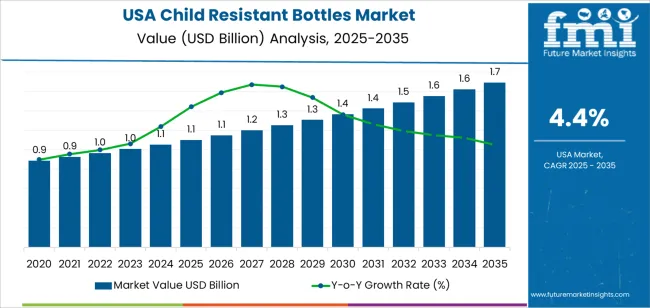

The demand for child resistant bottles in the USA is projected to grow from USD 1.1 billion in 2025 to USD 1.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.40%. These bottles are critical in packaging products that must be kept out of reach of children, including pharmaceuticals, household cleaners, and cannabis products. With stricter child safety packaging regulations and the continued growth of industries like pharmaceuticals and cannabis, the demand for child resistant bottles is expected to rise. Ongoing advancements in bottle designs and functionality, improving both safety and usability, will contribute to this growth.

The pharmaceutical and cannabis sectors are key drivers of this demand, particularly in regions where cannabis has been legalized. As these industries expand, the need for child resistant packaging will continue to increase. There is a growing focus on sustainable packaging solutions, prompting innovation in eco-friendly child resistant bottles that maintain high safety standards. As regulations become more stringent and consumer awareness of safety increases, the industry for child resistant bottles will expand, driving continued growth in the coming years. The convergence of safety, usability, and sustainability will be a major factor influencing this demand, ensuring the widespread adoption of child resistant packaging across various industries.

Between 2025 and 2030, the demand for child resistant bottles in the USA will grow from USD 1.1 billion to USD 1.4 billion, adding USD 0.3 billion. This growth is largely driven by the expansion of industries such as pharmaceuticals, cannabis, and household cleaning, where safety packaging is a regulatory requirement. As these industries continue to grow, more products will require child resistant packaging, especially with evolving regulations around child safety. Manufacturers will respond by increasing production capabilities and introducing more advanced packaging solutions. The demand for child resistant bottles will also be influenced by the increasing awareness of safety risks and the need to prevent accidental ingestion.

From 2030 to 2035, demand is projected to increase from USD 1.4 billion to USD 1.7 billion, adding another USD 0.3 billion. During this phase, the adoption of child resistant bottles is expected to become even more widespread across various sectors. Advances in packaging design, particularly those that enhance both security and consumer convenience, will support this growth. The growing emphasis on sustainability will drive the industry to adopt eco-friendlier child resistant packaging options. As manufacturers prioritize both safety and environmental responsibility, innovative packaging solutions will emerge, contributing to the demand. The combination of regulatory pressure, heightened safety awareness, and environmental considerations will ensure continued growth in the child resistant bottle industry through 2035.

| Metric | Value |

|---|---|

| Demand for Child Resistant Bottles in USA Value (2025) | USD 1.1 billion |

| Demand for Child Resistant Bottles in USA Forecast Value (2035) | USD 1.7 billion |

| Demand for Child Resistant Bottles in USA Forecast CAGR (2025 to 2035) | 4.40% |

The demand for child resistant bottles in the USA is growing largely because regulatory requirements and consumer safety expectations both emphasise prevention of accidental ingestion, especially by children. Many products such as pharmaceuticals, household chemicals, and consumer goods are subject to packaging standards that necessitate secure closures and restricted access. These safety mandates drive manufacturers to adopt child‑resistant bottles to comply with legislation and protect brand reputation.

Manufacturers are also innovating designs of child‑resistant bottles to provide better usability for adults while remaining secure for children. Features such as push‑and‑turn closures, squeeze‑and‑turn caps, and improved materials provide enhanced performance. At the same time, the rise in prescription usage, higher volumes of over‑the‑counter medication, and increasing availability of potentially hazardous domestic products are pushing demand for secure packaging formats.

The shift toward home‑based care and self‑administration of medication contributes to this growth. As more patients manage treatments at home, the requirement for safe, easy‑to‑use packaging becomes more important. Child‑resistant bottles designed for user convenience and safety help reduce risk of accidental ingestion in households. With these factors in motion, the demand for child resistant bottles in the USA is expected to continue climbing steadily through 2035.

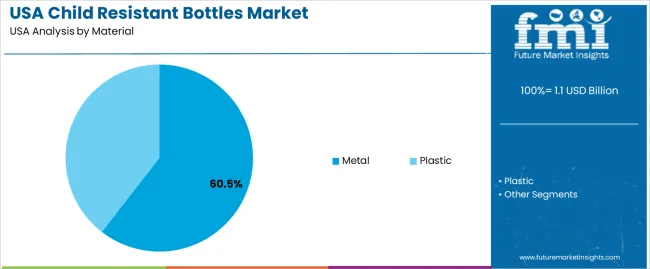

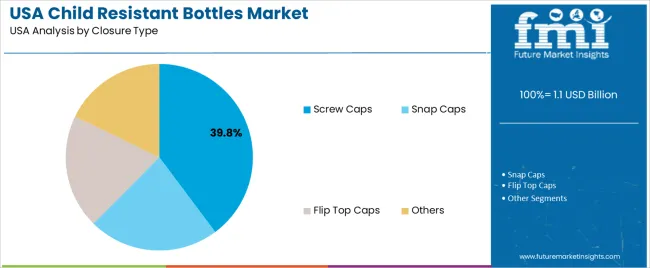

Demand for child resistant bottles in the USA is segmented by material, end use, capacity, closure type, and region. By material, demand is divided into metal and plastic, with metal holding the largest share at 61%. The demand is also segmented by end use, including pharmaceuticals, chemicals, beverages, and others, with pharmaceuticals leading the demand at 39%. In terms of capacity, demand is divided into less than 600 ml, 600 to 750 ml, 750 ml to 1,000 ml, 1,000 ml to 2,000 ml, and greater than 2,000 ml. Regarding closure type, demand is segmented into screw caps, snap caps, flip top caps, and others. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Metal bottles account for 61% of the demand for child-resistant bottles in the USA. The durability and strength of metal make it a preferred choice for applications where secure packaging is essential, such as pharmaceuticals and chemicals. Metal bottles are designed to provide an airtight seal, ensuring that the contents remain protected from contamination, which is particularly important for sensitive products like medications. Metal’s robust nature helps maintain the integrity of the packaging during transportation and storage, especially in challenging environmental conditions.

With the growing demand for tamper-evident and child-resistant packaging solutions in industries such as pharmaceuticals, chemicals, and personal care products, metal bottles offer a superior protective option. They are more resilient than plastic bottles, which makes them ideal for high-value products that require extra security. As consumer awareness of child safety and product integrity continues to rise, metal bottles are expected to maintain their dominant share of the child-resistant bottle industry, especially in sectors requiring high levels of security.

Pharmaceuticals account for 39% of the demand for child-resistant bottles in the USA. This sector requires packaging solutions that offer both security and reliability, especially for products that can be harmful to children, such as prescription medications, over-the-counter drugs, and liquid medicines. The regulatory landscape in the pharmaceutical industry often mandates the use of child-resistant packaging to prevent accidental ingestion and comply with safety standards. Given the sensitive nature of medical products, packaging that ensures protection against misuse is vital.

As the pharmaceutical industry continues to grow, driven by an aging population and the increasing prevalence of chronic diseases, the demand for secure packaging solutions remains high. Child-resistant bottles are essential for safe storage and transportation of medications, reducing the risk of accidental poisoning or misuse, particularly in households with children. With the increasing focus on patient safety, the pharmaceutical industry will continue to lead the demand for child-resistant bottles, ensuring their dominant position in the packaging industry.

Key drivers include stringent regulatory requirements (such as the Poison Prevention Packaging Act) mandating child‑resistant packaging for pharmaceuticals and hazardous household products, rising consumer awareness of accidental poisoning risks for children, and growth in industries like pharmaceuticals, cannabis, and household chemicals that require secure packaging. Restraints include the higher cost and complexity of designing true child‑resistant mechanisms, challenges around balancing adult usability (especially for elderly users) with child safety, volatile raw‑material costs for specialised plastics or closures, and slower adoption in lower‑margin product segments.

Why is Demand for Child Resistant Bottles Growing in USA?

In USA, demand for child‑resistant bottles is growing because manufacturers across sectors such as pharmaceuticals, cannabis edibles, OTC medications, and hazardous household chemicals must comply with safety standards protecting children from accidental ingestion. The shift toward online sales and home delivery means packaging must perform reliably during shipping and at‑home use. Consumer expectation for safer packaging is increasing, and brand differentiation through secure containers is becoming more important. At the same time, regulations continue to tighten, compelling companies to adopt certified child resistant bottle solutions to avoid liability and comply with law.

How are Technological Innovations Driving Growth of Child Resistant Bottles in USA?

Technological innovations are boosting the uptake of child‑resistant bottles in USA by improving both safety features and user experience. Innovations include push‑and‑turn and squeeze‑and‑turn closures that meet standard testing protocols, smarter materials and tamper‑evident seals, and incorporation of recyclable or biodegradable materials responding to environmental concerns. Automation in manufacturing and quality‑control systems ensures locking mechanisms meet reliability thresholds. Also, packaging designs are being tailored for e‑commerce logistics and long‑shelf‑life applications. These innovations reduce risk and increase functional appeal, which helps adoption in industries facing heavy regulation or consumer scrutiny.

What are the Key Challenges Limiting Adoption of Child Resistant Bottles in USA?

Despite strong demand, adoption of child‑resistant bottles in USA is limited by several challenges. One is cost: integrating certified closures, specialised materials, and manufacturing processes increases packaging costs, which may be prohibitive for low‑margin products. Another is usability: ensuring packaging is child‑resistant while still easy enough for adults (including elderly users or those with limited dexterity) remains technically demanding. Compliance testing and regulatory certification add time and expense. Material cost volatility and supply chain constraints (especially for sustainable or recycled materials) can hinder scaling. Some product categories or smaller brands may defer adoption due to these burdens.

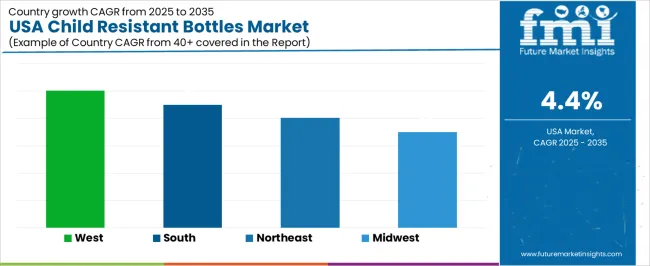

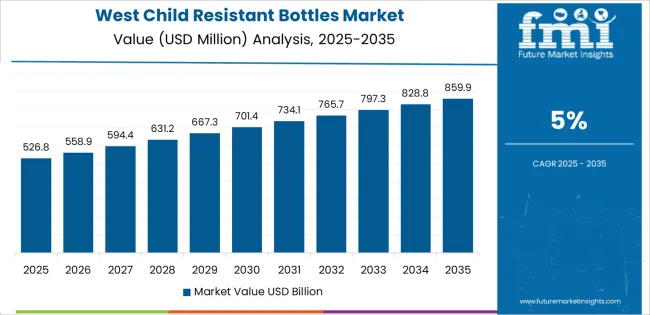

| Region | CAGR (%) |

|---|---|

| West | 5.0 |

| South | 4.5 |

| Northeast | 4.0 |

| Midwest | 3.5 |

Demand for child resistant bottles in USA is increasing across all regions, with the West leading at a 5.0% CAGR. This growth is driven by the region’s focus on safety and regulatory requirements, particularly in industries like pharmaceuticals and cannabis. The South follows with a 4.5% CAGR, supported by the growing pharmaceutical and cannabis sectors. The Northeast shows a 4.0% CAGR, driven by its well-established pharmaceutical industry and expanding cannabis industry. The Midwest experiences moderate growth at 3.5%, with increasing demand from the pharmaceutical and cannabis industries.

The West is experiencing the highest demand for child resistant bottles in USA, with a 5.0% CAGR. This growth is primarily driven by the region’s increasing focus on safety and regulatory requirements for packaging in industries like pharmaceuticals, cannabis, and over-the-counter medications. Major cities such as Los Angeles, San Francisco, and Seattle are at the forefront of regulatory changes, making the need for child resistant packaging more critical. The rise of the cannabis industry, which is highly regulated, has significantly contributed to the demand for child resistant bottles, as safety concerns remain a top priority.

The region’s growing awareness of safety standards in both healthcare and consumer products has accelerated the adoption of child resistant packaging. The West continues to prioritize safety in consumer goods, ensuring the demand for child resistant bottles remains strong, especially as new regulations continue to evolve.

The South is seeing strong demand for child resistant bottles in USA, with a 4.5% CAGR. The region’s growing pharmaceutical, cannabis, and consumer goods sectors have driven the need for child resistant packaging solutions. States like Texas, Florida, and Georgia have seen increases in the production of pharmaceuticals and cannabis products, where child resistant bottles are a necessity for both safety and regulatory compliance.

The rise in healthcare awareness and the expansion of regulated industrys have created a growing demand for packaging solutions that ensure safety, especially in households with children. As these industries continue to grow, businesses in the South are increasingly adopting child resistant bottles to meet consumer demand for safe and secure packaging. The region’s focus on consumer safety, along with investments in manufacturing processes to support compliance with packaging regulations, is expected to continue driving the demand for child resistant bottles in the South.

The Northeast is experiencing steady demand for child resistant bottles in USA, with a 4.0% CAGR. This growth is driven by the region’s well-established pharmaceutical industry, where child resistant packaging is essential for compliance with safety standards, particularly for medications and health-related products. Cities like New York and Boston are hubs for pharmaceutical companies, which have stringent packaging regulations that promote the use of child resistant bottles.

The rising use of child resistant packaging in the cannabis industry, which is seeing rapid expansion in states like Massachusetts, has also contributed to this demand. The region’s focus on healthcare and safety, combined with growing consumer concerns over the safety of products in homes with children, ensures that child resistant packaging will remain a significant demand driver. As regulations become stricter, companies in the Northeast are adopting more secure packaging solutions, fueling further growth in the demand for child resistant bottles.

The Midwest is seeing moderate demand for child resistant bottles in USA, with a 3.5% CAGR. This growth is driven by the increasing demand for safe packaging solutions in the pharmaceutical, cannabis, and consumer goods industries. States like Illinois and Michigan, with expanding cannabis industies, have seen an increase in the need for child resistant packaging to comply with state regulations.

The pharmaceutical industry in the Midwest, with major hubs like Chicago, also contributes to this demand, particularly as more products require child resistant packaging to meet safety standards. The demand for child resistant bottles is growing at a steady pace, supported by a rising focus on consumer safety and regulatory compliance. As the region’s pharmaceutical and cannabis sectors continue to expand, the adoption of child resistant bottles is expected to increase, driven by the need to ensure product safety in homes with children.

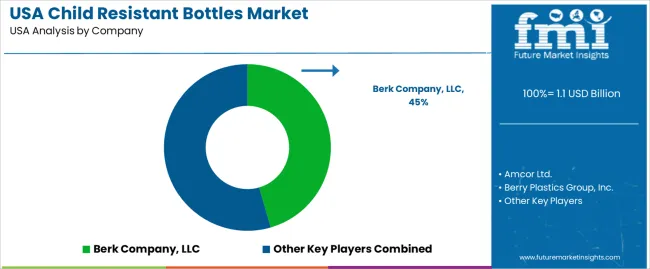

In the USA, demand for child‑resistant bottles is strongly driven by regulatory requirements in the pharmaceutical, household chemical, and personal care segments. Key global and domestic players active in this space include Berk Company, LLC with around 45.5 % share, Amcor Ltd., Berry Plastics Group, Inc., Gerresheimer AG, and Alpha Packaging. These companies compete by offering certified closures, tamper‑evident features, and multi‑material bottles that meet adult‑access/f child‑resistance regulations.

Berk Company maintains its position through strong manufacturing capacity, a broad product portfolio tailored to major end‑use industries in the USA, and longstanding compliance expertise. The other manufacturers distinguish themselves by specialization (for example glass for biotech), geographic reach, cost structure, and technical support services (such as custom moulding and testing). The competitive dynamics are influenced by buyers’ need for supply‑chain reliability, material flexibility (plastic, glass, recycled content), and fast turnarounds.

The competitive environment is shaped by three main forces: First, stricter legislation and enforcement drive demand for certified child‑resistant formats. Second, innovation in bottle design, closure systems, and material substitution adds differentiation. Third, new entrants and niche providers must overcome high regulatory certification costs, tooling investment, and strong incumbent relationships. The players that can combine regulatory compliance, material innovation, efficient production, and responsive service are positioned to secure growth in this segment.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Material | Metal, Plastic |

| Capacity | < 600 ml, 600 to 750 ml, 750 ml to 1,000 ml, 1,000 ml to 2,000 ml, 2,000 ml |

| Closure Type | Screw Caps, Snap Caps, Flip Top Caps, Others |

| End Use | Pharmaceuticals, Chemicals, Beverages, Others |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Players Profiled | Berk Company, LLC, Amcor Ltd., Berry Plastics Group, Inc., Gerresheimer AG, Alpha Packaging |

| Additional Attributes | Dollar sales by material, capacity, closure type, end use, and regional distribution focusing on pharmaceuticals, chemicals, and beverages. Trends in child-resistant solutions across various sectors, particularly in packaging innovations. Insights into regional preferences and regulatory compliance in packaging for safety. |

The demand for child resistant bottles in usa is estimated to be valued at USD 1.1 billion in 2025.

The market size for the child resistant bottles in usa is projected to reach USD 1.7 billion by 2035.

The demand for child resistant bottles in usa is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in child resistant bottles in usa are metal and plastic.

In terms of capacity, < 600 ml segment is expected to command 26.9% share in the child resistant bottles in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Child Resistant Bottles Market Size and Forecast

Demand for Child Resistant Bottles in Japan Size and Share Forecast Outlook 2025 to 2035

United States and Canada Child Resistant Bottles Market Size and Share Forecast Outlook 2025 to 2035

Child resistant Zipper Market Size and Share Forecast Outlook 2025 to 2035

Child-Resistant Pumps Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Re-Closable Edible Bags Market Size and Share Forecast Outlook 2025 to 2035

Child-Resistant Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Pouches Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Single Dose Pouches Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Pipette Closures Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Dropper Caps Market Size and Share Forecast Outlook 2025 to 2035

Child Resistant Locking Pouches Market from 2025 to 2035

Child-Resistant Containers Market Trends & Demand 2025 to 2035

Competitive Landscape of Child Resistant Re-Closable Edible Bags Providers

Market Share Distribution Among Child-Resistant Pouches Manufacturers

Leading Providers & Market Share in Child-Resistant Foil Packaging

Market Share Insights for Child Resistant Dropper Caps Manufacturers

Market Share Distribution Among Child Resistant Pipette Closures Manufacturers

Child Resistant Bags Market

Demand for Moisture-resistant Packaging in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA