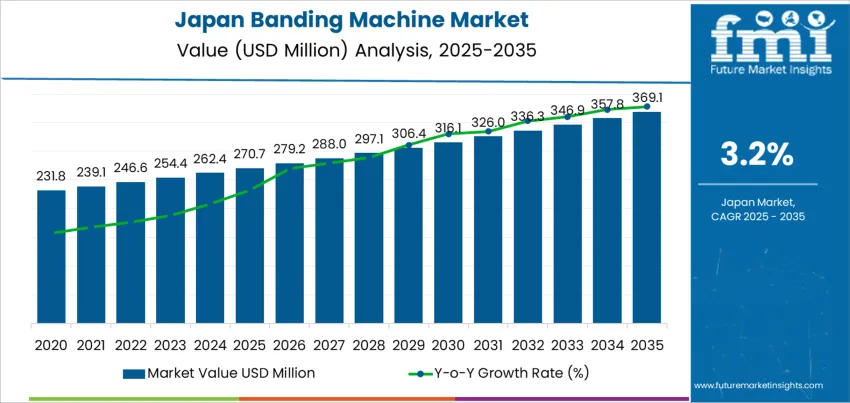

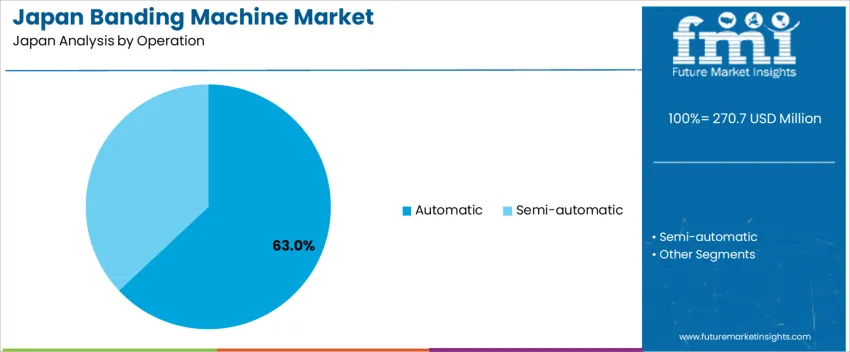

The Japan banding machine demand is valued at USD 270.7 million in 2025 and is expected to reach USD 369.1 million by 2035, reflecting a CAGR of 3.2%. Demand is influenced by automation upgrades in logistics, retail, printing, and food packaging operations. Banding systems help maintain bundle integrity, reduce material waste, and provide cost-efficient product unitization. Increased distribution activity in e-commerce and just-in-time manufacturing further supports equipment adoption. Automatic banding machines lead the product landscape. Their dominance is driven by faster throughput, reduced labour involvement, and consistent sealing quality for a wide variety of packages. Integration with conveyor systems, barcode tracking, and automated labelling supports operational efficiency in high-volume processing environments.

Kyushu & Okinawa, Kanto, and Kansai record the highest deployment levels due to concentrated industrial clusters, logistics hubs, and packaging service providers. Demand is reinforced by replacement cycles in established production facilities and the expansion of automated packaging lines across consumer goods and industrial sectors. Key suppliers include StraPack, Inc., Signode, Transpak, Dynaric, and Fromm. Their competitive focus covers machine durability, energy-efficient sealing systems, and compatibility with recyclable banding materials. Product enhancements target reduced maintenance requirements and improved flexibility for customized bundling applications.

Demand for banding machines in Japan shows a measured acceleration during periods of automation investment across packaging, logistics, and print-finishing operations. Efficiency targets in distribution centers and food packaging drive machine upgrades that accelerate demand, particularly where consistent band sealing improves product handling and labor productivity. Adoption in e-commerce fulfillment and pharmaceutical packaging adds further upward momentum as traceability and secure bundling become operational priorities.

Deceleration occurs when capital spending slows or when existing equipment provides sufficient performance, reducing the urgency for replacement. Small enterprises may delay purchases due to budget constraints and limited throughput needs. Regulatory or material changes that increase focus on minimal packaging can also temper demand, encouraging alternatives like adhesive or shrink wrapping in select segments.

The resulting trend reflects cycles in industrial investment rather than continuous expansion. Acceleration is tied to modernization and throughput optimization, while deceleration aligns with cost-control phases and established equipment life cycles. Growth remains steady but subject to operational decision timing within Japan’s advanced manufacturing and logistics infrastructure.

| Metric | Value |

|---|---|

| Japan Banding Machine Sales Value (2025) | USD 270.7 million |

| Japan Banding Machine Forecast Value (2035) | USD 369.1 million |

| Japan Banding Machine Forecast CAGR (2025-2035) | 3.2% |

Demand for banding machines in Japan is increasing because packaging operations in food processing, printing and logistics require secure bundling that protects products while reducing excess material use. Banding machines apply controlled tension and clean bands around items such as cartons, trays and printed materials, which improves presentation and supports efficient distribution through convenience stores and e-commerce channels. Food manufacturers adopt banding to maintain product visibility and labeling accuracy while meeting hygiene standards in chilled and fresh categories.

Automation trends in Japanese factories strengthen adoption, as banding machines integrate with conveyors and inspection systems to support consistent throughput and reduce manual labor. Printers and mail centers use banding equipment to organize catalogs, magazines and direct mail materials for efficient handling and delivery. Lightweight banding solutions also align with sustainability goals by reducing secondary packaging such as adhesives or shrink film. Constraints include investment cost for high speed models, space limitations in older facilities and operator training requirements. Small shops may continue manual bundling when production volume remains low. Procurement decisions can be delayed when packaging formats are under review.

Demand for banding machines in Japan is driven by strong automation adoption in packaging facilities and logistics hubs. Compact system design, high throughput efficiency, and reduced labor dependency support business continuity in a high-wage environment. Growth also aligns with standardized packaging practices in retail supply chains, where product bundling and tamper-resistance are essential for distribution accuracy. Investments in automated equipment increase as e-commerce and industrial shipping expand across urban and regional fulfillment networks.

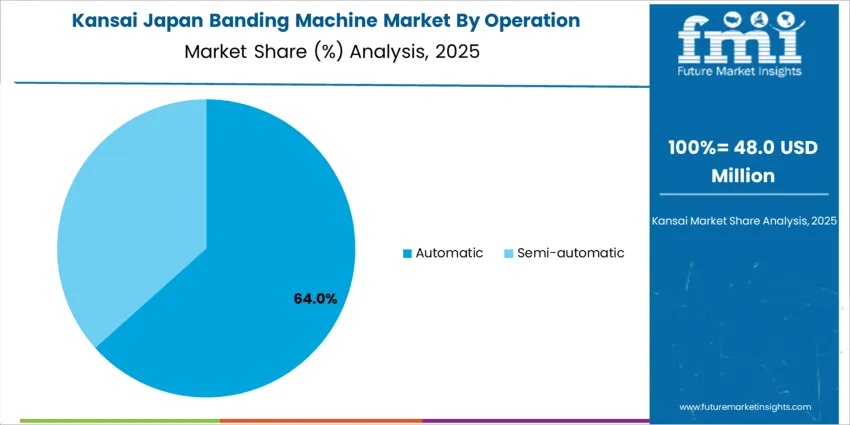

Automatic banding machines hold 63.0%, supported by widespread implementation in distribution centers, food packaging lines, and electronics assembly operations. These machines reduce manual intervention, minimize material waste, and improve cycle time, proving cost-efficient for continuous processing environments. Semi-automatic systems account for 37.0%, serving smaller businesses and varied packaging workflows where capital budgets are more conservative. Automatic solutions dominate due to alignment with Japan’s lean manufacturing principles, limited labor availability, and increasing shift toward fully integrated packaging automation. Demand is further reinforced by compatibility with conveyors, robotics, and smart factory applications that ensure consistent bundling accuracy for fragile or lightweight products.

Key Points:

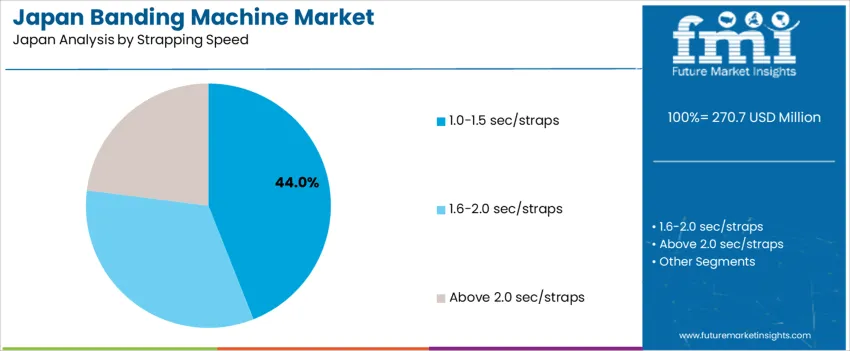

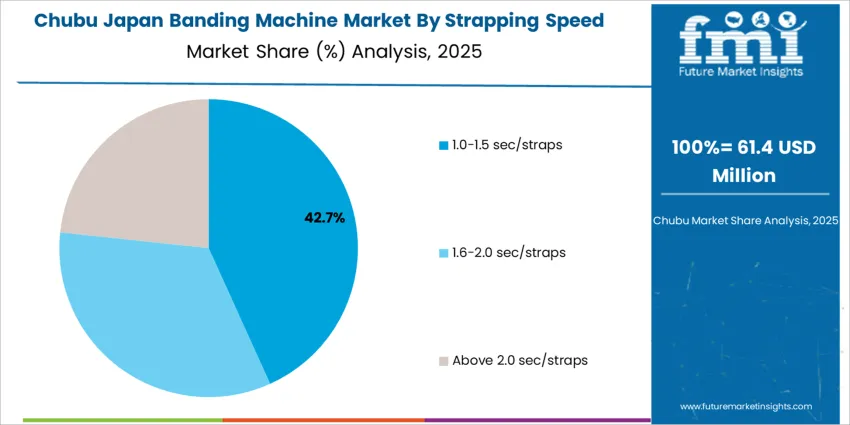

Strapping speeds of 1.0-1.5 seconds per strap represent 44.0%, reflecting requirements for medium-fast processes across consumer goods, parcel packaging, and food products. These machines achieve an optimal balance between cost and cycle time. Systems running at 1.6-2.0 seconds account for 33.0%, used in slower lines or operations with manual loading. Equipment exceeding 2.0 seconds represents 23.0%, typically deployed in low-volume or specialty packaging environments. Speed preferences reflect the configuration of Japanese logistics and production sites, where consistent performance and precision supersede ultra-high-speed operations that may compromise delicate items.

Key Points:

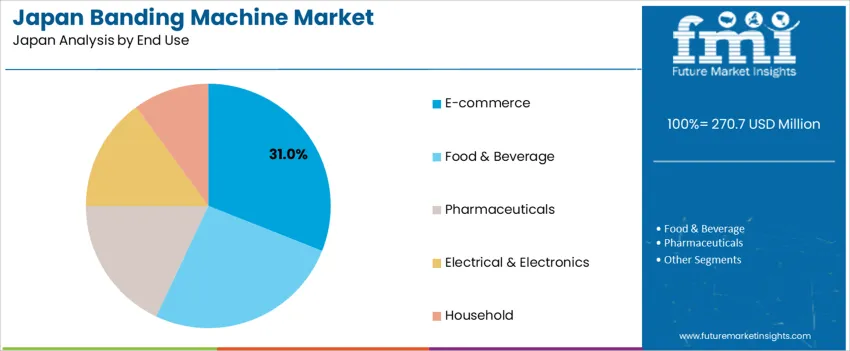

E-commerce accounts for 31.0%, driven by increasing parcel shipments requiring fast bundling, tamper-control, and unit consolidation for labeling and transport. Food and beverage contribute 26.0%, relying on hygienic, non-damaging strapping for boxed perishables. Pharmaceuticals represent 18.0%, demanding tight quality assurance and secure packaging for regulated medical goods. Electrical and electronics hold 15.0%, where static-safe and precision banding protects compact components. Household applications capture 10.0%, covering small-business packaging and retail presentation. The end-use structure reflects Japan’s expanding logistics operations and strict handling standards across consumer supply chains.

Key Points:

Growth of logistics automation, increased packaging efficiency needs in food production and rising demand for secure bundling in print and pharmaceutical sectors are driving demand.

In Japan, banding machines gain adoption as logistics operators in Kanto and Kansai automate parcel handling to manage high e-commerce volume. Food manufacturers require lightweight banding for trays, bento packaging and bundled produce sold in supermarkets and convenience stores, supporting improved shelf presentation and reduced shrink-wrap usage. Printing companies serving manga, catalog and promotional mailings rely on banding for protective bundling and organized delivery. Pharmaceutical packers use banding to maintain label visibility while meeting traceability requirements during distribution. Compact machines that fit limited floor space are popular among manufacturers operating in dense urban industrial zones, contributing to continuous demand across medium and high-speed packaging lines.

High capital cost for advanced automation, maintenance requirements for precision systems and limited workforce familiarity in smaller factories restrain adoption.

Manufacturers with narrow margins may postpone upgrades from manual bundling to mechanized systems when investment does not immediately reduce labor expenses. Banding machines require periodic adjustments to maintain tension and film-feed accuracy, adding maintenance tasks for facilities with small engineering teams. Some smaller food processors located in regional prefectures continue using basic taping or shrink solutions due to familiarity and lower upfront costs. These operational constraints lead to gradual rather than rapid transition to automated banding.

Shift toward paper banding for sustainability, increased integration with vision inspection and rising demand from convenience-food distributors define key trends.

Paper band materials are gaining traction because they support local recycling guidelines and reduce plastic use while maintaining barcode visibility. Machine suppliers are integrating vision systems that verify label accuracy, product count and orientation before banding to improve quality control. Convenience-food distributors require lightweight banding to secure single-serve products in chilled logistics, supporting higher throughput at fulfillment centers. Mobile and tabletop banding devices are expanding usage among bakeries and prepared-food operations that prioritize flexibility. These trends indicate steady, application-focused demand for banding machines aligned with Japan’s packaging efficiency and sustainability goals.

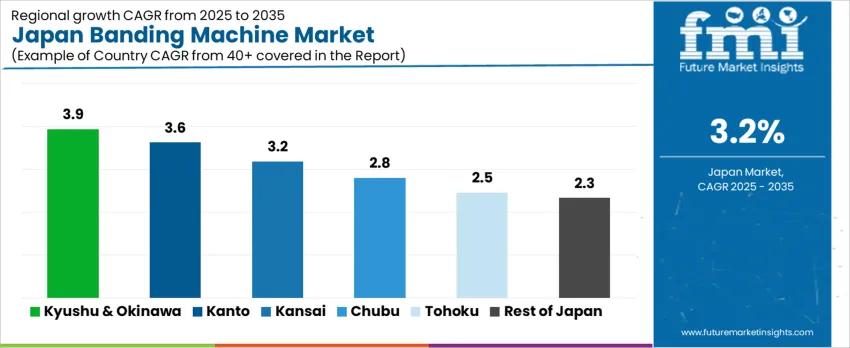

Demand for banding machines in Japan is guided by packaging automation in logistics, food processing, pharmaceuticals, and printed media distribution. Operational needs vary based on industrial density, transport volume, and equipment upgrade cycles. Regional performance is led by Kyushu & Okinawa (3.9% CAGR), followed by Kanto (3.6%), Kansai (3.2%), Chubu (2.8%), Tohoku (2.5%), and the Rest of Japan (2.3%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 3.9% |

| Kanto | 3.6% |

| Kansai | 3.2% |

| Chubu | 2.8% |

| Tohoku | 2.5% |

| Rest of Japan | 2.3% |

Kyushu & Okinawa record 3.9% CAGR, supported by logistics chains linked to coastal trade, food-processing facilities, and document-handling needs within retail distribution. Banding machines assist with bundling bottled beverages, packaged snacks, and produce items intended for regional and outbound shipment. Postal and office-supply environments continue using banding systems for organized stack handling. Demand reflects operational efforts to reduce manual packaging labor during high-volume dispatch cycles.

Local food-exporting companies require stable tension control to maintain product safety across transport stages. Compact, semi-automatic systems are preferred by SMEs due to simplified operator training. Decision factors emphasize equipment durability under repeated use and compatibility with varied band materials. Service availability within local industrial corridors reinforces purchasing confidence through responsive maintenance support.

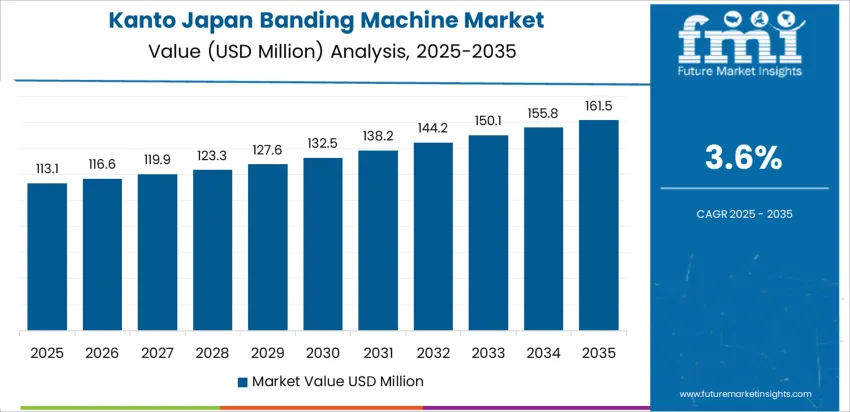

Kanto posts 3.6% CAGR as Tokyo-centered logistics, e-commerce fulfillment, and large-scale printing operations rely on automated banding to secure multi-item stacks. High-frequency outbound shipping drives sustained machine utilization in parcel-sorting environments. Retail warehouses employ banding for shelf-ready packaging, especially for multipacks of grocery and consumer goods. Fulfillment centers require stable strap-feed mechanisms maintaining throughput without stoppages. Manufacturers evaluate device compliance with corporate safety standards intended for automated lines. Print-media bundling continues within newspaper and leaflet distribution activities, creating recurring machine demand. Buyers prioritize clear maintenance pathways and integration capability with conveyor frameworks to optimize flow continuity.

Kansai grows at 3.2% CAGR due to Osaka and Kobe’s industrial supply networks and food production plants requiring secure product bundling. Automated lines in ready-to-eat food packaging adopt banding systems to improve conveyor speed alignment and reduce handling effort. Logistics hubs rely on tension consistency for carton grouping before palletizing. Regional distributors value equipment that reduces operational noise within warehouse environments. SMEs show interest in energy-efficient models for lower operating costs. Safety features ensuring clean-edge band placement reduce product damage risk during handling. Equipment selection includes models supporting quick band changeover to accommodate SKU variety.

Chubu posts 2.8% CAGR, influenced by automotive component distribution, industrial parts packaging, and document bundling in administrative operations. Stability in machinery supply chains results in banding systems used for organizing small hardware kits and parts containers. Distribution centers require equipment that maintains tension precision to protect packaging integrity. Transport networks connecting central Japan to national logistics corridors reinforce usage across multiple warehouse types. Procurement decisions favor reliability and equipment lifecycle support.

Tohoku records 2.5% CAGR, driven by bundled shipping for packaged food, beverages, and printed materials. Banding supports retail distribution for convenience outlets in smaller cities, where goods move in consolidated volumes. Offices handling physical document sets continue mechanical bundling to aid storage orderliness. Manufacturers evaluate machines for easy integration into existing workspace layouts.

The Rest of Japan posts 2.3% CAGR with stable demand across dispersed retail, agricultural packaging, and localized delivery services. Banding machines support ergonomic handling and reduce packaging waste linked to shrink-film alternatives. Procurement focuses on standardized solutions requiring minimal technician involvement. Seasonal agricultural output may influence short-term equipment utilization peaks.

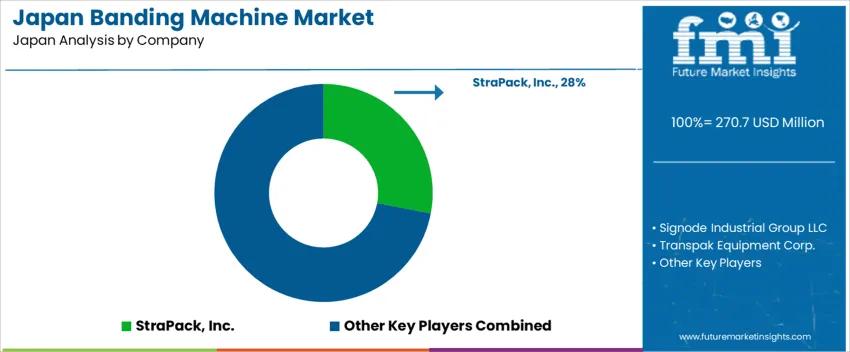

Demand for banding machines in Japan is driven by suppliers supporting secure bundling, packaging-line stability, and material-handling efficiency in logistics, printing, food distribution, and industrial production sites. StraPack, Inc. holds an estimated 28% share, supported by controlled strap-tension accuracy, compact machine footprints, and strong after-sales service through established regional maintenance networks. Its systems deliver reliable bundling performance suited to Japan’s high-frequency conveyor environments.

Signode Japan maintains solid participation with automated strapping systems where consistent seal integrity and durable tool construction are required in large distribution centers and manufacturing operations. Transpak Japan contributes presence in semi-automatic units used by small and mid-scale packaging workplaces, offering stable strap-feeding and straightforward operator control. Dynaric Japan supports selective demand in logistics workflows that require uniform strap application and dependable belt-tracking performance. Fromm Japan adds capability in industrial bundling where handheld strapping tools and system compatibility must maintain predictable strength during storage and transport.

Competition in Japan focuses on tension-control stability, machine-cycle reliability, consumable-strap compatibility, maintenance responsiveness, and integration with automated conveyors. Demand remains consistent as Japanese warehouses, printers, and food producers continue requiring high-reliability banding equipment that ensures stable product handling and efficient throughput across tightly managed domestic distribution operations.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Operation | Automatic, Semi-automatic |

| Strapping Speed | 1.0-1.5 sec/straps, 1.6-2.0 sec/straps, Above 2.0 sec/straps |

| End Use | E-commerce, Food & Beverage, Pharmaceuticals, Electrical & Electronics, Household |

| Regions Covered | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | StraPack, Inc., Signode, Transpak, Dynaric, Fromm |

| Additional Attributes | Sales distribution by automation level and speed category; penetration in logistics automation for parcel handling; adoption in food safety compliance packaging; integration with smart factory systems; rise of compact and energy-efficient banding machinery for urban production facilities across Japan. |

The demand for banding machine in Japan is estimated to be valued at USD 270.7 million in 2025.

The market size for the banding machine in Japan is projected to reach USD 369.1 million by 2035.

The demand for banding machine in Japan is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in banding machine in Japan are automatic and semi-automatic.

In terms of strapping speed, 1.0-1.5 sec/straps segment is expected to command 44.0% share in the banding machine in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Automatic Banding Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Banding Machine Market Growth & Industry Forecast 2025-2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Metal Banding Machine Market Trends - Growth & Forecast 2025 to 2035

Pallet Banding Machine Market Analysis - Growth & Forecast 2025 to 2035

Automatic Banding Machine Market Insights - Growth & Forecast 2025 to 2035

Demand for Banding Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Machine Safety in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Virtual Machines in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Banding Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Bandsaw Machines in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Labelling Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Box Sealing Machines in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Tire Marking Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Turbomachinery Control System in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Paper Loading Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Cup Fill and Seal Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Trash Rack Cleaning Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Softgel Encapsulation Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA