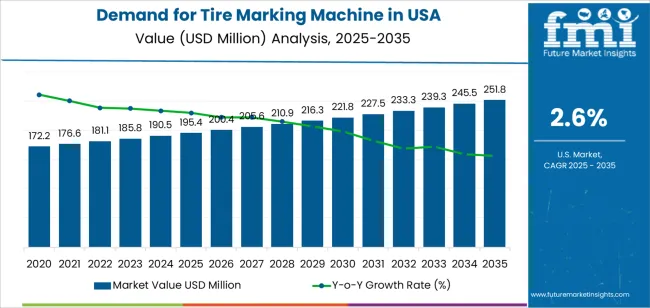

The demand for tire marking machines in the USA is expected to grow from USD 195.4 million in 2025 to USD 251.8 million by 2035, reflecting a CAGR of 2.6%. Tire marking machines are essential in the tire manufacturing industry for labeling, branding, and ensuring compliance with regulations governing tire identification. The growing need for automated marking systems, the expansion of the automotive sector, and the rising emphasis on supply chain efficiency and product traceability in tire production drive the demand for these machines. As tire manufacturers strive to improve their production processes and meet regulatory standards, the demand for advanced tire marking technology will continue to grow.

The market will also benefit from technological advancements in marking systems, such as laser engraving and inkjet printing, which allow for faster, more precise, and more efficient tire marking. Additionally, with the rising demand for high-performance tires, especially in the electric vehicle (EV) and autonomous vehicle (AV) segments, tire manufacturers are increasingly investing in automated marking systems that offer higher accuracy and better durability in the tire production process.

The absolute dollar opportunity for tire marking machines in the USA from 2025 to 2035 represents the total increase in market value over the forecast period. Starting at USD 195.4 million in 2025, the market is expected to grow to USD 251.8 million by 2035, contributing a total increase of USD 56.4 million in value.

From 2025 to 2030, the market will expand from USD 195.4 million to USD 221.8 million, adding USD 26.4 million in value. This growth is driven by rising demand for automated tire production technologies and the need for higher marking accuracy and efficiency in tire manufacturing. As manufacturers face increasing pressure to comply with regulatory standards and improve production speeds, tire marking machines will play an essential role.

From 2030 to 2035, the market will continue to grow from USD 221.8 million to USD 251.8 million, contributing another USD 30 million in absolute growth. This phase will see stronger growth driven by innovations in advanced marking systems, rising demand from electric vehicle and autonomous vehicle tire manufacturers, and the continued automation of tire production processes. The absolute dollar opportunity will reflect the ongoing industry shift toward more precise and efficient marking technologies, ensuring consistent growth throughout the forecast period.

| Metric | Value |

|---|---|

| USA Tire Marking Machine Industry Sales Value (2025) | USD 4.3 billion |

| USA Tire Marking Machine Industry Forecast Value (2035) | USD 7.5 billion |

| USA Tire Marking Machine Industry Forecast CAGR (2025 to 2035) | 5.6% |

Demand for tire marking machines in the USA is rising as tire manufacturers and retread operations seek to improve efficiency, accuracy, and compliance in marking and identification processes. These machines automate the task of applying logos, batch codes, safety labels, or wear indicators onto tire sidewalls, replacing manual methods that are slower and more prone to error. Growing production volumes and the increasing complexity of tire lines-particularly for performance, off road, and specialty tires-mean that consistency and traceability in marking are becoming more important. At the same time, regulatory requirements around labeling, traceability and safety mean that marking systems must meet higher standards for speed and quality, supporting increased investment in dedicated tire marking machines.

Another factor supporting demand is the integration of smart manufacturing practices and industry 4.0 initiatives in the tire industry. Manufacturers are deploying automated marking equipment that connects with MES (manufacturing execution systems), stores batch-level data, reports metrics in real-time and adjusts marking parameters automatically based on tire size or type. The trend toward customization, small batch production and aftermarket tire branding also contributes to demand, since marking machines allow rapid change over and minimal downtime. Challenges persist in terms of the upfront cost of advanced marking equipment, the need for technical training, and compatibility with existing plant layouts and workflow processes. Despite these hurdles, the imperative of traceability, efficiency and branding in the USA tire industry suggests that demand for tire marking machines will continue to grow steadily.

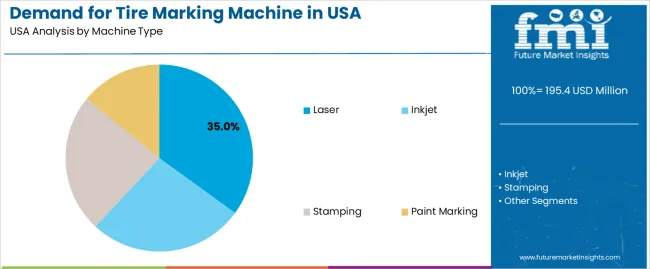

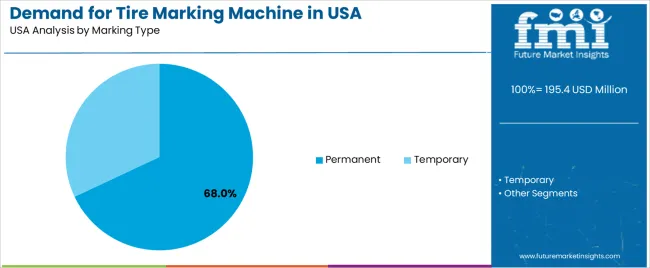

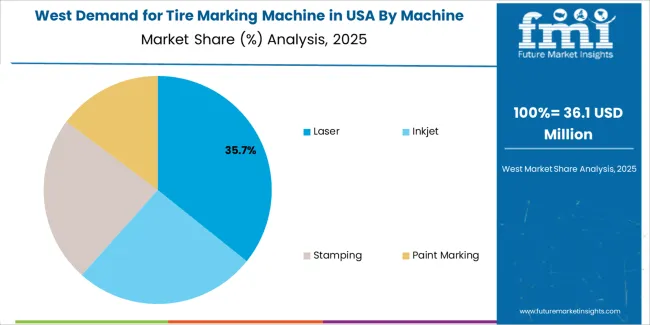

The demand for tire marking machines in the USA is driven by two primary factors: machine type and marking type. The leading machine type is laser, which captures 35% of the market share, while permanent marking is the dominant marking type, accounting for 68% of the demand. Tire marking machines are crucial for labeling and marking tires with information such as branding, specifications, and safety details. The increasing need for traceability, regulatory compliance, and efficient production processes in the automotive and tire manufacturing industries continues to drive the market for these machines.

Laser marking machines lead the tire marking machine market in the USA, holding 35% of the market share. Laser marking is a highly precise, permanent marking method that uses laser technology to etch or engrave information directly onto the surface of a tire. This method is preferred for its ability to produce clear, durable, and high-resolution marks without the need for consumables such as ink or paint.

The demand for laser marking is growing in the tire manufacturing industry due to its advantages in accuracy, speed, and cost-effectiveness over other marking methods. Laser machines can create permanent markings that are resistant to wear and tear, which is especially important for tire traceability and ensuring that tire identification remains legible throughout the product's life cycle. As regulatory standards for product traceability and quality control become stricter, the use of laser marking machines in the tire industry is expected to continue to rise, further cementing their position as the leading choice.

Permanent marking is the leading marking type for tire marking machines in the USA, accounting for 68% of the market share. Permanent marking is essential in the tire industry for ensuring long-term traceability and compliance with safety standards. Permanent marks are typically used to display important information such as tire identification numbers, manufacturing details, and safety certifications that must remain visible throughout the tire's entire lifespan.

The dominance of permanent marking is driven by its critical role in product quality control, safety verification, and regulatory compliance. Permanent markings on tires are necessary for identification purposes, as they help consumers, manufacturers, and regulatory bodies track the tire's origin, manufacturing date, and specifications. As tire safety regulations continue to evolve and the demand for consistent quality control grows, the need for permanent marking solutions is expected to remain high, ensuring its continued dominance in the market.

The demand for tire marking machines in the USA is growing due to increased regulatory requirements for traceability, advancements in manufacturing automation, and the growing importance of tire identification in production processes. Manufacturers are adopting high-precision marking systems, such as laser and inkjet technologies, to comply with safety standards and enhance operational efficiency. Additionally, with the rise of electric vehicles and the need for new tire types, the demand for flexible marking solutions continues to expand, positioning tire marking equipment as a vital part of smart factories.

The key drivers include regulatory pressures that require accurate and efficient tire identification systems, which push manufacturers to adopt marking equipment for traceability and compliance. The expansion of the electric vehicle (EV) market and the increasing demand for specialized tires are also contributing to the need for versatile and adaptable marking systems. Furthermore, the growth of factory automation and the need for smarter manufacturing processes are driving the investment in tire marking machines that seamlessly integrate with production lines, improving speed and precision while reducing errors.

Several challenges limit the demand for tire marking machines in the USA market. High upfront costs associated with advanced marking technologies, such as laser and inkjet systems, can be a significant barrier for smaller manufacturers. Additionally, the rapid pace of technological advancements may lead to faster obsolescence of existing equipment, raising concerns about long-term investments. The mature state of the USA tire manufacturing industry means that much of the demand for tire marking machines is driven by replacements and upgrades, limiting opportunities for new facility expansions.

Key trends include the growing preference for high-precision, non-contact marking systems, such as inkjet and laser technologies, which offer flexibility, speed, and reliability. Integration with digital systems, such as IoT and traceability platforms, is becoming increasingly common, enabling full lifecycle tracking of tires. Moreover, there is rising demand for specialized marking systems in electric vehicle (EV) and high-performance tire production, where custom markings are required. The shift toward localized production and regional supply chains is also driving the demand for USA-based tire marking equipment suppliers.

The demand for tire marking machines in the USA is growing as the automotive and manufacturing industries increasingly require precise and efficient methods for labeling tires with important details such as brand, size, and specifications. Tire marking machines are essential for streamlining the tire production process, ensuring accuracy, and meeting regulatory requirements. The growth in vehicle production, particularly in the automotive, commercial vehicle, and tire manufacturing sectors, is a key driver for the demand for these machines.

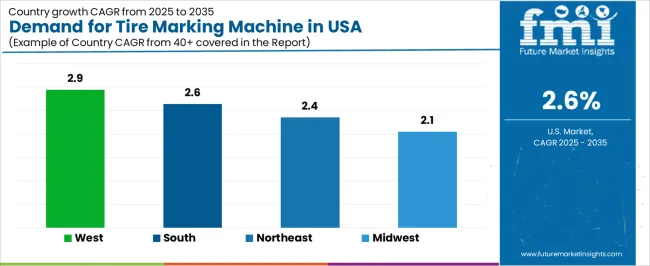

Additionally, advancements in technology, including automation and smart manufacturing processes, are contributing to the adoption of more efficient and cost-effective tire marking solutions. Regional demand varies depending on the concentration of tire manufacturing facilities, automotive production, and industrial development. The West leads in demand due to its significant manufacturing and automotive presence, while the South, Northeast, and Midwest show steady adoption driven by industrial growth and manufacturing requirements. This analysis explores the factors influencing the demand for tire marking machines across different regions in the USA.

| Region | CAGR (2025 to 2035) |

|---|---|

| West | 2.9% |

| South | 2.6% |

| Northeast | 2.4% |

| Midwest | 2.1% |

The West region leads the USA in the demand for tire marking machines with a CAGR of 2.9%. The region’s strong automotive manufacturing base, particularly in states like California, Nevada, and Arizona, contributes significantly to this demand. The West is home to major automotive manufacturers and tire production facilities, which require advanced tire marking solutions to ensure efficient production and compliance with industry regulations.

In addition to automotive manufacturing, the West’s focus on smart manufacturing, automation, and technological advancements in production processes is driving the adoption of more efficient tire marking machines. The region’s extensive distribution networks and e-commerce presence also support the demand for high-quality tire marking machines that help optimize manufacturing workflows. As the automotive and tire industries continue to expand in the West, the demand for tire marking machines will continue to grow at a steady pace.

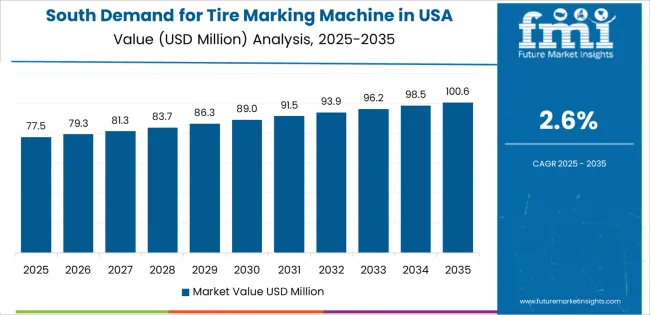

The South region shows strong demand for tire marking machines with a CAGR of 2.6%. The South has a significant presence in tire manufacturing, automotive production, and heavy-duty vehicle manufacturing, all of which rely on tire marking machines for labeling and tracking purposes. States like Tennessee, Alabama, and Georgia have large automotive manufacturing hubs and tire production facilities that require efficient and precise tire marking solutions.

In addition, the South’s emphasis on industrial growth, manufacturing efficiency, and the integration of advanced technologies in production lines further supports the adoption of tire marking machines. As the region’s automotive and commercial vehicle industries continue to grow, the demand for tire marking machines will remain robust. The region’s competitive manufacturing landscape also ensures steady adoption of these machines to optimize production processes and meet regulatory requirements.

The Northeast region demonstrates steady demand for tire marking machines with a CAGR of 2.4%. While the region is not as heavily concentrated in tire manufacturing as the West or South, it is home to several automotive component suppliers and manufacturers that require tire marking solutions for their production lines. The Northeast’s focus on innovation and quality manufacturing in various industries, including automotive, industrial equipment, and machinery, contributes to the steady demand for tire marking machines.

The region’s growing emphasis on manufacturing efficiency, sustainability, and technological upgrades in production processes also supports the adoption of more automated and precise tire marking systems. As the Northeast continues to focus on innovation in manufacturing, demand for tire marking machines will remain stable, driven by the need for quality control and accurate labeling in the tire production process.

The Midwest region shows moderate growth in the demand for tire marking machines with a CAGR of 2.1%. The Midwest has a well-established manufacturing base, particularly in automotive production and parts manufacturing, which is a key driver for the need for tire marking machines. States like Michigan, Ohio, and Indiana have long been centers for vehicle and tire manufacturing, making them essential markets for labeling and quality control equipment.

However, compared to the West and South, growth in the Midwest is slower due to a more traditional manufacturing setup in some areas, with less emphasis on automation and advanced production technologies. Despite this, as industries in the Midwest continue to modernize their manufacturing processes and adopt more efficient production methods, the demand for tire marking machines will gradually increase. The region’s automotive and commercial vehicle sectors will remain key contributors to the steady growth of tire marking equipment demand.

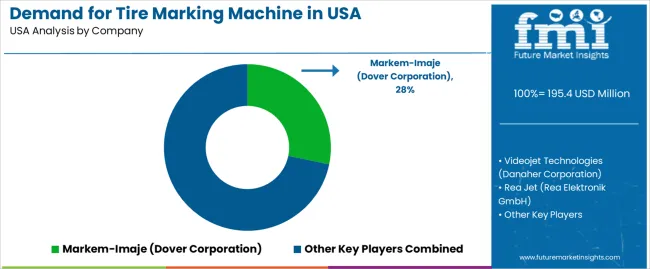

Demand for tire marking machines in the United States is increasing, driven by the growing automotive and manufacturing sectors, as well as the need for enhanced traceability, branding, and quality control in tire production. Companies like Markem-Imaje (Dover Corporation), holding approximately 28.2% market share, Videojet Technologies (Danaher Corporation), Rea Jet (Rea Elektronik GmbH), Koenig & Bauer Coding GmbH, and Domino Printing Sciences (Brother Industries) are leading suppliers of tire marking technology. These machines are used for marking vital information on tires such as production dates, batch numbers, tire specifications, and branding, ensuring regulatory compliance and facilitating the tire supply chain process.

Competition in the tire marking machine market is driven by technological advancements, including high-speed printing capabilities, durability in harsh manufacturing environments, and the ability to print on various tire surfaces and materials. Companies are also focusing on offering versatile and efficient machines that can handle different tire sizes and printing methods, such as inkjet or laser marking. Another competitive edge comes from integrating the machines with production lines, providing real-time data collection and tracking capabilities to improve operational efficiency. Marketing materials often emphasize features such as print quality, printing speed, ease of integration into existing systems, and low maintenance requirements. By aligning their products with the need for improved productivity, traceability, and compliance in the USA tire manufacturing sector, these companies are positioning themselves for continued growth in the tire marking machine market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | USA |

| Machine Type | Laser, Inkjet, Stamping, Paint Marking |

| Marking Type | Permanent, Temporary |

| Key Companies Profiled | Markem-Imaje (Dover Corporation), Videojet Technologies (Danaher Corporation), Rea Jet (Rea Elektronik GmbH), Koenig & Bauer Coding GmbH, Domino Printing Sciences (Brother Industries) |

| Additional Attributes | The market analysis includes dollar sales by machine type and marking type categories. It also covers regional demand trends in the United States, particularly driven by the tire manufacturing industry's need for efficient and durable marking solutions. The competitive landscape highlights key manufacturers focusing on innovations in laser, inkjet, stamping, and paint marking technologies. Trends in the growing demand for permanent and temporary tire markings, as well as advancements in printing technology for tires, are explored. |

The global demand for tire marking machine in USA is estimated to be valued at USD 195.4 million in 2025.

The market size for the demand for tire marking machine in USA is projected to reach USD 251.8 million by 2035.

The demand for tire marking machine in USA is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types in demand for tire marking machine in USA are laser, inkjet, stamping and paint marking.

In terms of marking type, permanent segment to command 68.0% share in the demand for tire marking machine in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA