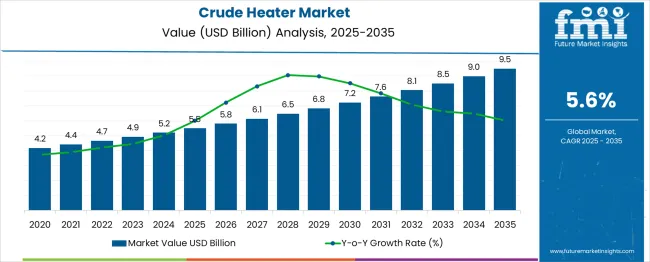

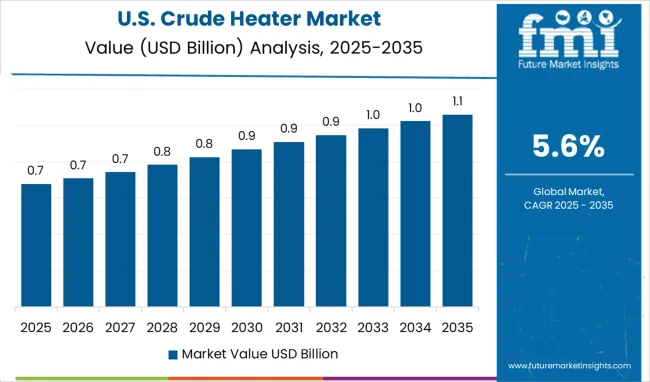

The Crude Heater Market is estimated to be valued at USD 5.5 billion in 2025 and is projected to reach USD 9.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The crude heater market is advancing steadily as oil refining and processing facilities continue to optimize thermal systems for improved efficiency. The demand for reliable crude heaters that support stable and efficient crude oil heating has grown with increased global refining capacity expansions. Industry experts have highlighted the importance of crude heaters in maintaining optimal feedstock temperature, which ensures smoother distillation and processing.

Rising investments in refineries with smaller capacity units have increased the adoption of compact heaters tailored for specific throughput requirements. Technological improvements in heater design have focused on energy efficiency and emissions reduction, supporting compliance with stricter environmental standards.

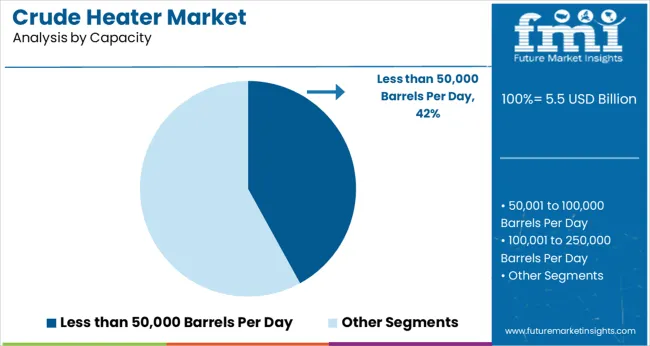

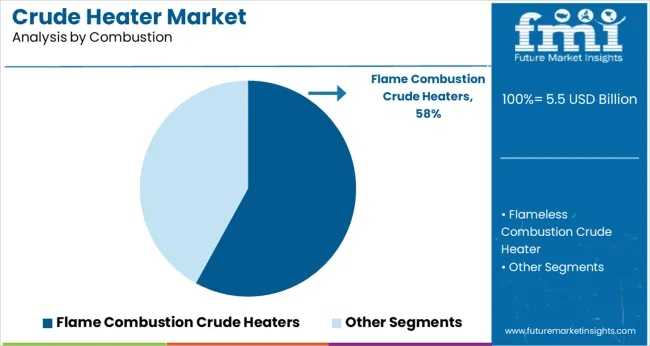

As crude oil processing complexity grows, the market outlook remains positive with ongoing efforts to upgrade existing infrastructure and build new capacity. Segmental growth is expected to be led by heaters with a capacity of less than 50,000 barrels per day and flame combustion crude heaters due to their operational efficiency and adaptability.

The market is segmented by Capacity and Combustion and region. By Capacity, the market is divided into Less than 50,000 Barrels Per Day, 50,001 to 100,000 Barrels Per Day, 100,001 to 250,000 Barrels Per Day, and Above 250,000 Barrels Per Day. In terms of Combustion, the market is classified into Flame Combustion Crude Heaters and Flameless Combustion Crude Heater.

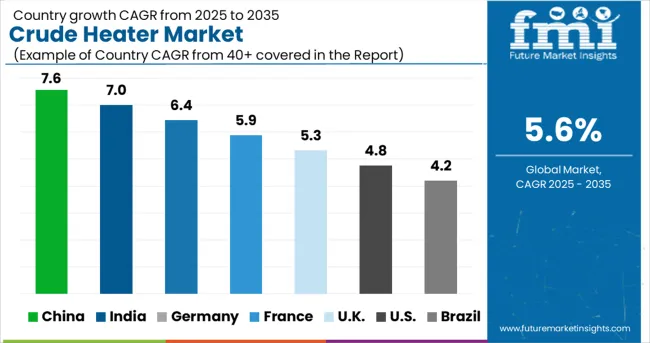

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The less than 50,000 barrels per day capacity segment is projected to hold 42.0% of the crude heater market revenue in 2025, securing its position as the leading capacity category. This segment's growth is driven by the increasing number of small to medium-sized refineries and processing units, especially in regions focusing on localized production.

Operators have favored heaters in this capacity range for their ability to efficiently manage feedstock heating without requiring oversized equipment. Additionally, the segment benefits from the flexibility to be integrated into modular refinery setups and revamp projects.

Demand for capacity-appropriate heaters that balance performance with operational cost has kept this segment attractive to refinery managers. The rise in demand for customized heating solutions tailored to specific refinery scales supports continued growth in this category.

The flame combustion crude heaters segment is projected to account for 58.0% of the market revenue in 2025, maintaining its dominance among combustion types. These heaters have been widely used due to their simplicity, proven reliability, and ability to provide high heat transfer rates necessary for crude oil processing.

The direct flame application allows efficient heating with effective fuel utilization, which is critical in refinery operations focused on energy management. The segment has also benefited from ongoing enhancements in burner technology that improve combustion efficiency and reduce emissions.

Regulatory requirements have prompted upgrades to cleaner and safer flame combustion systems, which maintain their preference due to operational familiarity and cost-effectiveness. The continued reliance on this combustion type ensures its strong market presence in crude heating applications.

With rapid surge in trend of industrialization and increasing usage of oil and petroleum derivatives such as gasoline, diesel, liquefied petroleum gas (LPG), and others, the consumption for crude oil has bolstered across the globe.

For instance, according to a report by the International Energy Agency, the demand for crude oil worldwide increased to 4.2 million barrels per day in the year 2020, in comparison to the 4.2 million barrels per day in 2020. Thus, governments in numerous countries are aiming at increasing their crude oil production to cater to the growing demand for crude oil.

According to the India Brand Equity Foundation, the Government of India announced investing nearly USD 5.5 billion for drilling more than 120 exploration wells to double the production of oil & gas in the country by 2025. As crude heaters are extensively used in the oil & gas refineries and production facilities for better separation of crude oil and improving fluidity, such initiatives for increasing production of crude oil are projected to fuel the demand in the global market.

Due to the rising environmental concerns pertaining to greenhouse gasses and volatile organic compounds (VOCs) emission, government and various other regulatory organizations are implementing numerous stringent regulations for declining the production of crude oil products. For instance, European Union announced laying regulatory Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulations addressing the production and use of substances such as process oil.

In addition to this, surging trend of electrification, ban on the sales of new diesel cars, and increasing inclination towards adopting electric vehicles has resulted in declining the demand for crude oil products, which is in turn, hindering the sales of crude oil sales in the market.

Future Market Insights states that Asia Pacific excluding Japan is expected to register the fastest growth in the global crude heater market from 2025 to 2035.

Demand for crude oil derivatives is rapidly increasing, owing to the expanding automotive industry and growing trend of industrialization and urbanization across Asia Pacific. Citing this trend, leading industry players are investing in expanding their production capacity and increasing refining efficiency to capitalize on the existing opportunity.

For instance, Bharat Petroleum Corporation Ltd, an Indian petroleum refineries company announced investing over 13.66 Bn to improve refining efficiency, enhance petrochemical capacity, and increase their petroleum derivatives production over a period of five years. A multiplicity of such developments is estimated to spur the sales of crude heaters in the Asia Pacific excluding Japan market.

As per FMI, North America is anticipated to account for a significant share in the global crude heater market over the forecast period 2025-2035.

A swift rise in sales of automotive vehicles is being witnessed across North America, resulting in propelling the demand for crude oil products. Thus, numerous industry players are aiming at launching new crude oil refineries to meet the surging demand.

For instance, in 2020, Targa Resources Corporation, a USA-based oil & gas company announced launching its new petroleum refinery at Channelview, Texas with refining capacity of 35,000 barrels per day. As crude heaters are increasingly used in oil & gas refineries, such developments across the USA and Canada are projected to augment the demand in the North America market.

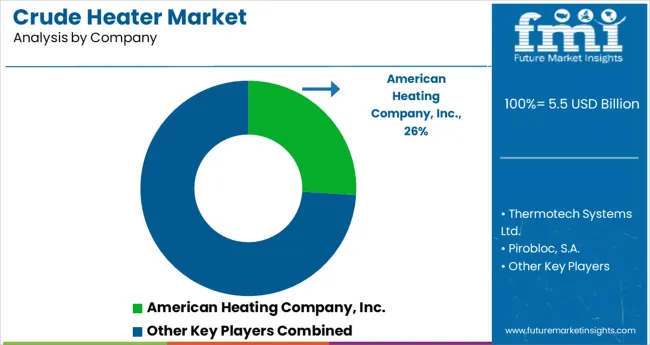

Some of the leading players in the crude heaters market are American Heating Company, Inc., Thermotech Systems Ltd., Pirobloc, S.A., Garcem Engineers, Exotherm Corporation, Chromalox, Inc., C. Broach Company, and Amec Foster Wheeler.

The market for crude heaters is highly competitive, due to large number of participants and increasing adoption of strategies such as collaboration, agreement, and partnership to strengthen the market share.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.6% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in billion, Volume in Kilotons and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Capacity, Combustion, Region |

| Countries Covered | North America, Latin America, Western Europe, Eastern Europe, APEJ, Japan, Middle East and Africa |

| Key Companies Profiled | American Heating Company, Inc.; Thermotech Systems Ltd.; Pirobloc, S.A.; Garcem Engineers; Exotherm Corporation; Chromalox, Inc.; C. Broach Company; Amec Foster Wheeler |

| Customization | Available Upon Request |

The global crude heater market is estimated to be valued at USD 5.5 billion in 2025.

It is projected to reach USD 9.5 billion by 2035.

The market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types are less than 50,000 barrels per day, 50,001 to 100,000 barrels per day, 100,001 to 250,000 barrels per day and above 250,000 barrels per day.

flame combustion crude heaters segment is expected to dominate with a 58.0% industry share in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.