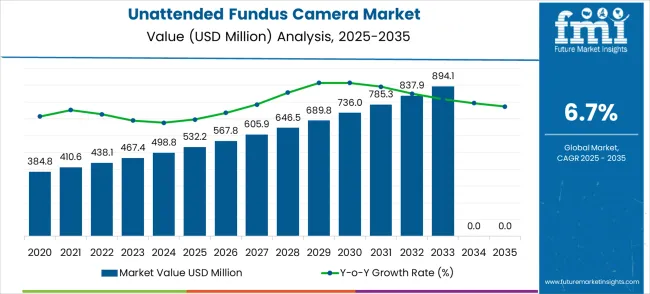

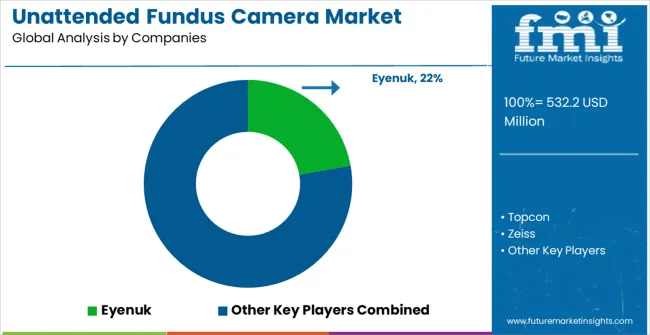

The unattended fundus camera market is valued at USD 532.2 million in 2025 and is projected to reach USD 1,017.9 million by 2035, with a forecast CAGR of 6.7%. This steady growth reflects increasing adoption of automated retinal imaging systems in ophthalmology, driven by rising prevalence of diabetes, growing awareness of eye health, and advancements in artificial intelligence for retinal diagnostics. The CAGR of 6.7% indicates sustained demand, supported by expansion in teleophthalmology and screening programs in emerging markets. Over the forecast period, the market is expected to nearly double in size, driven by technology adoption and integration in routine eye care workflows.

A closer examination of year-on-year (YoY) growth shows consistent expansion throughout the forecast period. The market grows from USD 532.2 million in 2025 to USD 567.8 million in 2026, a 6.7% increase, followed by steady increments each year. Between 2028 and 2029, the growth rate slightly accelerates, reflecting an increase from USD 646.5 million to USD 689.8 million, an absolute increase of USD 43.3 million. This growth spike can be correlated with technological adoption, particularly integration of AI-assisted diagnosis and increased telemedicine adoption in eye care.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 532.2 million |

| Forecast Value in (2035F) | USD 1,017.9 million |

| Forecast CAGR (2025 to 2035) | 6.7% |

Growth restraints in the market include challenges such as high initial capital costs of advanced fundus cameras, lack of trained professionals in certain regions, and regulatory barriers in healthcare technology approval. A slight deceleration in growth is observed between 2031 and 2032, with a YoY growth of about 6.3%, which may be attributed to saturation in mature markets and slower adoption in regions with limited healthcare infrastructure. These factors may temporarily constrain market expansion until new technological innovations or regulatory relaxations occur.

Inflection points appear between 2029 and 2030, when the market surpasses USD 736 million and begins to enter a phase of stronger momentum, driven by broader adoption in emerging economies and expansion of remote healthcare services. By 2035, the market reaches USD 1,017.9 million, representing the peak of the forecast period, with growth driven by AI integration, portable unattended fundus camera devices, and policy initiatives promoting preventative eye care. Overall, the market dynamics indicate steady growth, punctuated by technological adoption phases and occasional deceleration due to economic or regulatory constraints.

Market expansion is being supported by the increasing global demand for accessible eye screening technologies and the corresponding shift toward automated fundus imaging solutions that can provide superior diagnostic capabilities while meeting healthcare requirements for cost-effective and high-throughput retinal examination. Modern healthcare providers and telemedicine platforms are increasingly focused on incorporating unattended fundus cameras to enhance patient care while satisfying demands for early detection of diabetic retinopathy, glaucoma, and age-related macular degeneration. Unattended fundus cameras' proven ability to deliver superior image quality, automated operation, and remote monitoring capabilities makes them essential equipment for primary care facilities and teleophthalmology applications.

The growing focus on preventive healthcare and value-based care models is driving demand for high-quality unattended fundus camera products that can support distinctive screening capabilities and premium healthcare positioning across hospital systems, specialty clinics, and community health centers. Healthcare provider preference for cameras that combine imaging excellence with advanced automation compatibility is creating opportunities for innovative fundus camera implementations in both traditional and emerging healthcare applications. The rising influence of artificial intelligence technologies and digital health solutions is also contributing to increased adoption of premium unattended fundus camera products that can provide authentic high-resolution retinal imaging characteristics.

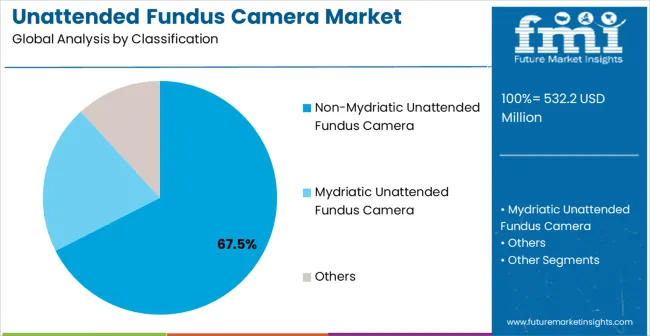

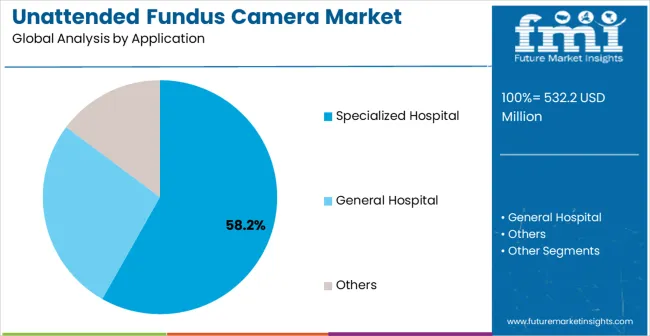

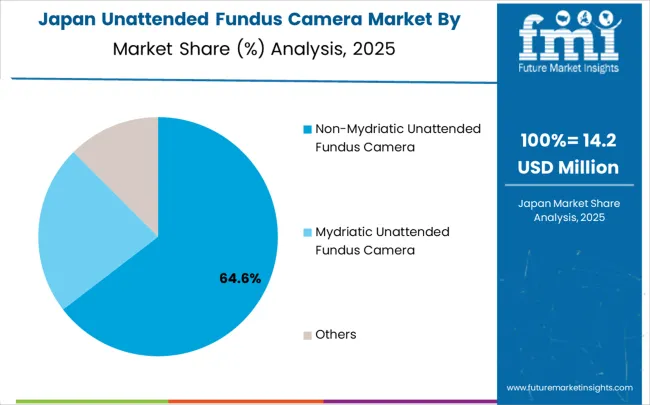

The market is segmented by camera type, application, and region. By camera type, the market is divided into non-mydriatic unattended fundus camera, mydriatic unattended fundus camera, and others. Based on application, the market is categorized into specialized hospitals, general hospitals, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The non-mydriatic unattended fundus camera segment is projected to account for 67.5% of the unattended fundus camera market in 2025, reaffirming its position as the leading camera type category. Healthcare providers and diagnostic specialists increasingly utilize non-mydriatic fundus cameras for their superior patient comfort, consistent performance characteristics, and ease of operation in automated screening systems across diverse healthcare applications. Non-mydriatic camera technology's standardized imaging configuration and patient-friendly operation directly address the healthcare requirements for comfortable retinal examinations and efficient screening in primary care and community health settings.

This camera type segment forms the foundation of modern retinal screening applications, as it represents the technology with the greatest patient acceptance and established compatibility across multiple healthcare screening systems. Healthcare provider investments in non-mydriatic camera optimization and imaging precision enhancement continue to strengthen adoption among medical equipment producers. With providers prioritizing patient comfort and screening accessibility, non-mydriatic fundus cameras align with both diagnostic objectives and operational requirements, making them the central component of comprehensive eye care screening strategies.

The mydriatic unattended fundus camera segment holds a 24.8% market share, serving specialized applications requiring pupil dilation for enhanced retinal visualization. The others segment, including handheld and portable variants, accounts for 7.7% of the market, addressing niche applications in mobile screening and resource-limited settings.

Specialized hospital applications are projected to represent the largest share of unattended fundus camera demand in 2025 at 58.2%, highlighting their critical role as the primary application for advanced screening solutions in ophthalmology departments and diabetic care centers. Healthcare providers prefer unattended fundus cameras for their exceptional imaging quality, automated operation capabilities, and ability to maintain consistent performance while supporting precise retinal examination requirements during specialized care processes. Positioned as essential equipment for high-performance ophthalmology operations, unattended fundus cameras offer both technological advancement and diagnostic reliability advantages.

The segment is supported by continuous growth in specialized healthcare services and the growing availability of specialized camera configurations that enable enhanced imaging precision and diagnostic optimization at the facility level. Specialized hospitals are investing in advanced diagnostic technologies to support comprehensive eye care and patient outcome consistency. As specialized healthcare continues to advance and providers seek superior screening automation solutions, specialized hospital applications will continue to dominate the application landscape while supporting technology advancement and diagnostic precision strategies.

The general hospital segment accounts for 32.6% of market demand, serving broader healthcare facility screening needs, while the others segment, including clinics and community health centers, represents 9.2% of applications, focusing on accessible primary care screening programs.

The market is advancing steadily due to increasing healthcare digitization investments and growing demand for automated screening solutions that emphasize superior diagnostic accuracy across ophthalmology practice and telemedicine applications. The market faces challenges, including high equipment costs compared to traditional screening alternatives, technical complexity in AI system integration, and competition from alternative imaging technologies. Innovation in digital imaging accuracy and application-specific camera development continues to influence market development and expansion patterns.

The growing adoption of unattended fundus cameras in telemedicine and remote patient monitoring is enabling healthcare providers to develop systems that provide distinctive screening capabilities while commanding premium positioning and enhanced diagnostic characteristics. Advanced teleophthalmology applications provide superior retinal imaging while allowing more sophisticated remote care development across various healthcare categories and technology segments. Healthcare providers are increasingly recognizing the competitive advantages of automated screening positioning for premium care development and remote healthcare market penetration.

Modern fundus camera suppliers are incorporating artificial intelligence algorithms, machine learning optimization, and automated diagnostic analytics to enhance imaging accuracy, improve screening reliability, and meet healthcare industry demands for intelligent and adaptive eye care solutions. These programs improve camera performance while enabling new applications, including automated disease detection and predictive analytics systems. Advanced AI integration also allows suppliers to support premium market positioning and technology leadership beyond traditional commodity imaging cameras.

Healthcare systems are increasingly adopting unattended fundus cameras to support value-based care initiatives, population health screening programs, and preventive care strategies that emphasize early detection and cost-effective treatment outcomes. This trend drives demand for automated screening solutions that can process large patient populations while maintaining diagnostic accuracy and reducing per-patient screening costs.

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| Brazil | 7.0% |

| USA | 6.4% |

| UK | 5.7% |

| Japan | 5.0% |

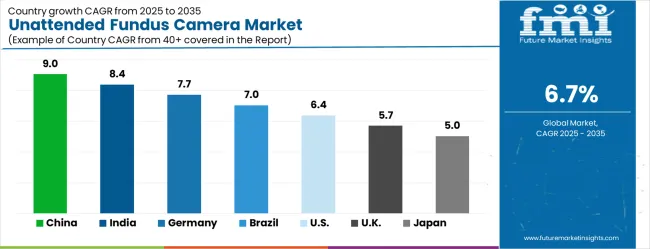

The market is experiencing robust growth globally, with China leading at a 9.0% CAGR through 2035, driven by the rapidly expanding healthcare digitization initiatives, massive investments in telemedicine infrastructure, and increasing adoption of automated diagnostic technologies. India follows at 8.4%, supported by growing healthcare accessibility programs, rising diabetes prevalence, and expanding teleophthalmology capabilities. Germany shows growth at 7.7%, focusing advanced medical technology and premium healthcare equipment implementation. Brazil records 7.0%, focusing on emerging healthcare digitization applications and medical technology development. The USA demonstrates 6.4% growth, prioritizing advanced healthcare automation and diagnostic innovation. The UK exhibits 5.7% growth, supported by specialized healthcare technology development and NHS digitization initiatives. Japan shows 5.0% growth, focusing healthcare excellence and high-quality diagnostic equipment adoption.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is forecasted to grow at a CAGR of 9.0% between 2025 and 2035, driven by increasing prevalence of ocular diseases, rising geriatric population, and growing investments in telemedicine. Unattended fundus cameras are becoming critical in enabling early detection of retinal conditions such as diabetic retinopathy, glaucoma, and age-related macular degeneration. Hospitals and diagnostic centers are increasingly adopting these systems to improve screening efficiency and reduce operational costs. Local manufacturers are developing compact, high-resolution models with AI-assisted diagnostics. Government healthcare programs focusing on preventive eye care and screening are expanding adoption. Rising awareness about eye health, coupled with technological innovation, is positioning China as a leading market for unattended fundus camera deployment.

India is projected to expand at a CAGR of 8.4% from 2025 to 2035, driven by rising prevalence of eye diseases and increasing demand for accessible ophthalmic screening solutions. Unattended fundus cameras are gaining traction in community health centers and telemedicine clinics for remote retinal examinations. Rapid growth in diabetes and other chronic diseases is pushing demand for efficient, non-invasive retinal imaging. Indian manufacturers are focusing on affordable, portable devices with AI-based analysis. Government healthcare initiatives and rural screening programs further encourage adoption. Increasing partnerships between technology providers and healthcare facilities strengthen deployment. India’s growing healthcare infrastructure and focus on preventive diagnostics make it a fast-growing market for unattended fundus camera systems.

Germany is forecasted to grow at a CAGR of 7.7% from 2025 to 2035, driven by a focus on advanced ophthalmic diagnostics and preventive healthcare. Unattended fundus cameras are increasingly adopted in ophthalmology clinics and hospitals for efficient retinal imaging and early disease detection. The integration of AI-based analysis and teleophthalmology solutions is driving demand. Germany’s strong medical device manufacturing sector enables continuous innovation in high-resolution imaging, user interface optimization, and portability. Increasing demand for screening services in rural and aging populations strengthens market growth. Regulatory support and focus on preventive care further accelerate adoption. These factors ensure Germany’s steady position in the global unattended fundus camera market.

Brazil is projected to grow at a CAGR of 7.0% from 2025 to 2035, driven by rising demand for accessible retinal screening in public health systems and increasing awareness of eye health. Unattended fundus cameras are becoming essential for diabetes-related eye disease detection in remote and underserved regions. Government initiatives for teleophthalmology and community eye care programs are expanding market penetration. Local manufacturers are investing in cost-effective, portable solutions tailored to Brazil’s healthcare infrastructure. Collaborations with global technology providers are enhancing product availability. Growth in private ophthalmology services and rural healthcare access further supports adoption. Brazil is positioned to see steady growth in unattended fundus camera deployment over the forecast period.

The United States is projected to grow at a CAGR of 6.4% from 2025 to 2035, driven by advancements in AI-assisted retinal imaging, expansion of teleophthalmology services, and increasing prevalence of diabetic retinopathy. Unattended fundus cameras are becoming integral to large-scale screening programs and chronic disease management. High demand from ophthalmic clinics, hospitals, and primary care centers supports market growth. USA manufacturers are focusing on enhancing image resolution, portability, and ease of integration into electronic health record systems. Government funding for vision health programs further boosts adoption. Rising focus on early disease detection and remote diagnostics ensures steady market growth.

The United Kingdom is expected to grow at a CAGR of 5.7% from 2025 to 2035, supported by increasing adoption of teleophthalmology and preventive eye care programs. Unattended fundus cameras are increasingly used in public health screenings, community clinics, and primary care centers to facilitate early detection of diabetic retinopathy and other retinal conditions. The integration of AI-assisted diagnostic tools improves efficiency and diagnostic accuracy. NHS initiatives and technology grants encourage adoption. Manufacturers are investing in improving portability and affordability to enhance accessibility. Rising awareness of vision health and growth in remote screening programs make the UK a steady-growing market for unattended fundus camera systems.

Japan is projected to expand at a CAGR of 5.0% from 2025 to 2035, driven by a strong healthcare infrastructure and rising demand for preventive ophthalmic care. Unattended fundus cameras are increasingly adopted in hospitals, clinics, and rural health programs to detect retinal diseases early. Japan’s advanced medical device manufacturing supports innovation in high-resolution imaging, compact design, and AI-assisted analysis. Rising elderly population and demand for telemedicine services fuel growth. Government programs promoting eye health and remote diagnostics strengthen adoption. Manufacturers focus on precision engineering to meet domestic and export demand, making Japan an important market for unattended fundus camera systems.

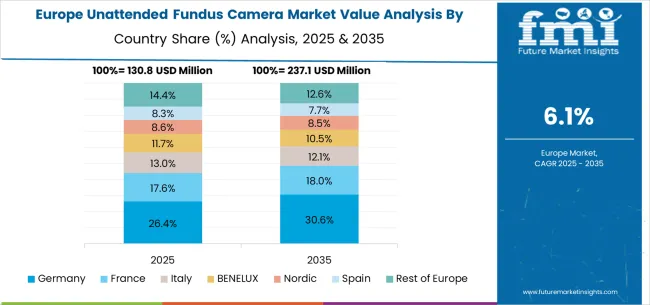

The unattended fundus camera market in Europe is projected to grow from USD 134.2 million in 2025 to USD 241.6 million by 2035, registering a CAGR of 6.1% over the forecast period. Germany is expected to maintain its leadership position with a 32.4% market share in 2025, remaining stable at 32.8% by 2035, supported by its advanced medical technology sector, healthcare equipment manufacturing industry, and comprehensive innovation capabilities serving European and international markets.

The United Kingdom follows with a 28.7% share in 2025, projected to reach 28.3% by 2035, driven by NHS digitization programs, specialized healthcare technology development, and a growing focus on telehealth solutions for premium applications. France holds a 18.6% share in 2025, expected to maintain 18.4% by 2035, supported by advanced healthcare demand and medical technology applications, but facing challenges from market competition and healthcare budget considerations. Italy commands a 12.1% share in 2025, projected to reach 12.3% by 2035, while Spain accounts for 6.8% in 2025, expected to reach 7.1% by 2035. The Netherlands maintains a 3.2% share in 2025, growing to 3.4% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to hold 18.2% in 2025, declining slightly to 17.7% by 2035, attributed to mixed growth patterns with moderate expansion in some advanced healthcare markets balanced by slower growth in smaller countries implementing healthcare digitization programs.

The market is characterized by competition among established medical device companies, specialized ophthalmic equipment manufacturers, and integrated healthcare technology solution suppliers. Companies are investing in advanced digital imaging technologies, AI-enhanced diagnostic systems, application-specific camera development, and comprehensive clinical support capabilities to deliver consistent, high-performance, and reliable fundus imaging products. Innovation in imaging quality optimization, automated analysis enhancement, and customized healthcare solutions is central to strengthening market position and customer satisfaction.

Eyenuk leads the market with a strong focus on AI-powered retinal screening technology and comprehensive automated diagnostic solutions, offering sophisticated unattended fundus camera products with focus on diagnostic accuracy and healthcare integration excellence. Topcon provides specialized ophthalmic equipment capabilities with a focus on precision applications and global healthcare networks. Zeiss delivers advanced optical and imaging technology with a focus on innovation and premium camera development. Canon specializes in digital imaging and optical solutions with focus on technical expertise and application optimization. Optos focuses on ultra-widefield retinal imaging technology. Nidek emphasizes ophthalmic equipment expertise with a focus on clinical integration and operational reliability.

Unattended fundus cameras represent advanced automated diagnostic technology that enables accessible, high-quality retinal screening critical for modern preventive healthcare and early disease detection. With the market projected to grow from USD 532.2 million in 2025 to USD 1,017.9 million by 2035 at a 6.7% CAGR, these cameras address the increasing demands for automated screening in diabetic care, teleophthalmology, and population health management systems. The dominance of non-mydriatic cameras (67.5% market share) and specialized hospital applications reflects the technology's critical role in enabling accessible healthcare delivery where traditional screening methods cannot achieve the required throughput or accessibility. Market expansion faces challenges including high equipment costs, complex AI system integration requirements, and competition from alternative diagnostic technologies. Maximizing growth potential requires coordinated efforts across medical device developers and manufacturers, healthcare providers and ophthalmology specialists, telehealth platform integrators and diagnostic service providers, clinical research institutions and regulatory organizations, and healthcare investment and technology commercialization partners.

Advanced Digital Imaging Technology Development: Invest in next-generation unattended fundus camera technologies, including enhanced optical designs, improved sensor systems, and advanced image processing algorithms that provide superior diagnostic accuracy, extended imaging capabilities, and faster screening speeds. Develop camera platforms that push the boundaries of automated retinal screening while maintaining reliability under clinical operating conditions.

AI-Enhanced Diagnostic Solutions: Create specialized AI-powered diagnostic algorithms integrated with fundus cameras optimized for specific conditions, including diabetic retinopathy detection, glaucoma screening, age-related macular degeneration identification, and comprehensive retinal health assessment. Develop cameras with application-specific features such as automated pathology detection, risk stratification capabilities, and clinical decision support systems.

User-Friendly Operating Systems: Integrate intuitive user interfaces, automated calibration systems, and simplified operation protocols into unattended fundus camera systems to enable effective use by non-specialist healthcare staff. Develop smart cameras that can automatically guide users through screening procedures, quality control checks, and patient positioning optimization.

Cost-Performance Optimization: Focus on manufacturing process improvements and design innovations that reduce camera costs while maintaining imaging quality and diagnostic reliability. Develop scalable production methods that enable broader market adoption without compromising the clinical performance characteristics that define premium fundus camera technology.

Connectivity and Data Integration: Create unattended fundus cameras with comprehensive connectivity options, including cloud integration, electronic health record compatibility, and seamless data sharing capabilities. Develop cameras that integrate easily with existing healthcare IT systems and provide real-time diagnostic data for immediate clinical decision-making.

Comprehensive Screening Protocol Development: Implement systematic retinal screening programs that leverage unattended fundus camera capabilities, including population-based screening initiatives, high-risk patient identification, and preventive care integration. Develop screening protocols that maximize the value of automated imaging while ensuring consistent diagnostic quality and regulatory compliance.

Clinical Workflow Integration: Integrate unattended fundus cameras into existing clinical workflows to enable efficient patient screening, diagnostic review, and care coordination. Develop streamlined processes that use camera automation to optimize patient throughput while maintaining clinical quality and provider satisfaction.

Staff Training and Competency Programs: Establish comprehensive training programs covering fundus camera operation, image quality assessment, basic troubleshooting, and patient interaction protocols. Develop certification programs for healthcare staff and provide ongoing education that ensures optimal camera utilization and diagnostic accuracy.

Quality Assurance and Clinical Validation: Implement rigorous quality control systems that validate fundus camera diagnostic accuracy, monitor screening program effectiveness, and ensure adherence to clinical guidelines. Use screening data to optimize patient care protocols and demonstrate program value through improved patient outcomes.

Patient Education and Engagement: Develop comprehensive patient education programs that explain the importance of retinal screening, fundus camera benefits, and screening procedure expectations. Create patient engagement strategies that improve screening compliance and support preventive eye care adoption.

Comprehensive Telemedicine Solutions: Provide complete teleophthalmology platforms that integrate unattended fundus cameras with remote diagnostic services, including image analysis, specialist consultation, and patient management systems. Develop standardized integration methodologies that reduce implementation complexity and accelerate deployment of remote screening solutions.

Remote Diagnostic Services: Establish specialized remote diagnostic services that provide expert image interpretation, clinical consultation, and diagnostic reporting for unattended fundus camera images. Provide scalable diagnostic services that enable healthcare providers to offer expert-level screening without requiring on-site ophthalmology specialists.

Data Management and Security: Implement advanced data management platforms that ensure secure image transmission, patient privacy protection, and regulatory compliance for teleophthalmology applications. Develop service platforms that enable efficient image storage, retrieval, and analysis while maintaining healthcare data security standards.

Clinical Decision Support: Provide advanced clinical decision support systems that help healthcare providers interpret fundus camera results, identify referral needs, and coordinate appropriate follow-up care. Develop automated systems that flag urgent findings and facilitate immediate clinical response.

Population Health Analytics: Implement comprehensive population health monitoring capabilities that use fundus camera screening data to identify disease trends, assess program effectiveness, and optimize resource allocation. Develop analytics platforms that support public health initiatives and evidence-based screening program development.

Clinical Validation Studies: Conduct comprehensive clinical studies validating unattended fundus camera diagnostic accuracy, screening effectiveness, and patient outcomes across diverse populations and healthcare settings. Support collaborative research programs between institutions and industry that address current technology limitations and enable breakthrough innovations.

Diagnostic Standards Development: Establish comprehensive diagnostic standards and clinical guidelines for unattended fundus camera use, including image quality specifications, diagnostic protocols, and screening recommendations. Develop international standards that ensure diagnostic consistency and enable global technology adoption.

Technology Assessment and Validation: Provide independent technology validation services that assess fundus camera performance, diagnostic accuracy, and clinical utility. Facilitate technology comparison studies that help healthcare providers make informed purchasing decisions and optimize screening program development.

Educational Program Development: Develop specialized education programs in automated retinal screening and teleophthalmology, including medical school curricula, residency training programs, and continuing medical education initiatives. Train the next generation of healthcare providers and support workforce development for digital health applications.

Regulatory Pathway Optimization: Work with regulatory agencies to streamline approval processes for innovative fundus camera technologies, establish clear regulatory pathways for AI-enhanced diagnostic systems, and develop evidence requirements that support technology advancement while ensuring patient safety.

Innovation Investment Programs: Fund breakthrough research and development programs in unattended fundus camera technology, including novel imaging approaches, advanced AI algorithms, and next-generation diagnostic capabilities. Support startups and established companies developing disruptive screening technologies that address current market limitations.

Market Development Capital: Finance market development activities, including clinical validation studies, demonstration projects, and healthcare provider education initiatives that accelerate fundus camera adoption in emerging applications and geographic markets. Support expansion into high-growth markets like China (9.0% CAGR) and India (8.4% CAGR).

Healthcare Infrastructure Investment: Provide capital for advanced manufacturing facilities, precision optical equipment, and quality control systems that enable cost-effective production of unattended fundus cameras at commercial scale. Support the development of manufacturing processes that maintain imaging quality while achieving competitive costs.

Strategic Partnership Facilitation: Support partnerships between camera manufacturers, healthcare providers, and technology companies that accelerate technology commercialization and market adoption. Facilitate joint development programs that address specific healthcare needs and create comprehensive screening solutions.

Global Market Expansion Support: Fund international business development, including the establishment of regional distribution networks, clinical support capabilities, and regulatory compliance programs. Support market entry strategies that leverage local partnerships and address regional healthcare requirements and standards.

Value-Based Care Integration: Finance the development of value-based care models that demonstrate the economic benefits of unattended fundus camera screening programs, including cost savings from early disease detection, reduced complications, and improved patient outcomes. Support healthcare providers in implementing screening programs that align with value-based payment models.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 532.2 million |

| Camera Type | Non-Mydriatic Unattended Fundus Camera, Mydriatic Unattended Fundus Camera, Others |

| Application | Specialized Hospital, General Hospital, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Eyenuk, Topcon, Zeiss, Canon, Optos, Nidek, Remidio, Digital Diagnostics, Forus Health, VoxelCloud, Vistel, and VisionX |

| Additional Attributes | Dollar sales by camera type and application, regional demand trends, competitive landscape, technological advancements in automated imaging, AI-enhanced diagnostic development initiatives, screening accuracy optimization programs, and healthcare integration enhancement strategies |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global unattended fundus camera market is estimated to be valued at USD 532.2 million in 2025.

The market size for the unattended fundus camera market is projected to reach USD 1,017.9 million by 2035.

The unattended fundus camera market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in unattended fundus camera market are non-mydriatic unattended fundus camera, mydriatic unattended fundus camera and others.

In terms of application, specialized hospital segment to command 58.2% share in the unattended fundus camera market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Unattended Ground Sensors (UGS) Market Trends - Forecast 2025 to 2035

Non-Mydriatic Fundus Camera Market Analysis – Growth & Forecast 2023-2033

Camera Accessories Market Size and Share Forecast Outlook 2025 to 2035

Camera Lens Market Size and Share Forecast Outlook 2025 to 2035

Camera Module Market Size and Share Forecast Outlook 2025 to 2035

Camera Technology Market Analysis – Trends & Forecast 2025 to 2035

Camera Case Market Trends & Industry Growth Forecast 2024-2034

IP Camera Market Trends – Growth, Demand & Forecast 2025 to 2035

3D Camera Market Growth – Trends & Forecast 2025 to 2035

TDI Camera Market Growth - Trends & Forecast 2025 to 2035

Intracameral Antibiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

CMOS Camera Market Size and Share Forecast Outlook 2025 to 2035

GigE Camera Market Size and Share Forecast Outlook 2025 to 2035

CCTV Camera Market Demand & Sustainability Trends 2025-2035

Smart Camera Market Analysis – Size, Share & Forecast 2025 to 2035

Drain Camera Market

InGaAs Cameras Market by Technology, Scanning Type, Industry & Region Forecast till 2035

Action Camera Market

Mobile Camera Module Market

Network Cameras and Video Analytics Market Analysis – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA