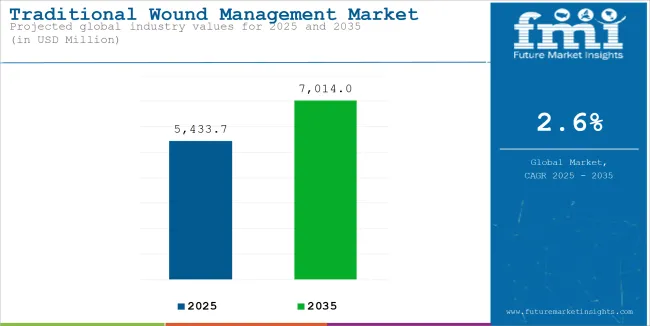

The global market for traditional wound management is forecasted to attain USD 5,433.7 million by 2025, expanding at 2.6% CAGR to reach USD 7,014.0 million by 2035. In 2024, the revenue of this market was around USD 5,306.5 million.

Traditional wound care market is expected to experience stable growth in 2025-2035 due to increasing acute and chronic wound incidences, ageing population, and health care spending worldwide.

Traditional wound items, including gauze, bandages, cotton, and plain wound dressings, have universal uses in clinics, hospitals, and home-care. They are cost-effective, easy to apply, and available, hence become unavoidable, especially in regions where there is a lack of sophisticated wound-care technologies.

The traditional ones are still relevant, though wound management continues to evolve; especially those countries where low- and middle-income mortalities offer sufficient constraints one defines profitable solutions.

With the above-average rise in the diabetic population and its complications, including diabetic foot ulcers, the products used for traditional wound care seem to have gained acceptance. Furthermore, the rising incidence of trauma and injuries along with burns and surgical wounds is keeping the demand for conventional dressings.

The traditional wound-care industry faces low innovation and increased competition on the advanced end from hydrocolloids, bioactive dressings, and the impending issue of non-sterile dressings posing a risk of wound contamination. Nevertheless, the traditional is still preferred, creating a bottleneck for the rising countries' healthcare infrastructure to ensure growth.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5,433.7 million |

| Industry Value (2035F) | USD 7,014.0 million |

| CAGR (2025 to 2035) | 2.6% |

Conventional wound care items, including gauze, bandages, and cotton, remain the market leaders because of their affordability, convenience, and universal availability. These items offer an economical way of managing wounds, hence remain a popular option in healthcare institutions and home care. Their ease of application and efficacy in simple wound healing also account for their continued popularity.

In low- and middle-income countries, where the budgets for healthcare are typically tight, traditional wound dressings continue to be the first choice in wound management. Most healthcare systems in these countries favor cost-effective solutions, particularly in rural communities with limited access to sophisticated wound care technology.

Humanitarian relief organizations and government health programs also tend to supply traditional wound care products as a component of standard medical supplies. Even with improved wound care, the cost and availability of traditional dressings guarantee that they will remain in use, especially in cost-conscious healthcare settings.

Gauze will dominate the Market Due to their wide application in wound dressing

Woven and non-woven gauzes are the most preferred gauzes or cloths with elastic properties, low cost, and versatility in different wound environments. Cotton woven gauzes are in high demand in the market as they are most suitable for exudating wounds by virtue of their terrific strength and absorbency.

Non-woven synthetic-fiber bonded gauzes have comingled benefits over woven gauzes such as improved absorbency, reduced linting, and better comfort. The market growth is aided by the rising demand for hi-tech non-woven gauze products and an increasing number of surgical operations and trauma cases.

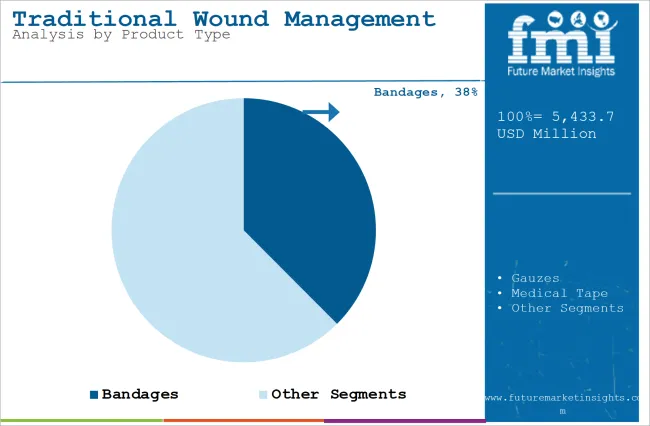

Bandages segment holds the second largest share in the market due to their essential role in wound protection, support, and healing.

Bandages segment holds the second largest share in the market due to their essential role in wound protection, support, and healing

Bandages are the second largest in the traditional wound care market because of their critical function of protecting, supporting, and healing wounds. The adhesive bandage and the compression bandages are the most common types of bandages in use.

Adhesive bandages are generally applied to smaller cuts, scrapes, and surgical wounds that require immediate wound protection. Moreover, the demand for waterproof and antimicrobial adhesive bandages grew.

Compression bandages are, however, one of the very critical parts of the management of chronic venous ulcers, deep wounds, and post-operative healing in that, compression therapy boosts blood circulation and helps reduce edema.

All these are driving the rise in demand on the market due to increasing incidences of chronic wounds coupled with the innovations in bandaging materials-one of which is the introduction of permeable and hypoallergenic bandages.

The Surgeries will dominate the market due to the growing number of surgeries worldwide

Surgical wound care happens to be the largest application in the traditional wound care management that is witnessing the highest growth with the rising number of surgeries across the world. Wound management after surgeries is carried out with bandages, gauzes, and sponges in order to provide protection from infection and facilitate healing.

Increasing incidences of chronic diseases such as cardiovascular diseases, cancer, and diabetes in turn increase the number of surgeries being done. This factor in turn has increased the demand for wound management products.

On the other hand, with the advancement in super-absorbent and antimicrobial dressings, surgical wound care is being enhanced and in turn decreases infection rates and assures health outcomes for patients. Increasing occurrences of pressure ulcerations and diabetic foot ulcers are driving demand for traditional wound care products mainly.

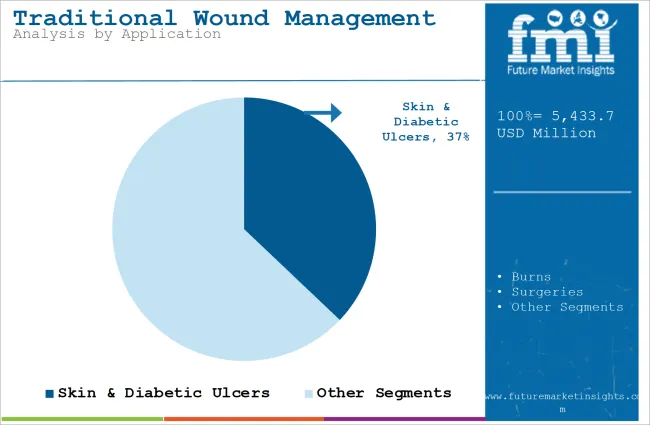

Skin and diabetic ulcers are another major segment as diabetic ulcers being a very dreadful complication of diabetes require frequent dressings of the wound.

Diabetes ulcer as a dreadful complication of diabetes require and deserve frequent dressing changes to prevent infection and promote healing. Bandages and gauzes, especially nonadherent dressings, play a significant role in the ulcer management as they provide optimum moist environment for the wound while minimizing trauma on the dressing process.

Although increases in cases of diabetes are universal, chronic wounds are becoming more prevalent in the older and aging population, establishing further credibility for the cost-effective traditional way of wound management.

North America is the winning region as far as conventional wound care is concerned, with high incidences of chronic wounds either from surgery or trauma. Another very significant factor contributing to the market growth is the elderly population, many of whom are prone to developing wounds like venous ulcers, pressure ulcers, and diabetic foot wounds.

Government healthcare schemes such as Medicare and Medicaid benefit in making wound care product availability easier for patients, hence driving demand further. Home healthcare with increased awareness of best practices for wound management is driving an even greater use of traditional wound care products.

The market, however, is challenged by innovative wound care technologies like hydrocolloid and foam dressings, which have faster healing rates and superior moisture management. But low-cost alternatives, especially for outpatient care applications and first aid uses, remain to support North American demand for conventional wound care products.

Europe is a significant market for conventional wound care due to increasing incidence of chronic wounds, the aging population, and well-developed healthcare infrastructure. Germany, France, and the UK are the most important markets with hospital and home healthcare services having a high value share in the use of conventional wound care products.

Growing numbers of procedures, especially orthopedic and cardiovascular procedures, are the cause of steady demand for bandages, gauze, and dressings. Additionally, cost-containment therapies as preferred by European healthcare policy have been a factor in continued use of older wound care products in public facilities and nursing homes.

Although, EU Medical Device Regulation (MDR) regulations pose compliance burdens to manufacturers that affect product availability. Rising demand for sophisticated products like antimicrobial dressings and bioactive wound care products also restricts development. Still, Europe's healthcare cost-saving solution demand and mounting interest in not infecting a wound are predicted to propel demand in the market.

Asia-Pacific is most likely to report the highest rate of growth for the traditional wound management market due to rising awareness of healthcare, more surgical processes, and rising population aging. China, India, and Japan are prime markets, and government initiatives for rural wound care facilities are also fueling business expansion.

Traumatic injuries, operations, and diabetes-induced high wound rates are fueling the demand within the region. Moreover, growing medical infrastructure within the region, increased disposable incomes, and heightened health awareness are driving higher adoption of wound care products.

These advancements notwithstanding, disadvantages such as irregularity in product quality, nonstandardization, and limited reimbursement schemes for wound management remain a hindrance to growth in the market. In addition, availability of spurious wound management products in some territories poses a threat to patient health.

However, with increased expenditure on healthcare as well as a bid to raise standards within hospitals, the Asia-Pacific traditional wound management market will grow actively in the forecasting period.

Competition from Advanced Wound Care Solutions Limiting the Market Growth

One of the greatest challenges for the traditional wound care industry is competition from innovative wound care products. With new technologies such as hydrogel dressings, negative pressure wound therapy (NPWT), and bioactive dressings taking hold, traditional products will see their market share eroded, especially in developed economies.

The other significant challenge is preventing infection and wound contamination. Traditional bandage and gauze dressings can have to be replaced numerous times, undermining wound healing as well as increasing the possibility of infection. Inferior or sterile products further augment such dangers, particularly in low-income economies. The regulatory hurdles and cost pressure are challenges for firms as well.

While cheaper than innovative products, conventional wound care products have price competition and pressure to conform to changing safety standards from their manufacturers. There are also narrow reimbursement policies of conventional wound care products in other areas that affect patients' access and affordability.

Emerging Economies Present Lucrative Growth Prospects

The conventional wound care market holds great opportunities, especially in the emerging markets where affordable healthcare solutions are highly demanded. With governments investing in widening access to healthcare, demand for low-cost wound care products will increase, with developing nations emerging as major growth regions.

The other opportunity is product innovation. Although generic wound care products appear simple, companies now innovated to make them more functional, including adding coatings with antimicrobial properties, moisture-receptive features, and biodegradable elements to improve healing of wounds.

The trend that also spurs this market is the increase in the e-commerce and direct-to-consumer sales channels. Most patients now buy wound care products online, especially for home healthcare. This is boosting accessibility and prompting manufacturers to invest in digital marketing strategies.

The historical market for wound management saw steady growth from 2020 to 2024 on account of the growing chronic wounds, surgeries, and trauma cases. Wheeled forward by the demand for conventional wound dressing and management items such as gauze, bandages, cotton dressings, and adhesive tapes, this demand was particularly keen in developing countries with more limited access to specialty products for wound care.

Such demand was further reinforced through rising healthcare expenditures as well as government initiatives aimed at improving the wound care management situation. This, however, has also posed challenges in the face of competition from advanced wound care products and sensitivity to prices in emerging markets.

Looking ahead to 2025 to 2035, growth will be influenced by the adoption in home healthcare environments, rural understanding of general wound care, and convergence with digital monitoring devices for health. Affordable solutions will continue to be paramount, fueling demand in lower-income groups and emerging economies.

Environmental sustainability issues will create momentum towards biodegradable and green wound care products. Supply chain optimization and localized production will further improve resilience and reach of markets.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with safety and sterilization standards; variations in reimbursement policies across regions. |

| Technological Advancements | Basic improvements in wound dressing materials and adhesive technology. |

| Consumer Demand | High demand in hospitals, home care settings, and emergency care due to affordability and ease of use. |

| Market Growth Drivers | Rising surgical procedures, increasing awareness of infection prevention, and growing healthcare investments. |

| Sustainability | Limited focus on eco-friendly materials, with high reliance on disposable wound care products. |

| Supply Chain Dynamics | Reliance on global supply chains; occasional disruptions due to raw material shortages and transportation issues. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Potential for global standardization of regulations, improved reimbursement frameworks, and stricter quality control measures. |

| Technological Advancements | Integration with smart wound monitoring systems, antimicrobial coatings, and eco-friendly materials. |

| Consumer Demand | Continued preference in cost-sensitive markets, with increasing adoption in home healthcare and first-aid applications. |

| Market Growth Drivers | Expansion in rural healthcare infrastructure, government health programs, and increased awareness of proper wound care. |

| Sustainability | Shift toward biodegradable dressings, sustainable packaging, and reduction of medical waste. |

| Supply Chain Dynamics | Greater localization of production, diversification of suppliers, and improved inventory management to prevent shortages. |

A rise in chronic wounds, the number of surgical procedures being performed, and the availability of a well-knit healthcare infrastructure are responsible for driving the traditional wound care market in the US. The need for economically priced and readily accessible wound care products for home care environments and long-term care facilities remains.

The presence of major medical device companies along with an efficient distribution network, which helps support the growth of the market. Moreover, more acceptance is given to cost-saving wound care products in the outpatient settings.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 1.4% |

Market Outlook

The German wound closure market, at its present state, is being supported by an established healthcare system, rising incidence of chronic wounds, and a good network of professionals for wound care. Wound-care products continue to receive a steady stimulus from a high volume of surgical cases and an increasing elderly population.

Advanced solutions for wound care exist, but because of the low cost and proven efficacy in primary care centers, traditional dressings remain popular.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 1.8% |

Market Outlook

India's traditional wound care industry is expanding with the rising need for affordable and accessible wound care products. Since there is a high incidence of injuries, burnings, and diabetic ulcers, there has always been huge demand in both urban and rural areas.

Government health programs are also supplementing availability of basic medical accessories, including traditional wound dressings. The demand for affordable and easily available wound care products continues to propel market expansion.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 3.2% |

This Japanese market is dominated by the strong influencing factors of an aging population, a growing incidence of chronic wounds, and an established healthcare infrastructure. The demand for wound care facilities will be highest in long-term-care centers and home healthcare environments.

Although many advanced wound care products are available, conventional dressings still hold wide use due to their economical nature and efficacy. This accessibility is further augmented by healthcare policy and insurance coverage.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.1% |

Brazil's traditional wound care market is expanding owing to the heavy demand for economical and available wound care products. The rise in the trauma injuries burden, chronic wounds, and surgical operations has stimulated demand for traditional wound dressings across hospitals, clinics, and home healthcare settings.

Government-run healthcare schemes are the biggest drivers in achieving mass penetration for wound management products, especially among rural communities.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 1.9% |

The conventional wound care market has been ever-growing since there is an increasing incidence of acute and chronic wounds, more and more surgeries, and an older population. Whereas advanced wound-management therapies are establishing themselves, conventional wound-care products still remain in the center stage of wound management due to their very reasonable cost and availability.

Major players in this respect are focusing on almost every aspect of enhancing their products, strengthening their distribution networks, and establishing alliances and partnerships to gain an upper hand in the market.

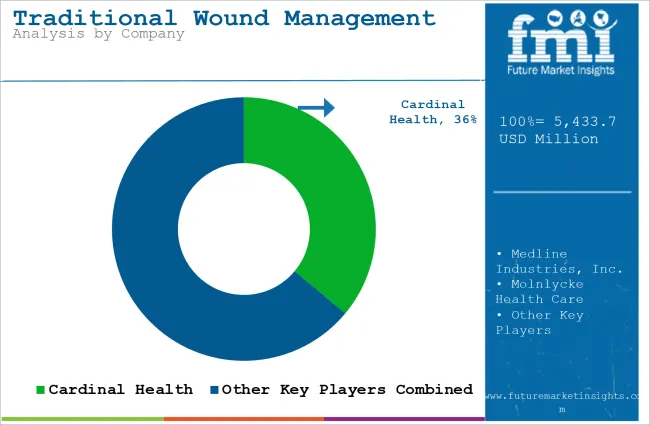

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cardinal Health | 18.7% |

| Medline Industries, Inc. | 16.2% |

| Molnlycke Health Care | 13.5% |

| 3M | 6.3% |

| Paul Hartman AG | 5.8% |

| Other Companies (combined) | 39.4% |

| Company Name | 3M Company |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Specializes in high-quality adhesive dressings, surgical tapes, and wound dressings. |

| Company Name | Medline Industries, LP |

|---|---|

| Year | 2025 |

| Key Offerings/Activities | Offers affordable and hospital-grade gauze, bandages, and wound care products. |

| Company Name | Smith & Nephew plc |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Develops high-performance wound care solutions, including antiseptic dressings. |

| Company Name | Cardinal Health |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Provides a wide range of bandages, gauze, and first-aid wound care products. |

Key Company Insights

Cardinal Health (18.7%)

Medtronic Plc, which is a technical leader in their field and offers access to innovative endovascular stent graft systems that enable minimally invasive surgery and are ideal to support the treatment of aortic aneurysm with better recovery times and fewer complications.

Medline Industries, Inc. (16.2%)

Cardinal Health is known to make a mark in the cardiovascular care industry through its array of medical devices and healthcare solutions used to treat aortic and vascular diseases. The company is crucial in providing stent graft technology and other key medical products to healthcare professionals. Cardinal Health is also concerned with digital health solutions and patient compliance programs, driving treatment success and better patient outcomes.

Molnlycke Health Care (13.5%)

Cook medical is a global medical devices company involved in designing personalized stent graft solutions specifically for individual patient anatomies to enhance procedural success rates and patient satisfaction.

3M (6.3%)

BD is one of the leaders in traditional wound management grafts manufacturers that support minimally invasive cardiovascular intervening using a diverse range of medical devices and vascular access solutions. BD focuses on developing next-generation stent graft delivery systems and driving advancements in endovascular repair technology to help enhance patient care

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

The global traditional wound management industry is projected to witness CAGR of 2.6% between 2025 and 2035.

The global traditional wound management market stood at USD 5,306.5 million in 2024.

The global traditional wound management market is anticipated to reach USD 7,014.0 million by 2035 end.

India is expected to show a CAGR of 3.2% in the assessment period.

The key players operating in the global traditional wound management industry are Cardinal Health, Medline Industries, Inc., Molnlycke Health Care, 3M, Paul Hartman AG, Medtronic, B. Braun SE, Smith & Nephew, DUKAL Corporation, BSN Medical and Others

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Traditional Toys and Games Market Size and Share Forecast Outlook 2025 to 2035

Wound Wash Market Size and Share Forecast Outlook 2025 to 2035

Wound Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Wound Evacuators Market Size and Share Forecast Outlook 2025 to 2035

Wound Skin Care Market - Demand & Forecast 2025 to 2035

Wound Stimulation Therapy Market Insights – Demand and Growth Forecast 2025 to 2035

Wound Care Surfactant Market Insights – Demand and Growth Forecast 2025 to 2035

Analysis and Growth Projections for Wound Healing Nutrition Market

Wound Irrigation Systems Market Growth - Trends & Forecast 2025 to 2035

Wound Debridement Products Market Analysis - Growth & Forecast 2025 to 2035

Global Wound Filler Market Analysis – Size, Share & Forecast 2024-2034

Wound Measurement Devices Market

Wound Irrigation Devices Market

Wirewound Resistor Market Size and Share Forecast Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Spiral Wound Membrane Market

The Chronic Wound Care Market is segmented by product, wound type and distribution channel from 2025 to 2035

Topical Wound Agents Market Analysis - Trends, Growth & Forecast 2025 to 2035

Digital Wound Measurement Devices Market is segmented by Diabetic Ulcer, Chronic Wounds, Burns from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA