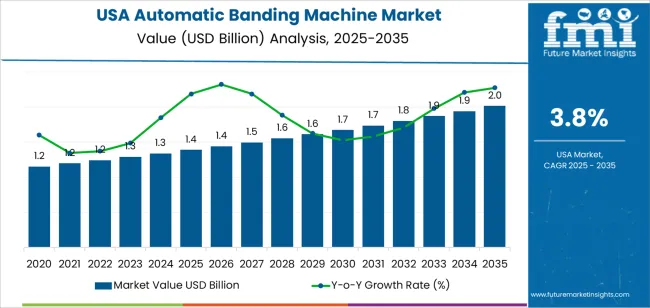

The USA automatic banding machine demand is valued at USD 1.4 billion in 2025 and is forecasted to reach USD 2.0 billion by 2035, reflecting a CAGR of 3.8%. Demand is supported by increased automation in packaging lines, requirements for secure bundling of printed materials, food products, and pharmaceuticals, and the push for reduced material usage compared to full-width strapping systems. Adoption is further shaped by the need to optimize labour efficiency and ensure consistent packaging quality in high-volume logistics environments.

Fully automatic systems lead the product landscape. These machines are preferred in facilities operating continuous, high-speed packaging workflows. Their integration into conveyor-controlled lines, improved sealing precision, and ability to operate with paper and film bands support selection in printing plants, food-processing units, and e-commerce distribution centers. Advancements targeting lower downtime, energy efficiency, and recyclable band materials also contribute to product uptake.

West USA, South USA, and Northeast USA exhibit the highest installation levels due to the presence of distribution-intensive industries, packaging equipment manufacturing, and strong investment in automated logistics infrastructure. Adoption is reinforced by modern warehousing networks and the expansion of third-party logistics operators. Key suppliers include Bandall Inc., Felins USA, Inc., Signode Industrial Group LLC, PAC Strapping Products, Inc., and TPC Packaging Solutions. These companies offer fully automatic and semi-automatic banding machines for commercial, food, industrial, and e-commerce packaging applications.

The automatic banding machine industry in the United States remains below saturation, with ongoing replacement cycles and gradual automation upgrades supporting growth. Adoption is strongest in well-established packaging environments such as food manufacturing, pharmaceuticals, and logistics hubs, where throughput efficiency and labor reduction are primary drivers. Despite strong penetration in these core industries, many small and mid-scale producers continue to rely on semi-automatic or manual banding methods due to cost sensitivity, showing that substantial untapped potential remains.

Saturation risk is moderated by changing packaging formats. E-commerce expansion and regulatory pressure for secure yet minimal packaging reinforce the shift toward recyclable banding solutions. Machine versatility in handling varied materials, including paper bands for plastic-reduction initiatives, extends applicability across sectors. Maintenance service requirements and technological updates, including integration with smart factory systems, create recurring value rather than one-time saturation effects.

The industry shows characteristics of a mid-stage adoption cycle, established in high-volume plants yet still expanding into decentralized and ecofriendly-driven packaging applications. Competitive differentiation in automation level, IoT-enabled monitoring, and material compatibility will delay saturation and maintain demand growth through the forecast horizon.

| Metric | Value |

|---|---|

| USA Automatic Banding Machine Sales Value (2025) | USD 1.4 billion |

| USA Automatic Banding Machine Forecast Value (2035) | USD 2.0 billion |

| USA Automatic Banding Machine Forecast CAGR (2025-2035) | 3.8% |

Demand for automatic banding machines in the USA is increasing because packaging operations in logistics, food processing and printing require faster and more precise bundling to handle rising throughput. These machines apply controlled tension on bands to secure products such as cartons, food trays and printed materials, which reduces manual labour and improves presentation quality. E commerce fulfilment centers and distribution facilities support adoption because banding provides clean, tamper evident packaging that works well for varied product sizes. Food producers use banding to secure fresh goods while maintaining visibility of labels and barcodes, which aligns with food safety and branding requirements.

Manufacturers also upgrade equipment to reduce material waste by switching from bulky materials to thin paper or film bands. Automation teams favour machines with integrated sensors and communication capabilities that support predictive maintenance and consistent cycle times. Constraints include capital investment for high speed systems, required operator training and adjustments needed for integration with existing conveyors. Smaller businesses may continue using manual banding tools until volume growth justifies automation. Supply chain variability in consumable materials can also affect purchasing decisions.

Demand for automatic banding machines in the United States aligns with expansion in packaging automation and standardized product handling across distribution, retail, and industrial facilities. These machines secure packaged items using sustainable bands and are selected for speed, integration compatibility, and reduced labor dependency. USA operations emphasize consistent tension control, material efficiency, and versatility for varying product sizes. Equipment adoption continues to grow in response to the need for organized bundling in logistics operations and increased throughput demands within manufacturing plants.

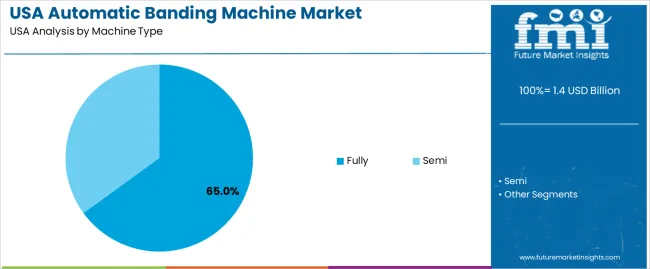

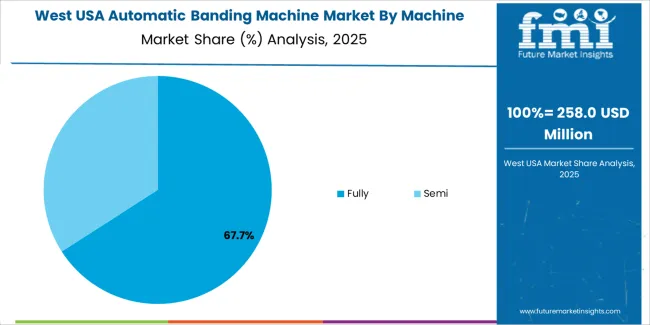

Fully automatic banding machines represent 65.0%, driven by their role in high-speed operations requiring continuous bundling without operator involvement. These systems integrate with conveyors, robotics, and labeling devices, supporting consistent tension and reduced manual handling. Semi-automatic machines account for 35.0%, primarily used in smaller USA facilities or mixed-volume workflows where flexibility and lower capital cost remain priorities.

The distribution reflects domestic production environments where automated lines dominate logistics and packaging tasks. Fully automatic equipment supports labor efficiency and predictable cycle times, while semi-automatic systems remain relevant for product variants and facilities operating in manual or small-batch configurations. Machine adoption aligns with throughput goals, workplace standardization, and uptime stability requirements.

Key points:

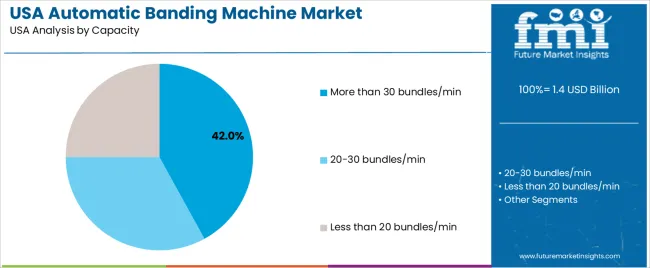

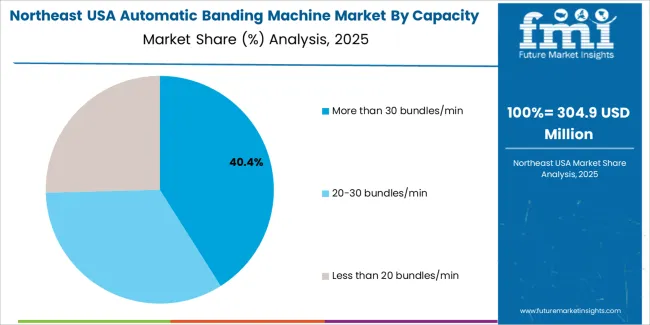

High-capacity units producing more than 30 bundles per minute hold 42.0%, supporting e-commerce fulfillment centers, food processing plants, and consumer goods packaging lines requiring high-speed bundling. Systems operating at 20-30 bundles per minute account for 33.0%, used in mid-volume production environments emphasizing steady performance with moderate automation.

Equipment with below 20 bundles per minute represents 25.0%, typically serving small manufacturers, warehouse pack-stations, and facilities transitioning from manual banding. The capacity distribution indicates the importance of cycle time optimization in USA packaging workflows. Performance selection depends on product flow rates, conveyor integration, and workload consistency, reinforcing preferences for scalable equipment that maintains stable throughput under continuous operation.

Key points:

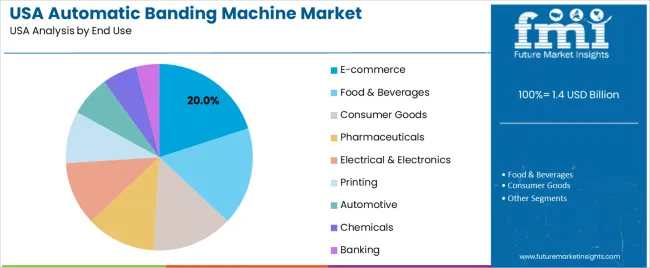

E-commerce accounts for 20.0%, reflecting increased shipment bundling to streamline handling and reduce secondary packaging materials in distribution hubs. Food and beverages represent 17.0%, requiring hygienic bundling for grouped goods. Consumer goods represent 14.0%, followed by pharmaceuticals at 12.0%, where precise label visibility and traceability influence equipment configuration. Electrical and electronics hold 11.0%, printing accounts for 9.0%, automotive represents 7.0%, and chemicals make up 6.0%. Banking contributes 4.0%, reflecting currency and document bundling volumes. End-use patterns show wide adoption across USA sectors with consistent focus on unit organization, product traceability, and compatibility with downstream sorting and labeling processes.

Key points:

Increased packaging-line automation, labor scarcity in manufacturing and rising throughput requirements in distribution facilities are driving demand.

In the United States, automatic banding machines are increasingly deployed in packaging plants as companies automate carton bundling and securement tasks to support high-volume fulfillment. Labor shortages across manufacturing and logistics operations reinforce investment in machinery that reduces manual packing time and ergonomic risk. E-commerce distribution centers and parcel handlers require reliable bundling of catalogs, small parcels and promotional multipacks, which strengthens procurement of adjustable automatic banding units. Printing and graphics businesses in the Midwest and Northeast also use these machines for automated stacking and securement of mailers and magazine bundles, supporting consistent demand across commercial printing hubs.

High upfront cost, integration challenges with legacy lines and slower adoption among small manufacturers restrain growth.

Automatic banding systems require capital expenditure that not all small USA producers can absorb, especially when existing manual or semi-automatic setups remain operational. Older facilities may face limitations in conveyor alignment, electrical layouts or floor space, reducing feasibility of a full upgrade. Some users hesitate to invest in advanced banding controls if production variability is high, which could lead to downtime or costly adjustments. These factors contribute to slower penetration in fragmented, lower-volume industrial segments.

Shift toward energy-efficient designs, wider use in food and pharmaceutical packaging and increased adoption of paper bands for ecofriendly compliance define key trends.

Manufacturers are expanding servo-driven banding models that reduce energy consumption and improve tension accuracy in automated lines. Food processors and pharmaceutical packagers are integrating automatic banders to secure lightweight trays, clamshells and cartons while maintaining clean presentation for retail shelves. Paper-based banding materials that replace shrink wrap or plastic strapping are gaining traction in response to ecofriendly commitments set by USA consumer-goods brands. Equipment suppliers are also offering modular systems and leasing models, making automation more accessible to mid-sized packaging operations. These trends indicate steady, sector-diversified growth for automatic banding machines across the United States.

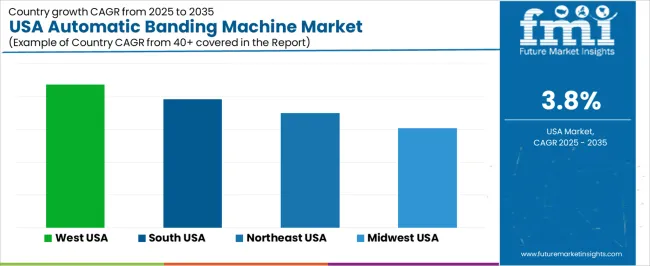

Demand for automatic banding machines in the United States reflects packaging automation, distribution-center activity, retail and food-processing requirements, and expansion of e-commerce and logistics operations. Equipment adoption supports secure bundling of product stacks, cartons, printed items, and consumer goods. Growth varies with regional warehousing density, labor-efficiency targets, and packaging-line modernization. West USA leads at 4.4%, followed by South USA (3.9%), Northeast USA (3.5%), and Midwest USA (3.0%).

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 4.4% |

| South USA | 3.9% |

| Northeast USA | 3.5% |

| Midwest USA | 3.0% |

West USA grows at 4.4% CAGR, supported by strong warehouse automation and continued e-commerce expansion across California, Washington, Nevada, and Arizona. Distribution centers adopt automatic banding equipment for fast-cycle bundling of parcel groups, printed leaflet stacks, fragile goods, and retail-package groupings. Food-processing hubs in California use banding units to secure packaged produce, beverage items, and meal-service components.

Technology-oriented packaging firms deploy machines with adjustable tension controls to improve product handling consistency and reduce manual strain in high-throughput environments. Industrial parks near Los Angeles and Seattle upgrade machinery to support increased demand for outbound order consolidation. Maintenance-ready designs improve line reliability, supporting continuous operations in fulfillment networks.

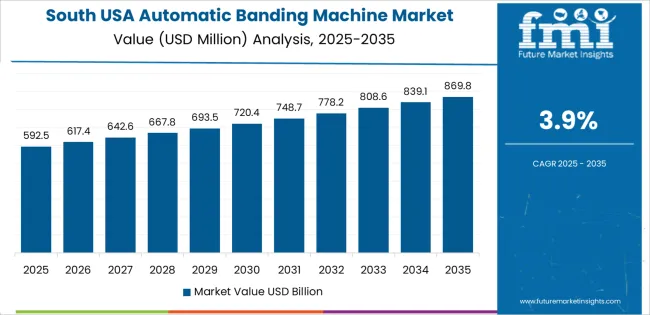

South USA grows at 3.9% CAGR, driven by expanding warehousing networks, consumer packaged goods manufacturing, and strong inflows of distribution infrastructure in Texas, Georgia, Florida, and Tennessee. Regional facilities integrate automatic banding units to reduce manual labor in carton stabilization, bundled product staging, and shrink-film alternatives. Food and beverage producers adopt banding systems to comply with packaging consistency standards in fast-moving supply chains. Industrial equipment distributors operate large coverage zones, improving accessibility to installation and after-sales service. Manufacturers favor machines capable of handling mixed package dimensions common in rural and suburban distribution.

Northeast USA expands at 3.5% CAGR, shaped by printing operations, food distribution, and dense packaging requirements in New York, New Jersey, and Pennsylvania. Commercial print facilities use automatic banding machines to bundle documents, mailers, and paper stacks. Cold-chain distribution adopts banding for stabilized produce and meal kits transported through urban delivery routes. Space-constrained logistics hubs prioritize compact automation equipment that supports higher line efficiency without requiring large operational footprints. Subscription-based consumer goods packing increases machine utilization in fulfillment workflows with frequent changeovers.

Midwest USA grows at 3.0% CAGR, driven by food manufacturing, industrial goods processing, and distribution of consumer products across Illinois, Ohio, Michigan, and Wisconsin. Automated banding supports secure pallet preparation, printed-material bundling, and protective grouping of warehouse shipments. Meat and packaged-food facilities adopt durable stainless-steel models suited to wash-down environments. Regional equipment buyers emphasize long service life and predictable maintenance over speed upgrades. Local distributors support plant procurement cycles tied to modernization rather than rapid equipment turnover.

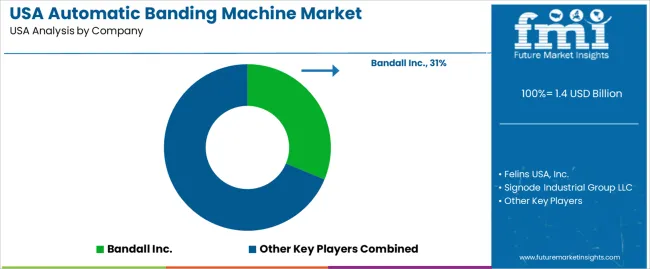

Demand for automatic banding machines in the USA is shaped by packaging-equipment suppliers supporting food processors, print and graphics plants, logistics centers, and consumer-goods manufacturers. Bandall Inc. holds an estimated 31.3% share, supported by controlled ultra-thin banding technology, consistent sealing performance on paper and film materials, and broad deployment in ecofriendly-driven packaging lines. Its systems provide predictable tension control and clean label alignment suited to retail-ready packaging.

Felins USA, Inc. maintains strong participation with bundling and banding equipment designed for food and industrial packaging applications. Its solutions provide reliable performance on variable product shapes, steady operating uptime, and service availability through regional support teams. Signode Industrial Group LLC contributes substantial share with automated banding and bundling systems integrated into high-volume logistics and manufacturing facilities, offering consistent throughput and durable machine construction.

PAC Strapping Products, Inc. serves mid-scale industrial users with dependable banding units providing stable sealing accuracy and straightforward maintenance. TPC Packaging Solutions supports converters and warehouse operations with configurable banding equipment that integrates predictably into existing packaging workflows. Competition in the USA centers on tension precision, material compatibility, cycle consistency, operator safety, and nationwide service coverage as facilities seek efficient, damage-free bundling that supports reduced packaging materials and improved product presentation.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Machine Type | Fully, Semi |

| Capacity | More than 30 bundles/min, 20-30 bundles/min, Less than 20 bundles/min |

| End Use | E-commerce, Food & Beverages, Consumer Goods, Pharmaceuticals, Electrical & Electronics, Printing, Automotive, Chemicals, Banking |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Companies Profiled | Bandall Inc., Felins USA, Inc., Signode Industrial Group LLC, PAC Strapping Products, Inc., TPC Packaging Solutions |

| Additional Attributes | Dollar sales by machine type, capacity, and end-use segments; efficiency benchmarking for high-throughput packaging in e-commerce, food, and pharmaceuticals; integration trends with automated conveyor systems and inline logistics; adoption influenced by material savings vs. shrink-wrap alternatives; developments in smart and energy-efficient banding units for industrial compliance and automation environments across USA regions. |

The demand for automatic banding machine in USA is estimated to be valued at USD 1.4 billion in 2025.

The market size for the automatic banding machine in USA is projected to reach USD 2.0 billion by 2035.

The demand for automatic banding machine in USA is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in automatic banding machine in USA are fully and semi.

In terms of capacity, more than 30 bundles/min segment is expected to command 42.0% share in the automatic banding machine in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Banding Machine Market Insights - Growth & Forecast 2025 to 2035

Demand for Banding Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Hand Towel Automatic Folding Machine in USA Size and Share Forecast Outlook 2025 to 2035

Banding Machine Market Growth & Industry Forecast 2025-2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Coffee Machine Market Analysis – Size, Share & Forecast 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filling Machine Market Analysis - Size, Growth, and Forecast 2025 to 2035

Automatic Capping Machine Market - Size, Share, and Forecast 2025 to 2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Automatic Ducting Machine Market Growth - Trends & Forecast 2025 to 2035

Automatic Grilling Machine Market

Metal Banding Machine Market Trends - Growth & Forecast 2025 to 2035

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Pallet Banding Machine Market Analysis - Growth & Forecast 2025 to 2035

Automatic Case Erecting Machine Market Size, Trend & Forecast 2024-2034

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Powder Filling Machines Market

Automatic Liquid Filling Machines Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA