The USA calf milk replacers market is projected to reach a value of USD 991.5 Million in 2025, growing at a CAGR of 8.0% over the next decade to an estimated value of USD 2,144.4 Million by 2035.

| Attributes | Description |

|---|---|

| Estimated USA Calf Milk Replacers Industry Size (2025E) | USD 991.5 million |

| Projected USA Calf Milk Replacers Industry Value (2035F) | USD 2,144.4 million |

| Value-based CAGR (2025 to 2035) | 8.0% |

The main reason for such stunning growth is the increased request for weight loss and low-cost nutrition solutions in the area of calf-rearing. The need for calf milk replacers (CMRs) to be involved with the promotion of healthy and productive calves per unit will grow due to the dairy sector continuing to flourish.

Calf milk replacers are nutrient-rich products that are prepared to ensure maximum nutrition for calves. Increase in adoption by commercial dairy farms and individual farmers is an indicator of recent interest in higher productivity in livestock with reduced mortality rates.

In addition, the recent progressions in the formulation of CMR, for instance, the incorporation of probiotics, prebiotics, and immune-boosting additives, are other factors that make this market move forward easily. The USA dairy farming sector has been one of the main forces that have pushed the market forward because farmers, in turn, are looking for the best and most dependable nutritional solutions for their animals.

The increasing demand for non-medicated CMRs along with the dominance of the powder forms reveal the changing waves of the industry. With the improvements in manufacturing and distribution, the USA calf milk replacers market is looking forward to subsequent growth during the next decade.

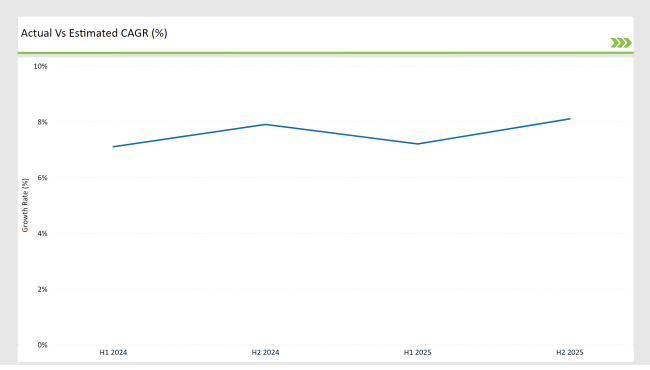

The table presented herein elucidates the semi-annual growth trajectories pertaining to the calf milk replacers market in the USA, revealing a consistent elevation in the CAGR over successive years. This analysis (which is quite comprehensive) underscores the market’s remarkable adaptability to evolving consumer preferences and technological advancements.

H1 signifies period from January to June, H2 Signifies period from July to December

Sophisticated formulations and a targeted distribution system have given the market alternative ways of serving its diverse needs. Yet another factor that has increased convenience of products by further enhancing their use are numerous innovations in packaging, from resalable bags to ready-to-mix powders, thus ensuring wider adoption across all segments of the market.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Recent Developments in the USA Calf Milk Replacers Market : Cargill Inc. introduced a new calf milk replacer with an advanced nutritional formula designed to enhance growth and improve digestive health in young calves. |

| February 2024 | Partnership Initiative by Land O’Lakes Inc.: Land O’Lakes Inc. announced a partnership with local dairy farms to promote the use of its premium calf milk replacers, emphasizing sustainability and nutrition. |

| March 2024 | New Product Line by Calva Products: Calva Products launched a new line of organic calf milk replacers, catering to the increasing demand for natural and eco-friendly livestock nutrition solutions. |

| April 2024 | Research Collaboration by Archer Daniels Midland: Archer Daniels Midland entered a research collaboration aimed at developing innovative calf milk replacers that enhance immune function and overall health in calves. |

| May 2024 | Expansion of Distribution Network by CHS Inc.: CHS Inc. expanded its distribution network for calf milk replacers across the Midwest, improving access to high-quality nutrition for dairy farmers in the region. |

Increasing Demand for Non-Medicated Calf Milk Replacers

There exists a growing demand for non-medicated CMRs in the market in terms of 62% market share by 2025. This arises from a very recent trend against chemical-based items, which progressively occurs when consumers seek items free from antibiotics.

Consumers are concerned about animal health and increased antibiotic resistance from livestock. Medicated CMRs do not carry any substances that would assist with the treatment of antibiotics in calves and, therefore, do not add antibiotics to medicated CMRs.

Advancement in Formulation Development and Product

Formulations of calf milk replacers have radically changed. Most calf milk replacer manufacturers are now using functional additives, such as probiotics, prebiotics, and omega-3 fatty acids, to increase calf immunity, gut health, and overall growth.These advancements not only improve the effectiveness of CMRs but also address specific challenges faced by farmers, such as weaning stress and the prevention of diarrhea.

Also, it offers high-fat and protein variants for specific requirements of high-performance breeds for adequate growth and productivity.

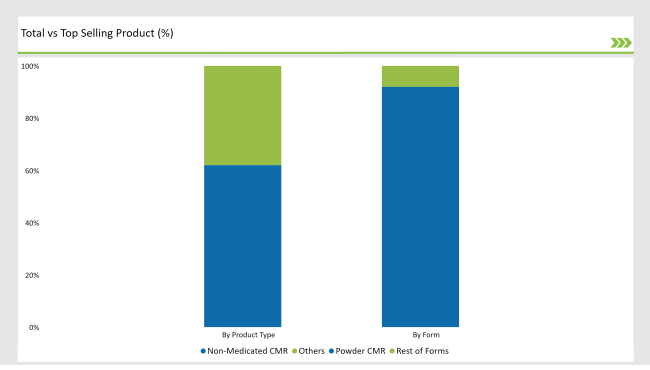

% share of Individual categories by Product Type and Form in 2025

The most important is the non-medicated calf milk replacers with 62% market share in 2025. Non-medicated calf milk replacers will fulfil the fast-emerging trend for natural livestock solutions. In avoiding antibiotics and synthetic additives, the growing interest is reflected. To these ends, most farmers value such methods in keeping farms as natural or organic.

These calf milk replacers give ideal nutrition with crucial proteins, fats, vitamins, and minerals in adequate quantities that give the calf ample nutritional means for its development. Their adaptability makes them suitable for different farming systems, such as intensive and extensive operations.

Expanding dairy farms that focus on productivity and animal welfare largely make use of the chemi-resistant bred animals. On top of this, the non-medicated CMRs diminish health-related issues that are linked to antibiotic resistance and make them much more precious. Transition to the usage of chemical-free products is parallel to the industry's path of more sustainability and reflects the consumer's rise in the need for ethical farming.

These milk powder substitutes for calves are undoubtedly the most popularly used and will clearly dominate all through to 2025 with an appreciable 92% of the market share. The widespread acceptance has much to do with their long shelf life, ease of transport, and storage.

Farmers exhibit a pronounced preference for powdered forms, largely because of their inherent flexibility; these formulations can be readily mixed to produce fresh feed on demand, thereby minimizing waste. Although these replacers are available in an array of nutritional formulations specifically tailored to distinct calf growth stages, they ensure optimal health and developmental outcomes.

Consistency in quality, cost-effectiveness, and adaptability to changing dietary needs of cattle further facilitate their standing as the top pick for the farming methods that are in trend nowadays. This conformity to the main agricultural requirements of effectiveness and sustainability is the main argument for their importance to the agricultural sphere nowadays.

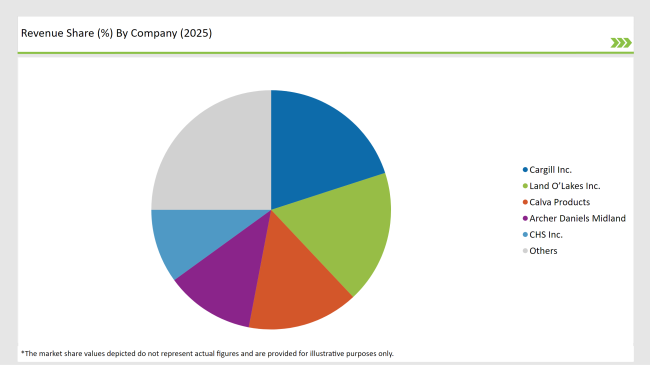

2025 Market share of USA Calf Milk Replacers suppliers

Note: above chart is indicative in nature

The USA calf milk replacers market features a blend of established international and regional producers. Cargill Inc., Land O'Lakes Inc., and Calva Products are prominent firms that occupy key positions because of their robust portfolio of products, distribution capabilities, and drive toward innovation. Cargill and Land O'Lakes and others are actively invested in the process of product R&D to maximize their nutritional strength with the result being healthy and improved growth for the calf.

Regional manufacturers play a critical role in addressing localized needs, offering cost-effective solutions and tailored formulations for specific farming practices. Some new manufacturers, focusing on organic and specialty CMRs, have also made a breakthrough in the market, especially with environmentally concerned farmers who want to avoid chemicals.

The competition in the market landscape has provided it with a lively environment. It has made it a place for both innovation and also a home to a variety of products.

The direct partners of the CMR manufacturers and dairy farms further aggregated the market concentration via strategic collaboration. Such alliances can yield a variety of products and services custom made to nutritional requirements of different breeds and farm circumstances.

Thus, it has become an increasingly important topic for many companies to examine the eco-friendliness of packaging as well as the sustainability of the raw materials used in their products, in their pursuit of continuously meeting the expectations of their clients and thus keeping up with the industry trends.

By type, the market includes medicated and non-medicated calf milk replacers.

By form, the industry is segmented into powder and liquid CMRs.

By distribution channel, the market is divided into direct sales/B2B and retail/B2C.

By end-user, the report covers commercial dairy farms, individual farmers, and research and academic institutions.

The market is expected to grow at a CAGR of 8.0% from 2025 to 2035.

The USA calf milk replacers market is projected to reach USD 2,144.4 Million by 2035.

Key drivers include increasing demand for efficient livestock nutrition, advancements in CMR formulations, and the growing adoption of sustainable farming practices.

Powdered CMRs dominate by form, while non-medicated CMRs lead by type in 2025.

Top manufacturers include Cargill Inc., Land O’Lakes Inc., Calva Products, Archer Daniels Midland, and CHS Inc.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA