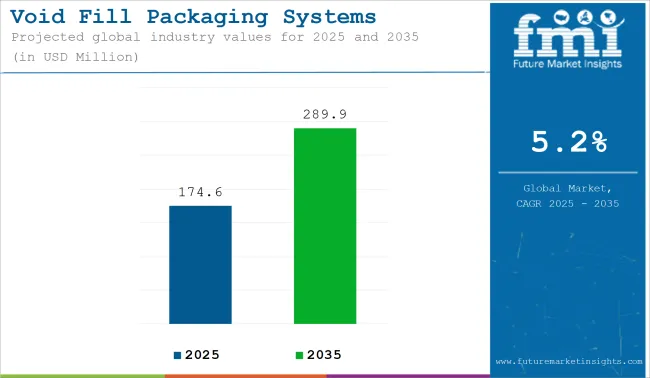

The void fill packaging systems market is projected to grow from USD 174.6 million in 2025 to USD 289.9 million by 2035, registering a CAGR of 5.2% during the forecast period. Sales in 2024 reached USD 166.0 million, reflecting a steady demand in the sector.

This growth has been attributed to the increasing need for efficient, cost-effective, and protective packaging solutions across various industries, including e-commerce, electronics, food & beverage, and pharmaceuticals. The rise in online shopping and global trade has necessitated advanced packaging methods that ensure product safety during transit, thereby boosting the demand for void fill packaging systems.

In April 2023, With PAPERplus® Dragonfly, Storopack is expanding its protective paper packaging portfolio. Based on the technology of the popular PAPERplus® Papillon machine, it is designed for fast and efficient void filling. PAPERplus® Dragonfly is different, innovative and performs better than any other machine on the market,” says Paul Deis, PAPER Product Manager at Storopack.

| Attribute | Details |

|---|---|

| Projected Value by 2025 | USD 174.6 million |

| Projected Value by 2035 | USD 289.9 million |

| CAGR (2025 to 2035) | 5.2% |

“There is no other system that can produce paper packaging with a comparable ‘fluffy’ volume. This reduces the amount of paper used in a box but still provides the best protection for the product.” The new PAPERplus® Dragonfly machine is designed to produce fluffy paper pads for fast and efficient void filling in large and medium-sized boxes.

Sustainability and innovation have played pivotal roles in shaping the void fill packaging systems market. The development of eco-friendly packaging solutions has been prioritized to meet environmental regulations and consumer preferences. Advancements in packaging design have led to improved energy efficiency and reduced material waste, enhancing overall sustainability.

Integration of smart features, such as real-time monitoring and predictive maintenance, has been implemented to ensure product safety and quality. These innovations have not only reduced the environmental footprint of packaging processes but have also opened new avenues for application in various industries.

The void fill packaging systems market is expected to witness steady growth, driven by increasing demand in the e-commerce and logistics sectors. Manufacturers focusing on sustainable and innovative solutions are anticipated to gain a competitive edge.

Emerging markets in Asia-Pacific and Latin America are projected to offer significant growth opportunities due to rising consumer awareness and industrialization. Strategic collaborations and investments in research and development are likely to foster product innovation and market expansion. As environmental concerns continue to influence consumer behavior, the adoption of eco-friendly void fill packaging systems is expected to become a key differentiator in the industry.

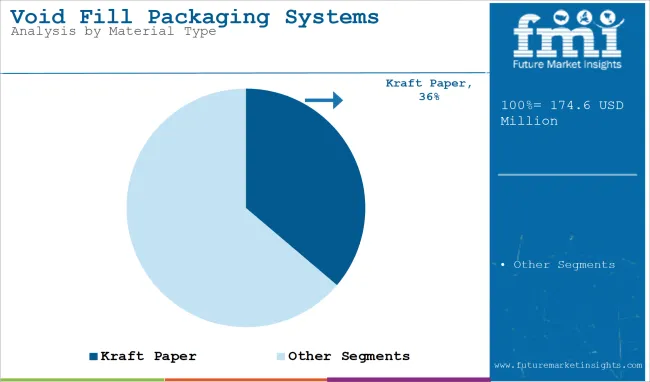

The market is segmented based on product type, material type, end use industry, and region. By product type, the market includes paper void fill systems, air pad machines, air cushioning machines, bubble wrap machines, and others. In terms of material type, the market is categorized into Kraft paper, recycled paper, polyethylene (PE) films, polypropylene (PP) films, and biodegradable & compostable materials.

By end use industry, the market comprises e-commerce & retail, electronics, food & beverage, automotive parts, cosmetics & personal care, pharmaceuticals, and transport & logistics. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Kraft paper has been estimated to account for 36.2% of the void fill packaging systems market in 2025, owing to its high strength, biodegradability, and consumer acceptance. It has been used extensively as a cushioning material for fragile items, particularly in eco-conscious markets across Europe and North America. Its tear resistance and flexibility have made it suitable for irregularly shaped products in transit.

The material has been increasingly preferred by retailers looking to eliminate plastic void fillers from their packaging lines. Void fill systems using kraft paper have been integrated into automated packing lines to reduce labor and material waste. Customizable lengths and feed rates have enabled efficient usage across varied carton sizes and order profiles. Suppliers have developed patented dispensing systems to maximize speed and minimize downtime.

High consumer acceptance has been noted in unboxing experiences, especially in premium retail packaging and gift shipments. Retailers have used kraft fill as part of a cohesive packaging aesthetic that communicates sustainability. Consumer feedback has indicated a growing aversion to plastic air pillows and foam, creating momentum for paper-based alternatives.

Major e-commerce brands have incorporated kraft-based systems in their eco-shipping initiatives to align with public and regulatory expectations. Brand owners have highlighted kraft paper’s recyclability and composability in their environmental impact reports. The segment has benefited from EPR policy shifts and bans on non-recyclable packaging in several jurisdictions. Innovation has continued around paper density, creasing, and crumpling efficiency. Growth has been supported by operational efficiency, regulatory alignment, and sustainability messaging.

The e-commerce and retail sector has been estimated to contribute 34.7% of the total demand for void fill packaging systems in 2025, driven by the surge in direct-to-consumer shipping. Businesses have relied on void fill to secure products during last-mile delivery and reduce return rates caused by in-transit damage. Packaging formats such as paper crumples, inflatable pillows, and biodegradable void fill have been deployed to enhance protection and brand value. Emphasis has been placed on lightweight, recyclable materials to reduce shipping costs and environmental impact.

Online retailers have standardized packing protocols using automated void fill machines to improve throughput and consistency. High-volume sellers have installed paper-based systems compatible with varied box sizes to minimize material usage. Enhanced customer experience during unboxing has also been prioritized by replacing noisy or unattractive plastic void fill.

Retail brands have used eco-friendly void fill not only to protect goods but also to communicate environmental stewardship. Custom-printed Kraft fill with brand logos and messages has been adopted to enhance consumer engagement. Retailers have reduced returns and improved customer retention by ensuring that goods arrive undamaged and well-presented.

Digital platforms and D2C brands have led the charge in using packaging as a brand narrative. Future growth is expected to be sustained by rising online shopping frequency and stricter packaging mandates. Retailers will likely expand the use of void fill to bulk and fragile shipments as product categories diversify. With growing consumer demand for sustainable delivery practices, e-commerce and retail will continue to drive innovations in eco-friendly void fill packaging.

The market for void fill packaging systems is expected to grow during the forecast period due to several reasons. The demand for void fill packaging systems is rising with the increase in the demand for void fill packaging solutions.

The void fill packaging is used to fill the open space left after putting the product. Void fill packaging is used as secondary packaging for protecting the product from shifting and moving of the product inside the package.

Preference for void-fill packaging products is attributed to a need to ensure product safety during transit. Modern trade has a tremendous impact on the logistics sector, across the globe, and has ultimately boosted growth in demand for packaging solutions such as void fill packaging products.

Void fill packaging systems produce various products such as loose fill peanuts, paper cushions, etc.

which provides employment across the packaging industry for goods delivery. However, the growth of global market for global void-fill packaging systems is solely dependent on packaging solutions used for protective packaging.

Void-fill packaging is also used to ensure that products reach their destination, intact, for an amazing first impression. These are the factors which might fuel the growth of the global void fill packaging systems over the forecast period.

Geographically, the global void fill packaging systems market has been segmented into North America, Latin America, Western Europe, Eastern Europe, Asia Pacific Excluding Japan (APEJ), Middle East & Africa and Japan.

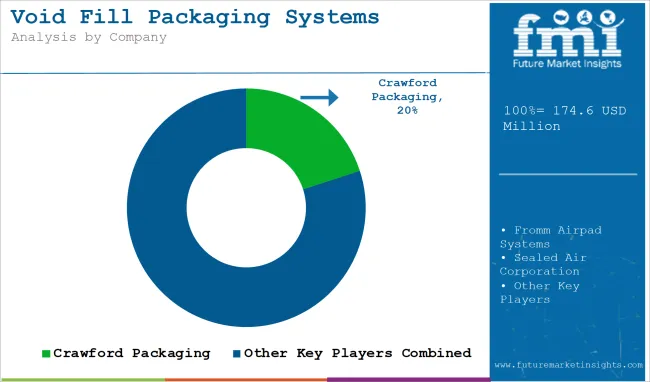

Some of the players in the global void fill packaging systems market are Crawford packaging, Fromm Airpad Systems, Sealed Air Corporation, Quantum Trading Enterprises Pty Ltd., GTI Industries, Inc., Storopack Hans Reichenecker GmbH, Rajapack Ltd., and Automated Packaging Systems. Many other small sized and local players are expected to contribute to the global void fill packaging systems market.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Void Fill Packaging Systems Manufacturers

Void Label Market Trends & Industry Growth Forecast 2024-2034

Voiding Cystourethrogram Market

Void Fill Pillows Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Void Fill Pillows Industry

Collision Avoidance Sensor Market Size and Share Forecast Outlook 2025 to 2035

Inflatable Void Fill System Market

Filler and Extender Cosmetics Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Filling and Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Fillers & Extenders Market Size and Share Forecast Outlook 2025 to 2035

Fill Finish Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Filling Fats Market Size, Growth, and Forecast for 2025 to 2035

Industry Share Analysis for Fillings and Toppings Companies

Refillable Pouches Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Refillable Deodorants Market Growth, Trends and Forecast from 2025 to 2035

Prefillable Inhalers Market Size and Share Forecast Outlook 2025 to 2035

Global Prefilled Formalin Vials Market Trends – Size, Share & Growth 2025 to 2035

Prefilled Syringe Drug Molecule Market Analysis - Size, Share, and Forecast 2025 to 2035

Lip Filler Market Analysis Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA