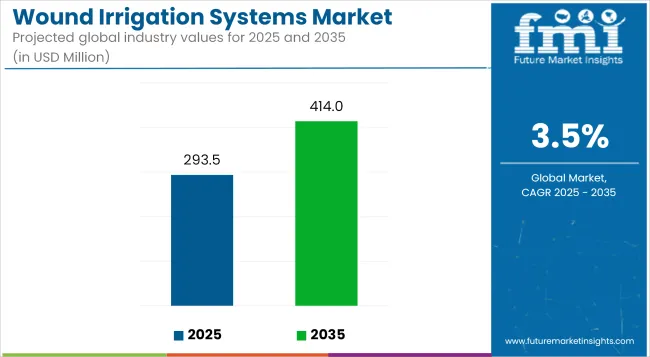

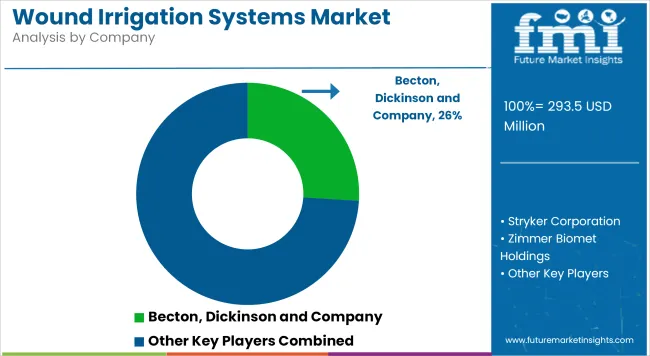

The global market for wound irrigation systems is forecasted to attain USD 293.5 million by 2025, expanding at 3.5% CAGR to reach USD 414.0 million by 2035. In 2024, the revenue of wound irrigation systems was around USD 284.3 million.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 293.5 Million |

| Industry Value (2035F) | USD 414.0 Million |

| CAGR (2025 to 2035) | 3.5% |

Wound irrigation is a critical step in the cleaning of wounds and the prevention of infection and is a pillar of evidence based clinical care. The increasing number of surgical procedures, especially among geriatric and diabetic patients, has highlighted the necessity of effective and safe irrigation methods for quicker healing and less bacterial contamination.

This has led to an increase in irrigating systems being incorporated into standardized wound care protocols by healthcare providers throughout acute care, outpatient wound clinics, and home healthcare settings, with the goal of reducing complications, lowering readmission rates, and which is expected to drive the market growth. The rising awareness for good antimicrobial stewardship and decrease in hospital acquired infections is an additional booster for the adoption.

Despite hurdles including reimbursement inconsistency and variability in clinical practise guidelines, increasing awareness and regulatory backing for novel wound care products is underpinning the market growth.

Manually Operated Wound Irrigation Systems

Manually operated wound irrigation systems, including syringes with splash shields, piston syringes, and squeeze bottles, are widely used due to their simplicity, low cost, and clinical familiarity. These systems are especially common in outpatient care, emergency rooms, and low-resource settings, where portability and control are critical.

The rising burden of acute and chronic wounds including diabetic foot ulcers, pressure ulcers, and post-surgical wounds combined with the growing demand for cost-effective wound care solutions, is driving this segment.

Asia-Pacific and Latin America show strong uptake due to affordability, while North America and Europe continue to use manual systems for non-complex cases. Future trends include ergonomic syringe designs, antimicrobial-coated irrigation tips, and disposable splash shields to reduce infection risk.

Battery-Operated and Electric Wound Irrigation Systems

Battery-powered and electric wound irrigation systems are increasingly adopted in hospitals, wound care clinics, and surgical centers for their ability to deliver controlled pressure, reduce cross-contamination, and improve wound cleansing efficiency.

These systems are often used for moderate to severe wounds, trauma cases, and surgical debridement procedures. The growing incidence of chronic wounds, technological advancements in portable powered devices, and the push for standardized wound care protocols in hospitals are fueling market growth.

North America and Western Europe are leading in adoption, with increased investments in advanced wound management technologies, while Middle East and Asia-Pacific markets are emerging with the growth of specialized wound clinics. Future innovations include AI-assisted flow control, rechargeable smart irrigation systems with fluid usage tracking, and integration with electronic wound documentation platforms.

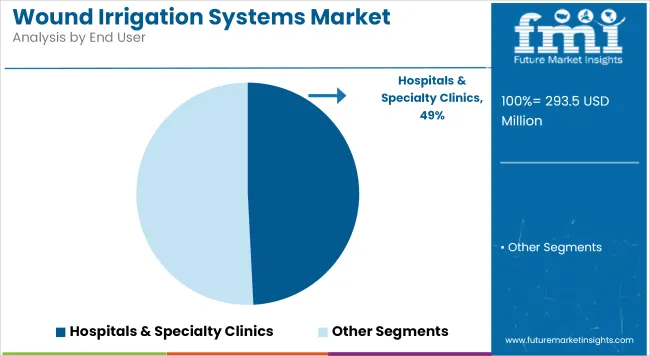

Hospitals Leading the Wound Irrigation Systems Landscape

Hospitals account for the largest share of the wound irrigation systems market, particularly for post-operative wound cleaning, trauma care, and complex debridement procedures. The demand is driven by increased surgical volumes, growing emphasis on infection control (especially in orthopedic and cardiovascular surgeries), and adoption of wound care guidelines recommending irrigation.

North America and Europe lead in hospital-based adoption due to robust infection prevention protocols and advanced infrastructure. AI-integrated irrigation units, built-in fluid warming systems, and closed-loop systems to reduce spillage are emerging trends in high-acuity settings.

Growing Demand for Wound Irrigation Systems in Ambulatory and Home Care Settings

With the rising prevalence of chronic wounds and the shift toward outpatient and home-based care, wound irrigation systems are increasingly used in ambulatory care settings and home wound management programs. These settings favor portable, easy-to-use irrigation systems, including both manual and battery-powered devices. The growing geriatric population, increased focus on reducing hospital readmissions, and expansion of home health reimbursement models are accelerating adoption.

North America leads in home-based wound irrigation, while Europe and APAC are experiencing growth through community nursing and home care initiatives. Future trends include compact irrigation kits for telehealth-guided wound care, antimicrobial irrigation fluids, and subscription-based wound care delivery platforms.

Comprehensive Analysis of Challenges Impacting the Wound Irrigation Systems Market

One of the primary challenges facing the wound irrigation systems market is the disparity in reimbursement policies across regions. In many low- and middle-income countries, wound irrigation procedures and devices are not covered by insurance, limiting their accessibility and use in public healthcare settings.

Additionally, there is a lack of standardization in clinical protocols for wound irrigation, with many providers relying on outdated or improvised methods, reducing consistency in patient outcomes. Cost pressures, especially in resource-constrained environments, further hinder the adoption of advanced or single-use systems.

Furthermore, limited awareness among general practitioners and nurses about the clinical efficacy of proper wound irrigation, particularly in non-urban settings, continues to affect utilization rates. The market also faces challenges from supply chain constraints and fluctuating raw material costs, especially for disposable systems. Regulatory hurdles and the need for extensive clinical data to support new product approvals may also slow innovation and market entry in certain regions.

Emerging Opportunities and Innovations Driving Growth in the Wound Irrigation Systems Market

Despite existing barriers, the wound irrigation systems market presents significant growth opportunities. Technological innovations in automated irrigation systems, pressure sensors, and antimicrobial solution delivery are enhancing efficacy and safety profiles, making these devices more attractive to healthcare providers.

The growing trend of decentralized care through outpatient facilities, ambulatory surgical centers, and home healthcare creates demand for portable, easy-to-use irrigation systems that can be safely operated outside of hospital environments. Additionally, aging populations and rising incidence of comorbid conditions such as diabetes and obesity are increasing the burden of chronic wounds, creating a sustained need for effective wound care solutions.

Clinical awareness campaigns, professional training programs, and the integration of wound irrigation into standardized care pathways are improving adoption. Moreover, partnerships between manufacturers and health ministries, especially in Asia-Pacific and Latin America, are expanding access to irrigation devices in public healthcare. Companies that focus on affordability, modularity, and ease of use while maintaining clinical efficacy are well-positioned to capitalize on the evolving landscape of global wound care.

One key emerging trend in the wound irrigation systems market is the development of smart irrigation devices that leverage digital technologies to optimize wound cleansing. These systems feature pressure sensors, flow regulators, and real-time feedback mechanisms that ensure consistent delivery and prevent tissue damage.

Some devices are integrated with digital interfaces that allow clinicians to track irrigation volume, frequency, and duration, supporting data-driven wound management and regulatory compliance. The adoption of such technologies is especially relevant in surgical and intensive care units where precision is critical.

From 2020 through 2024, the global wound irrigation systems market experienced steady growth, driven by the increasing prevalence of chronic wounds, rising number of surgical procedures, and advancements in wound care technologies.

Moreover the growth was also supported by the adoption of both manual and battery-operated wound irrigation systems aimed at improving wound cleansing and promoting faster healing. However, challenges such as high costs associated with advanced systems and limited awareness in developing regions have impeded broader market expansion during this period.

Looking ahead to 2025 to 2035, the wound irrigation systems market is poised for continued growth, propelled by technological innovations, increased investment in healthcare infrastructure, and a growing emphasis on effective wound management. The development of advanced wound irrigation systems with enhanced efficiency and user-friendliness is expected to enhance patient outcomes.

Additionally, expanding healthcare services in emerging markets and increasing awareness of advanced wound care solutions are anticipated to drive market growth.

Market Outlook

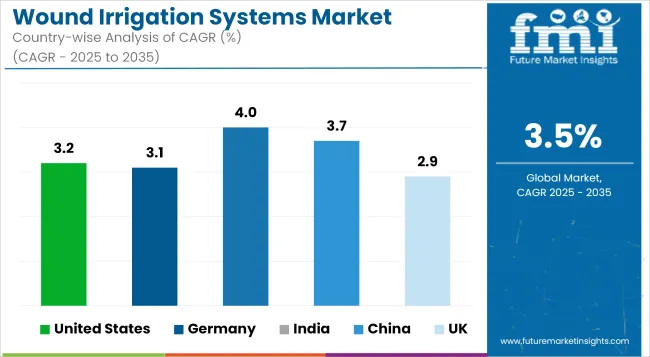

The United States leads the global wound irrigation systems market, fueled by high surgical volumes, increasing prevalence of chronic wounds, and a growing elderly population. The market benefits from well-established wound care protocols, advanced healthcare infrastructure, and widespread use of portable negative pressure wound therapy (NPWT) and pulsed lavage systems across hospitals, outpatient clinics, and home care settings.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

Market Outlook

Germany’s wound irrigation systems market is highly developed, driven by a structured wound care network, advanced surgical practices, and strong clinical guidelines supporting wound debridement and cleansing. The demand for both manual and automated irrigation systems is high across hospitals and long-term care centers, with growing emphasis on infection control and antibiotic stewardship.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.1% |

Market Outlook

India’s wound irrigation systems market is in a growth phase, fueled by the rising incidence of diabetes, increasing number of surgical interventions, and expanding rural wound care services. While manual irrigation systems dominate due to affordability, there is growing demand for single-use, sterile, and pressure-controlled devices, especially in urban hospitals and private clinics.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 4.0% |

Market Outlook

Japan’s wound irrigation systems market is advancing, driven by its aging population, increasing prevalence of diabetic foot ulcers and pressure injuries, and growing use of advanced wound cleansing technologies in both hospitals and nursing homes. Japanese healthcare facilities place high importance on hygiene and patient safety, making them receptive to automated and sterile irrigation systems.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 3.7% |

Market Outlook

The UK market for wound irrigation systems is growing steadily, supported by the National Health Service (NHS)'s focus on evidence-based wound care and infection prevention. With increasing demand for cost-effective wound management in community settings, the use of single-use irrigation kits, sterile saline systems, and low-pressure lavage devices is on the rise.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.9% |

The wound irrigation systems market is evolving rapidly due to increasing incidences of chronic and surgical wounds, rising awareness of infection control, and growing demand for advanced wound care solutions. These systems are vital in hospitals, ambulatory surgical centers, and home healthcare settings.

Key market players are focused on innovations in portable systems, disposable components, and pressure-controlled irrigation technologies. The market includes established wound care brands, surgical equipment manufacturers, and regional suppliers.

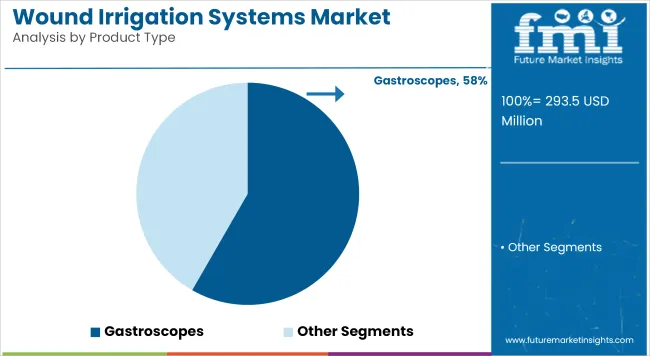

Gastroscopes and Esophagoscopes

Hospitals & Specialty Clinics, Ambulatory Surgical Centers and Others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for wound irrigation systems market was USD 293.5 million in 2025.

The wound irrigation systems market is expected to reach USD 414.0 million in 2035.

The wound irrigation systems market is driven by rising cases of chronic wounds, increasing surgical procedures, and growing awareness of infection control. Advancements in healthcare infrastructure, improved medical technologies, and the rising geriatric population further contribute to market growth, enhancing the demand for efficient wound care solutions.

The top key players that drives the development of wound irrigation systems market are, Becton, Dickinson and Company, Stryker Corporation, Zimmer Biomet Holdings, CooperSurgical Inc., and Medline Industries.

Battery Operated in product type of wound irrigation systems market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Wound, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Wound, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Wound, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Wound, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Wound, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Wound, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Wound, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Wound, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Wound, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Wound, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Wound, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Wound, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Wound, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Wound, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Wound, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Wound, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Wound, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Wound, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Wound, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Wound, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Wound, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Wound, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Wound, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Wound, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Wound, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Wound, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Wound, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Wound, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Wound, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Wound, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Wound, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Wound, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Wound, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Wound, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Wound, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Wound, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Wound, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Wound, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Wound, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Wound, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Wound, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Wound, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Wound, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Wound, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Wound, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Wound, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Wound, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Wound, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Wound, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Wound, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Wound, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Wound, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Wound, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Wound, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Wound, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Wound, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Wound, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Wound, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Wound, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Wound, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Wound, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Wound, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Wound, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Wound, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wound Wash Market Size and Share Forecast Outlook 2025 to 2035

Wound Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Wound Evacuators Market Size and Share Forecast Outlook 2025 to 2035

Wound Skin Care Market - Demand & Forecast 2025 to 2035

Wound Stimulation Therapy Market Insights – Demand and Growth Forecast 2025 to 2035

Wound Care Surfactant Market Insights – Demand and Growth Forecast 2025 to 2035

Analysis and Growth Projections for Wound Healing Nutrition Market

Wound Debridement Products Market Analysis - Growth & Forecast 2025 to 2035

Global Wound Filler Market Analysis – Size, Share & Forecast 2024-2034

Wound Measurement Devices Market

Wound Irrigation Devices Market

Wirewound Resistor Market Size and Share Forecast Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Spiral Wound Membrane Market

The Chronic Wound Care Market is segmented by product, wound type and distribution channel from 2025 to 2035

Topical Wound Agents Market Analysis - Trends, Growth & Forecast 2025 to 2035

Digital Wound Measurement Devices Market is segmented by Diabetic Ulcer, Chronic Wounds, Burns from 2025 to 2035

Advance Wound Care Market Analysis by Advance Wound Dressings, NPWT Devices and Others through 2035

Surgical Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA