of Tube Sealing Machines Providers

Breaking Down Market Share in Tube Laminating Films

Competitive Overview of Tube and Core Market Share

Tube and Dressing Securement Products Market

Tuberculosis Diagnostics Market

Tubes, Bottles and Tottles Market

U-Tube Viscometer Market Size and Share Forecast Outlook 2025 to 2035

Nontuberculous Mycobacterium Treatment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA