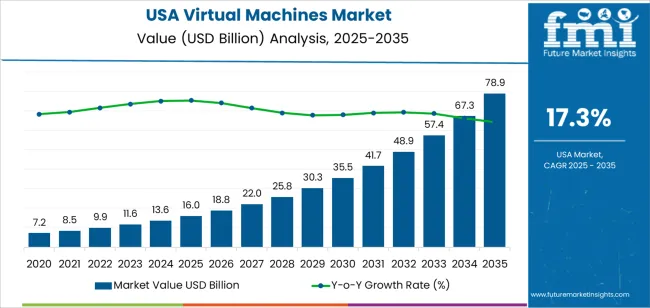

The demand for virtual machines in the USA is forecasted to rise from USD 16.0 billion in 2025 to USD 78.9 billion by 2035, representing a CAGR of 17.3%. VMs are vital in cloud computing, data centers, and enterprise IT infrastructure, providing the flexibility, scalability, and cost efficiency that organizations need to optimize their computing resources. As businesses increasingly adopt cloud-based solutions, VMs enable the seamless execution of applications across a wide range of environments, helping organizations manage workloads efficiently and reduce operational costs. The growing trend of virtualization will drive the demand for VMs, especially as businesses continue to move away from traditional IT infrastructure to more agile, cloud-based platforms.

As the adoption of containerization and serverless computing accelerates, VMs will continue to play an essential role in enabling scalable, efficient computing environments. The rise of edge computing will further boost demand for VMs as companies look to process data closer to the source to reduce latency and improve performance. Key industries such as telecommunications, healthcare, finance, and manufacturing will increasingly rely on VMs to support their IT infrastructure, especially with the expanding need for big data processing and AI-powered applications. The flexibility, security, and cost optimization provided by VMs make them crucial as businesses undergo digital transformation, ensuring steady growth in the industry over the forecast period.

Between 2025 and 2030, the demand for virtual machines is expected to increase from USD 16.0 billion to USD 22.0 billion. This phase will see steady growth, driven by the accelerating shift towards cloud computing and digital transformation in various industries. Enterprises will continue to embrace VMs as a cost-effective solution for managing workloads, enhancing IT efficiency, and scaling operations. The rise of hybrid cloud environments and multi-cloud strategies will increase the need for virtualized infrastructure, further boosting demand. The growing use of edge computing and the increasing reliance on data processing at the edge will contribute to the adoption of VMs as organizations seek to optimize their computing resources.

From 2030 to 2035, demand for virtual machines is expected to grow more rapidly, from USD 22.0 billion to USD 78.9 billion. This surge will be driven by the widespread adoption of virtualized environments across industries and the continuous expansion of cloud infrastructure. As businesses and enterprises accelerate their digital transformation and adopt cloud-first strategies, the demand for VMs will see significant growth. The shift towards containerization, serverless computing, and high-performance computing will further fuel the demand for virtual machines as organizations continue to optimize infrastructure for performance and flexibility.

| Metric | Value |

|---|---|

| Demand for Virtual Machines in USA Value (2025) | USD 16.0 billion |

| Demand for Virtual Machines in USA Forecast Value (2035) | USD 78.9 billion |

| Demand for Virtual Machines in USA Forecast CAGR (2025-2035) | 17.3% |

The demand for virtual machines in the USA is rapidly increasing due to the growing adoption of cloud computing, virtualization technologies, and the ongoing digital transformation of industries. Virtual machines are software-based emulations of physical computers that allow multiple operating systems to run on a single physical machine, enabling efficient resource utilization, scalability, and flexibility. As more businesses move towards cloud-based infrastructures and adopt hybrid and multi-cloud strategies, the need for virtual machines is expected to rise significantly.

A major driver of this growth is the increasing shift to cloud computing and Infrastructure-as-a-Service (IaaS) solutions. As enterprises continue to migrate their workloads to the cloud, virtual machines offer an efficient way to provision, scale, and manage computing resources. VMs enable businesses to reduce costs by consolidating hardware, improve disaster recovery capabilities, and enhance operational flexibility. With the growing emphasis on cost-effective IT infrastructure and operational efficiency, VMs are becoming a key component in modern enterprise IT environments.

The growing demand for containerization and microservices is contributing to the adoption of virtual machines. While containers are lightweight, virtual machines provide an added layer of isolation, security, and compatibility, making them ideal for running a variety of applications. The rise in AI, machine learning, and data analytics applications also drives the need for virtualized environments to run resource-intensive workloads. As more businesses embrace virtualization technologies to support innovation, the demand for virtual machines in the USA is expected to continue growing through 2035, supported by advancements in cloud computing, automation, and IT modernization.

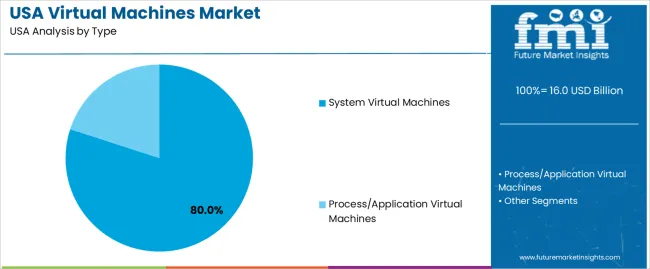

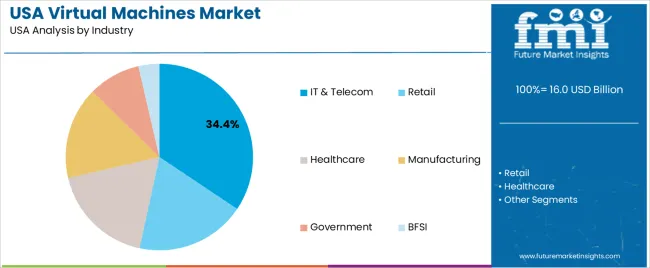

Demand for virtual machines in the USA is segmented by type and industry. By type, demand is divided into system virtual machines and process/application virtual machines. The demand is also segmented by industry, including IT & telecom, retail, healthcare, manufacturing, government, and BFSI (banking, financial services, and insurance). Virtual machines are widely used in these industries for server consolidation, efficient resource utilization, and scalability in cloud computing environments. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

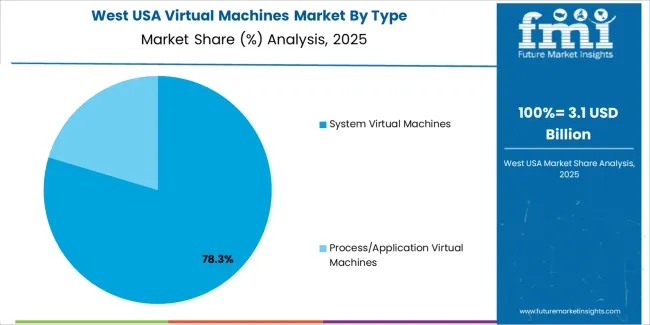

System virtual machines account for 80% of the demand for virtual machines in the USA. These virtual machines emulate an entire operating system, enabling multiple OS instances to run on a single physical machine. System virtual machines are crucial for applications requiring complete isolation between different operating systems and software environments, which is essential for IT infrastructure, server consolidation, and cloud computing. Their ability to enable high levels of scalability, flexibility, and resource optimization makes them highly desirable in sectors such as IT & telecom, healthcare, and manufacturing. As the demand for virtualized environments continues to grow, system virtual machines will remain the dominant choice, providing a robust foundation for managing IT resources and enabling the efficient operation of data centers and cloud services.

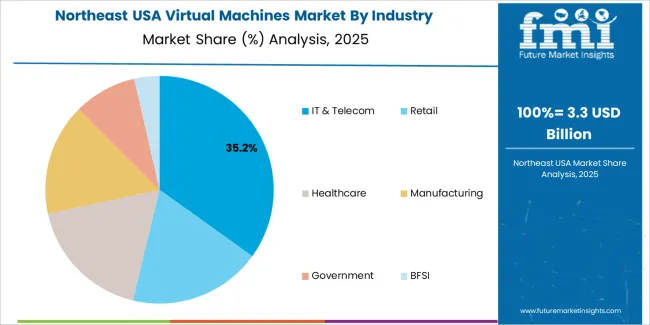

IT & telecom accounts for 34.4% of the demand for virtual machines in the USA. This sector is at the forefront of adopting virtualization technologies due to the need for efficient resource utilization, scalability, and cost-effective infrastructure management. Virtual machines are used extensively in data centers, cloud services, and telecom networks to optimize server use, support network functions, and enhance service delivery. IT & telecom companies leverage virtual machines for running multiple applications on the same hardware, improving performance, and ensuring operational continuity. As cloud computing, 5G networks, and virtualized network functions become increasingly central to the IT & telecom industry, the demand for virtual machines will continue to drive the sector’s digital transformation, ensuring efficient service delivery and seamless connectivity.

Demand for virtual machines in USA is rising as businesses across sectors increasingly seek scalable, flexible computing environments to support cloud migration, hybrid-cloud models, and workloads such as AI/ML, big data analytics, and micro services. Virtual machines enable enterprises to maximize resource utilization, reduce capital expenditure, and improve scalability by providing on-demand computing. However, challenges such as concerns over security (vulnerabilities, isolation), complexity in managing large VM deployments, and performance overhead in dense VM environments remain significant barriers.

Why is Demand for Virtual Machines Growing in USA?

In USA, demand for virtual machines is growing due to the increasing adoption of cloud computing and the need for flexible, on-demand infrastructure. Virtual machines allow organizations to maximize hardware utilization, reduce IT overhead, and scale resources up or down according to business needs. They are particularly beneficial for industries with fluctuating workloads, such as e-commerce, healthcare, and data analytics. The rise of remote work, coupled with a demand for high-performance computing in AI and big data analytics, is driving the need for efficient virtual environments. As businesses seek to optimize costs while maintaining the agility required to compete in the modern digital landscape, virtual machines provide an essential solution.

How are Technological Innovations Driving Growth of Virtual Machines in USA?

Technological advancements are significantly driving the demand for virtual machines in USA. Innovations in hypervisor technologies, improved performance capabilities, and the development of automated management systems make virtual machines more efficient and reliable for enterprise use. The integration of artificial intelligence (AI) and machine learning into VM management systems has optimized workload orchestration, improving resource allocation, performance, and security. Containerization and hybrid cloud technologies are driving the expansion of VM applications, enabling companies to create flexible, multi-cloud infrastructures. These innovations enhance scalability, reduce latency, and ensure that virtual machines meet the growing demands of industries such as data centers, AI, and edge computing, which further accelerates their adoption.

What are the Key Challenges Limiting Wider Adoption of Virtual Machines in USA?

Security concerns remain a significant issue, particularly regarding potential hypervisor attacks and data isolation risks. Virtual environments require robust security measures to prevent breaches and ensure compliance with regulatory standards. Managing large numbers of virtual machines can become complex, requiring skilled IT teams for proper deployment and maintenance, which adds operational costs. Performance overhead is another challenge, as virtual machines can introduce latency, especially in resource-intensive applications. Licensing costs for virtualization platforms, coupled with the need for specialized hardware, also pose financial constraints, especially for small or cost-sensitive businesses that may prefer more traditional, non-virtualized infrastructure.

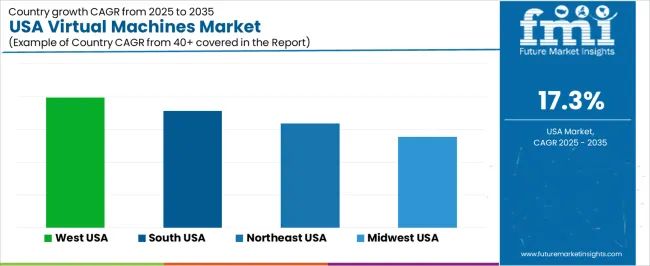

| Region | CAGR (%) |

|---|---|

| West USA | 19.9% |

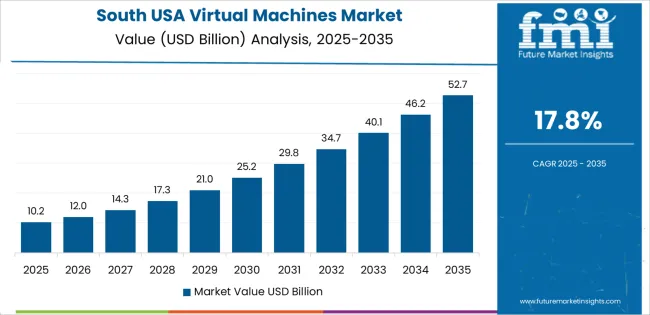

| South USA | 17.8% |

| Northeast USA | 15.9% |

| Midwest USA | 13.8% |

Demand for Virtual Machines in the USA is growing rapidly, with West USA leading at a 19.9% CAGR, driven by its strong tech industry and cloud infrastructure. South USA follows with a 17.8% CAGR, supported by the region’s expanding data centers and digital transformation efforts. Northeast USA shows a 15.9% CAGR, driven by industries like finance, healthcare, and education. Midwest USA experiences a 13.8% CAGR, supported by the adoption of VMs in manufacturing, automotive, and logistics sectors. As businesses continue adopting cloud and digital solutions, demand for VMs is expected to rise across all regions.

West USA is leading the demand for Virtual Machines (VMs), growing at an impressive 19.9% CAGR. The region’s technological hub, particularly in California’s Silicon Valley, plays a key role in this growth. West USA is home to numerous tech giants, startups, and cloud service providers who extensively use VMs to optimize resource allocation, improve scalability, and reduce operational costs. The demand for VMs is driven by industries such as IT services, software development, and cloud computing, where virtualization is essential for running multiple applications on a single physical server.

West USA’s strong focus on innovation in AI, machine learning, and big data analytics is driving the need for scalable, flexible infrastructure that VMs provide. As companies continue to adopt multi-cloud strategies and edge computing technologies, the demand for VMs is expected to increase further. The region’s continued growth in tech infrastructure and adoption of virtualization technologies ensures that West USA will remain at the forefront of VM demand.

South USA is experiencing strong demand for Virtual Machines, growing at a 17.8% CAGR. The region’s expanding tech and cloud infrastructure, particularly in states like Texas and Florida, is contributing significantly to the increased adoption of VMs. As industries in South USA, including finance, healthcare, and telecommunications, increasingly move to the cloud, the need for virtualized environments to manage resources efficiently is rising. VMs are critical in enabling businesses to run multiple applications on a shared infrastructure, reducing hardware costs and improving business continuity.

South USA's growing presence in data center construction and expansion, driven by both regional and global tech companies, is driving VM demand. These data centers require scalable and flexible infrastructure, which is best achieved through virtual machines. As the region continues to embrace digital transformation and cloud technologies, the demand for VMs is expected to rise steadily, supporting the growing reliance on virtualized computing for businesses across multiple industries.

Northeast USA is seeing steady demand for Virtual Machines, growing at a 15.9% CAGR. The region’s strong presence in finance, healthcare, and education is a key driver of this growth. Financial institutions and healthcare providers are increasingly adopting VMs to handle complex applications, run workloads on demand, and ensure the efficient use of resources. With the region’s focus on security, compliance, and regulatory standards, VMs provide a flexible and cost-effective solution for running applications securely across multiple environments.

The growing focus on digital transformation and cloud adoption in Northeast USA is further contributing to the rising demand for VMs. Industries such as media, entertainment, and research institutions are also leveraging virtualization to improve infrastructure management, reduce IT costs, and enhance scalability. As these sectors continue to invest in cloud services and infrastructure optimization, the need for Virtual Machines in Northeast USA is expected to grow steadily.

Midwest USA is seeing moderate demand for Virtual Machines, with a 13.8% CAGR. The region’s manufacturing, automotive, and logistics sectors are key drivers of this demand. As businesses in these industries adopt more digital solutions, virtualized environments are being increasingly used to enhance operational efficiency, optimize IT infrastructure, and run data-intensive applications. With the rise of Industry 4.0 and automation, companies in the Midwest are leveraging VMs to support manufacturing operations and data processing in a flexible, scalable manner.

Midwest USA’s growing adoption of cloud computing and SaaS solutions is further increasing the need for VMs. Many enterprises in the region are migrating to the cloud to reduce on-premise infrastructure costs, and VMs are essential in supporting these cloud environments. As the region continues to embrace digital technologies and cloud infrastructure, the demand for VMs is expected to grow, although at a slower rate compared to more tech-centric regions like West USA.

The demand for virtual machines (VMs) in the USA is growing rapidly as businesses and organizations continue to migrate their infrastructure to the cloud and embrace virtualization technologies for greater scalability, flexibility, and cost efficiency. Virtual machines are critical for cloud computing, enabling organizations to run multiple applications and services on a single physical machine, improving resource utilization and operational efficiency.

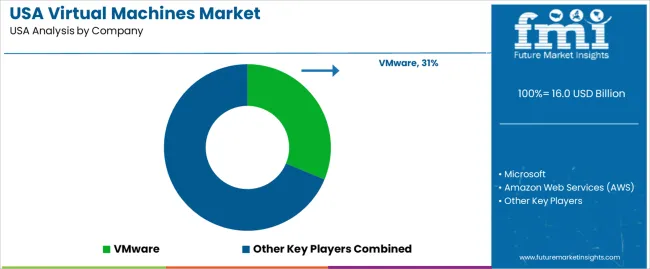

Leading companies in the virtual machine industry in the USA include VMware, Microsoft, Amazon Web Services (AWS), Google Cloud, and Oracle. VMware holds a significant industry share of 31.3%, offering a range of virtualization products and services that support both on-premises and cloud-based infrastructure. Microsoft provides virtual machines through its Azure platform, catering to both small businesses and large enterprises with scalable cloud solutions. Amazon Web Services (AWS) is a dominant player, offering EC2 (Elastic Compute Cloud) virtual machines that enable scalable computing power for cloud-based applications. Google Cloud offers Compute Engine, a service for running virtual machines that provide flexibility, scalability, and integration with other Google services. Oracle provides virtual machine solutions through Oracle Cloud, focusing on high-performance computing and enterprise-grade solutions for cloud infrastructure.

Companies compete by offering virtual machines that provide high-performance capabilities, enhanced security, and seamless integration with other cloud services. As businesses look to optimize their IT environments and embrace hybrid cloud models, virtual machines are essential for enabling workload mobility and resource flexibility. Providers also differentiate themselves by offering specialized features, such as advanced automation, better integration with existing systems, and competitive pricing.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | System Virtual Machines, Process/Application Virtual Machines |

| Industry | IT & Telecom, Retail, Healthcare, Manufacturing, Government, BFSI |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | VMware, Microsoft, Amazon Web Services (AWS), Google Cloud, Oracle |

| Additional Attributes | Dollar sales by type and industry; regional CAGR and adoption trends; demand trends in virtual machines; growth in IT, telecom, and healthcare sectors; technology adoption for virtualization solutions; vendor offerings including virtual machine solutions and services; regulatory influences and industry standards |

The demand for virtual machines in USA is estimated to be valued at USD 16.0 billion in 2025.

The market size for the virtual machines in USA is projected to reach USD 78.9 billion by 2035.

The demand for virtual machines in USA is expected to grow at a 17.3% CAGR between 2025 and 2035.

The key product types in virtual machines in USA are system virtual machines and process/application virtual machines.

In terms of industry, it & telecom segment is expected to command 34.4% share in the virtual machines in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

USA Network Function Virtualization (NFV) Market Insights – Size, Share & Growth 2025-2035

Demand for Virtual Event Platforms in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Bandsaw Machines in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Box Sealing Machines in USA Size and Share Forecast Outlook 2025 to 2035

Virtual Land NFT Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Virtual Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Virtual Customer Premises Equipment Market Size and Share Forecast Outlook 2025 to 2035

Virtual Infrastructure Manager Market Size and Share Forecast Outlook 2025 to 2035

Virtual Companion Care Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Radio Access Network Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Virtual Workspace Solutions Market Size and Share Forecast Outlook 2025 to 2035

Virtual Prototype Market Size and Share Forecast Outlook 2025 to 2035

Virtual Assistant Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA