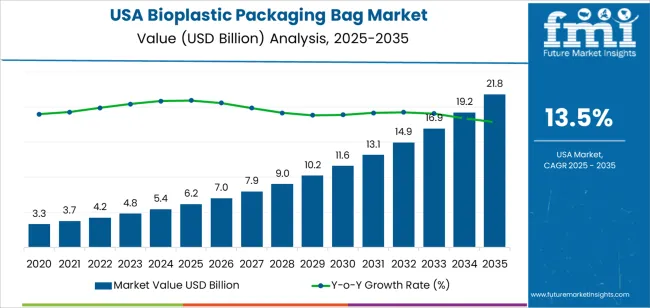

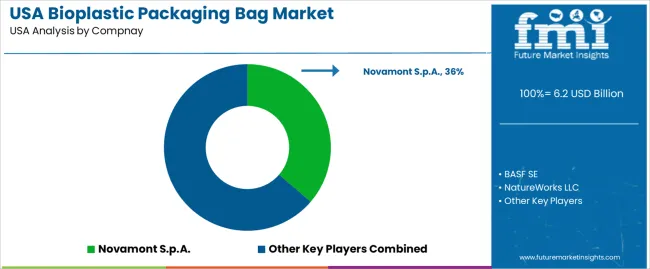

Bioplastic packaging bag demand in the USA is valued at USD 6.2 billion in 2025 and is projected to reach USD 21.8 billion by 2035 at a CAGR of 13.5%. Early market expansion is driven by regulatory pressure on conventional plastic bags at the state and municipal level, paired with rapid adoption by grocery chains, foodservice operators, and large retailers. Carryout bags, produce bags, and delivery packaging account for the largest share of early demand. Retailers adopt bioplastic formats to meet compliance targets while maintaining functional parity with polyethylene bags. Quick-service restaurants, meal delivery platforms, and institutional foodservice also contribute steady growth as compostable bag formats move into standard operating supply contracts across urban and suburban markets.

After 2030, demand growth becomes more infrastructure and scale driven than policy driven. Market value rises from about USD 11.6 billion in 2030 toward USD 21.8 billion by 2035 as domestic resin capacity, compounding, and bag conversion expand across the Midwest and Gulf Coast. E-commerce fulfillment and secondary packaging applications emerge as major growth contributors as brands replace plastic mailers with bio-based alternatives. Cost reduction through higher production volumes improves price competitiveness with conventional plastics in mass retail. Food waste collection programs add durable demand for compostable refuse bags. Procurement shifts toward long term supply contracts between retailers, municipalities, and integrated bioplastic producers to stabilize pricing and ensure consistent material performance across national distribution networks.

Bioplastic packaging bags sit at the intersection of packaging logistics, retail operations, and materials substitution policy, giving their demand curve a structurally accelerated profile rather than a replacement-led one. Demand in USA increases from USD 6.2 billion in 2025 to USD 7.9 billion by 2030, adding USD 1.7 billion in absolute value. This phase reflects rapid conversion away from conventional polyethylene carry bags in grocery, foodservice, apparel retail, and e commerce fulfillment. Growth is driven by state-level single-use plastic restrictions, retailer sustainability compliance mandates, and rising adoption of compostable and bio-based materials in private label packaging programs. Demand expansion during this phase is policy enabled and supply chain enforced rather than purely consumer preference driven.

From 2030 to 2035, the market expands sharply from USD 7.9 billion to USD 21.8 billion, adding a substantial USD 13.9 billion within five years. This back weighted acceleration reflects full-scale material substitution across mass retail, logistics distribution, agricultural produce packaging, and quick-service restaurant takeaway systems. Higher resin costs, multilayer bio-compounds, and improved mechanical strength raise value per unit alongside volume expansion. As bio-based feed stocks, industrial composting infrastructure, and municipal procurement standards align, bioplastic packaging bags shift from regulated alternatives to default packaging formats, pushing the demand curve into a structurally high-growth, regulation-anchored expansion phase through 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 6.2 billion |

| Forecast Value (2035) | USD 21.8 billion |

| Forecast CAGR (2025–2035) | 13.5% |

The demand for bioplastic packaging bags in USA has strengthened as environmental awareness, sustainability regulations and corporate responsibility commitments increasingly shape packaging decisions. Conventional single-use plastic bags have faced growing restrictions at state and local levels. As a result, many retailers, foodservice operators and e-commerce sellers have shifted toward compostable or biodegradable alternatives. Bioplastic bags made from plant-based or bio-derived polymers offer a way to meet regulatory compliance while preserving convenience and cost efficiency. Early growth came mainly from grocery, retail, and foodservice sectors moving away from conventional plastic bags. At the same time consumer preference for “eco-friendly” packaging supported adoption in niche retail and smaller scale producers.

Future growth for bioplastic packaging bags in the USA will depend on continued regulatory pressure, innovation in materials and shifting consumer demand. As more states expand bans or fees on single-use plastics, demand for bioplastic alternatives will rise across grocery, food-to-go, and online retail segments. Further, advances in bio-based polymers, compostable films, and improved barrier properties will expand bag use from simple carry bags to mail-order packaging and frozen-food pouches. Cost remains a barrier, but economies of scale, growing supply chain maturity, and corporate sustainability mandates will help lower prices. Bioplastic bag use may broaden beyond retail into industrial, agricultural, and food-service packaging where environmental footprint matters. The market’s pace will depend on regulatory clarity, consumer acceptance, and material performance across real-world use cases.

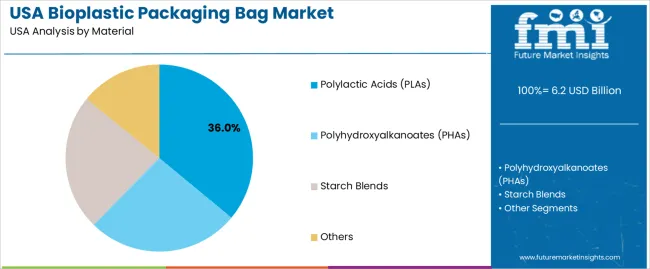

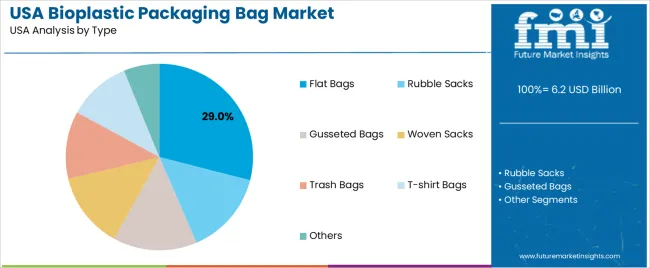

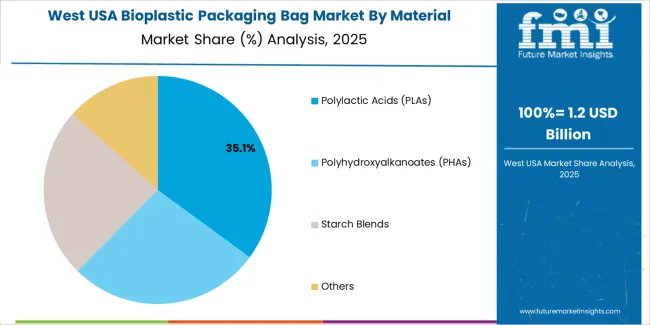

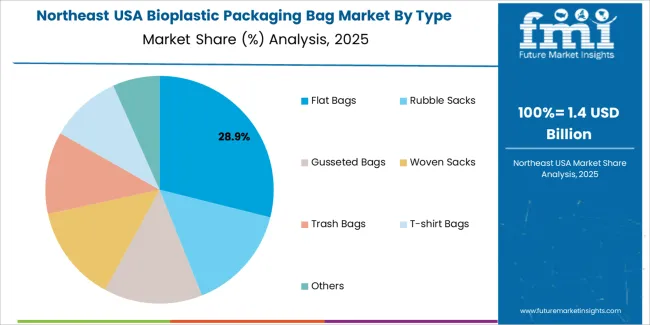

The demand for bioplastic packaging bags in the USA is structured by material composition and bag type. Polylactic acids account for 36% of total demand, followed by polyhydroxyalkanoates, starch blends, and other material systems. By type, flat bags represent 29.0% of total consumption, followed by rubble sacks, gusseted bags, woven sacks, trash bags, T shirt bags, and other specialty formats. Demand behavior is shaped by compostability performance, mechanical strength requirements, regulatory compliance at state and city levels, and end use handling needs. These segments reflect how material performance and functional bag design determine adoption across retail, waste management, food service, and industrial packaging use in the USA.

Polylactic acids account for 36% of total bioplastic packaging bag demand in the USA due to their commercial availability, compostability profile, and compatibility with existing film extrusion equipment. PLA resins provide good clarity, adequate tensile strength, and predictable seal performance for flat bags, grocery bags, and food service packaging. Production scalability supports steady output across domestic and imported supply chains. PLA bags are widely used in retail checkout operations, produce packaging, and quick service food outlets where compostable certification supports regulatory compliance and branding objectives.

PLA materials also benefit from starch derived feedstock availability and established processing infrastructure. Cost positioning remains more stable than several newer biopolymer systems, which supports higher volume procurement by retailers and municipal programs. Educational labeling and compostability certification further improve consumer acceptance. These manufacturing scalability, regulatory alignment, and cost accessibility factors collectively sustain polylactic acids as the leading material segment in the USA bioplastic packaging bag demand structure.

Flat bags account for 29.0% of total bioplastic packaging bag demand in the USA due to their broad use across retail, food packaging, produce handling, and takeaway service operations. Flat bags support simple filling, heat sealing, and stacking without requiring gusset structures or reinforced side walls. Their design aligns well with automated bagging equipment used in grocery stores, bakeries, and food processing lines. These operational advantages allow flat bags to move through high speed packing environments with consistent performance and minimal mechanical failure.

Flat bags also benefit from lower material usage per unit compared with structured bag types, which improves cost efficiency in large scale distribution programs. Municipal compostable bag initiatives frequently specify flat bag formats for food waste collection and retail use. Storage efficiency and reduced shipping volume further support adoption. These handling simplicity, material efficiency, and regulatory compatibility factors position flat bags as the dominant type within the USA bioplastic packaging bag demand structure.

Bioplastic packaging bag demand in the USA is increasingly driven by regulatory avoidance rather than consumer-driven brand positioning. State and municipal bans on traditional plastic carryout bags force retailers to adopt compostable or bio-based alternatives to maintain checkout operations without penalties. Grocery chains, pharmacies, and quick-service restaurants treat bioplastic bags as a functional substitute to maintain transaction flow under local restrictions. This demand is not aspirational; it is operational. Retailers select bags that meet legal definitions of biodegradability or compostability first, then optimize for strength, sealing, and cost recovery through bag fees.

Bioplastic bag demand in the USA is shaped as much by disposal infrastructure limitations as by retail usage volume. Many compostable bags enter standard landfill streams due to low access to industrial composting facilities. This creates hesitation among municipalities and retailers that fear mislabeling backlash. Some regions restrict compostable claims entirely to avoid contamination of recycling systems. As a result, adoption concentrates in cities with controlled organic waste programs and closed-loop foodservice operations. This infrastructure mismatch fragments national demand into localized clusters rather than enabling uniform nationwide scale.

Bioplastic bags in the USA carry higher resin costs tied to corn starch, PLA, sugarcane ethanol, and fermentation-based polymers. These inputs compete with food and fuel supply chains, introducing price volatility. Domestic biopolymer capacity remains limited relative to petroplastic output, which exposes supply to import dependency and freight cost swings. Thin-gauge strength limitations also require heavier material usage for load-bearing bags, raising per-unit cost further. Retailers often pass this cost to consumers through bag charges, which directly influences usage frequency and volume elasticity.

Bioplastic bag demand in the USA is shifting away from general retail toward private-label grocery programs and high-volume foodservice packaging. Chains now specify proprietary compostable bag formats optimized for kitchens, delivery, and waste separation. Restaurant groups use bioplastic liners and takeout bags to align with local waste rules while maintaining grease and moisture resistance. Brands increasingly avoid third-party labeling and instead manage material claims in-house. This shows demand moving from open market substitution toward controlled, contract-driven packaging ecosystems tied to food preparation and regulated disposal flows.

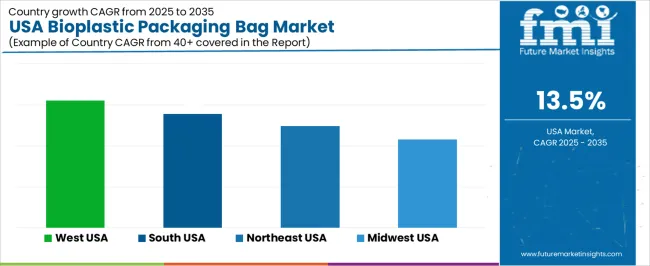

| Region | CAGR (%) |

|---|---|

| West | 15.5% |

| South | 13.9% |

| Northeast | 12.4% |

| Midwest | 10.8% |

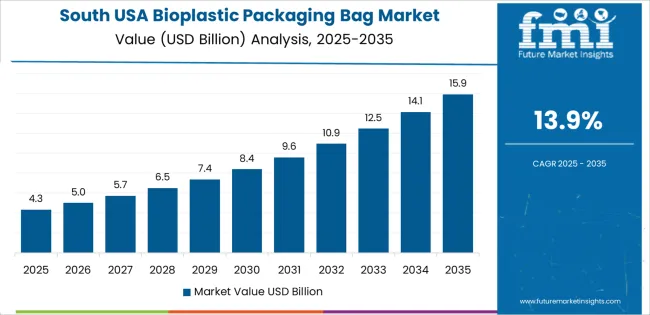

The demand for bioplastic packaging bags in the USA shows strong regional growth, with the West leading at a 15.5% CAGR. This region benefits from strict packaging regulations, high environmental awareness among consumers, and strong adoption of alternative packaging by retailers and foodservice operators. The South follows at 13.9%, driven by expanding retail networks, growth in packaged food consumption, and rising use of eco friendly packaging by regional brands. The Northeast records 12.4% growth, supported by municipal plastic reduction policies, urban retail demand, and institutional procurement of bioplastic products. The Midwest shows comparatively moderate growth at 10.8%, reflecting gradual adoption by manufacturers and retailers, along with continued cost sensitivity in large volume packaging applications.

Expansion in the West reflects a CAGR of 15.5% through 2035 for bioplastic packaging bag demand, supported by strict local packaging regulations, high retail compliance, and strong adoption across food service and grocery chains. Urban municipalities promote compostable and bio based carry bags in retail outlets. Organic food brands and meal delivery services also adopt bioplastic formats for brand positioning. Coastal export packaging adds secondary demand. Demand remains regulation and retail driven, with converters focused on large volume retail supply contracts rather than small specialty orders.

The South advances at a CAGR of 13.9% through 2035 for bioplastic packaging bag demand, driven by steady food processing growth, rising retail chain expansion, and agricultural produce packaging needs. Supermarkets and produce wholesalers adopt bioplastic bags for fresh fruits, vegetables, and bulk foods. State level policy adoption varies, but private retail standards push consistent usage. Poultry and seafood packaging also contribute steady volume. Demand remains volume driven and price sensitive, with manufacturers prioritizing cost efficient bio resin blends for high throughput production.

The Northeast records a CAGR of 12.4% through 2035 for bioplastic packaging bag demand, shaped by early policy enforcement, dense urban retail networks, and high consumer compliance with carry bag regulations. Food takeaway services, cafes, and urban grocery outlets show high replacement volumes. Cold climate does not limit usage, but storage durability remains a procurement focus. Institutional buyers such as universities and hospitals also contribute to volume. Demand remains compliance driven and replacement led, with steady reorder cycles across compact retail distribution zones.

The Midwest expands at a CAGR of 10.8% through 2035 for bioplastic packaging bag demand, supported by gradual adoption among grocery chains, farm produce distributors, and regional cooperatives. Policy adoption moves slower than coastal regions, but retailer driven standards encourage steady conversion. Grain, seed, and processed food packaging contribute moderate application volume. Cost sensitivity remains a limiting factor for rapid scale up. Demand remains transition driven and predictable, aligned with phased conversion from conventional plastic rather than immediate material replacement across regional retail and agriculture supply chains.

Demand for bioplastic packaging bags in the USA is rising as companies respond to growing environmental concerns and stricter regulations on single use plastics. Manufacturers in food & beverage, personal care, retail, and e commerce increasingly adopt bioplastic bags to meet consumer expectations for sustainable packaging. Rising consumer awareness about plastic waste drives demand for compostable or bio based alternatives that reduce reliance on fossil based plastics and lower carbon footprint. Advances in biopolymer technology have improved strength, barrier properties, and processability of bioplastic bags, making them viable substitutes for traditional plastic bags across a range of applications. Interest in circular economy principles and corporate sustainability commitments further fuels adoption.

Major suppliers shaping the USA bioplastic bag market include Novamont S.p.A., BASF SE, NatureWorks LLC, Mitsubishi Chemical Holdings, and Biome Bioplastics. Novamont and NatureWorks lead as innovative material providers, offering polylactic acid (PLA) and other bio based polymers tailored for bag applications. BASF and Mitsubishi Chemical supply a broader portfolio of bioplastic resins and support large-scale industrial demand. Biome Bioplastics and other niche producers contribute specialized formulations for compostable and flexible packaging needs. These firms influence the market through material innovation, supply chain capacity, and collaborations with retailers and brand owners seeking sustainable packaging solutions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Material | Polylactic Acids (PLAs), Polyhydroxyalkanoates (PHAs), Starch Blends, Others |

| Type | Flat Bags, Rubble Sacks, Gusseted Bags, Woven Sacks, Trash Bags, T-shirt Bags, Others |

| Application | Industrial, Institutional, Retail Sector, Consumer Users |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | Novamont S.p.A., BASF SE, NatureWorks LLC, Mitsubishi Chemical Holdings, Biome Bioplastics |

| Additional Attributes | Dollar by sales by material, Dollar by sales by type, Dollar by sales by application, Dollar by sales by region, Regional CAGR, Policy-driven adoption, Retail and e-commerce penetration, Compostable bag program impact, Industrial supply chain influence |

The demand for bioplastic packaging bag in USA is estimated to be valued at USD 6.2 billion in 2025.

The market size for the bioplastic packaging bag in USA is projected to reach USD 21.8 billion by 2035.

The demand for bioplastic packaging bag in USA is expected to grow at a 13.5% CAGR between 2025 and 2035.

The key product types in bioplastic packaging bag in USA are polylactic acids (plas), polyhydroxyalkanoates (phas), starch blends and others.

In terms of type, flat bags segment is expected to command 29.0% share in the bioplastic packaging bag in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bioplastic Packaging Bag Market Growth – Demand & Forecast 2025 to 2035

Demand for Bag-In-Box Packaging in USA Size and Share Forecast Outlook 2025 to 2035

USA Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

Understanding Market Share Trends in Bagasse Packaging

USA Stick Packaging Market Analysis – Growth, Trends & Forecast 2025-2035

Bag-in-box Packaging Market Size and Share Forecast Outlook 2025 to 2035

USA Sachet Packaging Market Report – Trends, Demand & Industry Outlook 2025-2035

USA Blister Packaging Market Trends – Demand & Growth 2025-2035

USA Barrier Packaging Market Analysis – Trends & Forecast 2024-2034

Bioplastics For Packaging Market Size and Share Forecast Outlook 2025 to 2035

Reusable Wine Bags Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Reusable Wine Bags Companies

USA Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

USA Pharmaceutical Packaging Market Insights – Demand, Size & Industry Trends 2025-2035

Bag Feed Seal Pouch Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Reusable Consumer Packaging Market

The USA & Canada Bag-in-Box Market Size and Share Forecast Outlook 2025 to 2035

Conical Bags Packaging Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Conical Bags Packaging Market

USA Flexible Plastic Packaging Market Insights – Trends, Demand & Growth 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA