The demand for banding machines in the USA is expected to grow from USD 1.8 billion in 2025 to USD 2.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.0%. Banding machines, used primarily for packaging and bundling items, are essential in industries such as logistics, manufacturing, and retail. As businesses continue to seek more efficient and automated packaging solutions, the demand for these machines is expected to increase steadily, driven by technological advancements and the growing need for streamlined operations.

The market will see consistent growth, with demand rising from USD 1.8 billion in 2025 to USD 1.9 billion in 2026, USD 2.0 billion in 2027, and USD 2.1 billion in 2028. The market will continue to expand, reaching USD 2.2 billion in 2029 and maintaining steady growth through the early 2030s. By 2035, the demand for banding machines is expected to reach USD 2.7 billion, reflecting ongoing demand from various sectors seeking cost-effective and efficient packaging solutions.

The banding machine market in the USA is expected to experience steady, incremental growth through 2035. Starting at USD 1.8 billion in 2025, the market will grow to USD 1.9 billion in 2026, and USD 2.0 billion in 2027. The demand will continue to increase gradually, reaching USD 2.1 billion by 2028 and USD 2.2 billion by 2029. By 2035, the market for banding machines is projected to reach USD 2.7 billion, supported by the rising adoption of packaging automation and continued investments in operational efficiency.

The YoY growth analysis for the banding machine market shows consistent but moderate annual growth. From USD 1.8 billion in 2025, the market will increase by USD 0.1 billion each year until 2029, with annual growth rates of approximately 5.6%. This steady progression reflects gradual market expansion as the adoption of banding machines continues across industries. The growth rate slightly moderates in the later years, but the overall upward trend remains stable, with the market reaching USD 2.7 billion by 2035. This consistent annual increase indicates that the market for banding machines is on a predictable growth path, driven by the steady demand for automated packaging solutions in a variety of industries.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 1.8 billion |

| Industry Forecast Value (2035) | USD 2.7 billion |

| Industry Forecast CAGR (2025 to 2035) | 4% |

Demand for banding machines in the USA is rising as industries increasingly emphasize efficient, reliable, and automated packaging solutions. Banding machines streamline the process of bundling or securing products for shipment or storage. Packaging, logistics, and manufacturing sectors use banding machines to replace manual strapping or less efficient methods. As production volumes and distribution needs grow, especially in sectors such as food & beverage, pharmaceuticals, electronics, consumer goods, and e commerce, companies prefer banding machines because they ensure consistent bundling with reduced labor input and improved throughput. The rise of e commerce and the need for rapid order fulfillment and packaging further supports demand for banding machines across logistics and warehousing operations.

Increasing automation pressures and demand for labor efficient solutions also drive adoption of automatic banding machines. Many firms invest in semi automatic or fully automatic machines to handle high speed banding for large volumes. Automation reduces risk of manual error, improves consistency, and lowers long term labor costs. As manufacturers and packers in the USA modernize their production lines, demand for banding machines grows noticeably. Advances in machine design, speed, reliability, and adaptability to different banding materials (paper, plastic, textile straps) increase their attractiveness. Given ongoing growth in manufacturing output, e commerce, and logistics workflows, demand for banding machines in the USA is expected to rise steadily in coming years.

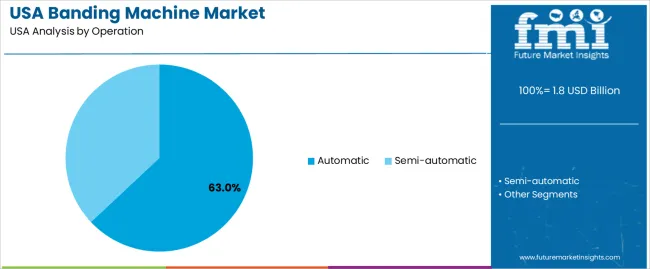

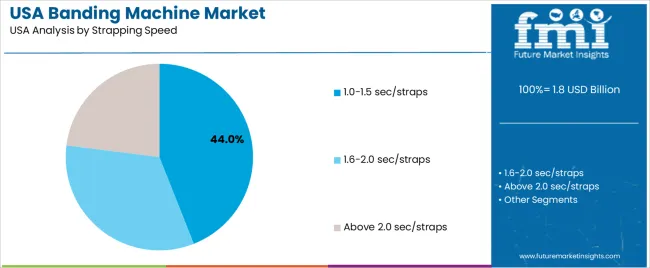

The demand for banding machines in the USA is primarily driven by operation and strapping speed. The leading operation type is automatic, capturing 63% of the market share, while the most common strapping speed range is 1.0-1.5 sec/strap, accounting for 44% of the demand. Banding machines are crucial for packaging and securing items quickly and efficiently, and their use spans across various industries, including logistics, manufacturing, and retail. As the demand for faster and more efficient packaging solutions grows, the adoption of automatic banding machines with higher strapping speeds continues to rise.

Automatic operation leads the demand for banding machines in the USA, holding 63% of the market share. Automatic banding machines are designed to increase efficiency and reduce the need for manual labor in the packaging process. These machines automatically feed the banding material, apply the strap around the product, and seal it without requiring constant human intervention. This level of automation is particularly valuable in high-volume packaging environments where speed and consistency are critical.

The demand for automatic banding machines is driven by the increasing need for faster and more efficient packaging processes. Industries such as logistics, warehousing, and e-commerce, where large volumes of goods need to be securely packaged and shipped, benefit greatly from the speed and reliability offered by automatic banding machines. With the growing emphasis on reducing labor costs, improving productivity, and streamlining operations, automatic banding machines are expected to continue leading the market in the USA.

1.0-1.5 sec/strap is the leading strapping speed range for banding machines in the USA, capturing 44% of the market share. Machines operating within this speed range provide a balance between efficiency and quality, ensuring that products are securely strapped within a reasonable timeframe without compromising the integrity of the packaging. This strapping speed is ideal for high-volume operations where rapid packaging is essential, but the quality of the banding process still needs to be maintained.

The demand for banding machines with a strapping speed of 1.0-1.5 sec/strap is driven by the need for faster packaging solutions across industries. With the rise of e-commerce, retail, and logistics, businesses are increasingly looking for machines that can keep up with growing demands for quick turnarounds and efficient packaging. This speed range strikes a good balance between speed and quality, making it a preferred choice for many manufacturers and distributors. As packaging efficiency continues to be a key focus, the demand for banding machines with 1.0-1.5 sec/strap strapping speed is expected to remain strong.

Demand for banding machines in the USA has been rising as manufacturers, logistics firms, and e commerce operators increasingly seek efficient, secure, and automated bundling solutions. Banding machines are used to wrap straps or bands around packages, cartons or bundles to stabilize them for storage and transport. As shipments — both domestic and cross border — grow in volume, the need for reliable packaging machinery like banding systems becomes stronger. This results in steady growth in the banding machine segment, reflecting broader expansion of the packaging and logistics sectors in the USA.

What are the Drivers of Demand for Banding Machines in the USA?

Several factors drive demand for banding machines across the USA. First, growth in e commerce and rapid increase in shipments and parcel volumes push companies to adopt automated packaging and bundling equipment to ensure speed, consistency, and safety of packages. Second, manufacturers in industries like food & beverage, pharmaceuticals, consumer goods, and logistics require efficient bundling and palletizing for boxes, cartons, and bundles — banding machines offer a cost effective, secure alternative to manual strapping or adhesive based packaging.

Third, labour cost pressures and shortage of manual workers encourage automation of repetitive packaging tasks; banding machines reduce reliance on manual labour and increase throughput. Fourth, the need for damage protection, load stability during transport, and compliance with handling and transport standards motivates companies to switch to mechanized banding systems rather than manual or less reliable methods. Fifth, demand for packaging solutions that are flexible and adapt to different package sizes, bundle types, or pallet configurations supports use of banding machines over single purpose packaging lines.

What are the Restraints on Demand for Banding Machines in the USA?

Despite growing demand, some factors restrain adoption of banding machines. One restraint is initial investment cost: high speed or fully automatic banding machines represent a significant capital expenditure, which small or low volume businesses may find difficult to justify. Another restraint is maintenance and operational complexity: mechanized banding requires maintenance, correct calibration, and sometimes specialized materials (bands, straps) — raising total cost of ownership and possibly deterring smaller operators.

Third, not all products or packaging formats benefit from banding; for light or low value shipments, manual strapping or simpler packaging may suffice, limiting demand for machine based banding. Fourth, competition from alternate packaging and bundling methods — such as shrink wrapping, stretch film wrapping, adhesive sealing or other automated packaging lines — may reduce the share of banding machines in some segments. Finally, fluctuations in demand (seasonal or cyclical) and variation in shipment volume can make it difficult for some companies to justify continuous operation of banding equipment, leading to under utilization and lower ROI.

What are the Key Trends Influencing Demand for Banding Machines in the USA?

Important trends shaping the demand for banding machines include increasing automation across the packaging, logistics, and manufacturing industries — companies are moving away from manual strapping to automated banding to boost efficiency and reduce labour dependence. Another trend is growth in e commerce and omnichannel retail, which drives high volumes of packaged goods requiring secure bundling for shipping.

There is also rising demand for flexible packaging lines capable of handling diverse products, bundle sizes, and pallet configurations — banding machines offering adjustable settings and easy integration are preferred. Adoption of more sustainable packaging practices and reduction of waste — as banding uses less material than some wrapping methods — supports banding solutions. Additionally, technological improvements including faster cycle times, semi automatic to fully automatic banders, and easier maintenance increase attractiveness of banding machines for newer and retrofit packaging lines.

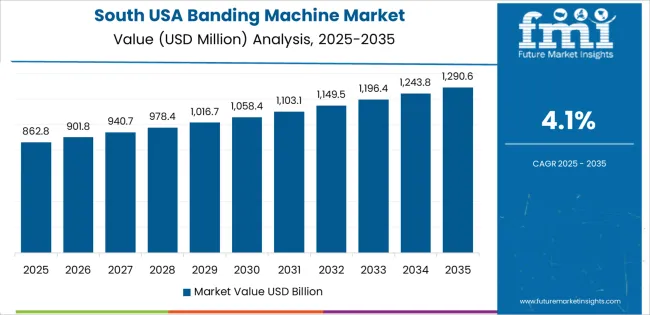

The demand for banding machines in the USA is projected to grow steadily across all regions, with the West USA leading at a CAGR of 4.6%. The South USA follows with a CAGR of 4.1%, driven by industrial growth and manufacturing demand. The Northeast USA is expected to grow at 3.7%, while the Midwest USA shows slightly slower growth at 3.2%. These differences in demand are influenced by regional manufacturing activity, packaging needs, and the adoption of automation technology in various industries.

| Region | CAGR (%) |

|---|---|

| West USA | 4.6 |

| South USA | 4.1 |

| Northeast USA | 3.7 |

| Midwest USA | 3.2 |

In the West USA, the demand for banding machines is projected to grow at a CAGR of 4.6%. This growth is driven by the region's strong industrial base and its focus on packaging automation. States like California are major hubs for manufacturing, logistics, and distribution, creating significant demand for efficient packaging solutions like banding machines. These machines are used to secure products and materials for shipment, which is essential in industries such as agriculture, retail, and e-commerce. The West’s early adoption of automation technology and a growing focus on reducing operational costs support the steady demand for banding machines.

In the South USA, the demand for banding machines is expected to grow at a CAGR of 4.1%, reflecting the region's industrial expansion. The South has seen significant growth in sectors like automotive, food processing, and consumer goods manufacturing. These industries require reliable and cost-effective packaging solutions, which increases the demand for banding machines. Additionally, the growing e-commerce sector in the South, with its emphasis on streamlined logistics and packaging efficiency, further contributes to the uptake of banding machines. The region's manufacturing capacity and logistics infrastructure ensure that demand for banding machines will continue to rise as businesses seek to enhance their packaging processes.

In the Northeast USA, the demand for banding machines is projected to grow at a CAGR of 3.7%. The Northeast is home to a diverse range of industries, including pharmaceuticals, electronics, and food manufacturing, all of which require packaging solutions. Banding machines are increasingly being adopted in these sectors to improve packaging efficiency, reduce labor costs, and ensure product safety during transportation. The region's established manufacturing base, coupled with its focus on operational efficiency, supports the steady demand for banding machines. Although growth is slower than in more industrialized regions, the Northeast's emphasis on innovation and efficiency ensures that demand remains strong.

In the Midwest USA, the demand for banding machines is expected to grow at a CAGR of 3.2%. The Midwest has a strong presence in manufacturing, particularly in sectors like automotive, machinery, and consumer goods. However, compared to the West and South, the region has a lower growth rate in the adoption of packaging automation. As manufacturers in the Midwest seek ways to optimize their operations and reduce packaging costs, the demand for banding machines is expected to rise steadily. The growing interest in automation, combined with the need for cost-effective packaging solutions in the region’s diverse industries, ensures a stable market for banding machines over the forecast period.

The banding machine market in the USA remains driven by demand for efficient packaging and bundling solutions across logistics, manufacturing, food & beverage, pharmaceuticals, and e commerce industries. Leading supplier Dynaric, Inc. holds approximately 28.2% of the market. Other key companies include StraPack, Inc., Transpak Equipment Corp., Signode Industrial Group LLC and Fromm Holding AG. These firms supply a range of banding and strapping machines — from semi automatic units suitable for small scale packaging to fully automatic high-throughput systems used in large warehouses and manufacturing lines. The US market benefits from growth in logistics and e commerce. Increased throughput demands and automated packaging requirements support sales of banding machines. The banding approach appeals because it can use paper or plastic bands, reducing waste and supporting sustainability goals. Its ease of removal and ability to integrate branding or labelling add value over traditional strapping or shrink wrap methods.

Suppliers differentiate through strategies such as product variety, customisation, automation level, and material options. Dynaric offers a broad portfolio covering food, newspaper, electronics and other sectors. StraPack and Transpak focus on semi-automatic and fully automatic strap/band machines with flexible material support. Signode and Fromm emphasise heavy duty and industrial scale banding systems for high load or pallet-level bundling. Some firms prioritise customization allowing various band widths and materials — plastic, paper, or metal — depending on application. Others highlight integration capabilities with conveyor lines, high-speed operations, and lower labour costs. Marketing materials and brochures stress reliability, packaging speed, sustainability, and lower environmental impact. The result is a competitive environment where companies compete on breadth of machine types, adaptability to different end uses, automation, and operational cost savings.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Operation | Automatic, Semi-automatic |

| Strapping Speed | 1.0-1.5 sec/straps, 1.6-2.0 sec/straps, Above 2.0 sec/straps |

| End Use | E-commerce, Food & Beverage, Pharmaceuticals, Electrical & Electronics, Household |

| Key Companies Profiled | Dynaric, Inc., StraPack, Inc., Transpak Equipment Corp., Signode Industrial Group LLC, Fromm Holding AG |

| Additional Attributes | The demand for banding machines in the USA is driven by the increasing need for efficient and reliable packaging solutions across various industries, including e-commerce, food and beverage, pharmaceuticals, and electronics. Banding machines, both automatic and semi-automatic, are used to secure products for transport or storage, with the strapping speed playing a key role in determining the machine's efficiency. Faster machines (above 2.0 sec/straps) are commonly used in high-volume industries like e-commerce, while slower machines (1.0-1.5 sec/straps) may be used in lower-volume or specialty packaging applications. Companies such as Dynaric, StraPack, and Signode Industrial Group dominate the market, offering a range of banding machines tailored to different end uses. The market is expected to grow as demand for automation and faster packaging solutions increases across key sectors in the USA. |

The demand for banding machine in USA is estimated to be valued at USD 1.8 billion in 2025.

The market size for the banding machine in USA is projected to reach USD 2.7 billion by 2035.

The demand for banding machine in USA is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in banding machine in USA are automatic and semi-automatic.

In terms of strapping speed, 1.0-1.5 sec/straps segment is expected to command 44.0% share in the banding machine in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Automatic Banding Machine in USA Size and Share Forecast Outlook 2025 to 2035

Banding Machine Market Growth & Industry Forecast 2025-2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Metal Banding Machine Market Trends - Growth & Forecast 2025 to 2035

Pallet Banding Machine Market Analysis - Growth & Forecast 2025 to 2035

Automatic Banding Machine Market Insights - Growth & Forecast 2025 to 2035

Demand for Bandsaw Machines in USA Size and Share Forecast Outlook 2025 to 2035

USA Beauty and Personal Care (BPC) Retail Vending Machine Market Outlook 2025 to 2035

Demand for Slitting Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Labelling Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Box Sealing Machines in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Tire Marking Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Paper Loading Machine in USA Size and Share Forecast Outlook 2025 to 2035

Hot Food Vending Machine Industry Analysis in USA & Canada - Size, Share, and Forecast 2025 to 2035

Demand for Feed Preparation Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Cup Fill and Seal Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Trash Rack Cleaning Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Softgel Encapsulation Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Corrugated Cardboard Cutting Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Hand Towel Automatic Folding Machine in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA