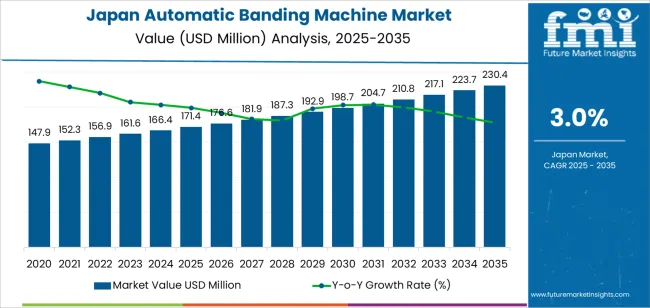

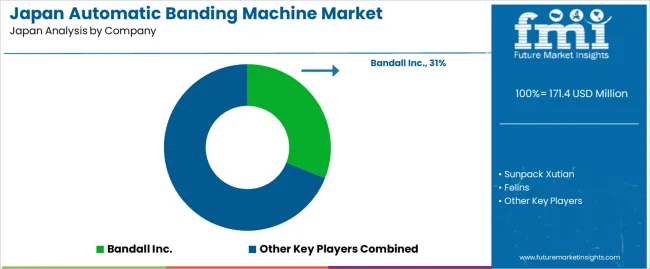

In 2025, demand for automatic banding machines in Japan is recorded at USD 171.4 million and is projected to reach USD 230.4 million by 2035 at a CAGR of 3.0%. Growth in the first half of the forecast is shaped by steady capital spending across food processing, pharmaceuticals, printing, and logistics operations. Japanese manufacturers favor banding systems for unitizing lightweight cartons, bundled paper products, and medical packaging where surface protection and clean appearance are required. Demand also reflects rising use in small and mid-sized automated lines that prioritize compact footprints and low energy usage. Equipment replacement cycles in mature factories support baseline sales volume alongside selective capacity expansion projects.

After 2030, market progress reflects incremental expansion rather than structural shifts in packaging automation. Demand moves from USD 198.7 million in 2030 toward USD 230.4 million by 2035, supported by upgrades to servo driven systems, integration with inspection units, and higher throughput requirements in parcel sorting and fulfillment centers. Key buyers include domestic manufacturers, contract packers, and export oriented producers in electronics and precision goods. Suppliers active in Japan compete on machine uptime, strapping accuracy, and adaptation for mixed product sizes. Strategies focus on modular designs, faster changeover capability, and long term maintenance contracts that stabilize recurring revenue through the later forecast years.

The long term value accumulation curve for automatic banding machines in Japan shows a controlled industrial compounding pattern rather than a speculative growth cycle. From USD 147.9 million in 2020 to USD 171.4 million in 2025, the market accumulates USD 23.5 million in incremental value, with yearly additions consistently staying within the USD 4.4 to 4.9 million range. This phase confirms that demand is anchored in stable packaging, printing, and warehouse automation requirements rather than new sector entry. The accumulation slope during this period remains shallow but reliable, shaped by replacement demand, steady production throughput, and incremental upgrades across logistics operations rather than large-scale facility expansions.

From 2025 to 2035, the accumulation curve steepens structurally as the market expands from USD 171.4 million to USD 230.4 million, adding USD 59.0 million in cumulative value. Annual value additions widen gradually from about USD 5.2 million to nearly USD 6.7 million by the final years, reflecting compounding on a larger installed base. This phase reflects value accumulation through equipment refresh cycles, higher automation density per facility, and steady expansion of e commerce driven packaging lines. The curve remains smooth without inflection spikes, confirming that long term value creation is driven by throughput optimization and lifecycle replacement rather than episodic capital investment waves.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 171.4 million |

| Forecast Value (2035) | USD 230.4 million |

| Forecast CAGR (2025–2035) | 3.0% |

Demand for automatic banding machines in Japan has grown from rising expectations for high-quality packaging and increasing use of automation in manufacturing and logistics. Japanese firms in food & beverage, pharmaceuticals, cosmetics and electronics have sought reliable, precise banding systems to align with strict packaging standards and shrink-wrap or bundling requirements. The surge in e-commerce and logistics throughput over the past decade heightened pressure on packaging lines to deliver speed and consistency. Automatic banding machines thus replaced manual strapping or semi-automatic operations to cut labour, save time, and reduce error and damage during handling.

Future demand in Japan will be driven by continued growth of packaged consumer goods, automation upgrades, and tighter supply-chain efficiency. As manufacturers and logistics providers aim to reduce labour dependency and improve throughput, they will favour fully automatic banding systems that integrate with conveyor lines, robotic sorters and automated palletizing. Increasing regulation around packaging safety and consumer convenience will raise demand for consistent and tight banding, especially for fragile or export-bound goods. Further, rising interest in eco-friendly band materials and recyclable packaging may push adoption of newer banding technologies compatible with sustainable band materials, which could broaden demand beyond current sectors.

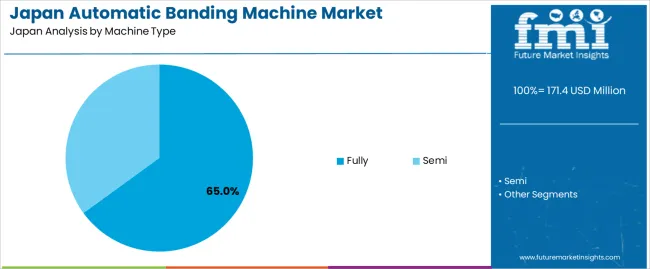

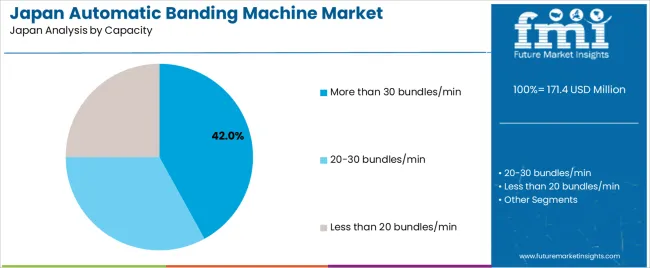

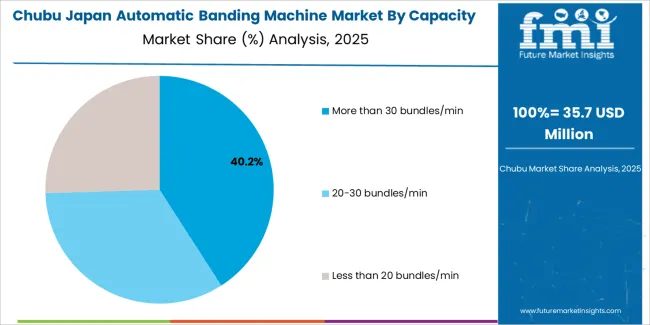

The demand for automatic banding machines in Japan is influenced by machine type and operating capacity. Fully automatic machines account for 65% of total demand, while semi automatic machines serve smaller scale operations. By capacity, machines operating at more than 30 bundles per minute hold 42% share, followed by 20 to 30 bundles per minute and less than 20 bundles per minute categories. Purchasing decisions reflect packaging line speed, labor availability, floor space, and production consistency requirements. These segments illustrate how industrial throughput targets and automation standards guide equipment deployment across manufacturing, logistics, and distribution facilities nationwide.

Fully automatic banding machines account for 65% of total demand in Japan. Their dominance reflects the strong focus on labor efficiency, consistent output, and reduced handling time across industrial packaging lines. Fully automatic systems integrate with conveyors and end of line packaging equipment, allowing continuous operation without manual intervention. These machines deliver uniform band tension, precise alignment, and repeatable performance across high volume workflows. This supports stable packaging quality in sectors such as logistics, food packaging, pharmaceuticals, and printed materials.

Factory labor constraints also support automation adoption. Fully automatic machines reduce dependency on skilled operators and stabilize throughput across multi shift operations. Maintenance cycles are predictable, which supports production planning. The ability to integrate barcode scanning, counting systems, and robotic handling further improves operational control. Capital investment is justified by lower long term operating costs and improved packaging accuracy. These factors sustain the strong preference for fully automatic banding machines across Japan industrial facilities.

Machines with capacity above 30 bundles per minute represent 42% of total demand in Japan. This leadership reflects the concentration of high throughput packaging environments serving logistics hubs, print finishing, and mass production manufacturing. High speed machines enable continuous bundling of cartons, paper stacks, and medical packs without bottlenecks. These capacities align with automated sorting lines and distribution centers processing thousands of units per hour.

High speed banding reduces downstream queue buildup and stabilizes shipment preparation schedules. These machines are commonly deployed where packaging accuracy must be maintained under tight time constraints. Cooling systems, reinforced motors, and stable band tracking support continuous duty cycles. Maintenance downtime per unit output remains lower than slower machines. These performance characteristics justify higher capacity selection where daily volume targets and shipment cut off times dominate equipment planning decisions across Japan high density production zones.

Demand for automatic banding machines in Japan is rising primarily because e-commerce, food & beverage, and manufacturing sectors require faster, more reliable packaging for shipping and logistics. The surge in parcel volumes and frequent small-batch shipments demands consistent bundling and packing throughput. High standards for packaging quality, combined with pressure to reduce labour costs and avoid injuries from manual strapping, motivate firms to adopt automated banding. Industries such as pharmaceuticals and consumer goods, which require secure bundling for safety and handling, also contribute to rising interest in banding automation.

Japan faces demographic headwinds and chronic labour shortages in warehousing and logistics operations. Manual strapping and bundling remain labour-intensive and carry safety risks. Automated banding machines offer a solution by reducing dependence on labour and enabling high-speed bundling with minimal manual intervention. Furthermore, Japanese factories and warehouses often have limited floor space. Compact, efficient automatic banding units that can integrate into existing lines without large footprints align well with these constraints. In that context, automation through banding machines becomes a practical response to structural labour and space challenges.

High upfront cost is a significant barrier for small and mid-sized firms in Japan that may lack capital or stable volumes to justify investment. Some production lines involve frequent changeovers, different package sizes, or small batch runs, making dedicated banding machines less attractive without flexible configuration. Maintenance requirements and need for technical expertise to operate advanced banding units deter adoption. In segments with tight margins — for instance, small-scale manufacturers or seasonal producers — the cost-benefit balance may favour manual methods or simpler strapping tools over full automation.

Banding machine demand in Japan is increasingly influenced by interest in sustainable materials and operational efficiency. There is growing use of eco-friendly banding materials such as paper bands or recyclable straps, reflecting consumer and regulatory pressure to reduce plastic waste. Manufacturers are integrating smart-automation features, including sensors for tension control and jam detection, to improve consistency and reduce errors. Some lines incorporate modular units that can switch between banding, wrapping, and palletizing depending on output, maximizing utility for diverse product types. These trends highlight rising demand for flexible, environmentally conscious, high-precision banding solutions.

Sectors likely to lead demand include pharmaceuticals, consumer electronics, food & beverage, and e-commerce fulfilment, where consistent bundling and secure packaging are critical. Pharmaceutical manufacturing demands hygienic, precise packaging lines; consumer electronics require secure bundling for fragile components; food & beverage producers benefit from speed and hygiene in packaging operations; e-commerce and logistics firms need reliable bundling to reduce shipping damage. Additionally, metal fabrication and construction-component manufacturers that export or ship large bundles domestically may adopt banding machines to improve safety and efficiency in handling heavy or irregular loads.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.8% |

| Kanto | 3.5% |

| Kinki | 3.0% |

| Chubu | 2.7% |

| Tohoku | 2.3% |

| Rest of Japan | 2.2% |

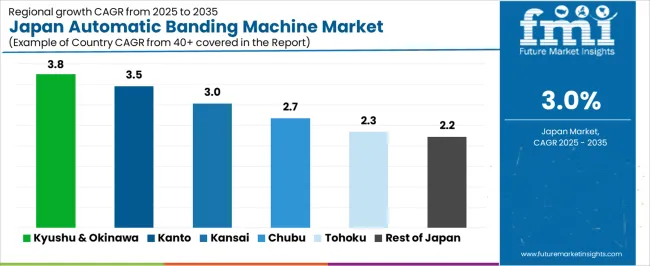

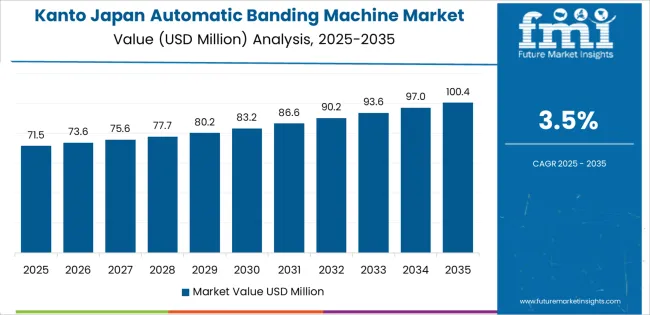

The demand for automatic banding machines in Japan shows regional variation with Kyushu & Okinawa leading at 3.8 % CAGR. This region likely benefits from packaging-machinery manufacturers and growth in logistics and distribution operations that favour automated bundling solutions. The Kanto region’s 3.5 % growth reflects strong concentration of manufacturing, e-commerce fulfilment, and packaging-line investments where efficiency and labour savings drive adoption. In Kinki (3.0 %) and Chubu (2.7 %) demand grows moderately, supported by regional industrial firms updating packaging equipment. Tohoku (2.3 %) and the Rest of Japan (2.2 %) show slower uptake, reflecting fewer high-volume packaging operations and lower investment intensity. The overall trend aligns with national packaging-machinery market growth where automation and efficiency motivate machine deployment.

Expansion in Kyushu and Okinawa reflects a CAGR of 3.8% through 2035 for automatic banding machine demand, supported by growing food processing, seafood packaging, and regional logistics operations. Export oriented agricultural and marine products rely on secure banding for carton stabilization during transit. Distribution centers near ports increase demand for compact automated strapping solutions. Small and medium manufacturing units adopt banding equipment to improve packaging consistency. Demand remains tied to regional processing industries rather than large scale fulfillment hubs, keeping growth steady but moderate across food, beverage, and light industrial packaging workflows.

Kanto advances at a CAGR of 3.5% through 2035 for automatic banding machine demand, driven by dense warehousing, ecommerce fulfillment, and printed materials distribution across Tokyo dominated logistics zones. High parcel sorting volumes require automated bundling to improve throughput efficiency. Publishing, pharmaceuticals, and consumer goods packaging also sustain consistent machine utilization. Service networks and leasing models reduce capital entry barriers for smaller operators. Demand aligns closely with intra city distribution intensity and rapid order processing requirements rather than export packaging, reinforcing steady equipment replacement and moderate new installation activity.

Kinki records a CAGR of 3.0% through 2035 for automatic banding machine demand, shaped by stable manufacturing output and steady retail distribution activity in Osaka and neighboring prefectures. Apparel, printed goods, and food packaging contribute consistent bundling requirements. Space limitations in urban facilities favor compact banding equipment over high capacity lines. Warehouse modernization proceeds gradually due to mixed age infrastructure. Equipment procurement depends heavily on replacement cycles rather than capacity expansion, keeping growth moderate but reliable across packaging operations serving local consumption markets.

Chubu expands at a CAGR of 2.7% through 2035 for automatic banding machine demand, influenced by automotive component packaging, industrial parts distribution, and regional manufacturing workflows. Banding supports bundling of metal parts, printed instructions, and small assemblies before shipment. Demand remains tied to automotive production rhythms rather than retail fulfillment. Capital investment prioritizes production automation over end of line packaging equipment. Machine adoption occurs mainly within tier one and tier two supplier warehouses, keeping volumes moderate and installation activity selective across industrial logistics facilities.

Tohoku shows a CAGR of 2.3% through 2035 for automatic banding machine demand, supported by food processing, agricultural produce packaging, and regional distribution centers. Installation density remains low due to limited scale logistics operations. Demand comes from cooperatives and mid-sized packers upgrading from manual strapping. Cold climate logistics require secure bundling for long distance shipment stability. Growth remains steady but modest, following incremental modernization rather than rapid automation deployment across packaging facilities serving rural and prefectural transport networks.

The rest of Japan reflects a CAGR of 2.2% through 2035 for automatic banding machine demand, supported by dispersed manufacturing, municipal logistics, and small scale packaging workshops. Equipment sales rely on distributor networks serving local industries such as agricultural packaging, print shops, and consumer goods assembly. Low shipment volumes limit large capacity system adoption. Manual strapping remains common, with automation selected only where labor constraints justify investment. Demand stability depends on equipment refurbishment cycles and selective upgrades rather than network wide deployment across secondary industrial regions.

The demand for automatic banding machines in Japan is rising due to expanding packaging, logistics, and e commerce activity. Manufacturers and logistics providers require consistent, high speed bundling of goods to meet tight delivery schedules and handle growing parcel and pallet volumes. Japan’s emphasis on precise packaging quality and automation in production lines encourages adoption of banding machines. Use cases span food & beverage, consumer goods, printing and pharmaceutical industries where safe, compact and efficient bundling matters. The trend toward automation reduces reliance on manual labour and improves throughput and packaging reliability across supply chains.

Among machine suppliers, one firm leads globally with approximately 31 % market share. Other significant providers include Sunpack Xutian, Felins, HXCP Precision Machinery, and TPC Packaging Solutions. These companies supply automatic banding systems to Japan and global markets. The market share distribution suggests a moderate concentration: the leading supplier holds a substantial share, but there is scope for regional and niche firms to serve specialized packaging needs. This competitive structure supports continued innovation and tailored solutions for Japanese packaging requirements.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Machine Type | Fully Automatic, Semi-Automatic |

| Capacity | More than 30 bundles/min, 20–30 bundles/min, Less than 20 bundles/min |

| End Use Industry | E-commerce, Food & Beverages, Consumer Goods, Pharmaceuticals, Electrical & Electronics, Printing, Automotive, Chemicals, Banking |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Bandall Inc., Sunpack Xutian, Felins, HXCP Precision Machinery Co., Ltd., TPC Packaging Solutions |

| Additional Attributes | Dollar by sales by machine type, capacity, and end use; regional CAGR and volume growth projections; fully vs semi-automatic machine adoption; high-speed machine penetration (>30 bundles/min); replacement vs new installation; compact vs standard footprint deployment; sector-specific adoption patterns (e-commerce, logistics, pharmaceuticals, food & beverage, printing); operational efficiency trends including integration with conveyors and inspection units; eco-friendly band material adoption; modular system use; maintenance and service contract penetration; regional industrial concentration impact on machine demand; workflow automation trends and lifecycle replacement influence. |

The demand for automatic banding machine in Japan is estimated to be valued at USD 171.4 million in 2025.

The market size for the automatic banding machine in Japan is projected to reach USD 230.4 million by 2035.

The demand for automatic banding machine in Japan is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in automatic banding machine in Japan are fully and semi.

In terms of capacity, more than 30 bundles/min segment is expected to command 42.0% share in the automatic banding machine in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Banding Machine Market Insights - Growth & Forecast 2025 to 2035

Demand for Banding Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Banding Machine in USA Size and Share Forecast Outlook 2025 to 2035

Banding Machine Market Growth & Industry Forecast 2025-2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Coffee Machine Market Analysis – Size, Share & Forecast 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filling Machine Market Analysis - Size, Growth, and Forecast 2025 to 2035

Automatic Capping Machine Market - Size, Share, and Forecast 2025 to 2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Automatic Ducting Machine Market Growth - Trends & Forecast 2025 to 2035

Automatic Grilling Machine Market

Metal Banding Machine Market Trends - Growth & Forecast 2025 to 2035

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Pallet Banding Machine Market Analysis - Growth & Forecast 2025 to 2035

Automatic Case Erecting Machine Market Size, Trend & Forecast 2024-2034

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Powder Filling Machines Market

Automatic Liquid Filling Machines Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA