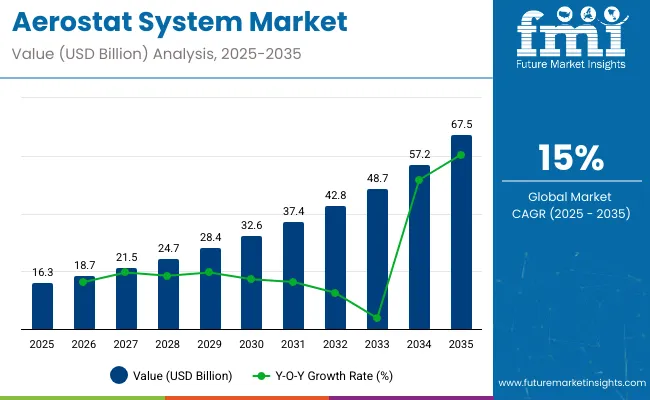

In 2025, the aerostat system market stands at USD 16.3 billion and will reach approximately USD 67.5 billion by 2035, growing at a CAGR of 15%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 16.3 billion |

| Industry Value (2035F) | USD 67.5 billion |

| CAGR (2025 to 2035) | 15% |

Analysis of the contribution of volume versus price growth indicates that expansion is driven by both increased deployment of aerostat systems and technological advancements that enable higher-value offerings. Volume growth is supported by rising demand in defense, surveillance, and disaster management applications, as governments and organizations invest in persistent aerial monitoring capabilities.

Price growth contributes through the introduction of advanced systems with enhanced payload capacity, improved sensor integration, longer endurance, and autonomous operation. Premium systems command higher prices, reflecting technological sophistication and operational efficiency. Early in the decade, volume expansion accounts for the larger share of growth as adoption spreads across regions with emerging security and monitoring requirements. In the later years, price growth becomes more significant as advanced aerostat systems gain preference over conventional models, offering superior performance and reliability. By 2035, with the market reaching 67.5 billion and a multiplying factor of about 4.1x, growth is expected to balance contributions from both volume and price, demonstrating that long-term expansion is supported by widespread adoption and continuous technological innovation across aerospace and defense sectors.

The market is expanding with rising defense surveillance requirements and technological upgrades. Global defense budgets allocated for ISR (intelligence, surveillance, reconnaissance) platforms increased by 8% in 2024, directly driving aerostat adoption. High-altitude aerostat systems capable of carrying payloads up to 600 kg have seen deployment growth of 20% year-on-year in border security operations. Integration with advanced radar, EO/IR sensors, and communication relays is improving monitoring coverage by 30-35% per system. Lighter envelope materials and tether management technologies are enhancing operational endurance, with flight durations extending from 7 to 15 days per deployment. Strategic partnerships between OEMs and military agencies are accelerating production, while modular payload designs are increasing versatility and cost efficiency.

The market is influenced by multiple upstream sectors. Defense and homeland security applications account for approximately 44%, reflecting demand for surveillance, border security, and reconnaissance. Aerospace and unmanned systems manufacturing contributes about 27%, providing platforms, tether systems, and payload integration. Sensors and electronic systems represent roughly 15%, supplying radars, cameras, and communication modules. Service providers and operational support make up around 9%, covering deployment, maintenance, and training. Research and development institutions hold close to 5%, focusing on technology enhancement, system optimization, and testing.

Military applications dominate, accounting for nearly 70% of deployments, followed by commercial surveillance and communication networks. Large tethered systems with payload capacities of 500-1,200 kg are primarily used for border security and early warning, while smaller 50-200 kg units serve disaster monitoring and temporary network coverage. Average operational endurance ranges from 7 days for compact units to 30 days for large strategic platforms. North America and Europe contribute over 65% of the installed base, while Asia Pacific and the Middle East are growing fastest due to infrastructure monitoring and security expansion.

Rising requirements for long-duration surveillance and early warning systems are driving aerostat adoption. Large tethered systems can cover areas of 100-250 km² per unit, hosting multiple sensors simultaneously, including radar, optical, and communication payloads. Operational cost per flight hour is roughly 30-50% lower than equivalent manned aircraft or drone missions. Military and defense organizations are deploying aerostats for border monitoring, critical infrastructure protection, and persistent area surveillance. Strategic aerostats also serve as platforms for electronic intelligence collection and communication relays, improving situational awareness. Growth in government security budgets and increased focus on cross-border monitoring are expected to sustain adoption.

Aerostats are increasingly used in commercial sectors such as pipeline surveillance, disaster management, traffic monitoring, and wireless communication extension. Systems with 50-200 kg payloads can operate continuously for 15-30 days with minimal maintenance. Integration with UAVs and ground-based sensors enhances monitoring efficiency and allows scalable deployment across urban and remote areas. Energy-efficient tethered designs reduce operational costs by up to 20% compared with conventional temporary monitoring solutions. Emerging industrial customers are exploring aerostats for real-time data collection, temporary communication networks, and emergency response, expanding the market beyond traditional defense applications.

Next-generation aerostats feature smart payloads including radar, electro-optical sensors, and communication relays with integrated real-time data transmission. Stabilized platforms maintain accuracy under high wind speeds of 25-35 km/h, improving monitoring quality. Remote monitoring and predictive maintenance reduce downtime by 12-15%, while tether and material innovations extend operational endurance by 10-20%. Connectivity with UAVs, satellites, and ground networks enables coordinated surveillance and rapid response. Some large platforms can carry payloads exceeding 1,000 kg while maintaining 30-day continuous operation, supporting military, border security, and industrial monitoring applications simultaneously.

High procurement costs ranging from USD 500,000 for compact units to USD 20 million for large strategic platforms limit adoption among cost-sensitive buyers. Regulatory approval for airspace use and payload certification can extend deployment timelines by 6-12 weeks. Maintenance and ground support add 15-20% to operational expenditures. Supply chain constraints for specialized sensors, radar, and tether materials can delay production. Export controls and regional airspace regulations restrict global sales. Large-scale deployments require substantial investment in ground infrastructure, training, and maintenance planning, making initial cost and regulatory compliance the primary adoption barriers.

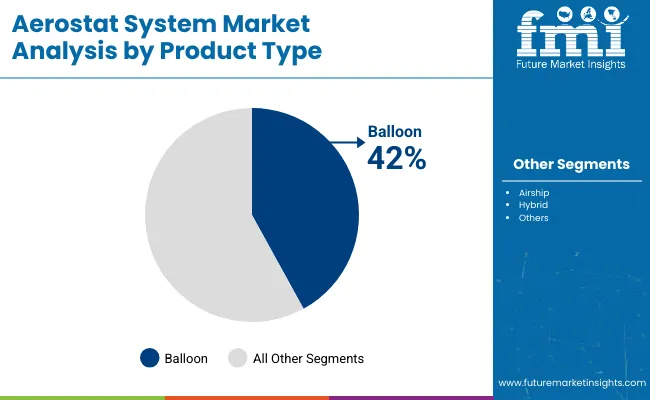

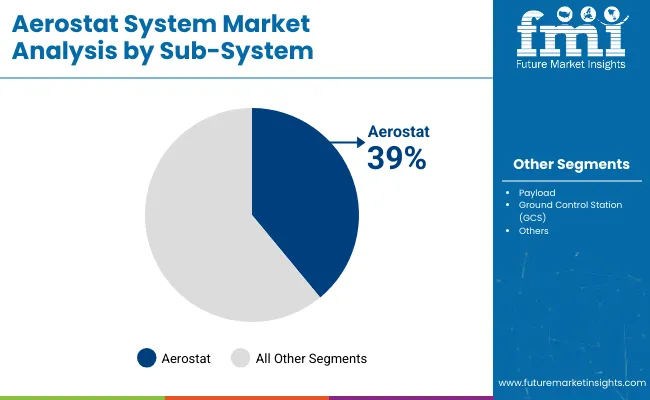

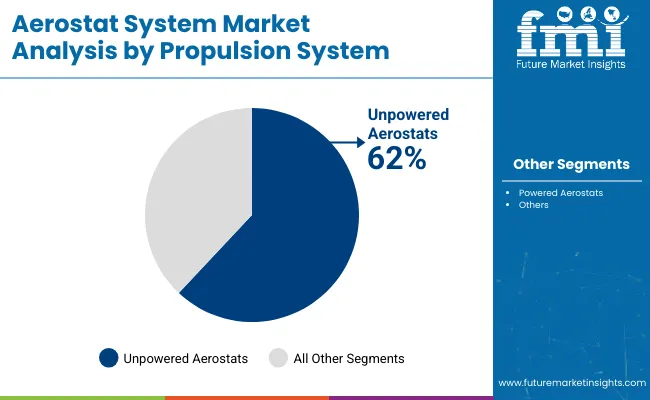

The market in 2025 is shaped by increasing demand for surveillance, reconnaissance, and communication applications. Balloon systems dominate product demand at 42%, followed by airships at 36% and hybrid systems at 22%. Aerostat envelopes lead sub-system demand with 39% share, followed by payloads at 34% and ground control stations (GCS) at 27%. Unpowered aerostats account for 62% of propulsion system demand, while powered aerostats hold 38%. OEMs such as Lockheed Martin, Raven Aerostar, and TCOM supply global defense and commercial operators. Rising border security initiatives, persistent aerial surveillance, and low-cost monitoring solutions drive market adoption. Lightweight envelopes, advanced payload integration, and mission-specific designs remain critical for operational efficiency and system reliability.

Balloon systems capture 42% of product demand, widely used in high-altitude surveillance and intelligence gathering due to low operational cost and simple deployment. Airships account for 36% of demand, suitable for long-endurance missions with heavier payloads, while hybrid systems contribute 22%, balancing lift and propulsion for tactical and mobile operations. Balloons are preferred for commercial monitoring and environmental observation, while airships and hybrid aerostats serve defense missions requiring persistent observation and data relay. OEMs such as Lockheed Martin, TCOM, and Raven Aerostar optimize payload capacity, flight endurance, and material strength to meet diverse operational needs. Market growth is closely tied to rising demand for cost-effective, reliable aerial platforms capable of long-duration missions.

Aerostat envelopes lead sub-system demand with 39%, providing lift, stability, and environmental resistance. Payload modules account for 34% of demand, including EO/IR sensors (21%), surveillance radars (23%), communication intelligence (16%), and inertial navigation systems (14%). Ground control stations (27%) ensure precise command, navigation, and real-time data management. Lockheed Martin, Raven Aerostar, and TCOM integrate these sub-systems into fully operational platforms for commercial and defense applications. Aerostat envelopes use high-strength polymer composites for high-altitude performance, while payload modules are engineered for signal fidelity and mission-specific tasks. GCS units facilitate reliable data relay and operational control. Growth in border security, defense monitoring, and commercial surveillance programs underpins the continued expansion of this segment.

Unpowered aerostats dominate propulsion system demand with 62% share, used extensively for stationary surveillance, persistent monitoring, and cost-efficient deployment. Powered aerostats hold 38%, enabling mobile reconnaissance, heavier payload transport, and tactical military operations. Unpowered systems are widely deployed in commercial monitoring, environmental surveillance, and border security missions, while powered aerostats support mobile intelligence, communications relay, and long-duration defense operations. OEMs such as Lockheed Martin, Raven Aerostar, and TCOM manufacture these systems using advanced material design, aerodynamic stability, and payload integration. Operational efficiency, high-altitude endurance, and low-cost deployment make unpowered aerostats the preferred solution for large-scale surveillance, while powered aerostats address tactical and mobility-focused missions.

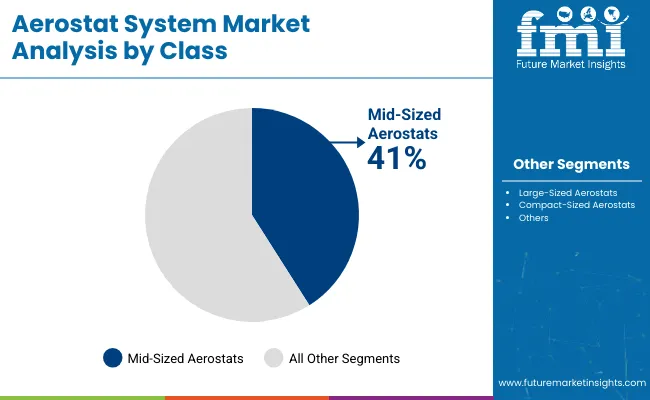

Mid-sized aerostats dominate the class segment with 41% share in 2025, providing a balance of payload capacity, flight endurance, and operational flexibility. Large-sized aerostats account for 33%, preferred for long-duration missions carrying heavy surveillance radar and communication payloads. Compact-sized aerostats contribute 26%, ideal for rapid deployment, border security, and tactical reconnaissance. OEMs including Lockheed Martin, Raven Aerostar, and TCOM manufacture all classes with high-strength envelopes, modular payload integration, and ground control compatibility. Mid-sized systems are widely used in commercial and defense monitoring, large aerostats in persistent military surveillance, and compact systems for agile intelligence gathering. Material choice, endurance, and payload efficiency determine mission suitability across applications.

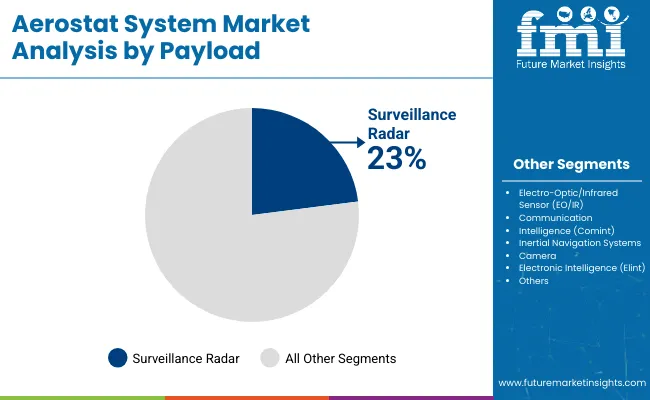

Surveillance radar leads the payload segment with 23% share, supporting high-altitude situational awareness and border security. EO/IR sensors hold 21%, enabling day/night reconnaissance and target identification, while Communication Intelligence (Comint) payloads account for 16%, providing real-time signal interception and communication monitoring. Inertial navigation systems contribute 14%, cameras 13%, and Electronic Intelligence (Elint) 13%. OEMs such as Lockheed Martin, TCOM, and Raven Aerostar integrate these payloads into aerostat systems, ensuring optimized weight distribution, power management, and data fidelity. Commercial aerospace applications prioritize EO/IR and cameras, while military applications rely on surveillance radar, Comint, and Elint for persistent intelligence operations. Payload selection directly impacts mission effectiveness, operational duration, and real-time data acquisition.

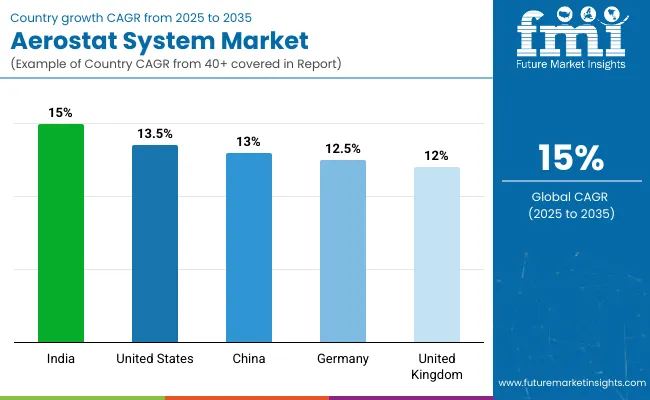

In 2025, the global aerostat system market is growing at a CAGR of 15% through 2035. India leads at 14.0%, slightly below the global rate, supported by BRICS-driven investment in surveillance, defense, and monitoring applications. The United States follows at 13.5%, −10% under the global CAGR, reflecting OECD-backed deployment in defense and border security projects. China records 13.0%, −13% below the global level, driven by BRICS-focused technological development and strategic infrastructure projects. Germany stands at 12.5%, −17% under the global average, shaped by steady adoption in OECD defense systems and aerial monitoring. The United Kingdom posts 12.0%, −20% compared with the global rate, reflecting incremental deployment in commercial and defense operations. The BRICS nations like India and China are advancing adoption rapidly, while OECD countries maintain steady growth supported by regulatory frameworks and technological upgrades.

The aerostat system market in the United States is projected to grow at a CAGR of 13.5%, below the global 15%, producing a multiplication factor of 0.90. Growth is driven by defense surveillance, border monitoring, and commercial applications. Platforms have been upgraded for high-altitude imaging, tethering reliability, and payload enhancement to meet operational demands. Strategic collaborations with domestic aerospace contractors have increased deployment efficiency, while research focuses on extending endurance and enabling persistent monitoring in multiple terrains. Advanced analytics software has been integrated for mission planning and real-time tracking. By 2035, the United States is expected to operate over 1,800 aerostat units supporting industrial, commercial, and defense missions.

China exhibits a CAGR of 13.0%, below the global 15%, giving a multiplication factor of 0.87. Expansion is driven by maritime surveillance, border security, and environmental monitoring. Platforms emphasize modular payloads and extended flight duration. Remote sensing capabilities and automated flight controls are widely adopted to enhance operational efficiency. Partnerships with regional suppliers have increased both production volume and system reliability. Investment in sensor technology and payload customization has accelerated adoption for civil and defense missions. By 2035, China is expected to operate over 1,650 aerostat units, providing persistent monitoring in both domestic and Asia-Pacific operational zones.

India records a CAGR of 14.0%, slightly below the global 15%, producing a multiplication factor of 0.93. Growth is driven by border security, disaster management, and critical infrastructure monitoring. High-end platforms have been optimized for endurance, payload versatility, and persistent observation over strategic areas. Domestic manufacturing and joint ventures have improved system availability and reduced lead times. Investment in sensor technologies and mission optimization has accelerated market adoption. By 2035, India is projected to operate over 1,400 aerostat units, supporting both defense and civil monitoring projects. Advanced software tools for monitoring, data transmission, and real-time reporting are being widely implemented to enhance operational efficiency.

Germany is expected to grow at a CAGR of 12.5%, below the global 15%, resulting in a multiplication factor of 0.83. Growth is linked to industrial monitoring, environmental surveillance, and selective defense applications. Platforms are designed for precision deployment, payload modularity, and operational reliability under varying weather conditions. Manufacturers emphasize durability, quality assurance, and system standardization. Integration with ground-based monitoring networks enhances coverage for research, industrial, and civil applications. By 2035, Germany is expected to operate over 1,050 aerostat units supporting environmental monitoring, energy infrastructure supervision, and regional defense programs. Advanced payload calibration and data processing capabilities are widely used to maintain operational accuracy.

The United Kingdom aerostat system market is projected to grow at a CAGR of 12.0%, below the global 15%, giving a multiplication factor of 0.80. Adoption is concentrated on maritime surveillance, defense monitoring, and emergency response programs. Platforms emphasize high payload capacity, operational stability, and integration with real-time intelligence networks. Collaboration with European manufacturers enhances standardization and capability expansion. By 2035, the United Kingdom is expected to maintain a fleet of over 950 aerostat units supporting civil, defense, and maritime operations. Upgrades focus on operational flexibility, sensor integration, and advanced mission planning. Endurance optimization and payload expansion are widely adopted to increase mission coverage.

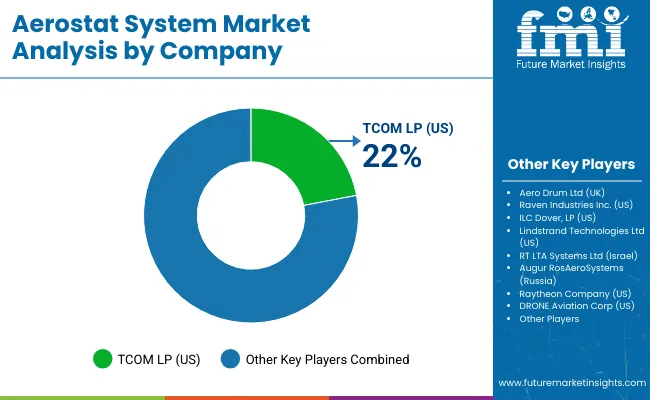

The industry is driven by global defense and surveillance technology providers offering tethered and free-flying lighter-than-air platforms. TCOM LP (US) is considered the leading player due to its advanced aerostat designs, high-altitude surveillance capabilities, and strong government and military contracts. Aero Drum Ltd (UK) and Raven Industries Inc. (US) maintain strong positions with modular aerostat solutions suited for both defense and civilian monitoring applications. ILC Dover, LP (US) focuses on aerostat envelopes and lifting systems with lightweight and durable materials, while Lindstrand Technologies Ltd (US) delivers custom aerostat solutions for specialized missions.

Other key companies are strengthening the market with regional and niche strategies. RT LTA Systems Ltd (Israel) develops aerostat systems tailored for border security and reconnaissance operations. Augur RosAeroSystems (Russia) emphasizes high-altitude surveillance and payload integration. Raytheon Company (US) and DRONE Aviation Corp (US) provide systems integrated with advanced sensors and communications technology for military applications. These players compete through technology reliability, operational endurance, and service support, ensuring a competitive landscape with both established leaders and specialized emerging companies in the aerostat system market.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 16.3 billion |

| Projected Market Size (2035) | USD 67.5 billion |

| CAGR (2025 to 2035) | 15% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Types Analyzed (Segment 1) | Balloon, Airship, Hybrid |

| Sub-Systems Analyzed (Segment 2) | Aerostat, Ground Control Station (GCS), Payload |

| Propulsion System Segments Analyzed (Segment 3) | Powered Aerostats, Unpowered Aerostats |

| Class Segments Analyzed (Segment 4) | Compact-Sized Aerostats, Mid-Sized Aerostats, Large-Sized Aerostats |

| Payload Types Analyzed (Segment 5) | Surveillance Radar, Inertial Navigation Systems, Camera, Communication Intelligence (Comint), Electro-Optic/Infrared Sensor (EO/IR), Electronic Intelligence (Elint) |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, United Kingdom, Germany, France, Italy, Russia, Israel, China, Japan, India, Australia, UAE, Saudi Arabia |

| Leading Players | TCOM LP, Aero Drum Ltd, Raven Industries Inc., ILC Dover LP, Lindstrand Technologies Ltd, RT LTA Systems Ltd, Augur RosAeroSystems, Raytheon Company, DRONE Aviation Corp |

| Additional Attributes | Dollar sales by system type and application, demand dynamics across surveillance, communication, and defense, regional trends across North America, Europe, and Asia-Pacific, innovation in tethered aerostat designs, payload capacity, long-endurance systems, environmental impact of materials and operations, emerging use in border security, disaster monitoring, and persistent aerial surveillance |

The market size is valued at USD 16.3 billion in 2025.

It is projected to reach USD 67.5 billion by 2035.

The market is expected to grow at a CAGR of 15% during 2025-2035.

Balloon holds the largest share with 42% in 2025.

TCOM LP is the leading player with 22% share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerostat Systems Market

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Systemic Infection Treatment Market

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

DWDM System Market Analysis by Services, Product, Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Brake System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

X-ray System Market Analysis - Size, Share, and Forecast 2025 to 2035

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Cough systems Market

Atomic System Clocks Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA