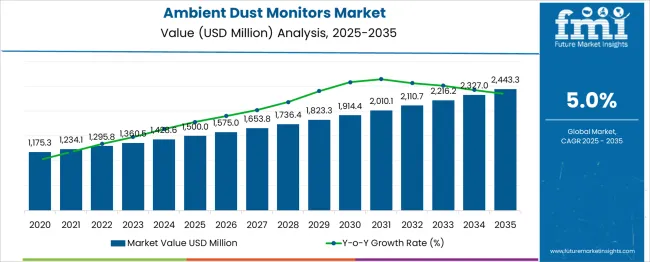

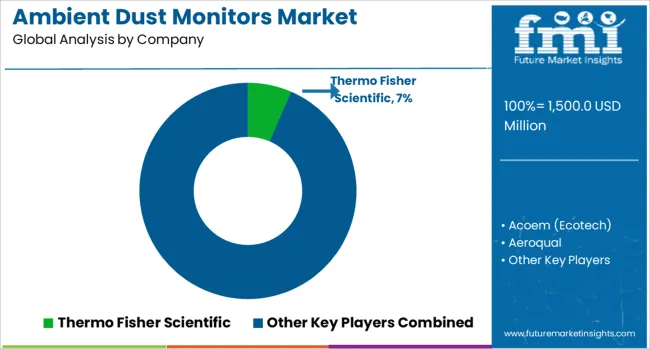

The global ambient dust monitors market is projected to grow from USD 1,500.0 million in 2025 to approximately USD 2443.3 million by 2035, recording an absolute increase of USD 943.3 million over the forecast period. This translates into a total growth of 62.9%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.0% between 2025 and 2035. The overall market size is expected to grow by nearly 1.63X during the same period, supported by the rising adoption of air quality monitoring systems and increasing demand for environmental compliance monitoring following stricter regulations and growing awareness of air pollution health impacts.

Between 2025 and 2030, the ambient dust monitors market is projected to expand from USD 1,500.0 million to USD 1,910.8 million, resulting in a value increase of USD 410.8 million, which represents 43.4% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of smart city initiatives in global urban areas, increasing industrial fenceline monitoring requirements, and growing awareness among regulatory bodies about the importance of continuous air quality monitoring. Service providers and manufacturers are expanding their monitoring capabilities to address the growing complexity of modern environmental monitoring systems.

From 2030 to 2035, the market is forecast to grow from USD 1,910.8 million to USD 2443.3 million, adding another USD 532.5 million, which constitutes 56.6% of the overall ten-year expansion. This period is expected to be characterized by expansion of portable monitoring solutions, integration of advanced IoT and cloud-based monitoring systems, and development of standardized monitoring protocols across different regulatory frameworks. The growing adoption of real-time data analytics and AI-powered environmental monitoring will drive demand for more sophisticated monitoring devices and specialized technical expertise.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,500.0 million |

| Forecast Value in (2035F) | USD 2443.3 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

Between 2020 and 2025, the ambient dust monitors market experienced steady expansion from USD 1,223.5 million to USD 1,500.0 million, driven by increasing environmental regulations and growing awareness of air pollution health impacts. The market developed as government agencies and industrial facilities recognized the need for continuous monitoring equipment to comply with environmental standards and protect public health. Environmental agencies and industrial operators began emphasizing proper monitoring procedures to maintain compliance with air quality standards and regulatory requirements.

Market expansion is being supported by the rapid increase in environmental regulations worldwide and the corresponding need for continuous air quality monitoring systems. Modern cities and industrial facilities rely on precise dust monitoring to ensure compliance with environmental standards including PM10, PM2.5, and total suspended particulate (TSP) measurements. Even minor changes in air quality can require comprehensive monitoring to maintain optimal environmental protection and public health safety.

The growing complexity of air pollution sources and increasing health consciousness are driving demand for professional monitoring systems from certified providers with appropriate equipment and expertise. Government agencies are increasingly requiring proper monitoring documentation to maintain environmental compliance and ensure public health protection. Regulatory requirements and environmental standards are establishing standardized monitoring procedures that require specialized equipment and trained technicians.

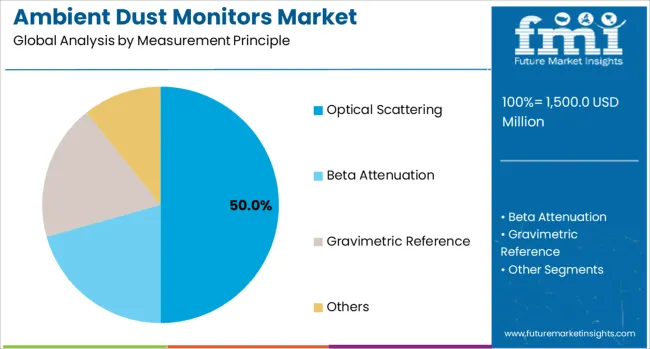

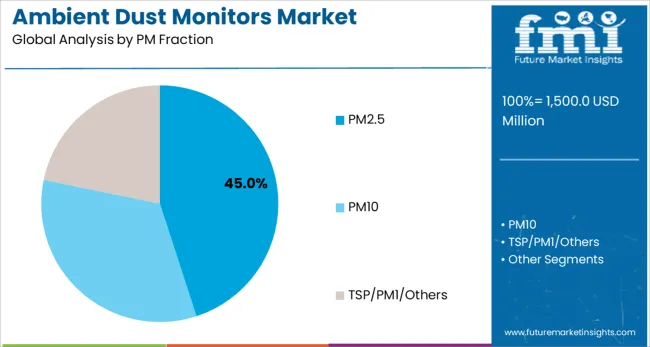

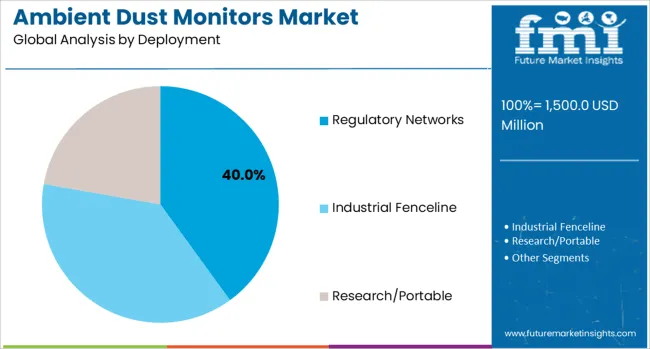

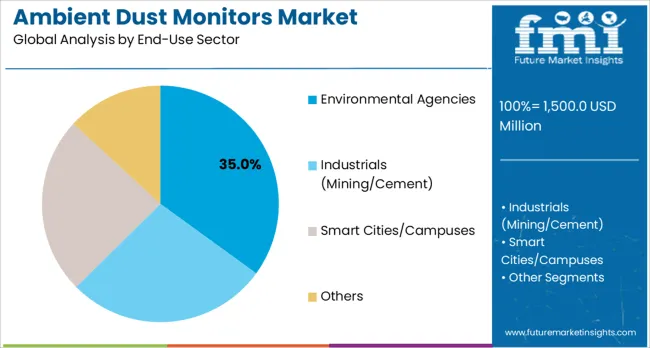

The market is segmented by measurement principle, PM fraction, deployment type, end-use sector, and region. By measurement principle, the market is divided into optical scattering, beta attenuation, gravimetric reference, and others. Based on PM fraction, the market is categorized into PM10, PM2.5, and TSP/PM1/Others. In terms of deployment type, the market is segmented into regulatory networks, industrial fenceline, and research/portable applications. By end-use sector, the market is classified into environmental agencies, industrials (mining/cement), smart cities/campuses, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The optical scattering segment is projected to account for 50% of the ambient dust monitors market in 2025, making it the dominant measurement principle. Optical scattering, also known as light scattering, detects airborne particles by measuring the intensity of light reflected or refracted as particles pass through a laser beam. This method provides continuous, real-time data, which is critical for both regulatory and industrial applications requiring immediate response to changing air quality conditions.

Its ability to measure varying particle concentrations across multiple size ranges makes it versatile and reliable. Widespread adoption is supported by standardized measurement protocols, regulatory acceptance, and broad availability of optical scattering monitors from multiple global suppliers. The segment also benefits from advancements in sensor miniaturization and digital integration, enabling cost-effective deployment in both fixed networks and portable devices. These advantages ensure optical scattering remains the preferred monitoring technology.

PM2.5 monitoring is forecasted to represent 45% of PM fraction monitoring demand in 2025, reflecting its critical role in public health protection. PM2.5, or fine particulate matter measuring less than 2.5 micrometers, is small enough to penetrate deep into the lungs and even enter the bloodstream, causing cardiovascular, respiratory, and neurological health issues. As a result, PM2.5 has become the most regulated and closely tracked pollutant worldwide, particularly in urban areas with high traffic, industrial activity, and biomass burning.

Governments are mandating PM2.5 monitoring as part of stricter air quality standards, while public awareness of its health impacts continues to rise. The segment benefits from growing demand for accurate and continuous PM2.5 data to inform regulatory actions, urban planning, and health advisories. Increasing consumer access to personal PM2.5 monitors further complements government-led initiatives, reinforcing this fraction’s dominance.

The regulatory networks segment is projected to account for 40% of the ambient dust monitors market in 2025, highlighting the central role of government-operated monitoring systems. Regulatory networks deploy fixed monitoring stations across urban and industrial regions to collect standardized, high-quality air quality data. These systems are critical for compliance with national and international air quality standards, while also serving as the foundation for public health warnings, pollution alerts, and long-term environmental planning.

Regulatory networks typically utilize robust, reference-grade equipment capable of continuous monitoring across multiple particulate fractions. With governments investing heavily in environmental monitoring infrastructure and expanding network coverage, demand for ambient dust monitors in this segment is expected to rise steadily. The complexity of modern air quality management systems ensures regulatory networks will remain a cornerstone deployment model.

Environmental agencies are projected to hold 35% of the ambient dust monitors market in 2025, underscoring their leadership as the primary end-use sector. These agencies are tasked with ensuring compliance with air quality regulations, protecting public health, and conducting environmental research. Their monitoring activities cover a wide range of objectives, including pollution source identification, emission trend analysis, and enforcement of environmental standards.

Agencies operate both standalone and networked monitoring systems, ensuring comprehensive coverage across industrial, urban, and rural environments. The segment benefits from increasing government focus on environmental sustainability, climate change, and urban air quality management. As public awareness of air pollution’s health effects grows, environmental agencies face rising pressure to provide accurate, transparent, and timely data. This responsibility ensures they remain the leading driver of demand for high-quality ambient dust monitoring solutions.

The ambient dust monitors market is advancing steadily due to increasing environmental regulations and growing recognition of air quality monitoring importance. However, the market faces challenges including high equipment costs, need for continuous maintenance and calibration, and varying monitoring requirements across different regulatory frameworks. Standardization efforts and certification programs continue to influence equipment quality and market development patterns.

The growing deployment of IoT-enabled monitoring systems is enabling real-time data transmission to cloud-based platforms, environmental management centers, and regulatory databases. Smart monitors equipped with wireless connectivity and advanced sensors provide comprehensive air quality data while reducing manual data collection requirements. These systems are particularly valuable for smart city initiatives and industrial facilities that require continuous monitoring without operational delays.

Modern monitoring system providers are incorporating advanced data analytics and artificial intelligence that improve measurement accuracy and enable predictive environmental management. Integration of machine learning algorithms and real-time data processing systems enables more precise pollution source identification and comprehensive trend analysis. Advanced technologies also support monitoring of complex pollution patterns including multi-source emissions and atmospheric dispersion modeling.

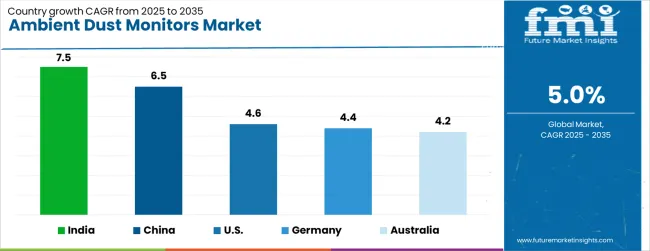

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.5% |

| China | 6.5% |

| USA | 4.6% |

| Germany | 4.4% |

| Australia | 4.2% |

The ambient dust monitors market is growing rapidly, with India leading at a 7.5% CAGR through 2035, driven by rapid urbanization, industrial expansion, and strengthening environmental regulations. China follows at 6.5%, supported by massive air pollution control initiatives and smart city development programs. The United States grows at 4.6%, emphasizing advanced monitoring technologies and comprehensive environmental compliance. Germany records 4.4%, focusing on precision monitoring and industrial emission control. Australia shows steady growth at 4.2%, driven by mining industry monitoring requirements and urban air quality management. Overall, India and China emerge as the leading drivers of global ambient dust monitors market expansion.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from ambient dust monitors in India is projected to exhibit the highest growth rate with a CAGR of 7.5% through 2035, driven by rapid urbanization and increasing industrial activity creating significant air quality challenges. The country's expanding smart city initiatives and growing environmental awareness are creating substantial demand for monitoring systems. Major environmental agencies and industrial facilities are establishing comprehensive monitoring networks to support air quality management across urban and industrial areas.

Revenue from ambient dust monitors in China is expanding at a CAGR of 6.5%, supported by comprehensive air pollution control initiatives and massive investment in environmental monitoring infrastructure. The country's commitment to air quality improvement and industrial emission control is driving demand for advanced monitoring systems. Government agencies and industrial facilities are rapidly establishing monitoring capabilities to support national air quality improvement goals.

Revenue from ambient dust monitors in the USA is growing at a CAGR of 4.6%, driven by advanced technology integration and comprehensive environmental monitoring requirements. The country's established regulatory framework and emphasis on data quality is creating demand for sophisticated monitoring systems. Environmental agencies and research institutions are investing in next-generation monitoring technologies that support comprehensive air quality management.

Demand for ambient dust monitors in Germany is projected to grow at a CAGR of 4.4%, supported by the country's emphasis on environmental technology innovation and precision monitoring systems. German environmental agencies and industrial facilities are implementing comprehensive monitoring capabilities that meet stringent quality standards and environmental regulations. The market is characterized by focus on technical excellence, advanced equipment integration, and compliance with comprehensive environmental protection requirements.

Demand for ambient dust monitors in Australia is expanding at a CAGR of 4.2%, driven by mining industry monitoring requirements and growing urban air quality management needs. Large mining operations and environmental agencies are establishing comprehensive monitoring capabilities to serve environmental compliance and community health protection. The market benefits from mining industry investment in environmental monitoring and urban air quality management initiatives.

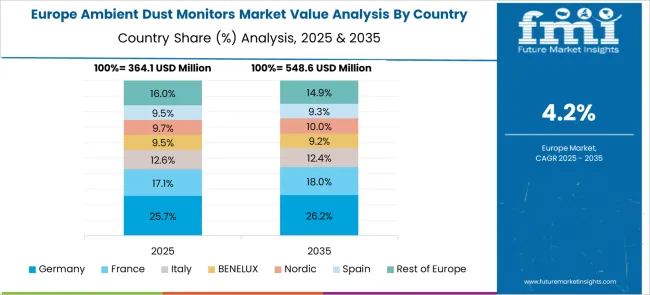

The European ambient dust monitors market demonstrates advanced development across major economies with Germany leading through its precision instrumentation capabilities and strong environmental monitoring sector, supported by companies like GRIMM Aerosol Technik, Palas GmbH, and TSI Incorporated pioneering innovative particulate monitoring technologies for diverse air quality applications. France and the UK show significant growth in urban air quality monitoring and industrial compliance, where stringent environmental regulations drive demand for advanced dust monitoring solutions.

Swedish company OPSIS AB leverages Nordic expertise in environmental technology, while international players like Thermo Fisher Scientific and Teledyne API establish strong European presence. Italy and Spain exhibit expanding adoption in industrial fenceline monitoring and regulatory networks, driven by EU air quality directives and environmental compliance requirements. Nordic countries emphasize comprehensive environmental monitoring and climate change research, while Eastern European markets show growing interest in upgrading air quality infrastructure. The market benefits from strict EU environmental regulations, sustainability initiatives, and the region's leadership in environmental technology, positioning Europe as a key innovation center for next-generation ambient dust monitoring solutions.

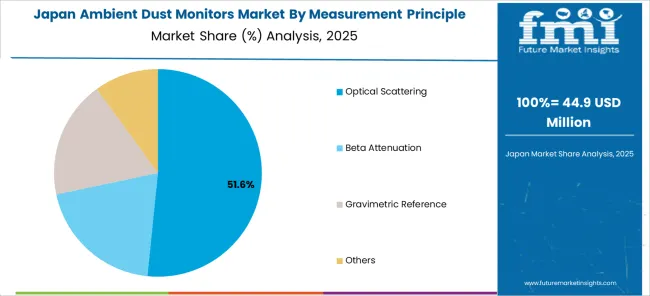

The largest share is captured by optical scattering, accounting for 51.6% of the market. This dominance suggests that optical scattering is the preferred method in Japan due to its ability to provide real-time monitoring, cost-effectiveness, and ease of deployment across urban and industrial environments. Its reliability in tracking PM2.5 and PM10 concentrations makes it an attractive solution for compliance with Japan’s stringent air quality regulations.

Beta Attenuation and Gravimetric Reference together hold a significant portion of the market, indicating their continued use in regulatory and scientific applications where precision and standardization are critical. Gravimetric methods, though less dominant, remain the benchmark for accuracy, often used for calibration and validation purposes.

The Others category, though smaller, points toward emerging technologies or niche monitoring techniques that could gain relevance with technological advancements and policy shifts.

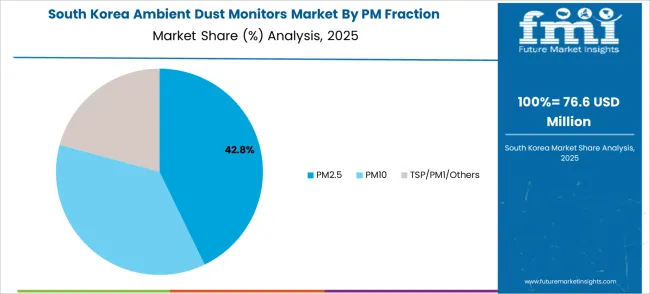

The South Korean ambient dust monitors market shows sophisticated technological focus with PM2.5 monitoring commanding 42.8% market share, demonstrating priority attention to fine particulate matter that poses significant health risks and aligns with growing public awareness of air quality impacts. Companies like Aeroqual, TSI Incorporated, and Teledyne API contribute through their advanced particulate monitoring technologies, supporting South Korea's comprehensive air quality management initiatives and environmental monitoring programs.

PM10 monitoring maintains 35% market share, addressing coarse particulate matter requirements and regulatory compliance needs across urban and industrial environments. TSP, PM1, and other particle fraction monitoring represent 20% of the market, supporting specialized research and comprehensive air quality assessment programs. The market's emphasis on PM2.5 technology reflects South Korea's focus on public health protection and environmental quality, driving demand for precision monitoring solutions with enhanced accuracy and real-time data capabilities. Integration with Korean expertise in electronics and environmental technology positions the market as both a significant consumer base and innovation catalyst for advanced ambient dust monitoring applications worldwide.

The ambient dust monitors market is defined by competition among specialized equipment manufacturers, environmental technology companies, and measurement solution providers. Companies are investing in advanced sensor technologies, IoT connectivity, data analytics capabilities, and comprehensive service support to deliver precise, reliable, and cost-effective monitoring solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Acoem (Ecotech), France-based, offers comprehensive ambient dust monitoring solutions with focus on precision measurement, data quality, and regulatory compliance. Aeroqual, operating from New Zealand, provides portable and fixed monitoring systems with emphasis on user-friendly operation and data accessibility. GRIMM Aerosol Technik, Germany, delivers technologically advanced monitoring solutions with high-precision measurement capabilities. HORIBA, Japan, emphasizes comprehensive environmental monitoring systems with integrated data management.

Met One Instruments, USA-based, offers regulatory-grade monitoring equipment with focus on accuracy and reliability. OPSIS AB, Sweden, provides optical measurement systems with advanced data analysis capabilities. Palas GmbH, Germany, delivers specialized aerosol measurement technology for research and industrial applications. TSI Incorporated, USA, offers comprehensive particle measurement solutions with global service support. Teledyne API and Thermo Fisher Scientific, both USA-based, provide complete environmental monitoring systems with advanced analytical capabilities and comprehensive technical support.

| Items | Values |

|---|---|

| Quantitative Units | USD 1,500 million |

| Measurement Principle | Optical Scattering, Beta Attenuation, Gravimetric Reference, Others |

| PM Fraction | PM10, PM2.5, TSP/PM1/Others |

| Deployment | Regulatory Networks, Industrial Fenceline, Research/Portable |

| End-Use Sector | Environmental Agencies, Industrials, Smart Cities/Campuses, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Acoem (Ecotech), Aeroqual, GRIMM Aerosol Technik, HORIBA, Met One Instruments, OPSIS AB, Palas GmbH, TSI Incorporated, Teledyne API, and Thermo Fisher Scientific |

| Additional Attributes | Dollar sales by monitoring technology and particle size range, regional demand trends, competitive landscape, buyer preferences for portable versus fixed units, integration with regulatory compliance platforms, innovations in real-time sensors, IoT connectivity, and low-maintenance designs |

The global ambient dust monitors market is estimated to be valued at USD 1,500.0 million in 2025.

The market size for the ambient dust monitors market is projected to reach USD 2,443.3 million by 2035.

The ambient dust monitors market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in ambient dust monitors market are optical scattering, beta attenuation, gravimetric reference and others.

In terms of pm fraction, pm2.5 segment to command 45.0% share in the ambient dust monitors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ambient Packaging Market Analysis Size, Share & Forecast 2025 to 2035

Automotive Interior Ambient Lighting Market Growth - Trends & Forecast 2025 to 2035

Dust Control System Market Size and Share Forecast Outlook 2025 to 2035

Dust Suppressant Market Size and Share Forecast Outlook 2025 to 2035

Dust Extractor Market Growth – Trends & Forecast 2025 to 2035

Dust Covers Market

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA