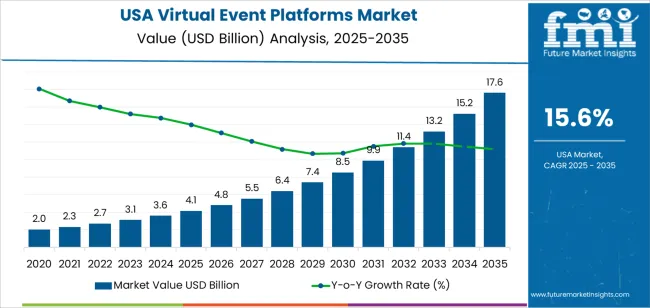

The USA virtual event platforms demand is valued at USD 4.1 billion in 2025 and is forecasted to reach USD 17.6 billion by 2035, recording a CAGR of 15.6%. Demand is driven by continued use of digital event formats across corporate communication, education, training, and marketing functions. Virtual platforms support large-scale attendee engagement, streamlined content delivery, and reduced logistical costs, making them integral to hybrid work structures and distributed organisational models. Growth is reinforced by rising adoption of interactive features including real-time chat, analytics dashboards, breakout rooms, and integrated registration tools.

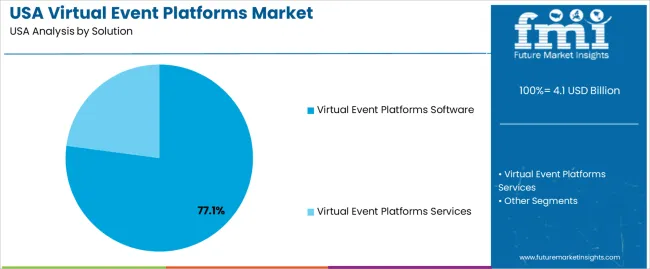

Virtual event platforms software represents the leading solution category, reflecting its role in enabling end-to-end digital event management. These platforms provide configurable interfaces, multimedia content support, and secure access controls suitable for conferences, webinars, trade shows, and internal corporate events. Improvements in video rendering, cloud scalability, and engagement tracking continue to strengthen reliability and user experience.

Demand is highest in the West, South, and Northeast, where enterprise activity, technology adoption, and remote collaboration requirements are most concentrated. Major suppliers include Cisco Systems, Zoom Video Communications Inc., Microsoft Corporation, vFairs, and Cvent Inc. Their development priorities focus on platform stability, integration with productivity tools, and enhanced interaction features suitable for high-attendance events.

Growth rate volatility analysis indicates a moderate-to-high volatility index during the early years, driven by fluctuating enterprise adoption patterns and varying levels of hybrid-event activity. Between 2025 and 2028, annual growth may shift more noticeably as organisations rebalance physical and virtual formats, adjust event budgets, and refine platform requirements related to scalability, engagement tools, and data security. Demand from technology, education, and professional-services sectors will anchor early expansion despite these shifts.

From 2029 to 2035, the volatility index is expected to decline as virtual and hybrid formats become institutionalised components of corporate communication, training, and marketing. Adoption will stabilise through subscription-based usage, long-term licensing, and integration with CRM, learning-management, and collaboration systems. Improvements in analytics, accessibility features, and multi-device performance will support consistent procurement. While cyclical event activity may create minor variations, baseline demand will remain strong across enterprises seeking flexible, cost-efficient engagement channels. The long-term volatility profile reflects a maturing digital-engagement ecosystem moving from rapid experimentation toward stable, structured operational use across USA organisations.

| Metric | Value |

|---|---|

| USA Virtual Event Platforms Sales Value (2025) | USD 4.1 billion |

| USA Virtual Event Platforms Forecast Value (2035) | USD 17.6 billion |

| USA Virtual Event Platforms Forecast CAGR (2025 to 2035) | 15.6% |

Demand for virtual event platforms in the USA is growing because organisations need flexible, scalable and remote ways to host events, conferences and training without the constraints of physical venues. Companies operating across multiple time zones, industries and stakeholder groups increasingly adopt platforms that enable webinars, hybrid events and fully virtual gatherings. Advances in streaming technology, interactive features like chat rooms, polling, virtual exhibitor booths and data analytics make these platforms attractive for marketers and event planners seeking to maximise engagement and reach.

The growing focus on cost efficiency, reduced travel and environmental impact further supports usage of virtual solutions. Post-pandemic shifts toward hybrid models where live and virtual audiences participate concurrently drive continuous investment in platform capabilities. Constraints include the challenge of replicating the in-person network experience online, concerns about attendee fatigue during prolonged virtual sessions and the need for strong internet infrastructure and technical support. Some smaller organisations may lack the budget or expertise to deploy high-feature platforms at scale.

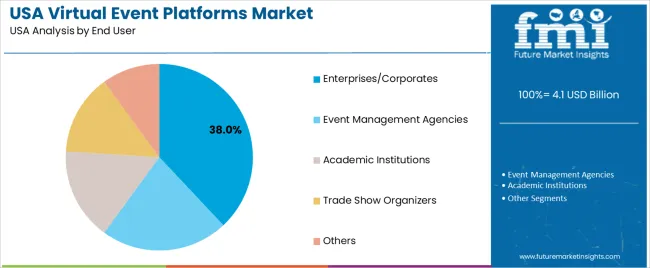

Demand for virtual event platforms in the United States reflects continued use of digital communication tools across corporate, academic, and professional environments. Adoption patterns vary by solution type, organisational scale, and the specific needs of end-user groups. Demand distribution highlights reliance on software-driven event infrastructure, broad enterprise participation, and diverse applications ranging from corporate meetings to academic programming and trade-show coordination.

Virtual-event software holds 77.1% of USA demand, making it the dominant solution category. Software platforms support live streaming, attendee interaction tools, analytics dashboards, content hosting, and multi-session management. Organisations prioritise software due to its scalability, integration with collaboration systems, and ability to support hybrid or fully digital event structures. Services account for 22.9%, including technical support, event design, moderation, and platform management. Service demand remains significant among enterprises requiring external expertise for complex events or large attendee volumes. Solution distribution reflects reliance on software capability for consistent event performance and the continued need for service-based operational support during large-scale events.

Key drivers and attributes:

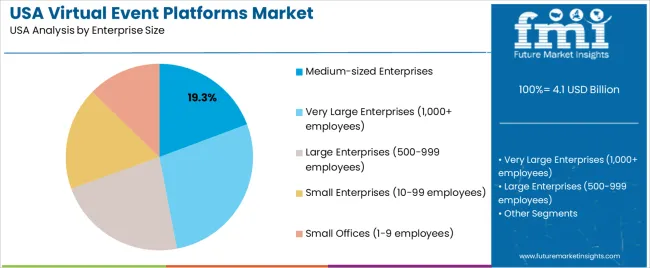

Very large enterprises with 1,000+ employees hold 27.7% of USA demand. These organisations conduct frequent internal meetings, stakeholder briefings, training sessions, and large cross-regional events requiring stable virtual-event platforms. Large enterprises (500-999 employees) hold 22.5%, using virtual platforms for structured communication and departmental coordination. Medium-sized enterprises account for 19.3%, representing sustained adoption for product launches, client engagement, and team collaboration. Small enterprises (10-99 employees) hold 17.8%, often selecting platforms for cost-efficient outreach and remote collaboration. Small offices (1-9 employees) represent 12.7%, using virtual platforms for meetings, workshops, and localised training.

Key drivers and attributes:

Enterprises and corporates account for 38.0% of USA demand. They use virtual platforms for internal communications, client events, onboarding, training, and annual business activities. Event-management agencies hold 22.0%, coordinating multi-client virtual conferences, product showcases, and branded digital experiences. Academic institutions represent 16.0%, using platforms for lectures, academic fairs, and remote learning events. Trade-show organisers hold 14.0%, adopting digital tools to support exhibitor sessions, virtual booths, and remote attendee engagement. The remaining 10.0% includes non-profits, community groups, and professional associations conducting virtual programmes.

Key drivers and attributes:

In the United States, demand for virtual event platforms is rising as companies support distributed workforces and frequent online interactions across internal teams, clients, and partners. The expansion of corporate webinars, product launches, global conferences and remote training drives adoption of platforms that can host large-scale events, manage registrants, and deliver live streaming with engagement tools. Marketing departments are increasingly using virtual events to reach global audiences cost-effectively and collect data on attendee behavior. The ability to scale events without physical venue constraints supports increased usage of virtual platforms across enterprise segments.

As in-person events resume in many industries, some organizations reduce spending on purely virtual events or shift to hybrid models instead of fully virtual formats. The cost of advanced event platform subscriptions, integration with enterprise IT systems, and production quality (such as video and interactive features) may deter smaller organizations from investing. Users may experience fatigue from frequent virtual gatherings, lowering attendance and engagement over time which can reduce the perceived value of virtual-only events. These factors moderate the pace of growth in this industry.

Virtual event platforms are evolving to support hybrid formats that combine physical and virtual participation, enabling organizers to widen their reach while maintaining in-person components. Platform vendors are adding detailed analytics, AI-driven matchmaking, interactive networking, and personalised content delivery to improve attendee engagement and ROI. Small and mid-sized enterprises are increasingly adopting lower-cost, self-service virtual event platforms to run customer webinars, partner presentations and community-oriented sessions. These trends support continued demand for virtual event platforms in the USA.

Demand for virtual event platforms in the United States is rising through 2035, driven by continued use of hybrid formats, expanded remote-work structures, and steady adoption of digital engagement tools across corporate, education, healthcare, and public-sector environments. Organizations use virtual event platforms for conferences, training programs, product demonstrations, and large-scale communication workflows.

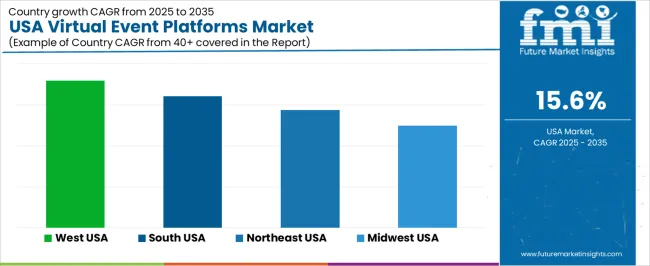

Growth varies by regional technology adoption, industry concentration, and demand for distributed collaboration. The West leads with a 17.9% CAGR, followed by the South (16.0%), the Northeast (14.3%), and the Midwest (12.5%). Demand is reinforced by analytics-enabled platforms, improved content-delivery systems, and broader use of cloud-hosted event infrastructure.

| Region | CAGR (2025-2035) |

|---|---|

| West | 17.9% |

| South | 16.0% |

| Northeast | 14.3% |

| Midwest | 12.5% |

The West grows at 17.9% CAGR, supported by strong adoption among technology firms, digital-media companies, universities, and distributed enterprise teams. States such as California, Washington, Oregon, and Colorado rely on virtual event platforms for product launches, developer summits, corporate communication, and hybrid educational programs. Tech-sector organizations use data-driven engagement tools, breakout-session management, and integrated registration systems to support global participation.

Entertainment and creative-industry users adopt platforms for virtual premieres, workshops, and large-scale community events. Universities and research institutions deploy virtual-learning solutions for seminars and multi-campus coordination. Widespread remote-work practices reinforce recurring procurement of scalable platforms.

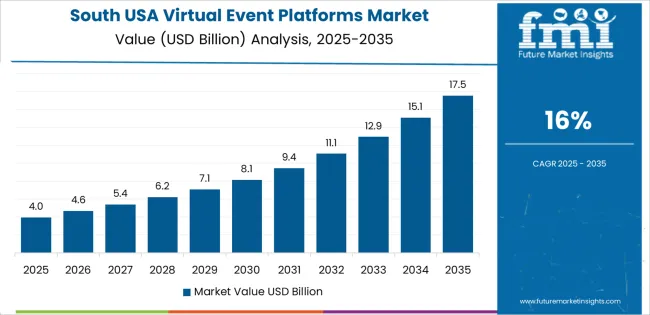

The South grows at 16.0% CAGR, supported by expanding corporate hubs, strong service-sector activity, and widespread adoption of virtual platforms for workforce training and customer-engagement programs. Texas, Florida, Georgia, and North Carolina maintain strong demand for enterprise meetings, hybrid sales events, and training sessions across healthcare, telecom, and financial-services providers. Regional universities use virtual platforms for continuing-education programs and multi-campus academic events. Large corporations adopt platforms for onboarding, compliance training, and communication with distributed teams. Growth is reinforced by competitive operating conditions that favor digital engagement tools over frequent travel-based coordination.

The Northeast grows at 14.3% CAGR, supported by major financial, healthcare, academic, and consulting organizations that rely on virtual platforms for structured communication and professional events. States including New York, New Jersey, Massachusetts, and Pennsylvania use virtual platforms for investor briefings, medical education, policy discussions, and specialized training. Universities conduct conferences and academic symposiums through hybrid formats that require integrated scheduling, streaming, and interactive tools. Consulting firms use virtual platforms for multi-client briefings and knowledge-transfer programs. Corporate headquarters maintain steady deployment for cross-regional communication, reducing travel dependency and improving event scalability.

The Midwest grows at 12.5% CAGR, supported by manufacturing, healthcare, education, and service organizations that use virtual platforms for training, internal communication, and customer-support events. States such as Illinois, Michigan, Ohio, and Wisconsin rely on digital platforms for workforce-development programs, equipment-training sessions, and supply-chain coordination. Universities and community colleges adopt hybrid event systems for academic outreach and institutional communication. Healthcare providers employ virtual platforms for continuing-education clinics and administrative coordination across regional networks. Although growth is slower than in coastal regions, steady digital transformation in legacy industries supports continued adoption.

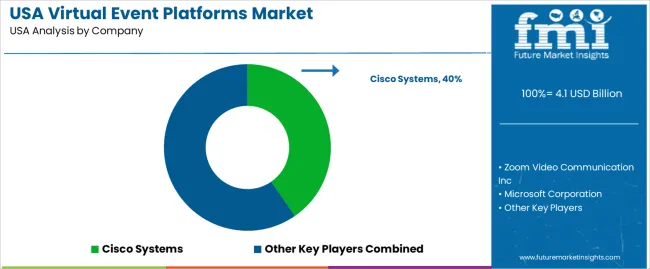

Demand for virtual event platforms in the USA is shaped by a concentrated group of technology providers supporting conferences, webinars, hybrid events, corporate communication, and large-scale digital gatherings. Cisco Systems holds the leading position with an estimated 40.4% share, supported by the long-standing presence of Webex, stable video infrastructure, and strong adoption across enterprise and public-sector organizations. Its position is reinforced by reliable security features, controlled latency performance, and integration with corporate collaboration ecosystems.

Zoom Video Communications Inc. and Microsoft Corporation follow as major participants, supplying scalable platforms used for webinars, live events, and hybrid communication programmes. Their strengths include intuitive interfaces, dependable streaming quality, and alignment with broader productivity suites. Microsoft benefits from seamless integration with Teams and enterprise identity systems, while Zoom remains strong among small and mid-sized organizations requiring flexible event hosting and audience-engagement tools.

Specialist providers such as vFairs and Cvent Inc. maintain notable positions through event-focused platforms designed for multi-session conferences, virtual expos, attendee networking, and analytics-driven engagement. Their systems are adopted for academic events, recruitment fairs, and large organizational gatherings requiring structured content delivery and detailed post-event reporting.

Competition across this segment centers on platform stability, audience-capacity management, security controls, engagement features, integration with CRM and marketing systems, and hybrid-event capability. Demand remains supported by continued use of virtual and hybrid formats for corporate training, academic conferences, and distributed workforce communication, as organizations prioritize scalable, secure, and analytics-enabled digital event solutions across recurring and large-audience applications.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Solution | Virtual Event Platforms Software, Virtual Event Platforms Services |

| Enterprise Size | Medium-sized Enterprises, Very Large Enterprises (1,000+ employees), Large Enterprises (500-999 employees), Small Enterprises (10-99 employees), Small Offices (1-9 employees) |

| End User | Enterprises/Corporates, Event Management Agencies, Academic Institutions, Trade Show Organizers, Others |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | Cisco Systems, Zoom Video Communication Inc., Microsoft Corporation, vFairs, Cvent Inc. |

| Additional Attributes | Dollar sales by solution type, enterprise size, and end-user categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of virtual event software and service providers; advancements in AI-driven networking tools, immersive 3D event environments, and hybrid event integrations; integration with corporate communications, academic programs, digital trade shows, and large-scale virtual conferences in the USA. |

The global demand for virtual event platforms in USA is estimated to be valued at USD 4.1 billion in 2025.

The market size for the demand for virtual event platforms in USA is projected to reach USD 17.6 billion by 2035.

The demand for virtual event platforms in USA is expected to grow at a 15.6% CAGR between 2025 and 2035.

The key product types in demand for virtual event platforms in USA are virtual event platforms software and virtual event platforms services.

In terms of enterprise size, medium-sized enterprises segment to command 19.3% share in the demand for virtual event platforms in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Virtual Event Platforms Market Trends - Growth & Forecast 2025 to 2035

Competitive Landscape of Virtual Event Platforms Market Share

Demand for Virtual Event Platforms in Japan Size and Share Forecast Outlook 2025 to 2035

USA Network Function Virtualization (NFV) Market Insights – Size, Share & Growth 2025-2035

Virtual Land NFT Market Size and Share Forecast Outlook 2025 to 2035

Event Tourism Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Virtual Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Virtual Customer Premises Equipment Market Size and Share Forecast Outlook 2025 to 2035

Virtual Infrastructure Manager Market Size and Share Forecast Outlook 2025 to 2035

Virtual Companion Care Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Radio Access Network Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Virtual Workspace Solutions Market Size and Share Forecast Outlook 2025 to 2035

Virtual Prototype Market Size and Share Forecast Outlook 2025 to 2035

Virtual Assistant Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA