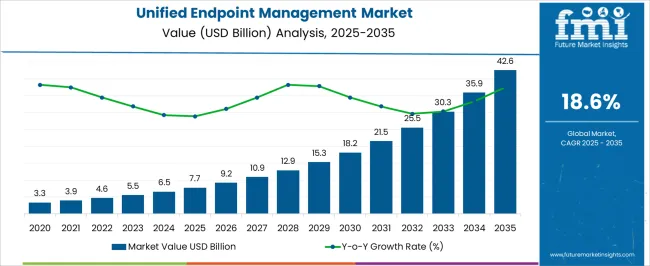

The Unified Endpoint Management Market is estimated to be valued at USD 7.7 billion in 2025 and is projected to reach USD 42.6 billion by 2035, registering a compound annual growth rate (CAGR) of 18.6% over the forecast period.

| Metric | Value |

|---|---|

| Unified Endpoint Management Market Estimated Value in (2025 E) | USD 7.7 billion |

| Unified Endpoint Management Market Forecast Value in (2035 F) | USD 42.6 billion |

| Forecast CAGR (2025 to 2035) | 18.6% |

The Unified Endpoint Management market is witnessing robust growth, driven by the increasing adoption of cloud computing and the growing need for centralized management of enterprise endpoints. Organizations are prioritizing solutions that enable consistent monitoring, security, and configuration across desktops, laptops, mobile devices, and IoT endpoints. The shift toward remote and hybrid work models has further accelerated cloud-based deployment adoption, as it allows real-time device management, scalability, and reduced infrastructure costs.

Integration with security platforms, identity management, and analytics tools enhances operational efficiency while ensuring compliance with data protection regulations. The demand for streamlined IT operations, simplified policy enforcement, and improved user experience continues to drive market expansion.

Investments in automation, AI-driven monitoring, and analytics capabilities are also supporting the adoption of unified endpoint management platforms As enterprises seek to optimize endpoint performance and mitigate cyber risks, cloud-based and scalable solutions are expected to sustain long-term growth, particularly in highly digitalized and regulated industries.

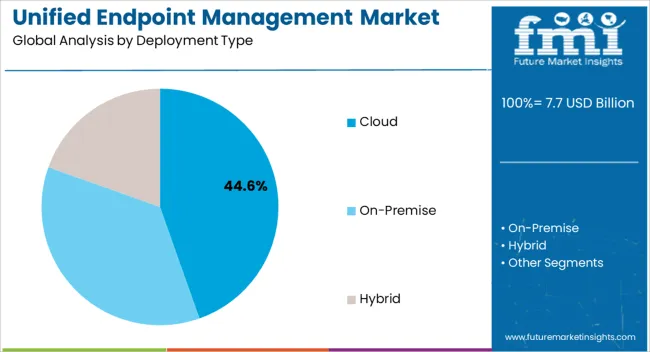

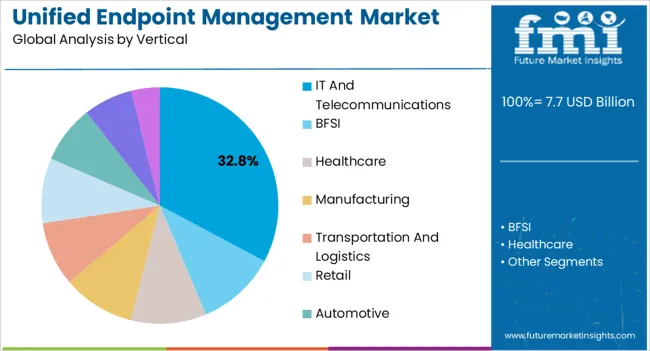

The unified endpoint management market is segmented by deployment type, vertical, and geographic regions. By deployment type, unified endpoint management market is divided into Cloud, On-Premise, and Hybrid. In terms of vertical, unified endpoint management market is classified into IT And Telecommunications, BFSI, Healthcare, Manufacturing, Transportation And Logistics, Retail, Automotive, Government And Defense, and Others. Regionally, the unified endpoint management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cloud deployment segment is projected to hold 44.6% of the market revenue in 2025, establishing it as the leading deployment type. Growth is being driven by the ability to manage a diverse set of endpoints across distributed and remote workforces without the need for significant on-premises infrastructure. Cloud-based solutions provide real-time visibility, automated patching, and seamless integration with enterprise security tools, which improve operational efficiency and reduce IT overhead.

Scalability and flexibility offered by cloud deployments allow organizations to respond quickly to changing business needs and technology adoption. Regulatory compliance, data protection requirements, and the need for centralized monitoring have further accelerated cloud adoption.

Enterprises benefit from reduced total cost of ownership, easier software updates, and simplified endpoint lifecycle management As organizations continue to embrace hybrid work models and expand their digital ecosystems, cloud deployment is expected to maintain its leading position, supported by continuous innovation in cloud security, AI-based monitoring, and multi-device management capabilities.

The IT and telecommunications vertical segment is anticipated to account for 32.8% of the market revenue in 2025, making it the largest industry segment. Growth is being driven by the increasing number of endpoints and complex networks in IT and telecom organizations, which require centralized management, security enforcement, and compliance monitoring. Unified endpoint management platforms enable efficient device provisioning, configuration, and monitoring across multiple locations and remote sites.

The adoption of cloud-based solutions enhances flexibility, real-time control, and scalability, addressing the evolving needs of digital services and infrastructure. Automation, AI-driven analytics, and integration with cybersecurity tools allow organizations to identify vulnerabilities, enforce policies, and optimize performance across all endpoints.

Increasing regulatory requirements for data protection and operational reliability further support market growth As IT and telecom companies continue to expand digital services, deploy remote networks, and adopt hybrid workplace models, the sector’s reliance on unified endpoint management solutions is expected to reinforce its position as the leading vertical in the market.

The approach followed by unified endpoint management tools is to secure and control personal computers, smartphones and tablets in a connected, cohesive manner from a single console.

Unified endpoint management basically relies on mobile device management APIs (application programming interface) in desktop and mobile operating systems. Hence, it is observed that most vendors market unified endpoint management as a feature of their broader enterprise mobility management software suites.

Unified endpoint management solutions were initially developed to provide one point access to all endpoints and at the same time to provide business-centric approach to enterprise mobility management solutions.

The increasing need to manage rapidly growing number of traditional and non-traditional mobile devices drives the unified endpoint management market growth. Several opportunities lie in deploying unified endpoint management solutions that support wide range of endpoints as well as offer smart endpoint security and compliance.

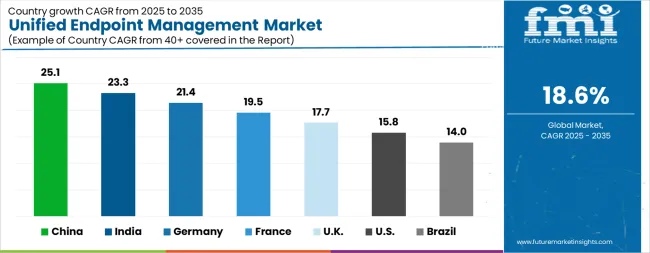

| Country | CAGR |

|---|---|

| China | 25.1% |

| India | 23.3% |

| Germany | 21.4% |

| France | 19.5% |

| UK | 17.7% |

| USA | 15.8% |

| Brazil | 14.0% |

The Unified Endpoint Management Market is expected to register a CAGR of 18.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 25.1%, followed by India at 23.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 14.0%, yet still underscores a broadly positive trajectory for the global Unified Endpoint Management Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 21.4%. The USA Unified Endpoint Management Market is estimated to be valued at USD 2.7 billion in 2025 and is anticipated to reach a valuation of USD 11.6 billion by 2035. Sales are projected to rise at a CAGR of 15.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 365.1 million and USD 248.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.7 Billion |

| Deployment Type | Cloud, On-Premise, and Hybrid |

| Vertical | IT And Telecommunications, BFSI, Healthcare, Manufacturing, Transportation And Logistics, Retail, Automotive, Government And Defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

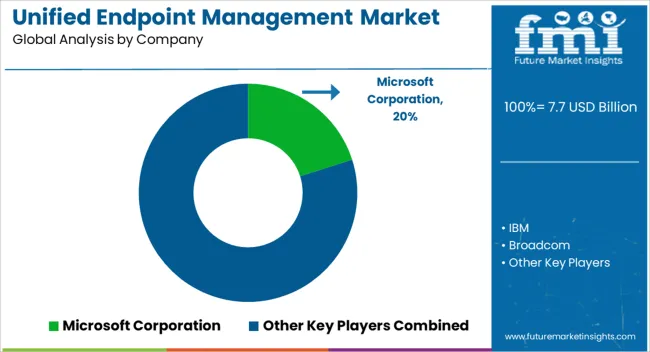

| Key Companies Profiled | Microsoft Corporation, IBM, Broadcom, Blackberry Ltd., Ivanti, Samsung KNOX, and Hexnode |

The global unified endpoint management market is estimated to be valued at USD 7.7 billion in 2025.

The market size for the unified endpoint management market is projected to reach USD 42.6 billion by 2035.

The unified endpoint management market is expected to grow at a 18.6% CAGR between 2025 and 2035.

The key product types in unified endpoint management market are cloud, on-premise and hybrid.

In terms of vertical, it and telecommunications segment to command 32.8% share in the unified endpoint management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Unified Communications and Collaboration Market Size and Share Forecast Outlook 2025 to 2035

Unified Communication as a Service (UCaaS) Market by Solution, Enterprise Size, Vertical & Region Forecast till 2035

Unified Network Management Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Endpoint Detection and Response Market Growth - 2025 to 2035

Endpoint Protection Platform Market Growth – Trends & Forecast 2025-2035

Endpoint Security Solutions Market

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA